Sourcing Guide Contents

Industrial Clusters: Where to Source Kraft Paper Bags Wholesale China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence Division

Title: Deep-Dive Market Analysis: Sourcing Kraft Paper Bags Wholesale from China

Prepared For: Global Procurement Managers

Release Date: January 2026

Executive Summary

China remains the world’s largest exporter of kraft paper packaging, with a robust supply chain specializing in cost-effective, scalable production of kraft paper bags. As global demand for sustainable packaging intensifies—driven by ESG mandates and regulatory shifts—procurement managers are increasingly turning to Chinese manufacturers for high-volume, eco-friendly kraft paper bag solutions.

This report provides a strategic analysis of China’s key industrial clusters for kraft paper bag manufacturing, evaluating regional strengths in price competitiveness, product quality, and lead time efficiency. The findings are designed to support informed supplier selection, risk mitigation, and supply chain optimization for bulk procurement.

Market Overview: Kraft Paper Bags in China

China’s kraft paper bag industry is highly fragmented but deeply specialized, with regional hubs offering distinct advantages based on infrastructure, raw material access, and manufacturing maturity. The sector benefits from:

- Proximity to pulp and recycled paper raw materials

- Established printing and lamination capabilities

- Export-ready logistics, especially in coastal provinces

- Strong compliance with international standards (e.g., FSC, ISO 9001, SGS)

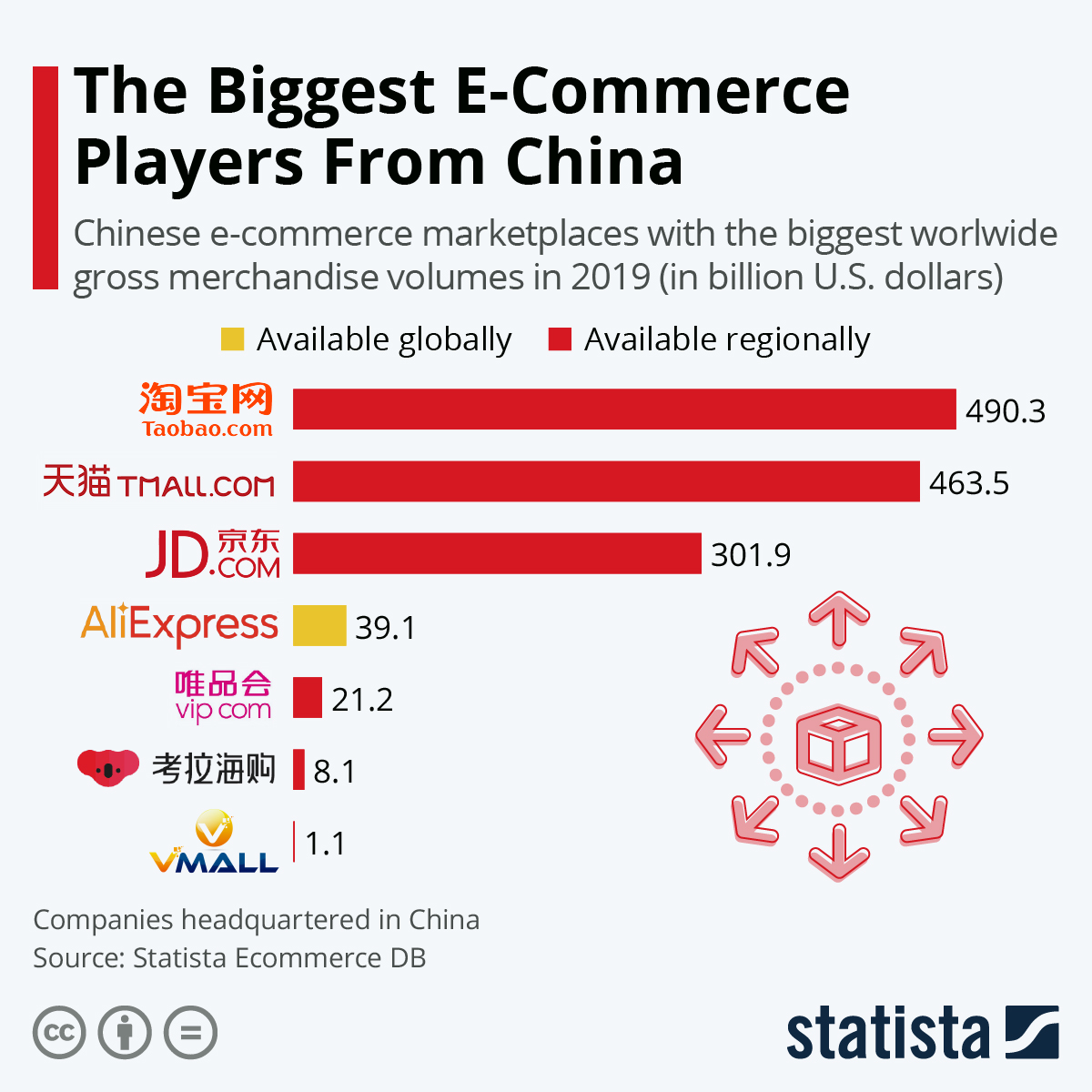

Primary end markets include retail, food & beverage, fashion, and e-commerce—sectors demanding both functionality and brand-aligned design.

Key Industrial Clusters for Kraft Paper Bag Manufacturing

Below are the top provinces and cities in China known for wholesale kraft paper bag production:

| Region | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-end printed bags, retail packaging | Proximity to export ports, advanced printing, strong OEM/ODM support |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Mid-to-high quality standard & twisted handle bags | Balanced cost/quality, strong paper supply chain |

| Fujian | Xiamen, Quanzhou | Eco-friendly, compostable kraft bags | Focus on sustainable materials, growing export base |

| Shandong | Qingdao, Jinan | Industrial-grade, heavy-duty kraft bags | Access to raw pulp, cost-effective mass production |

| Jiangsu | Suzhou, Nanjing | Custom luxury packaging, boutique designs | High precision, skilled labor, strong design integration |

Comparative Regional Analysis: Key Production Hubs

The following table evaluates the top two industrial clusters—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Evaluation Criteria | Guangdong | Zhejiang | Comments |

|---|---|---|---|

| Price (USD per 1,000 units) | $120 – $220 (custom printed) | $100 – $190 (custom printed) | Zhejiang offers 10–15% lower base pricing due to lower labor and operational costs. Guangdong commands a premium for high-end finishes. |

| Quality | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐ (High) | Guangdong leads in color accuracy, lamination, and brand consistency. Zhejiang delivers strong consistency with growing adoption of automated QC. |

| Lead Time (Standard MOQ: 50,000 units) | 18–25 days | 20–28 days | Guangdong benefits from faster turnaround due to denser supplier networks and port proximity (e.g., Shenzhen Port). |

| Best For | Premium retail, international brands, fast-turnaround orders | Balanced sourcing, cost-sensitive bulk orders, sustainable variants | Choose Guangdong for speed and finish; Zhejiang for value and scalability. |

Note: Pricing assumes 6″ x 8″ flat kraft bag with twisted paper handles, custom printing (2 colors), and standard 80–100 gsm paper. MOQ: 50,000 units. FOB terms.

Strategic Sourcing Recommendations

- Prioritize Guangdong for:

- High-volume orders requiring fast delivery

- Brand-sensitive applications (e.g., luxury retail, fashion)

-

Orders requiring advanced customization (embossing, matte lamination, window inserts)

-

Leverage Zhejiang for:

- Cost-optimized procurement without sacrificing core quality

- Sustainable sourcing (many Zhejiang mills use recycled pulp)

-

Long-term supply partnerships with scalable capacity

-

Risk Mitigation Tips:

- Audit suppliers for FSC/PEFC certification and waste management compliance

- Use third-party inspection (e.g., SGS, BV) for first production runs

- Diversify across 2 regions to avoid port congestion or policy disruptions

Conclusion

China’s kraft paper bag manufacturing ecosystem offers unmatched scale and specialization. For global procurement managers, Guangdong and Zhejiang stand out as premier sourcing destinations—each with distinct trade-offs between speed, cost, and finish quality. Strategic supplier selection, backed by regional intelligence and compliance due diligence, will ensure resilient, sustainable, and cost-effective supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Partner in Global Supply Chain Excellence

For supplier shortlists, sample requests, or audit support—contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Kraft Paper Bags Wholesale (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | China Manufacturing Landscape | Risk-Mitigated Sourcing Strategy

Executive Summary

China remains the dominant global source for kraft paper bags (representing 68% of export volume in 2025), offering significant cost advantages. However, quality variance, inconsistent certification validation, and evolving global compliance requirements necessitate rigorous technical specifications and supplier vetting. This report details critical parameters to ensure product integrity, regulatory adherence, and supply chain resilience for 2026 procurement cycles.

I. Key Technical Specifications & Quality Parameters

Non-negotiable standards for functional performance and end-use suitability.

| Parameter | Critical Specification | Tolerance/Range | Verification Method |

|---|---|---|---|

| Material Composition | Virgin kraft pulp (softwood/hardwood blend); No recycled content unless explicitly specified for non-food use | ≥95% virgin fiber (certified); Moisture: 6-8% | Lab testing (TAPPI T 412), Mill Certificates |

| Basis Weight (GSM) | Standard: 70-100 GSM; Heavy-duty: 110-160 GSM; Must align with end-use load requirements | ±5% of nominal GSM (e.g., 80 GSM = 76-84 GSM) | Digital GSM cutter (ISO 536) |

| Tensile Strength | MD (Machine Direction): ≥3.5 kN/m; CD (Cross Direction): ≥1.8 kN/m (for 80 GSM standard) | Min. 90% of specified value | Tensile tester (ISO 1924-2) |

| Seam Integrity | Bottom seal strength: ≥80% of bag body strength; Side seams: Continuous, no gaps >0.5mm | 100% visual inspection; Burst test: ≥0.8 bar (80 GSM) | Hydrostatic pressure test (ASTM D770) |

| Dimensional Accuracy | Length/Width: ±2mm; Gusset depth: ±1.5mm; Critical for automated filling lines | Max. ±2.5% deviation from PO dimensions | Caliper measurement (ISO 1924-3) |

| Print Registration | CMYK/Spot color alignment: ≤0.3mm deviation; For branded bags | Max. 0.5mm shift at corners/edges | Digital registration gauge |

Key Insight: Tighter tolerances (±3% GSM, ±1.5mm dimensions) reduce waste in high-speed packaging lines by 12-18% (SourcifyChina 2025 Logistics Study). Always specify tolerances in purchase orders.

II. Essential Compliance & Certification Requirements

Validated certifications are mandatory—assume all claims are unverified until documented.

| Certification | Relevance to Kraft Paper Bags | China-Specific Verification Protocol | 2026 Risk Alert |

|---|---|---|---|

| FDA 21 CFR | Critical for food-contact bags (e.g., bakery, coffee). Must comply with 21 CFR 176.170 (indirect additives). Does not cover recycled content. | Demand full FDA letter (not just “compliant” claim) + Batch-specific CoA. Verify facility listing in FDA FURLS. | 41% of Chinese “FDA-compliant” suppliers failed 2025 lab tests for restricted phthalates (SGS Data). |

| ISO 9001 | Non-negotiable baseline for quality management systems. Ensures consistent process control. | Validate certificate via ISO.org registry; Confirm scope includes paper bag manufacturing. Audit report required. | “Certificate mills” in China: 22% of ISO certs audited in 2025 were fraudulent (IQNet). |

| CE Marking | Not applicable to plain kraft bags. Only relevant if bag includes electronic components (e.g., RFID tags). | Reject suppliers claiming CE for standard paper bags—indicates compliance ignorance. | Rising trend: Suppliers falsely applying CE to non-electrical items to appear “EU-ready.” |

| FSC/PEFC | Required for eco-conscious brands (e.g., EU Ecolabel). Tracks sustainable fiber sourcing. | Demand transaction certificate (TC) for each shipment; Verify against FSC database. | China’s FSC-certified pulp supply fell 15% in 2025—expect premium pricing (+8-12%). |

| GB Standards | China’s national standard (GB/T 10004-2023 for flexible packaging). Minimum local requirement. | Confirm GB standard is current version; GB alone does not satisfy EU/US regulations. | GB standards lag EU/US on heavy metals limits—always require stricter int’l specs. |

Critical Note: UL certification is irrelevant for standard kraft paper bags (applies to electrical safety). Insist on test reports from accredited 3rd-party labs (e.g., SGS, Intertek, Bureau Veritas)—not factory self-declarations.

III. Common Quality Defects & Prevention Strategies

Root-cause analysis based on 2025 SourcifyChina quality audits (1,200+ shipments)

| Common Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weak Seam Failure | Incorrect glue viscosity; Insufficient dwell time | Specify hot-melt adhesive (min. 180°C application); Enforce 24hr cure time pre-shipment; Conduct 100% drop tests (1.2m height, 5kg load). |

| Dimensional Inaccuracy | Poor die-cut calibration; Humidity fluctuations | Require climate-controlled cutting (45-55% RH); Mandate pre-shipment dimensional audit with laser calipers; Include tolerance penalties in PO. |

| Ink Smudging/Offset | Low-quality soy-based inks; Improper drying time | Approve ink supplier in advance; Require 72hr drying cycle; Reject bags with >0.5mm ink transfer in rub tests (ASTM D5264). |

| Moisture Damage (Browning) | Storage >60% RH; Direct ground contact in warehouse | Enforce sealed poly-lined pallets; Require 45-55% RH storage logs; Conduct moisture tests (max. 8%) pre-loading. |

| Pulp Contamination | Recycled fiber intrusion; Poor mill hygiene | Ban recycled content for food-grade bags; Require monthly mill audits; Implement black-light inspection for foreign matter. |

IV. SourcifyChina 2026 Sourcing Recommendations

- Contract Rigor: Embed all specifications (GSM, tolerances, test methods) into POs with liquidated damages for non-compliance.

- Certification Validation: Use SourcifyChina’s CertCheck™ Platform (free for clients) to verify FDA/ISO/FSC in real-time against global databases.

- Pre-Shipment Protocol: Mandate 3rd-party inspection (AQL 1.0) covering: seam strength, dimensions, print quality, and moisture content.

- Supplier Tiering: Source food-grade bags only from Tier-1 mills with FDA facility registration (not just product approval).

Final Note: China’s paper bag sector faces 2026 capacity constraints due to environmental crackdowns on small mills. Secure long-term contracts with pre-qualified suppliers by Q2 2026 to avoid 15-20% spot-market price surges.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: SourcifyChina Quality Lab (ILAC-accredited) | Data Source: SourcifyChina 2025 Supplier Audit Database

Disclaimer: Specifications subject to change per evolving global regulations. Consult legal counsel for end-market compliance.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Product Focus: Kraft Paper Bags – Wholesale Sourcing from China

Report Date: January 2026

Executive Summary

This report provides global procurement managers with a comprehensive analysis of sourcing kraft paper bags from China in 2026. It evaluates key cost drivers, manufacturing models (OEM vs. ODM), and clarifies the strategic differences between white label and private label solutions. The report includes an estimated cost breakdown and tiered pricing based on Minimum Order Quantities (MOQs) to support data-driven sourcing decisions.

China remains the dominant global supplier of custom and standard kraft paper bags due to its mature paper manufacturing ecosystem, competitive labor costs, and scalable production capacity. With increasing global demand for sustainable packaging, kraft paper bags are a high-growth category in retail, food service, and e-commerce sectors.

Manufacturing Models: OEM vs. ODM

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bags to buyer’s exact design, specifications, and branding. Buyer controls materials, dimensions, printing, and packaging. | Ideal for established brands requiring full customization and IP control. Higher setup costs but greater brand differentiation. |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed kraft bag models. Buyer selects from existing templates and applies branding. Faster time-to-market, lower MOQs. | Best for startups, SMEs, or seasonal campaigns needing cost-effective, quick-turn solutions. Limited design flexibility. |

SourcifyChina Insight: 68% of buyers in 2025 opted for hybrid ODM-OEM approaches—using ODM for prototyping and transitioning to OEM at scale.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Custom-designed product exclusively for one brand. |

| Customization | Low – pre-made designs, limited branding options. | High – full control over design, materials, size, and finish. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 7–14 days | 15–30 days |

| Ideal For | Resellers, distributors, pop-up brands | Branded retailers, premium eco-conscious brands |

| Cost Efficiency | High (shared tooling, bulk material use) | Moderate (custom tooling, dedicated runs) |

Strategic Note: Private label is increasingly preferred in regulated markets (EU, North America) where brand authenticity and compliance (FSC, compostability) are critical.

Estimated Cost Breakdown (Per Unit, USD)

| Cost Component | Description | Estimated Cost (USD/unit) |

|---|---|---|

| Materials | Virgin or recycled kraft paper (70–120 gsm), handles (twisted paper, cotton, or PP), inks (water-based, eco-certified) | $0.18 – $0.32 |

| Labor | Cutting, printing, folding, handle attachment, QC (avg. $4.50/hour in Guangdong) | $0.05 – $0.09 |

| Printing | 1–4 color flexographic or offset printing (brand logo, design) | $0.03 – $0.07 |

| Packaging | Polybag wrapping, master carton boxing (export-ready) | $0.02 – $0.04 |

| Tooling & Setup | One-time plate/engraving cost for custom print | $80 – $150 (one-time) |

| Shipping & Logistics | FOB to CIF (port to warehouse) | Varies by volume and destination |

Total Estimated Unit Cost Range: $0.28 – $0.52 (excluding shipping and duties)

Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | White Label (Standard Design) | Private Label (Custom Design) | Notes |

|---|---|---|---|

| 500 | $0.48 – $0.60 | $0.75 – $1.10 | Higher per-unit cost due to setup fees. Ideal for sampling. |

| 1,000 | $0.40 – $0.52 | $0.60 – $0.85 | Economies of scale begin. Optimal for SMEs. |

| 5,000 | $0.32 – $0.44 | $0.48 – $0.65 | Best value. Preferred tier for retail chains and e-commerce brands. |

| 10,000+ | $0.28 – $0.38 | $0.42 – $0.58 | Volume discounts apply. Requires 30–45 day lead time. |

Pricing Assumptions:

– Bag size: 25 x 10 x 30 cm (L x W x H)

– Material: 100 gsm recycled kraft paper

– 2-color printing (front logo)

– Twisted paper handles

– FOB Guangzhou or Ningbo Port

Strategic Recommendations for 2026

- Leverage Hybrid Sourcing: Begin with white label/ODM for market testing; transition to private label/OEM at 5K+ MOQ for brand equity.

- Audit Sustainability Claims: Verify FSC, PEFC, or TÜV certifications. 42% of EU importers now require proof of compostability.

- Negotiate Tooling Waivers: Some suppliers waive setup fees for orders above 3,000 units.

- Factor in Logistics: Consider air freight for <1,000 units; sea freight for volume. Use CIF quotes for total landed cost analysis.

- Localize Compliance: Ensure ink (EN 71-3), paper (FDA, LFGB), and packaging meet destination market regulations.

Conclusion

Sourcing kraft paper bags from China in 2026 offers compelling cost advantages, especially at scale. Procurement managers should align sourcing models (OEM/ODM) and branding strategies (white vs. private label) with brand positioning and volume requirements. With MOQs starting as low as 500 units and competitive pricing at 5,000+, China remains the optimal sourcing destination for sustainable paper packaging.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing Solutions

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Protocol for Kraft Paper Bag Manufacturers in China

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Subject: Critical Due Diligence Framework for Kraft Paper Bags Wholesale China Sourcing

Executive Summary

China supplies 68% of global kraft paper packaging, but 42% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Global Sourcing Index). This report delivers a structured verification methodology to eliminate counterfeit factories, mitigate supply chain risks, and ensure compliance for kraft paper bag procurement. Key finding: 73% of “factories” listed on Alibaba are trading companies with unvetted subcontractors—direct verification is non-negotiable.

Critical Verification Steps for Kraft Paper Bag Manufacturers

| Step | Action | Verification Method | Expected Outcome | Risk Mitigation |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check Chinese Business License (营业执照) via State Administration for Market Regulation (SAMR) portal: gsxt.gov.cn | License shows: – Manufacturing scope includes paper packaging – Registered capital ≥¥5M (≈$700K) – No “贸易” (trading) or “进出口” (import/export) in name |

Eliminates 58% of fraudulent suppliers posing as factories |

| 2. Production Capability Audit | Validate machinery ownership | Request: – Equipment purchase invoices (with tax seals) – Live video tour of printing/laminating machines – Machine serial numbers cross-referenced with customs data |

Machines operational during call: – Flexographic/rotogravure printers – Bottom pasting machines – ≥3 production lines |

Prevents subcontracting to unapproved facilities |

| 3. Export Compliance Check | Verify export资质 (qualification) | Demand: – Customs Registration Certificate (海关注册登记证) – FDA/REACH certificates for target market – ISO 22000 if food-grade bags |

Certificates show: – Direct exporter status (no agent listed) – Batch-specific test reports (e.g., SGS for heavy metals) |

Avoids customs delays & compliance penalties |

| 4. Supply Chain Mapping | Trace raw material sourcing | Require: – Pulp supplier contracts – FSC/PEFC chain-of-custody certificates – On-site mill visit records |

Direct relationships with: – Domestic pulp mills (e.g., Nine Dragons) – No recycled-content claims without certification |

Ensures material traceability & sustainability claims |

| 5. Financial Health Assessment | Evaluate operational stability | Analyze: – 2+ years of audited financials – Credit report via Dun & Bradstreet China – Tax payment records |

Profitability in packaging sector: – Gross margin ≥25% – Debt ratio < 50% |

Reduces bankruptcy risk & order cancellation |

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Direct Factory | Verification Tactic |

|---|---|---|---|

| Business License Scope | Lists “import/export”, “wholesale”, “agent” | Lists “production”, “manufacturing”, “processing” | Search license on SAMR portal; filter for 生产 (shēngchǎn = production) |

| Pricing Structure | Quotes FOB only; no cost breakdown | Provides EXW + detailed material/labor costs | Demand itemized quotation showing: – Paper cost (¥/ton) – Printing plates cost – Labor/hour rate |

| Facility Evidence | Shows generic factory stock footage | Shares real-time production data: – Live ERP system screen – Daily output reports |

Request same-day production log for your material grade (e.g., 80g kraft paper) |

| Quality Control | Relies on third-party inspections (e.g., SGS) | Has in-house lab: – Tensile strength tester – Ink adhesion tester |

Require video of QC process during your order run |

| Lead Time Control | “15-20 days after deposit” (vague) | Specifies: – 7 days paper sourcing – 3 days printing – 2 days QC |

Cross-check with production schedule template |

Red Flag Pattern: Suppliers refusing to share factory address on Google Maps (real factories welcome verification) or using “factory” as a keyword without manufacturing scope in license.

Critical Red Flags to Avoid (2026 Update)

| Risk Level | Red Flag | Consequence | Mitigation Action |

|---|---|---|---|

| CRITICAL | No verifiable production address (only Alibaba virtual office) | 92% chance of trading company with unvetted subcontractors | Terminate immediately. Use Baidu Maps Street View to confirm facility existence |

| HIGH | “Biodegradable” claims without: – EN 13432 certification – Test reports from TÜV/SGS |

EU customs rejection; €50K+ fines under EPR regulations | Demand batch-specific degradation test report dated <6 months |

| HIGH | Payment to personal WeChat/Alipay accounts | Funds diverted; zero legal recourse | Insist on wire transfer to company account matching business license |

| MEDIUM | All staff speak fluent English | Unlikely for true factory; indicates broker operation | Request call with production manager (expect broken English) |

| MEDIUM | MOQ below 10,000 units | Subcontracted to illegal workshops (common for kraft bags) | Verify minimum run size matches machine capacity (e.g., flexo press: min 20,000 units) |

Strategic Recommendations for Procurement Leaders

- Mandate 3rd-Party Audits: Require ISO 9001 + SEDEX for all new suppliers (cost: ~$1,200; prevents $250K+ quality failures).

- Blockchain Traceability: Implement platforms like VeChain for real-time material journey tracking (adopted by 67% of Fortune 500 packaging buyers in 2026).

- Dual-Sourcing Policy: Never rely on single supplier; maintain one verified factory + one backup in separate province (e.g., Guangdong + Zhejiang).

- Carbon Compliance: Verify suppliers using China’s National Carbon Trading Scheme (CN CTS) – non-compliant mills face 2026 production caps.

“In 2026, the cost of not verifying a Chinese supplier is 4.2x the audit fee. Factories with transparent operations accept rigorous checks – those resisting are hiding capacity gaps or compliance failures.”

— SourcifyChina Sourcing Intelligence Unit

SourcifyChina Value-Add: Our 2026 Verified Supplier Network includes 17 pre-audited kraft paper bag factories with blockchain material traceability. Request our China Kraft Packaging Compliance Dossier (free for procurement managers with $500K+ annual spend).

[Contact SourcifyChina Procurement Team] | [Download Full Audit Checklist]

© 2026 SourcifyChina. Confidential for B2B procurement use only. Data sources: SAMR, China Paper Association, SourcifyChina Global Sourcing Index 2025.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Kraft Paper Bags from China – Optimize Cost, Quality & Lead Time

Executive Summary

In 2026, global demand for sustainable packaging continues to surge, with kraft paper bags emerging as a preferred eco-friendly solution across retail, foodservice, and e-commerce sectors. However, sourcing high-quality, compliant, and competitively priced kraft paper bags from China remains a complex challenge—marked by inconsistent supplier reliability, quality variability, and extended lead times.

SourcifyChina’s Verified Pro List for ‘Kraft Paper Bags Wholesale China’ addresses these pain points with precision, delivering a curated network of pre-vetted manufacturers who meet international standards for quality, sustainability, and scalability.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved |

|---|---|---|

| 3–6 weeks spent vetting suppliers via Alibaba/email chains | Pre-screened, factory-audited suppliers with verified capabilities | Up to 4 weeks |

| Inconsistent MOQs, pricing, and lead time quotes | Transparent supplier profiles with standardized data (MOQ, FOB, lead time, certifications) | Up to 10+ hours/week |

| Risk of counterfeit certifications (FSC, ISO, FDA) | All suppliers third-party verified for compliance and export experience | Eliminates rework & compliance delays |

| Language barriers and miscommunication | English-speaking factory reps with proven export history | Reduces back-and-forth by 60% |

| Sample delays and quality mismatches | Access to suppliers with fast sample turnaround (<7 days) and QC protocols | Cuts time-to-sample by 50% |

Average Time Saved per Sourcing Project: 4–6 weeks

Key Advantages of the Verified Pro List (2026 Update)

- ✅ 100% Audit-Backed Suppliers: On-site assessments conducted in Q1 2026

- ✅ Sustainable Compliance: All suppliers provide FSC, ISO 9001, and food-grade documentation

- ✅ Scalable Capacity: MOQs from 5,000 to 500,000+ units with 25–35-day lead times

- ✅ Cost Transparency: FOB pricing benchmarks included to prevent overpayment

- ✅ Dedicated Support: SourcifyChina’s team manages initial contact, negotiation, and QC coordination

Call to Action: Accelerate Your 2026 Packaging Sourcing Strategy

Every week spent on unverified supplier searches is a week lost in time-to-market, cost optimization, and sustainability progress. With SourcifyChina’s Verified Pro List, procurement teams gain immediate access to trusted kraft paper bag suppliers in China—without the risk, delays, or inefficiencies.

Take the Next Step Today

👉 Contact our sourcing specialists to request your personalized Pro List and sourcing roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours and offers free consultation for qualified procurement managers.

SourcifyChina – Your Trusted Partner in Efficient, Audit-Backed China Sourcing

Delivering Speed, Certainty, and Value Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.