The global ladder equipment market is experiencing steady expansion, driven by increasing demand across construction, industrial maintenance, and residential sectors. According to Grand View Research, the global ladders market size was valued at USD 6.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by rising infrastructure development, stringent workplace safety regulations, and the growing adoption of lightweight, durable materials such as fiberglass and aerospace-grade aluminum. Additionally, expanding urbanization and the proliferation of DIY culture in both developed and emerging economies are amplifying product demand. As competition intensifies, innovation in design, load capacity, and safety features has become a key differentiator among manufacturers. In this dynamic landscape, nine companies have emerged as industry leaders, combining engineering excellence, global distribution networks, and a commitment to compliance with international safety standards. Here’s an in-depth look at the top ladder equipment manufacturers shaping the future of elevated work solutions.

Top 9 Ladder Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manufacturer Members

Domain Est. 2000

Website: americanladderinstitute.org

Key Highlights: Lynn Ladder and Scaffolding Co., Inc. is a full line manufacturer and distributor of ladders, scaffolding, truck equipment and specialty items. For over 65 ……

#2 Aluminum Ladder Manufacturer, Falcon Ladder & Scaffold

Domain Est. 1999

Website: falconladder.com

Key Highlights: Falcon Ladder & Scaffold has been a manufacturer of high quality ladders, scaffolding and aluminum products in the Okanagan of British Columbia, Canada, since ……

#3 Werner Ladder

Domain Est. 1996

Website: wernerco.com

Key Highlights: Werner is the world leader in the manufacturing and distribution of ladders, climbing equipment, fall protection and ladder accessories….

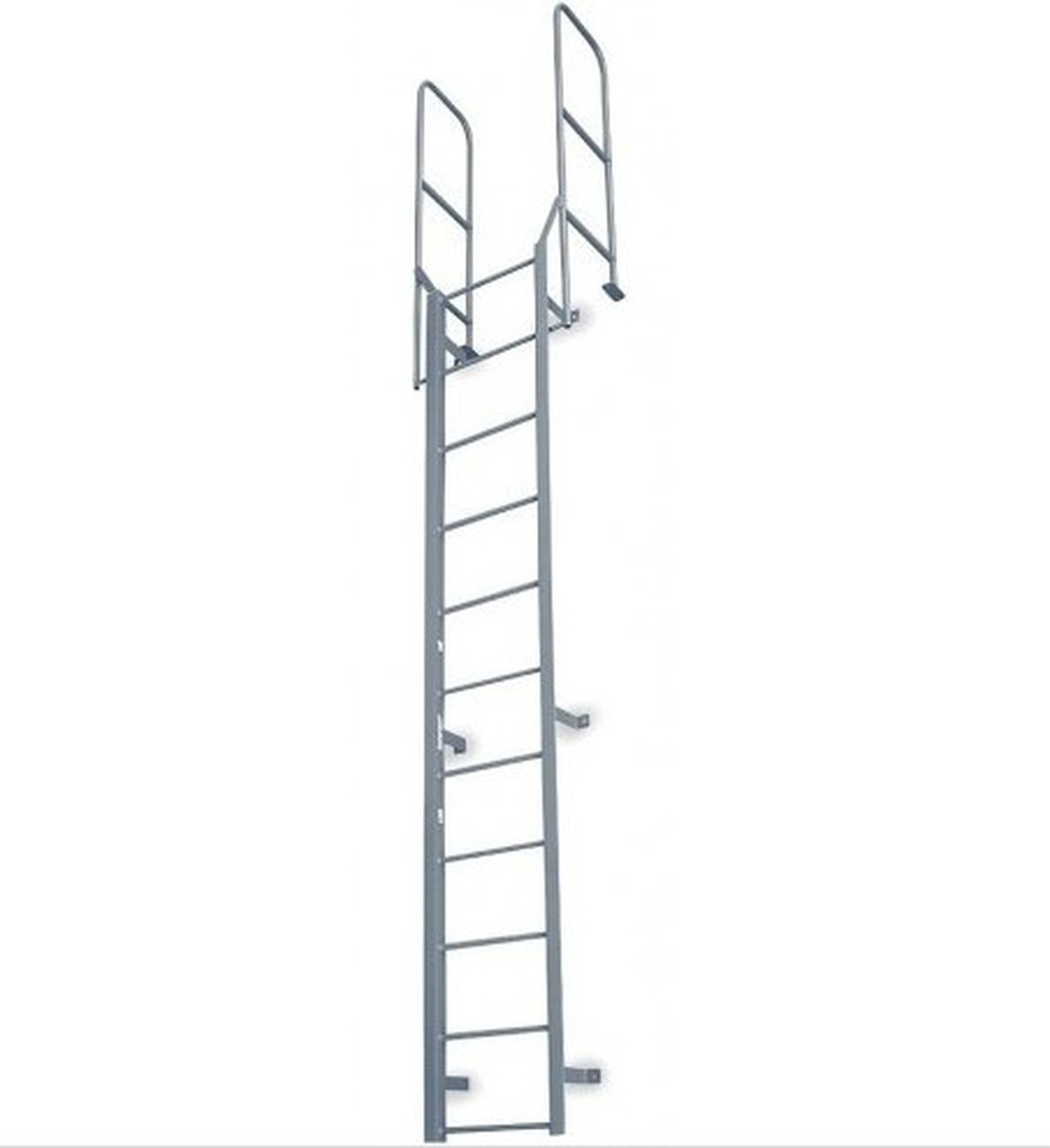

#4 Cotterman

Domain Est. 1996 | Founded: 1925

Website: cotterman.com

Key Highlights: Quality ladders made in the USA since 1925 with locations in Michigan, Georgia, Texas and California waiting to serve you….

#5 Louisville Ladder

Domain Est. 1997

Website: louisvilleladder.com

Key Highlights: Find the right ladder for the right job, from pavement to soil, changing a bulb to chiseling stone, the leader in ladders Louisville Ladder….

#6 Ballymore Safety Products

Domain Est. 1997

Website: ballymore.com

Key Highlights: Ballymore, the inventor of the rolling safety ladder, continuing to lead the industry in introducing new and innovating products to the market. Contact Us….

#7 Ladder Safety Products

Domain Est. 1998

Website: levelok.com

Key Highlights: At LeveLok, our primary goal is to provide the most innovative, cutting-edge ladder safety equipment available, ultimately reducing ladder injuries….

#8 nationalladder

Domain Est. 1999

Website: nationalladder.com

Key Highlights: Level your Werner Ladder with Precision & Convenience. Shop LevelSafe Pro ladders here. Knaack Heavy Duty Storage Solutions….

#9 Metallic Ladder

Domain Est. 2000

Website: metallicladder.com

Key Highlights: Metallic Ladder manufactures aerospace-grade aluminum ladders, stairs, commercial gangways and work platforms that have a reputation for long service life….

Expert Sourcing Insights for Ladder Equipment

H2: 2026 Market Trends for Ladder Equipment

The global ladder equipment market is poised for steady growth and transformation by 2026, driven by advancements in materials, safety regulations, and evolving end-user demands across construction, industrial, and residential sectors. Key trends shaping the market include:

-

Increased Demand for Lightweight and Durable Materials

Manufacturers are increasingly adopting advanced materials such as fiberglass and aerospace-grade aluminum to produce ladders that are both lightweight and highly durable. These materials offer improved strength-to-weight ratios, corrosion resistance, and longer product lifespans, appealing to professionals seeking efficiency and safety. -

Rising Focus on Safety and Compliance

With stricter occupational health and safety regulations in regions like North America and Europe, there is growing demand for ladders that meet OSHA, ANSI, and EN standards. Features such as non-slip rungs, anti-slip feet, and integrated stabilizers are becoming standard, driving innovation and product differentiation. -

Growth in the Residential and DIY Market

The surge in home improvement projects, accelerated by remote work trends and aging housing stock, is expanding the consumer segment for ladder equipment. Compact, multipurpose, and easy-to-store models (e.g., step ladders, telescoping ladders) are gaining popularity among DIY users, boosting retail sales through e-commerce platforms. -

Technological Integration and Smart Features

While still in early stages, smart ladder technology—featuring load sensors, angle indicators, and stability alerts—is emerging in premium product lines. These innovations enhance user safety and are anticipated to gain traction in industrial and commercial applications by 2026. -

Sustainability and Eco-Friendly Manufacturing

Environmental concerns are influencing production practices, with companies adopting recyclable materials and energy-efficient manufacturing processes. Brands emphasizing sustainability are likely to gain a competitive edge, particularly in environmentally conscious markets. -

Expansion in Emerging Economies

Rapid urbanization and infrastructure development in Asia-Pacific, Latin America, and Africa are creating new growth opportunities. Countries like India and Brazil are witnessing increased construction activity, driving demand for affordable and reliable ladder solutions. -

E-Commerce and Direct-to-Consumer Sales Growth

Online retail channels are becoming critical distribution avenues, enabling global reach and faster delivery. Manufacturers and distributors are investing in digital marketing and user experience to capture a larger share of the online hardware market.

In conclusion, the ladder equipment market in 2026 will be characterized by innovation, safety-centric design, and responsiveness to regional and sector-specific demands. Companies that prioritize product differentiation, sustainability, and digital engagement are expected to lead the market.

Common Pitfalls When Sourcing Ladder Equipment (Quality, IP)

Poor Material Quality and Construction

One of the most frequent issues when sourcing ladder equipment is receiving products made from substandard materials. This includes using low-grade aluminum or fiberglass that may not support the required load, thin rungs prone to bending, or weak joints that compromise structural integrity. Inferior construction can lead to premature wear, increased accident risk, and non-compliance with safety standards such as OSHA or ANSI.

Lack of Compliance with Safety and IP Standards

Many suppliers, especially those from regions with lax regulatory oversight, fail to adhere to international safety certifications. Sourcing ladders without proper IP (Ingress Protection) ratings—especially for use in wet or outdoor environments—can result in electrical hazards or corrosion. Additionally, counterfeit or unlicensed designs may infringe on intellectual property rights, exposing buyers to legal risks and reputational damage.

Inadequate Load Rating and Duty Classification

Buyers often overlook the importance of matching ladder duty ratings (light, medium, heavy, extra-heavy) to the intended use. Sourcing ladders with incorrect load capacity can lead to equipment failure under stress. Mislabeling or ambiguous specifications from suppliers exacerbate this issue, making due diligence essential.

Insufficient Weather and Environmental Resistance

For outdoor or industrial use, ladders must resist moisture, UV exposure, and temperature extremes. Sourcing equipment without proper IP ratings (e.g., IP54 or higher for dust and water resistance) may result in rapid degradation, especially in construction or marine environments. Fiberglass ladders, while non-conductive, may crack under prolonged UV exposure if not UV-stabilized.

Counterfeit or IP-Infringing Products

Some suppliers offer ladders that mimic branded designs protected by patents or trademarks. Purchasing such items not only risks legal action but also often means sacrificing quality and safety. These counterfeit products typically lack rigorous testing and certification, increasing liability for the end user.

Inconsistent Quality Control and Batch Variability

Sourcing from manufacturers with weak quality assurance processes can result in inconsistent product batches. One shipment may meet specifications while the next contains defective welds, misaligned rungs, or incorrect labeling. This variability undermines reliability and safety, especially in large-scale procurement.

Misleading or Incomplete Product Documentation

Suppliers may provide incomplete or inaccurate technical documentation, including missing IP ratings, incorrect weight limits, or omitted compliance certifications. This lack of transparency complicates due diligence and increases the risk of non-compliant purchases.

Overlooking Supplier Verification and Audits

Failing to conduct on-site audits or verify a supplier’s credentials can lead to partnerships with unreliable manufacturers. Third-party certifications (e.g., ISO, CE) should be validated, and past performance reviewed to avoid sourcing from vendors with histories of recalls or compliance violations.

Cost-Driven Decisions Compromising Safety

Choosing suppliers solely based on low prices often results in compromised quality and safety. The total cost of ownership—including accident risk, downtime, and replacement—can far exceed initial savings. Investing in reputable suppliers with strong quality and IP compliance is crucial for long-term safety and operational efficiency.

Logistics & Compliance Guide for Ladder Equipment

Overview

This guide outlines the essential logistics and compliance considerations for the safe handling, transportation, storage, and use of ladder equipment. Adherence to these standards ensures worker safety, regulatory compliance, and operational efficiency across all stages of ladder lifecycle management.

Regulatory Standards & Compliance

Ladder equipment must comply with national and international safety standards. Key regulations include:

– OSHA (Occupational Safety and Health Administration) – 29 CFR 1910.23 (General Requirements for All Ladders) and 1926.1053 (Construction Industry Ladders).

– ANSI (American National Standards Institute) – ANSI A14 Series (e.g., A14.2 for portable ladders, A14.5 for fixed ladders).

– EU/UK Regulations – EN 131 (portable ladders) and Work at Height Regulations 2005 (UK).

– Other Regional Codes – Local building and occupational health and safety codes must also be observed.

All ladders must be certified to applicable standards and include manufacturer labels indicating load capacity, material type, and compliance marks.

Procurement & Supplier Requirements

Ensure suppliers provide:

– Ladders tested and certified by accredited third parties.

– Documentation including user manuals, compliance certificates, and material safety data sheets (if applicable).

– Traceability through batch/serial numbers.

– Warranty and recall procedures.

Prefer suppliers adhering to ISO 9001 (Quality Management) and ISO 14001 (Environmental Management).

Transportation & Handling

Follow these logistics protocols to prevent damage and maintain safety:

– Packaging: Secure ladders in protective wrapping or crates to prevent bending, scratches, or structural compromise.

– Loading: Use padded straps and avoid overhanging loads; secure ladders horizontally on flatbeds or vertically in racks.

– Vehicle Requirements: Ensure transport vehicles are equipped with tie-down points and non-slip surfaces.

– Handling: Use mechanical aids (e.g., forklifts with ladder cradles) when moving heavy or long ladders; never drag ladders on the ground.

Storage Protocols

Proper storage maintains ladder integrity and extends service life:

– Store indoors in a dry, well-ventilated area away from direct sunlight and corrosive chemicals.

– Use wall-mounted racks or freestanding ladder stands to prevent warping or deformation.

– Keep ladders off the ground to avoid moisture absorption (wood) or corrosion (metal).

– Segregate by type (e.g., fiberglass, aluminum, step ladders) and size for easy access and inventory control.

Inspection & Maintenance

Regular checks are mandatory for compliance and safety:

– Pre-Use Inspection: Conduct by end-user before each use—check for cracks, loose rungs, damaged locks, and wear.

– Scheduled Inspections: Perform monthly (or per manufacturer schedule) by trained personnel. Document findings.

– After Incident Inspection: Inspect following any impact, fall, or overload. Remove damaged ladders immediately.

– Maintenance: Repair only using OEM parts; never alter structural components. Tag and quarantine defective units.

Training & User Compliance

All personnel using ladders must receive training covering:

– Proper setup (e.g., 4:1 angle rule for extension ladders).

– Weight limits and load classification (Type I, II, III, etc.).

– Safe climbing techniques and fall prevention.

– Recognition of hazards (e.g., electrical risks with metal ladders).

– Emergency procedures.

Training records must be maintained and refreshed annually or after policy changes.

Recordkeeping & Documentation

Maintain a compliance log for each ladder, including:

– Purchase date and supplier information.

– Inspection and maintenance history.

– Repair records and parts replaced.

– Certification and compliance documentation.

– Decommissioning date and disposal method.

Digital asset management systems are recommended for tracking.

Disposal & End-of-Life

Retire ladders that are:

– Beyond repair.

– No longer compliant with current safety standards.

– Subject to manufacturer recall.

Dispose of responsibly:

– Recycle metal and composite materials per local regulations.

– Follow WEEE or hazardous waste protocols if applicable.

– Document disposal to close asset lifecycle.

Emergency & Incident Reporting

In the event of an accident involving ladder equipment:

– Secure the scene and provide medical assistance if needed.

– Report the incident per OSHA or local regulatory timelines.

– Preserve the ladder for investigation.

– Review procedures and implement corrective actions to prevent recurrence.

Conclusion

Effective logistics and compliance management of ladder equipment reduces workplace injuries, ensures regulatory adherence, and supports operational continuity. By following this guide, organizations can maintain a safe and compliant working environment for all personnel involved with ladder use.

In conclusion, sourcing ladder equipment requires a careful balance between safety, quality, durability, and cost-effectiveness. It is essential to evaluate suppliers based on their product compliance with industry standards (such as OSHA or EN131), material quality, warranty offerings, and customer support. Prioritizing safety certifications and user-specific requirements—such as ladder type (step, extension, platform), weight capacity, and working environment (indoor, outdoor, industrial)—ensures that the selected equipment meets operational needs while minimizing workplace risks. Additionally, considering long-term value over initial price, through durability and reduced maintenance, contributes to sustainable procurement practices. Ultimately, a well-informed sourcing strategy for ladder equipment enhances worker safety, improves efficiency, and supports regulatory compliance across various industries.