The global laboratory containers market is experiencing robust growth, driven by increasing demand from pharmaceutical, biotechnology, and academic research sectors. According to Grand View Research, the global labware market size was valued at USD 13.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. This growth is fueled by rising R&D expenditures, stringent regulatory standards requiring high-purity consumables, and the expansion of healthcare infrastructure worldwide. As laboratories demand containers with superior chemical resistance, sterility, and precision, manufacturers are innovating with advanced materials like borosilicate glass, polypropylene, and cyclic olefin copolymers. In this evolving landscape, identifying reliable and high-performing lab container manufacturers is critical for ensuring data integrity, process efficiency, and regulatory compliance. Based on market presence, product innovation, and global reach, the following nine manufacturers stand out as leaders in the industry.

Top 9 Lab Container Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Globe Scientific Producers of Exceptional Quality Laboratory Supplies

Domain Est. 1997

Website: globescientific.com

Key Highlights: Globe Scientific — Producers of exceptional quality laboratory supplies including test tubes, microscope slides, transfer pipets, pipette tips, ……

#2 International Scientific Laboratory Equipment Supplies

Domain Est. 2002

Website: intscientific.com

Key Highlights: International Scientific Supplies Ltd · Proud to be a UK Manufacturer · Labelling, Kitting and Filling Capabilities · Supplying Critical Sectors for Over 25 Years….

#3 Cell Culture,Disposable Labware, Lab equipment, Lab Equipment …

Domain Est. 2021

Website: nest-biotech.com

Key Highlights: We are manufacturer of Cell Culture in China, if you want to buy Molecular Biology, Lab Equipment, Medical Instruments, please contact us….

#4 Lab Sample Containers

Domain Est. 1996

Website: dwk.com

Key Highlights: Click here to browse a wide range of sample containers in various shapes and sizes. Our sample bottles are ideal for chemistry and the life sciences….

#5 Laboratory Containers & Storage

Domain Est. 1998

Website: sigmaaldrich.com

Key Highlights: We offer essential, flexible lab storage solutions including bottles and carboys, plates, racks and boxes, reservoirs, sealing films, and tubes that protect ……

#6 LA Container

Domain Est. 2004 | Founded: 1984

Website: lacontainer.com

Key Highlights: 100% USA Made Small Round Hinged Lid Plastic Containers and Vials Since 1984. Lacons® Round Hinged Lid Plastic Containers. Learn More….

#7 Lacontainer USA Made Small Hinged Lid Plastic Containers and Vials

Domain Est. 2006

Website: lacontainerstore.com

Key Highlights: Lacontainer’s online container store featuring hundreds of USA made round and square polypropylene plastic containers with attached hinged lids, ……

#8 Standard BioProcess Containers

Domain Est. 2006

Website: thermofisher.com

Key Highlights: Next-generation centrifuge-ready BioProcess Containers provide a single-use, sterilized, closed system for cell harvesting in BioProcessing….

#9 Specialty Laboratory Containers

Domain Est. 2019

Website: advancedextractionlabs.com

Key Highlights: Discover our range of specialty containers designed for secure and efficient extraction storage. Shop now to find the perfect solution for your lab’s needs!…

Expert Sourcing Insights for Lab Container

H2: Projected 2026 Market Trends for Lab Containers

The global lab container market is poised for significant evolution by 2026, driven by technological innovation, regulatory shifts, and growing demand across pharmaceutical, biotechnology, and academic research sectors. Key trends shaping the market under the H2 business environment—characterized by heightened digital transformation, sustainability mandates, and supply chain recalibration—are expected to redefine product design, material selection, and distribution strategies.

1. Increased Demand for Single-Use and Disposable Lab Containers

With biopharmaceutical manufacturing scaling up, particularly in cell and gene therapy, the demand for sterile, single-use lab containers is accelerating. These containers reduce contamination risks, lower cleaning-validation costs, and improve operational efficiency. By 2026, disposable containers made from advanced polymers like COP (cyclo olefin polymer) and COPP are expected to capture over 35% of the market, especially in GMP-compliant facilities.

2. Emphasis on Sustainable and Eco-Friendly Materials

Environmental regulations and ESG (Environmental, Social, and Governance) goals are pushing lab container manufacturers to shift toward biodegradable or recyclable materials. In response, companies are investing in bio-based plastics and reusable container systems. By 2026, over 40% of new product launches are projected to feature sustainable materials, driven by European Green Deal policies and U.S. EPA guidelines.

3. Smart Lab Containers with Integrated IoT Capabilities

The integration of IoT (Internet of Things) sensors into lab containers—enabling real-time monitoring of temperature, humidity, and container integrity—is gaining traction. These “smart containers” support cold chain traceability and compliance in clinical trials and vaccine storage. By 2026, the smart lab container segment is forecasted to grow at a CAGR of 14%, with North America and Western Europe leading adoption.

4. Regional Expansion and Supply Chain Localization

Geopolitical tensions and pandemic-related disruptions have prompted a shift toward regionalized supply chains. In H2 2026, we expect increased manufacturing of lab containers in Asia-Pacific (especially India and South Korea) and Latin America to serve local research hubs and reduce import dependencies. This trend supports faster delivery times and compliance with regional regulatory standards.

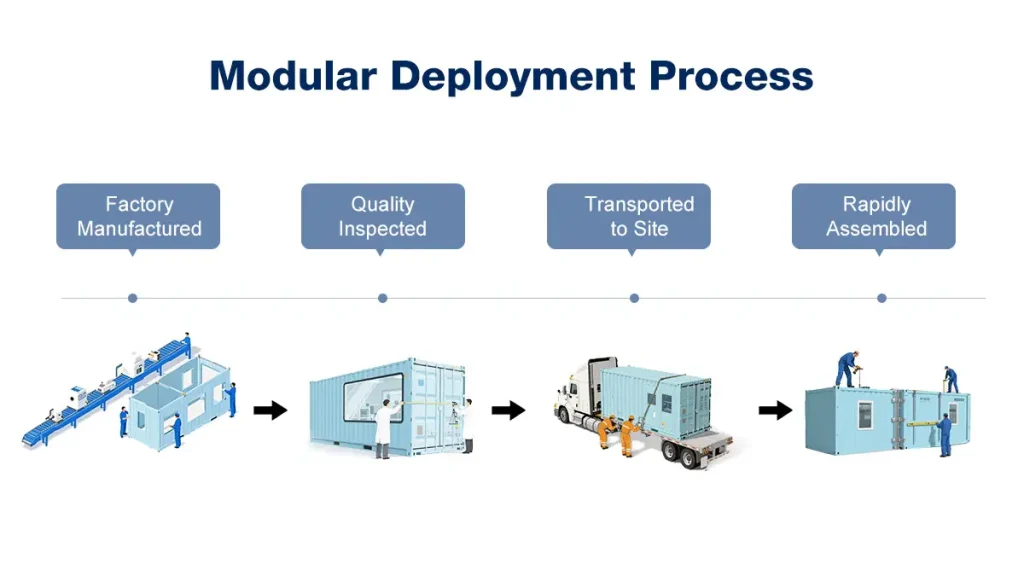

5. Customization and Modular Design

As research becomes more specialized, demand for customizable container formats—such as modular vial trays, nesting tubes, and automation-compatible racks—is rising. By 2026, over 50% of leading suppliers are expected to offer AI-driven design platforms allowing researchers to configure containers based on specific experimental needs.

6. Regulatory Harmonization and Quality Standards

Regulatory bodies like the FDA and EMA are pushing for stricter material traceability and leachables/extractables testing. As a result, lab container manufacturers are aligning with ISO 15189 and USP <665> guidelines. Compliance will be a competitive differentiator by 2026, especially for containers used in clinical diagnostics and drug development.

Conclusion

By 2026, the lab container market will be defined by innovation in materials, digital integration, and sustainability. Companies that align with H2 macro-trends—resilience, automation, and environmental responsibility—are likely to capture significant market share. Strategic partnerships between container manufacturers, labs, and logistics providers will be essential to meet evolving demands in life sciences and healthcare.

Common Pitfalls Sourcing Lab Containers (Quality, IP)

Sourcing lab containers—such as glassware, bioreactors, microplates, or custom single-use systems—entails significant risks if not managed carefully. Two critical areas where organizations often encounter challenges are product quality and intellectual property (IP) protection. Overlooking these aspects can lead to project delays, regulatory non-compliance, and legal exposure.

Quality-Related Pitfalls

Inconsistent Material Specifications

Lab containers must meet strict material standards (e.g., USP Class VI, ISO 10993) for biocompatibility, chemical resistance, and sterility. Sourcing from suppliers without certified quality management systems (e.g., ISO 13485) increases the risk of receiving substandard materials that compromise experimental integrity or patient safety in GMP environments.

Lack of Traceability and Documentation

Many suppliers fail to provide full documentation such as Certificates of Conformance (CoC), lot traceability, or extractables/leachables data. Without these, laboratories may face audit failures or struggle to validate processes, especially in regulated industries like pharmaceuticals or diagnostics.

Inadequate Sterility Assurance

For single-use containers, improper sterilization methods or poor packaging can lead to contamination. Relying on suppliers without validated sterilization processes (e.g., gamma irradiation with dose mapping) risks compromising sterile workflows and experimental outcomes.

Unverified Performance Claims

Suppliers may overstate container performance (e.g., low protein binding, high clarity, or temperature resistance). Without independent testing or third-party validation, users may discover compatibility issues only after significant investment in time and materials.

Intellectual Property (IP)-Related Pitfalls

Unprotected Custom Designs

When sourcing custom lab containers (e.g., specialty microfluidic chips or proprietary bioreactor configurations), failing to secure IP rights through proper agreements can result in the supplier claiming ownership or reselling similar designs to competitors.

Ambiguous Contract Terms

Purchase agreements that omit clear IP clauses may leave the buyer without rights to modify, reverse engineer, or reuse container designs. This is especially problematic in R&D collaborations or when transitioning from development to commercial scale.

Supplier Use of Your IP

Some suppliers may use customer-provided designs or specifications to develop their own product lines. Without non-disclosure agreements (NDAs) and IP assignment clauses, businesses risk losing competitive advantages and facing future competition from their own suppliers.

Infringement Risks from Supplier Designs

Using containers based on patented technologies (e.g., specific well geometries or closure systems) without due diligence may expose the buyer to third-party IP litigation. Suppliers may not disclose existing patents, leaving the end user liable for infringement.

Mitigation Strategies

- Conduct thorough supplier audits, including quality certifications and manufacturing practices.

- Require full technical documentation and batch-specific testing data.

- Use legally reviewed contracts that clearly define IP ownership, usage rights, and confidentiality.

- Perform patent landscape analyses when adopting new container technologies.

- Engage legal counsel early when sourcing custom or high-value lab containers.

Avoiding these pitfalls ensures reliable performance, regulatory compliance, and protection of innovation throughout the research and development lifecycle.

Logistics & Compliance Guide for Lab Container

This guide outlines the essential logistics and compliance considerations when transporting and handling laboratory containers, whether for research, clinical, or industrial applications. Adhering to these standards ensures safety, legal compliance, and integrity of contents.

H2: Transportation Regulations

Ensure all lab containers comply with relevant transportation regulations based on content type (biological, chemical, radioactive, etc.). Key frameworks include:

– IATA Dangerous Goods Regulations (DGR) – for air transport of hazardous materials

– IMDG Code – for international maritime shipment

– 49 CFR (DOT) – for domestic U.S. ground and air transport

Classify materials correctly (e.g., UN3373 for biological substances, Category B) and use approved packaging systems tested to performance standards.

H2: Packaging Standards

Use triple-layer packaging for diagnostic or biological specimens:

– Primary container: Leak-proof and capable of withstanding internal pressure

– Secondary container: Leak-proof and impact-resistant, with absorbent material if liquid

– Outer packaging: Rigid, labeled appropriately, and capable of withstanding handling

All packaging must pass drop, stack, and pressure tests as per regulatory requirements.

H2: Labeling and Documentation

Accurate labeling and documentation are mandatory:

– Attach UN number, proper shipping name, hazard class, and orientation arrows where applicable

– Include biohazard, infectious substance, or chemical hazard labels as needed

– Provide a completed Shipper’s Declaration for Dangerous Goods (when required)

– Include sender/recipient information with emergency contact details

H2: Cold Chain Management

For temperature-sensitive lab containers:

– Use validated cold chain packaging (e.g., dry ice, gel packs, refrigerated shippers)

– Monitor temperature with data loggers or indicators

– Label packages with “Keep Refrigerated” or “Do Not Freeze” as appropriate

– Document temperature control in shipping records

H2: Regulatory Compliance

Ensure compliance with local and international agencies:

– CDC and USDA (U.S.)

– WHO guidelines for infectious substances

– REACH and CLP (EU)

– Institutional Biosafety Committee (IBC) or equivalent approval for biological materials

Maintain records of training, shipment manifests, and permits for at least two years.

H2: Handling and Training

Personnel must be trained in:

– Hazardous material handling and emergency procedures

– Use of personal protective equipment (PPE)

– Spill response and waste disposal protocols

Training must be documented and refreshed annually or per regulatory updates.

H2: Import/Export Requirements

International shipments require:

– Export declarations and import permits (e.g., CITES for certain biological samples)

– Verification of destination country regulations (e.g., phytosanitary certificates)

– Use of licensed freight forwarders familiar with lab material shipments

Coordinate with customs brokers to prevent delays.

H2: Security and Chain of Custody

Maintain integrity through:

– Tamper-evident seals on containers

– Chain of custody documentation for forensic or regulated samples

– Secure storage during transit and layovers

– Tracking via GPS or scanning systems for high-value or sensitive materials

H2: Emergency Response

Prepare for incidents by:

– Including emergency spill kits appropriate for container contents

– Providing 24/7 emergency contact information on all packages

– Training staff in incident reporting and containment procedures

– Establishing protocols with local hazmat response teams if handling high-risk materials.

H2: Waste Disposal and Decontamination

After use:

– Decontaminate reusable lab containers per biosafety level (BSL) guidelines

– Dispose of single-use containers as biohazardous or chemical waste following local regulations

– Document disposal through certified waste management providers.

Conclusion for Sourcing Lab Containers

After a comprehensive evaluation of potential suppliers, material specifications, cost considerations, and compliance requirements, the sourcing of laboratory containers has been strategically aligned with organizational needs for quality, safety, and efficiency. The selected vendors offer containers that meet necessary regulatory standards (such as ISO, USP, and GLP), are compatible with diverse laboratory applications (including sample storage, chemical handling, and sterile environments), and demonstrate durability and reliability under controlled conditions.

Furthermore, factors such as scalability, lead times, sustainability (e.g., recyclable or reusable materials), and total cost of ownership have been carefully weighed to ensure long-term value. Establishing partnerships with reputable suppliers will not only enhance supply chain resilience but also support consistent laboratory operations and data integrity.

In conclusion, the sourcing strategy for lab containers balances performance, compliance, and cost-effectiveness, enabling the laboratory to maintain high operational standards while adapting to future demands. Ongoing supplier performance monitoring and periodic market reviews are recommended to ensure continued alignment with evolving research and safety requirements.