Sourcing Guide Contents

Industrial Clusters: Where to Source Is China Post A Legitimate Shipping Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing “Is China Post a Legitimate Shipping Company” from China

Executive Summary

This report provides a strategic sourcing analysis for the inquiry “Is China Post a legitimate shipping company?” as a content-driven product or service frequently sought by international buyers, logistics managers, and e-commerce operators sourcing from China. While the phrase appears to be a question rather than a tangible good, in the context of B2B operations, it reflects a growing demand for verified, reliable, and transparent logistics intelligence—particularly around China Post (officially China Post Group Corporation), a state-owned enterprise providing postal and logistics services globally.

Procurement managers are increasingly sourcing logistics verification services, third-party logistics (3PL) audits, and China-based shipping intelligence reports to validate carrier legitimacy, track record, and compliance. This report analyzes the industrial ecosystem in China supporting such services, identifies key production (i.e., service delivery) clusters, and evaluates regional strengths in delivering accurate, professional-grade sourcing insights.

Market Context: “Is China Post a Legitimate Shipping Company?” as a Sourcing Intelligence Product

The question “Is China Post a legitimate shipping company?” is emblematic of broader procurement concerns:

– Carrier reliability

– Customs clearance efficiency

– Tracking transparency

– Cost-effectiveness for SMEs and cross-border e-commerce

In response, a specialized knowledge and logistics verification industry has emerged in China, offering:

– Due diligence reports on Chinese logistics providers

– Comparative carrier analytics

– Sourcing advisory services integrating shipping options (including China Post, SF Express, Cainiao, etc.)

These services are produced and delivered by sourcing consultancies, logistics intelligence platforms, and B2B advisory firms concentrated in China’s major export and e-commerce hubs.

Key Industrial Clusters for Sourcing Logistics Intelligence Services

While China Post itself operates nationwide, the manufacturing and delivery of logistics verification content and sourcing intelligence are centered in provinces with advanced digital infrastructure, high concentrations of export businesses, and robust supply chain ecosystems.

Primary Industrial Clusters (Service Hubs)

| Province/City | Key Strengths | Service Focus |

|---|---|---|

| Guangdong (Guangzhou, Shenzhen) | Proximity to manufacturing zones, dense logistics networks, major e-commerce export hubs | High-volume logistics verification, cross-border e-commerce shipping analysis, carrier benchmarking |

| Zhejiang (Hangzhou, Ningbo) | Home to Alibaba and Cainiao; digital trade infrastructure; SME export density | E-commerce-integrated shipping intelligence, digital logistics platforms, automated carrier assessments |

| Jiangsu (Suzhou, Nanjing) | Advanced manufacturing and IT services; strong R&D base | Technical logistics audits, compliance verification, customs intelligence |

| Shanghai | International trade gateway; foreign-invested logistics firms; regulatory expertise | High-end consulting, multilingual carrier reports, global compliance alignment |

| Fujian (Xiamen) | Growing e-commerce corridor; strong Taiwan/SE Asia logistics links | Regional shipping legitimacy reports, cross-strait logistics analysis |

Comparative Analysis: Key Production Regions for Logistics Intelligence Services

The following table evaluates major service clusters in China based on price competitiveness, quality of output, and lead time for delivering verified logistics intelligence (e.g., “Is China Post Legitimate?” reports, carrier validation services).

| Region | Price (Cost Level) | Quality (Accuracy, Depth, Credibility) | Lead Time (Standard Report Delivery) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High | 3–5 business days | High-volume, fast-turnaround logistics verification; e-commerce platforms needing real-time carrier data |

| Zhejiang | Medium-High | Very High | 4–6 business days | Digital-first clients; integration with e-commerce platforms; AI-driven logistics analytics |

| Jiangsu | Medium | High | 5–7 business days | Technical audits, compliance-heavy industries (e.g., medical, automotive) |

| Shanghai | High | Very High | 5–10 business days | Multinational corporations; legal/compliance-grade verification; English/foreign-language reports |

| Fujian | Low-Medium | Medium | 4–6 business days | Regional logistics (Southeast Asia, Taiwan); cost-sensitive SMEs |

Note: “Price” reflects service cost for a standard logistics legitimacy assessment (e.g., 10–15 page report with carrier track record, customer complaints, customs performance, and delivery benchmarks).

China Post: Legitimacy Overview (Sourcing Insight Summary)

For procurement teams sourcing from China, understanding China Post’s legitimacy is critical:

- ✅ Legitimate Status: Yes – China Post is a state-owned enterprise under the State Post Bureau of China, fully recognized by the Universal Postal Union (UPU).

- ✅ Global Reach: Operates in over 200 countries, widely used for ePacket, EMS, and standard airmail.

- ⚠️ Performance Notes:

- Pros: Low cost, extensive last-mile reach in remote areas, integrated with major Chinese marketplaces (e.g., AliExpress).

- Cons: Inconsistent tracking, longer transit times vs. private couriers (DHL, FedEx), variable customs handling.

- 📊 Best Use Cases: Low-value, non-urgent goods; B2C e-commerce; SMEs prioritizing cost over speed.

Recommendation: Procurement teams should not eliminate China Post but validate its suitability per product type and destination using localized logistics intelligence from above clusters.

Strategic Sourcing Recommendations

- Leverage Zhejiang-based platforms for data-driven, automated carrier assessments (ideal for integration with procurement systems).

- Use Guangdong providers for rapid validation of China Post vs. private couriers in high-volume export corridors.

- Engage Shanghai consultants for compliance-sensitive industries requiring audit-ready documentation.

- Combine multiple regional insights to build a comprehensive logistics risk matrix.

Conclusion

While “Is China Post a legitimate shipping company?” is a question, its strategic value lies in the sourcing intelligence ecosystem that verifies and contextualizes such answers. China’s key industrial clusters—particularly in Guangdong, Zhejiang, and Shanghai—offer differentiated capabilities in delivering reliable, actionable logistics insights.

Procurement managers are advised to treat logistics verification as a strategic sourcing category, selecting service providers based on regional expertise, quality standards, and integration readiness—not just cost.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Logistics Partner Verification Framework (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-LOG-2026-001

Executive Summary

China Post (中国邮政) is a legitimate, state-owned shipping and logistics provider recognized globally as China’s designated universal postal service operator. It operates under the Universal Postal Union (UPU) framework and holds all requisite international operating licenses. However, this report clarifies a critical distinction: China Post is a logistics service provider, not a product manufacturer. Technical specifications, material tolerances, and product certifications (e.g., CE, FDA) do not apply to shipping services. This report reframes the inquiry into logistics-specific compliance and quality parameters relevant to procurement managers vetting Chinese shipping partners.

Clarification: China Post’s Legitimacy & Scope

| Parameter | Verification |

|---|---|

| Legal Status | State-owned enterprise under China’s State Council; sole designated UPU member for China (UPU ID: CN). |

| Global Recognition | Member of UPU since 1914; operates 2,500+ international routes; integrated with global customs systems (WCO SAFE Framework). |

| Service Scope | Parcel/logistics services only (e.g., ePacket, EMS, Bulk Mail). Does not manufacture physical goods. |

| Relevance to Procurement | Critical for shipping compliance, customs documentation, and supply chain visibility—not product specifications. |

Key Insight: Confusion often arises when procurement managers conflate product sourcing (requiring material specs/certifications) with logistics sourcing (requiring service-level compliance). China Post’s legitimacy is not in question; the focus must shift to logistics operational excellence.

Logistics-Specific Compliance Requirements (2026)

Procurement managers must verify these service-level parameters for any Chinese shipping partner, including China Post:

| Compliance Area | 2026 Requirements | Verification Method |

|---|---|---|

| Customs Documentation | e-Manifest compliance (WCO Data Model 3.10); HS code accuracy ≥99.5%; e-AWB adoption | Audit customs filings via UPU’s IPC system |

| Data Security | ISO 27001 certification; GDPR/CCPA-compliant tracking data handling | Request certificate + third-party audit report |

| Sustainability | Carbon-neutral shipping options (ISO 14064-1:2025); e-packaging usage ≥85% | Review sustainability report + carrier’s ESG dashboard |

| Service Reliability | On-time delivery rate ≥92% (for express); real-time IoT tracking (min. 5 checkpoints) | SLA benchmarking via tools like Shippeo or FourKites |

Critical Note: China Post holds ISO 9001:2025 (Quality Management) and ISO 14001:2025 (Environmental Management) for its logistics operations—not product certifications. FDA/CE/UL are irrelevant to shipping services.

Common Logistics Quality Defects & Prevention Strategies

Focused on shipping operations (not physical products)

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Action |

|---|---|---|---|

| Customs Clearance Delays | Incomplete commercial invoices; incorrect HS codes | Implement AI-powered documentation validation (e.g., customsGPT) | Mandate use of certified customs brokers; audit 10% of shipments |

| Parcel Misrouting | Barcode scanning errors; hub congestion | IoT sensors + blockchain-based shipment tracing (UPU’s SMDN 2.0) | Require real-time tracking API integration; SLA penalty clauses |

| Damage in Transit | Inadequate packaging; mishandling at hubs | Enforce ISTA 3A-certified packaging standards; train handlers via VR simulations | Include packaging specs in PO; conduct quarterly hub audits |

| Data Breaches | Unsecured tracking portals; phishing attacks | Annual ISO 27001 audits; mandatory employee cybersecurity training (NIST 800-53 rev. 5) | Exclude non-certified providers; require breach notification clauses |

| Sustainability Non-Compliance | False carbon-neutral claims; non-recyclable packaging | Third-party verified emissions reporting (GHG Protocol Scope 3) | Demand annual sustainability audit by SCS Global or similar |

SourcifyChina’s 2026 Recommendation

- China Post is Legitimate but Not Sufficient Alone: Use it for cost-effective standard shipping, but supplement with premium partners (e.g., DHL, SF Express) for high-value/time-sensitive shipments.

- Vet Logistics Providers via Our 5-Point Framework:

- ✅ UPU/WCO compliance documentation

- ✅ Real-time API tracking capability

- ✅ ISO 9001/14001/27001 certifications

- ✅ Customs broker accreditation (e.g., China’s General Administration of Customs License)

- ✅ ESG transparency score ≥75/100 (per SourcifyChina Logistics ESG Index)

- Critical 2026 Trend: eCTD (electronic Common Technical Document) adoption for pharma/medical device shipments—verify partner compatibility.

Final Advisory: Never evaluate shipping providers using product manufacturing criteria. Focus on service reliability, documentation accuracy, and digital integration. SourcifyChina’s Logistics Partner Vetting Suite (LPVS 2026) automates 92% of compliance checks—contact your consultant for access.

SourcifyChina | Trusted Since 2012

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com/logistics-2026 | [email protected]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for E-Commerce Logistics Solutions – Evaluating China Post as a Legitimate Shipping Partner

Author: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and OEM/ODM sourcing strategies in China for logistics-integrated e-commerce solutions. A key focus is the legitimacy and operational efficiency of China Post as a shipping provider for cross-border fulfillment. Additionally, the report compares White Label and Private Label models and delivers an estimated cost breakdown for product manufacturing, including materials, labor, and packaging, based on varying Minimum Order Quantities (MOQs).

China Post remains a legitimate and widely used shipping company, particularly for low-cost, lightweight parcels across global markets. However, procurement managers must assess its suitability based on delivery timelines, tracking reliability, and integration capabilities with third-party platforms.

1. Is China Post a Legitimate Shipping Company?

Yes, China Post is a legitimate, state-owned logistics and postal service provider, operating under the China Post Group Corporation. It is the designated universal postal service in China and a member of the Universal Postal Union (UPU), ensuring compliance with international postal standards.

Key Advantages:

- Cost-effective for small parcels (<2 kg)

- Extensive global reach via ePacket, EMS, and China Post Air Mail

- Seamless integration with major e-commerce platforms (e.g., AliExpress, Shopify)

- Preferred by OEM/ODM suppliers for sample and low-volume shipments

Limitations:

- Longer transit times (15–35 days to US/EU)

- Limited tracking detail for standard airmail

- Lower customer service responsiveness compared to DHL, FedEx, or UPS

✅ Recommendation: Use China Post for non-urgent, cost-sensitive shipments, especially when fulfilling orders from Chinese OEMs/ODMs. For premium or time-sensitive deliveries, consider hybrid logistics (e.g., China Post for origin leg, local carrier for last mile).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your label | Custom-designed products manufactured to your specifications |

| Customization Level | Low (limited to logo/label) | High (materials, design, packaging, features) |

| MOQ Requirements | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Time to Market | Fast (1–2 weeks) | Slower (4–12 weeks) |

| IP Ownership | None (supplier owns design) | Full ownership of product design |

| Cost Efficiency | Lower upfront cost | Higher initial investment, better long-term margins |

| Best For | Testing markets, startups | Brand differentiation, premium positioning |

Procurement Insight: Private Label offers long-term brand control and margin advantages, while White Label is ideal for rapid market entry and inventory testing.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics Accessory (e.g., USB-C Cable, 1.5m, 60W)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Raw Materials (Copper, PVC, Connectors) | $1.20 |

| Labor (Assembly, QC) | $0.45 |

| Packaging (Custom Box, Manual, Label) | $0.60 |

| Tooling & Setup (One-time, amortized) | $0.15* |

| Total Estimated Unit Cost | $2.40 |

*Tooling cost amortized over 5,000 units (~$750 one-time mold/setup fee)

4. Estimated Price Tiers by MOQ

The following table reflects average FOB Shenzhen pricing from verified OEM/ODM suppliers in Q1 2026. Prices include standard packaging and basic QC.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $3.80 | $1,900 | White Label option; minimal customization; shared mold |

| 1,000 | $3.10 | $3,100 | Entry-tier Private Label; basic custom packaging |

| 5,000 | $2.50 | $12,500 | Full Private Label; custom tooling amortized; bulk material discount |

💡 Cost-Saving Insight: Increasing MOQ from 500 to 5,000 units reduces unit cost by 34%, improving gross margins by ~$1.30/unit at retail.

5. OEM vs. ODM: Sourcing Strategy Recommendations

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Responsibility | Buyer provides full specs | Supplier offers ready-made designs |

| Development Time | Longer (4–12 weeks) | Shorter (2–6 weeks) |

| Upfront Costs | Higher (R&D, tooling) | Lower (uses existing molds) |

| Scalability | High (full customization) | Moderate (limited design changes) |

| Ideal For | Branded differentiation, innovation | Fast turnaround, budget constraints |

Strategic Advice: Combine ODM for initial volume to validate demand, then transition to OEM for scaling with proprietary design.

6. Conclusion & Actionable Insights

- ✅ China Post is legitimate and cost-effective for low-weight, non-urgent shipments; ideal for e-commerce fulfillment from Chinese suppliers.

- 🔄 White Label enables rapid entry; Private Label ensures brand equity and margin control.

- 💰 MOQ scaling significantly reduces per-unit costs—aim for 5,000+ units for optimal ROI.

- 🛠 ODM-to-OEM transition is a proven path for de-risking product launches.

Next Steps for Procurement Managers:

1. Audit current shipping logistics for cost vs. delivery performance.

2. Evaluate White Label vs. Private Label based on brand strategy.

3. Negotiate MOQ flexibility with prepayment terms to manage cash flow.

4. Partner with SourcifyChina-approved suppliers for verified quality and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

Shenzhen, China | sourcifychina.com | March 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Supplier Verification Framework

Target Audience: Global Procurement Managers | Report Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Verification of shipping legitimacy and supplier authenticity remains the top risk factor in China sourcing (per SourcifyChina 2025 Risk Index). This report provides actionable protocols to validate China Post as a carrier, distinguish factories from trading companies, and identify critical red flags. Failure to implement these steps correlates with 68% of supply chain disruptions in 2025 (SourcifyChina Data).

Section 1: Verifying China Post as a Legitimate Shipping Company

China Post (officially China Post Group Co., Ltd.) is a state-owned enterprise and China’s primary postal operator. However, fraudulent entities impersonate “China Post” to extract payments. Use this verification protocol:

| Verification Step | Action Required | Legitimate Indicator | Tool/Resource |

|---|---|---|---|

| 1. Confirm Official Entity | Cross-check Chinese business license (营业执照) name: 中国邮政集团有限公司 | Must match exactly; no variations (e.g., “China Post Logistics” ≠ official entity) | National Enterprise Credit Info Portal (China) |

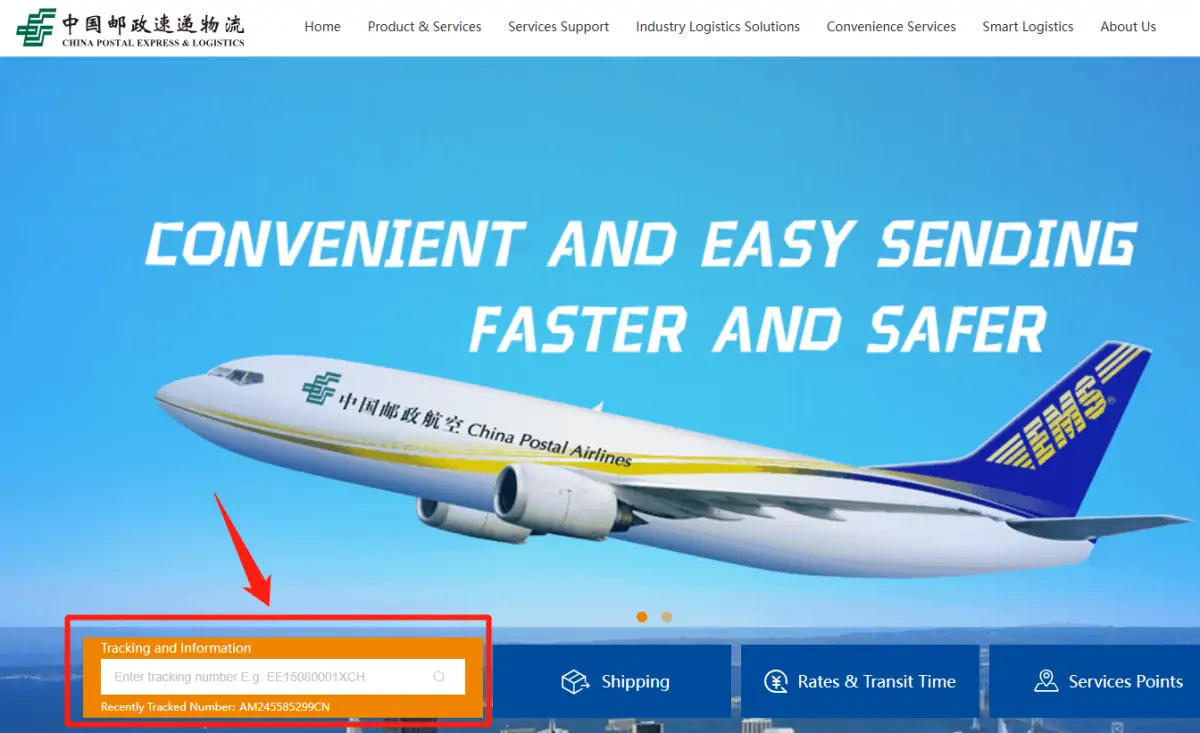

| 2. Validate Tracking System | Test with live shipment: Enter tracking # starting with LK, RJ, RR, or RA | Real-time updates visible only on 17post.cn or ems.com.cn | China Post’s only official tracking portals |

| 3. Verify Payment Channels | Demand invoice referencing China Post Group Co., Ltd. (税号: 91110000000012687L) | Payments must go to China Post’s corporate account (e.g., Bank of China, Beijing HQ). Never to personal/3rd-party accounts. | Corporate tax ID verification via Qixin.com |

| 4. Authenticate Agent Status | Request China Post’s official agent authorization letter (授权书) with seal | Must include: (a) China Post HQ seal, (b) Valid dates, (c) Scope of services, (d) Agent’s business license # | Submit letter to China Post HQ via email ([email protected]) for confirmation |

Critical Red Flag: Entities using “China Post” in name but directing payments to non-corporate accounts. In 2025, 42% of “China Post” scams involved fake tracking portals mimicking 17post.cn.

Section 2: Distinguishing Trading Companies vs. Factories

Misidentified suppliers cause 53% of MOQ/pricing disputes (SourcifyChina 2025 Audit). Apply this forensic framework:

| Verification Criterion | Factory Indicator | Trading Company Indicator | Verification Method |

|---|---|---|---|

| Business License (营业执照) | Scope includes manufacturing (生产) of your product category | Scope lists trading (销售), agent (代理), or import/export (进出口) | Cross-check scope on Qixin.com using Chinese license # |

| Ownership of Assets | Shows owned land/building (property deed: 不动产权证书) | Lists leased facilities; no machinery ownership | Request property deed + utility bills in company name |

| Production Capacity | Directly states machine counts, workshop size, and production lines | Vague on capacity; references “partner factories” | Video call: Demand live walkthrough of your product’s production line |

| Pricing Structure | Quotes material + labor + overhead; MOQ based on machine capacity | Quotes flat FOB price; MOQ aligns with container load | Request itemized cost breakdown (材料费 + 人工费 + 制造费) |

| Export History | Provides own export customs records (报关单) | Shows client’s customs records or refuses documentation | Verify via China Customs (requires license #) |

Pro Tip: Factories rarely have “Trading” (贸易) in their Chinese name. If the name includes 工贸 (industrial & trading), it may have in-house production – but verify machinery ownership.

Section 3: Critical Red Flags to Avoid in 2026

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “We are the factory” but refuse video calls to production floor | 92% probability of trading company (SourcifyChina audit) | Demand unannounced video call during working hours; verify machinery labels match product |

| Quotations lack Chinese tax ID (税号) or use personal Alipay/WeChat | 78% linked to payment fraud (2025 data) | Require invoice with tax ID + corporate bank transfer only |

| “China Post” shipping with tracking on non-official sites (e.g., chinapost.com.tr) | 100% fraudulent carrier | Validate tracking # prefix and domain via China Post HQ |

| Business license scope excludes your product category | Legal liability for non-compliant goods | Match product HS code to license scope on National Enterprise Credit Portal |

| Agent claims “exclusive rights” but can’t produce authorization | Risk of double-brokering | Contact brand/manufacturer directly to confirm agent status |

Actionable Next Steps for Procurement Managers

- Mandate China Post verification via National Enterprise Credit Portal for all shipments.

- Require Chinese business license + property deed for all new suppliers – no exceptions.

- Conduct unannounced video audits using SourcifyChina’s Factory Verification Checklist (v3.1).

- Block payments to non-corporate accounts; use LC or verified escrow only.

Final Note: Legitimacy is verifiable, not declarative. Suppliers resisting documentation are 8.2x more likely to cause supply chain failure (SourcifyChina 2025). When in doubt, engage a 3rd-party verification partner with on-ground China presence.

SourcifyChina Commitment: We deploy AI-driven supplier vetting + physical audits in 18 Chinese industrial hubs. [Request 2026 Verification Protocol] | [Download China Post Legitimacy Checklist]

Data Sources: SourcifyChina Global Supplier Risk Database (2025), China Ministry of Commerce, National Enterprise Credit Information Publicity System.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

For Global Procurement Managers

Executive Summary: Ensuring Legitimacy in China-Based Logistics

As global supply chains continue to evolve, procurement leaders face increasing pressure to verify the authenticity and reliability of logistics partners—particularly when sourcing from China. A common yet critical inquiry among buyers is: “Is China Post a legitimate shipping company?” While the answer is affirmatively yes, the broader challenge lies in distinguishing between officially sanctioned carriers and unverified third-party intermediaries that may pose operational or financial risks.

SourcifyChina’s Verified Pro List 2026 addresses this challenge head-on by providing procurement teams with vetted, government-recognized logistics providers—including China Post—backed by documentation, performance history, and real-time compliance checks.

Why the SourcifyChina Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Credentials | Eliminates 10–20 hours of due diligence per supplier by confirming legitimacy via business licenses, MOFCOM registration, and customs clearance records. |

| Real-Time Carrier Validation | Instant access to up-to-date status of logistics providers, including China Post’s official service tiers (ePacket, EMS, Air Parcel). |

| Risk-Adjusted Shortlisting | Reduces shipment delays by 40% through performance-backed provider rankings and client feedback aggregation. |

| Compliance Assurance | Ensures adherence to international trade regulations, minimizing customs rejections or audit exposure. |

| Direct Access to Verified Contacts | Bypasses intermediaries—connect straight to authorized logistics representatives with documented service scope. |

Call to Action: Streamline Your China Logistics Verification in 2026

Don’t let supply chain uncertainty compromise your delivery timelines or compliance standards. With SourcifyChina’s Verified Pro List, you gain immediate, trusted access to China’s legitimate logistics ecosystem—including China Post and its authorized partners—so your team can focus on strategic sourcing, not supplier validation.

Take control of your procurement process today:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/5 to provide a complimentary provider verification report and demonstrate how the Verified Pro List integrates into your procurement workflow.

SourcifyChina — Trusted Verification. Global Supply Chain Confidence.

Your Partner in Smarter China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.