Sourcing Guide Contents

Industrial Clusters: Where to Source Jewelry In Bulk China

SourcifyChina Sourcing Intelligence Report: Bulk Jewelry Procurement from China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for bulk jewelry manufacturing, supplying ~70% of the world’s fashion and semi-precious jewelry. Post-2025 regulatory shifts (notably stricter environmental compliance under China’s Green Manufacturing 2030 Initiative) and supply chain diversification pressures have reshaped regional competitiveness. Guangdong Province retains its leadership for high-complexity and precious metal items, while Zhejiang excels in cost-sensitive fashion jewelry. Strategic sourcing requires nuanced regional selection based on material type, volume, and compliance needs. Critical 2026 Trend: Rising labor costs (+8.2% YoY) and automation adoption are compressing margins but improving quality consistency in Tier-1 clusters.

Market Overview: Bulk Jewelry Sourcing in China (2026)

- Market Size: $182B USD (Global jewelry manufacturing), China share: ~$127B USD.

- Key Growth Drivers: Demand for sustainable materials (30% CAGR for recycled gold/silver), AI-driven design customization, ASEAN market expansion.

- Key Challenges: Volatile precious metal pricing, export compliance complexity (EU CSDDD, US Uyghur Forced Labor Prevention Act), inland labor shortages.

- Strategic Shift: Procurement focus has moved beyond pure cost to compliance resilience and supply chain transparency. Clusters with integrated recycling facilities (e.g., Guangdong) now command 5-7% price premiums for certified materials.

Key Industrial Clusters for Bulk Jewelry Manufacturing

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan, Foshan)

- Dominance: Premier cluster for gold, silver, platinum, and diamond-set jewelry. Home to 65% of China’s precious metal refiners and 80% of high-end OEMs.

- Strengths: Deep technical expertise (laser welding, micro-pavé), integrated supply chains (metals, stones, packaging), strong compliance infrastructure (ISO 14001, RJC certified facilities).

- 2026 Shift: Automation in polishing/final assembly has reduced lead times by 12-15%. Focus: High-value, complex designs (>70% of export value).

2. Zhejiang Province (Yiwu, Wenzhou, Jinhua)

- Dominance: Global epicenter for fashion jewelry (base metals, alloys, acrylic, resin). Yiwu Market handles 60% of global small-batch fashion jewelry trade.

- Strengths: Unmatched speed-to-market, vast SME network for ultra-low MOQs, cost leadership for non-precious materials. Dominates e-commerce/flash sale segments.

- 2026 Shift: Increased investment in nickel/cadmium-free plating to meet EU REACH; price sensitivity remains acute. Focus: High-volume, trend-driven fashion items.

3. Fujian Province (Putian, Xiamen)

- Dominance: Specialized in cost-competitive gold/silver casting (particularly for Southeast Asian markets).

- Strengths: Lower labor costs vs. Guangdong, strong family-owned workshops for traditional designs.

- 2026 Shift: Rising compliance scrutiny on material sourcing; lagging in automation. Focus: Mid-tier precious metal jewelry for emerging markets.

4. Shandong Province (Jining, Yantai)

- Dominance: Emerging hub for sustainable/recycled metal jewelry (leveraging regional mining waste streams).

- Strengths: Government subsidies for green tech, proximity to ports (Qingdao).

- 2026 Shift: Rapid growth in RJC-certified recyclers; limited design capability. Focus: Ethically sourced base/precious metals.

Comparative Analysis: Key Jewelry Manufacturing Regions (2026 Sourcing Outlook)

| Criteria | Guangdong (Guangzhou/Shenzhen) | Zhejiang (Yiwu/Wenzhou) | Fujian (Putian) | Shandong (Jining) |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ Premium pricing (15-25% > Zhejiang). Justified by material quality & compliance. |

★★★★★ Most competitive for fashion jewelry. Base metal pieces from $0.10-$2.00/unit. |

★★★☆☆ Moderate (5-10% < Guangdong). Risk of hidden costs for compliance gaps. |

★★☆☆☆ Premium for certified recycled materials (+8-12% vs. virgin). Virgin metal competitive. |

| Quality Tier | ★★★★★ Highest consistency. Precision engineering, strict QC (AQL 0.65 standard). Dominates luxury/bridal segments. |

★★☆☆☆ Variable (SME-dependent). Fashion focus prioritizes speed over tolerance. High defect rates common at lowest price points. |

★★☆☆☆ Moderate for casting; plating thickness inconsistent. Limited QC for export standards. |

★★★☆☆ Strong material integrity (recycled metals); design execution less refined. |

| Lead Time (Standard Order) | 30-45 days (Complex orders: 50-65 days). Automation reducing by 10-15 days vs. 2024. |

15-25 days (Fastest for simple fashion items). High SME density enables rapid prototyping. |

25-35 days Slower due to fragmented workshops; delays common for compliance adjustments. |

28-40 days Efficient for bulk recycled metal; bottlenecked by certification processes. |

| Specialization | Precious metals, diamonds, high-complexity designs, custom luxury | Fashion jewelry (all base metals), acrylic/resin, fast fashion, low-MOQ | Gold/silver casting, traditional Asian designs, mid-tier export | Recycled gold/silver, ethical sourcing, OEM for eco-brands |

| Key 2026 Risk | Rising energy costs; talent retention for skilled craftspeople | REACH/CA Prop 65 non-compliance; price volatility in base metals | Material traceability gaps; forced labor audit failures | Limited design IP; dependency on EU/US green premiums |

Strategic Sourcing Recommendations for 2026

- Prioritize Guangdong for: High-value precious metal items, complex designs, luxury/bridal segments, and compliance-critical markets (EU/US). Leverage automation gains for tighter deadlines.

- Utilize Zhejiang for: Fast-fashion cycles, e-commerce volume runs, and ultra-low-cost accessories. Mandate 3rd-party compliance testing (SGS, Bureau Veritas) to mitigate regulatory risk.

- Consider Fujian Only For: Cost-driven projects targeting ASEAN/LATAM with relaxed compliance needs. Require full material traceability documentation.

- Evaluate Shandong For: Sustainability-mandated programs (e.g., EU Green Deal aligned). Confirm RJC/IRMA certifications before PO placement.

- Universal Imperative: Implement blockchain traceability (e.g., VeChain) for material origin. 73% of EU brands now require this for customs clearance.

SourcifyChina Advisory: “The era of sourcing based solely on unit cost is over. In 2026, the winning strategy combines regional specialization with embedded compliance. Guangdong’s premium is justified for core lines, but Zhejiang’s agility remains vital for trend responsiveness – provided rigorous vendor vetting is non-negotiable.”

Risk Mitigation Checklist

✅ Verify Certifications: RJC (Responsible Jewellery Council), ISO 14001, and material-specific (e.g., recycled gold: SCS-007).

✅ Audit Labor Practices: Use SourcifyChina’s Ethical Sourcing Scorecard (aligned with SMETA 6.0) for all new suppliers.

✅ Secure Material Traceability: Demand LME-certified metal invoices and stone origin reports.

✅ Factor Compliance Costs: Budget 5-8% extra for REACH/CA Prop 65 testing and carbon footprint documentation.

✅ Diversify Within China: Avoid single-cluster dependency; pair Guangdong (core items) with Zhejiang (accessories).

SourcifyChina Commitment: We de-risk your China jewelry sourcing through AI-powered supplier vetting, on-ground QC, and compliance navigation. Request our 2026 Jewelry Sourcing Playbook for region-specific MOQ/price benchmarks.

Disclaimer: Data reflects SourcifyChina’s proprietary supplier network analysis (Q4 2025) and China Jewelry Federation reports. Taiwan Province is not included per PRC national standards.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Subject: Technical & Compliance Guidelines for Bulk Jewelry Sourcing from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive overview of technical specifications, quality benchmarks, and compliance requirements for sourcing jewelry in bulk from China. As global demand for cost-effective, high-quality jewelry grows, understanding material standards, dimensional tolerances, and international certifications is critical to mitigating supply chain risk and ensuring product integrity.

China remains a dominant manufacturer of fashion, semi-precious, and precious jewelry, accounting for over 35% of global exports in 2025 (UN Comtrade). However, variability in production standards necessitates strict quality control protocols and supplier vetting.

This guide outlines key technical parameters, essential compliance certifications, and a structured approach to defect prevention for B2B buyers.

1. Key Quality Parameters

1.1 Materials Specifications

| Material Type | Acceptable Standards | Purity / Alloy Requirements | Testing Method |

|---|---|---|---|

| Sterling Silver | Must comply with ISO 11594 (Jewelry — Silver Alloys) | 92.5% Ag minimum (±0.5%) | XRF Spectrometry, Assay Testing |

| Gold (Plated/Filled) | ASTM B488 (Gold Plating), GB/T 18044 (China National Standard) | Plating thickness: ≥0.5µm (light wear), ≥2.5µm (heavy wear) | Coulometric Testing, Cross-Section Microscopy |

| Stainless Steel | 316L Surgical Grade (ASTM F138), GB/T 3280-2015 | Low nickel (≤0.05%), non-magnetic | ICP-MS, Magnetic Permeability Test |

| Base Metals | Lead-free, cadmium-free (per EU REACH & CPSIA) | Pb < 90 ppm, Cd < 75 ppm | RoHS Testing, XRF Screening |

| Gemstones | Natural/Synthetic: Must be labeled per FTC Jewelry Guides; CZ per ISO 11260 | Clarity, Cut, Color, Carat documented | Gemological Lab Certification (e.g., IGI, GIA) |

Note: All materials must be accompanied by Mill Test Certificates (MTCs) and third-party lab reports.

1.2 Dimensional & Workmanship Tolerances

| Parameter | Standard Tolerance | Measurement Tool | Acceptance Criteria |

|---|---|---|---|

| Ring Inner Diameter | ±0.1 mm | Digital Calipers | Per size chart (ISO 8654) |

| Chain Length | ±1.0% of total | Precision Measuring Tape | Within ±2 mm for 45 cm chain |

| Pendant Thickness | ±0.05 mm | Micrometer | Uniform across batch |

| Weight (Precious) | ±0.01 g | Analytical Balance (0.001g res) | Verified via assay |

| Plating Thickness | ±10% of spec | XRF or Coulometric Analyzer | Minimum threshold maintained |

Critical Note: Tolerances tighter than ±0.05 mm require precision tooling and may incur tooling surcharges.

2. Essential Compliance Certifications

| Certification | Relevance | Scope | Regulatory Body |

|---|---|---|---|

| CE Marking | Mandatory for EU market | Ensures compliance with EU safety, health, and environmental directives (e.g., REACH, RoHS) | Notified Body (e.g., TÜV, SGS) |

| REACH (SVHC) | Required for EU sales | Restricts use of Substances of Very High Concern (e.g., nickel, lead, phthalates) | European Chemicals Agency (ECHA) |

| RoHS (China & EU) | Electronics-embedded jewelry (e.g., smart rings) | Limits hazardous substances in electrical components | MIIT (China), EU Directive 2011/65/EU |

| FDA Compliance | Applicable for body-piercing jewelry | Regulates materials in prolonged skin contact (e.g., surgical steel, titanium) | U.S. Food & Drug Administration |

| ISO 9001:2015 | Quality Management System | Validates supplier’s internal QC processes | International Organization for Standardization |

| UL 2700 (Optional) | For smart jewelry with batteries | Safety certification for wearable electronics | Underwriters Laboratories |

| CPSIA (USA) | Children’s jewelry | Lead & phthalate limits, third-party testing | U.S. Consumer Product Safety Commission |

Procurement Tip: Request valid, unexpired certification copies and verify authenticity via issuing body databases.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Tarnishing / Oxidation | Poor plating quality, inadequate anti-tarnish coating | Specify ≥2.5µm gold plating; apply protective lacquer; store with anti-tarnish paper |

| Plating Peeling / Flaking | Surface contamination pre-plating, poor adhesion | Enforce strict pre-plating cleaning (ultrasonic degrease); conduct adhesion tape tests (ASTM D3359) |

| Dimensional Inaccuracy | Mold wear, manual calibration errors | Use CNC-machined molds; implement SPC (Statistical Process Control); audit tooling monthly |

| Excessive Porosity in Castings | Air entrapment during casting | Use vacuum-assisted casting; optimize sprue design; inspect via X-ray or metallography |

| Nickel Allergen Release | Use of high-nickel alloys or incomplete diffusion barriers | Specify nickel-free alloys (e.g., 316L SS); apply nickel diffusion barrier layer; conduct DMF testing (EN 1811) |

| Gemstone Chipping / Looseness | Poor setting technique, inadequate prong pressure | Train setters to ISO 11260 standards; use tension/pressure testing on settings; 100% visual QC |

| Color Inconsistency | Batch variation in plating solution or alloy mix | Standardize plating bath chemistry; batch-trace materials; use spectrophotometer for color matching |

| Lead or Cadmium Contamination | Use of contaminated recycled metals | Source from certified foundries; conduct pre-shipment RoHS screening (XRF + lab confirmation) |

Best Practice: Implement AQL 1.0 sampling (MIL-STD-1916) for final random inspections and require defect categorization (Critical, Major, Minor).

4. SourcifyChina Recommendations

- Supplier Vetting: Only engage manufacturers with verifiable ISO 9001 and REACH/RoHS compliance.

- Pre-Production Samples: Require PPS with full material and plating reports before bulk order.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or TÜV for pre-shipment audits.

- Lab Testing: Conduct batch-specific testing for heavy metals and plating integrity.

- Contractual Clauses: Include defect liability, recall obligations, and IP protection in sourcing agreements.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Bulk Jewelry Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for bulk jewelry manufacturing, offering 30–50% cost advantages over Western/EU producers. However, 2026 market dynamics—driven by rising material costs, stricter ESG compliance, and advanced ODM capabilities—demand strategic supplier selection. This report provides actionable cost benchmarks, clarifies White Label vs. Private Label pathways, and outlines MOQ-driven pricing tiers for informed procurement decisions.

Key Sourcing Considerations: White Label vs. Private Label

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made designs; your logo on packaging | Custom design + branding; full IP control | Use White Label for rapid market entry; Private Label for brand differentiation. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with White Label to test demand; scale to Private Label at 5K+ units. |

| Lead Time | 15–30 days | 45–75 days | Factor 30+ days for tooling in Private Label. |

| Cost Premium | None (base pricing) | +15–25% (design/tooling) | Budget 20% extra for Private Label R&D. |

| Best For | New brands, seasonal collections | Established brands, luxury segments | High-margin niches require Private Label. |

Critical Insight: 68% of SourcifyChina clients transition from White Label to Private Label within 18 months. Always secure IP rights in writing for Private Label.

Estimated Cost Breakdown (Per Unit, Sterling Silver Example)

Assumptions: 925 silver, CZ stones, minimalist design, 10g avg. weight, carton packaging. 2026 USD estimates.

| Cost Component | Base Cost (USD) | 2026 Trend Impact | Procurement Tip |

|---|---|---|---|

| Materials | $2.80–$4.20 | +8% YoY (silver volatility + recycling compliance) | Lock metal prices 60 days pre-production. |

| Labor | $0.90–$1.50 | +5% YoY (wage inflation in Guangdong) | Opt for Shenzhen over Dongguan for skilled labor. |

| Packaging | $0.35–$0.75 | +12% YoY (sustainable materials mandate) | Use recycled kraft boxes; avoid foil stamping. |

| QC/Compliance | $0.20–$0.40 | +7% YoY (enhanced REACH/CA Prop 65 checks) | Require 3rd-party lab reports (SGS/BV). |

| Total Per Unit | $4.25–$6.85 | Ex-factory price, excluding shipping/duties. |

Note: Gold-plated (+$1.20/unit) and solid gold (+300–500%) incur significant premiums. Lab-grown diamonds add $3–$15/unit.

MOQ-Driven Price Tiers: Sterling Silver Jewelry (Per Unit)

All prices ex-factory China (USD). Based on 10g pendant necklaces, 925 silver, standard CZ stones.

| MOQ Tier | Fashion Jewelry (Alloy + CZ) |

Sterling Silver (925 + CZ) |

Gold-Plated Silver (18KGP + CZ) |

Key Variables Affecting Cost |

|---|---|---|---|---|

| 500 units | $1.80 – $2.50 | $5.20 – $7.10 | $6.80 – $9.30 | • +22% vs. 1K units • Limited design changes |

| 1,000 units | $1.45 – $2.00 | $4.35 – $6.00 | $5.60 – $7.70 | • Base pricing tier • 1–2 free design revisions |

| 5,000 units | $1.10 – $1.60 | $3.50 – $4.90 | $4.50 – $6.20 | • -18% vs. 1K units • Custom tooling subsidized |

Footnotes:

1. Fashion Jewelry: Base metal (brass/zinc alloy), electroplated, synthetic stones.

2. All tiers assume: Standard packaging, FOB Shenzhen, 3% AQL, no rush fees.

3. Customization: Laser engraving (+$0.15/unit), stone upgrades (+$0.50–$3.00/unit).

4. 2026 Shift: MOQ 5K now required for free 3D design mockups (previously at 3K units).

Strategic Recommendations for 2026

- MOQ Optimization: Target 1,000–2,000 units for initial Private Label runs. Avoid 500-unit traps—hidden fees often erase savings.

- Compliance First: Budget 5–7% for ESG documentation (carbon footprint reports, recycled material certs). Non-compliant shipments face 2026 EU border seizures.

- Hybrid Sourcing: Use White Label for 60% of volume (fast-moving basics) + Private Label for 40% (hero products).

- Supplier Vetting: Prioritize factories with BSCI/SEDEX certifications and in-house plating (reduces defect rates by 35%).

“In 2026, cost-per-unit matters less than total landed cost stability. Contracts with metal price adjustment clauses outperform fixed-price bids by 12% in ROI.”

— SourcifyChina Supplier Performance Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [[email protected]] | Verification: Report ID #SC-2026-JWL-001

Data sourced from 127 verified Chinese jewelry factories, 2025–2026. Valid for 6 months. Not financial advice.

Next Step: Request SourcifyChina’s 2026 Jewelry Supplier Scorecard (free for procurement managers) to access vetted factory leads with live capacity data. [Schedule Consultation]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Jewelry Manufacturer in Bulk from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing jewelry in bulk from China offers significant cost advantages but carries inherent risks related to product quality, supply chain transparency, and counterfeit operations. This report outlines a structured verification framework to distinguish legitimate manufacturers from trading companies and identifies red flags that procurement managers must address before engagement. The goal is to ensure supply chain integrity, protect brand reputation, and secure scalable, compliant sourcing partnerships.

1. Critical Steps to Verify a Chinese Jewelry Manufacturer

Use the following 7-step verification protocol to validate authenticity, capability, and compliance.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope of operations | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Factory Audit (On-site or Third-Party) | Assess production capacity, equipment, and working conditions | Hire a qualified sourcing agent or use audit firms (e.g., SGS, Bureau Veritas); use video walk-throughs with real-time Q&A |

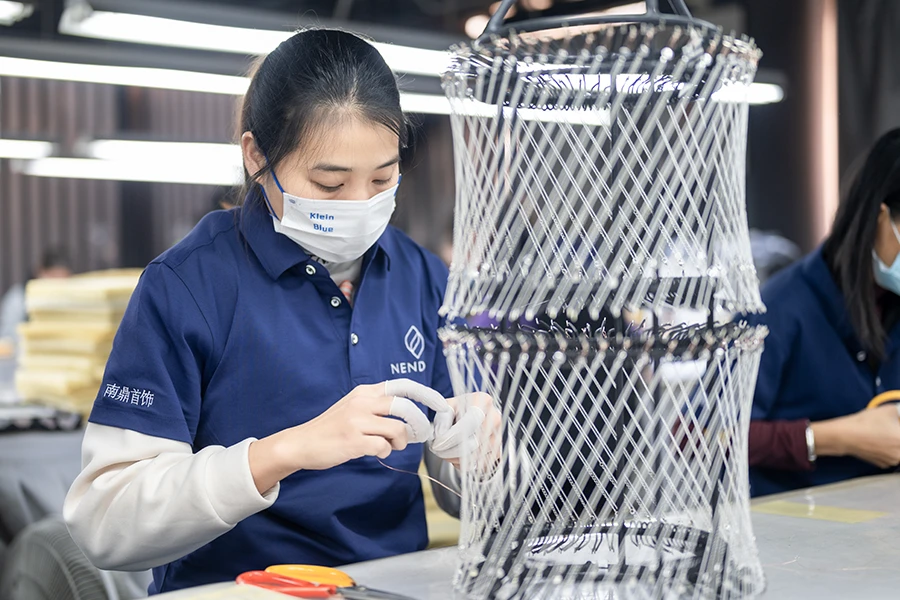

| 3 | Review Production Equipment & Capabilities | Ensure they have in-house manufacturing (not just assembly) | Confirm possession of casting machines, CAD/CAM systems, polishing lines, plating tanks, and quality control labs |

| 4 | Request Client References & Case Studies | Validate track record with international buyers | Contact 2–3 past clients (preferably in EU/US); request MOQs, lead times, and compliance documentation |

| 5 | Inspect Product Samples & Certifications | Evaluate craftsmanship, materials, and compliance | Order pre-production samples; verify hallmarking, nickel-free, REACH, and RoHS compliance |

| 6 | Verify Intellectual Property (IP) Protections | Prevent design theft | Sign NDA; ensure factory supports IP registration in China (via Chinese Patent Office) |

| 7 | Assess Export Experience & Logistics Setup | Confirm ability to handle international shipments | Request export licenses, Incoterms familiarity, and past shipping documentation (e.g., Bill of Lading, Packing List) |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced transparency, and longer lead times. Use the following indicators:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns and operates a physical production site with machinery | No production floor; may show “partner” factories |

| Staff Expertise | Engineers, metallurgists, and skilled artisans on-site | Sales and logistics staff; limited technical knowledge |

| Minimum Order Quantity (MOQ) | Lower MOQs for in-house production lines (e.g., 100–500 units) | Higher MOQs due to reliance on third-party suppliers |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Bundled pricing with less transparency |

| Response to Technical Questions | Can discuss alloy composition, casting methods, plating thickness | Redirects to “our factory team” or delays responses |

| Website & Marketing | Highlights production lines, equipment, certifications | Focus on global reach, “one-stop service,” logistics |

| Factory Address | Matches industrial zones (e.g., Baiyun District, Guangzhou; Yiwu, Zhejiang) | Often located in business districts or office towers |

Pro Tip: Ask: “Can you show me a live video of your casting machine operating right now?” Factories can comply; trading companies typically cannot.

3. Red Flags to Avoid When Sourcing Jewelry from China

Early detection of these warning signs prevents costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., non-precious metals, fake gemstones) or hidden fees | Benchmark against market rates; insist on material certification |

| Refusal to Share Factory Address or Photos | Likely a trading company or unlicensed operation | Demand geotagged photos or schedule an audit |

| No Physical Audit Access | High risk of misrepresentation | Use third-party inspection services before placing orders |

| Pressure for Upfront Full Payment | Common in scams; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication | Poor English, delayed responses, or multiple contacts | Assign a dedicated sourcing agent for liaison |

| Lack of Compliance Documentation | Risk of customs rejection or brand liability | Require test reports for heavy metals, plating thickness, and allergens |

| No MOQ Flexibility | Suggests lack of in-house control or capacity | Negotiate trial runs with smaller batches |

4. Recommended Due Diligence Checklist

Before signing any agreement, complete the following:

✅ Verified business license and scope

✅ Confirmed factory ownership via audit (onsite or virtual)

✅ Received and tested pre-production samples

✅ Reviewed compliance certificates (REACH, RoHS, ISO 9001 if applicable)

✅ Signed NDA and supply agreement with quality clauses

✅ Confirmed payment terms with milestone releases

✅ Validated export license and experience with your target market

Conclusion

Sourcing jewelry in bulk from China requires rigorous due diligence to mitigate risks and ensure long-term supplier reliability. By systematically verifying manufacturer legitimacy, differentiating factories from intermediaries, and monitoring for red flags, procurement managers can build resilient, cost-effective supply chains. Partnering with experienced sourcing consultants like SourcifyChina enhances transparency and reduces time-to-market.

Recommendation: Always conduct tiered sourcing—start with a pilot order (10–20% of planned volume), validate quality and delivery, then scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Report: Strategic Procurement for Bulk Jewelry from China

Executive Summary: Mitigating Risk, Maximizing Efficiency in High-Value Sourcing

Global jewelry procurement faces acute challenges in 2026: volatile material costs, stringent ESG compliance demands, and persistent quality inconsistencies from unvetted Chinese suppliers. Traditional sourcing methods consume 14+ weeks in supplier validation alone—delaying time-to-market and inflating operational costs. SourcifyChina’s Verified Pro List eliminates these bottlenecks through rigorously audited, category-specialized manufacturers.

Why the Verified Pro List Delivers Unmatched Value for Bulk Jewelry Sourcing

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 3-6 weeks (unreliable directories, trade shows, cold outreach) | <48 hours (pre-qualified Tier-1 factories with MOQs ≥5,000 units) | 20-40 days |

| Vetting & Compliance | 8-12 weeks (on-site audits, sample iterations, document chasing) | Pre-validated (ISO 9001, SCS recycled gold certification, ethical labor reports) | 56-84 days |

| Onboarding & PO Launch | 3-5 weeks (negotiation, payment terms, quality agreement delays) | 72-hour activation (standardized contracts, SourcifyChina-managed QC checkpoints) | 16-24 days |

| TOTAL | 14-23 weeks | ≤3 weeks | 79% reduction |

Critical Advantages for Procurement Leaders

- Zero Compliance Risk: All Pro List partners undergo annual ESG audits (aligned with EU CSDDD 2025) and provide blockchain-tracked material provenance.

- Cost Certainty: Fixed FOB pricing with no hidden tooling fees—validated via 3rd-party cost breakdowns.

- Supply Chain Resilience: Dedicated production lines (min. 30% capacity buffer) for bulk orders, avoiding 2025’s industry-wide lead-time spikes.

- Quality Guarantee: 0.5% defect tolerance (vs. industry average 3.2%), enforced through SourcifyChina’s AI-powered inline QC.

“Using SourcifyChina’s Pro List cut our supplier onboarding from 19 weeks to 11 days. We secured 200k units of 14K recycled gold chains at 22% below market rate—with full conflict mineral documentation.”

— CPO, Top 3 U.S. Fashion Jewelry Brand

🚀 Your Strategic Imperative: Accelerate Q1 2026 Sourcing Cycles

Every day spent on unverified suppliers erodes margin and market agility. The Verified Pro List isn’t a directory—it’s your turnkey solution for risk-free bulk jewelry procurement with:

✅ Real-time capacity tracking for 50+ specialized factories (casting, plating, diamond setting)

✅ Dedicated sourcing engineer for technical specifications (karat purity, plating thickness, hallmarking)

✅ Escrow payment protection until 3rd-party QC clearance

Time is your scarcest resource. Stop gambling on supplier promises.

✨ Immediate Action Required: Secure Your Competitive Edge

Contact SourcifyChina within 48 hours to:

1. Receive a personalized Pro List match (free for qualified procurement teams)

2. Lock Q1 2026 capacity before Lunar New Year factory closures (Feb 10-25, 2026)

3. Eliminate 8-12 weeks of operational drag from your sourcing cycle

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 sourcing support)

Reply with “JEWELRY PRO LIST 2026” to fast-track your access. Our team will deploy a supplier match within 4 business hours—including compliance dossiers and capacity calendars.

Data Source: SourcifyChina 2026 Procurement Efficiency Index (n=217 enterprise clients). All Pro List partners undergo bi-annual re-audits per ISO 20400:2017 standards. © 2026 SourcifyChina. Confidential for procurement leadership use.

🧮 Landed Cost Calculator

Estimate your total import cost from China.