The global lace plastic market has experienced steady expansion, driven by rising demand across packaging, construction, automotive, and consumer goods sectors. According to Grand View Research, the global plastic packaging market—where lace plastic components are increasingly utilized for decorative and functional designs—was valued at USD 427.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. This growth is fueled by advancements in polymer technology, increased emphasis on lightweight materials, and the rising adoption of aesthetic plastic trims in industrial design. Additionally, Mordor Intelligence reports that innovations in recyclable and bio-based plastics are reshaping manufacturing priorities, prompting leading producers to invest in sustainable lace plastic solutions. As demand intensifies, a select group of manufacturers has emerged at the forefront, combining precision engineering, scalability, and material innovation to meet evolving global standards. The following list highlights the top nine lace plastic manufacturers leading this transformation through technological advancement and robust production capabilities.

Top 9 Lace Plastic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HOH — Company Founded in 1880

Domain Est. 2012

Website: tissura.com

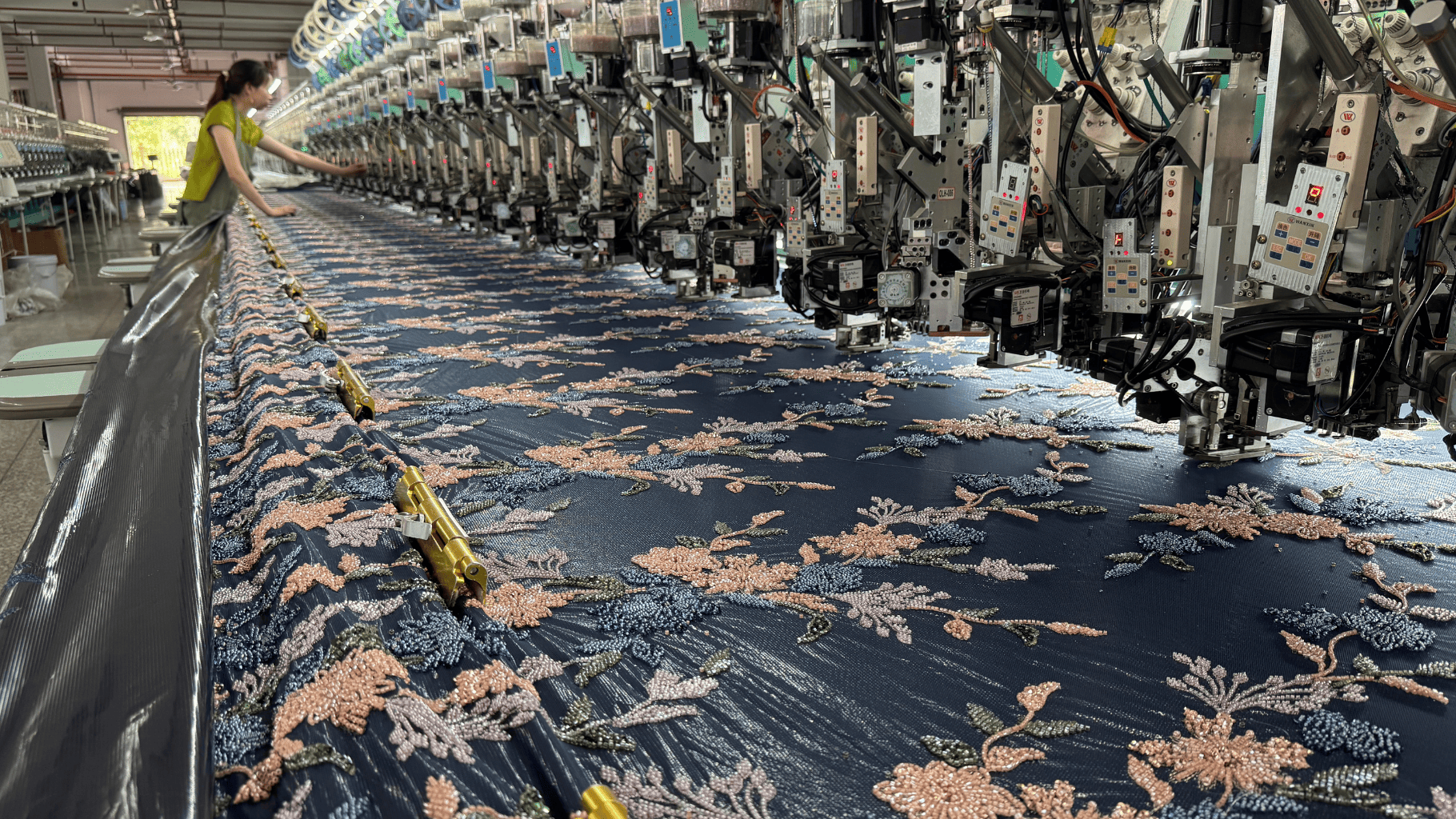

Key Highlights: 3–13 day delivery 14-day returnsHOH Hoferhecht Stickereien is a legendary Austrian manufacturer of fashion fabrics for special occasions. It produces high-end embroideries, sequine…

#2 Plastic Buckle Manufacturer, SR Buckles & Lace locks NIFCO

Domain Est. 2016

Website: en.nifcobuckle.com

Key Highlights: Nifco is a Japanese plastic buckle manufacturer providing the most innovative buckle and fastener solutions to the largest global sports brands….

#3 Braids & Laces

Domain Est. 2023 | Founded: 1936

Website: braidlace.ca

Key Highlights: Braids & Laces: Explore premium ropes and laces from BraidLace, a trusted manufacturer since 1936. Find quality solutions for your needs today….

#4 Laces and shoelaces

Domain Est. 1998

Website: trencilo.com

Key Highlights: We produce laces and shoelaces in a wide range of thicknesses, from 0.8mm to 200mm both in natural and synthetic raw materials….

#5 The Original Elastic No-Tie Shoelaces

Domain Est. 1999

Website: locklaces.com

Key Highlights: Original 48” Lock Laces® are our best-selling laces. With an assortment of 13 different colors, they look great in any shoe from athletic to casual everyday ……

#6 MH

Domain Est. 2001

Website: mh-chine.com

Key Highlights: From premium threads and zippers to lace, tape, ribbon, and more, our extensive range of tailoring materials is designed to provide unparalleled performance ……

#7 HICKIES

Domain Est. 2002

Website: hickies.com

Key Highlights: HICKIES No Tie Shoelaces turn shoes into slip ons so you never have to tie your sneakers again. HICKIES laces can be used on almost any type of shoes….

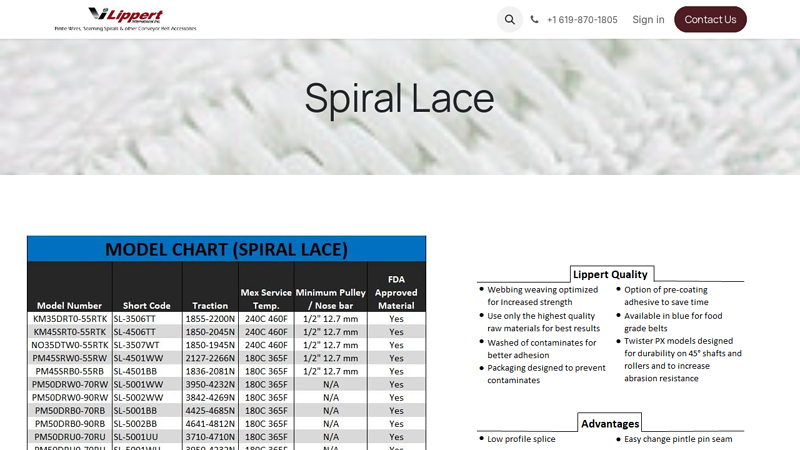

#8 Spiral Lace

Domain Est. 2003

Website: lippertint.com

Key Highlights: Lippert International Inc options for Spiral Lace / Band….

#9 Dental Lace

Domain Est. 2015

Website: dentallace.com

Key Highlights: Dental Lace offers a zero-waste solution with 100% plastic-free packaging. If you compost our Dental Lace Silk Floss after use, it will turn into soil within 6 ……

Expert Sourcing Insights for Lace Plastic

H2: 2026 Market Trends for Lace Plastic

As we approach 2026, the market for lace plastic—commonly used in packaging, construction, textiles, and consumer goods—reflects a dynamic convergence of sustainability mandates, technological innovation, and shifting consumer preferences. The second half of the decade is marked by structural changes in supply chains, regulatory pressures, and demand diversification, all of which are shaping the trajectory of lace plastic applications and production.

1. Sustainability and Regulatory Pressures Intensify

By H2 2026, global regulations on single-use plastics have significantly tightened, particularly in the EU, North America, and parts of Asia-Pacific. The European Union’s Extended Producer Responsibility (EPR) schemes and plastic packaging taxes are compelling manufacturers to reformulate lace plastic products using recyclable or biodegradable alternatives. As a result, demand is shifting toward bio-based polymers and recycled content integration. Companies investing in chemical recycling and PCR (post-consumer recycled) materials are gaining competitive advantage.

2. Innovation in Material Science

Advancements in polymer engineering have led to the development of high-performance lace plastics with enhanced durability, flexibility, and lower environmental impact. Notably, PHA (polyhydroxyalkanoates) and PLA (polylactic acid) variants are being integrated into lace structures for disposable and semi-durable applications. These materials maintain the aesthetic and functional qualities of traditional lace plastics while offering compostability in industrial settings.

3. Growth in Niche Applications

Lace plastic is experiencing renewed demand in specialized markets:

– Construction and Architecture: Used in facade designs, sunscreens, and temporary formwork due to lightweight and moldable properties.

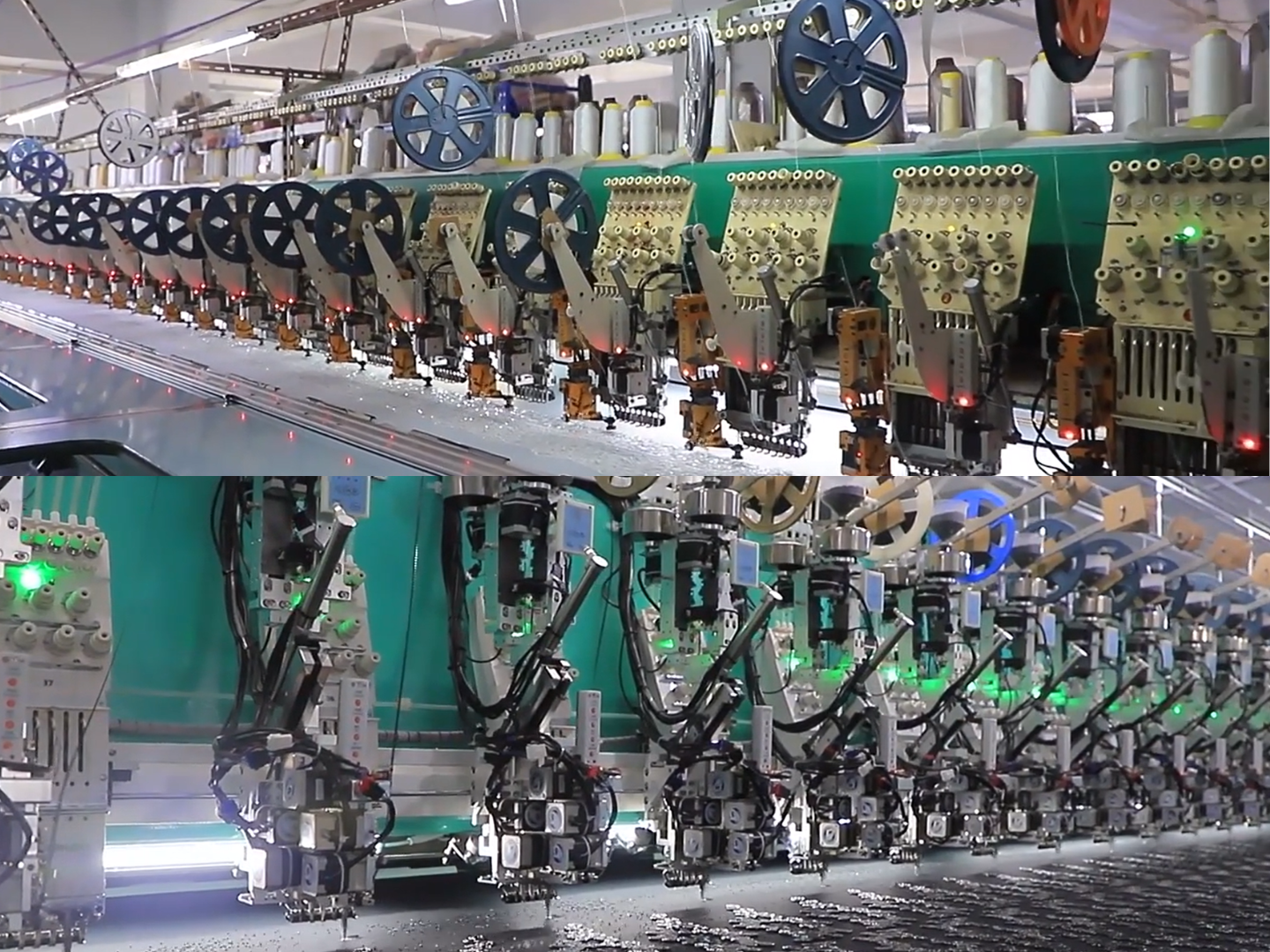

– Fashion and Wearables: With the rise of synthetic textiles and eco-conscious fashion, lace plastic is being used in innovative fabric blends and protective overlays.

– Agriculture: Employed in crop netting and plant supports, where durability and UV resistance are critical.

4. Regional Market Shifts

Asia-Pacific remains the largest producer and consumer of lace plastic, driven by manufacturing activity in China, India, and Vietnam. However, in H2 2026, Southeast Asian countries are implementing stricter waste management laws, prompting local producers to adopt circular economy models. Meanwhile, North America sees growth in domestic production due to nearshoring trends and supportive policies under the U.S. Inflation Reduction Act, which incentivizes sustainable materials innovation.

5. Digitalization and Supply Chain Resilience

The integration of digital tools—such as AI-driven demand forecasting, blockchain for traceability, and IoT-enabled production lines—is improving efficiency and transparency in lace plastic manufacturing. Companies are increasingly using smart packaging solutions where lace plastic components include QR codes or NFC tags for consumer engagement and lifecycle tracking.

6. Consumer Awareness and Brand Accountability

End consumers are more informed and demanding transparency in material sourcing. Brands using lace plastic are under pressure to disclose environmental footprints and adopt take-back programs. This has led to collaborative initiatives between plastic producers, brand owners, and waste management firms to close the loop.

Conclusion

In H2 2026, the lace plastic market is transitioning from a commodity-driven industry to a value-added, sustainability-focused sector. While challenges around recycling infrastructure and cost competitiveness remain, innovation and regulation are driving a transformation. Companies that prioritize eco-design, invest in alternative materials, and engage in circular business models are best positioned to thrive in this evolving landscape.

Common Pitfalls When Sourcing Lace Plastic (Quality, IP)

Sourcing lace plastic—often used in packaging, fashion, and decorative applications—can present several challenges, particularly concerning material quality and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply and legal compliance.

Poor Material Quality and Inconsistent Aesthetics

One of the most frequent issues is receiving lace plastic that fails to meet desired quality standards. This includes inconsistent patterns, weak structural integrity, color variations, or brittleness. Low-grade resins or improper manufacturing processes can result in products that degrade quickly or do not perform as expected. Buyers may also face batch-to-batch inconsistencies, especially when sourcing from suppliers with inadequate quality control systems.

Misrepresentation of Material Composition

Suppliers may claim that lace plastic is made from specific polymers (e.g., PP, PET, or biodegradable materials), but actual composition can differ. This mislabeling affects not only performance but also regulatory compliance and sustainability claims. Without proper material certification or third-party testing, buyers risk product failure or reputational damage.

Lack of Traceability and Compliance Documentation

Many suppliers, especially in less-regulated markets, fail to provide essential documentation such as certificates of compliance, RoHS/REACH statements, or food-grade certifications (if applicable). This lack of traceability increases the risk of non-compliance with safety and environmental regulations in the buyer’s target market.

Intellectual Property Infringement

Lace plastic designs—especially intricate or branded patterns—may be protected by design patents, copyrights, or trademarks. Sourcing from generic suppliers increases the risk of inadvertently purchasing counterfeit or IP-infringing products. Using such materials can lead to legal disputes, shipment seizures, or forced product recalls.

Unlicensed Use of Proprietary Patterns

Some lace patterns are proprietary, developed and owned by specific manufacturers or designers. Suppliers may replicate these patterns without authorization, offering them at lower prices. Buyers who unknowingly source these copies expose themselves to legal liability, especially in markets with strong IP enforcement.

Inadequate Supplier Vetting and Due Diligence

Relying solely on online marketplaces or brokers without verifying a supplier’s legitimacy increases exposure to both quality and IP risks. Failure to conduct site audits, request samples, or verify design rights can result in supply chain disruptions and legal complications.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough due diligence, request material data sheets and IP documentation, test samples rigorously, and work with reputable suppliers who respect intellectual property rights. Contracts should include quality specifications and IP indemnification clauses to protect against unforeseen liabilities.

Logistics & Compliance Guide for Lace Plastic

This guide outlines the essential logistics and compliance considerations for handling, transporting, and managing lace plastic materials in accordance with industry standards and regulatory requirements.

Material Handling & Storage

Lace plastic, often composed of polyethylene (PE), polypropylene (PP), or other synthetic polymers, must be stored in a clean, dry, and temperature-controlled environment. Protect from direct sunlight and extreme temperatures to prevent degradation. Store rolls or sheets off the ground on pallets and cover to avoid dust, moisture, and physical damage. Minimize exposure to sharp objects or abrasive surfaces during handling to maintain product integrity.

Packaging Requirements

Ensure lace plastic is securely packaged to prevent unraveling, creasing, or contamination during transit. Use robust outer cartons, stretch wrap, or protective banding as appropriate. Clearly label packaging with product details, batch numbers, and handling symbols (e.g., “Fragile,” “This Way Up”). Include moisture barriers if shipping to humid environments.

Transportation & Shipping

Use clean, enclosed vehicles for transportation to protect against weather and contamination. Secure loads to prevent shifting during transit, especially for bulk shipments. Adhere to weight limits and stacking guidelines. For international shipments, ensure compliance with carrier-specific requirements and Incoterms (e.g., FOB, CIF). Maintain proper shipping documentation, including packing lists and commercial invoices.

Regulatory Compliance

Lace plastic must comply with relevant regional and international regulations. In the EU, adhere to REACH and RoHS directives regarding restricted substances. In the U.S., ensure compliance with FDA regulations if intended for food-contact applications. Verify that materials meet ASTM or ISO standards for performance and safety. Maintain documentation such as Safety Data Sheets (SDS) and certificates of compliance.

Environmental & Sustainability Standards

Support sustainability by using recyclable or biodegradable lace plastic where feasible. Clearly label recyclability information on packaging. Follow local waste management regulations for offcuts and production waste. Where applicable, comply with Extended Producer Responsibility (EPR) schemes and report plastic usage as required by law.

Import/Export Documentation

For cross-border movement, prepare accurate Harmonized System (HS) codes for lace plastic (typically under Chapter 39: Plastics and Articles Thereof). Submit required customs documentation, including export declarations, certificates of origin, and compliance statements. Account for tariffs, duties, and any anti-dumping measures that may apply.

Quality Assurance & Traceability

Implement a traceability system to track batches from raw material to final product. Conduct regular quality checks for dimensional accuracy, tensile strength, and color consistency. Maintain records for audits and customer inquiries. Align quality processes with ISO 9001 standards where applicable.

Incident Reporting & Corrective Actions

Establish procedures for reporting non-conformances, shipping damages, or compliance issues. Investigate root causes and implement corrective and preventive actions (CAPA). Notify relevant authorities or customers promptly if regulatory breaches are identified.

Adherence to this guide ensures efficient logistics operations and full compliance with legal and environmental standards for lace plastic throughout the supply chain.

Conclusion for Sourcing Lace Plastic:

Sourcing lace plastic requires a strategic approach that balances quality, cost, sustainability, and supplier reliability. After evaluating various suppliers, material specifications, and market trends, it is evident that selecting the right source involves thorough due diligence. Key factors such as durability, aesthetic finish, environmental impact, and compliance with industry standards play a crucial role in decision-making. Partnering with reputable manufacturers who offer consistent quality, transparent production practices, and scalability ensures long-term success. Additionally, considering eco-friendly alternatives and circular economy principles can enhance brand value and meet evolving consumer demands. In conclusion, effective sourcing of lace plastic not only supports product excellence but also aligns with operational efficiency and sustainability goals.