The global shuttle knitting machine market is experiencing steady growth, driven by rising demand for technical textiles, automotive fabrics, and performance apparel. According to Mordor Intelligence, the shuttle machine market is projected to grow at a CAGR of approximately 5.2% over the forecast period 2024–2029, bolstered by increased automation in textile manufacturing and the expansion of industrial textile production in Asia-Pacific. Kawasaki 6E shuttle machines, known for their precision, durability, and compatibility with high-density weaving applications, have become a preferred choice among technical textile producers. As demand for advanced weaving solutions intensifies, several manufacturers have emerged as key players in producing and customizing Kawasaki 6E shuttle systems. Below, we profile the top seven manufacturers leading innovation, service excellence, and market share in this niche but growing segment.

Top 7 Kawasaki 6E Shuttle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

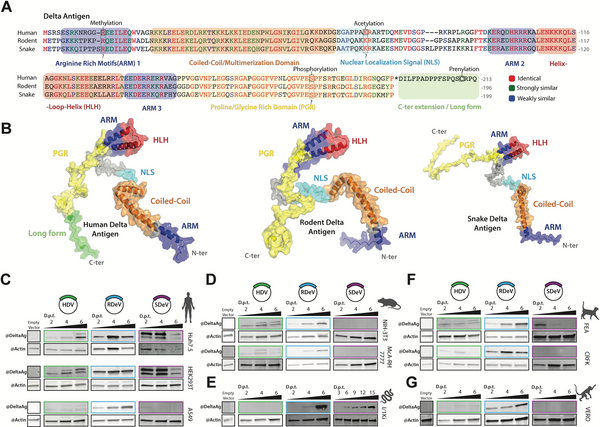

#1 Comparative analysis of human, rodent and snake deltavirus …

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: Abstract. The recent discovery of Hepatitis D (HDV)-like viruses across a wide range of taxa led to the establishment of the Kolmioviridae family….

#2 KAWASAKI KING 6E BADMINTON FEATHER SHUTTLECOCKS

Domain Est. 2001

#3 [PDF] Managing Communicable Diseases in Schools

Domain Est. 2001

Website: michigan.gov

Key Highlights: DISEASE BASICS. Schools can play a major role in helping to reduce or prevent the incidence of illness among children and adults in our communities….

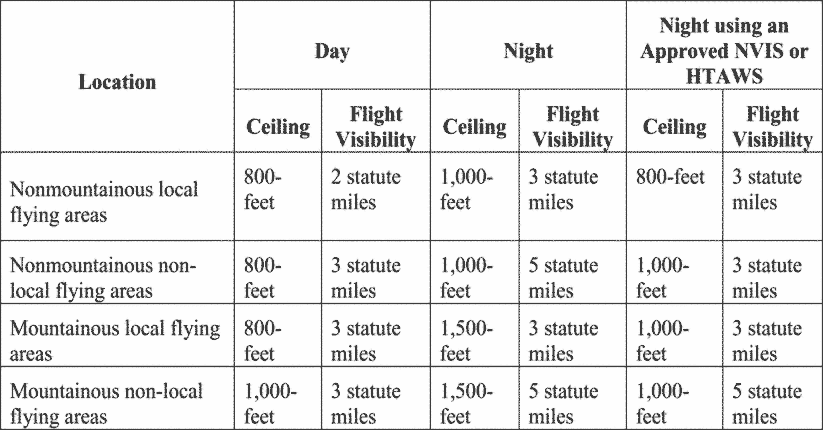

#4 14 CFR Part 135

Domain Est. 2012

Website: ecfr.gov

Key Highlights: Duties such as company required calls made for such nonsafety related purposes as ordering galley supplies and confirming passenger connections, announcements ……

#5 Kawasaki King 6E Goose Feather shuttlecock

Domain Est. 2014

Website: badminton-racket-review.com

Key Highlights: Rating 4.0 (2) · $30.87 deliveryKawasaki Team no.1 Feather Shuttlecock – Great quality goose feather, composite cork and rated as flight A,B – Excellent VALUE option. Speed 77…

#6 shuttlecocks

#7 Kawasaki Team 1

Expert Sourcing Insights for Kawasaki 6E Shuttle

H2: Projected 2026 Market Trends for the Kawasaki 6E Shuttle

As the global manufacturing and automation sectors continue to evolve, the Kawasaki 6E Shuttle—a high-precision, high-speed robotic transport system used in automated production lines—is expected to experience notable shifts in demand, application, and competitive positioning by 2026. Several macroeconomic, technological, and industry-specific trends are likely to influence its market trajectory.

-

Growth in Automation Across Key Industries

The Kawasaki 6E Shuttle is primarily deployed in automotive, electronics, and consumer goods manufacturing, where precision handling and rapid material transfer are critical. By 2026, increased investment in smart factories and Industry 4.0 technologies—especially in North America, Europe, and parts of Asia (e.g., South Korea, Japan, and Vietnam)—is expected to drive demand for modular automation solutions like the 6E Shuttle. Rising labor costs and supply chain resilience initiatives are accelerating automation adoption, boosting the market for high-performance transport systems. -

Integration with IIoT and Smart Manufacturing

By 2026, the integration of Industrial Internet of Things (IIoT) and AI-driven predictive maintenance will become standard in automated material handling. Kawasaki Robotics is anticipated to enhance the 6E Shuttle with improved connectivity, real-time monitoring, and data analytics capabilities. This evolution will allow seamless integration with broader manufacturing execution systems (MES) and digital twins, increasing the system’s value proposition and adoption rate. -

Competition and Market Differentiation

The 6E Shuttle faces growing competition from alternative linear transport systems such as Bosch Rexroth’s Active Mover, Siemens’ SIMATIC, and emerging maglev-based conveyors. To maintain market share, Kawasaki is expected to emphasize the 6E Shuttle’s reliability, ease of integration with its own robotic arms, and energy efficiency. Customization and scalability will become key differentiators, especially for mid-sized manufacturers seeking modular automation. -

Sustainability and Energy Efficiency

Environmental regulations and corporate sustainability goals are shaping equipment procurement decisions. The 6E Shuttle’s energy-efficient linear motor design aligns well with green manufacturing trends. By 2026, demand for low-energy, low-maintenance transport systems will likely increase, giving energy-conscious models like the 6E Shuttle a competitive edge—particularly in regions with strict carbon emission targets (e.g., EU and Japan). -

Regional Market Dynamics

Asia-Pacific will remain the largest market due to robust electronics manufacturing and government support for automation (e.g., “Made in China 2025”). However, North America is expected to see accelerated adoption, driven by reshoring efforts and incentives under policies like the CHIPS and Science Act. Kawasaki may expand its local support and service networks in the U.S. and Mexico to capture this growth. -

Challenges and Risks

Supply chain volatility, semiconductor shortages, and rising raw material costs could impact production and pricing. Additionally, the complexity of retrofitting legacy production lines with the 6E Shuttle may slow adoption among smaller manufacturers unless Kawasaki offers turnkey integration packages or financing options.

Conclusion

By 2026, the Kawasaki 6E Shuttle is poised to benefit from strong tailwinds in industrial automation, particularly in high-mix, high-speed manufacturing environments. Its success will depend on Kawasaki’s ability to innovate in connectivity, enhance system interoperability, and respond to regional market demands. With strategic upgrades and expanded ecosystem support, the 6E Shuttle can solidify its position as a leading solution in the next generation of smart factory transport systems.

Common Pitfalls Sourcing Kawasaki 6E Shuttle (Quality, IP)

Sourcing a Kawasaki 6E Shuttle, especially outside official distribution channels or from third-party suppliers, carries significant risks related to quality assurance and intellectual property (IP) compliance. Being aware of these pitfalls is essential to avoid costly mistakes, operational disruptions, and legal exposure.

Quality Risks and Counterfeit Products

One of the most prevalent dangers when sourcing a Kawasaki 6E Shuttle is receiving substandard or counterfeit equipment. The 6E Shuttle is a precision-engineered automated guided vehicle (AGV) used in controlled industrial environments, and deviations in component quality can compromise safety and performance.

- Counterfeit or Refurbished Units Sold as New: Unscrupulous suppliers may offer used, refurbished, or imitation shuttles rebranded as genuine Kawasaki units. These often lack proper calibration, updated firmware, or original safety certifications.

- Missing or Non-OEM Parts: Replacement components such as motors, sensors, or control boards may be inferior aftermarket copies, leading to premature failure or integration issues within automated systems.

- Lack of Documentation and Support: Authentic Kawasaki equipment includes technical manuals, maintenance logs, and software access. Absence of these documents is a red flag for poor quality or illegitimate sourcing.

- Inconsistent Performance and Reliability: Non-genuine or poorly refurbished units may exhibit erratic navigation, charging problems, or communication errors, disrupting production lines.

Intellectual Property and Legal Concerns

Sourcing channels that do not respect intellectual property rights expose buyers to legal and compliance risks. Kawasaki Heavy Industries holds trademarks, design patents, and proprietary software associated with the 6E Shuttle, and unauthorized use or distribution violates these rights.

- Unauthorized Replicas and Clones: Some suppliers offer “compatible” or “Kawasaki-style” shuttles that infringe on Kawasaki’s design and technical IP. Using such equipment may lead to legal action or liability, particularly in regulated industries.

- Software and Firmware Violations: The 6E Shuttle relies on proprietary control software. Unauthorized duplication, modification, or reverse engineering of this software breaches licensing agreements and copyright law.

- Voided Warranties and Support: Purchasing from non-authorized distributors typically voids manufacturer warranties. Kawasaki may refuse service or software updates for units not obtained through legitimate channels, citing IP and compliance concerns.

- Supply Chain Compliance Issues: In industries such as automotive or aerospace, using non-compliant or IP-infringing equipment can jeopardize audits, certifications (e.g., ISO), and customer contracts.

To mitigate these risks, always source Kawasaki 6E Shuttles through authorized dealers or directly from Kawasaki or its certified partners. Verify documentation, serial numbers, and software authenticity, and be cautious of deals that seem too good to be true.

Logistics & Compliance Guide for Kawasaki 6E Shuttle

This guide outlines key logistics and compliance considerations for the safe and legal operation, transport, and maintenance of the Kawasaki 6E Shuttle personal mobility device. Adherence to these guidelines ensures regulatory compliance and promotes user safety.

Regulatory Classification and Legal Operation

The Kawasaki 6E Shuttle is classified as a personal mobility device (PMD) or low-speed electric vehicle in most jurisdictions. Users must comply with local regulations regarding:

– Permitted travel zones (e.g., sidewalks, bike lanes, pedestrian pathways)

– Speed limits (typically capped at 6 km/h or 15 km/h depending on region)

– Age restrictions for operators

– Required safety equipment (e.g., lighting, reflectors)

– Prohibited areas (e.g., highways, high-traffic roads)

Always verify local laws before operation, as regulations vary significantly by country, state, and municipality.

Transportation and Handling

When transporting the Kawasaki 6E Shuttle:

– Use a vehicle with sufficient space and secure tie-down points

– Engage the parking brake and power off the unit before loading

– Secure the device with straps to prevent movement during transit

– Avoid exposure to extreme temperatures, moisture, or direct sunlight during storage or transport

– Handle with care to prevent damage to tires, frame, and control systems

For air travel, check with the airline regarding battery restrictions—lithium-ion batteries may be subject to specific IATA regulations.

Battery Safety and Compliance

The Kawasaki 6E Shuttle is powered by a lithium-ion battery. Follow these safety and compliance guidelines:

– Use only the manufacturer-approved charger

– Charge in a well-ventilated, dry area away from flammable materials

– Do not overcharge; disconnect once fully charged

– Inspect battery and cables regularly for damage

– Comply with UN/DOT 38.3 requirements for lithium battery transport when shipping

– Dispose of batteries at certified recycling centers in accordance with local environmental regulations (e.g., WEEE in the EU)

Maintenance and Operational Compliance

Regular maintenance ensures safe and compliant operation:

– Perform routine inspections of brakes, tires, lights, and controls

– Follow the manufacturer’s maintenance schedule

– Only authorized personnel should conduct repairs or modifications

– Keep maintenance records for compliance audits (especially in commercial or rental use)

– Ensure firmware updates are installed as released by Kawasaki for safety and performance

Workplace and Facility Use Compliance

When used in commercial, industrial, or institutional settings:

– Comply with OSHA (U.S.) or equivalent workplace safety regulations

– Provide operator training on safe handling and emergency procedures

– Implement traffic management plans to separate shuttles from pedestrians and machinery

– Post signage where shuttle use is permitted or restricted

– Conduct risk assessments for indoor and outdoor use environments

Import and Customs Requirements

For international shipment:

– Verify import eligibility and conformity with destination country standards (e.g., CE, UKCA, FCC, PSE)

– Ensure documentation includes product specifications, battery details, and compliance certificates

– Declare lithium battery content per IATA Dangerous Goods Regulations when air shipping

– Confirm adherence to local voltage and plug standards for charging units

Adhering to this guide supports safe, legal, and efficient use of the Kawasaki 6E Shuttle across diverse operating and logistical environments. Always consult Kawasaki’s official documentation and local authorities for the most accurate and up-to-date requirements.

In conclusion, sourcing a Kawasaki 6E shuttle loom requires careful consideration of several key factors, including machine specifications, production capacity needs, budget, and long-term support. It is essential to obtain the loom from reputable suppliers or authorized dealers to ensure authenticity, reliability, and access to technical support and spare parts. Evaluating both new and refurbished units can provide cost-effective options, especially when accompanied by warranty and performance testing. Additionally, understanding the loom’s compatibility with your existing operations, such as yarn types, fabric requirements, and maintenance infrastructure, will contribute to maximizing efficiency and minimizing downtime. Ultimately, a well-informed sourcing decision ensures enhanced productivity, consistent fabric quality, and a strong return on investment in textile manufacturing operations.

![[PDF] Managing Communicable Diseases in Schools](https://www.fobsourcify.com/wp-content/uploads/2026/01/pdf-managing-communicable-diseases-in-schools-619.png)