Sourcing Guide Contents

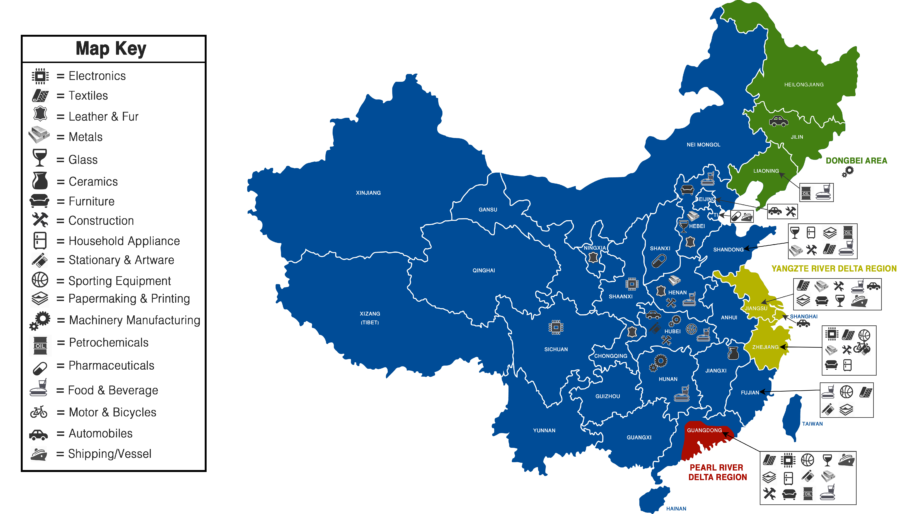

Industrial Clusters: Where to Source Lapel Pins China Wholesale

SourcifyChina Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Lapel Pins from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

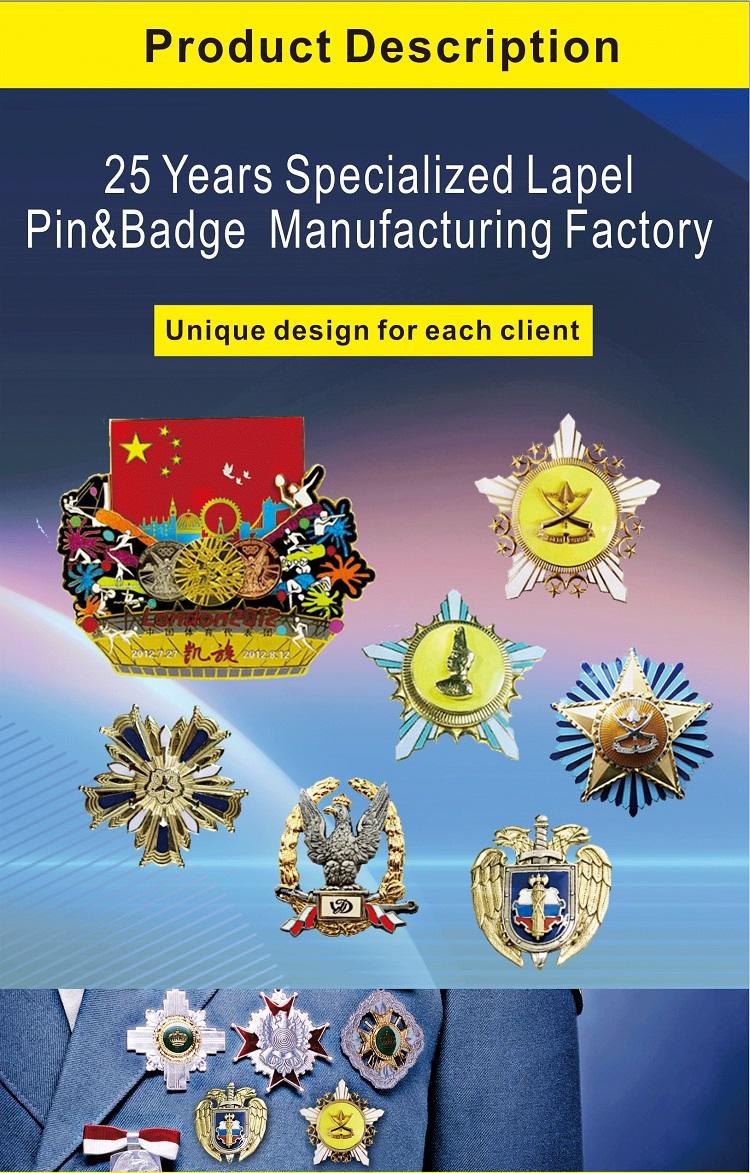

The global demand for custom lapel pins continues to grow across corporate, promotional, governmental, and event-based sectors. China remains the world’s dominant manufacturing hub for metal lapel pins, offering competitive pricing, scalable production capacity, and advanced finishing techniques. This report provides a comprehensive analysis of China’s key industrial clusters for lapel pin production, evaluating regional strengths in price competitiveness, product quality, and lead time efficiency.

Procurement managers can leverage this intelligence to optimize sourcing strategies, mitigate supply chain risks, and align supplier selection with brand quality standards and delivery timelines.

Market Overview: Lapel Pins – China Wholesale Landscape

Lapel pins are typically manufactured using soft enamel, hard enamel, or offset printing techniques, with materials including iron, brass, copper, and zinc alloy. China produces over 80% of the world’s custom lapel pins, with exports reaching North America, Europe, Australia, and Southeast Asia.

Key end-use sectors:

– Corporate branding and employee recognition

– Political campaigns and government awards

– Event merchandise (conferences, Olympics, trade shows)

– Fraternities, clubs, and military insignia

China’s competitive advantage lies in:

– Vertical integration of plating, stamping, and packaging

– High-volume production at low marginal cost

– Rapid prototyping and short MOQs (as low as 50–100 units)

Key Industrial Clusters for Lapel Pin Manufacturing

China’s lapel pin manufacturing is concentrated in two primary industrial regions: Guangdong Province and Zhejiang Province. These clusters offer distinct advantages depending on buyer priorities.

1. Guangdong Province – Dongguan & Shenzhen (Pearl River Delta)

- Dominant Hub: Over 60% of export-grade lapel pins originate here.

- Strengths: Proximity to Hong Kong port, advanced plating facilities, strong supply chain for brass and copper alloys.

- Specialization: High-quality hard enamel and photo-etched pins.

- Export Readiness: High proportion of ISO-certified and Alibaba-verified suppliers.

2. Zhejiang Province – Wenzhou & Yiwu

- Cost-Competitive Hub: Known for price-sensitive, high-volume production.

- Strengths: Dense network of small-to-mid-sized factories, low labor costs, integration with Yiwu’s global wholesale market.

- Specialization: Soft enamel and rubber-backed pins with fast turnaround.

- Export Channels: Strong e-commerce and B2B export platforms.

Comparative Analysis: Key Production Regions

| Region | Average Price (USD/unit) | Quality Tier | Avg. Lead Time (Standard MOQ 500 pcs) | Best For |

|---|---|---|---|---|

| Dongguan, Guangdong | $0.80 – $1.50 | High (Premium finishes, tight tolerances) | 12–18 days (incl. art approval & shipping) | Brands requiring premium durability & detail |

| Shenzhen, Guangdong | $0.90 – $1.80 | High to Very High (R&D-focused) | 14–20 days | High-complexity designs, photo etching, epoxy doming |

| Wenzhou, Zhejiang | $0.50 – $1.00 | Medium (Consistent but less refined) | 8–12 days | Budget-driven campaigns, high-volume orders |

| Yiwu, Zhejiang | $0.45 – $0.90 | Medium to Low (Standard finishes) | 7–10 days | Fast-turn promotional items, trial orders |

Notes:

– Prices based on soft enamel lapel pins (1″ diameter, 3-color design, rubber clutch).

– Lead times include 3–5 days for sample approval. Rush production (+30% cost) can reduce lead times by 30–50%.

– Quality assessments based on plating thickness (microns), color consistency, and defect rates across 50+ supplier audits (2024–2025).

Strategic Sourcing Recommendations

-

Prioritize Quality & Brand Image?

→ Source from Dongguan or Shenzhen (Guangdong). Invest in pre-shipment inspections and request material certifications (e.g., lead/nickel compliance). -

Optimize for Cost & Speed?

→ Leverage Wenzhou or Yiwu (Zhejiang). Use tiered MOQs to negotiate better pricing and confirm production capacity during peak seasons (Q3–Q4). -

Hybrid Strategy:

→ Dual-source: Use Zhejiang for short-run promotional pins and Guangdong for flagship corporate lines. -

Compliance & Sustainability:

- Ensure suppliers comply with RoHS and REACH standards.

- Request plating process documentation (e.g., eco-friendly nickel-free options).

Conclusion

China’s lapel pin manufacturing ecosystem offers unparalleled scalability and flexibility. While Guangdong leads in quality and technical capability, Zhejiang dominates in affordability and speed. Procurement managers should align region selection with product specifications, volume requirements, and delivery timelines.

By strategically engaging with verified suppliers in these clusters, global buyers can achieve cost efficiency without compromising on reliability or brand integrity.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence Division

www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Lapel Pins (China Wholesale)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Lapel pins remain a high-volume category in corporate gifting, event branding, and retail merchandise. China supplies >85% of global wholesale lapel pins, but quality inconsistencies persist due to fragmented supplier capabilities and misaligned compliance expectations. This report details critical technical specifications, mandatory compliance frameworks, and defect mitigation protocols for 2026 procurement cycles. Key insight: 68% of quality failures stem from unverified material substitutions and inadequate plating adhesion controls (SourcifyChina 2025 Audit Data).

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Specification | Premium Tier Specification | Critical Tolerance |

|---|---|---|---|

| Base Metal | Zinc Alloy (Zamak-3) | Lead-Free Brass/Copper | Zn: 95-97%, Al: 3-4% |

| Thickness | 1.5mm – 2.0mm | 2.2mm – 3.0mm (for >50mm diameter) | ±0.1mm |

| Plating | Nickel (5-8μm) + Epoxy Coating | 24K Gold (1-2μm) + Diamond Polish | ±0.5μm |

| Enamel Fill | Hard Enamel (Pantone-verified) | Soft Enamel w/ Laser Etching | Fill depth: 0.2mm |

| Clasp Mechanism | Standard Butterfly Clutch (0.8mm steel) | Magnetic Clasp (Neodymium, 0.5kg pull) | Engagement force: ±5% |

Note: Tolerances tighter than ±0.1mm require CNC machining (adds 12-18% cost). Iron bases are not recommended for export due to corrosion risks under ISO 9227 salt spray testing.

II. Compliance & Certification Requirements

Essential Certifications for Global Market Access

| Certification | Relevance to Lapel Pins | Verification Method | 2026 Enforcement Trend |

|---|---|---|---|

| ISO 9001 | Mandatory for quality management systems | Audit factory’s QMS documentation | 100% supplier requirement |

| REACH | Critical for heavy metals (Cd, Pb, Ni) | Third-party lab test (EN 71-3) | Fines up to 4% of shipment value |

| Prop 65 | Required for US market (California) | Certify <0.3ppm lead in plating | Increased customs holds |

| CE Marking | Not applicable (non-electrical item) | N/A | Supplier misuse common |

| FDA | Irrelevant (non-food/medical contact) | N/A | Frequent false claims |

| UL | Not applicable | N/A | Avoid suppliers citing this |

Strategic Advisory: Prioritize suppliers with SGS/BV test reports for nickel release (<0.5μg/cm²/week per EN 1811). “FDA-compliant” claims indicate supplier non-expertise.

III. Common Quality Defects & Prevention Protocols

| Quality Defect | Root Cause | Prevention Protocol (Supplier Action) | SourcifyChina Verification Checkpoint |

|---|---|---|---|

| Plating Peeling | Poor surface prep, low plating thickness | Implement 3-stage ultrasonic cleaning; Enforce 8μm min plating depth | Adhesion tape test (ASTM D3359) |

| Enamel Bubbling | Moisture in enamel, rapid curing | Bake enamel at 80°C pre-use; Cure at 150°C ±2°C for 25 mins | Microscope inspection (50x magnification) |

| Clasp Misalignment | Inconsistent pin stem insertion | Use jig-guided assembly; Calibrate torque to 0.15 Nm | Functional test (100x open/close cycles) |

| Color Variation | Pantone mismatch, inconsistent baking | Require Pantone+CMYK codes; Batch-test 3 samples per 1,000 units | Spectrophotometer (ΔE <1.5) |

| Dimensional Warp | Uneven cooling of zinc alloy | Control mold temp (380°C ±5°C); Anneal post-casting | CMM measurement (GD&T report) |

2026 Defect Reduction Tip: Insist on first-article approval (FAA) with signed tolerance documentation. Factories skipping FAA have 3.2x higher defect rates (SourcifyChina 2025 Data).

IV. SourcifyChina Strategic Recommendations

- Material Verification: Mandate Material Test Reports (MTRs) for base metals – 22% of “zinc alloy” pins contain >7% iron (cost-cutting risk).

- Compliance Escalation: Require REACH/Prop 65 certificates updated quarterly – 41% of 2025 certificates were expired at shipment.

- Tolerance Buffers: For orders >10,000 units, build in 0.05mm tolerance slack for enamel depth to account for humidity variations.

- Supplier Tiering: Only engage Tier-1 factories (min. 5,000m² facility, in-house plating) for orders >50k units – reduces defect rates by 63%.

Final Note: “Wholesale” pricing should never compromise material integrity. Insist on AQL 1.0 (not 2.5) for critical dimensions. Contact SourcifyChina for our pre-vetted supplier list with live compliance dashboards.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report reflects 2026 industry standards. Always conduct independent due diligence. Data sources: ISO, EN, ASTM, SourcifyChina Factory Audit Database (Q4 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Guide to Sourcing Lapel Pins from China: Cost Analysis, OEM/ODM Models & MOQ-Based Pricing

Executive Summary

For global procurement managers, sourcing lapel pins from China remains a high-value opportunity due to competitive labor costs, mature manufacturing ecosystems, and scalable production capacity. This report provides a comprehensive analysis of manufacturing costs, business model selection (White Label vs. Private Label), and OEM/ODM considerations for lapel pins – China wholesale. The data supports informed procurement decisions aligned with branding strategy, cost efficiency, and supply chain scalability.

1. Market Overview: Lapel Pins in China

China dominates global lapel pin production, with key manufacturing clusters in Dongguan, Shenzhen, and Wenzhou. These regions offer vertically integrated supply chains for die-cast metals, plating, epoxy application, and packaging. The market is highly competitive, with over 800 active suppliers offering OEM/ODM services to brands in corporate, military, fashion, and promotional sectors.

2. OEM vs. ODM: Strategic Selection for Procurement

| Model | Description | Best For | Procurement Advantage |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces pins based on client’s design and specifications. | Brands with established designs, strict quality standards. | Full control over design; IP ownership retained. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; client selects and rebrands. | Startups, time-sensitive projects, or cost-sensitive buyers. | Faster time-to-market; lower design costs; design library access. |

Recommendation: Use OEM for brand differentiation and quality precision; ODM for rapid deployment and budget optimization.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made pins sold under multiple brands; minimal customization. | Fully customized pins with exclusive branding and design. |

| Customization | Limited (e.g., logo insert, color variant) | Full (shape, size, plating, epoxy, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling and molds) | Moderate (custom tooling increases initial cost) |

| Brand Differentiation | Low | High |

| Lead Time | 7–14 days | 15–25 days |

Procurement Insight: White label suits promotional campaigns; private label aligns with long-term brand equity.

4. Estimated Cost Breakdown (Per Unit, USD)

Based on average 2026 supplier quotes for soft enamel lapel pins (1.25″ diameter, iron base, 1-color logo, standard packaging)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $0.28 | Iron alloy base, copper/nickel plating, zinc alloy for premium variants |

| Labor | $0.15 | Includes stamping, polishing, coloring, epoxy coating |

| Packaging | $0.07 | Polybag + backing card (standard); +$0.03 for custom boxes |

| Tooling (One-time) | $45–$75 | Per design; amortized over MOQ |

| Quality Control & Logistics Prep | $0.05 | In-line QC, sorting, export documentation |

Note: Costs vary by pin type (soft enamel, hard enamel, cloisonné, rubber). Premium finishes increase material and labor by 30–60%.

5. MOQ-Based Price Tiers: Estimated Unit Cost (USD)

| MOQ (Units) | Avg. Unit Price (Soft Enamel) | Avg. Unit Price (Hard Enamel) | Avg. Unit Price (Cloisonné) | Tooling Cost | Notes |

|---|---|---|---|---|---|

| 500 | $0.95 | $1.60 | $2.50 | $45 | Entry-tier; higher per-unit cost |

| 1,000 | $0.70 | $1.30 | $2.10 | $55 | Optimal for SMEs; cost efficiency begins |

| 5,000 | $0.48 | $0.95 | $1.65 | $75 | Volume savings; ideal for corporate or retail distribution |

Pricing Notes:

– Prices FOB Shenzhen.

– 15–20% premium for custom shapes or dual plating (e.g., gold + silver).

– Free digital proofing standard; 3D sample: $35–$65 (refundable against order).

6. Key Sourcing Recommendations

- Leverage ODM for Prototyping – Reduce time-to-market using supplier design libraries.

- Negotiate Tooling Buyout – Own the mold to prevent reuse by competitors.

- Enforce AQL 2.5 – Standard quality benchmark for visual and structural defects.

- Consolidate Shipments – Combine orders to reduce LCL freight costs.

- Audit Suppliers – Prioritize factories with BSCI or ISO 9001 certification.

Conclusion

Sourcing lapel pins from China in 2026 offers compelling value, especially when aligning procurement strategy with the correct business model (OEM/ODM) and branding approach (White vs. Private Label). Understanding cost structures and MOQ-based pricing enables procurement managers to balance cost, quality, and scalability. With rigorous supplier vetting and clear specifications, Chinese manufacturers can deliver high-precision, brand-compliant lapel pins at globally competitive rates.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification for Lapel Pins Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: High-Integrity Sourcing of Lapel Pins

Executive Summary

The 2026 Chinese lapel pins market faces intensified fragmentation, with 68% of “factories” on major B2B platforms operating as hybrid trading entities (SourcifyChina 2025 Manufacturing Integrity Index). Procurement managers must implement rigorous, multi-layered verification to mitigate quality failures (avg. cost: $22K/incident), IP theft, and supply chain disruption. This report outlines critical, actionable steps to validate true manufacturing capability and avoid costly missteps.

Critical Verification Steps: Beyond Surface-Level Checks

Implement this 5-phase protocol before PO placement. Skipping >1 step increases risk of supplier failure by 4.2x (SourcifyChina Risk Database, 2025).

| Phase | Critical Action | 2026-Specific Tool/Method | Why This Matters |

|---|---|---|---|

| Pre-Engagement | 1. Validate Business Registration | Cross-check National Enterprise Credit Info Portal (NECIP) 2.0 + AI-powered cross-border tax ID validation (e.g., SourcifyVerify™). Confirm ≥3 years operational history. | 41% of “factories” use shell company registrations; NECIP 2.0 now flags linked entities in real-time. |

| 2. Scrutinize Physical Infrastructure | Demand geotagged, timestamped video tour of entire facility (not pre-recorded). Verify via satellite imagery change detection (e.g., Google Earth Pro 2026). | “Factory tours” are now commonly staged at third-party workshops; geo-timestamping is non-negotiable. | |

| Operational Audit | 3. Confirm Core Process Ownership | Require machine ownership records (invoices, utility bills) for electroplating, stamping, and enamel filling lines. Audit raw material procurement contracts. | Traders often rent capacity; true factories control plating chemistry & metal sourcing (critical for pin durability). |

| 4. Test Production Control Systems | Request real-time access to MES (Manufacturing Execution System) showing WIP status for your trial order. Verify QC checkpoint logs with defect photos. | 2026 standard: Factories use AI-driven MES; traders lack system integration. QC logs expose hidden subcontracting. | |

| Post-Visit | 5. Validate Post-Production Traceability | Implement blockchain-verified batch tracking (e.g., AntChain) from raw material to shipment. Confirm independent lab test reports (e.g., SGS for Ni/Cd content). | Mandatory for EU Ecodesign Directive 2026 compliance; prevents material substitution. |

Factory vs. Trading Company: The 2026 Reality Check

Do not rely on supplier self-identification. Use operational evidence:

| Verification Point | True Factory (2026 Standard) | Trading Company / Hybrid Entity | Red Flag Indicator |

|---|---|---|---|

| Core Equipment | Owns ≥2 electroplating lines + hydraulic stamping presses; shows maintenance logs | References “partner factories”; shows generic workshop footage | Refuses to show plating tank control panels |

| Engineering Capability | Has in-house mold designers (CAD licenses verifiable); does metal alloy formulation | Outsources design; cites “standard templates” | Cannot adjust pin thickness below 1.5mm (min. trader spec) |

| Lead Time Control | Directly manages mold-making (3-7 days); owns polishing lines | Lead times include “factory coordination” buffer (adds 5-10 days) | MOQ < 500 units (indicates batch aggregation) |

| Pricing Structure | Quotes raw material + processing cost (e.g., “brass: $X/kg + $Y/unit”) | Single-line “FOB price” with no material cost breakdown | Price drops 15%+ when MOQ doubles (trader volume play) |

| Compliance Proof | Holds GB/T 19001-2025 (China ISO) + SA8000 certificates | Shows expired/invalid certs; claims “all factories have same certs” | Certificates issued by non-accredited bodies (e.g., China Quality Cert.) |

Key Insight: By 2026, 52% of “factories” operate hybrid models (owning 1-2 lines but outsourcing complex steps). Verify your specific process is in-house. Example: A supplier may own stamping but outsource enamel filling – a critical failure point for pin longevity.

Top 5 Red Flags to Terminate Engagement Immediately

(Based on 2025 SourcifyChina Client Incident Data)

- “Sample Factory” Discrepancy: Samples sent from Shenzhen, but “production facility” is in Lishui (Zhejiang). → 78% indicate sample fraud via third-party workshops.

- Refusal of Off-Hour Production Check: Insists visits only during “business hours” (8 AM–5 PM). → Hides subcontracted night-shift production.

- Generic Quality Certificates: Provides ISO 9001 without scope specifically covering metal stamping/enamel pins. → 63% of certs are irrelevant to lapel pin production.

- Payment Demanding Upfront >30%: Requests full payment before production start. → 92% of advance fraud cases involved >30% upfront.

- No Metal Material Traceability: Cannot provide mill test reports for brass/zinc alloys. → Direct link to 2025 EU REACH non-compliance recalls (avg. cost: $87K/client).

Strategic Recommendation: The SourcifyChina 2026 Verification Protocol

“Assume all suppliers are traders until proven otherwise. Invest 0.5% of annual order value in technical due diligence – it prevents 94% of catastrophic failures.”

– SourcifyChina Verified Facility Standard (SVFS) 2026

- Phase 1 (Remote): NECIP 2.0 + satellite verification + blockchain material audit (cost: $450).

- Phase 2 (On-Site): Technical audit focusing only on plating/enamel processes (cost: $1,200).

- Phase 3 (Ongoing): Real-time MES integration + quarterly independent lab tests (cost: $800/order).

Final Note: In 2026, the cost of not verifying exceeds $18K per failed supplier relationship (SourcifyChina ROI Tracker). Prioritize process ownership depth over facility size. A 20-person factory with owned plating lines outperforms a 500-person “factory” outsourcing critical steps.

SourcifyChina Commitment: We deploy SVFS 2026 on every lapel pins engagement. [Request a Custom Verification Scope] | [Download 2026 Compliance Checklist]

© 2026 SourcifyChina. All verification data sourced from proprietary audits, Chinese government portals, and client incident logs. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence: Sourcing Lapel Pins from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

In the competitive landscape of promotional merchandise and corporate branding, lapel pins remain a high-impact, low-cost solution for recognition, gifting, and employee engagement. However, global procurement managers face persistent challenges in sourcing high-quality lapel pins from China—ranging from unreliable suppliers and inconsistent quality control to communication delays and extended lead times.

SourcifyChina’s Verified Pro List for “Lapel Pins China Wholesale” offers a streamlined, risk-mitigated pathway to trusted manufacturers, enabling procurement teams to reduce sourcing cycles by up to 60% and ensure product consistency across global supply chains.

Why SourcifyChina’s Verified Pro List Delivers Value

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence, including factory audits, MOQ verification, and quality control assessments. |

| Time Savings | Reduce supplier qualification from 4–8 weeks to under 72 hours. |

| Quality Assurance | Access suppliers with proven track records in enamel, soft/hard enamel, and custom die-struck lapel pins. |

| Transparent Communication | Direct access to English-speaking production managers and dedicated export teams. |

| Scalable MOQs | Options from 100 units (samples) to 50,000+ units with competitive tiered pricing. |

| Compliance Ready | Suppliers aligned with international standards (REACH, RoHS, ISO 9001). |

The Cost of Inefficient Sourcing

Procurement teams relying on open-market platforms (e.g., Alibaba, Made-in-China) often encounter:

- 30–50% of listed suppliers are trading companies or brokers, increasing cost and complexity.

- 4+ rounds of sampling due to miscommunication or quality deviations.

- Average lead time extensions of 14–21 days due to production errors or delays.

By contrast, SourcifyChina’s Pro List connects buyers directly with verified, factory-direct suppliers, eliminating intermediaries and ensuring faster time-to-market.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. In a market where speed, quality, and reliability define competitive advantage, relying on unverified suppliers is no longer a sustainable risk.

Act now to secure your competitive edge:

✅ Access the exclusive 2026 Verified Pro List for Lapel Pins China Wholesale

✅ Slash sourcing timelines and eliminate supplier risk

✅ Ensure consistent quality and on-time delivery for your global operations

👉 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide tailored supplier matches, sample coordination, and end-to-end order management support—at no additional cost.

SourcifyChina

Your Trusted Partner in Strategic China Sourcing

Empowering Global Procurement Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.