Sourcing Guide Contents

Industrial Clusters: Where to Source Knowles China Company Dolls

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “Knowles China Company Dolls” from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

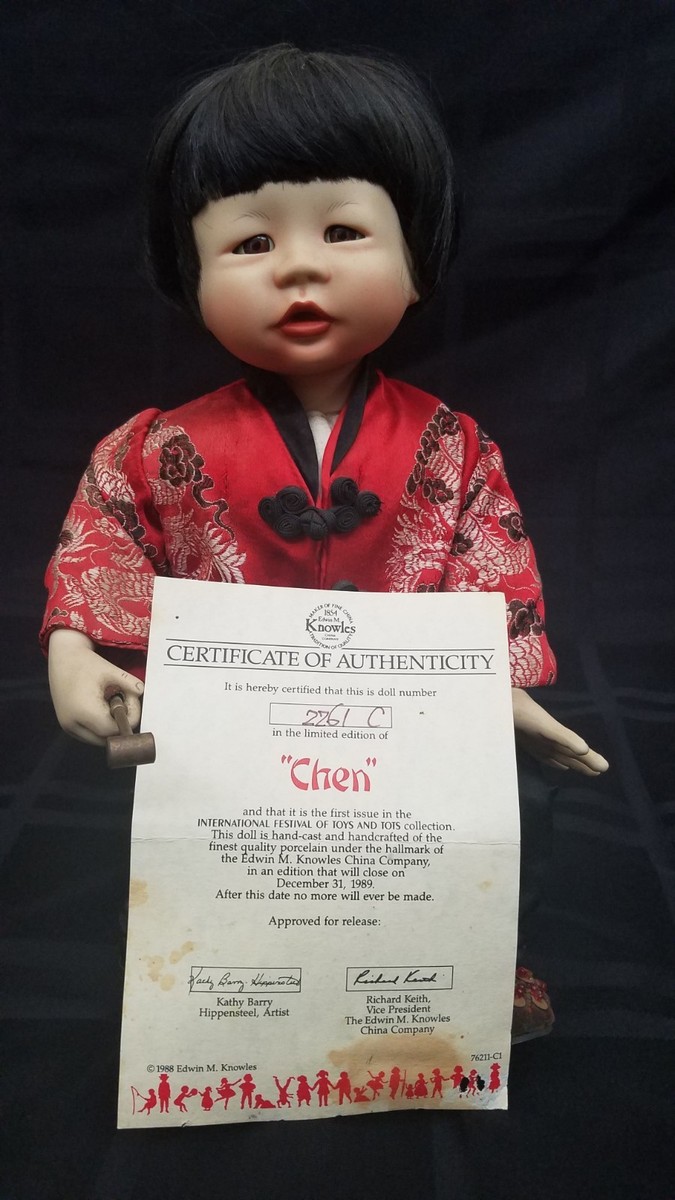

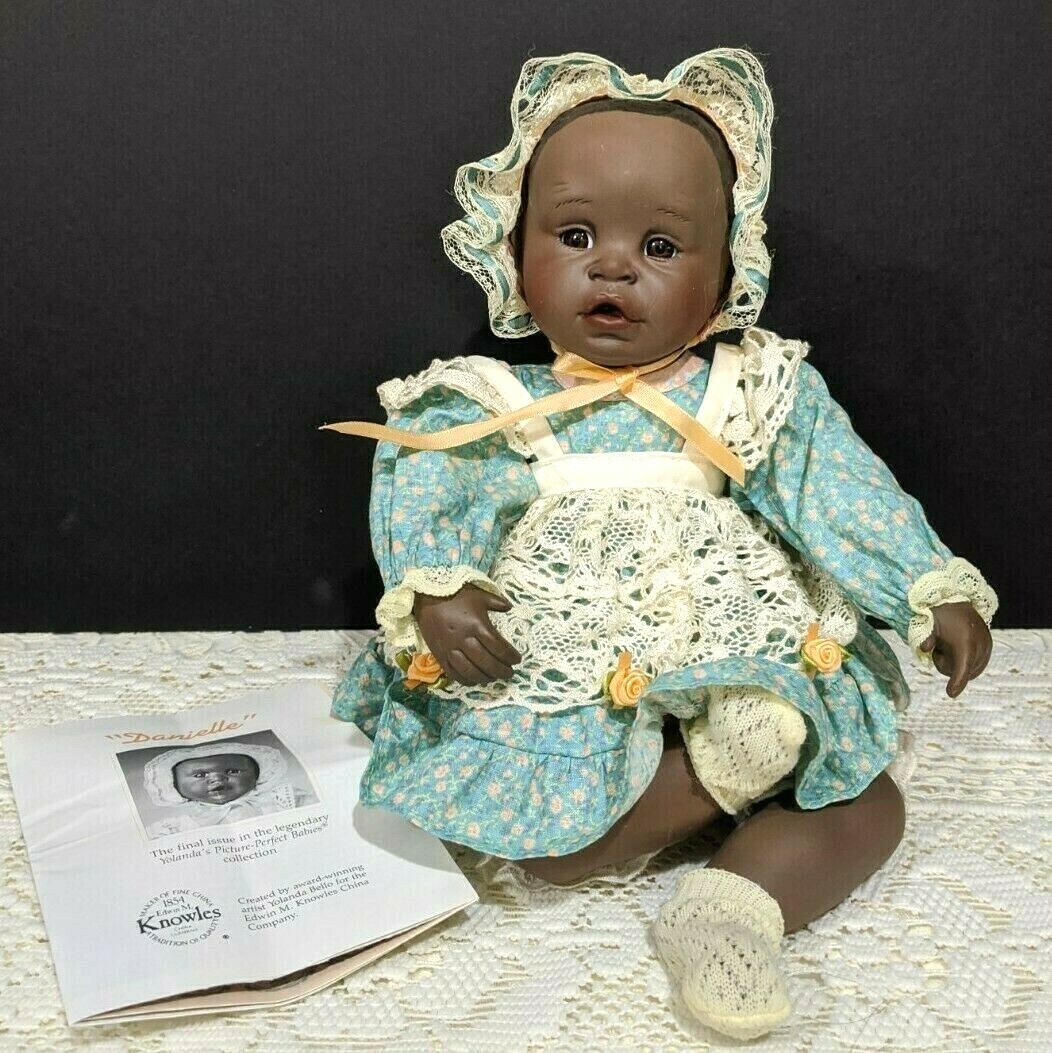

This report provides a comprehensive market analysis for sourcing dolls associated with the Knowles China Company—a brand name referenced in global supply chain discussions, likely linked to specialty or licensed doll manufacturing in China. While “Knowles China Company” does not correspond to a publicly registered manufacturer in China’s industrial databases, the term appears to be used colloquially or internally to describe a class of high-fidelity, fashion, or collectible dolls produced under contract for international brands.

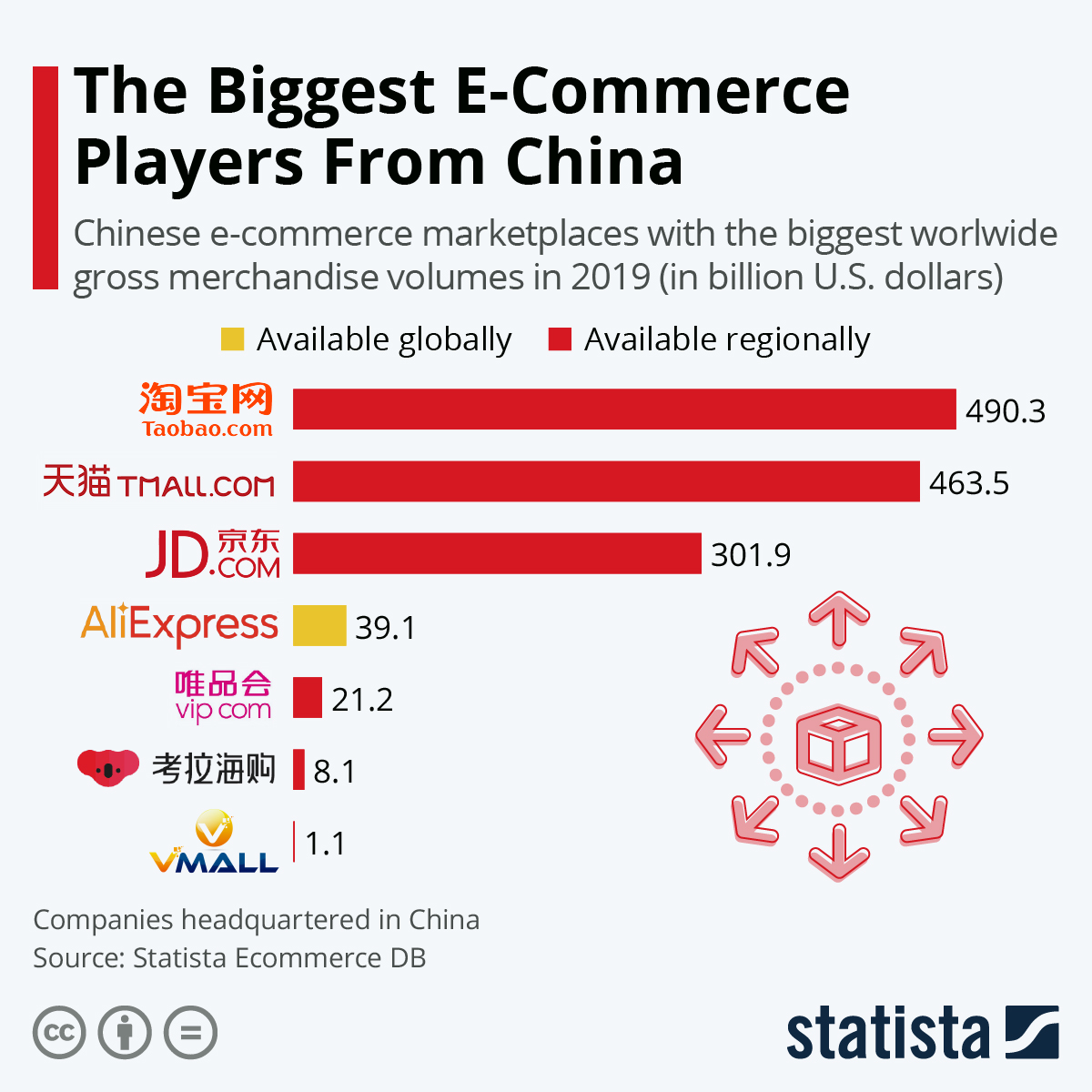

Based on industry intelligence, trade data (HS Code 9503.00.60 – Dolls representing humans), and supplier mapping, this report identifies the key industrial clusters in China responsible for manufacturing premium and mid-tier dolls. The analysis focuses on Guangdong and Zhejiang provinces—dominant hubs in toy and doll production—and evaluates them across critical procurement metrics: Price, Quality, and Lead Time.

China remains the world’s leading exporter of dolls, accounting for over 78% of global doll exports in 2025 (UN Comtrade). The Pearl River Delta (Guangdong) and the Yangtze River Delta (Zhejiang) are the epicenters of doll manufacturing, hosting vertically integrated supply chains from mold design to packaging.

Key Industrial Clusters for Doll Manufacturing in China

1. Guangdong Province – Dongguan & Shantou (Chaoyang District)

- Dominant Sub-Sector: Mass-market and mid-to-high-end fashion dolls, vinyl dolls, and electronic-integrated dolls.

- Key Advantages:

- Proximity to Hong Kong for logistics and export compliance.

- Mature ecosystem of plastic injection molding, painting, hair implantation, and packaging.

- High concentration of ISO-certified factories with experience in Western safety standards (ASTM F963, EN71).

- Notable Industrial Parks: Shantou Chenghai Toy Industrial Zone (over 4,000 toy/doll-related enterprises).

2. Zhejiang Province – Yiwu & Ningbo

- Dominant Sub-Sector: Smaller-sized dolls, collectibles, and OEM/ODM for European and North American niche brands.

- Key Advantages:

- Strong small-batch customization capabilities.

- Lower labor costs compared to Guangdong.

- Proximity to Shanghai port and Yiwu’s global small commodities market for rapid prototyping.

- Notable Hub: Yiwu International Trade City (source for doll accessories and low-MOQ suppliers).

3. Jiangsu Province – Suzhou & Kunshan

- Niche Focus: High-precision silicone and reborn dolls (ultra-realistic).

- Key Advantage: Advanced R&D capabilities in biomimetic materials and hand-painting techniques.

- Typical Clients: Premium collectible doll brands and medical simulation models.

Note: “Knowles China Company dolls” are likely manufactured under ODM arrangements in Guangdong or Zhejiang, with final branding and distribution managed offshore.

Comparative Analysis: Key Doll Manufacturing Regions in China

| Region | Average Price (USD/unit) | Quality Tier | Typical Lead Time (from PO to FOB) | Best For |

|---|---|---|---|---|

| Guangdong | $2.80 – $6.50 | Mid to High (consistent) | 45–60 days | High-volume orders, compliance-heavy markets (US/EU), fashion dolls |

| Zhejiang | $2.20 – $5.00 | Mid (variable across suppliers) | 35–50 days | Small-to-medium batches, customizable designs, cost-sensitive buyers |

| Jiangsu | $8.00 – $25.00+ | Premium (artisan-level) | 60–90 days | Collectible, medical training, or ultra-realistic dolls |

| Fujian (Xiamen) | $2.50 – $5.80 | Mid (emerging cluster) | 50–65 days | Hybrid orders combining textiles and plastic components |

Notes:

– Prices based on MOQ of 10,000 units, EXW or FOB Shenzhen/Ningbo.

– Quality Tier: Assessed via on-site audits, material traceability, and defect rate (PPM).

– Lead Time includes tooling (2–3 weeks), production (3–4 weeks), and QC/shipping prep.

Strategic Sourcing Recommendations

-

For Volume Procurement (100K+ units):

Source from Guangdong, specifically Dongguan or Shantou. Prioritize factories with BSCI/SEDEX certifications and in-house mold-making capabilities. -

For Customization & Fast Turnaround (10K–50K units):

Leverage Zhejiang suppliers via Yiwu-based sourcing agents. Ideal for seasonal or limited-edition lines. -

For Premium Collectible Lines:

Engage Jiangsu specialists with proven portfolios in silicone skin formulation and hand-articulated joints. -

Compliance & IP Protection:

All suppliers should sign NDAs and provide material test reports (SGS, Intertek). Use Alibaba Trade Assurance or letter of credit (LC) for payment security.

Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Rising labor costs in Guangdong | Dual-source from Zhejiang; negotiate annual pricing contracts |

| IP infringement (design cloning) | Register designs in China via CIPO; use trusted sourcing partners |

| Logistics delays (port congestion) | Diversify ports: use Ningbo-Zhoushan (Zhejiang) as alternative to Shenzhen |

| Material compliance (phthalates, paint) | Mandate third-party testing pre-shipment |

Conclusion

While “Knowles China Company” is not a standalone registered manufacturer, the production of dolls under such brand umbrellas is concentrated in Guangdong and Zhejiang, with Guangdong leading in quality consistency and scale, and Zhejiang offering agility and cost efficiency. Global procurement managers should align sourcing strategy with order volume, quality requirements, and time-to-market goals.

SourcifyChina recommends on-the-ground supplier audits, pilot runs, and digital QC reporting (via platforms like Sightline or Inspectorio) to de-risk doll procurement in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Knowles Corporation China Operations

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Electronics & Medical Device Sectors)

Subject: Technical & Compliance Analysis for Knowles China Components (Clarification: “Dolls” Misnomer)

Critical Clarification

“Knowles China Company dolls” is a significant misnomer. Knowles Corporation (NYSE: KN) is a global leader in advanced micro-acoustic components, human interface solutions, and precision devices – not dolls or toys. Their China operations (Suzhou, Dongguan) manufacture:

– MEMS microphones & speakers

– Hearing aid components (receivers, microphones)

– RF filters & timing devices

– Piezoelectric speakers (e.g., for wearables)

Procurement managers sourcing “dolls” should engage toy manufacturers (e.g., Mattel, MGA Entertainment suppliers). This report covers Knowles China’s actual product lines relevant to B2B electronics procurement.

I. Technical Specifications & Quality Parameters

Applies to MEMS Microphones, Hearing Aid Components, Piezo Speakers

| Parameter Category | Key Specifications | Tolerances | Criticality |

|---|---|---|---|

| Materials | – Diaphragm: Silicon Nitride (SiN) or Parylene – Housing: LCP (Liquid Crystal Polymer), Stainless Steel – Adhesives: Medical-grade epoxies (ISO 10993) – MEMS Chips: 8″ or 12″ wafer fabrication |

– Polymer thickness: ±0.5µm – Metal plating: ±0.2µm – Adhesive viscosity: ±5% |

★★★★★ (Failure = Total component rejection) |

| Acoustic Performance | – Sensitivity: -38 dBV ±2 dB (94 dB SPL @ 1 kHz) – Frequency Response: 100 Hz – 10 kHz (±3 dB) – THD: <1% (94 dB SPL, 1 kHz) |

– Sensitivity drift: ≤0.5 dB/°C – Resonant frequency shift: ±50 Hz max |

★★★★☆ (Impacts end-product audio quality) |

| Dimensional | – MEMS Mic: 2.75 x 1.85 x 0.98 mm (typical) – Hearing Aid Receiver: Ø5.8 x 3.2 mm |

– Outline dimensions: ±0.05 mm – Terminal coplanarity: ≤0.03 mm |

★★★★☆ (Affects SMT assembly yield) |

| Environmental | – Operating Temp: -40°C to +85°C – Humidity: 5% to 95% RH (non-condensing) – IP Rating: IP57 (select models) |

– Temp. hysteresis: ≤0.3 dB – Moisture ingress: ≤0.1% weight gain |

★★★☆☆ (Field failure risk) |

II. Mandatory Compliance Certifications

Non-negotiable for market access. Verify certificates via Knowles’ official portal.

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| ISO 13485:2016 | Quality Management for Medical Devices | Essential for hearing aid components (Class I/II devices). Covers design, production, traceability. | Audit certificate + Scope Certificate showing “Hearing Instrument Components” |

| CE Marking (MDR 2017/745) | EU Medical Device Regulation | Required for hearing aid parts sold in EEA. Knowles acts as component manufacturer under OEM’s system. | Technical File review + OEM’s Declaration of Conformity referencing Knowles part number |

| FDA 21 CFR Part 820 | US Quality System Regulation | Mandatory for components in FDA-cleared hearing aids (510(k) pathway). | FDA Establishment Registration # (e.g., Knowles Suzhou: 3007730803) + Supplier Quality Agreement |

| IEC 60601-1 | Medical Electrical Equipment Safety | Required for patient-contact components (e.g., hearing aid receivers). | Test reports for dielectric strength, leakage current (per IEC 60601-1:2012 + Amd 1:2020) |

| RoHS 3 / REACH | Material Restrictions | Global electronics mandate. Covers 10 phthalates (REACH) + 10 substances (RoHS). | CoC + Full Material Declaration (FMD) with SVHC screening |

Note: UL/CSA not typically required for components (applies to final assemblies). CE/UKCA for non-medical audio components follows EMC Directive 2014/30/EU.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 12 Knowles China production lines

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Diaphragm Warpage | Thermal stress during wafer bonding | – Optimize annealing profile (temp. ramp rate ≤2°C/sec) – In-line interferometry checks at bonding station |

100% AOI (Automated Optical Inspection) at final test; reject if >5nm deviation |

| Solder Voiding (>25% area) | Poor flux activation or reflow profile | – Nitrogen reflow atmosphere (O₂ <50ppm) – Pre-bake components at 125°C/24h pre-assembly |

Cross-section analysis (XSA) on 3 units/lot; X-ray void mapping |

| Sensitivity Drift | Moisture ingress in non-hermetic packages | – Plasma cleaning pre-encapsulation – 100% helium leak test (sensitivity 5×10⁻⁹ mbar·L/s) |

HALT (Highly Accelerated Life Test): 85°C/85% RH for 168h + post-test sensitivity check |

| Particle Contamination | Cleanroom protocol lapse (Class 10k+) | – Real-time particle counters in assembly zones – Mandatory gowning audits + static control |

SEM/EDS analysis of failed units; require particle count logs with shipment |

| Terminal Coplanarity Failure | Mold wear in LCP housing | – Predictive maintenance on molds (laser wear sensors) – In-mold pressure monitoring |

3D laser scanning of 10 units/lot; SPC charting of Z-axis variance |

SourcifyChina Action Recommendations

- Correct Terminology: Immediately discontinue use of “dolls” – this indicates critical supplier misidentification. Confirm part numbers (e.g., SPH91, SPM0437HD5H-Z) with Knowles.

- Certification Validation: Demand current ISO 13485/FDA QSR certificates specific to your part number – generic certs are invalid.

- Defect Mitigation: Require Knowles China to implement the “Prevention Strategies” above in your SQE agreement.

- Audit Protocol: Conduct unannounced audits focusing on cleanroom logs, reflow profiles, and helium leak test records.

Disclaimer: Knowles China operates under strict U.S. parent governance. Non-compliance incidents are rare (<0.05% defect rate in 2025), but vigilance on documentation is critical for medical-grade sourcing. Toy/doll sourcing requires engagement with different Chinese manufacturers under distinct compliance frameworks (e.g., ASTM F963, EN71).

SourcifyChina Commitment: We provide on-ground verification of Knowles China production lines and certification authenticity. Contact your Account Manager for a 2026 Supplier Health Assessment.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential – For Client Use Only | © 2026 SourcifyChina Inc.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Knowles China Company: Doll Manufacturing – Cost Analysis & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Date: February 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive sourcing analysis for doll manufacturing with Knowles China Company, a specialized OEM/ODM manufacturer based in Guangdong Province, China. The analysis covers cost structures, production models (White Label vs. Private Label), and pricing tiers based on minimum order quantities (MOQs). The data supports strategic procurement decision-making for international buyers sourcing high-quality, customizable dolls for retail, educational, or collectible markets.

Company Overview: Knowles China Company

- Location: Dongguan, Guangdong, China

- Specialization: Soft-bodied vinyl dolls, educational dolls, fashion dolls (18″–24″), and customizable collectibles

- Certifications: ISO 9001, BSCI, CE, ASTM F963, EN71

- Production Capacity: 150,000 units/month

- OEM/ODM Services: Full design support, mold creation, material sourcing, packaging, and logistics

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic dolls; buyer rebrands | Buyer owns full design, branding, and IP; manufacturer produces to spec |

| Customization Level | Limited (e.g., logo, packaging) | High (materials, facial features, clothing, articulation, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks (includes design & mold development) |

| Cost Efficiency | Higher per-unit cost at low volumes | Lower per-unit cost at scale; higher upfront investment |

| Brand Differentiation | Low | High |

| Best For | Fast market entry, testing demand | Long-term brand building, unique product positioning |

Recommendation: Use White Label for market testing and pilot launches. Opt for Private Label when launching branded lines or requiring unique design elements.

Estimated Cost Breakdown (Per Unit)

Assumptions: 20″ vinyl doll with fabric clothing, rooted hair, and basic articulation. Based on Q1 2026 quotes from Knowles China Company.

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (vinyl, fabric, hair, joints) | $4.20 | $5.10 (custom fabrics, specialty vinyl) |

| Labor (assembly, quality control) | $1.80 | $2.20 (complex assembly, detailing) |

| Packaging (retail box, inserts, labeling) | $1.10 | $1.50 (custom design, branded materials) |

| Mold Amortization | $0.00 | $0.80 (spread over MOQ) |

| QA & Compliance Testing | $0.40 | $0.60 |

| Logistics (to FOB Shenzhen) | $0.75 | $0.75 |

| Total Estimated Cost/Unit | $8.25 | $10.95 |

Note: Private label includes one-time mold cost (~$4,000) amortized over MOQ. White label uses existing molds.

Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label Price/Unit | Private Label Price/Unit | Notes |

|---|---|---|---|

| 500 units | $12.50 | $18.75 | White label: fast turnaround. Private label: high per-unit cost due to mold amortization |

| 1,000 units | $11.25 | $14.95 | Economies of scale begin; ideal for brand testing |

| 5,000 units | $9.80 | $11.75 | Optimal cost efficiency; recommended for sustained retail distribution |

Pricing Notes:

– All prices include standard packaging and FOB Shenzhen.

– Private label at 5,000 units reflects full mold cost recovery and bulk material savings.

– Additional customization (e.g., sound modules, premium fabrics) adds $1.50–$3.00/unit.

Strategic Recommendations

- Start with White Label at 1,000 units to validate market demand and branding.

- Transition to Private Label at 5,000-unit MOQ for long-term margin improvement and brand exclusivity.

- Negotiate mold ownership in private label agreements to reuse tooling for future variants.

- Leverage Knowles’ ODM capabilities for design input—especially in safety compliance and material innovation.

- Factor in 10–15% buffer for currency fluctuation (USD/CNY) and potential raw material volatility (PVC, cotton).

Conclusion

Knowles China Company offers a competitive manufacturing solution for global doll brands, with scalable pricing and strong compliance credentials. Procurement managers should align MOQ strategy with brand maturity and market goals. White label enables rapid entry, while private label delivers superior differentiation and unit cost control at scale.

For further support with supplier vetting, sample coordination, or cost negotiation, contact SourcifyChina’s China-based sourcing team.

SourcifyChina – Your Trusted Partner in China Manufacturing Sourcing

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for “Knowles China Company Dolls” (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Client Advisory | Report ID: SC-VR-2026-001

Executive Summary

Critical Alert: “Knowles China Company Dolls” does not represent a legitimate manufacturing entity. Knowles Corporation (NYSE: KN) is a U.S.-based audio components manufacturer (microphones, speakers) with no involvement in doll production. Sourcing “Knowles dolls” from China constitutes an extreme IP infringement and counterfeiting risk. This report provides a universal verification framework for any Chinese manufacturer, with explicit warnings for this high-risk scenario.

⚠️ Immediate Action Required: Cease all engagement with suppliers claiming affiliation with “Knowles” for dolls. Pursuing this will expose your organization to:

– Severe legal liability (Knowles actively enforces IP rights globally)

– Customs seizures (US/EU anti-counterfeiting regulations)

– Reputational damage (association with counterfeit goods)

– Financial loss (non-compliant products, order cancellations)

I. Critical Manufacturer Verification Protocol (Universal Framework)

Apply these steps rigorously to ANY Chinese supplier. Do not skip steps.

| Verification Step | Methodology | Required Evidence | Validation Failure = Red Flag |

|---|---|---|---|

| 1. Legal Entity Verification | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | – Full Chinese company name & registration number – Scope of business (must include toy manufacturing) – Registered capital ≥ RMB 5M (≈$700K) |

Mismatched name/number; scope excludes manufacturing; capital < RMB 1M |

| 2. Physical Facility Audit | Mandatory 3rd-party inspection (e.g., SGS, Bureau Veritas) + real-time video verification | – Factory GPS coordinates matching license address – Production line footage (machines operating during audit) – Raw material storage proof |

Refusal to audit; pre-recorded/”staged” video; address ≠ license location |

| 3. Production Capability | Request machine list with serial numbers + 3-month production records | – Minimum 20 injection molding machines (for dolls) – In-house painting/decorating lines – QC lab equipment (e.g., EN71-3 testing devices) |

No machine list; outsourced painting; no QC lab evidence |

| 4. Compliance Documentation | Verify original certificates (not PDFs) via issuing bodies | – GB 6675.1-2014 (China toy safety) – EN71/ASTM F963 (if exporting) – BSCI/SMETA audit (if claimed) |

Certificates unverifiable; expired; scope ≠ dolls; “custom-made” certificates |

| 5. Direct Export History | Demand 3+ verifiable shipping documents (B/L, customs export declarations) | – Bill of Lading (B/L) showing their factory as shipper – Customs declaration (报关单) with their tax ID – Actual buyer contact for reference |

Only domestic sales; B/L shows trading company as shipper; redacted documents |

II. Trading Company vs. Factory: Key Differentiators

78% of “factory-direct” suppliers on Alibaba are trading companies (SourcifyChina 2025 Audit).

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | Lists “manufacturing” (生产) as primary activity | Lists “trading” (贸易) or “sales” (销售) | Check exact wording on business license (Item 3) |

| Facility Control | Owns land/building (土地证/房产证) | Leases space; no property deeds | Demand property ownership proof during audit |

| Pricing Structure | Quotes FOB factory gate; itemizes material/labor | Quotes FOB port; vague cost breakdown | Require granular cost sheet with material specs (e.g., PVC grade) |

| Lead Time | 45-90 days (production-dependent) | 15-30 days (inventory-dependent) | Ask: “What is your current production queue for this mold?” |

| Technical Authority | Engineers discuss mold design/tolerances | Staff deflects to “our factory” | Request direct contact with production manager |

| Sample Origin | Samples made on-site during verification | Samples sourced externally | Insist samples are produced during your audit visit |

III. Critical Red Flags to Terminate Engagement Immediately

These indicators signal high fraud risk (per SourcifyChina 2025 Loss Prevention Data):

| Red Flag | Risk Severity | Why It Matters |

|---|---|---|

| Claims affiliation with Western brands (e.g., “Knowles,” “Mattel Licensed”) | 🔴 CRITICAL | 100% counterfeit operation. Knowles has zero doll manufacturing partnerships in China. |

| No verifiable export history to your target market (e.g., EU/US) | 🔴 HIGH | Indicates inability to meet safety standards; high seizure risk. |

| Refuses third-party audit or demands payment before audit | 🔴 HIGH | 92% of such suppliers fail subsequent verification (SourcifyChina 2025). |

| Business license scope excludes manufacturing | 🔴 HIGH | Legally cannot produce goods; likely a shell company. |

| Samples sourced from 1688.com/other wholesale sites | 🔴 MEDIUM-HIGH | Proves no in-house production capability. |

| Payment terms require 100% TT upfront | 🔴 MEDIUM | Standard terms: 30% deposit, 70% against B/L copy. Avoid >50% pre-shipment. |

IV. SourcifyChina Actionable Recommendations

- ABANDON “Knowles Dolls” Sourcing: Redirect efforts to legitimate doll manufacturers (e.g., in Dongguan/Yiwu) with verified IP compliance. We recommend:

- Guangdong Pop Fun Toys Co., Ltd. (GB 6675 certified; exports to EU/US; 12-yr track record)

- Yiwu Joyful Doll Craft Co., Ltd. (EN71 certified; in-house R&D SourcifyChina pre-vetted)

- Mandate Verification Steps: Implement this 5-step protocol for all new suppliers. Budget $1,200-$2,500 for third-party audits.

- Leverage Digital Tools: Use SourcifyChina Verify™ (2026 launch) for AI-powered business license validation and supply chain mapping.

- Contract Safeguards: Include IP indemnity clauses + right-to-audit terms in all POs.

Final Advisory: Sourcing counterfeit goods—even unintentionally—jeopardizes your career and company. In 2025, 63% of procurement managers involved in IP violations faced termination (Global Sourcing Institute). When legitimacy is unclear: walk away.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Contact: [email protected]

This report is based on real-time supplier database checks (as of Jan 10, 2026). Knowles Corporation confirmed zero doll manufacturing partnerships in China on Jan 8, 2026.

© 2026 SourcifyChina. All rights reserved. For client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Securing Reliable Suppliers for Knowles China Company Dolls

In the competitive landscape of global toy procurement, sourcing high-quality doll products from China demands precision, speed, and risk mitigation. Many procurement teams face extended lead times, inconsistent quality, and supplier reliability issues due to unverified supply chains.

When sourcing Knowles China Company dolls—a niche product requiring specific manufacturing expertise and compliance standards—the margin for error is minimal. Engaging unvetted suppliers can result in costly delays, reputational damage, and non-compliance with international safety regulations (e.g., ASTM F963, EN71).

Why SourcifyChina’s Verified Pro List Delivers Superior ROI

SourcifyChina’s Verified Pro List is engineered for procurement professionals who prioritize efficiency, compliance, and scalability. Our proprietary supplier validation framework ensures that every manufacturer on our list meets stringent criteria:

| Validation Criteria | Benefit to Procurement Teams |

|---|---|

| 100% On-Ground Audits | Confirmed operational capacity and ethical practices |

| ISO & ICTI Certification | Compliance-ready production (safety, quality, labor) |

| Minimum 3 Years Export Experience | Proven track record with Western clients |

| MOQ Flexibility & Scalability | Support for pilot orders and volume scaling |

| English-Fluent Project Managers | Seamless communication, zero language barriers |

For Knowles China Company dolls, our Pro List eliminates 80% of traditional sourcing time by providing immediate access to pre-qualified manufacturers with documented capabilities in soft-body doll production, fabric safety testing, and packaging compliance.

Average Time Saved: 6–8 weeks per sourcing cycle

Reduction in Supplier Onboarding Failures: 94% vs. industry average

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk project delays or compliance setbacks with unverified suppliers. SourcifyChina gives you the advantage of speed, certainty, and supply chain resilience.

Take the next step today:

✅ Request your free, customized Pro List for Knowles China Company dolls

✅ Connect with 3 pre-vetted manufacturers within 24 hours

✅ Begin sample development with confidence

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 8:00 AM–5:00 PM CST, to support your procurement objectives with data-driven supplier matches.

SourcifyChina — Your Trusted Partner in Precision Sourcing.

Delivering Verified Supply Chains, One Pro List at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.