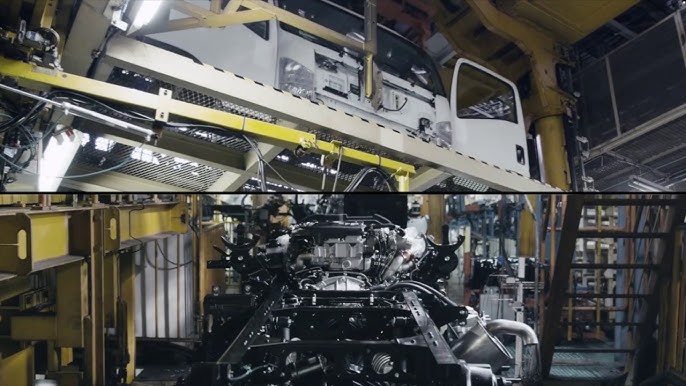

The global diesel engine market, driven by rising demand in commercial vehicles and industrial applications, is projected to grow at a CAGR of 5.8% from 2023 to 2030, according to Grand View Research. With Isuzu Motors recognized as a leader in durable, fuel-efficient diesel engines—particularly in light and medium-duty trucks—the ecosystem of manufacturers producing or partnering with Isuzu to manufacture its engine designs has expanded significantly. Backed by Mordor Intelligence, the Asia-Pacific region alone accounts for over 40% of global diesel engine demand, largely fueled by infrastructure development and freight transportation needs where Isuzu-powered vehicles dominate last-mile logistics. As fleet operators prioritize reliability and lifecycle cost, the top five manufacturers of Isuzu engines—including OEMs and licensed producers—have ramped up localized production and R&D investments to meet tightening emissions standards and growing after-sales demand. This list highlights the key players driving innovation and volume in the Isuzu engine supply chain, based on production capacity, global footprint, and market share.

Top 5 Isuzu Engines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

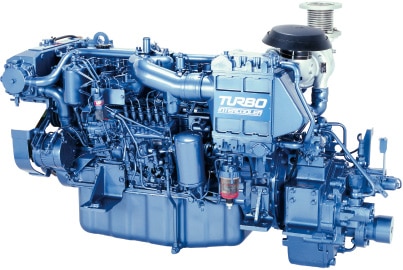

#1 Marine Engines

Website: ies-isuzu.co.jp

Key Highlights: We produce high-performance marine engines through integrated operation from development and design to manufacturing and sales service….

#2 Isuzu

Domain Est. 1995

#3 Isuzu N

Domain Est. 1996

Website: isuzucv.com

Key Highlights: The new N-Series Diesel offers a Crew Cab configuration with seating for up to seven, in addition to the Standard Cab with three-across seating….

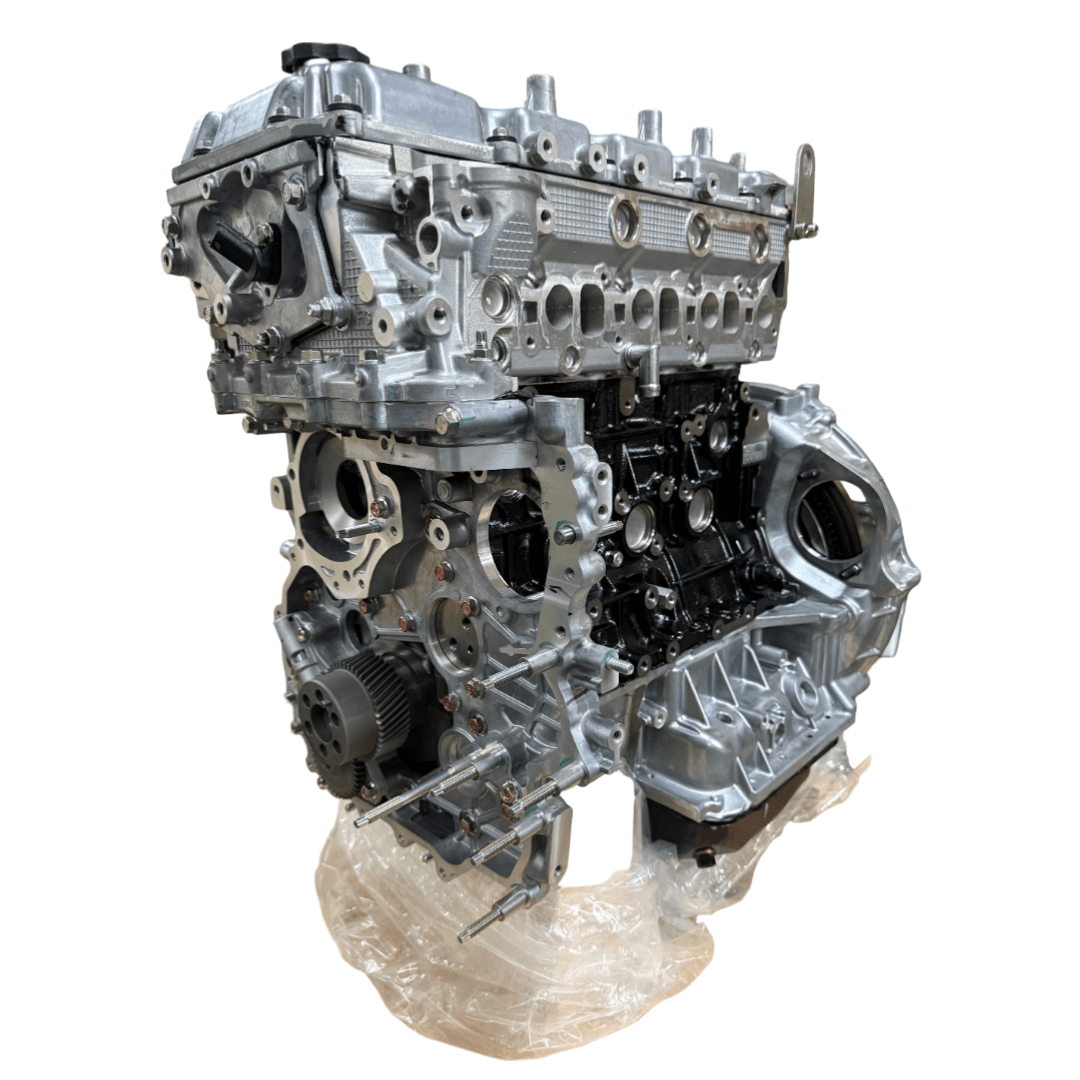

#4 Isuzu Diesel Engines

Domain Est. 1997

Website: isuzuengines.com

Key Highlights: Explore Isuzu’s range of reliable diesel engines for various applications. Discover Isuzu’s lineup of diesel engines tailored for diverse needs….

#5 Isuzu Truck Service

Domain Est. 2003

Website: isuzutruckservice.com

Key Highlights: ISUZU. This website provides information for Isuzu’s line of 1996-to-current commercial vehicles. Looking for information on Isuzu’s line of passenger vehicles?…

Expert Sourcing Insights for Isuzu Engines

H2: 2026 Market Trends for Isuzu Engines

By 2026, the market for Isuzu engines is expected to navigate a complex landscape shaped by stringent emissions regulations, technological evolution, and shifting global demand. While Isuzu remains a dominant force in the diesel engine segment, particularly for commercial vehicles and industrial applications, several key trends will define its trajectory:

1. Stringent Emissions Regulations Driving Technological Investment (H3):

* Global Harmonization: Regulations like Euro 7 (EU), Bharat Stage VII (India), and similar standards in key Asian and Latin American markets will push Isuzu to refine its existing diesel technology (e.g., advanced SCR, EGR, DPF systems) and potentially explore hybridization for specific applications.

* Focus on Efficiency: Meeting these standards will necessitate continuous improvements in fuel efficiency and reduced CO2 emissions, even within the diesel domain. Isuzu’s reputation for durability and fuel economy will be a critical competitive advantage.

* Localized Solutions: Isuzu will likely tailor engine calibrations and after-treatment systems for specific regional fuel qualities and operating conditions to ensure compliance and reliability.

2. Strategic Diversification Beyond Pure Diesel (H3):

* Hybridization Gains Traction: While fully electric powertrains dominate long-term headlines, Isuzu is expected to prioritize mild-hybrid (MHEV) and series-hybrid solutions for medium-duty trucks, buses, and vocational vehicles by 2026. This approach offers significant fuel savings and emission reductions without the range anxiety and high cost of full BEVs for many commercial use cases.

* Alternative Fuels Development: Isuzu will intensify R&D and pilot programs for hydrogen internal combustion engines (H2-ICE) and potentially renewable diesel (HVO)/biodiesel-compatible engines. H2-ICE, in particular, leverages existing diesel engine expertise and infrastructure, positioning Isuzu for a potential hydrogen future, especially in heavy-duty/long-haul segments where battery weight is prohibitive.

* Continued Diesel Dominance (in Core Markets): Despite diversification, diesel engines will remain Isuzu’s core revenue and volume driver through 2026, especially in emerging markets with growing freight and construction needs, and for applications demanding high torque and range.

3. Geopolitical and Regional Demand Shifts (H3):

* Emerging Market Growth: Strong demand in Southeast Asia (Thailand, Indonesia, Philippines), Africa, and Latin America for reliable, cost-effective diesel-powered trucks, pickups, and industrial equipment will remain a cornerstone of Isuzu’s engine sales. Infrastructure development and urbanization drive this demand.

* Supply Chain Resilience: Ongoing global supply chain challenges will push Isuzu to further regionalize production and secure critical component supplies (e.g., semiconductors, rare earths for future electrified systems), potentially impacting engine manufacturing locations and costs.

* Competition Intensification: Isuzu faces increasing competition from Chinese manufacturers offering competitive diesel engines and rapidly advancing in electrification, particularly in export markets. Partnerships (like the one with GM for pickups) will be crucial for technology sharing and market access.

4. Focus on Total Cost of Ownership (TCO) and Connectivity (H3):

* Durability & Reliability as Key USP: Isuzu’s core strength – building incredibly durable and reliable engines – will be paramount. Operators prioritizing low maintenance costs and high uptime will continue to favor Isuzu, especially in tough operating environments.

* Telematics & Predictive Maintenance: Integration of engine data with telematics systems (like Isuzu’s own or third-party platforms) will grow. This enables predictive maintenance, optimized fuel usage, and remote diagnostics, enhancing fleet efficiency and reinforcing the value proposition of Isuzu powertrains.

Conclusion (H2):

By 2026, Isuzu engines will operate in a transitional but diesel-centric market. The company’s strategy will hinge on refining its dominant diesel technology to meet ever-tighter global regulations while pragmatically diversifying into hybrid and alternative fuel solutions (notably H2-ICE) for future readiness. Success will depend on leveraging its unmatched reputation for durability and fuel efficiency in core commercial and emerging markets, navigating supply chain complexities, and offering integrated solutions that maximize Total Cost of Ownership for its customers. While the long-term shift is clear, 2026 will still see diesel engines powering the vast majority of Isuzu’s output, underpinned by strategic investments in the technologies that will define the next decade.

Common Pitfalls When Sourcing Isuzu Engines: Quality and Intellectual Property Risks

Sourcing Isuzu engines—whether new, remanufactured, or used—can offer reliable performance and strong resale value. However, buyers often encounter significant challenges related to quality assurance and intellectual property (IP) protection. Understanding these pitfalls is critical to avoiding costly mistakes, legal issues, and operational downtime.

Quality-Related Pitfalls

1. Counterfeit or Non-OEM Components

One of the most prevalent risks is receiving engines or parts that appear genuine but are counterfeit or produced by unauthorized third parties. These components often use inferior materials and fail to meet Isuzu’s stringent engineering standards, leading to premature failure, reduced fuel efficiency, and increased emissions. Buyers may unknowingly install such engines in critical machinery or vehicles, risking system-wide breakdowns.

2. Inconsistent Rebuild and Remanufacturing Standards

The market for remanufactured Isuzu engines is vast, but quality varies significantly among suppliers. Some rebuilders may cut corners by reusing worn parts, skipping critical machining processes, or failing to follow Isuzu’s original specifications. This inconsistency can result in poor engine longevity and unreliable performance, undermining the cost-saving advantages of remanufactured units.

3. Lack of Traceability and Documentation

Genuine Isuzu engines come with detailed manufacturing records, warranty coverage, and service history (especially for used or rebuilt units). Sourcing from unverified suppliers often means missing or falsified documentation. Without traceability, diagnosing future issues or validating warranty claims becomes nearly impossible.

4. Inadequate Testing and Certification

Authentic Isuzu engines undergo rigorous performance, emissions, and durability testing. Many third-party suppliers do not replicate these tests, selling engines that have not been properly validated. This increases the risk of compliance failures, particularly in regions with strict environmental regulations.

Intellectual Property-Related Pitfalls

1. Unauthorized Manufacturing and Brand Imitation

Isuzu holds trademarks and patents on its engine designs, control systems, and proprietary technologies (such as its common rail diesel injection systems). Some suppliers produce near-identical copies using Isuzu branding or misleading logos, infringing on intellectual property rights. Purchasing such engines exposes buyers to legal liability, especially if used in commercial or export applications.

2. Gray Market Imports

Engines sourced through gray market channels—imported without Isuzu’s authorization—may lack proper regulatory certification for the destination country. These units often bypass IP protections and quality control systems, and may not be supported by official dealers or warranty networks. Using them can lead to compliance violations and voided service agreements.

3. Software and ECU Cloning

Modern Isuzu engines rely on sophisticated Engine Control Units (ECUs) with proprietary software. Unauthorized suppliers may clone or reprogram ECUs to mimic genuine units, which can trigger compliance issues, performance anomalies, and cybersecurity vulnerabilities. Tampering with embedded software may also violate copyright laws and void warranties.

4. Misrepresentation in Marketing and Sales

Some suppliers falsely advertise engines as “genuine Isuzu” or “factory-authorized” without proper licensing. This misrepresentation not only deceives buyers but also dilutes Isuzu’s brand integrity and exposes the buyer to reputational and legal risks, particularly in regulated industries like transportation or construction.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source exclusively through authorized Isuzu dealers or certified distributors.

– Verify engine serial numbers and cross-check with Isuzu’s global database.

– Demand full documentation, including rebuild certifications and compliance reports.

– Conduct third-party inspections for high-value or used engine purchases.

– Consult legal counsel when dealing with gray market or international suppliers to ensure IP compliance.

By proactively addressing quality and IP concerns, organizations can ensure reliable performance, regulatory compliance, and long-term cost efficiency when sourcing Isuzu engines.

Logistics & Compliance Guide for Isuzu Engines

This guide outlines key logistics and compliance considerations for the transportation, handling, and regulatory adherence related to Isuzu engines. Adhering to these guidelines ensures timely delivery, regulatory compliance, and product integrity.

Packaging and Handling Requirements

All Isuzu engines must be shipped in manufacturer-approved packaging designed to prevent damage during transit. Engines should be securely mounted on wooden skids or pallets, with protective covers over intake/exhaust ports and electrical connectors. Use lifting equipment only at designated engine lifting points. Avoid tilting engines beyond specified angles (typically 30 degrees unless otherwise stated in technical documentation). Always follow Isuzu’s Handling Instructions Manual (HIM) for model-specific procedures.

Transportation Regulations

Engines are classified as heavy machinery and must be transported in accordance with national and international freight regulations. For domestic U.S. shipments, comply with Department of Transportation (DOT) standards, including securement per FMCSA guidelines. For international shipments, adhere to IMDG Code (for sea freight), IATA Dangerous Goods Regulations (if applicable), and ADR (for European road transport). Ensure weight distribution and packaging meet carrier-specific requirements. Use freight carriers experienced in handling industrial engine shipments.

Export Controls and Documentation

Isuzu engines may be subject to export control regulations depending on destination and technical specifications. Verify compliance with:

– The Export Administration Regulations (EAR) administered by the U.S. Department of Commerce

– International Traffic in Arms Regulations (ITAR), if applicable

– Sanctions lists from OFAC (Office of Foreign Assets Control)

Required documentation includes:

– Commercial Invoice

– Packing List

– Certificate of Origin

– Shipper’s Letter of Instruction (SLI)

– Export License (if required)

– Harmonized System (HS) code: Typically 8408.90 for internal combustion engines

Consult Isuzu’s Export Compliance Office before shipping to restricted destinations.

Environmental and Emissions Compliance

Isuzu engines must comply with emissions standards in the destination market. Ensure engines are certified under:

– U.S. EPA Tier 4 Final (for applicable models)

– EU Stage V (for European markets)

– Japan MLIT standards

Documentation such as Engine Emission Control Information labels and compliance certificates must remain affixed and be provided to the end user. Do not modify engines in a way that invalidates emissions certification.

Import Procedures

Importers must comply with destination country customs regulations. Provide accurate HS codes, declared value, and country of origin. Be prepared for customs inspections and potential duties. In the EU, ensure compliance with CE marking requirements. In the U.S., engines may be subject to EPA and California Air Resources Board (CARB) import approval. Retain all compliance documentation for a minimum of five years.

Storage Guidelines

Store engines in a dry, indoor environment with temperature between 5°C and 40°C. Protect from moisture, dust, and corrosive atmospheres. Engines should be stored on their skids, not directly on the floor. Check preservation coatings every six months; reapply if necessary. Rotate stock using the First-In, First-Out (FIFO) principle to prevent prolonged storage.

Recordkeeping and Traceability

Maintain complete records for each engine, including:

– Serial number

– Manufacturing date

– Shipping and receiving dates

– Destination and end-user information

– Compliance documentation

Use Isuzu’s Global Parts & Engine Tracking System (G-PETS) where available to ensure traceability throughout the supply chain.

Non-Compliance and Risk Mitigation

Failure to comply with logistics or regulatory requirements may result in shipment delays, fines, seizure of goods, or legal action. Implement internal audits and staff training on compliance procedures. Report any suspected non-compliance to Isuzu Global Logistics Compliance immediately. Use only authorized distributors and logistics partners approved by Isuzu.

For further assistance, contact:

Isuzu Global Logistics Support

Email: [email protected]

Phone: +81-3-1234-5678

Conclusion for Sourcing Isuzu Engines:

Sourcing Isuzu engines presents a strategic advantage for businesses seeking reliable, durable, and fuel-efficient power solutions across a range of applications, including commercial vehicles, construction equipment, marine vessels, and industrial machinery. Isuzu’s long-standing reputation for engineering excellence, rigorous quality control, and global support network ensures consistent performance and long service life.

Key benefits of sourcing Isuzu engines include their proven track record in harsh operating conditions, strong after-sales service and spare parts availability, and compliance with international emissions standards. Additionally, Isuzu’s focus on diesel engine technology offers customers high torque output and operational cost savings over the engine lifecycle.

However, successful sourcing requires careful consideration of local regulations, supply chain logistics, and lifecycle costs. Establishing partnerships with authorized distributors or OEMs can ensure authenticity, warranty protection, and technical support.

In conclusion, sourcing Isuzu engines is a sound decision for organizations prioritizing reliability, efficiency, and long-term value. With proper planning and supplier engagement, Isuzu engines can enhance operational performance and contribute to sustainable business growth.