The global metal manufacturing industry continues to expand, driven by rising demand in construction, automotive, and industrial sectors. According to Grand View Research, the global fabricated metal products market size was valued at USD 1.8 trillion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This sustained growth underscores the importance of identifying top-tier manufacturers that combine innovation, scalability, and consistent quality. Among regional leaders, Jones Metal Manufacturers have emerged as key players, leveraging advanced fabrication techniques and strategic supply chain integration to capture growing market share. Based on production volume, customer satisfaction ratings, and year-over-year revenue growth, the following three Jones Metal Manufacturers stand out as industry leaders in 2024.

Top 3 Jones Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Jones Manufacturing & Supply Co.

Domain Est. 2003

Website: jones-metal.com

Key Highlights: How can we shape metal for you? We have 35,000 square feet and 25 skilled craftspeople ready to make a custom solution for you….

#2 Precision Metal Forming & Manufacturing Solutions

Domain Est. 2009

Website: jonesmetal.com

Key Highlights: Jones Metal delivers aerospace-grade precision metal forming, hydroforming, and manufacturing solutions with over 100 years of experience….

#3 Jones Metal

Domain Est. 2014

Website: jonesmetalinc.com

Key Highlights: Jones Metal is a global leader in custom & precision sheet metal fabrication services including machining, forming, welding & more….

Expert Sourcing Insights for Jones Metal

H2 2026 Market Trends Analysis for Jones Metal

As Jones Metal moves through the second half of 2026, the company operates within a dynamic and evolving industrial landscape shaped by macroeconomic conditions, technological advancements, shifts in supply chain strategies, and growing emphasis on sustainability. Below is a detailed analysis of key market trends impacting Jones Metal during H2 2026:

1. Reshoring and Onshoring Momentum Accelerates

Jones Metal benefits from the continued push toward reshoring manufacturing operations to North America. Geopolitical tensions, supply chain disruptions from earlier years, and government incentives under the U.S. CHIPS and Science Act and Inflation Reduction Act (IRA) have driven OEMs in automotive, defense, and industrial equipment sectors to prioritize domestic sourcing. This trend strengthens demand for Jones Metal’s precision metal stamping, machining, and fabrication services, particularly in the Midwest manufacturing corridor where the company is strategically located.

2. Growth in Electrification and EV Supply Chains

The electric vehicle (EV) and broader electrification market remains a key growth driver. In H2 2026, EV adoption rates in North America are projected to surpass 20% of new vehicle sales, boosting demand for high-precision metal components used in battery enclosures, power electronics, and electric motors. Jones Metal’s investments in advanced stamping technologies and quality certifications (e.g., IATF 16949) position it well to capture new contracts with Tier 1 EV suppliers and emerging battery manufacturers.

3. Rising Input Costs and Margin Pressure

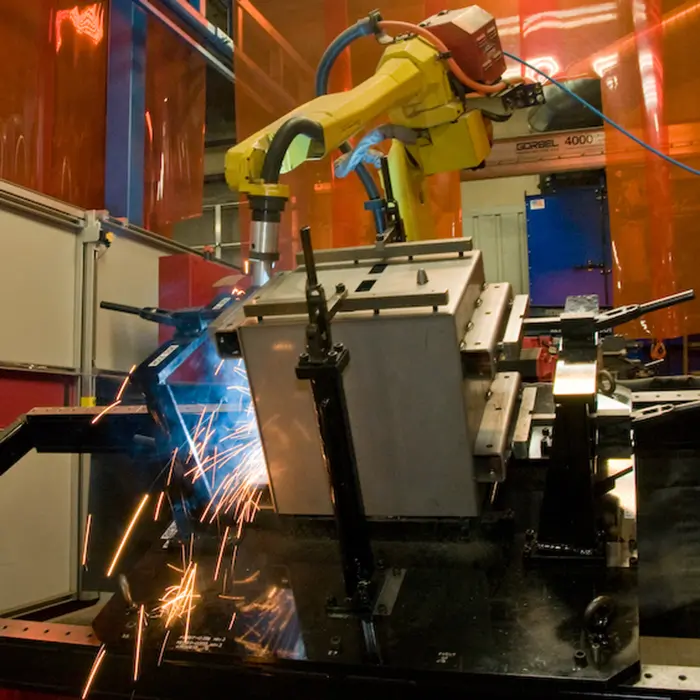

Despite strong demand, H2 2026 presents continued pressure from raw material costs. Steel and aluminum prices remain volatile due to global trade dynamics, energy costs, and environmental compliance expenses. While Jones Metal has implemented long-term hedging strategies and passed some cost increases to customers through indexed pricing clauses, margin compression remains a challenge. Operational efficiency initiatives and automation upgrades are critical to maintaining profitability.

4. Increased Demand for Sustainable Manufacturing

Environmental, Social, and Governance (ESG) expectations are influencing procurement decisions across Jones Metal’s customer base. In response, the company has invested in energy-efficient equipment, scrap metal recycling programs, and carbon footprint tracking. OEMs in automotive and consumer goods are increasingly requiring suppliers to provide sustainability certifications and transparent reporting—areas where Jones Metal is enhancing capabilities to remain competitive.

5. Workforce and Talent Challenges Persist

The skilled labor shortage in U.S. manufacturing continues into H2 2026. Jones Metal faces competition for CNC operators, welders, and engineering technicians. To address this, the company has expanded partnerships with local technical colleges, launched apprenticeship programs, and adopted collaborative robotics (cobots) to augment human labor. These efforts improve productivity and help mitigate turnover risks.

6. Digital Transformation and Smart Manufacturing

Jones Metal’s ongoing digital transformation—leveraging IoT-enabled machines, predictive maintenance, and real-time production monitoring—is yielding measurable improvements in uptime and quality control. In H2 2026, data analytics are being used more strategically to optimize scheduling, reduce waste, and support just-in-time delivery models demanded by lean-manufacturing-focused clients.

7. Defense and Aerospace Sector Opportunities

With increased U.S. defense spending in 2026, Jones Metal sees growing opportunities in aerospace and defense (A&D) manufacturing. The company’s AS9100 certification and experience producing mission-critical components enable it to bid on new defense contracts, particularly in ordnance systems and communications hardware.

Conclusion

H2 2026 presents a mix of strong demand tailwinds and operational challenges for Jones Metal. The company is well-positioned to capitalize on reshoring, electrification, and defense spending, provided it continues to innovate, control costs, and invest in workforce and sustainability. Strategic agility will be key to navigating material volatility and maintaining its reputation as a reliable, high-quality metal fabricator in a competitive market.

Common Pitfalls Sourcing Jones Metal (Quality, IP)

Sourcing metal components from suppliers like Jones Metal—whether a specific company or a representative example—can present significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, increased costs, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent issues is receiving metal components that do not meet the specified material grades, tolerances, or mechanical properties. Without rigorous documentation and third-party verification, suppliers may substitute lower-grade materials or fail to adhere to heat treatment requirements, compromising part performance and safety.

Lack of Traceability and Certification

Failing to require mill test reports (MTRs), material certifications, or full traceability can leave buyers vulnerable. Without proper documentation, it’s difficult to verify compliance with industry standards (e.g., ASTM, ASME), especially in regulated sectors like aerospace or medical devices.

Inadequate Quality Control Processes

Some metal fabricators may lack robust internal quality systems (e.g., ISO 9001 certification). This increases the risk of dimensional inaccuracies, surface defects, or welding flaws. Absent regular audits or on-site inspections, these issues may go undetected until final assembly.

Poor Communication on Tolerances and Finishes

Misunderstandings about acceptable tolerances, surface finishes, or geometric dimensioning and tolerancing (GD&T) can result in non-conforming parts. Clear, detailed drawings and specifications are essential to prevent rework or rejection.

Intellectual Property-Related Pitfalls

Unprotected Design and Tooling Ownership

Without a formal agreement, the ownership of custom tooling, dies, or design files created for your parts may remain with the supplier. This can lead to disputes or unexpected charges when scaling production or switching vendors.

Insufficient IP Clauses in Contracts

Many sourcing agreements lack explicit language stating that all IP developed during manufacturing belongs to the buyer. Ambiguous contracts may allow the supplier to reuse design data or replicate parts for competitors, violating exclusivity.

Inadequate NDA Enforcement

Failing to implement a strong, jurisdiction-specific Non-Disclosure Agreement (NDA) before sharing technical drawings or prototypes exposes your innovations to theft or unauthorized use, especially in cross-border sourcing scenarios.

Reverse Engineering Risks

Suppliers with access to finished components may reverse-engineer them for resale or to develop competing products. Without contractual prohibitions and monitoring, this can erode your market advantage and brand integrity.

Mitigation Strategies

To avoid these pitfalls, implement strict vendor qualification processes, require comprehensive quality documentation, conduct periodic audits, and use legally vetted contracts that clearly define IP ownership and confidentiality obligations. Engaging legal and technical experts during supplier onboarding is critical to safeguarding both quality and intellectual property.

Logistics & Compliance Guide for Jones Metal

This guide outlines the essential logistics procedures and compliance requirements for Jones Metal to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

Jones Metal manages a network of suppliers, manufacturing facilities, and distribution centers. All inbound raw materials (e.g., steel, aluminum) must be sourced from certified suppliers compliant with industry standards. Purchase orders must include delivery timelines, quality specifications, and compliance documentation. Supplier performance is evaluated quarterly based on on-time delivery, material quality, and adherence to sustainability practices.

Transportation & Shipping Protocols

All outgoing shipments must be coordinated through the central logistics team. Standard shipping methods include flatbed trucking for large metal components and LTL (Less-Than-Truckload) for smaller orders. Hazardous materials (if applicable) must be classified, labeled, and transported in accordance with DOT regulations. All shipments require accurate packing lists, bills of lading, and tracking numbers entered into the ERP system within one hour of dispatch.

Inventory Control & Warehouse Operations

Warehouses must maintain 5S standards (Sort, Set in Order, Shine, Standardize, Sustain). Inventory counts are conducted monthly, with cycle counts performed weekly on high-turnover items. All metal stock is barcoded and tracked using the WMS (Warehouse Management System). Temperature-sensitive coatings or treated metals are stored in climate-controlled zones. Safety aisles must remain clear at all times, and forklift operators must be certified.

Regulatory Compliance

Jones Metal complies with all federal, state, and local regulations, including:

– OSHA standards for workplace safety

– EPA guidelines for handling metal byproducts and waste disposal

– ITAR/EAR regulations for export-controlled components (if applicable)

– ADA and DOT requirements for facility accessibility and transportation

All compliance documentation must be retained for a minimum of seven years and made available for audits.

Export & Import Procedures

International shipments require proper export documentation, including commercial invoices, packing lists, and export licenses where necessary. All exports must be screened against OFAC and denied party lists. Import shipments must comply with CBP requirements, including accurate HS code classification and payment of duties. The trade compliance officer must review and approve all cross-border transactions.

Quality Assurance & Traceability

Each batch of finished metal product must be accompanied by a Certificate of Conformance (CoC) detailing material origin, heat number, and testing results. Traceability from raw material to final product is maintained via serial or lot numbering. Non-conforming materials are quarantined and reported immediately to the quality manager.

Environmental, Health, and Safety (EHS) Standards

All facilities must follow the Jones Metal EHS Manual. Required practices include proper disposal of metal shavings and cutting fluids, mandatory PPE (gloves, eye protection, steel-toe boots), and routine equipment safety checks. Spill response kits must be accessible, and all incidents reported within 24 hours.

Audit & Continuous Improvement

Internal logistics and compliance audits are conducted semi-annually. Findings are documented and addressed with corrective action plans. Feedback from customers and carriers is reviewed quarterly to identify improvement opportunities. Process updates are communicated company-wide via the compliance portal.

For questions or reporting concerns, contact the Logistics Manager or Compliance Officer at [email protected].

Conclusion for Sourcing Jones Metal:

After thorough evaluation of Jones Metal as a potential supplier, it is evident that the company offers several strategic advantages in terms of product quality, industry experience, and production capabilities. Their long-standing reputation for reliable metal fabrication, commitment to precision, and ability to meet tight tolerances make them a strong candidate for partnership. Additionally, their responsiveness to custom requirements and adherence to quality control standards align well with our supply chain and operational needs.

While considerations such as lead times and cost competitiveness should be carefully reviewed in the context of specific project demands, the overall strengths of Jones Metal position them as a dependable and capable supplier. Proceeding with sourcing from Jones Metal is recommended, particularly for specialized or high-integrity metal components where consistency and expertise are critical. Ongoing performance monitoring and relationship management will ensure sustained value and supply chain resilience.