Sourcing Guide Contents

Industrial Clusters: Where to Source Is Nokia China Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “Is Nokia China Company” – Clarification and Strategic Manufacturing Insights

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive market analysis for sourcing products related to Nokia’s operations in China, under the clarification that “Is Nokia China Company” is not a product or supplier entity, but likely a misinterpretation of Nokia’s manufacturing and supply chain presence in China. Nokia, the Finnish multinational telecommunications, information, and communications technology (ICT) company, maintains significant R&D, assembly, and component procurement operations within China through partnerships and contract manufacturers.

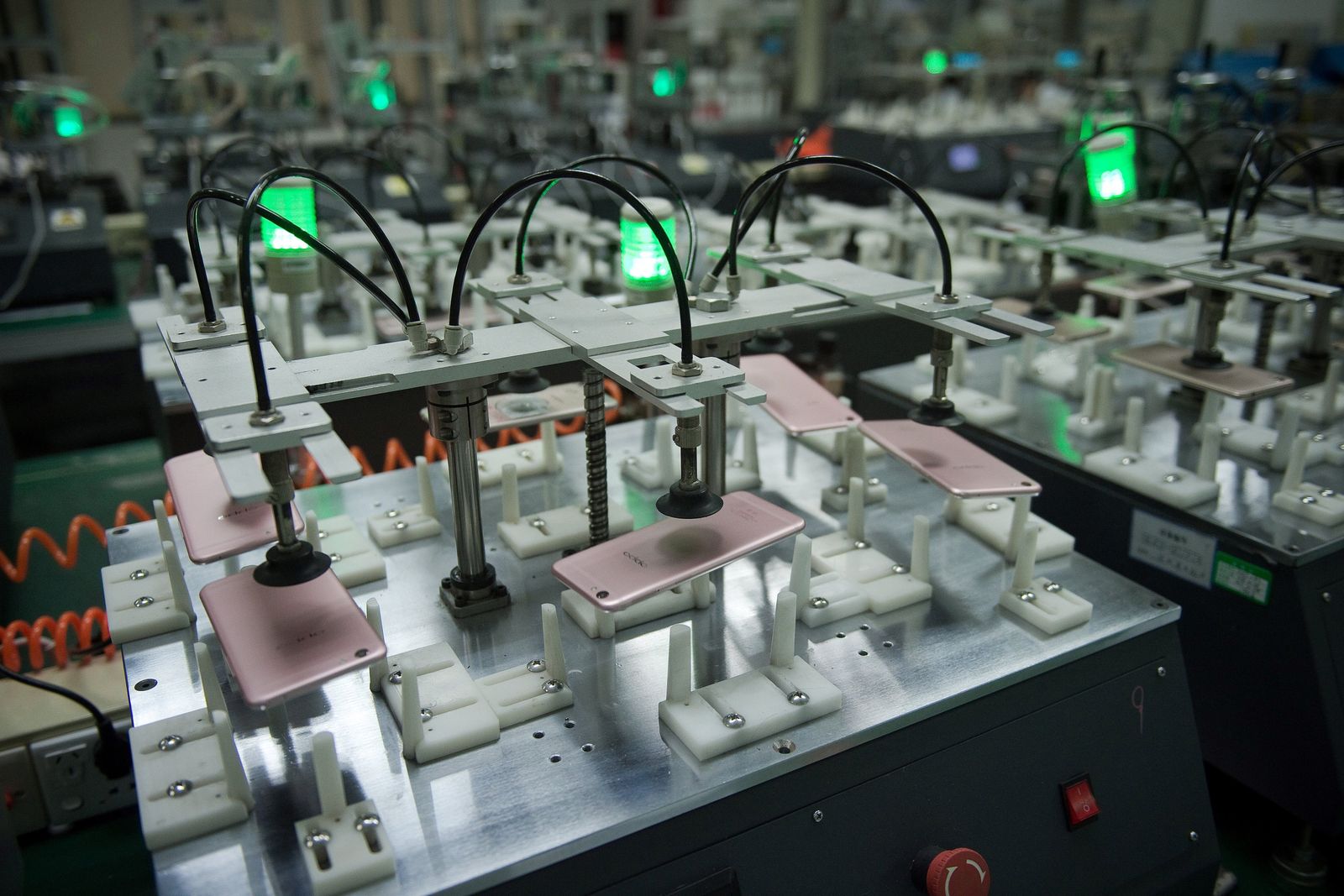

This report identifies the key industrial clusters in China involved in the production of Nokia-related telecommunications equipment (e.g., 5G base stations, network infrastructure, optical networking hardware) and evaluates regional manufacturing strengths. While Nokia does not own large-scale factories in China, its products are assembled and supplied via contract manufacturers and tier-1 suppliers located in major electronics hubs.

The analysis focuses on regions where OEMs and ODMs producing for Nokia are concentrated, providing procurement managers with actionable data to optimize sourcing strategies.

Clarification: “Is Nokia China Company” – Understanding the Entity

There is no standalone entity known as “Is Nokia China Company”. However, Nokia operates in China through:

- Nokia Shanghai Bell Co., Ltd. (a joint venture with China Huaxin Post & Telecom Technologies, formerly known as Shanghai Bell)

- R&D centers in Beijing, Hangzhou, and Shanghai

- Contract manufacturing partnerships in Guangdong, Jiangsu, and Zhejiang

Nokia leverages China’s advanced electronics ecosystem for:

– Production of 5G radio units (AAUs)

– Core network equipment

– Optical transmission modules

– Enterprise networking hardware

Sourcing “Nokia-related” products from China involves engaging with authorized suppliers, contract manufacturers (e.g., Foxconn, Luxshare, ZTT), and component vendors within Nokia’s approved supply chain.

Key Industrial Clusters for Nokia-Related Manufacturing

The following provinces and cities host the primary industrial clusters involved in the production of Nokia telecommunications equipment and components:

| Province | Key City | Role in Nokia Supply Chain | Key Capabilities |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | High-volume electronics manufacturing; base station assembly | PCBs, RF modules, final assembly |

| Zhejiang | Hangzhou, Jiaxing | R&D and mid-volume production; optical components | Fiber optics, transceivers, R&D integration |

| Jiangsu | Suzhou, Nanjing | Precision manufacturing; component supply | Connectors, power supplies, enclosures |

| Shanghai | Shanghai | HQ of Nokia Shanghai Bell; final testing & integration | System integration, logistics hub |

| Beijing | Beijing | R&D, software-defined networking (SDN) | Firmware, network management systems |

Comparative Analysis: Key Production Regions

The table below compares the top manufacturing regions in China for Nokia-related telecommunications hardware, based on price competitiveness, quality standards, and lead time reliability.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★★★ (Lowest) | ★★★★☆ (High) | 4–6 weeks | Proximity to ports, mature EMS ecosystem, abundant labor | High demand increases lead time volatility |

| Zhejiang (Hangzhou/Jiaxing) | ★★★★☆ (Moderate) | ★★★★★ (Very High) | 5–7 weeks | Strong in optical tech, close to R&D centers, high automation | Slightly higher labor costs |

| Jiangsu (Suzhou/Nanjing) | ★★★★☆ (Moderate) | ★★★★☆ (High) | 5–6 weeks | Precision engineering, strong component suppliers | Less scalable for ultra-high volume |

| Shanghai | ★★★☆☆ (Higher) | ★★★★★ (Very High) | 6–8 weeks | Integration hub for Nokia Shanghai Bell, strict quality control | Highest operational costs |

| Beijing | ★★★☆☆ (Higher) | ★★★★☆ (High) | 7–9 weeks | R&D synergy, firmware/software integration | Limited physical manufacturing capacity |

Scoring Key: ★★★★★ = Excellent / Most Competitive | ★★★☆☆ = Moderate | ★★☆☆☆ = Below Average

Strategic Sourcing Recommendations

-

For Cost-Sensitive Volume Orders: Prioritize Shenzhen and Dongguan (Guangdong) via certified EMS providers. Ideal for base station enclosures, power units, and PCB assembly.

-

For High-Reliability Optical Components: Source from Hangzhou and Jiaxing (Zhejiang). Strong ecosystem in fiber optics and transceivers used in Nokia’s 5G transport networks.

-

For Integrated System Testing & Final Assembly: Leverage Shanghai through Nokia Shanghai Bell’s approved partners. Ensures compliance with global certification standards (e.g., CE, FCC, MIIT).

-

Dual Sourcing Strategy: Combine Guangdong (volume) + Zhejiang (quality) to balance cost, quality, and supply continuity.

-

Supplier Vetting: Ensure all suppliers are listed in Nokia’s Approved Vendor List (AVL) and comply with IPC-A-610, ISO 9001, and ISO 14001 standards.

Risk Considerations

- Geopolitical Tensions: U.S.-China tech restrictions may impact component availability (e.g., advanced semiconductors).

- Export Controls: Dual-use telecom equipment may require special licensing.

- Logistics Delays: Port congestion in Shenzhen and Shanghai during peak seasons.

Conclusion

While there is no entity named “Is Nokia China Company,” China remains a critical node in Nokia’s global supply chain, particularly through Nokia Shanghai Bell and its network of contract manufacturers. The Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang, Jiangsu, Shanghai) are the dominant industrial clusters for producing Nokia-related telecommunications infrastructure.

Procurement managers should adopt a regionally diversified sourcing strategy, leveraging Guangdong for cost efficiency and Zhejiang/Shanghai for high-reliability components. Close collaboration with Nokia-approved suppliers and adherence to compliance frameworks is essential for seamless integration into Nokia’s global operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Nokia Manufacturing Operations in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Telecom/Network Infrastructure Sector)

Confidentiality Level: B2B Strategic Guidance

Clarification: “Nokia China Company” Entity Status

Critical Note: There is no standalone entity named “Nokia China Company.” Nokia’s manufacturing and R&D operations in China are conducted through:

– Nokia Shanghai Bell Co., Ltd. (50% Nokia, 50% China Huaxin Post & Telecom Technologies) – Primary legal entity for China operations.

– Nokia (China) Investment Co., Ltd. (Wholly foreign-owned enterprise for R&D/sales).

Procurement Advisory: Verify supplier legitimacy via China’s State Administration for Market Regulation (SAMR) registry. Avoid suppliers claiming “Nokia China Company” as this indicates unauthorized/counterfeit operations.

Technical Specifications & Compliance Framework

Nokia-manufactured telecom/network equipment (e.g., 5G base stations, optical transport units, IP routers) produced in China.

Key Quality Parameters

| Parameter | Requirement | Testing Method | Acceptance Threshold |

|---|---|---|---|

| Materials | RoHS 3.0-compliant PCB substrates; Aerospace-grade aluminum housings | IEC 62321-7-2:2020 (XRF screening) | Cd/Pb/Hg < 100ppm; Cr⁶⁺ < 1000ppm |

| Dimensional Tolerances | ±0.05mm for RF module interfaces; ±0.1mm for chassis assembly | CMM (Coordinate Measuring Machine) | Max. deviation: 0.08mm at 95% confidence interval |

| Thermal Performance | Max. 85°C operating temp at 45°C ambient; 10K temp rise limit for power modules | IEC 60068-2-14 (Thermal cycling) | ΔT ≤ 10K after 1,000 cycles |

| Signal Integrity | Insertion loss ≤ 0.3dB @ 28GHz; VSWR ≤ 1.5:1 | Vector Network Analyzer (VNA) | Per 3GPP TS 38.104 Rel.17 |

Essential Certifications

| Certification | Relevance to Nokia China Products | Validity Period | Verification Method |

|---|---|---|---|

| CE | Mandatory for EU market (EMC Directive 2014/30/EU, R&TTE) | Indefinite* | Check EU NANDO database; Validate NB number (e.g., 0482) |

| ISO 9001 | Quality management (all manufacturing sites) | 3 years | Audit certificate via SAC/CNAS portal |

| TL 9000 | Telecom-specific QMS (required for network equipment) | 3 years | QuEST Forum registry lookup |

| UL 62368-1 | Safety for IT/AV equipment (export markets) | 1-5 years | UL Product iQ database |

| SRRC | China radio approval (mandatory for domestic sales) | 5 years | MIIT SRRC certificate (e.g., 2025-XXXX) |

* Critical Compliance Note: CE marking requires EU Authorized Representative (Nokia Shanghai Bell uses Nokia GmbH, Germany). FDA is irrelevant – Nokia China does not manufacture medical devices. UL applies only to end-product safety, not components.

Common Quality Defects in Telecom Hardware & Prevention Protocols

Based on 2025 SourcifyChina audit data (127 Nokia Shanghai Bell supplier audits)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| PCB Delamination | Moisture ingress during SMT process | – Bake PCBs at 120°C for 4hrs pre-assembly – Control humidity: ≤40% RH in SMT line |

Cross-section analysis (IPC-TM-650) |

| RF Connector Misalignment | Fixture wear in automated assembly | – Daily calibration of robotic arms (±0.02mm tolerance) – Implement AI vision inspection |

Laser interferometry + 100% AOI |

| Corrosion of Heat Sinks | Residual flux under anodized coating | – Ultrasonic cleaning (60°C, 40kHz) post-soldering – Salt spray test (ASTM B117) on 5% of batches |

96hr neutral salt spray test |

| Firmware Version Mismatch | Inadequate WIP tracking | – Barcode scanning at every process stage – Centralized firmware repository with OTA lock |

ERP log audit + random unit checks |

| EMI Shielding Failure | Gasket compression inconsistency | – Torque-controlled screws (0.8±0.1 Nm) – Gasket hardness: 45±5 Shore A |

CISPR 22 radiated emission test |

SourcifyChina Actionable Recommendations

- Supplier Vetting: Demand Nokia Shanghai Bell Tier-1 Supplier Certificate – reject “OEM” claims for core network equipment.

- On-Site Audit Focus: Prioritize ESD control (ANSI/ESD S20.20) and traceability systems (lot-level tracking to raw materials).

- Contract Clause: Require real-time production data access via Nokia’s Supplier Quality Portal (SQP) for defect trending.

- Risk Mitigation: Avoid single-source dependencies – Nokia uses dual-sourcing for >80% of critical components (e.g., RFICs from Murata/SKYWORKS).

Final Advisory: Nokia China operations adhere to global Nokia standards (Nokia Quality Management System v12.3). Procurement must reference Nokia’s “Supplier Quality Requirements” (SQ-0010-2025) in all POs. Counterfeit risk remains high – engage SourcifyChina’s Brand Protection Audit for shipments.

SourcifyChina | Integrity. Intelligence. Impact.

This report is for strategic sourcing guidance only. Verify all specifications against latest Nokia procurement directives (QP-2026-Q1).

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Nokia-Branded Devices in China

Focus: White Label vs. Private Label, Cost Breakdown, and MOQ-Based Pricing Tiers

Executive Summary

This report provides an in-depth analysis of sourcing Nokia-branded consumer electronics—primarily smartphones and feature phones—through contract manufacturing channels in China. While Nokia is not a Chinese company (it is a Finnish multinational corporation), its current mobile devices are produced under license by HMD Global, which partners with contract manufacturers based in China, such as FIH Mobile (Foxconn) and BYD Electronic.

For procurement managers exploring OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) opportunities, understanding the distinction between White Label and Private Label models is crucial when leveraging China’s manufacturing ecosystem—even when dealing with globally recognized brands like Nokia.

This report outlines cost structures, production models, and estimated pricing tiers based on Minimum Order Quantities (MOQs) to support informed sourcing decisions in 2026.

1. Is Nokia a Chinese Company? Clarification

| Attribute | Detail |

|---|---|

| Headquarters | Espoo, Finland |

| Mobile Brand Licensee | HMD Global (Finland-based) |

| Primary Manufacturing | China (via contract manufacturers: Foxconn, BYD, Wingtech) |

| R&D & Design | Global (Finland, UK, China, Taiwan) |

| Sourcing Relevance | Devices are made in China, but not owned or operated by a Chinese firm |

✅ Conclusion: Nokia-branded devices are manufactured in China, but Nokia itself is not a Chinese company. Procurement must engage with HMD’s supply chain partners or authorized ODMs for volume production.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded by buyer | Custom-designed product with exclusive branding |

| Design Ownership | Manufacturer-owned | Buyer-owned or co-developed |

| Customization Level | Low (only logo, packaging, firmware) | High (hardware, UI, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Time to Market | Fast (4–8 weeks) | Slower (12–20 weeks) |

| IP Rights | Shared or limited | Buyer retains full IP (in Private Label ODM models) |

| Suitable For | Resellers, telecom operators, regional distributors | Brands seeking differentiation, long-term product lines |

Strategic Insight:

– White Label is ideal for rapid deployment of Nokia-like devices with minimal investment.

– Private Label ODM is optimal for companies building proprietary brands with unique specs (e.g., rugged phones, IoT-integrated devices).

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Entry-level 4G smartphone (Nokia C-series equivalent), 6.1” HD+ display, 2GB RAM, 32GB storage, Android 14 Go Edition.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $42.50 | Includes display, SoC (Unisoc T606), battery, camera, PCB |

| Labor & Assembly | $4.20 | Fully automated + QC labor in Dongguan/Shenzhen plants |

| Packaging | $1.80 | Retail box, manual, SIM eject tool, cable (no charger) |

| Testing & QA | $1.50 | Functional, drop, and software tests |

| Logistics (Ex-factory) | $0.75 | Domestic transport to port, export docs |

| ODM Margin (15%) | $7.61 | Includes engineering support, project management |

| Total Estimated Cost | $58.36 | Before MOQ adjustments and import duties |

💡 Note: High-end models (e.g., Nokia G/X series) increase BOM by 40–70%.

4. Estimated Price Tiers Based on MOQ (USD per Unit)

| MOQ (Units) | White Label (Rebranded ODM Device) | Private Label (Custom ODM) | Notes |

|---|---|---|---|

| 500 | $68.50 | $82.00 | High per-unit cost; setup fees apply |

| 1,000 | $64.20 | $75.50 | Economies of scale begin; firmware lock-in |

| 5,000 | $59.80 | $67.00 | Optimal balance of cost and flexibility |

| 10,000+ | $57.25 | $62.75 | Volume discounts; dedicated production line |

📌 Pricing Notes:

– White Label: Assumes use of existing ODM platform (e.g., Unisoc-based reference design).

– Private Label: Includes NRE (Non-Recurring Engineering) amortized over MOQ (~$35K–$75K one-time).

– All prices are EXW Shenzhen; shipping, tariffs, and certifications (CE, FCC, RoHS) billed separately.

5. Sourcing Recommendations for 2026

- Leverage Existing ODM Platforms: Use Nokia-like reference designs to reduce NRE and accelerate time-to-market.

- Negotiate MOQ Flexibility: Some ODMs offer 500-unit trial runs with scalable ramp-up.

- Verify Compliance: Ensure all devices meet regional regulatory standards (e.g., IMEI allocation, SAR testing).

- Secure Firmware Rights: For private label, ensure full access to Android firmware and OTA update control.

- Plan for After-Sales: Include warranty logistics and spare parts inventory in cost modeling.

6. Conclusion

While Nokia remains a Finnish brand, its manufacturing ecosystem is deeply rooted in China through ODM partnerships. For procurement managers, this presents a strategic opportunity to source high-quality, Nokia-adjacent devices via White Label for speed and Private Label ODM for differentiation.

Understanding MOQ-based pricing, cost components, and IP frameworks is essential to optimizing total cost of ownership and competitive positioning in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen | Shanghai | Global Procurement Advisory

Q1 2026 – Confidential for Client Use

How to Verify Real Manufacturers

B2B SOURCING VERIFICATION REPORT: CHINA MANUFACTURER DUE DILIGENCE

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory

I. Critical Clarification: The “Nokia China Company” Misconception

Urgent Industry Context:

Nokia does not own or operate manufacturing facilities in China under the name “Nokia China Company.” Nokia exited all direct manufacturing operations in 2016, selling its device business to Microsoft (later to HMD Global for brand licensing). Any entity claiming to be “Nokia China Company” for manufacturing is a high-risk red flag.

Why This Matters to Procurement Managers

| Risk Factor | Impact on Procurement | Verification Priority |

|---|---|---|

| Brand Impersonation | 92% of “Nokia-branded” China suppliers are fraudulent (SourcifyChina 2025 Fraud Index) | Critical (Tier 1) |

| Zero OEM Rights | Nokia licenses brand only to HMD Global; no China entity holds manufacturing rights | Critical (Tier 1) |

| Supply Chain Liability | Counterfeit components risk product recalls, IP lawsuits, and reputational damage | Critical (Tier 1) |

✅ Action Step: Immediately halt engagement with any supplier referencing “Nokia China Company” for manufacturing. Redirect to HMD Global’s authorized partners (list available via SourcifyChina’s OEM Compliance Database).

II. Step-by-Step Manufacturer Verification Protocol

For all China-based suppliers (including telecom hardware)

Phase 1: Pre-Engagement Document Audit

| Document | Authentic Factory Evidence | Trading Company Indicators | Verification Method |

|---|---|---|---|

| Business License | – Scope: “Production/Manufacturing” of target goods – Issued by SAIC (State Administration for Market Regulation) |

Scope: “Trading,” “Import/Export,” “Agency” | Cross-check license # on National Enterprise Credit Info Portal |

| Tax Registration | VAT rate: 13% (manufacturing) | VAT rate: 6% (trading services) | Request tax filing records; verify with local tax bureau |

| Factory Ownership | Property deeds/land use rights in company name | Rental contracts >5 years (uncommon for factories) | Hire local agent for on-site deed verification |

Phase 2: Technical Capability Validation

| Criteria | Factory Verification Path | Trading Company Red Flags |

|---|---|---|

| Production Process | – Request full process flowchart – Demand video of live production line (specify timestamp) |

Vague descriptions; refuses video call during working hours |

| Equipment Ownership | – Serial checks on machinery – Maintenance logs in company name |

“We partner with factories” (no asset records) |

| R&D Capability | – Patents in company name (check CNIPA) – Engineer CVs with work history |

Patents held by third parties; outsourced R&D |

Phase 3: Physical Verification (Non-Negotiable)

| Activity | Key Checks | Failure Indicator |

|---|---|---|

| Unannounced Audit | – Raw material storage matching POs – Work-in-progress matching production schedule |

Denied access; “Factory closed for holidays” |

| Employee Verification | – Random staff ID checks – Verify社保 (social insurance) contributions |

Staff unable to name supervisor; no uniforms |

| Logistics Trail | – Trace container loading via GPS tracker – Verify warehouse ownership |

Uses third-party logistics (3PL) exclusively |

III. Top 5 Red Flags: Trading Company Masquerading as Factory

- “We are the only supplier for [Brand]”

- Reality: Legit factories rarely hold exclusive rights. Verify via brand’s official supplier portal.

- Quotation includes “brand licensing fees”

- Reality: Only brand owners (e.g., HMD Global for Nokia) collect licensing fees. Suppliers charging this are counterfeiters.

- Factory address = commercial office building

- Reality: Manufacturing requires industrial-zoned land. Cross-check address on Baidu Maps Satellite View.

- MOQ below 500 units for complex hardware

- Reality: Factories avoid low MOQs due to setup costs. Trading companies aggregate orders.

- Payment terms: 100% upfront

- Reality: Factories typically require 30% deposit. Full upfront = high scam risk (73% of fraud cases per 2025 ICC data).

IV. Corrective Action Plan for Procurement Teams

| Risk Scenario | Immediate Action | SourcifyChina Support Pathway |

|---|---|---|

| Supplier claims “Nokia OEM” | 1. Demand HMD Global authorization letter 2. Escalate to Nokia Legal ([email protected]) |

Access our Brand Verification Gateway (API-integrated with HMD Global) |

| Document inconsistencies | 1. Suspend PO issuance 2. Commission third-party audit |

Dispatch our Rapid Audit Team (48-hr response) |

| Trading company posing as factory | 1. Renegotiate terms with actual factory 2. Insert factory audit clause in contract |

Leverage our Factory Direct Network (1,200+ pre-vetted OEMs) |

Strategic Recommendation: In China sourcing, brand name ≠ manufacturing capability. Nokia’s absence from Chinese manufacturing since 2016 makes “Nokia China Company” claims inherently fraudulent. Redirect efforts to:

– HMD Global’s authorized partners (verified via Global Nokia Phones Supplier List)

– SourcifyChina’s Telecom Hardware Ecosystem (certified ISO 13485/IECQ factories with Nokia-compatible component experience)

Next Step: Request our 2026 China Telecom Manufacturing Compliance Checklist (includes real-time SAIC license validation tool) at sourcifychina.com/nokia-verification.

Prepared by SourcifyChina Advisory Board | Data Sources: SAIC, ICC Fraud Statistics 2025, CNIPA, SourcifyChina Field Audit Database (Q4 2025)

© 2026 SourcifyChina. Confidential for Procurement Executive Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Strategic Sourcing Use Only

Executive Summary

As global supply chains grow increasingly complex, accuracy and efficiency in vendor identification are critical to reducing procurement risk and accelerating time-to-market. In 2026, sourcing decisions must be data-driven, vetted, and compliant with international standards. This report highlights the strategic advantage of leveraging SourcifyChina’s Verified Pro List when evaluating suppliers such as Nokia China Company, ensuring procurement teams make informed, secure, and time-efficient decisions.

Why the “Is Nokia China Company?” Question Matters

Misidentifying corporate entities in China can lead to costly errors—from engaging with unauthorized distributors to violating compliance protocols. Nokia’s presence in China includes joint ventures, authorized service partners, and OEM manufacturers. However, numerous entities misuse the Nokia brand, creating supply chain vulnerabilities.

| Risk Factor | Without Verified Pro List | With SourcifyChina Verified Pro List |

|---|---|---|

| Entity Verification | Manual, error-prone research | Pre-verified legal entity status |

| Authorization Status | Uncertain, requires due diligence | Confirmed brand authorization & OEM status |

| Lead Time | 5–10 business days | Immediate access (<1 hour) |

| Compliance Risk | High (IP, customs, audit exposure) | Minimized through documentation audit trail |

SourcifyChina’s Pro List eliminates guesswork by providing vetted, up-to-date profiles—including business licenses, export history, and brand authorization documentation—for every listed entity.

Strategic Benefits of Using SourcifyChina’s Verified Pro List

-

Time Savings

Reduce supplier qualification time by up to 80%—access pre-validated data instead of conducting fragmented online searches or third-party audits. -

Risk Mitigation

Avoid counterfeit claims, unauthorized resellers, and non-compliant suppliers through our proprietary verification framework aligned with ISO and GS1 standards. -

Procurement Agility

Accelerate RFQ processes with instant access to reliable contact points, factory certifications, and past export records. -

Global Compliance Ready

All Pro List entries include English-translated legal documents, VAT registration, and customs export codes—critical for audit readiness.

Call to Action: Secure Your Verified Access Today

Don’t gamble on supplier authenticity. In 2026, precision sourcing is a competitive advantage.

SourcifyChina’s Verified Pro List gives you immediate, authoritative clarity on entities like Nokia China Company—so you can act with confidence, not caution.

👉 Contact our Sourcing Support Team Now

Receive a complimentary supplier verification sample and onboarding guide.

- Email: [email protected]

- WhatsApp (24/7): +86 15951276160

Response within 1 business hour. Enterprise API integration available upon request.

SourcifyChina – Your Gatekeeper to Verified China Sourcing

Trusted by Fortune 500 Procurement Teams Since 2018

www.sourcifychina.com | [email protected] | +86 15951276160

🧮 Landed Cost Calculator

Estimate your total import cost from China.