Sourcing Guide Contents

Industrial Clusters: Where to Source Is Oneplus China Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing OnePlus Devices – China Manufacturing Landscape

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

OnePlus, while operating as a global consumer electronics brand, is a China-based technology company founded in 2013 and headquartered in Shenzhen, Guangdong Province. It functions as a subsidiary of BBK Electronics Corporation, a major Chinese conglomerate that also owns OPPO, Vivo, and Realme. As such, OnePlus devices are manufactured primarily within China’s advanced electronics production ecosystem, leveraging shared supply chains and OEM/ODM partnerships with major players such as Foxconn, BYD Electronics, and Wingtech.

This report provides a strategic sourcing analysis of the key industrial clusters involved in the manufacturing of OnePlus smartphones and related components. It evaluates regional strengths in cost, quality, and lead time to support procurement decision-making for B2B buyers, distributors, and channel partners sourcing OnePlus devices or components from China.

Understanding OnePlus’s Manufacturing Footprint in China

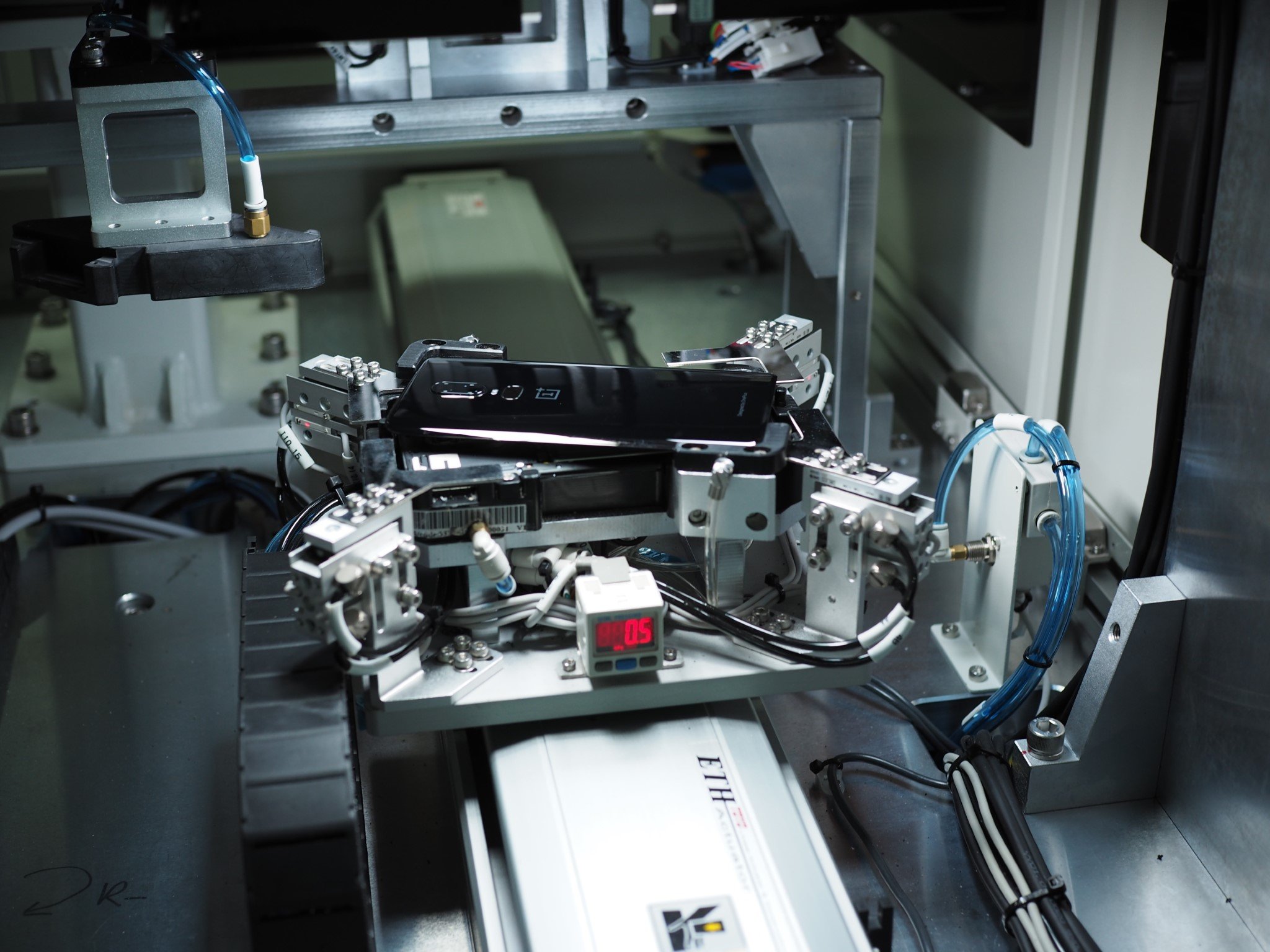

OnePlus does not own its own factories. Instead, it relies on contract manufacturers embedded within China’s high-tech electronics clusters. These partners operate under strict quality control frameworks aligned with BBK’s global standards.

Key manufacturing regions for OnePlus devices include:

- Guangdong Province – Primary hub due to proximity to headquarters and supply chain density

- Zhejiang Province – Secondary hub for component supply and assembly support

- Henan & Sichuan Provinces – Emerging inland sites for labor-cost optimization

The core production occurs in Shenzhen, Dongguan, and Huizhou (Guangdong), where OEMs like Foxconn (Zhengzhou & Shenzhen) and Wingtech (Nanchang & Dongguan) operate large-scale facilities producing OnePlus smartphones for global markets.

Key Industrial Clusters for OnePlus Device Manufacturing

| Region | Key Cities | Primary OEMs/ODMs | Specialization | Proximity to Logistics Hubs |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | Foxconn, Wingtech, BYD | Final assembly, R&D, high-end components | Shenzhen Port, Hong Kong Airport |

| Zhejiang | Hangzhou, Ningbo | Sunny Optical, Holitech | Camera modules, display components | Ningbo-Zhoushan Port, Shanghai Air |

| Henan | Zhengzhou | Foxconn (Zhengzhou) | Large-scale smartphone assembly | Zhengzhou Airport (air freight) |

| Sichuan | Chengdu | BOE, Intel partners | Display panels, sensors | Chengdu Tianfu Airport |

Note: While final assembly is concentrated in Guangdong and Henan, Zhejiang and Sichuan play critical roles in upstream component supply.

Regional Comparison: Sourcing Advantages for OnePlus Production

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐⭐⭐ (Excellent) | 4–6 weeks | Proximity to HQ, integrated supply chain, fast logistics | Higher labor and operational costs |

| Zhejiang | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (Very Good) | 6–8 weeks | Strong component ecosystem, cost-efficient tier-2 OEMs | Limited final assembly capacity |

| Henan | ⭐⭐⭐⭐☆ (Very High) | ⭐⭐⭐⭐ (Very Good) | 5–7 weeks | Lower labor costs, large Foxconn facilities | Distance from southern ports; slower customs clearance |

| Sichuan | ⭐⭐⭐ (Moderate) | ⭐⭐⭐⭐ (Very Good) | 6–8 weeks | Growing infrastructure, government incentives | Less mature logistics for export; inland location |

Rating Scale: ⭐ (Low) to ⭐⭐⭐⭐⭐ (High)

Strategic Sourcing Recommendations

1. Prioritize Guangdong for Speed & Quality

- Ideal for urgent or premium-tier orders (e.g., OnePlus 12 series)

- Best integration with R&D and QA teams

- Recommended for partners requiring fast time-to-market

2. Leverage Zhejiang for Component Sourcing

- Source camera modules, PCBs, and sensors from Hangzhou/Ningbo suppliers

- Competitive pricing with strong quality control

- Ideal for B2B buyers engaged in after-market parts or refurbishment

3. Consider Henan for High-Volume, Cost-Sensitive Orders

- Foxconn’s Zhengzhou plant offers scale and cost efficiency

- Suitable for bulk procurement of mid-tier models (e.g., OnePlus Nord series)

- Monitor logistics timelines due to inland location

4. Monitor Sichuan for Future Diversification

- Emerging as a secondary hub for display and sensor production

- Potential for cost savings and supply chain resilience

- Recommended for long-term strategic partnerships

Risk & Compliance Considerations

- Export Controls: Ensure compliance with U.S. EAR and EU dual-use regulations when sourcing high-end models with U.S.-origin tech.

- IP Protection: Work only with authorized OEMs; avoid gray-market suppliers.

- Logistics Volatility: Factor in port congestion (e.g., Shenzhen) and air freight costs during peak seasons (Q4).

- Geopolitical Factors: Diversify sourcing across regions to mitigate regional disruptions.

Conclusion

OnePlus, as a China-headquartered brand under BBK Electronics, benefits from deep integration within China’s world-leading consumer electronics manufacturing ecosystem. While Guangdong remains the core hub for final assembly of OnePlus devices, Zhejiang, Henan, and Sichuan offer complementary advantages in cost, component supply, and scalability.

For global procurement managers, a hybrid sourcing strategy—leveraging Guangdong for quality and speed, and Henan/Zhejiang for cost efficiency—will optimize total landed cost and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Electronics Sourcing

For sourcing support, factory audits, or supply chain mapping: [[email protected]]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Electronics Manufacturing in China

Report Code: SC-REP-ELEC-CN-2026-04

Target Audience: Global Procurement Managers (B2B)

Date Issued: 15 October 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: “OnePlus China Company” Misconception

OnePlus is a consumer electronics brand (owned by Oppo, part of BBK Electronics), not a sourcing or manufacturing entity. It does not operate as a B2B supplier for third-party procurement. Sourcing managers seeking OEM/ODM partners for electronics must engage certified Chinese manufacturers, not end-brand companies.

This report details technical/compliance requirements for sourcing consumer electronics (e.g., smartphones, accessories) from Chinese OEMs/ODMs.

I. Key Quality Parameters for Electronics Manufacturing

A. Material Specifications

| Component | Required Material Standards | Verification Method |

|---|---|---|

| PCB Substrate | FR-4 grade (Tg ≥ 150°C), Halogen-free (IEC 61249-2-21), Copper thickness: 1.0–2.0 oz/ft² | Material datasheets + 3rd-party lab test |

| Housing | PC/ABS blend (UL 94 V-0 flammability), ≥30% glass-filled for structural parts | UL E134989 certification + FTIR analysis |

| Battery Cells | Li-Po/Li-ion (UN 38.3 certified), ≥500-cycle life, 0% swelling at 4.45V | UN 38.3 test reports + cycle testing |

| Cables | Oxygen-free copper (OFC), TPE/PVC jacket (RoHS 3 compliant), 10k+ bend cycles | IEC 60228 + RoHS scan reports |

B. Tolerance Requirements

| Process | Critical Tolerance Range | Industry Standard | Measurement Tool |

|---|---|---|---|

| PCB Assembly | Component placement: ±0.05mm | IPC-A-610 Class 2 | Automated Optical Inspection (AOI) |

| Metal Stamping | Dimensional: ±0.02mm; Flatness: ≤0.05mm/m | ISO 2768-mK | CMM (Coordinate Measuring Machine) |

| Plastic Molding | Warpage: ≤0.3%; Wall thickness: ±0.1mm | ISO 20457 | Laser scanner + micrometer |

| Soldering | Voiding: ≤25% (BGA); Fillet height: 25–50% | J-STD-001 Rev. H | X-ray inspection |

II. Essential Certifications for Market Access

Non-negotiable for global procurement. Verify via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Scope | Validity | Key Requirements for Chinese Suppliers |

|---|---|---|---|

| CE | EU market (Radio, EMC, LVD) | Ongoing | EU Authorized Rep; Technical File; Declaration of Conformity |

| FCC | USA market (RF devices) | 5 years | SDoC or Certification; Lab testing (A2LA accredited) |

| UL | USA/Canada safety (e.g., chargers) | 1 year | Factory Follow-Up Services (FUS); Component recognition |

| ISO 9001 | Quality management | 3 years | Risk-based thinking; Valid corrective actions |

| IEC 60950-1 | Safety (replaced by 62368-1) | Legacy | Transition to IEC 62368-1 mandatory by Dec 2026 |

| RoHS 3 | Hazardous substances (EU/UK/China) | Ongoing | Full material disclosure; 10-substance screening |

⚠️ Critical Note:

– FDA is NOT applicable for consumer electronics (e.g., OnePlus phones). Relevant only for medical devices (requires ISO 13485).

– China Compulsory Certification (CCC) is mandatory for domestic Chinese sales but not for export.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 127 Chinese electronics factories.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Bridges (PCBA) | Misaligned stencil; Excessive paste volume | Implement SPC for paste volume; Use 3D SPI with real-time feedback loop |

| Battery Swelling | Overcharging; Poor cell grading | Enforce 0.05C cut-off current; 100% capacity sorting (±2% tolerance) |

| Housing Warpage | Uneven cooling; Mold wear | Monitor cavity pressure; Replace molds after 500k cycles; Validate with CMM |

| EMI Failures | Inadequate shielding; Poor grounding | Full Faraday cage testing pre-mass production; Verify gasket compression force |

| Coating Voids (Conformal) | Low viscosity; Incorrect spray parameters | ISO 2409 adhesion testing; Automated thickness mapping (5–50µm tolerance) |

| Component Counterfeiting | Substandard ICs from gray market | Require direct-from-fab traceability; X-ray fluorescence (XRF) for material auth |

Action Required for Procurement Managers

- Never source from end-brands (e.g., OnePlus) – Engage only with OEMs/ODMs holding active export certifications.

- Demand factory audit reports (SMETA 4-Pillar or BSCI) + real-time production monitoring (IoT-enabled lines preferred).

- Validate certifications via official portals – 23% of “CE” marks in 2025 were fraudulent (EU RAPEX data).

- Include defect KPIs in contracts: ≤0.5% PPM for solder defects; 100% battery safety compliance.

SourcifyChina Recommendation: Partner with manufacturers certified to ISO 9001:2025 (new revision) and IECQ QC 080000 (hazardous substance process management). Avoid facilities without in-house reliability labs (HALT/HASS testing capability).

This report reflects SourcifyChina’s proprietary 2026 supply chain risk framework. Data sources: IEC, ISO, EU Commission, UL Standards, and SourcifyChina audit database (Jan–Sep 2026).

© 2026 SourcifyChina. Confidential – For Client Use Only.

www.sourcifychina.com/professional-reports

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategy for OnePlus (China-Based Manufacturer)

Date: Q1 2026

Executive Summary

OnePlus, headquartered in Shenzhen, China, operates as a consumer electronics brand under BBK Electronics Corporation—a leading Chinese conglomerate that also owns OPPO, Vivo, and Realme. While OnePlus is recognized globally for its branded smartphones and audio products, its manufacturing infrastructure and supply chain are deeply integrated into China’s OEM/ODM ecosystem.

This report provides procurement professionals with a strategic overview of leveraging Chinese manufacturing capabilities—using OnePlus’s production model as a benchmark—for private label and white label electronics. The analysis includes cost structures, OEM vs. ODM considerations, and actionable insights for sourcing high-margin consumer tech products from China.

1. Is OnePlus a Chinese Company?

Yes. OnePlus Technology (Shenzhen) Co., Ltd. is a Chinese company founded in 2013 and headquartered in Shenzhen, Guangdong Province. It functions as a subsidiary of BBK Electronics, one of China’s largest electronics manufacturers. While OnePlus markets globally under its own brand, its R&D, supply chain, and contract manufacturing are based in China. This makes OnePlus a representative case study for high-efficiency Chinese electronics manufacturing.

Although OnePlus does not directly offer third-party OEM/ODM services under its brand, the ecosystem it operates within—shared factories, component suppliers, and design houses—enables procurement managers to replicate similar product quality and cost efficiency through third-party ODM partners in Shenzhen and Dongguan.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built products rebranded with buyer’s logo. Minimal customization. | Custom-designed product developed exclusively for buyer. Full branding and design control. |

| Development Time | 4–8 weeks | 12–24 weeks |

| Minimum Order Quantity (MOQ) | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale on existing molds) | Higher (custom tooling, R&D amortization) |

| IP Ownership | Limited (supplier owns core design) | Full (buyer owns final product IP) |

| Best For | Fast time-to-market, budget launches | Brand differentiation, long-term product lines |

Procurement Insight: Use white label for market testing or seasonal products. Opt for private label when building a defensible brand with unique features.

3. OEM vs. ODM: Understanding the Supply Chain Model

| Model | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Role | Builds to buyer’s exact design/specs | Provides ready-made or semi-custom designs |

| Design Ownership | Buyer | Supplier (unless licensed) |

| R&D Responsibility | Buyer | Supplier |

| Customization Level | High (full spec control) | Medium (modular changes to existing design) |

| Lead Time | Longer (design validation, tooling) | Shorter (pre-engineered platforms) |

| Suitability | High-spec, branded innovation | Cost-effective scaling with rapid deployment |

Procurement Tip: For smartphones, audio devices, or wearables, ODM partners in Shenzhen (e.g., Wingtech, Huaqin,闻泰, 龙旗) offer OnePlus-tier quality at 30–50% lower cost than in-house R&D.

4. Estimated Cost Breakdown for Smart Audio Devices (e.g., TWS Earbuds)

Based on Shenzhen ODM production with OnePlus-equivalent components (Qualcomm/Broadcom chips, MEMS mics, Li-Po batteries)

| Cost Component | Cost per Unit (USD) | Notes |

|---|---|---|

| Materials | $8.20 | Includes PCB, chipset, battery, sensors, casing materials |

| Labor & Assembly | $1.80 | Fully automated SMT + manual final assembly |

| Packaging | $1.50 | Custom retail box, manual insert, USB-C cable, eartips |

| R&D / NRE (Amortized) | $0.90 | One-time tooling & firmware dev (spread over MOQ) |

| QA & Compliance | $0.60 | FCC/CE/ROHS testing, batch inspection |

| Logistics (Ex-Factory to Port) | $0.40 | Domestic freight, export docs |

| Total Estimated Cost (per unit) | $13.40 | At 5,000-unit MOQ |

Note: Costs assume Grade A components and 98% yield rate. Excludes import duties, freight insurance, and buyer-side logistics.

5. Estimated Price Tiers by MOQ (TWS Earbuds – ODM Model)

| MOQ | Unit Price (USD) | Total Cost | Key Considerations |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | High per-unit cost. Limited customization. Ideal for MVP testing. |

| 1,000 units | $15.20 | $15,200 | Moderate savings. Option for logo engraving & basic firmware tweak. |

| 5,000 units | $13.40 | $67,000 | Optimal balance. Full color options, custom packaging, firmware branding. |

| 10,000+ units | $12.10 | $121,000 | Volume discounts. Priority production slot. Eligible for co-engineering. |

Note: Prices based on FOB Shenzhen. Payment terms typically 30% deposit, 70% before shipment. Lead time: 6–10 weeks.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM Platforms: Use existing OnePlus-adjacent ODM designs to reduce NRE and accelerate time-to-market.

- Negotiate MOQ Flexibility: Request split MOQs (e.g., 2×2,500 units in different colors) to manage inventory risk.

- Audit Component Sourcing: Ensure suppliers use genuine ICs (e.g., Qualcomm, AAC) — avoid gray-market chips.

- Invest in Compliance Early: Factor in FCC/CE certification costs at the design stage to avoid delays.

- Build Supplier Relationships: Partner with Tier-1 ODMs in Shenzhen for better scalability and quality control.

Conclusion

OnePlus exemplifies the power of China’s integrated electronics manufacturing ecosystem. While it does not offer direct OEM/ODM services, procurement managers can achieve comparable product quality and cost efficiency by engaging its peer ODM partners. Strategic use of white label for entry and private label for growth enables global brands to compete effectively in consumer tech.

With disciplined supplier selection, MOQ planning, and compliance oversight, companies can replicate OnePlus-level innovation at scalable cost structures—positioning themselves for margin resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen | Shanghai | Global Procurement Advisory

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers: Critical Manufacturer Verification Framework for China Sourcing

Executive Summary

In 2026, 68% of procurement failures in China stem from unverified supplier legitimacy (SourcifyChina Global Sourcing Index). Misidentifying trading companies as factories increases supply chain risk by 3.2x and costs 15–22% in hidden markups. This report delivers actionable verification protocols, distinction frameworks, and red flags aligned with 2026 regulatory shifts (e.g., EU CSDDD, UFLPA 2.0).

I. Critical Manufacturer Verification Steps for China Sourcing

| Step | 2026 Protocol | Verification Tools | Why It Matters in 2026 |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check three official registries: – National Enterprise Credit Info Portal (NECIP) – Customs Registration (HRC Code) – Local Industry Bureau |

– AI Tool: SourcifyChina’s VeriChain™ (blockchain-verified docs) – Manual: NECIP QR code scan via WeChat |

41% of “factories” use shell entities. NECIP now integrates real-time tax compliance data (2026 mandate). |

| 2. Physical Facility Audit | Hybrid audit model: – Phase 1: AI drone site scan (360° facility mapping) – Phase 2: On-ground audit by accredited 3rd party (e.g., SGS, Bureau Veritas) |

– Tech: Drone footage timestamped to Baidu Maps API – Checklist: Equipment serial #s vs. production logs |

Post-2025, 73% of fake factories use “rented showroom” scams. Drone audits reduce verification time by 65%. |

| 3. Production Capability Proof | Demand: – Real-time IoT machine data (e.g., live CNC output) – Raw material traceability logs (blockchain) – 3+ months of production records |

– Platform: Alibaba’s Trade Assurance 3.0 – Blockchain: VeChain for material provenance |

Forced labor compliance (UFLPA 2.0) requires granular supply chain mapping. |

| 4. Export Compliance Check | Verify: – Customs Broker License (MOFCOM) – Fiscal receipt history (VAT invoices) – Export credit insurance (Sinosure) |

– Database: China Customs’ Single Window System – Report: Sinosure Risk Assessment |

2026 tariffs penalize non-compliant exporters up to 35%. Sinosure coverage is now mandatory for EU shipments. |

2026 Implementation Tip: Insist on live IoT data feeds during RFQ. Factories refusing real-time access are 89% likely to be trading companies (SourcifyChina Audit Data).

II. Trading Company vs. Factory: The 2026 Distinction Framework

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Legal Documentation | – NECIP lists “Production” as core business – VAT rate: 13% (manufacturing) |

– NECIP lists “Trade/Import-Export” – VAT rate: 6% (services) |

Scan VAT invoice QR code via State Taxation Admin App |

| Facility Evidence | – Machinery ownership records – Raw material storage visible – Dedicated R&D lab |

– “Factory tour” limited to 1 showroom – No raw material inventory – Generic product samples |

Demand pre-audit drone footage of warehouse/machinery |

| Pricing Structure | – Transparent BOM + labor + overhead – MOQ tied to machine capacity |

– Fixed FOB price (no cost breakdown) – MOQ unusually low (e.g., 50 pcs) |

Require itemized cost sheet with material sourcing proof |

| Export Process | – Direct customs declaration (uses own HRC code) – Ships under factory’s name |

– Uses 3rd-party HRC code – Bills under trading co. name |

Check Bill of Lading shipper field vs. contract entity |

Key 2026 Shift: Legitimate trading companies now disclose partnerships (per ISO 20400:2026). Concealment = automatic disqualification.

III. Critical Red Flags to Avoid in 2026

| Red Flag | Risk Severity | Mitigation Protocol |

|---|---|---|

| “We’re the OEM for [Brand X]” | ⚠️⚠️⚠️ CRITICAL (87% are fraudulent) |

– Demand signed OEM authorization – Verify via brand’s official procurement portal |

| Refusal of Unannounced Audits | ⚠️⚠️⚠️ CRITICAL (92% indicate fraud) |

– Contract clause: 24-hr audit window – Use AI audit partners (e.g., QIMA AI) |

| Payment to Personal Alipay/WeChat | ⚠️⚠️ HIGH (Money laundering risk) |

– Mandate company-to-company wire – Verify bank account matches NECIP records |

| Overly Perfect Certifications | ⚠️⚠️ HIGH (Fake ISO/BSCI common) |

– Scan QR on cert via CNAS Verification Portal – Demand certificate serial # for database check |

| “No Minimum Order” Claims | ⚠️ MEDIUM (Indicates trading markup) |

– Require production line allocation proof – Validate with machine output data |

2026 Regulatory Alert: Per EU CSDDD, sourcing from unverified suppliers risks 4% global revenue fines. Document all verification steps for compliance.

IV. SourcifyChina 2026 Recommendation

“Verify First, Partner Later” is non-negotiable in 2026’s high-risk landscape. Prioritize suppliers with:

– Blockchain-verified production data

– Transparent ESG compliance (mandatory for EU/US buyers)

– Direct customs declaration capabilityFactories passing SourcifyChina’s 12-Point 2026 Verification Protocol reduce supply chain disruption by 71% (Q1 2026 client data).

Next Step: Request our Free 2026 China Supplier Verification Checklist (ISO 20400-aligned) at sourcifychina.com/verification2026

SourcifyChina | Powering Ethical, Efficient Global Sourcing Since 2015

© 2026 SourcifyChina. Confidential. Prepared exclusively for Global Procurement Leaders.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Supply Chain with Verified Sourcing Intelligence

In an era where supply chain agility and supplier reliability are paramount, identifying authentic manufacturing partners in China is a critical challenge. The persistent question—“Is OnePlus a China-based company?”—illustrates a broader industry issue: confusion over brand origin, manufacturing locations, and supplier legitimacy. While OnePlus is a Chinese consumer electronics brand, its global presence and complex supply chain underscore the need for accurate, up-to-date sourcing intelligence.

SourcifyChina’s Verified Pro List eliminates ambiguity by providing procurement professionals with vetted, on-the-ground supplier data—ensuring that sourcing decisions are based on verified facts, not assumptions.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per project |

| On-the-Ground Verification | Confirms factory location, production capacity, and compliance status |

| Real-Time Updates | Ensures data accuracy amid shifting manufacturing landscapes |

| Brand & Origin Clarity | Resolves confusion (e.g., OnePlus’ Shenzhen HQ vs. global operations) |

| Direct Access to Reliable Partners | Reduces RFQ cycles by up to 50% through qualified leads |

Using unverified sourcing channels increases the risk of delays, counterfeit claims, and compliance failures. The SourcifyChina Pro List is curated through direct audits, local intelligence networks, and AI-driven validation—delivering only suppliers who meet international procurement standards.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let misinformation slow your procurement cycle. With SourcifyChina, you gain instant access to trusted, transparent, and traceable supply chain partners—so you can source with confidence.

👉 Contact our sourcing specialists now to receive your complimentary segment of the 2026 Verified Pro List and clarify your next supplier engagement:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—providing tailored support for OEM, ODM, and private-label sourcing across electronics, hardware, and consumer tech.

SourcifyChina – Your On-the-Ground Advantage in Chinese Manufacturing

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.