The global jute fabric market is experiencing steady growth, driven by rising environmental concerns and increasing demand for sustainable, biodegradable textiles across packaging, agriculture, fashion, and home décor sectors. According to a report by Mordor Intelligence, the global jute market was valued at USD 4.72 billion in 2023 and is projected to reach USD 6.13 billion by 2029, growing at a CAGR of approximately 4.5% during the forecast period. This resurgence is fueled by government initiatives promoting eco-friendly materials, especially in South Asia, alongside expanding applications in geotextiles and composite materials. As sustainability becomes a boardroom priority, jute—a low-cost, renewable fiber with a minimal carbon footprint—is reclaiming its place in global supply chains. In this evolving landscape, leading jute cloth manufacturers are scaling production, adopting advanced spinning and weaving technologies, and expanding export networks to meet rising international demand. Below are the top 10 jute cloth manufacturers shaping the industry through innovation, capacity, and market reach.

Top 10 Jute Cloth Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Janata Jute Mills

Domain Est. 2005

Website: janata-sadat-jute.com

Key Highlights: Janata Jute Mills Ltd & Sadat Jute Industries Ltd – which combined together, is the largest manufacturer & exporter of Jute products in the private sector ……

#2 Gloster Limited

Domain Est. 2005

Website: glosterjute.com

Key Highlights: The Company is engaged in manufacturing and exporting of all types of Jute & Jute allied products, Woven & Non-Woven Jute Geotextiles, Treated Fabric-Rot Proof ……

#3 Ludlow Jute: Jute Manufacturing Factory

Domain Est. 2007

Website: ludlowjute.com

Key Highlights: Ludlow Jute is an India-based jute manufacturing factory that supplies eco-friendly jute products in the USA. We have a wide range of jute products at ……

#4 Jute Sacking Bag Manufacturer,Jute Hessian Fabric Supplier,Exporter

Domain Est. 2014

Website: hooghlyjute.com

Key Highlights: HOOGHLY INFRASTRUCTURE PVT LTD is leading manufacturer,exporter and supplier of Jute Netting Fabric from Kolkata,West Bengal, India – Customization is ……

#5 Imperial Jute

Domain Est. 2020

Website: imperialjute.com

Key Highlights: Imperial Jute is a top manufacturer, exporter, and supplier of eco-friendly jute bags, Hessian, ropes, fabrics, yarn, and hanks in 20+ countries worldwide….

#6 Quality manufacturer of Jute & Jute

Domain Est. 2022

Website: victoriajute.com

Key Highlights: The Company is renowned for manufacturing superior quality, technical jute & Jute-Cotton fabrics and fully customized Jute Shopping Bags….

#7 Ganges Jute

Domain Est. 2004

Website: gangesjute.com

Key Highlights: To stand as the unrivaled global leader in manufacturing top-tier jute products. We are driven by a resolute commitment to craft jute goods that not only excel ……

#8 National Jute Manufactures Corporation Limited

Domain Est. 2016

Website: njmc.org.in

Key Highlights: To make Jute growing and processing the most reliable and sound pillar of livelihood for millions to attain inclusive growth….

#9 Kelvinjute

Domain Est. 2017

Website: kelvinjute.com

Key Highlights: Specializes in producing premium jute yarn, fabric, and bags. With a daily output of 100 metric tons, trust us for sustainable and high-quality jute ……

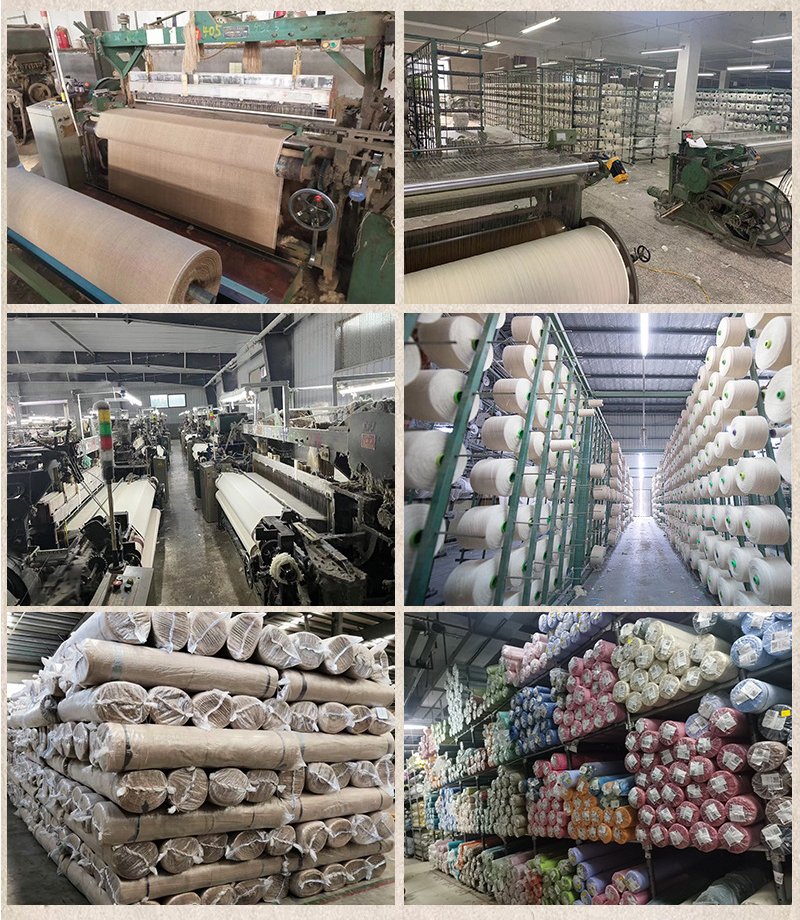

#10 Mony Jute

Domain Est. 2023

Website: monyjute.com

Key Highlights: Our monthly production capacity of 150,000 yards in fabrics and 75,000 meticulously crafted bags speaks volumes about our dedication to quality and scale….

Expert Sourcing Insights for Jute Cloth

H2: Jute Cloth Market Trends in 2026 – Sustainability Drives Growth Amid Challenges

The global jute cloth market in 2026 is poised for significant transformation, driven primarily by escalating environmental consciousness and regulatory shifts. As a natural, biodegradable, and rapidly renewable fiber, jute is experiencing a resurgence, positioning it as a key player in the sustainable materials landscape. However, this growth trajectory is not without hurdles, including competition from synthetic alternatives and supply chain complexities.

1. Sustainability as the Primary Growth Engine:

Consumer and corporate demand for eco-friendly packaging and textiles will be the dominant force shaping the 2026 jute market. With global bans on single-use plastics expanding and Extended Producer Responsibility (EPR) regulations tightening, industries are actively seeking sustainable substitutes. Jute cloth, particularly in packaging (sacks, bags, wraps), is emerging as a premium, compostable alternative to plastic. Brands in organic food, fashion, and retail are increasingly adopting jute to enhance their environmental credentials and meet ESG (Environmental, Social, Governance) targets, creating sustained demand.

2. Expansion Beyond Traditional Sectors:

While agriculture and commodity packaging remain core markets, jute cloth is gaining traction in high-value applications by 2026. The fashion and home décor industries are embracing jute for its rustic aesthetic and sustainability, using it in garments, accessories, rugs, and wall coverings. Additionally, the construction and automotive sectors are exploring jute composites for insulation, paneling, and interior components due to its acoustic and thermal properties, opening new revenue streams.

3. Geopolitical and Supply Chain Dynamics:

Bangladesh and India will continue to dominate jute production, accounting for over 90% of global supply. In 2026, geopolitical stability, government support (e.g., India’s mandatory jute packaging rules), and investment in modern farming and processing technologies will be critical. However, climate change impacts—such as erratic monsoon patterns—pose risks to yield and quality. Supply chain resilience, including ethical sourcing and transparent traceability, will become increasingly important for global buyers.

4. Innovation and Blending Technologies:

To overcome jute’s inherent limitations (e.g., lower durability when wet, coarse texture), R&D efforts will focus on fiber blending (with cotton, wool, or synthetics) and chemical treatments. By 2026, expect wider availability of softer, more durable, and water-resistant jute fabrics, expanding its usability in apparel and technical textiles. Digital printing on jute is also advancing, enabling customizable, high-end designs that appeal to fashion and branding markets.

5. Price Volatility and Competitive Pressures:

Despite its eco-advantages, jute faces pressure from cheaper synthetic alternatives like PP (polypropylene) and recycled polyester. Fluctuations in raw jute prices due to weather and labor costs may challenge smaller producers. However, the long-term cost of environmental impact and potential carbon taxes could shift the economic balance in jute’s favor, especially in regulated markets.

Conclusion:

By 2026, the jute cloth market will be characterized by strong growth fueled by sustainability mandates and innovation. While challenges around cost and climate vulnerability persist, strategic investments in technology, supply chain efficiency, and market diversification will enable jute to solidify its position as a cornerstone of the circular economy. Stakeholders who prioritize sustainability, transparency, and product innovation are likely to capture the greatest value in this evolving landscape.

Common Pitfalls When Sourcing Jute Cloth: Quality and Intellectual Property Issues

Poor Quality Control and Inconsistent Fiber Grades

One of the most frequent challenges in sourcing jute cloth is inconsistent quality due to variations in fiber grading, spinning techniques, and manufacturing standards. Jute quality depends heavily on the region of cultivation, harvesting time, and retting process. Buyers may receive batches with differing tensile strength, color, or texture if suppliers do not adhere to standardized grading (e.g., Tossa vs. White jute). Without third-party quality inspections or clear specifications in contracts, companies risk receiving substandard material unsuitable for end-use applications.

Lack of Transparency in Supply Chain Origins

Many jute suppliers, especially intermediaries, may not disclose the actual source of raw materials. This opacity increases the risk of unintentionally sourcing from regions with poor labor practices or environmentally damaging production methods. Additionally, undisclosed blending with lower-grade fibers or synthetic materials can compromise product integrity and mislead eco-conscious branding efforts.

Inadequate Testing and Certification

Jute cloth marketed as “eco-friendly” or “biodegradable” may lack verifiable certifications (e.g., ISO, GOTS, or OEKO-TEX). Without proper documentation, buyers cannot confirm claims about chemical residues, dye safety, or sustainable practices. Relying solely on supplier assurances without independent lab testing opens the door to greenwashing and compliance risks, especially in regulated markets.

Intellectual Property Infringement in Design and Weaving Patterns

When sourcing decorative or specialty jute fabrics (e.g., for fashion or home décor), there is a risk of inadvertently using protected designs or traditional patterns. Some weaving techniques or print motifs may be subject to geographical indications (GIs) or community-owned intellectual property, particularly in countries like India or Bangladesh. Sourcing without due diligence can lead to legal disputes or reputational damage.

Counterfeit or Misrepresented Products

Unscrupulous suppliers may pass off blended fabrics as 100% jute or use recycled content without disclosure. This misrepresentation not only affects performance but can also violate labeling regulations in target markets. Buyers should insist on material test reports and conduct spot audits to verify authenticity.

Overlooking Long-Term Supplier Reliability

Focusing solely on low upfront costs may lead to partnerships with unstable suppliers who lack capacity for consistent volume or quality. Seasonal fluctuations in jute harvests can disrupt supply, and without long-term contracts or ethical sourcing partnerships, businesses may face delays or quality degradation during peak demand periods.

Conclusion

To mitigate these pitfalls, buyers should establish clear quality benchmarks, require certifications, conduct supply chain audits, and consult legal experts regarding IP rights—especially when using region-specific designs. Building relationships with reputable, transparent suppliers is key to ensuring sustainable and compliant jute cloth sourcing.

Logistics & Compliance Guide for Jute Cloth

Jute cloth, a natural fiber textile known for its eco-friendliness and strength, requires specific handling and adherence to international regulations throughout the supply chain. This guide outlines key logistics considerations and compliance requirements for importing, exporting, and transporting jute cloth.

Product Classification and Harmonized System (HS) Code

Accurate classification is essential for customs clearance, duty calculation, and regulatory compliance. Jute cloth is typically classified under the following HS codes:

- 5309.21: Woven fabrics of jute, containing >= 85% jute by weight, unbleached or bleached

- 5309.29: Other woven fabrics of jute (e.g., mixed with other fibers or finished)

- 5311.00: Other vegetable textile fibers, including jute yarn

Note: Specific sub-codes may vary by country. Always confirm the correct HS code with the importing and exporting country’s customs authority.

Packaging and Handling Requirements

Proper packaging ensures product integrity and prevents damage during transit:

- Moisture Protection: Jute is highly absorbent and susceptible to mildew. Use moisture-resistant packaging such as polyethylene liners inside jute or polypropylene woven bags.

- Palletization: Securely stack rolls or bales on wooden or plastic pallets. Wrap with stretch film to prevent shifting and exposure.

- Ventilation: Allow airflow in storage and shipping containers to minimize condensation, especially in maritime transport.

- Avoid Contamination: Store and transport away from chemicals, strong odors, and food products to prevent absorption.

Transportation Modes and Considerations

- Maritime Shipping: Most common for bulk shipments. Use dry, clean containers. Monitor humidity levels and consider desiccants.

- Air Freight: Suitable for urgent or high-value shipments. Faster but more expensive; ensure packaging is lightweight yet protective.

- Land Transport: Use covered trucks to protect against rain and dust. Ensure secure loading to prevent abrasion.

Import and Export Documentation

Ensure all required documents are accurate and complete:

- Commercial Invoice: Details product description, quantity, value, and Incoterms.

- Packing List: Specifies weight, dimensions, and packaging type per unit.

- Bill of Lading (B/L) or Air Waybill (AWB): Contract of carriage and title document.

- Certificate of Origin: Required by many countries to determine tariff eligibility; may be needed for preferential trade agreements (e.g., GSP, SAFTA).

- Phytosanitary Certificate: May be required if importing country has plant health regulations (less common for processed jute cloth but verify).

- Import/Export License: Check if required by origin or destination country (rare for finished jute cloth, but possible for raw jute).

Regulatory and Environmental Compliance

- REACH & SVHC (EU): Ensure no restricted substances (e.g., certain dyes or finishes) are present above thresholds.

- Proposition 65 (California, USA): Verify compliance if selling in California; jute itself is not listed, but chemical treatments might be.

- Customs Bond and Duties: Pay applicable import duties and taxes. Rates vary by country and may be reduced under trade agreements.

- Sustainable Sourcing & Certification: Consider certifications like GOTS (Global Organic Textile Standard) or Fair Trade if marketing eco-friendly or ethically produced jute.

- Textile Labeling Laws: Comply with country-specific labeling requirements (e.g., fiber content, country of origin, care instructions).

Incoterms and Risk Management

Choose appropriate Incoterms to define responsibilities:

- FOB (Free on Board): Seller delivers to port; buyer assumes risk and cost thereafter.

- CIF (Cost, Insurance, Freight): Seller pays shipping and insurance to destination port.

- DDP (Delivered Duty Paid): Seller handles all logistics and customs clearance.

Ensure clear agreements on liability for delays, damage, or non-compliance.

Storage and Shelf-Life

- Storage Conditions: Keep in dry, well-ventilated warehouses off the ground. Ideal humidity: 50–60%.

- Shelf Life: Jute cloth has a long shelf life if stored properly but can degrade with prolonged moisture or UV exposure.

Special Considerations by Region

- India and Bangladesh: Major producers; ensure export documentation complies with local textile export policies.

- EU and UK: Strict chemical and labeling regulations; pre-shipment verification recommended.

- USA: CBP (Customs and Border Protection) may inspect for fiber content accuracy and labeling.

Conclusion

Successful logistics and compliance for jute cloth depend on accurate classification, protective packaging, complete documentation, and adherence to destination-specific regulations. Partnering with experienced freight forwarders and customs brokers familiar with textile trade can streamline the process and reduce delays. Regular audits of compliance practices ensure ongoing adherence to evolving standards.

Conclusion for Sourcing Jute Cloth:

Sourcing jute cloth presents a sustainable and cost-effective solution for businesses seeking eco-friendly packaging, fashion, and home décor materials. With its biodegradability, durability, and low environmental impact, jute aligns well with global trends toward sustainable consumption. Key sourcing regions such as India and Bangladesh offer competitive pricing and established supply chains, making them ideal partners for scalable procurement. However, buyers must conduct thorough due diligence on quality standards, ethical labor practices, and logistics to ensure reliability and sustainability throughout the supply chain. By building strong relationships with certified suppliers and considering long-term environmental and social impacts, businesses can leverage jute cloth as a responsible and strategic raw material choice that supports both ecological goals and brand integrity.