The global aftermarket agricultural machinery parts market is experiencing robust growth, driven by increasing demand for cost-effective maintenance solutions and extended equipment lifespans. According to Mordor Intelligence, the global agricultural machinery market is projected to grow at a CAGR of 6.8% from 2023 to 2028, with aftermarket parts playing a pivotal role in this expansion. As Kubota tractors and utility vehicles remain among the most widely used in both commercial farming and landscaping, the demand for reliable, high-performance aftermarket components has surged. This growing ecosystem has given rise to specialized manufacturers offering durable alternatives to OEM parts—covering everything from hydraulic components and filters to clutches and engine parts. Based on market penetration, customer reviews, and product availability, the following five aftermarket manufacturers have emerged as leaders in supplying high-quality Kubota-compatible parts.

Top 5 Kubota Aftermarket Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Orange Aftermarket

Domain Est. 2011

Website: orangeaftermarket.com

Key Highlights: All products shown are strictly aftermarket from a variety of manufacturers. No products shown were tested by, approved by, or recommended by Kubota….

#2 Kubota Engine Division

Domain Est. 1997

Website: engine.kubota.com

Key Highlights: Welcome to Kubota Engine Division website.This website offers information about Products, Kubota Engine, R&D, Exhibition schedule and our support….

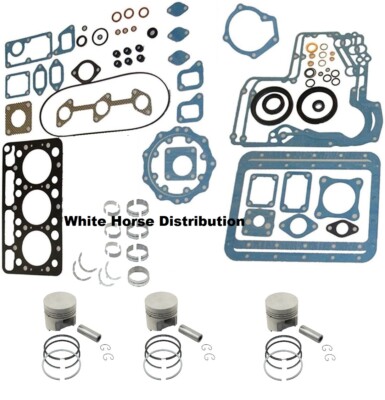

#3 Aftermarket Kubota Engine Replacement Parts for Sale

Domain Est. 1997

Website: rrproducts.com

Key Highlights: Free delivery over $150Shop our wide selection of Kubota engine replacement parts for sale at R&R Products. We offer fuel filters, fuel pumps, v-belts, ……

#4 Kubota Engine America

Domain Est. 1999

Website: kubotaengine.com

Key Highlights: Kubota Engine America has a vast service network in North and South America to provide parts and service support for your Kubota engines and generators….

#5 Kubota Parts Depot at MB Tractor

Domain Est. 2000

Expert Sourcing Insights for Kubota Aftermarket Parts

H2: Kubota Aftermarket Parts Market Trends Forecast for 2026

The Kubota aftermarket parts market is poised for significant evolution by 2026, driven by technological advancements, shifting customer expectations, and broader industry dynamics. Here’s a detailed analysis of the key trends shaping the landscape:

1. Accelerated Digitalization and E-Commerce Expansion

By 2026, digital platforms will be central to Kubota aftermarket distribution. Expect:

– Enhanced Online Marketplaces: Kubota and authorized dealers will expand robust e-commerce portals with real-time inventory, AI-driven part recommendations, and mobile-responsive interfaces.

– Digital Twins & AR Support: Integration of digital part catalogs with augmented reality (AR) tools will enable technicians to visualize part installations and troubleshoot issues remotely, increasing first-time fix rates.

– Predictive Maintenance Platforms: IoT-enabled Kubota equipment will generate data used to predict part wear, triggering automated aftermarket part orders and reducing downtime.

2. Growth of Remanufactured and Sustainable Parts

Environmental regulations and cost-conscious customers will drive demand for:

– Remanufactured Components: Kubota’s reman programs (e.g., engines, hydraulics) will expand, offering OEM-quality alternatives at 30–50% lower cost with comparable warranties.

– Circular Economy Initiatives: Increased focus on part recycling, material reuse, and carbon footprint labeling to meet ESG goals, particularly in Europe and North America.

3. Intensified Competition from Third-Party and Grey Market Parts

- Quality Improvements in Aftermarket Alternatives: Non-OEM suppliers will continue improving quality, leveraging reverse engineering and global manufacturing, capturing market share in price-sensitive segments.

- Kubota’s Countermeasures: Kubota will likely strengthen anti-counterfeit technologies (e.g., QR codes, blockchain traceability) and emphasize value-added services (e.g., warranty, technical support) to maintain loyalty.

4. Regional Market Diversification and Localization

- Emerging Markets Growth: Asia-Pacific (especially India and Southeast Asia), Latin America, and Africa will see rising demand due to agricultural mechanization and infrastructure development.

- Localized Supply Chains: To reduce lead times and tariffs, Kubota may increase regional warehousing and partner with local distributors for faster part delivery.

5. Electrification and Technology Shifts Impacting Part Demand

- Transition to Electric Equipment: As Kubota expands its electric mini-excavators and utility vehicles, demand will shift from traditional ICE parts (e.g., fuel injectors, exhaust systems) to batteries, motors, and power electronics.

- Hybrid Systems Proliferation: Interim hybrid models will require dual maintenance ecosystems, creating niche aftermarket opportunities for specialized components.

6. Consolidation and Strategic Partnerships

- Distribution Network Optimization: Kubota may consolidate dealer networks or form joint ventures to enhance service coverage and inventory efficiency.

- OEM-Third Party Collaborations: Partnerships with tech firms for telematics and analytics will enable smarter inventory management and customer engagement.

7. Workforce and Skills Gap Challenges

- Technician Training Demand: As equipment becomes more complex, Kubota will invest in certified training programs for dealers and independent shops to ensure proper part installation and diagnostics.

- Knowledge-Based Services: Revenue from technical support, software updates, and calibration services will grow alongside physical parts.

Conclusion

By 2026, the Kubota aftermarket parts market will be more digital, sustainable, and customer-centric. Success will depend on Kubota’s ability to leverage data, maintain OEM quality leadership, and adapt to electrification and global supply chain shifts. Companies that integrate seamless digital experiences, support evolving equipment technology, and prioritize sustainability will dominate the competitive landscape.

Common Pitfalls Sourcing Kubota Aftermarket Parts (Quality, IP)

Sourcing aftermarket parts for Kubota equipment can offer cost savings, but it also comes with significant risks—particularly concerning quality and intellectual property (IP). Being aware of these pitfalls is crucial for maintaining equipment performance, safety, and legal compliance.

Poor Quality and Inconsistent Performance

One of the most prevalent issues with aftermarket Kubota parts is inconsistent quality. Unlike genuine Kubota parts, which are manufactured to strict OEM (Original Equipment Manufacturer) standards, aftermarket components often vary widely in material quality, precision engineering, and durability. This can lead to premature part failure, reduced machine efficiency, and increased downtime. Low-quality aftermarket parts may not meet the load, temperature, or pressure specifications required for Kubota machinery, potentially causing collateral damage to other components.

Misfit and Compatibility Issues

Aftermarket parts manufacturers may not always replicate Kubota’s exact specifications, resulting in parts that don’t fit properly or function as intended. Even minor dimensional deviations in hydraulic components, engine parts, or transmission systems can compromise equipment safety and performance. Operators may face installation challenges, leaks, or system inefficiencies that are difficult to diagnose and costly to repair.

Lack of Warranty and Support

Many aftermarket suppliers offer limited or no warranties compared to the comprehensive support provided with genuine Kubota parts. In the event of a part failure, users may face delays in replacements or denial of claims due to lack of traceability or documentation. This absence of reliable customer support increases operational risk and undermines long-term cost savings.

Intellectual Property (IP) Infringement

Using or distributing counterfeit or unauthorized aftermarket parts can raise serious IP concerns. Kubota holds patents, trademarks, and design rights on many of its components. Aftermarket parts that closely mimic these designs without licensing may infringe on Kubota’s IP, exposing buyers and resellers to legal liability. Even if not counterfeit, some parts may be reverse-engineered in ways that violate intellectual property laws, particularly in jurisdictions with strong IP protections.

Voided Equipment Warranties

Installing non-genuine aftermarket parts can void the manufacturer’s warranty on Kubota equipment. If a failure occurs and an aftermarket part is implicated—even if it wasn’t the root cause—Kubota or its authorized dealers may deny warranty coverage. This risk is especially critical for newer machines still under factory warranty.

Supply Chain Transparency and Traceability

Aftermarket parts often lack transparency in their manufacturing origin and supply chain. This opacity makes it difficult to verify compliance with safety and environmental standards. In regulated industries or applications involving public safety (e.g., agriculture, construction), using untraceable parts can lead to compliance issues during audits or inspections.

Conclusion

While aftermarket Kubota parts may appear cost-effective upfront, the risks related to quality, fit, warranty, and IP infringement can lead to higher total ownership costs and operational vulnerabilities. Buyers should carefully vet suppliers, prioritize parts with certifications or quality assurance documentation, and consider the long-term reliability and legal implications before choosing non-OEM components.

Logistics & Compliance Guide for Kubota Aftermarket Parts

This guide outlines the essential logistics and compliance considerations for handling Kubota aftermarket parts to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

Establish a reliable network of suppliers and distributors that provide genuine-quality aftermarket parts compatible with Kubota equipment. Prioritize partners with proven track records in quality control and on-time delivery. Implement inventory management systems to monitor stock levels, prevent overstocking or shortages, and support just-in-time (JIT) delivery where applicable.

Parts Identification and Traceability

Ensure all aftermarket parts are accurately labeled with part numbers, compatibility information, and sourcing details. Maintain a digital catalog that cross-references Kubota OEM part numbers with aftermarket equivalents. Implement batch tracking and traceability systems to support recalls, warranty claims, and compliance audits.

Import/Export Compliance

When shipping parts across international borders, comply with all relevant customs regulations, including accurate Harmonized System (HS) code classification, proper documentation (commercial invoices, packing lists, certificates of origin), and adherence to export control laws. Verify that parts meet destination country requirements for labeling, safety, and environmental standards.

Quality Assurance and Certification

Source aftermarket parts from manufacturers compliant with recognized quality standards such as ISO 9001. Conduct regular quality audits and performance testing to ensure parts meet or exceed OEM specifications. Maintain records of certifications and test results for regulatory and customer inquiries.

Environmental and Regulatory Compliance

Dispose of packaging materials and defective parts in accordance with local environmental regulations. Comply with directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) where applicable. Provide proper documentation for the safe handling and disposal of parts containing hazardous materials.

Transportation and Warehousing

Use secure, climate-appropriate packaging to prevent damage during transit. Partner with logistics providers experienced in handling industrial parts, ensuring timely delivery and real-time shipment tracking. Maintain clean, organized warehouses with proper inventory controls, fire safety measures, and safeguards against theft or damage.

Warranty and Returns Management

Establish clear policies for warranty claims and returns that align with Kubota’s service standards. Train customer service teams to handle inquiries efficiently and process returns in compliance with regulatory and environmental guidelines. Keep detailed records of all warranty repairs and part exchanges.

Data Security and Recordkeeping

Protect customer and transaction data in compliance with data privacy regulations such as GDPR or CCPA. Maintain secure digital records of shipments, compliance documents, supplier agreements, and quality certifications for a minimum of seven years or as required by law.

Training and Compliance Monitoring

Provide regular training for logistics, procurement, and customer service staff on compliance requirements, product knowledge, and safety procedures. Conduct internal audits to ensure adherence to this guide and make improvements as regulations or business needs evolve.

In conclusion, sourcing Kubota aftermarket parts offers a cost-effective and practical solution for maintaining and repairing Kubota machinery without compromising performance or reliability. Aftermarket parts provide greater availability, competitive pricing, and compatibility with a wide range of models, making them an attractive alternative to OEM components. However, it is crucial to prioritize quality by selecting reputable suppliers and ensuring parts meet or exceed original specifications. With proper research and due diligence, operators can achieve significant savings while maintaining the efficiency and longevity of their equipment. Ultimately, sourcing Kubota aftermarket parts—when done wisely—strikes a balanced approach between affordability and functionality, supporting uninterrupted operations across agricultural, construction, and landscaping applications.