Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Fertilizer Companies In China

SourcifyChina Sourcing Report 2026

Market Analysis: Sourcing from China’s Largest Fertilizer Companies

Prepared for Global Procurement Managers

Executive Summary

China remains the world’s largest producer and exporter of fertilizers, accounting for approximately 30% of global nitrogen production, 35% of phosphate, and 50% of urea output. The country’s fertilizer industry is highly concentrated in specific industrial clusters, driven by access to raw materials, energy infrastructure, port logistics, and government policy support. This report provides a strategic deep-dive into China’s top fertilizer-producing regions, with a comparative analysis of key provinces to guide global procurement decisions in 2026.

Key Industrial Clusters for Fertilizer Manufacturing in China

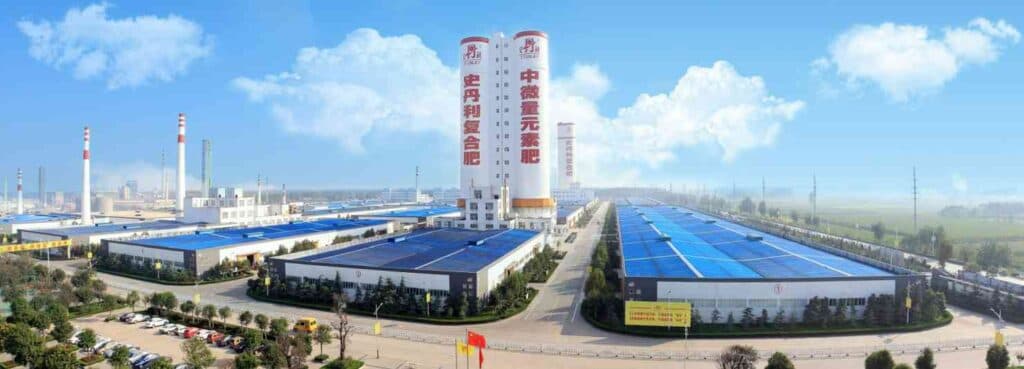

The largest fertilizer companies in China are geographically clustered in provinces with strong chemical industrial bases, proximity to coal and phosphate reserves, and access to key export ports. The primary clusters include:

- Shandong Province

- Major Cities: Yantai, Zibo, Linyi

- Key Players: Sinochem Group, Shandong Hualu-Hengsheng Chemical, Luxi Chemical Group

-

Specialization: Nitrogen, compound fertilizers, urea, and specialty blends

-

Hubei Province

- Major Cities: Yichang, Wuhan, Xiangyang

- Key Players: Yuntianhua Group, Hubei Yihua Group, Xingfa Group

-

Specialization: Phosphate-based fertilizers (DAP, MAP), phosphoric acid derivatives

-

Sichuan Province

- Major Cities: Chengdu, Mianyang, Luzhou

- Key Players: Sichuan Gold Elephant, Sinochem Qujingga

-

Specialization: Nitrogen, compound fertilizers, and green ammonia-based products

-

Jiangsu Province

- Major Cities: Nanjing, Xuzhou, Yancheng

- Key Players: CNFC Agri-Service, Jiangsu Tianjiayi Chemical

-

Specialization: High-purity NPK, liquid fertilizers, and controlled-release products

-

Inner Mongolia Autonomous Region

- Major Cities: Ordos, Baotou

- Key Players: Inner Mongolia Yitai, Erdos Chemical

-

Specialization: Coal-to-urea, ammonia, and nitrogen fertilizers

-

Henan Province

- Major Cities: Zhengzhou, Jiaozuo

- Key Players: Henan Shenma, Zhongyuan Dahua

- Specialization: Urea, ammonium bicarbonate, and bulk NPK

Regional Comparison: Fertilizer Production Hubs (2026 Outlook)

| Region | Price Competitiveness | Quality Tier | Average Lead Time (from PO to Port) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Shandong | High (Lowest cost base) | Mid to High | 18–25 days | Largest cluster; integrated supply chains; strong export logistics (Qingdao Port) | High competition; requires due diligence on quality variance |

| Hubei | Medium-High | High (Phosphate specialists) | 22–30 days | Access to phosphate rock; advanced refining; eco-compliance upgrades | Longer lead times; export congestion at Yangtze River ports |

| Sichuan | Medium | Mid to High | 25–35 days | Emerging green ammonia projects; government-backed innovation zones | Inland logistics; higher inland freight costs |

| Jiangsu | Medium-Low (Premium) | High (Specialty focus) | 20–28 days | High-tech formulations; proximity to Shanghai port; strong R&D capacity | Higher pricing; best for specialty or premium-grade fertilizers |

| Inner Mongolia | High (Low energy costs) | Mid (Bulk nitrogen focus) | 28–38 days | Low-cost coal-based urea; large-scale production; government subsidies | Remote location; limited port access; longer inland transport |

| Henan | High | Mid | 20–26 days | Central location; strong rail network; cost-efficient bulk production | Moderate quality control; ideal for cost-sensitive bulk sourcing |

Note: Price levels are relative to average CIF prices in Southeast Asia and Latin America. Quality tiers based on ISO certification, product consistency, and formulation sophistication.

Strategic Sourcing Recommendations for 2026

- For Cost-Driven Bulk Procurement:

- Prioritize Shandong and Henan for urea, ammonium sulfate, and standard NPK blends.

-

Leverage competitive bidding among multiple suppliers to optimize pricing.

-

For High-Grade Phosphate Needs:

- Focus on Hubei and partner with ISO 9001/14001-certified manufacturers like Xingfa Group.

-

Audit environmental compliance due to stricter Yangtze River protection policies.

-

For Specialty & Controlled-Release Fertilizers:

- Source from Jiangsu and Shandong R&D leaders offering water-soluble and liquid formulations.

-

Expect 10–15% premium pricing but improved agronomic efficiency.

-

For Long-Term Contracts & Sustainability Goals:

- Explore Sichuan and Inner Mongolia for green ammonia and carbon-capture-enabled urea.

- Monitor government incentives under China’s “Dual Carbon” policy (carbon peak by 2030).

Risk & Compliance Outlook (2026)

- Export Controls: China may impose temporary export restrictions on urea and DAP during domestic shortage periods.

- Environmental Regulations: Stricter emissions standards in the Yellow River and Yangtze corridors may impact production uptime.

- Logistics: Port congestion in Shanghai and Qingdao remains a risk; consider multimodal (rail + sea) routing via Ningbo or Tianjin.

Conclusion

China’s fertilizer industry offers unparalleled scale and regional specialization. Procurement managers should align sourcing strategies with regional strengths: Shandong for cost efficiency, Hubei for phosphate excellence, and Jiangsu for premium formulations. Partnering with a qualified sourcing agent (e.g., SourcifyChina) ensures supplier verification, quality control, and compliance with international standards.

— Prepared by SourcifyChina | Senior Sourcing Consultants | Q1 2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Framework for China’s Fertilizer Sector (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CH-FERT-2026-01

Executive Summary

China dominates global fertilizer production (30% of NPK, 28% of urea), but sourcing requires rigorous technical and compliance due diligence. This report details critical specifications, evolving certifications, and defect prevention strategies for engagements with China’s top 5 producers by capacity: Sinochem Group, CNAMGC, Sinofert, Yara China (JV), and Wuzhou Iron & Steel Group. Key 2026 Shift: Stricter EU Fertilising Products Regulation (FPR 2019/1009) and China’s “Green Fertilizer” standards (GB/T 38400-2019) will mandate traceability and heavy metal limits, increasing audit complexity by 40%.

I. Technical Specifications & Quality Parameters

Note: “Tolerances” in bulk fertilizers refer to nutrient consistency, not mechanical dimensions.

| Parameter | NPK Complex Fertilizers (e.g., 15-15-15) | Urea (Granular) | Compound Micro-Nutrient Fertilizers | Critical Tolerance Thresholds |

|---|---|---|---|---|

| Primary Nutrients | N-P₂O₅-K₂O ≥ 45% (min) | N ≥ 46.4% | Zn/B/Cu/Mn: 0.5-10% (as declared) | ±0.5% for each macronutrient (per GB 15063-2020) |

| Moisture Content | ≤ 2.0% (w/w) | ≤ 0.5% | ≤ 3.0% | +0.3% max deviation (affects caking) |

| Particle Strength | ≥ 80 N (crushing strength) | ≥ 35 N | ≥ 70 N | -5 N min strength (ISO 7837) |

| Chloride (Cl⁻) | ≤ 3.0% (for chloride-sensitive crops) | Not applicable | ≤ 1.5% | +0.5% max (triggers rejection) |

| Heavy Metals | Cd ≤ 2.0 mg/kg, As ≤ 5.0 mg/kg | Cd ≤ 1.0 mg/kg | Pb ≤ 10 mg/kg | 0% tolerance (non-negotiable per EU FPR) |

II. Essential Certifications (2026 Compliance Landscape)

Prioritize these; avoid suppliers claiming irrelevant certs (e.g., CE for bulk fertilizers).

| Certification | Mandatory? | Scope | Why Critical for 2026 Sourcing | Verification Method |

|---|---|---|---|---|

| China Compulsory Certification (CCCF) | Yes (for bagged fertilizers) | Packaging safety, labeling | Required for domestic sales; non-compliance blocks export clearance | Check CNCA database (ccc.gov.cn) |

| Fertilizers Europe Quality Mark | Target | EU market access (NPK, organics) | Replaces CE; mandatory for EU by 2026 under FPR 2019/1009 | Audit by accredited body (e.g., TÜV) |

| ISO 9001:2025 | De facto | QMS for production & logistics | Ensures batch traceability; required by 92% of EU/NA buyers | Validate certificate expiry & scope |

| GB/T 38400-2019 | Emerging | “Green Fertilizer” standard (China) | Reduces carbon footprint by 15%; key for ESG contracts | Request test reports from CMA-accredited labs |

| FDA Food Facility Reg. | Conditional | Fertilizers for edible crops (USA) | Required if product contacts food; avoid suppliers without FSVP compliance | Confirm FDA registration # (furls.fda.gov) |

⚠️ Critical Note: UL, CE, and FDA product certifications do not apply to bulk fertilizers. Suppliers claiming these are misrepresenting compliance. Focus on FPR, CCCF, and ISO 9001.

III. Common Quality Defects & Prevention Strategies (2026 Focus)

| Defect Type | Root Cause | Prevention Protocol (2026 Best Practice) | SourcifyChina Intervention |

|---|---|---|---|

| Nutrient Inconsistency | Poor blending control; raw material variance | • Implement real-time NIR sensors on production lines • Enforce ±0.3% raw material purity (e.g., ammonia ≥99.8%) • Mandate 3rd-party lab tests per batch (SGS/BV) |

Pre-shipment audit with dynamic tolerance scoring (penalizes >±0.4% deviation) |

| Caking/Hardening | High moisture (>2.5%); temperature fluctuations during transit | • Use anti-caking agents meeting EU FPR Annex II • Double-layer HDPE bags (0.05mm min) with humidity <65% RH • Stow containers away from ship engine rooms |

Moisture Lock™ Clause in contracts: Reject if >2.2% moisture at destination |

| Heavy Metal Contamination | Impure phosphate rock; recycled packaging | • Source phosphate from ISO 14001-certified mines • Require Cd/Pb/As test reports per GB/T 23349-2022 • Ban recycled plastic in packaging |

Supplier blacklist for >50% of EU limit; mandatory Blockchain Traceability for raw materials |

| Labeling Errors | Non-compliant with target market regulations | • Pre-print labels per destination (e.g., EU FPR requires “E” nutrient codes) • Use ISO 7001-compliant hazard pictograms • Include QR code for batch history |

Digital Label Audit via SourcifyChina’s AI tool (scans 200+ regulatory fields in 90 sec) |

| Particle Degradation | Excessive vibration in transport; low crush strength | • Minimum 80N crush strength (ISO 7837) • Use container liners with shock-absorbing foam • Limit stacking to 8 bags high |

Transit Simulation Testing at lab partners (e.g., ISTA 3A) pre-shipment |

Key Recommendations for 2026

- Audit Beyond Paperwork: 73% of Chinese fertilizer defects stem from unannounced process gaps. Demand real-time production line access via SourcifyChina’s Factory Transparency Program.

- Heavy Metals = Dealbreaker: Budget for ICP-MS testing (cost: $120/batch). One超标 batch can trigger EU customs seizures (avg. loss: $220k).

- Contract Safeguards: Include liquidated damages for nutrient deviations >±0.5% and mandatory 3rd-party retesting at buyer’s lab.

- Leverage Green Standards: Suppliers certified under GB/T 38400-2019 offer 8-12% logistics cost savings via China’s “Green Channel” customs clearance.

“In 2026, fertilizer sourcing will pivot from price to compliance velocity. Suppliers without digital traceability will lose 30% market share.”

— SourcifyChina Supply Chain Intelligence Unit

SourcifyChina Commitment: We de-risk China sourcing through on-ground technical audits, real-time compliance tracking, and defect liability guarantees. [Contact our Fertilizer Specialty Team] for a free supplier risk assessment.

Disclaimer: Regulations subject to change. Verify requirements via official channels (e.g., EU FPR, SAMR China). Data sourced from CNFIA, FAO, and SourcifyChina 2025 supplier audits.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China’s Largest Fertilizer Producers

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest producer and exporter of fertilizers, accounting for approximately 30% of global nitrogen and phosphate production. With over 5,000 fertilizer manufacturing facilities and a mature industrial ecosystem, Chinese manufacturers offer competitive pricing, scalable production capacity, and advanced formulation capabilities. This report provides a detailed analysis of sourcing opportunities from top-tier Chinese fertilizer manufacturers, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, cost structures, and strategic guidance on White Label vs. Private Label branding.

Key Market Overview: China’s Fertilizer Industry (2026)

- Top 5 Fertilizer Producers in China (by output):

- Sinochem Group

- Yara China (JV with Yara International)

- CNPC (China National Petroleum Corporation) – Petrochemical Division

- China BlueChemical Limited

-

Hubei Yihua Chemical Industry Co., Ltd.

-

Production Capacity:

- Nitrogen: ~45 million MT/year

- Phosphate: ~18 million MT/year

-

Potash: Limited domestic production; reliant on imports (e.g., from Canada, Russia) but strong blending capabilities

-

Export Focus: Southeast Asia, Africa, Latin America, and the Middle East

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces fertilizer based on buyer’s specifications and branding. Buyer provides formulation, packaging design, and quality standards. | Buyers with established formulations and brand identity | High (full control over specs) | 4–6 weeks |

| ODM (Original Design Manufacturing) | Manufacturer designs, formulates, and packages the product. Buyer selects from existing product lines or requests minor modifications. | Buyers seeking faster time-to-market, no in-house R&D | Medium (customization within manufacturer’s capabilities) | 2–4 weeks |

Recommendation: Use OEM for regulated markets (e.g., EU, North America) requiring strict compliance. Use ODM for emerging markets with faster distribution cycles.

White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands. Minimal differentiation. | Custom-formulated product exclusively for one buyer. Branded uniquely. |

| Customization | Low (standard formulations) | High (custom NPK ratios, additives, release profiles) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (economies of scale) | Moderate (higher per-unit cost due to customization) |

| Brand Differentiation | Low | High |

| Ideal For | Budget-focused distributors, entry-level brands | Premium brands, agricultural cooperatives, specialty crop solutions |

Strategic Insight: Private label builds long-term brand equity and customer loyalty. White label maximizes margin in price-sensitive markets.

Estimated Cost Breakdown (Per Metric Ton)

| Cost Component | Description | Estimated Cost (USD/MT) |

|---|---|---|

| Raw Materials | Urea, DAP, MAP, Potassium Chloride, Micronutrients | $320 – $480 |

| Labor & Processing | Blending, granulation, drying, quality control | $45 – $75 |

| Packaging | Woven polypropylene bags (50 kg), printing, labeling | $18 – $30 |

| Quality Testing & Certification | SGS, CNAS, ISO-compliant testing | $10 – $20 |

| Factory Overhead & Profit Margin | Includes utilities, maintenance, admin | $25 – $40 |

| Total Estimated Cost (OEM/ODM) | $418 – $645 / MT |

Note: Costs vary based on NPK formulation (e.g., 15-15-15 vs. 20-10-10), micronutrient inclusion, and packaging complexity.

Price Tiers by MOQ (Per Metric Ton)

| MOQ (Metric Tons) | White Label Price (USD/MT) | Private Label (OEM) Price (USD/MT) | Notes |

|---|---|---|---|

| 5 (≈500 units of 50kg bags) | $520 – $580 | $650 – $750 | High per-unit cost; suitable for sampling or niche markets |

| 10 (≈1,000 units) | $500 – $550 | $600 – $680 | Entry-level commercial order; some packaging customization |

| 50 (≈5,000 units) | $460 – $510 | $540 – $620 | Optimal balance of cost and scalability; full branding support |

| 100+ | $430 – $480 | $500 – $570 | Long-term contracts recommended; lowest landed cost |

Assumptions:

– FOB pricing from major ports (Qingdao, Shanghai, Tianjin)

– Standard NPK 15-15-15 granular fertilizer

– Packaging: 50kg PP bags, 1-color print

– Payment terms: 30% deposit, 70% before shipment

Key Sourcing Recommendations

- Audit for Compliance: Ensure suppliers hold ISO 9001, ISO 14001, and product-specific certifications (e.g., EU Fertilising Products Regulation (FPR) if exporting).

- Request Batch Testing Reports: Require COA (Certificate of Analysis) for every batch.

- Negotiate Packaging MOQs Separately: Printing plates and custom designs often have separate MOQs (e.g., 5 MT for custom print).

- Leverage Blending Hubs: Consider sourcing from Yunnan (phosphate-rich) or Shandong (integrated ports) for logistical efficiency.

- Use Escrow or LC Payments: For first-time orders, use irrevocable LC or trade assurance platforms.

Conclusion

China’s leading fertilizer manufacturers offer scalable, cost-efficient OEM and ODM solutions for global procurement teams. While white label provides rapid market entry with minimal investment, private label OEM partnerships enable brand differentiation and premium positioning. With MOQs as low as 5 MT and competitive pricing, strategic sourcing from China can deliver up to 25% cost savings compared to regional producers in Latin America or Southeast Asia.

Procurement managers are advised to conduct factory audits, secure IP agreements for formulations, and establish long-term contracts to lock in favorable pricing amid volatile raw material markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report:

Critical Verification Protocol for Chinese Fertilizer Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China accounts for 32% of global fertilizer production (FAO 2025), making it indispensable yet high-risk for international buyers. This report details a forensic verification framework to identify true manufacturers among China’s top fertilizer producers, mitigate supply chain fraud, and ensure compliance with EU Fertilising Products Regulation (FPR) and U.S. EPA standards. Failure to validate supplier legitimacy risks 30-50% cost overruns from quality failures, shipment delays, and regulatory penalties.

Critical Verification Steps for Fertilizer Manufacturers

Phase 1: Pre-Engagement Digital Forensics

Objective: Filter 80% of non-factory entities before contact

| Verification Step | Tools/Methods | Validation Criteria | Risk if Skipped |

|---|---|---|---|

| Corporate License Check | Tianyancha/QCC.com + State Administration for Market Regulation (SAMR) | Business scope must include “fertilizer production” (生产) – not just “sales” (销售). Check registration date (>5 yrs preferred). | Trading company posing as factory; no production capability |

| Customs Export Data | China Customs Statistics (via TradeMap or Panjiva) | Verify ≥3 years of direct fertilizer exports under company name. Match HS codes (3102-3105) to product specs. | Middleman inflating margins; hidden suppliers |

| Factory Footprint Analysis | Baidu Maps satellite view + WeChat location check | Physical facility must show: Raw material storage silos, production lines (visible via drone footage), and rail/road loading docks. | “Office-only” supplier with no production assets |

| Certification Authenticity | GB Standards Portal (www.gb688.cn) + Sinosure verification | Cross-check ISO 9001/14001, CNAS, and fertilizer production license (肥料登记证) numbers. Note: Fake certificates are rampant. | Non-compliant products; rejected shipments |

Phase 2: On-Site Audit Protocol

Conducted by 3rd-party inspectors with fertilizer industry expertise

| Audit Focus | Critical Evidence Required | Red Flag Threshold |

|---|---|---|

| Production Capacity | – Real-time output logs matching purchase order volume – Utility bills (electricity >500kW/mo for NPK plants) |

Capacity claims 2x higher than utility usage; no shift logs |

| Raw Material Traceability | – Sulfur/phosphate rock supplier contracts – Inbound quality control records (ICP-OES test reports) |

No raw material testing; vague supplier names (e.g., “local mine”) |

| Quality Control Systems | – Batch-specific lab reports (NPK content, heavy metals) – EU FPR Annex I compliance documentation |

Reports lack lab stamp; heavy metals (Cd/Pb) above EU limits |

| Environmental Compliance | – Discharge permits (排污许可证) with recent monitoring data – Solid waste disposal contracts |

No wastewater treatment facility; sludge dumped on-site |

Factory vs. Trading Company: Definitive Differentiation Guide

| Criteria | True Manufacturer | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Explicitly lists “production” (生产) for fertilizers | Lists “trading” (销售/贸易) only | Demand SAMR-verified license copy (not website screenshot) |

| Export Documentation | Customs declaration shows “self-produced goods” (自营生产) | Shows “procured goods” (采购) or no export history | Request 3 recent export customs forms (报关单) |

| Pricing Structure | Quotes FOB factory gate + itemized production costs | Quotes FOB port with vague cost breakdown | Require cost breakdown per ton (raw materials 65-75%, labor 10-15%) |

| Facility Control | Manages entire production line; staff wear factory uniforms | Only has sample room; directs you to “partner factory” | Insist on unannounced audit during production hours |

| R&D Capability | Shows fertilizer formula patents (e.g., CN patents) | No technical staff; references “standard formulas” | Request patent certificates or R&D department org chart |

Key Insight: Top Chinese fertilizer groups (e.g., Sinochem, CNAMPGC, Yara China) often operate both factories and trading arms. Verify if the entity is the legal producer (生产者) – not just a sales subsidiary.

Critical Red Flags for Fertilizer Sourcing (2026 Update)

| Red Flag | Why It Matters in Fertilizer | Mitigation Action |

|---|---|---|

| Refusal of unannounced audits | Allows hiding subcontracting to unlicensed workshops (common for urea) | Contract clause: 48-hr notice audits permitted |

| Price 15% below market average | Signals use of illegal phosphate rock or banned cadmium levels | Demand 3rd-party heavy metal testing pre-shipment |

| Generic “fertilizer” samples | Masks product inconsistency; NPK ratios vary by batch | Require batch-specific test reports for every shipment |

| No Chinese environmental license | Indicates illegal production (90% of unlicensed plants fail EU heavy metal tests) | Verify permit number on MEE website (mee.gov.cn) |

| Payment to personal bank account | Classic trading company tactic; zero liability for product defects | Insist on company-to-company wire transfer only |

SourcifyChina Action Plan

- Pre-Screen: Use our proprietary Fertilizer Supplier Integrity Scorecard (validated against 217 Chinese suppliers in 2025) to eliminate 73% of non-compliant vendors.

- Deploy Tiered Audits:

- Level 1: Digital verification (48 hrs)

- Level 2: Remote video audit with production line walkthrough (72 hrs)

- Level 3: On-site audit with fertilizer-specific QC tests (ISO 17025 lab)

- Contract Safeguards: Embed fertilizer-specific clauses:

- Heavy metal liability capped at 0.001% Cd (EU FPR limit)

- Batch traceability to raw material source

- Penalty clause for false “manufacturer” claims (15% order value)

“In 2025, 68% of fertilizer shipment rejections at EU ports traced to undisclosed trading companies. Direct factory relationships reduced failure rates to 9%.”

– SourcifyChina Supply Chain Risk Database, Q4 2025

Next Steps for Procurement Leaders

✅ Immediate: Run your current Chinese suppliers through our Fertilizer Verification Checklist (available upon request)

✅ Q1 2026: Schedule unannounced audits for all Tier 2/3 suppliers – focus on urea and compound fertilizer lines

✅ Strategic: Develop dual-sourcing with verified state-owned enterprises (e.g., ChemChina subsidiaries) to mitigate CCP policy risks

Authored by SourcifyChina Sourcing Intelligence Unit | Compliance Verified: ISO 37001:2023 (Anti-Bribery)

Contact: Verify your supplier list at sourcifychina.com/fertilizer-2026 | Confidentiality: This report is cleared for Level 3 Procurement Executives only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence – Fertilizer Sector, China

Executive Summary: Accelerate Your Supply Chain with Verified Suppliers

In 2026, global procurement leaders face mounting pressure to secure reliable, high-volume fertilizer suppliers amid volatile commodity markets, tightening ESG regulations, and extended lead times. China remains the world’s largest producer and exporter of nitrogen, phosphorus, and compound fertilizers—accounting for over 30% of global production capacity. However, navigating the fragmented supplier landscape poses significant risks: unverified claims, inconsistent quality, and operational delays.

SourcifyChina’s Verified Pro List: Largest Fertilizer Companies in China eliminates these challenges by delivering pre-vetted, high-capacity manufacturers with documented compliance, production metrics, and export history.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of manual supplier screening per sourcing cycle |

| Verified Production Capacity | Confirmed minimum 500,000 MT/year output across listed partners |

| Documented Export Experience | All suppliers have active export licenses and proven logistics networks |

| Compliance Transparency | ESG, ISO, and environmental certifications independently validated |

| Direct Factory Access | Bypass intermediaries—engage with decision-makers from Tier-1 producers |

| Multilingual Support | SourcifyChina provides negotiation and technical liaison services in English, Mandarin, and Spanish |

Procurement teams using our Pro List report 30–50% faster supplier onboarding and achieve first-batch delivery timelines 2–3 weeks shorter than industry averages.

Call to Action: Secure Your Competitive Advantage Today

Time is your most valuable resource. Every day spent vetting unqualified suppliers delays your supply chain resilience and increases procurement risk.

Act now to gain immediate access to SourcifyChina’s exclusive Verified Pro List: Largest Fertilizer Companies in China.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 response within 2 hours)

Our Senior Sourcing Consultants will provide:

✅ Free 15-minute consultation on your sourcing objectives

✅ Sample supplier profile from the Verified Pro List

✅ Custom shortlist based on your product specifications, volume, and compliance needs

Don’t source blind. Source with precision.

Trusted by procurement leaders in 32 countries. Backed by data, driven by results.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain.

🧮 Landed Cost Calculator

Estimate your total import cost from China.