The Italian electric plugs manufacturing sector is experiencing steady growth, driven by rising infrastructure investments, stringent safety standards, and increased demand for energy-efficient electrical components. According to a 2023 report by Mordor Intelligence, the Italy Electrical Plugs and Sockets Market is projected to grow at a CAGR of over 4.2% during the forecast period of 2023–2028. This expansion is supported by the country’s modernization of electrical grids, rising construction activities, and the adoption of smart home technologies. Additionally, Grand View Research indicates that Europe’s broader push toward sustainable and reliable electrical systems is boosting domestic manufacturing capabilities, with Italian firms leveraging innovation and design excellence to maintain a competitive edge. As demand surges both locally and across EU markets, a select group of Italian manufacturers are emerging as leaders in quality, compliance, and technological integration—setting new benchmarks in plug and socket manufacturing.

Top 10 Italian Electric Plugs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Electrical and Electronic Connectors

Domain Est. 1996

Website: hirose.com

Key Highlights: Hirose Electric Co., Ltd. is a leading global supplier of innovative interconnects, employing advanced engineering services, superior customer support and ……

#2 Sockets and plugs

Domain Est. 1995

Website: vimar.com

Key Highlights: Plugs, sockets, adapters and cable reels. From the portable multiple socket outlet to the adjustable plugs to the space zero, from adapters with USB socket ……

#3 HomePage

Domain Est. 1997

Website: bticino.com

Key Highlights: Adapters, plugs and sockets, multi-sockets and electrical extensions … Italian design meets global smart living. Proudly Made in Italy, trusted everywhere….

#4 Cembre

Domain Est. 1997

Website: cembre.com

Key Highlights: CEMBRE designs and manufactures solutions for the connection and termination of electrical conductors: connectors, cable lugs, tools for their installation, ……

#5 MTA

Domain Est. 1997

Website: mta.it

Key Highlights: MTA is a leading Italian company in the design and production of electrical and electronic components for automotive, off-highway and motorcycles….

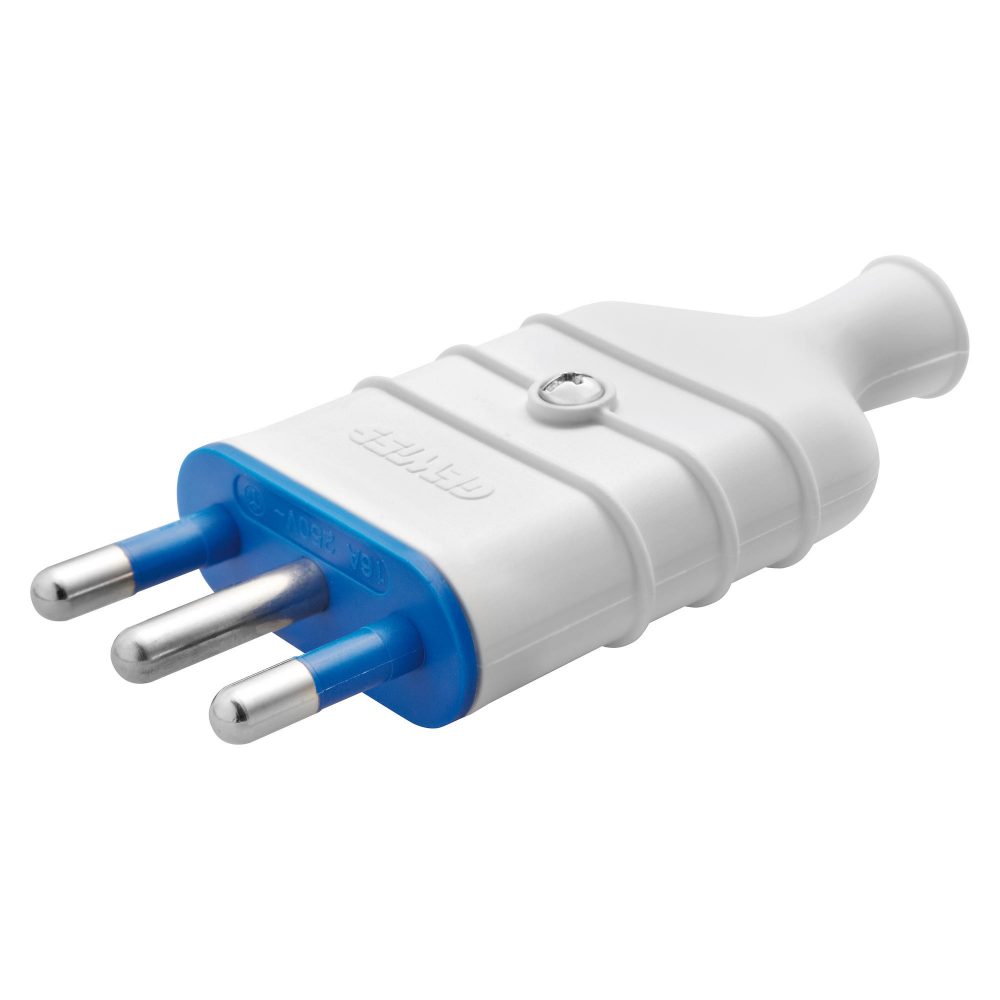

#6 Gewiss

Domain Est. 1997

Website: gewiss.com

Key Highlights: GEWISS is a key player on the market manufacturing solutions for home & building automation, energy protection and distribution systems, smart lighting and e- ……

#7 Italy_AC Plug_Plugs & Wiring parts_Products

Domain Est. 1999

Website: phino.com

Key Highlights: Phino Electric is certified for sales of AC power cords, plugs, sockets, connectors around the world….

#8 Elettrocanali

Domain Est. 2000

Website: elettrocanali.com

Key Highlights: We provide high quality electrical solutions, made with passion and expertise, offering products that are not only functional and safe, but also innovative….

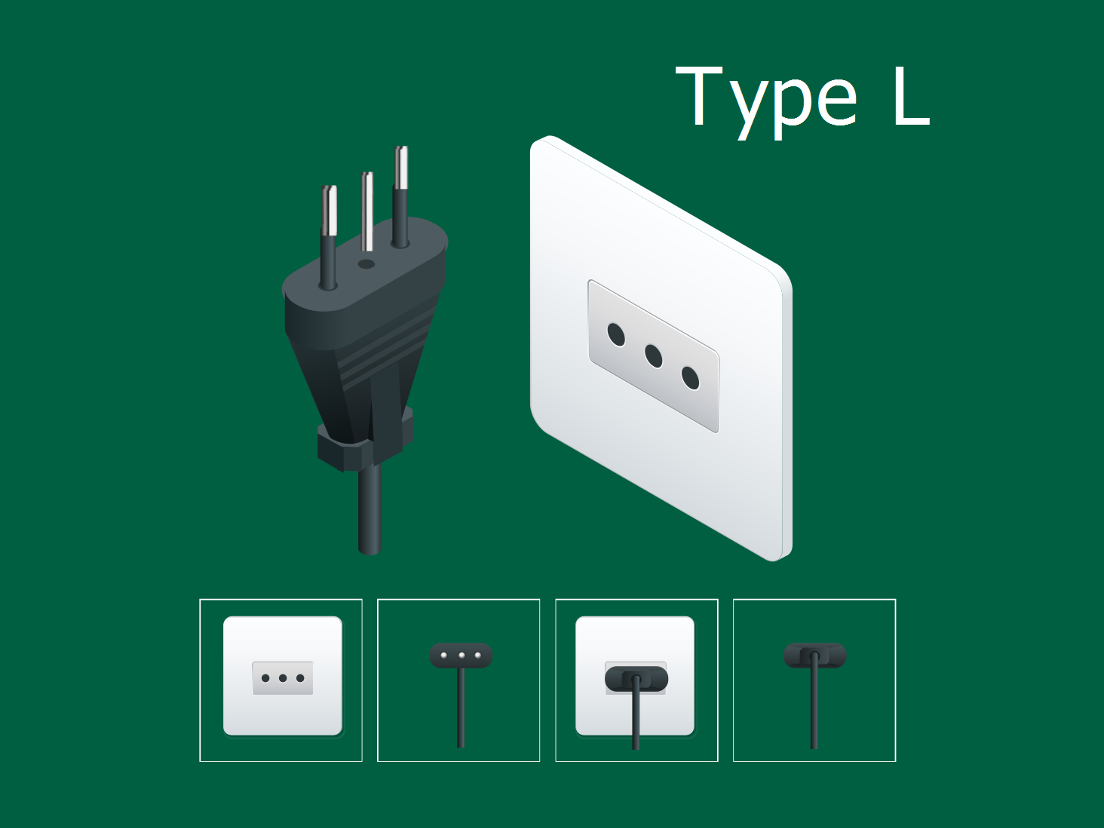

#9 Type L (electrical socket/electrical plug)

Domain Est. 2012

Website: netio-products.com

Key Highlights: This electrical socket is common in: Italy A “universal“ socket, consisting of a “Schuko” socket for Type C, E, F and L plugs and a “bipasso” socket for ……

#10 World plugs

Website: iec.ch

Key Highlights: Select a location, electric potential or frequency to discover what plug type(s), voltage and frequency are used there….

Expert Sourcing Insights for Italian Electric Plugs

H2: 2026 Market Trends for Italian Electric Plugs

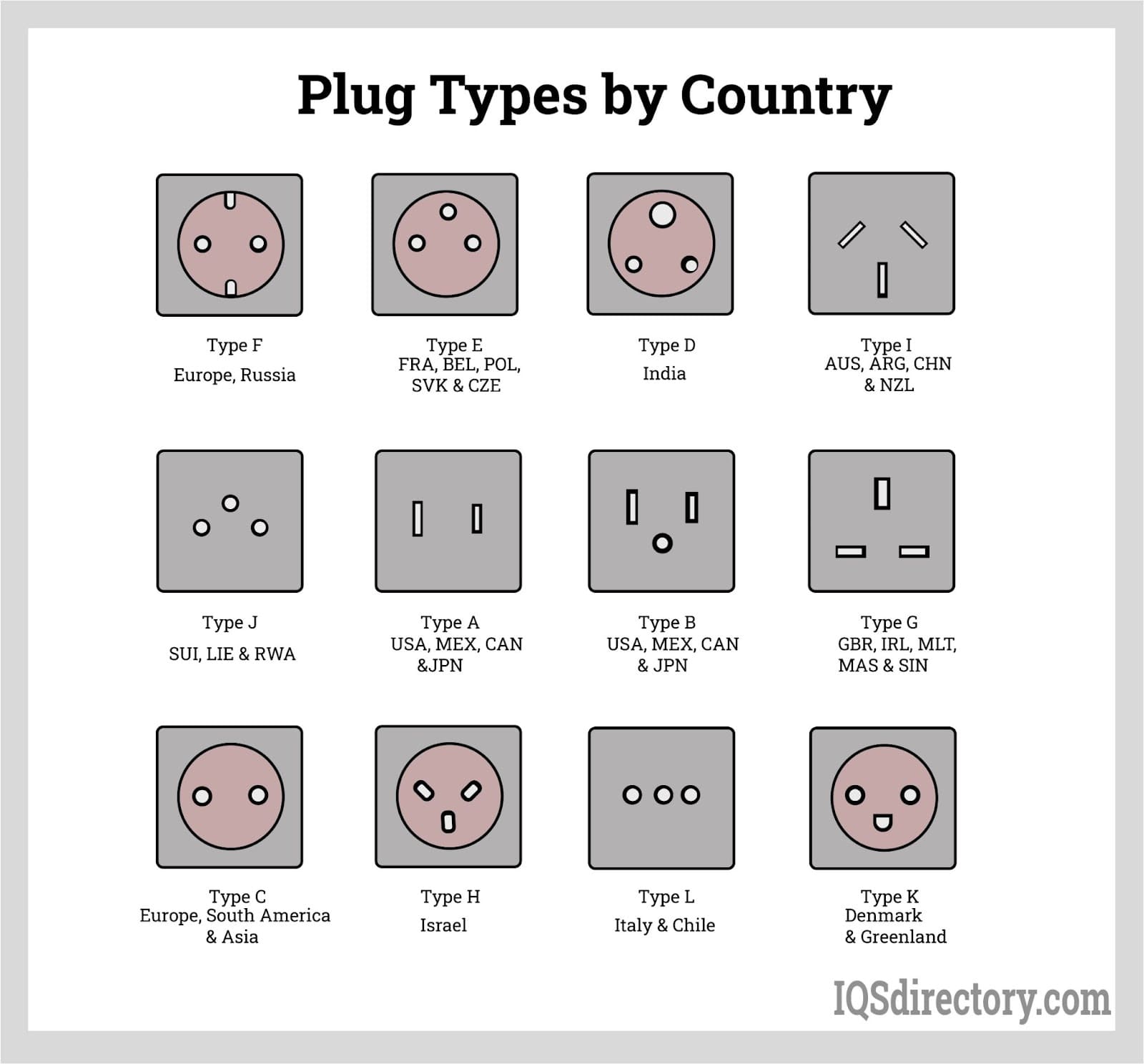

The market for Italian electric plugs (characterized by the CEE 7/16, CEE 7/17, and primarily the CEE 7/4 “Type L” standard) in 2026 is poised for significant evolution, driven by technological advancements, regulatory shifts, and changing consumer demands. Here’s a breakdown of key trends shaping this specific niche within the broader European electrical infrastructure market:

1. Smart Plug Integration and IoT Convergence:

* Dominant Trend: The most significant shift will be the mainstream adoption of smart Italian plugs. These integrate Wi-Fi, Bluetooth, or Zigbee connectivity, enabling remote control, scheduling, energy monitoring, and voice assistant integration (Alexa, Google Assistant, Siri via HomeKit).

* Drivers: Rising demand for home automation, energy efficiency awareness, and the proliferation of smart home ecosystems.

* 2026 Impact: Smart Type L plugs will transition from premium niche products to widely available, competitively priced options. Features like real-time power consumption tracking and overload protection will become standard expectations. Integration with Italian energy providers’ demand-response programs for dynamic pricing is a potential growth area.

2. Enhanced Safety and Compliance Focus:

* Dominant Trend: Stricter enforcement and evolution of safety standards (e.g., updates to CEI standards in Italy, alignment with EU-wide Low Voltage Directive and Radio Equipment Directive for smart devices) will be paramount.

* Drivers: Regulatory pressure, consumer safety concerns (especially with high-power appliances like air conditioners and EVs), and the need to prevent electrical fires.

* 2026 Impact: Increased demand for plugs featuring advanced safety mechanisms: child-proof shutters (mandatory but evolving), robust materials resistant to overheating, improved overload/short-circuit protection (especially crucial for smart plugs), and certification transparency. Counterfeit, substandard plugs will face stronger market and regulatory pushback.

3. Electrification and High-Power Demand:

* Dominant Trend: Growing demand for plugs rated at 16A (and potentially higher future standards) to support high-power appliances, driven by the electrification of transport and heating.

* Drivers: Surging adoption of Electric Vehicles (EVs) requiring home charging (often via dedicated 16A Type L sockets), increased use of heat pumps and induction cooking.

* 2026 Impact: The 16A variant of the Type L plug will become the de facto standard for new installations in homes, garages, and workplaces. Development of more durable, thermally optimized 16A plugs and sockets to handle sustained high loads will be critical. Potential for specialized high-current connectors alongside Type L, but Type L 16A will remain dominant for general high-power use.

4. Sustainability and Circular Economy:

* Dominant Trend: Increased focus on the environmental impact of plugs, encompassing materials, manufacturing, lifespan, and end-of-life.

* Drivers: EU Green Deal, Circular Economy Action Plan, corporate ESG goals, and consumer preference for sustainable products.

* 2026 Impact: Growth in plugs made with recycled plastics (especially post-consumer recycled content), bio-based materials, and designed for disassembly and recycling. Longer warranties and modular designs (e.g., replaceable connectors) will gain traction. Packaging will shift towards minimal, recyclable materials. “Green certifications” will become a market differentiator.

5. Design, Aesthetics, and User Experience:

* Dominant Trend: Plugs will be seen less as purely utilitarian and more as integrated design elements, especially in modern homes and offices.

* Drivers: Consumer desire for cohesive interior design, the visibility of smart home devices, and competition among manufacturers.

* 2026 Impact: Wider availability of Type L plugs in various colors, finishes (matte, glossy, metallic), and compact, minimalist designs. Improved ergonomics, easier insertion/removal mechanisms, and clearer labeling will be standard. Smart plug interfaces (apps) will prioritize user-friendliness and advanced features like energy usage reports and automation routines.

6. Market Consolidation and Branding:

* Dominant Trend: Increased competition will favor established brands with strong distribution, certification expertise, and R&D capabilities, potentially leading to consolidation.

* Drivers: High costs of certification, R&D for smart/IoT features, and building consumer trust in safety.

* 2026 Impact: The market may see fewer but larger players dominating, while niche players focus on specialized segments (e.g., ultra-premium design, specific industrial applications). Brand reputation for safety, reliability, and innovation will be crucial for market share.

Conclusion:

By 2026, the Italian electric plug market will be fundamentally transformed. The traditional plug will be augmented by intelligent, connected, and safety-enhanced versions. The core Type L standard will persist but will increasingly be synonymous with 16A capacity and smart capabilities. Success will depend on manufacturers’ ability to innovate in IoT integration, prioritize safety and sustainability, cater to design-conscious consumers, and navigate an increasingly complex regulatory landscape, all while supporting the nation’s broader electrification goals. The plug will evolve from a simple connector into an intelligent node within the smart home and energy ecosystem.

Common Pitfalls When Sourcing Italian Electric Plugs (Quality and IP Protection)

Sourcing Italian electric plugs—commonly known as Type L plugs (available in 10A and 16A variants)—requires careful attention to quality standards and Ingress Protection (IP) ratings, especially for applications exposed to dust or moisture. Overlooking key factors can lead to safety hazards, non-compliance, and product failure. Below are common pitfalls to avoid:

Inadequate Quality Control and Non-Compliance with Standards

Many suppliers, particularly outside the EU, offer Italian plugs that appear visually correct but fail to meet essential safety and performance standards. A major pitfall is sourcing products that lack certification to Italian and European norms such as CEI 23-50 (the Italian standard for plugs and sockets). Plugs may use substandard materials (e.g., brittle thermoplastics or undersized conductors), leading to overheating, short circuits, or mechanical failure. Always verify compliance with CE marking, IMQ certification (Italy’s national certification body), and RoHS directives to ensure electrical safety and material safety.

Misunderstanding IP (Ingress Protection) Ratings

A frequent oversight is assuming that all Italian plugs offer environmental protection. Standard indoor plugs typically have no IP rating or only minimal protection (e.g., IP20), making them unsuitable for outdoor, industrial, or wet environments. Buyers often source standard plugs for applications requiring dust or water resistance, resulting in equipment damage or safety risks. Ensure the plug specifies an appropriate IP rating—such as IP44 (splash-resistant) or IP67 (dust-tight and waterproof for temporary submersion)—and confirm that both the plug and mating socket are rated accordingly.

Poor Build Quality and Material Selection

Low-cost suppliers may use inferior plastics that degrade under UV exposure, heat, or mechanical stress. This can lead to cracking, loss of insulation, or loosening of the earth pin—a critical safety component in Type L plugs. Additionally, improper crimping or soldering of cable connections can cause high resistance points and overheating. Insist on robust materials such as thermoset plastics or high-grade thermoplastics and request samples for durability testing.

Inconsistent Dimensions and Pin Configuration

Although Type L plugs have standardized dimensions (e.g., 4.0 mm pin diameter for 10A, 5.0 mm for 16A), some manufacturers produce plugs with slight dimensional variances. This can result in poor contact, overheating, or incompatibility with Italian sockets. Always verify pin spacing, length, and alignment according to CEI 23-50 specifications and conduct fit tests with standard sockets.

Lack of Traceability and Supplier Reliability

Sourcing from unknown or unverified suppliers increases the risk of counterfeit or uncertified products. Reliable suppliers should provide test reports, material certifications, and batch traceability. Avoid vendors who cannot supply documentation or refuse factory audits. Establishing a relationship with a reputable EU-based or IMQ-authorized manufacturer reduces the risk of receiving subpar products.

Overlooking Application-Specific Requirements

Different environments (e.g., construction sites, marine applications, food processing) demand specific features such as UV resistance, oil resistance, or enhanced mechanical strength. Failing to match plug specifications to the intended use leads to premature failure. Clearly define operational conditions—temperature range, exposure to chemicals, vibration—and select plugs engineered for those conditions.

By avoiding these common pitfalls, buyers can ensure the safe, reliable, and compliant use of Italian electric plugs in their applications. Prioritize certified suppliers, validate IP ratings, and conduct thorough product testing before large-scale procurement.

Logistics & Compliance Guide for Italian Electric Plugs

Overview of Italian Electric Plug Standards

Italian electric plugs, commonly referred to as Type L plugs, are defined by Italian standard CEI 23-50. These plugs are unique to Italy and a few other countries and come in two primary variants: 10A (10/16) and 16A (16/25), with differing pin diameters and spacing. Compliance with CEI standards is mandatory for electrical devices sold or used in Italy.

Plug Specifications

- Voltage and Frequency: Italy operates on a 230V, 50Hz electrical system. All compliant plugs and devices must be rated accordingly.

- Pin Configuration: Type L plugs have three round pins arranged in a line: two power pins (live and neutral) and one grounding pin. The 10A version has 4 mm diameter pins spaced 26 mm apart; the 16A version has 5 mm diameter pins spaced 26 mm apart.

- Compatibility: Type L sockets are designed to accept only the corresponding plug type. Adapters may be used but are not a substitute for compliance.

Regulatory Compliance Requirements

Electrical products, including plugs and appliances, must comply with:

– CE Marking: Mandatory for all electrical equipment placed on the EU market, indicating conformity with health, safety, and environmental protection standards.

– Low Voltage Directive (LVD) 2014/35/EU: Ensures electrical equipment within certain voltage limits is safe.

– EMC Directive 2014/30/EU: Governs electromagnetic compatibility.

– Italian National Standards (CEI): Products must meet CEI 23-50 for plug compatibility and safety.

Manufacturers or importers must provide a Declaration of Conformity (DoC) and maintain technical documentation for market surveillance.

Import and Customs Considerations

- Customs Documentation: Include commercial invoices, packing lists, and DoC. Accurate HS codes are essential (e.g., 8536.69 for electrical plugs and sockets).

- Product Labeling: Must include CE marking, manufacturer details, voltage, and compliance with CEI standards.

- Conformity Assessment: May require testing by a Notified Body depending on product risk classification.

Non-compliant products may be detained or rejected at customs.

Logistics and Distribution

- Packaging: Plugs must be packaged to prevent damage during transit. Insulation and secure fastening are critical.

- Storage Conditions: Store in dry, temperature-controlled environments to avoid material degradation.

- Distribution Channels: Work with distributors familiar with Italian electrical standards to ensure end-user compliance.

Safety and Certification

- Testing and Certification: Conduct testing at accredited labs to verify compliance with CEI, LVD, and EMC requirements. Certification from bodies like IMQ (Istituto Italiano del Marchio di Qualità) enhances market acceptance.

- Periodic Audits: Maintain quality control through regular audits of production and supply chain.

Market Surveillance and Penalties

Italian authorities (e.g., Ministry of Economic Development and local ASL offices) conduct market surveillance. Non-compliant products may result in:

– Fines and product recalls

– Suspension of sales

– Legal liability in case of injury or fire

Best Practices for Compliance

- Verify your product’s plug type matches CEI 23-50 specifications.

- Obtain CE marking and relevant certifications before market entry.

- Partner with local experts or consultants familiar with Italian regulations.

- Maintain full technical documentation for at least 10 years.

- Monitor updates to CEI standards and EU directives.

Adhering to these guidelines ensures smooth logistics operations and legal compliance when distributing products using Italian electric plugs.

In conclusion, sourcing Italian electric plugs requires careful consideration of technical specifications, regulatory compliance, and supplier reliability. Italian plugs follow the CEI 23-50 standard, commonly using Type L plugs with 10A or 16A configurations, which are distinct from other European plug types. Ensuring compatibility with local voltage (230V, 50Hz) and obtaining products certified by recognized bodies such as IMQ or under the CE marking is essential for safety and legal compliance.

Sourcing options include both local Italian suppliers and international manufacturers, with each offering advantages in terms of authenticity, lead time, and cost. Building relationships with reputable suppliers, verifying product certifications, and conducting quality checks are critical steps in securing reliable and compliant electrical components.

Ultimately, successful sourcing of Italian electric plugs depends on attention to technical detail, adherence to EU and Italian safety standards, and proactive supply chain management to ensure product reliability, safety, and operational efficiency.