The global firewood splitter market is experiencing steady growth, driven by rising demand for efficient wood processing in residential, agricultural, and commercial applications. According to Grand View Research, the global log splitter market size was valued at USD 548.6 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by increasing adoption of mechanized forestry equipment, a resurgence in wood-burning heating systems, and expanding rural infrastructure development. As demand for high-capacity, durable firewood splitters rises—particularly among large-scale operators and industrial users—manufacturers are scaling innovation in hydraulic power, splitting force, and operational efficiency. In this competitive landscape, a select group of industry leaders has emerged, combining engineering excellence with global distribution networks to meet growing needs. Below are the top nine large firewood splitter manufacturers shaping the market in 2024.

Top 9 Large Firewood Splitter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Eastonmade Wood Splitters

Domain Est. 2014

Website: eastonmadewoodsplitters.com

Key Highlights: Eastonmade Wood Splitters high quality industrial grade firewood equipment, log splitters, firewood processors and more!…

#2 BruteForce USA

Domain Est. 2020

Website: bruteforceusa.com

Key Highlights: BruteForce USA is a quality manufacturer of heavy-duty, commercial-grade firewood processors, log splitters, firewood bundlers, firewood conveyors, ……

#3 Log Splitters

Domain Est. 1996

#4 Wood Splitters

Domain Est. 1998

Website: hud-son.com

Key Highlights: Hud-Son wood splitters are towable and built tough. Many styles and sizes available to meet your firewood splitting needs….

#5 DYNA Products

Domain Est. 2005

Website: dyna-products.com

Key Highlights: DYNA Products, a market leader in the firewood processor and Wood Chipper industry. Visit DYNA today for equipment for sale and rent!…

#6 All Wood Log Splitters

Domain Est. 2010

Website: allwoodlogsplitters.com

Key Highlights: All of our log splitters come with a hydraulic log lift, hydraulic wedge lift, Honda GX series engine, torsion axle, highway tires and quality hydraulic ……

#7 Boss Log Splitters: Hydraulic Log Splitters & Accessories

Domain Est. 2012

#8 Log Splitters

Domain Est. 2012

Website: ruggedmade.com

Key Highlights: Shop commercial gas-powered, electric, and pull-start-engine log splitters at the best prices for all your wood splitting jobs….

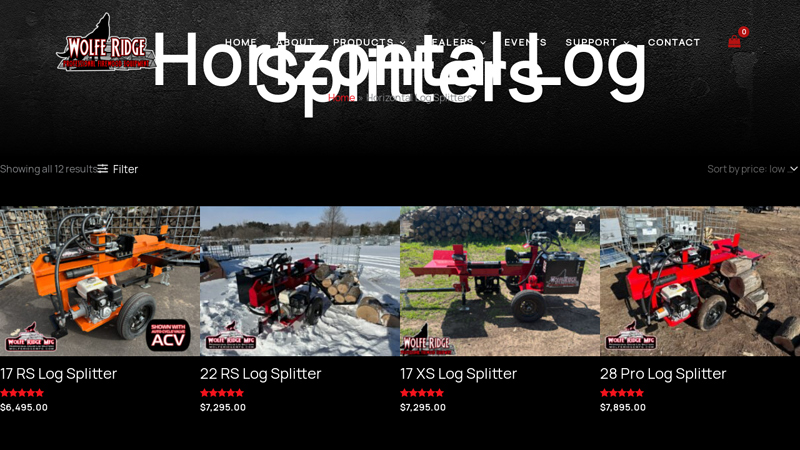

#9 Horizontal Log Splitters

Domain Est. 2015

Website: wolferidgemfg.com

Key Highlights: Horizontal Log Splitters ; 17 RS Log Splitter · 6,495.00 ; 22 RS Log Splitter · 7,295.00 ; 17 XS Log Splitter · 7,295.00 ; 28 Pro Log Splitter · 7,895.00 ; 28 Pro-X Log ……

Expert Sourcing Insights for Large Firewood Splitter

H2: 2026 Market Trends for Large Firewood Splitters

The global market for large firewood splitters is poised for steady growth and transformation by 2026, driven by a combination of environmental, economic, and technological factors. As demand for sustainable heating alternatives rises and rural electrification expands, large-capacity wood splitters are becoming essential tools for homeowners, land managers, and commercial firewood producers. Below are the key trends shaping the large firewood splitter market in 2026:

-

Increased Demand for Off-Grid and Renewable Heating Solutions

With rising energy costs and growing concerns over carbon emissions, more households—especially in colder climates—are turning to wood-burning stoves and boilers as reliable, renewable heating sources. This shift is fueling demand for efficient, high-capacity firewood processing equipment. Large firewood splitters, capable of handling logs over 24 inches in diameter and producing high volumes of split wood, are increasingly adopted by both individual users and small businesses. -

Growth in Commercial Firewood Production

The commercial firewood industry is expanding, particularly in North America, Northern Europe, and parts of Asia. Entrepreneurs and forestry businesses are investing in large hydraulic and horizontal splitters to meet rising consumer demand for seasoned firewood. By 2026, this segment is expected to account for a significant share of large splitter sales, driven by profitability and low entry barriers in rural economies. -

Technological Advancements and Automation

Manufacturers are integrating smart technologies into large firewood splitters, including electric start systems, programmable cycle controls, and enhanced safety features like automatic reset and overload protection. Some premium models now offer IoT connectivity for remote monitoring and maintenance alerts. These innovations improve efficiency, reduce operator fatigue, and appeal to tech-savvy users. -

Shift Toward Hydraulic and High-Tonnage Models

High-tonnage hydraulic splitters (30+ tons) are gaining preference due to their ability to handle dense hardwoods like oak and hickory. Horizontal and vertical-horizontal combination models dominate the large splitter category, offering versatility and higher throughput. By 2026, hydraulic systems are expected to outperform kinetic (screw or cone) splitters in both residential and commercial applications. -

Sustainability and Eco-Friendly Design

Environmental regulations and consumer preferences are pushing manufacturers to adopt greener practices. This includes using recyclable materials, reducing hydraulic fluid leakage, and offering electric or PTO-powered models that lower carbon emissions compared to gas-powered units. Electric large splitters, powered by solar-charged batteries or grid electricity, are particularly emerging in eco-conscious markets. -

Regional Market Dynamics

North America remains the largest market for large firewood splitters due to abundant forest resources and a strong culture of wood heating. Europe follows closely, especially in Scandinavian and Alpine countries where wood is a primary heating source. In contrast, Asia-Pacific is witnessing rapid growth, particularly in Japan and South Korea, where wood-burning stoves are gaining popularity among rural and suburban homeowners. -

Supply Chain and Raw Material Challenges

The market faces intermittent disruptions due to steel price volatility and semiconductor shortages affecting electronic components. However, by 2026, manufacturers are expected to stabilize supply chains through regional sourcing and modular designs that simplify production and repair. -

Rise of E-Commerce and Direct-to-Consumer Sales

Online platforms are becoming key distribution channels for large firewood splitters. Brands are leveraging digital marketing, customer reviews, and video demonstrations to reach rural and remote buyers. Subscription-based maintenance packages and bundled accessory kits are also enhancing consumer appeal.

In summary, the 2026 market for large firewood splitters is characterized by innovation, sustainability, and expanding commercial use. As energy independence and environmental responsibility become priorities, the demand for robust, efficient, and user-friendly splitters will continue to rise, positioning the sector for sustained growth in the coming years.

Common Pitfalls When Sourcing a Large Firewood Splitter (Quality, IP)

Sourcing a large firewood splitter involves significant investment and operational impact, making it crucial to avoid common pitfalls related to quality and intellectual property (IP). Overlooking these areas can result in equipment failure, legal issues, and long-term financial losses.

Poor Build Quality and Material Selection

Many suppliers cut costs by using substandard steel, weak welds, or inferior hydraulic components. This leads to premature wear, frequent breakdowns, and safety hazards—especially under the high stress of splitting large logs. Always verify material specifications (e.g., grade of steel, cylinder wall thickness) and request third-party quality certifications.

Inadequate Hydraulic System Design

Low-quality splitters often feature undersized pumps, unreliable valves, or poorly routed hydraulic lines. These flaws reduce splitting force, increase cycle times, and raise the risk of leaks or system failure. Ensure the hydraulic system is appropriately sized for continuous heavy-duty use and complies with industry standards.

Lack of IP Protection and Risk of Infringement

Sourcing from manufacturers that copy patented designs—such as unique beam configurations, safety interlocks, or self-feeding mechanisms—exposes buyers to legal liability. Always confirm that the equipment does not infringe on existing patents, especially from well-known brands. Request documentation showing IP clearance or original design rights.

Misrepresentation of Performance Claims

Some suppliers exaggerate tonnage ratings or cycle speeds without real-world testing data. A splitter rated at 30 tons may deliver far less effective force due to inefficient hydraulics or frame flex. Demand verified performance reports or on-site demonstrations before purchase.

Insufficient Safety Features

High-capacity splitters require robust safety mechanisms, such as two-hand start, emergency stop systems, and protective shielding. Avoid models that omit these features to reduce costs, as they increase operator risk and may violate workplace safety regulations.

Absence of Warranty and After-Sales Support

Low-cost splitters often come with limited or voidable warranties and poor technical support. Without reliable service and spare parts availability, downtime can cripple operations. Choose suppliers with clear, comprehensive warranties and a proven service network.

Counterfeit or Reverse-Engineered Equipment

Some manufacturers produce near-identical copies of premium models, violating IP rights and offering inferior reliability. These units may lack engineering validation and fail under sustained load. Verify the manufacturer’s originality through design documentation and customer references.

Avoiding these pitfalls requires due diligence: inspect build quality firsthand, verify IP legitimacy, validate performance claims, and choose reputable suppliers with strong support infrastructure.

Logistics & Compliance Guide for Large Firewood Splitter

Overview

Large firewood splitters are heavy, industrial-grade machines used to process logs into firewood. Proper logistics planning and regulatory compliance are essential to ensure safe transportation, legal operation, and environmental responsibility throughout the equipment lifecycle—from manufacturing to end use.

Transportation & Handling

Weight and Dimensions

Large firewood splitters typically weigh between 1,500 to 5,000+ pounds and vary in length from 6 to 12 feet. Accurate dimensions and weight must be confirmed before shipping to comply with transportation regulations and select appropriate lifting and transport methods.

Loading and Unloading

Use forklifts, skid steers, or telehandlers with sufficient lift capacity. Ensure equipment is secured with straps or chains during transit. Use ramps rated for the machine’s weight when loading onto trailers. Never transport with hydraulic cylinders extended.

Transport Vehicles

Use flatbed trailers, enclosed utility trailers, or lowboy trailers. Confirm axle weight limits and overall trailer GVWR (Gross Vehicle Weight Rating). Secure the splitter with at least four tie-downs per DOT regulations in the U.S. (FMCSA Part 393).

Permits and Routing

For oversized loads (exceeding state width, height, or weight limits), obtain oversize/overweight permits. Plan routes to avoid low bridges, narrow roads, or weight-restricted bridges. Escort vehicles may be required.

Regulatory Compliance

Federal Motor Carrier Safety Administration (FMCSA) – U.S.

Ensure carriers comply with FMCSA standards for commercial vehicle operation, including driver qualifications, hours of service, and vehicle maintenance. Proper load securement is mandatory under FMCSA Part 393.

Department of Transportation (DOT) Placarding

If transporting fuel (e.g., hydraulic oil or diesel-powered splitters), follow DOT Hazardous Materials Regulations (49 CFR) when applicable. Most firewood splitters do not require placards unless carrying significant quantities of flammable liquids.

Environmental Protection Agency (EPA) – U.S.

Splitter engines must meet EPA Tier 4 emission standards if powered by diesel or gasoline. Ensure compliance documentation is available from the manufacturer. Used oil and hydraulic fluid must be disposed of per EPA regulations.

Occupational Safety and Health Administration (OSHA) – U.S.

Handlers and operators must follow OSHA safety standards. Provide training on machine operation, lockout/tagout (LOTO) procedures, and personal protective equipment (PPE). Guard all moving parts during operation.

International Shipping Considerations

Customs Documentation

Prepare commercial invoice, bill of lading, packing list, and certificate of origin. Declare the HS Code (e.g., 8433.30 for agricultural or forestry machinery) accurately to avoid delays.

Import Duties and Tariffs

Research import duties in the destination country. Some nations impose additional tariffs on heavy machinery. Confirm if the splitter meets local technical standards (e.g., CE marking in the EU, CSA in Canada).

Packaging and Crating

Use weather-resistant, secured wooden crates for ocean freight. Include desiccants to prevent rust. Clearly label with handling instructions (e.g., “Do Not Invert,” “Fragile,” “This Side Up”).

Operational Compliance

Noise Regulations

Large splitters can exceed 85 dB. Comply with local noise ordinances, especially in residential areas. Use sound-dampening enclosures or operate during permitted hours.

Emissions and Air Quality

Ensure engine emissions meet regional standards. Avoid operating in areas with air quality alerts or burn bans. Maintain engines to minimize smoke and particulate output.

Worker Safety Standards

Follow ANSI B175.1 or CSA Z299.2 standards for portable power equipment. Conduct regular maintenance and safety inspections. Install emergency shut-offs and safety shields.

Maintenance & End-of-Life Compliance

Fluid Management

Dispose of used hydraulic fluid, engine oil, and coolant through certified waste handlers. Never drain fluids into soil or storm drains. Store waste fluids in labeled, sealed containers.

Equipment Disposal

Recycle metal components through certified scrap metal recyclers. Follow local regulations for hazardous waste (e.g., batteries, contaminated filters). Document disposal for compliance audits.

Recordkeeping

Maintain logs of transportation, maintenance, safety training, and disposal activities. Retain records for a minimum of 3–5 years depending on jurisdiction.

Conclusion

Proper logistics and compliance for large firewood splitters involve coordinated planning across transportation, safety, environmental, and regulatory domains. Adhering to federal, state, and international standards ensures legal operation, protects personnel, and minimizes environmental impact. Consult local authorities and equipment manufacturers for region-specific requirements.

In conclusion, sourcing a large firewood splitter requires careful consideration of several key factors, including splitting capacity, power source (electric, hydraulic, or gas-powered), portability, durability, safety features, and overall cost. Evaluating your specific needs—such as volume of wood to be processed, frequency of use, and operating environment—will help narrow down the most suitable model. Additionally, researching reputable manufacturers, reading user reviews, and comparing warranties and customer support can ensure a reliable and long-term investment. By selecting a high-quality, appropriately sized firewood splitter from a trusted supplier, you can significantly increase efficiency, reduce physical labor, and meet your firewood processing demands effectively and safely.