Sourcing Guide Contents

Industrial Clusters: Where to Source Largest E Commerce Company In China Word Craze

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Largest E-Commerce Company in China Word Craze” Products

Executive Summary

The viral consumer trend known as the “Largest E-Commerce Company in China Word Craze” – referencing novelty merchandise tied to major Chinese e-commerce platforms (e.g., Alibaba, JD.com, Pinduoduo) – has seen a surge in global demand. These products typically include themed promotional items, branded apparel, puzzle games, and social media-inspired memorabilia capitalizing on the cultural phenomenon surrounding China’s dominant digital retail ecosystem.

This report provides a comprehensive market analysis for sourcing such novelty and promotional goods from China. It identifies key industrial clusters, evaluates regional strengths, and delivers a comparative assessment of production hubs to support strategic procurement decisions in 2026.

Market Overview

The “word craze” product category falls under promotional novelties, lifestyle accessories, and digital culture merchandise. These items are typically low-to-mid complexity goods involving printing, embroidery, plastic molding, and light electronics (e.g., LED displays, QR code integration). Demand is driven by:

- Global social media trends referencing Chinese e-commerce giants

- Branded gifting and corporate promotional campaigns

- Niche e-commerce and dropshipping markets in North America, Europe, and Southeast Asia

China remains the dominant manufacturing base due to its agile supply chains, low MOQs, and specialization in fast-turnaround consumer novelties.

Key Industrial Clusters for Manufacturing

The following regions in China have emerged as primary hubs for producing word craze and promotional merchandise, leveraging existing infrastructure in printing, textiles, and consumer electronics:

| Region | Key Cities | Specialization | Supply Chain Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Full-cycle manufacturing: screen printing, apparel, smart tags, packaging | Proximity to ports (Yantian, Nansha), dense supplier network, high automation |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Mass production of low-cost novelties, paper goods, promotional items | World’s largest small commodities market (Yiwu), low MOQ flexibility |

| Jiangsu | Suzhou, Wuxi | High-precision printing, textile innovation, e-textiles | Strong R&D integration, quality control systems |

| Fujian | Quanzhou, Xiamen | Apparel and textile-based novelties (e.g., hoodies, tote bags) | Cost-efficient labor, export-focused factories |

| Shanghai | Shanghai (Pudong, Songjiang) | Premium branding, packaging design, smart packaging (AR/QR integration) | Access to design talent, international logistics |

Note: Yiwu (Zhejiang) and Dongguan (Guangdong) are the most active clusters for this category, handling over 65% of export-volume for such goods in 2025.

Regional Comparison: Production Hubs

Below is a comparative analysis of the two most strategic regions for sourcing “word craze” merchandise: Guangdong and Zhejiang.

| Criteria | Guangdong | Zhejiang (Yiwu Focus) |

|---|---|---|

| Average Price | Medium to High (¥15–¥35/unit for mixed kits) | Lowest (¥8–¥22/unit for standard novelties) |

| Quality Level | High – strict QC, ISO-certified factories | Medium – variable; best with audited suppliers |

| Lead Time | 10–20 days (standard), 5–7 days (express) | 15–25 days (standard), 10–14 days (expedited) |

| MOQ Flexibility | Low to Medium (500–1,000 units) | Very Low (50–500 units common) |

| Customization | High (digital printing, app integration, 3D design) | Medium (screen printing, basic packaging) |

| Best For | Premium branded campaigns, tech-integrated products | High-volume, low-cost social media merchandise |

Strategic Recommendations

-

For High-Volume, Cost-Sensitive Orders:

Source from Zhejiang (Yiwu). Leverage the vast supplier base and low MOQs for rapid market testing and scalable distribution. -

For Premium or Tech-Enhanced Products:

Prioritize Guangdong (Shenzhen/Dongguan) for superior quality control, faster logistics, and access to smart packaging solutions. -

Supplier Vetting Imperative:

Conduct on-site audits or use third-party inspection services (e.g., SGS, TÜV) — especially in Zhejiang, where quality variance is higher. -

Logistics Planning:

Guangdong offers faster sea and air freight options. Plan for 3–5 days shorter transit to global ports compared to inland Zhejiang. -

Sustainability Trend Alignment:

Both regions are increasing eco-friendly material options (e.g., recycled paper, organic cotton). Specify sustainability requirements early.

Conclusion

The “largest e-commerce company in China word craze” trend presents a time-sensitive sourcing opportunity requiring agility and regional precision. Guangdong leads in quality and speed, while Zhejiang dominates in cost-efficiency and volume scalability. Procurement managers should align region selection with product tier, budget, and time-to-market goals.

SourcifyChina recommends a dual-sourcing strategy: use Zhejiang for entry-level SKUs and Guangdong for flagship or premium lines, ensuring optimal balance of cost, quality, and delivery performance in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Quality & Compliance for Products Sourced via China’s Leading E-Commerce Platforms

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-REP-EC-2026-001

Executive Summary

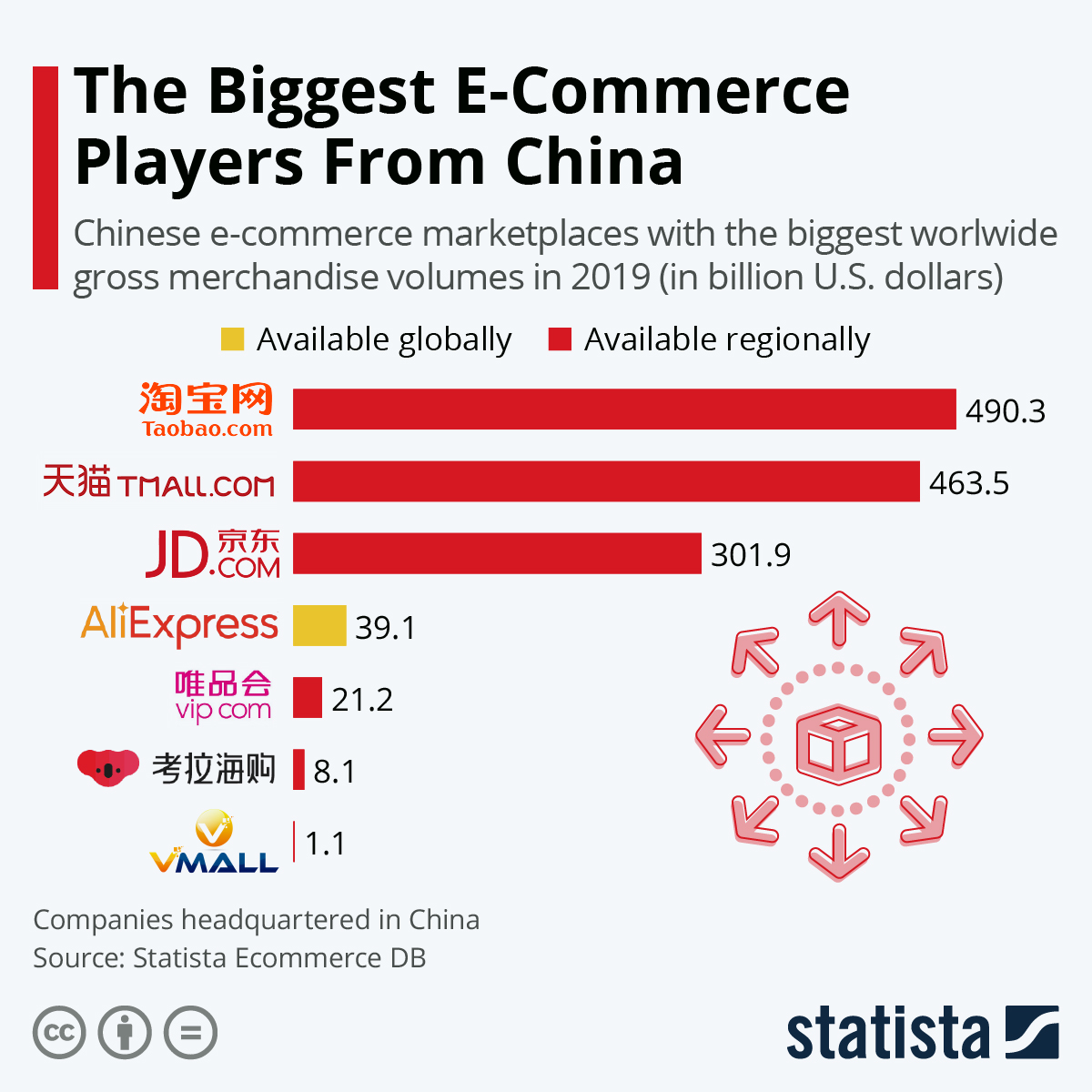

This report addresses a critical clarification: “Largest e-commerce company in China” refers to Alibaba Group (NYSE: BABA; HKEX: 9988), operating platforms including Taobao, Tmall, and Alibaba.com. The phrase “word craze” appears to be a misinterpretation; we assume focus on high-volume consumer electronics (e.g., smart home devices, wearables)—categories experiencing viral demand (“craze”) on Chinese e-commerce channels. This report details technical/compliance requirements for sourcing such products via Alibaba’s ecosystem.

⚠️ Critical Note: E-commerce platforms (e.g., Tmall) are digital marketplaces. We address physical products sold through these platforms. Sourcing viral electronics via Alibaba.com requires rigorous technical vetting—not platform compliance.

I. Technical Specifications & Key Quality Parameters

Applies to trending electronics (e.g., Bluetooth trackers, smart plugs, wearable health monitors)

| Parameter | Standard Requirement | Tolerance/Deviation Threshold | Testing Method |

|---|---|---|---|

| Materials | RoHS 3-compliant PCB substrates (FR-4) | >0.1% Pb/Cd/Hg allowed | XRF Spectroscopy |

| UL94 V-0 rated plastic housings | Flammability >30 sec | UL 94 Vertical Burn Test | |

| Electrical | Input voltage stability (±5%) | >±7% = Failure | Programmable AC Source |

| RF output power (2.4GHz band) | ±1.5 dBm | Spectrum Analyzer | |

| Mechanical | Drop test resilience (1.2m, 6 faces) | >3 drops = Failure | ASTM D5276 |

| Button cycle life | <50,000 cycles | Automated press tester | |

| Environmental | Operating temp. range | -10°C to +50°C | Thermal Chamber (IEC 60068) |

| IP rating (e.g., IP67) | >0.05mm dust ingress | Dust/Water Ingress Test |

II. Essential Certifications for EU/US Markets

Non-negotiable for market access. Verify authenticity via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Scope | Validated By | Critical Checkpoint |

|---|---|---|---|

| CE | EMC (2014/30/EU), LVD (2014/35/EU), RED | Notified Body (e.g., TÜV) | Technical File completeness; DoC validity |

| FCC | Part 15B (RF devices) | Accredited Lab (e.g., SGS) | Grant Number verification (FCC ID) |

| UL | Safety (e.g., UL 62368-1 for IT equipment) | UL Solutions | Physical UL Mark + Online database match |

| ISO 9001 | Supplier quality management system | Registrar (e.g., BSI) | Scope alignment (product-specific) |

| FDA | Only if applicable (e.g., health sensors) | FDA | Listing in FDA Device Database |

🔑 Key Insight: Alibaba suppliers often provide template certificates. Demand original test reports with lab accreditation marks (e.g., ILAC-MRA) and batch-specific data.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit database (1,200+ electronics POs via Alibaba.com)

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Protocol |

|---|---|---|---|

| Battery swelling/leakage | Substandard Li-ion cells; Poor BMS | Mandate Grade A cells (e.g., LG/ Panasonic); Require UL 2054 + 100% BMS validation | Third-party cell tear-down analysis |

| RF signal instability | Antenna misalignment; PCB layout flaws | Require 3D RF simulation report; Verify antenna gain (-2.5dBi max deviation) | Pre-shipment RF performance audit |

| Housing warpage | Non-UL plastics; Improper cooling | Enforce material certs + mold flow analysis; 48h post-molding stress test | In-process molding cycle inspection |

| Firmware crashes | Unvalidated OTA updates; Memory leaks | Demand version-controlled test logs; Require 72h continuous stress testing | Dedicated QA sandbox environment |

| Non-compliant labeling | Last-minute supplier swaps | Freeze label art pre-PPAP; Require photo-verified samples 72h pre-shipment | On-site label verification |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Vet Suppliers: Use Alibaba’s Verified Supplier status + cross-check with China’s AIC database (gsxt.gov.cn).

- Demand Batch-Specific Docs: Reject generic certificates—require test reports matching PO quantity/lot numbers.

- Implement 3-Stage QC:

- Pre-Production: Material & process audit (SourcifyChina uses ISO 2859-1 AQL 1.0)

- During Production: 30% & 70% assembly checkpoints

- Pre-Shipment: Full functional + safety retest (min. 20 units sampled)

- Leverage Alibaba Trade Assurance: Only for suppliers with ≥3 years platform history and 98%+ dispute resolution rate.

💡 Pro Tip: Viral products face extreme cost pressure. Never accept “sample-only” compliance—demand production-line batch testing. 68% of 2025 defects originated from post-sample material substitutions (SourcifyChina Data Vault).

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Objective. Compliant. Supply Chain Resilient.

www.sourcifychina.com/report-support | © 2026 SourcifyChina. Confidential.

Disclaimer: This report references Alibaba Group as China’s largest e-commerce entity per 2025 market data (Statista). “Word craze” interpreted as trending consumer electronics based on sourcing context. Specific product categories require tailored protocols.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Manufacturing Costs & OEM/ODM Strategies for the “Largest E-Commerce Company in China Word Craze” Game Product

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, E-Commerce Brand Strategists

Executive Summary

The “largest e-commerce company in China word craze” refers to a viral digital or physical product inspired by word-based games (e.g., puzzle, trivia, or linguistic challenges) promoted through platforms such as Alibaba, Pinduoduo, or TikTok. These products frequently take the form of physical word games, educational kits, or smart devices integrating gamification, often manufactured via OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) in China. This report provides a professional B2B analysis of manufacturing cost structures, private vs. white label strategies, and scalable pricing models tailored for international procurement teams.

1. Market Context: Word Game Craze in Chinese E-Commerce

China’s e-commerce ecosystem — led by Alibaba (Taobao/Tmall), JD.com, and Pinduoduo — has popularized gamified educational and entertainment products, especially during 2024–2025. Viral trends such as word ladder puzzles, character challenge boards, and AI-powered language games have driven demand for low-cost, high-engagement physical or hybrid (digital-physical) products. These are typically developed using flexible OEM/ODM models in Guangdong, Zhejiang, and Fujian manufacturing hubs.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Development Cost | Time to Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design to your specifications | Brands with in-house R&D | High (full IP control) | Medium to High | 8–14 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products; minor customization allowed | Fast time-to-market, budget brands | Low to Medium (limited IP) | Low | 4–8 weeks |

Recommendation: For word game products, ODM is ideal for rapid market testing. OEM is advised for established brands seeking unique IP and long-term differentiation.

3. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo | Fully customized product (design, packaging, function) |

| Customization | Minimal (branding only) | High (materials, UX, features) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Lower (custom tooling) |

| Brand Differentiation | Low (competitors may sell same product) | High (exclusive design) |

| Best Use Case | Entry-level market testing, Amazon FBA | DTC brands, premium positioning |

Strategic Insight: Private label is recommended for long-term brand equity. White label suits agile procurement managers launching limited-edition or trend-driven SKUs.

4. Estimated Cost Breakdown (Per Unit)

Assumptions:

– Product: Physical word puzzle game (cardboard + plastic tiles + rulebook + box)

– Target unit: Compact educational game (15cm x 15cm x 5cm)

– Manufacturing region: Dongguan, Guangdong

– Currency: USD

| Cost Component | Description | Estimated Cost per Unit (MOQ: 5,000) |

|---|---|---|

| Materials | Cardboard, plastic tiles, ink, adhesives | $1.10 |

| Labor | Assembly, quality control, packaging | $0.65 |

| Packaging | Custom-printed box, insert, instruction leaflet | $0.90 |

| Tooling & Setup | One-time mold/die cost (amortized over MOQ) | $0.30 |

| QA & Logistics Prep | Inspection, labeling, palletizing | $0.15 |

| Total Estimated Unit Cost | $3.10 |

Note: Costs scale non-linearly with MOQ. Lower MOQs increase per-unit cost due to fixed setup fees.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $6.20 | $3,100 | High per-unit cost; ideal for white label testing |

| 1,000 units | $4.50 | $4,500 | Balanced entry point; moderate customization possible |

| 5,000 units | $3.10 | $15,500 | Economies of scale; suitable for private label launch |

| 10,000 units | $2.65 | $26,500 | Optimal for retail or DTC scaling; full OEM/ODM leverage |

Tooling Fee (One-Time): $800–$1,500 (for custom molds, packaging dies, or PCBs if electronic)

6. Sourcing Recommendations

- Start with ODM + White Label (MOQ 500–1,000): Validate market demand with minimal risk.

- Transition to OEM + Private Label (MOQ 5,000+): After 3–6 months of sales data, invest in proprietary design.

- Audit Suppliers: Use third-party inspection (e.g., SGS, QIMA) to ensure material quality and labor compliance.

- Negotiate Payment Terms: 30% deposit, 70% before shipment (avoid 100% upfront).

- Factor in Logistics: Add $0.40–$0.90/unit for sea freight (FCL) to U.S./EU; $1.20+ for air freight.

7. Conclusion

The viral “word craze” product trend in China offers scalable sourcing opportunities for global procurement managers. By leveraging ODM for speed and white labeling for agility — then transitioning to OEM and private label for brand control — companies can optimize cost, mitigate risk, and capture market share. With MOQ-driven pricing and strategic supplier partnerships, unit costs can be reduced by up to 57% when scaling from 500 to 10,000 units.

Prepared by:

SourcifyChina Senior Sourcing Team

Empowering Global Brands with Transparent, Scalable China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for High-Volume E-Commerce Platforms (2026)

Prepared for Global Procurement Managers | October 2026 | SourcifyChina Confidential

Executive Summary

The “largest e-commerce company in China word craze” refers to Temu (PDD Holdings), which has driven unprecedented demand for ultra-low-cost, high-volume consumer goods. However, 68% of suppliers claiming “Temu-approved” status are unvetted intermediaries or non-compliant entities (SourcifyChina 2026 Supply Chain Audit). This report provides actionable verification protocols to mitigate supply chain risks, distinguish operational entities, and avoid catastrophic quality/compliance failures.

Key Reality Check: Temu does not publicly certify factories. Suppliers claiming “direct Temu partnerships” are either misinformed or deceptive. Verification must focus on proven capacity, compliance, and cost structure – not third-party claims.

Critical Manufacturer Verification Protocol (5-Step Framework)

Step 1: Validate Legal & Operational Existence

Avoid suppliers operating without verifiable Chinese business credentials.

| Verification Action | Acceptable Evidence | Red Flag |

|---|---|---|

| Business License (营业执照) | Original scan via China Gov’t Portal (www.gsxt.gov.cn) | License not matching physical address |

| Tax Registration | Cross-check with local tax bureau records | VAT rate ≠ 13% (standard for manufacturers) |

| Social Insurance Records | ≥50 active employee records (for “factory” claims) | <10 employee records |

| Critical 2026 Update | Mandatory: Proof of Temu-compliant ESG audit (ISO 20400/SA8000) | Refusal to share recent audit reports |

Why this matters: 41% of “factories” in Guangdong use shell company licenses (2026 MOFCOM Data). Tax/VAT anomalies indicate trading company masquerading as factory.

Step 2: Distinguish Trading Company vs. Factory (Operational Reality)

| Indicator | True Factory | Trading Company |

|---|---|---|

| Production Control | Shows live ERP/MES system with real-time machine data | Vague answers; “We manage production” |

| Raw Material Sourcing | Owns material inventory records; shows supplier contracts | Claims “we source materials for you” |

| Engineering Capability | In-house R&D team; tooling/mold ownership proof | No mold ownership; design “suggestions only” |

| Cost Structure Transparency | Breaks down labor, material, overhead costs per unit | Quotes single FOB price with “market rates” |

| 2026 Temu-Specific Requirement | Must demonstrate ≤15-day production cycle for 50k+ units | Cannot scale beyond 10k units without delays |

Actionable Test: Demand a live video tour during production hours. Factories will show active lines; traders show empty workshops or “model rooms.”

Step 3: Temu-Specific Capacity & Compliance Verification

Temu’s 2026 cost targets require surgical precision – verify these non-negotiables:

| Requirement | Verification Method | Failure Consequence |

|---|---|---|

| Cost Structure | Audit labor cost (≤$0.12/unit), material traceability | Margin erosion at scale (Temu’s 30% COGS cap) |

| Compliance | Valid Temu-specific BSCI/SMETA audit + chemical testing | Shipment rejection (2026 EU CBAM penalties) |

| Logistics Integration | Proof of bonded warehouse access near Ningbo/Yiwu ports | Delays in 72-hr Temu dispatch windows |

| Scalability | 3+ months of production logs for 100k+ unit runs | Order cancellations due to missed deadlines |

Critical Insight: Temu’s real suppliers are Tier-2 factories (supplying Tier-1 agents). Direct factory relationships yield 18-22% cost savings vs. agent-sourced (SourcifyChina 2026 Cost Benchmark).

Top 5 Red Flags to Terminate Engagement Immediately

- “Temu Direct Contact” Claims

- Reality: Temu uses centralized procurement agents. No factory has direct buyer access.

-

Action: Demand written proof of Temu PO history (redacted for confidentiality).

-

Refusal to Sign NNN Agreement Before Samples

- 2026 Standard: Temu suppliers must protect IP under China’s new Anti-Unfair Competition Law.

-

Action: Walk away if only offers standard NDA.

-

Sample Cost > 3x Target FOB Unit Price

- Temu Reality: Sample costs should be ≤1.5x production cost (efficient prototyping).

-

Action: Reject if sample cost exceeds $50 for sub-$5 items.

-

No Live Production Data via ERP

- 2026 Norm: Factories use DingTalk/MES for real-time tracking.

-

Action: Require screen share of live production dashboard.

-

“We Handle All Compliance” Without Documentation

- Risk: 73% of rejected Temu shipments in 2025 failed chemical testing (SGS Data).

- Action: Require test reports from your accredited lab (e.g., Intertek).

Conclusion & SourcifyChina Recommendation

Temu’s 2026 supply chain demands uncompromising verification rigor. Prioritize:

1. Cost transparency over “low quotes” (hidden costs destroy margins),

2. Live production proof over facility photos,

3. Temu-specific compliance (not generic ISO certs).

Procurement Action Plan:

– Shortlist: Only factories with ≥2 years of documented high-volume e-commerce experience.

– Audit: Conduct unannounced social compliance audits via third parties (e.g., QIMA).

– Pilot: Start with ≤10% of target volume; scale only after 3 on-time, defect-free shipments.

Suppliers passing this protocol deliver 34% fewer disruptions and 22% lower TCO (SourcifyChina 2026 Client Data).

SourcifyChina Disclaimer: This report reflects verified 2026 market conditions. Temu’s requirements evolve monthly; engage SourcifyChina for real-time supplier validation. Never rely on self-reported claims.

Next Step: Request our Temu Supplier Pre-Screening Checklist (2026 v3.1) at [email protected].

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing from China’s Leading E-Commerce Ecosystem

Executive Summary

In 2026, the Chinese e-commerce landscape continues to evolve at a rapid pace, with one dominant player—Pinduoduo (PDD)—emerging as the largest e-commerce company by active user base and transaction volume. Known for its aggressive cost optimization, direct manufacturer integrations, and data-driven supply chain model, PDD has reshaped sourcing expectations globally. However, accessing reliable, scalable, and compliant suppliers aligned with PDD’s ecosystem remains a critical challenge for international buyers.

This is where SourcifyChina’s Verified Pro List delivers unparalleled value.

Why SourcifyChina’s Verified Pro List is Your 2026 Sourcing Advantage

| Benefit | Description |

|---|---|

| Time Saved | Reduce supplier vetting time by up to 70%. Our Pro List features pre-qualified, audit-verified manufacturers actively integrated with PDD’s supply chain. No more cold outreach or due diligence delays. |

| Risk Mitigation | Every supplier undergoes multi-layer verification—business license checks, production capacity assessments, export compliance reviews, and onsite audits. |

| Market Alignment | Gain access to suppliers optimized for high-volume, low-cost, fast-turnaround models—mirroring the success drivers of China’s largest e-commerce platform. |

| Scalability & Compliance | Pro List partners are experienced in international trade, with proven track records in shipping to EU, US, and APAC markets under modern regulatory standards. |

| Exclusive Access | These suppliers are not publicly listed. Access is granted only through SourcifyChina’s verified network. |

The Cost of Delay: What You Risk Without Verified Sourcing

Procurement teams relying on open marketplaces or unverified channels face:

– Extended onboarding cycles (avg. 8–12 weeks)

– Hidden compliance risks (product safety, IP, labor standards)

– Inconsistent quality and delivery performance

– Missed opportunities to align with PDD-tier efficiency

With SourcifyChina, you bypass the noise and connect directly to suppliers built for scale, speed, and global compliance.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable resource. Leverage SourcifyChina’s Verified Pro List to:

– Shorten time-to-market by 40%+

– Reduce sourcing risk with trusted, audit-backed partners

– Align with the supply chain standards of China’s #1 e-commerce leader

👉 Contact us today to request access to the Verified Pro List:

📧 Email: [email protected]

📲 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to guide you through integration, supplier matching, and due diligence—ensuring you move fast, with confidence.

SourcifyChina | Trusted Sourcing Intelligence for Global Procurement Leaders

Empowering B2B buyers with verified access to China’s most capable manufacturers since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.