The global laminate flooring market, valued at USD 35.4 billion in 2022, is projected to grow at a CAGR of 6.8% from 2023 to 2030, according to Grand View Research. A key enabler of this expansion is the rising demand for seamless flooring transitions, driving increased adoption of laminate-to-laminate transition strips. These components not only enhance aesthetic continuity but also improve durability and safety in residential and commercial spaces. As flooring installations become more sophisticated, manufacturers specializing in precision-engineered transition solutions are gaining strategic importance. With North America and Europe leading in renovation activity and Asia-Pacific witnessing rapid urbanization, the need for high-quality, easy-to-install transition strips has never been greater. This growth trajectory, supported by trends in modular construction and DIY home improvement, sets the stage for innovation among leading laminate transition strip producers. Based on market reach, product quality, and technological advancements, the following nine manufacturers represent the vanguard of this essential niche within the broader flooring supply chain.

Top 9 Laminate To Laminate Transition Strip Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Trim & Moldings

Domain Est. 2019

Website: mohawkfactoryoutlet.com

Key Highlights: Free delivery over $50Buy discontinued first-quality flooring directly from the world’s biggest flooring manufacturer! Our brands include: Mohawk, Pergo, Simple Solutions, ……

#2 Floor transition moldings, trims & strips manufacturer

Domain Est. 2010

Website: mtemillwork.com

Key Highlights: MTE Millwork’s comprehensive guide to floor transition moldings, including versatile options like quarter rounds, T-moldings, stair noses, and more….

#3 Profiles for laminate flooring

Domain Est. 1995

Website: int.pergo.com

Key Highlights: Use an end profile between laminate and windows and an adapter profile between laminate and lower floor surfaces, an elegant way to make a transition….

#4 High

Domain Est. 2001

Website: framerica.com

Key Highlights: Framerica offers a broad selection of transition moldings designed to cater to various flooring types, including laminate, vinyl, tile, and carpet….

#5 Products

Domain Est. 2004

Website: versatrim.com

Key Highlights: Versatrim manufactures, sells, and distributes a complete line of custom coordinated floor moldings and trims for laminate and vinyl flooring. Versatrim’s ……

#6 Laminate To Tile Transition Strip

Domain Est. 2004

Website: tiletrim.com

Key Highlights: Laminate to tile transition strip is a narrow, flexible strip that bridges the gap between two different flooring materials, namely laminate and tile….

#7 PERFORMANCE ACCESSORIES

Domain Est. 2006

Website: flooringaccessories.com

Key Highlights: TRIMS & TRANSITIONS … Our products ensure your floor meets or exceeds the current warranty requirements for most wood, laminate, and resilient / vinyl flooring….

#8 Flooring Transition Strips – Moldings – Trims

Domain Est. 2012

Website: onflooring.com

Key Highlights: Find your perfect match from 30000+ flooring transition strips, moldings and trims. Precise color blending for most brands and fast ……

#9 Futura Transitions

Domain Est. 2019

Website: futuratransitions.com

Key Highlights: Futura Transitions manufactures flooring trims in a variety of materials and in dimensions that coordinate with current flooring products….

Expert Sourcing Insights for Laminate To Laminate Transition Strip

H2: Projected Market Trends for Laminate to Laminate Transition Strips in 2026

The global market for laminate to laminate transition strips is poised for steady growth by 2026, driven by evolving consumer preferences, advancements in flooring technology, and increased construction activities. Several key trends are expected to shape the market landscape over the next few years.

-

Rising Demand in Residential Renovations

Home improvement and DIY renovation projects are on the rise, especially in North America and Europe. Consumers are increasingly opting for laminate flooring due to its affordability, durability, and aesthetic versatility. As a result, the need for seamless transitions between rooms or varying floor levels is fueling demand for laminate to laminate transition strips. These strips not only protect edges but also enhance the visual continuity of flooring, making them a critical component in modern interior design. -

Innovation in Design and Materials

Manufacturers are focusing on enhancing the aesthetic and functional qualities of transition strips. By 2026, expect to see more products that mimic natural wood grains, offer color-matching capabilities, and utilize eco-friendly composite materials. Pre-finished aluminum, PVC, and recycled polymer blends are becoming popular due to their durability and low maintenance. Integration with smart flooring systems may also emerge as a niche trend, particularly in high-end residential and commercial applications. -

Expansion in Emerging Markets

Growth in urbanization and disposable incomes in regions like Asia-Pacific, Latin America, and the Middle East is creating new opportunities. Countries such as India, Vietnam, and Brazil are witnessing a surge in both residential and commercial construction, where cost-effective flooring solutions like laminate are preferred. This trend is expected to boost regional demand for compatible transition products, prompting global suppliers to expand distribution networks and localize product offerings. -

Sustainability and Green Building Standards

Environmental regulations and green building certifications (e.g., LEED, BREEAM) are pushing manufacturers to adopt sustainable practices. By 2026, transition strips made from recycled materials or those with low volatile organic compound (VOC) emissions will gain market preference. Companies that emphasize recyclability and carbon footprint reduction in their supply chains are likely to achieve stronger brand loyalty and regulatory compliance. -

E-Commerce and Direct-to-Consumer Sales Growth

Online retail platforms are transforming how transition strips are marketed and sold. Consumers now prefer the convenience of purchasing flooring accessories online, supported by detailed product guides and virtual visualization tools. Brands investing in digital marketing, augmented reality (AR) for product previews, and seamless delivery logistics will have a competitive edge in capturing market share.

In conclusion, the laminate to laminate transition strip market in 2026 will be shaped by innovation, sustainability, and evolving consumer behavior. As laminate flooring continues to dominate in both new builds and renovations, transition strips will remain essential, with growth concentrated in technologically advanced, eco-conscious, and digitally engaged market segments.

Common Pitfalls When Sourcing Laminate to Laminate Transition Strips (Quality, IP)

Sourcing the right laminate to laminate transition strip is crucial for a seamless and durable flooring installation. However, several pitfalls related to quality and intellectual property (IP) can compromise both the final appearance and long-term performance of the floor. Being aware of these issues helps ensure a successful project.

Poor Material Quality and Durability

One of the most frequent issues is selecting transition strips made from substandard materials. Low-quality laminates may use inferior core boards or wear layers that are prone to chipping, warping, or fading over time. These strips may not withstand foot traffic or environmental changes (e.g., humidity), leading to premature failure. Always verify that the transition strip matches the wear class and thickness of the main flooring to ensure compatibility and longevity.

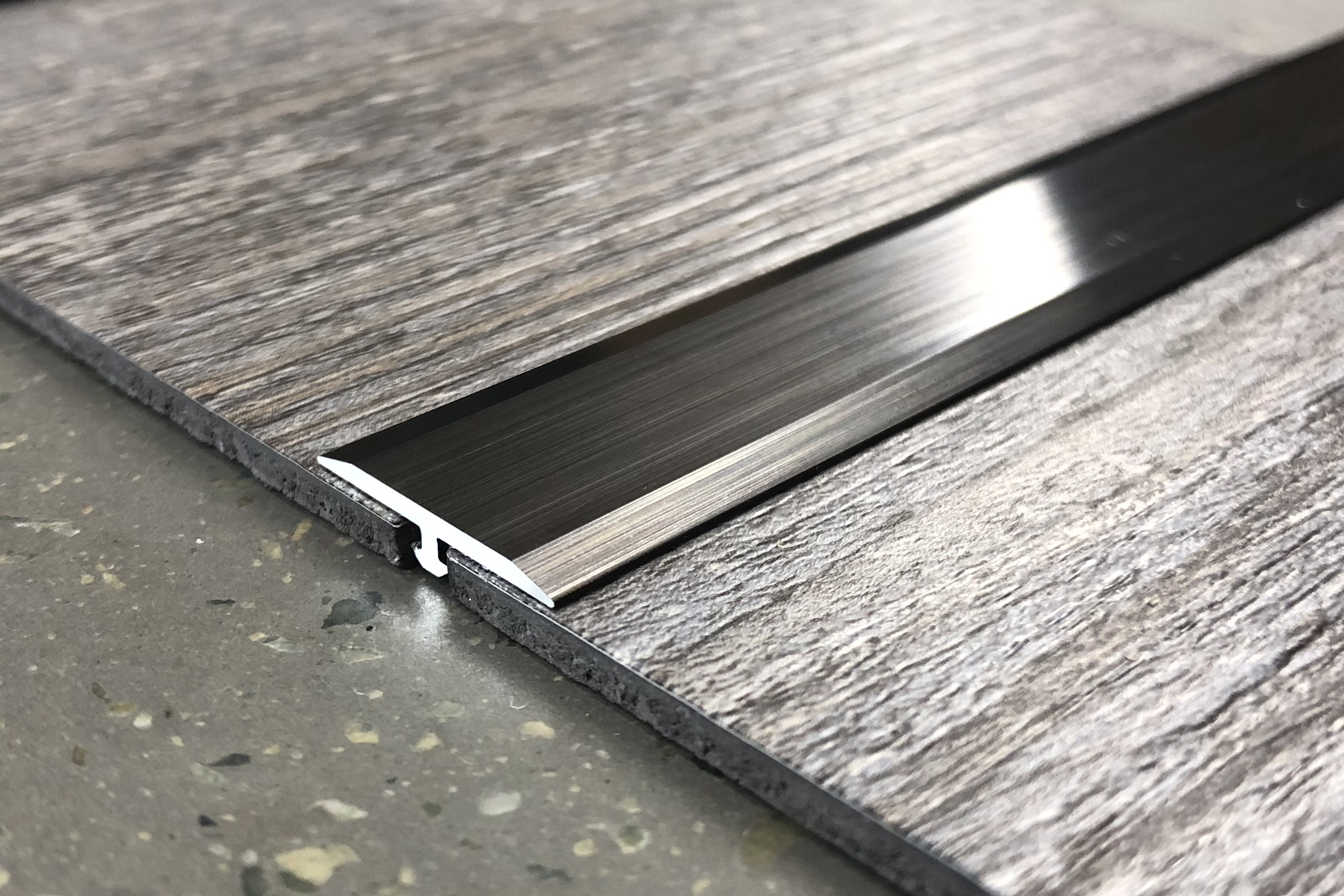

Inconsistent Visual Matching

Even if the base material is acceptable, poor color, texture, or finish matching can ruin the aesthetic continuity of the floor. Some suppliers offer generic or universal transition strips that only approximate the look of popular laminate lines. These mismatches become especially noticeable in well-lit areas or under certain viewing angles, undermining the professional finish.

Lack of Manufacturer Certification or Compatibility

Using transition strips not certified or recommended by the original laminate flooring manufacturer can void warranties. Many brands engineer their transition profiles specifically for their product lines to ensure proper fit and expansion control. Third-party or non-OEM strips may not align correctly, leading to gaps, lifting edges, or damage to the locking mechanisms of the laminate planks.

Intellectual Property (IP) Infringement Risks

Sourcing transition strips from unauthorized or unlicensed suppliers may involve IP violations. Major flooring brands often patent their transition profile designs, including the shape, locking mechanism, and decorative elements. Using counterfeit or imitation products not only risks legal liability but also compromises quality and performance. Always verify that the supplier is authorized and the product is genuine to avoid IP-related complications.

Inadequate Technical Specifications and Documentation

Some suppliers fail to provide comprehensive technical data, such as expansion coefficients, installation guidelines, or compatibility charts. This lack of documentation makes it difficult to ensure proper integration with the main flooring system, especially in environments with fluctuating temperature or humidity levels. Always request detailed product specifications and installation instructions before purchase.

Overlooking Regional or Environmental Suitability

Not all transition strips are suitable for every environment. For example, strips designed for residential use may not perform well in commercial settings with heavier traffic. Similarly, some materials may degrade in high-moisture areas like kitchens or bathrooms. Failing to consider the environmental demands of the installation space can lead to early failure and increased maintenance costs.

By avoiding these common pitfalls—focusing on verified quality, visual accuracy, manufacturer compatibility, IP compliance, and proper technical support—buyers can ensure a durable, aesthetically pleasing, and legally sound flooring transition.

Logistics & Compliance Guide for Laminate to Laminate Transition Strip

This guide outlines key logistics and compliance considerations for the distribution, handling, and installation of Laminate to Laminate Transition Strips. Proper adherence ensures product integrity, regulatory compliance, and successful installation.

Product Specifications and Packaging

Transition strips must be clearly labeled with product type, dimensions (length, width, height), color/finish, material composition (e.g., aluminum, PVC, wood composite), and batch/lot number. Packaging should be robust to prevent deformation or damage during transit—typically shrink-wrapped or boxed in sturdy cartons. Each package should include installation instructions and safety data where applicable.

Transportation and Handling

Use climate-controlled transport where necessary to prevent warping or degradation, especially for plastic-based or composite materials. Avoid exposure to direct sunlight, extreme temperatures, or moisture during storage and transit. Handle with care; do not stack packages excessively. Forklifts and pallet jacks should be operated cautiously to avoid crushing edges. Store materials indoors on flat, dry surfaces, elevated off the floor, and away from high-traffic zones.

Import/Export Compliance (if applicable)

Ensure compliance with international trade regulations when shipping across borders. Provide accurate Harmonized System (HS) codes—typically under 7308.90 (other iron or steel construction elements) or 3925.30 (plastic fittings for floors) depending on material. Include commercial invoices, packing lists, and certificates of origin. Verify adherence to destination country standards (e.g., CE marking for EU, FCC/CPSC in the U.S. if applicable).

Environmental and Safety Regulations

Verify that materials comply with environmental directives such as REACH (EU), RoHS (for metal components), and California Proposition 65 (if sold in California). Volatile Organic Compound (VOC) emissions must meet FloorScore or CARB2 standards if applicable. Provide Safety Data Sheets (SDS) for any components requiring them. Packaging should follow local recyclability guidelines; minimize plastic use where possible.

Building Code and Installation Compliance

Transition strips must meet dimensional and safety requirements outlined in regional building codes (e.g., ADA guidelines for trip hazards in the U.S., where height differences must not exceed ¼ inch without a beveled edge). Ensure product design allows for proper expansion gaps and secure fastening to subfloor, as per manufacturer instructions. Use only tools and adhesives compatible with the strip material and flooring type.

Quality Assurance and Traceability

Maintain a traceability system using batch/lot numbers for quality control and recall readiness. Conduct routine inspections upon receipt and before installation to identify defects. Retain shipping and compliance documentation for a minimum of five years, or as required by jurisdiction.

Disposal and End-of-Life

Dispose of damaged or excess transition strips in accordance with local waste regulations. Recycle metal or plastic components where facilities exist. Avoid landfill disposal when recyclable alternatives are available.

Conclusion for Sourcing Laminate to Laminate Transition Strip:

Sourcing the appropriate transition strip for laminate to laminate flooring installations is essential for both functionality and aesthetics. After evaluating various options, it is clear that selecting the right profile—such as a T-molding, reducer strip, or flush threshold—depends on factors including height alignment, expansion gaps, and design continuity between adjacent laminate sections. Prioritizing durable, moisture-resistant materials that match or complement the laminate flooring ensures long-term performance and visual appeal. Sourcing from reputable suppliers or manufacturers that offer color-matching options and reliable installation support further enhances installation efficiency and customer satisfaction. Ultimately, careful consideration of product quality, compatibility, and availability leads to a seamless and professional finish in laminate flooring transitions.