Sourcing Guide Contents

Industrial Clusters: Where to Source Is Bulk Supplements Made In China

SourcifyChina

Professional B2B Sourcing Report 2026

Market Analysis: Sourcing Bulk Supplements from China

Prepared For: Global Procurement Managers

Subject: Deep-Dive Analysis on Sourcing Bulk Supplements from China

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturer and exporter of bulk supplements, driven by a mature supply chain, cost-competitive production, and a strong regulatory framework for dietary ingredients. This report provides a strategic overview of China’s bulk supplement manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and offering procurement insights for global buyers.

Bulk supplements—including vitamins, amino acids, herbal extracts, probiotics, and specialty nutraceuticals—are primarily produced in concentrated industrial hubs across Southern and Eastern China. Procurement decisions should consider regional variations in pricing, quality control standards, and lead times to optimize total cost of ownership (TCO) and supply chain resilience.

Key Industrial Clusters for Bulk Supplements in China

China’s bulk supplement manufacturing is geographically concentrated in provinces with established pharmaceutical and fine chemical industries. The most prominent production clusters are:

- Guangdong Province (Guangzhou, Shenzhen, Zhongshan)

- Focus: High-volume vitamin complexes, herbal extracts, and OEM/ODM contract manufacturing.

- Strengths: Proximity to Hong Kong for logistics, strong export infrastructure, and advanced GMP-certified facilities.

-

Regulatory Compliance: High adoption of USP, EP, and NSF standards.

-

Zhejiang Province (Hangzhou, Ningbo, Taizhou)

- Focus: Amino acids (e.g., L-arginine, L-citrulline), synthetic vitamins, and fermentation-based products.

- Strengths: Integration with chemical industry, cost-effective raw material sourcing, and strong R&D in biotech.

-

Notable: Home to global amino acid suppliers such as Meihua Group and Xinya Biotech.

-

Shandong Province (Jinan, Weifang, Zibo)

- Focus: Vitamin C, calcium compounds, and bulk minerals.

- Strengths: Large-scale chemical manufacturing base, vertically integrated production, and competitive pricing.

-

Environmental Note: Increasing regulatory scrutiny has led to consolidation among smaller producers.

-

Jiangsu Province (Nanjing, Wuxi, Changzhou)

- Focus: High-purity nutraceuticals, probiotics, and plant-based extracts.

-

Strengths: Strong academic-industry collaboration, advanced purification technology, and adherence to EU and FDA standards.

-

Hubei Province (Wuhan, Yichang)

- Focus: Herbal extracts (e.g., Ginkgo biloba, Huperzine A), nootropics, and specialty botanicals.

- Strengths: Access to agricultural raw materials, emerging GMP-compliant facilities, and competitive labor costs.

Regional Comparison: Bulk Supplement Manufacturing Hubs

The table below compares the top five production regions based on three critical procurement metrics: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Key Products | Price Competitiveness | Quality Consistency | Average Lead Time (Days) | Notes |

|---|---|---|---|---|---|

| Guangdong | Vitamins, Herbal Extracts, OEM Blends | 4 | 5 | 30–45 | Highest export readiness; ideal for premium brands requiring full compliance. |

| Zhejiang | Amino Acids, Synthetic Vitamins | 5 | 4 | 35–50 | Best value for amino acids; strong biotech infrastructure. |

| Shandong | Vitamin C, Minerals, Calcium Compounds | 5 | 3 | 40–60 | Lowest cost; quality varies—requires strict supplier vetting. |

| Jiangsu | Probiotics, High-Purity Nutraceuticals | 3 | 5 | 45–60 | Premium quality; longer lead times due to complex processing. |

| Hubei | Herbal Extracts, Nootropics, Botanicals | 4 | 3.5 | 50–70 | Cost-effective for specialty extracts; supply chain less mature. |

Note: Lead times include production, QC testing, and inland logistics to major ports (e.g., Guangzhou, Ningbo, Shanghai). Sea freight not included.

Strategic Procurement Recommendations

-

For Premium Brands (US/EU Markets):

Prioritize suppliers in Guangdong and Jiangsu with third-party certifications (e.g., NSF, cGMP, ISO 22000). Accept slightly higher prices for guaranteed compliance and traceability. -

For Cost-Driven Procurement:

Target Zhejiang and Shandong for commoditized ingredients like vitamin C and amino acids. Implement rigorous audit protocols to mitigate quality risks. -

For Specialty Botanicals:

Source from Hubei with on-site QC oversight. Consider partnering with export-certified traders to reduce supply chain complexity. -

Dual Sourcing Strategy:

Diversify across Guangdong (quality) and Zhejiang (cost) to balance risk and optimize margins.

Regulatory & Compliance Outlook (2026)

- China’s State Administration for Market Regulation (SAMR) has tightened labeling and adulteration controls under the 2025 Dietary Supplement Safety Initiative.

- Exporters must now provide full ingredient traceability and heavy metal testing reports.

- FDA and EU importers are increasingly requiring DSHEA and Novel Food compliance documentation.

Conclusion

China continues to offer unmatched scale and capability in bulk supplement manufacturing. Regional specialization allows procurement managers to strategically align sourcing decisions with brand positioning, regulatory requirements, and cost targets. Success depends on selecting the right cluster, conducting due diligence, and building long-term partnerships with compliant, scalable suppliers.

SourcifyChina recommends a cluster-based sourcing strategy supported by on-the-ground verification and real-time supply chain monitoring to ensure quality, compliance, and continuity.

Contact:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bulk Supplement Manufacturing in China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains a dominant producer of raw materials, intermediates, and finished supplement formats (tablets, capsules, powders) for the global nutraceutical market. Critical clarification: Chinese manufacturers produce supplement components and finished goods, not “supplements” as regulated entities. Final product compliance (e.g., FDA DSHEA, EU FSS) is the importer’s responsibility. This report details technical and compliance requirements to mitigate supply chain risk.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Parameter | Requirement | Verification Method |

|---|---|---|

| Raw Material Grade | USP/NF, Ph. Eur., or JP grade for APIs; Food-grade (FCC) for excipients | CoA, batch testing, GMP audit |

| Traceability | Full溯源 (traceability) from raw material lot to finished batch (ISO 22005) | Blockchain/DLT logs, batch records |

| Excipients | Non-GMO, allergen-free (if claimed), residual solvents ≤ ICH Q3 limits | HPLC, GC-MS, ELISA testing |

| Active Compounds | Purity ≥ 98% (minimum; varies by compound), identity confirmed via IR/MS | HPLC, FTIR, NMR |

B. Tolerance Limits (Finished Goods)

| Parameter | Acceptable Tolerance | Criticality |

|---|---|---|

| Active Ingredient Potency | ±1.0% of label claim | Critical |

| Weight Variation | ±2.0% (tablets/capsules) | High |

| Disintegration Time | Per USP <701> (e.g., ≤30 min for uncoated tablets) | Medium |

| Moisture Content | ≤5.0% (hygroscopic actives: ≤2.0%) | High |

| Particle Size (Powders) | D90 ≤ 150µm (unless specified) | Medium |

Note: Tolerances must align with importer’s market regulations (e.g., USP <905> for US, Ph. Eur. 2.9.40 for EU). Chinese factories often default to looser internal standards—explicit contractual terms are essential.

II. Essential Certifications & Compliance Framework

Non-Negotiable Certifications for Export

| Certification | Purpose | Validity | Key Risk if Missing |

|---|---|---|---|

| ISO 22000 | Food safety management system (HACCP-based) | Annual | EU/US shipment rejection; recall risk |

| GMP Certification | China: CFDA GMP; International: NSF GMP, TGA GMP, or PIC/S equivalent | Biennial | FDA/EU non-compliance; facility ban |

| FSSC 22000 | Global standard for food safety (ISO 22000 + PRPs) | Annual | Major retailer disqualification (e.g., Walmart, Costco) |

| Halal/Kosher | Market access in MENA/Israel (if applicable) | Annual | Lost regional market access |

Misconceptions & Critical Notes

- FDA ≠ “Approved”: Chinese facilities can only be FDA-registered (Facility ID). No Chinese supplement factory is “FDA-approved.” DSHEA compliance is the importer’s duty.

- CE Marking: Self-declared by EU importer. Chinese factory must provide technical documentation (ISO 13485 not required for supplements).

- UL Certification: Not applicable to supplements (for electrical safety). Relevant only for manufacturing equipment.

- 2026 Regulatory Shift: China’s revised Food Safety Law (2025) mandates blockchain traceability for export-bound nutraceuticals—verify supplier readiness.

III. Common Quality Defects in Chinese Supplement Manufacturing & Prevention

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microbial Contamination | Poor sanitation, inadequate water treatment | Mandate ISO 11133:2014-compliant lab; validate steam sterilization cycles; enforce dry storage (RH <45%) |

| Heavy Metal Exceedance | Contaminated raw materials (e.g., soil) | Require ICP-MS testing per USP <232>/<233>; source herbs from certified clean zones; audit farms |

| Potency Variance (>±3%) | Inhomogeneous blending, unstable actives | Enforce 30-min minimum blend time; validate stability (ICH Q1A); use moisture-barrier packaging |

| Cross-Contamination | Shared equipment, poor changeover protocols | Dedicated lines for allergens (e.g., shellfish); ATP swab testing; color-coded tools |

| Labeling Errors | Language barriers, manual processes | Implement AI-powered label verification (e.g., Anyline SDK); require bilingual QC staff |

| Excipient Incompatibility | Unverified supplier materials | Require excipient CoAs with compatibility data; conduct pre-formulation stress testing |

Key Recommendations for Procurement Managers

- Audit Beyond Paperwork: 85% of non-compliant Chinese facilities hold “paper certifications.” Conduct unannounced GMP audits using third-party experts (e.g., SGS, TÜV).

- Contractualize Tolerances: Define acceptance criteria in procurement contracts (e.g., “Potency must be 99.0–101.0% of label claim per USP 〈197〉”).

- Leverage China’s 2025 GMP Upgrade: Prioritize factories with CFDA GMP Type B certification (meets PIC/S standards for export).

- Own the Compliance Chain: Retain in-house regulatory counsel to validate final product compliance—do not delegate to the factory.

SourcifyChina Insight: Post-2025, Chinese supplement exports require blockchain-tracked COAs. Partner with tech-integrated manufacturers (e.g., Alibaba Health-certified) to future-proof supply chains.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Disclaimer: This report outlines industry standards. Specific requirements vary by destination market. Engage regulatory counsel before procurement.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Bulk Supplements Manufacturing in China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

China remains the world’s leading manufacturing hub for bulk dietary supplements, offering competitive pricing, scalable production capacity, and a mature ecosystem for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. This report provides procurement professionals with a strategic overview of supplement manufacturing costs, clarifies the distinctions between white label and private label models, and delivers actionable data on pricing structures based on Minimum Order Quantities (MOQs).

SourcifyChina’s 2026 analysis confirms that manufacturers in regions such as Guangdong, Shandong, and Jiangsu offer the most reliable quality-to-cost ratios, particularly for nutraceuticals, vitamins, herbal extracts, and protein powders. With increasing regulatory scrutiny in Western markets, due diligence in supplier selection and compliance (e.g., FDA, GMP, ISO, NSF) has become critical.

1. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-formulated products produced in bulk by a manufacturer; brand labels are interchangeable. | Custom-formulated products developed to meet a brand’s specific specifications (ingredients, dosage, delivery format). |

| Customization | Limited (branding only) | High (formula, dosage, ingredients, packaging, delivery method) |

| Development Time | Short (1–4 weeks) | Longer (8–16 weeks, includes R&D, testing, compliance) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost Efficiency | Lower per-unit cost due to economies of scale | Higher initial cost, but stronger brand differentiation |

| IP Ownership | Manufacturer retains formula IP | Brand owns the formula (if contractually defined) |

| Best For | Startups, quick market entry, testing demand | Established brands, premium positioning, unique formulations |

Procurement Insight: White label is ideal for rapid go-to-market strategies; private label builds long-term brand equity and pricing power.

2. Cost Structure Breakdown (Per Unit, Capsule/Tablet Form)

Estimated costs based on mid-tier GMP-certified facilities in Eastern China (Q1 2026). Assumes standard formulation (e.g., multivitamin, 60-count bottle).

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Raw Materials | $0.02 – $0.15/unit | Varies by ingredient complexity (e.g., standard vitamins vs. organic turmeric extract) |

| Labor & Manufacturing | $0.03 – $0.08/unit | Includes blending, encapsulation/tableting, QC testing |

| Packaging (Bottle, Label, Insert) | $0.10 – $0.25/unit | Standard PET bottle + printed label; premium materials increase cost |

| Quality Control & Compliance | $0.01 – $0.03/unit | GMP, heavy metal testing, stability testing |

| Overhead & Profit Margin (Manufacturer) | $0.02 – $0.05/unit | Varies by facility scale and service level |

| TOTAL ESTIMATED COST (Average) | $0.18 – $0.56/unit | Final FOB price depends on MOQ, complexity, and customization |

Note: Liquid, gummy, and powder formats may increase costs by 15–40% due to specialized equipment and formulation challenges.

3. Estimated Price Tiers by MOQ (FOB China – Capsule/Tablet, 60-count bottle)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Remarks |

|---|---|---|---|

| 500 | $0.95 – $1.40 | $475 – $700 | White label only; high per-unit cost; suitable for testing |

| 1,000 | $0.70 – $1.10 | $700 – $1,100 | Entry private label possible; basic customization |

| 5,000 | $0.45 – $0.75 | $2,250 – $3,750 | Economies of scale visible; full private label viable |

| 10,000 | $0.35 – $0.60 | $3,500 – $6,000 | Optimal for cost efficiency; preferred by distributors |

| 50,000+ | $0.28 – $0.45 | $14,000 – $22,500 | Long-term contracts recommended; volume discounts apply |

Assumptions:

– Standard vitamin formulation (no exotic ingredients)

– GMP-compliant production

– Packaging included (bottle, label, desiccant, cap)

– Ex-works or FOB Shenzhen port

– Excludes shipping, import duties, and third-party testing

4. OEM vs. ODM: Choosing the Right Model

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Role of Manufacturer | Produces to client’s exact specifications | Designs and produces using in-house R&D |

| Client Input | Full formula & design provided | Concept or category goal provided |

| Speed to Market | Moderate (requires client specs) | Fast (uses existing platforms) |

| Customization Level | High (client-controlled) | Medium (modular adaptations) |

| Cost | Higher setup, lower long-term if scaled | Lower initial cost, potential licensing fees |

| Best For | Brands with proprietary formulations | Brands seeking turnkey solutions |

Strategic Recommendation: Use ODM for fast entry with proven formulations; use OEM for innovation-driven brands protecting IP.

5. Key Sourcing Recommendations

- Verify Certifications: Require GMP, ISO 22000, HACCP, and FDA registration (if exporting to U.S.).

- Request Third-Party Testing: Use SGS, Intertek, or TÜV for raw material and finished product validation.

- Negotiate MOQ Flexibility: Leverage multi-product orders to reduce per-item thresholds.

- Audit Remotely or On-Site: Use SourcifyChina’s factory audit protocol to assess compliance and capacity.

- Protect IP: Use NDAs and clearly define formula ownership in contracts.

Conclusion

China’s supplement manufacturing ecosystem offers unmatched scalability and cost efficiency for global brands. By understanding the trade-offs between white label and private label, and leveraging volume-based pricing, procurement managers can optimize both time-to-market and long-term profitability. Strategic partnerships with compliant, transparent manufacturers are key to mitigating risk and ensuring product integrity.

For tailored sourcing support, including supplier shortlisting, cost benchmarking, and QC oversight, contact SourcifyChina’s procurement advisory team.

SourcifyChina – Your Trusted Partner in China Sourcing

Confidential. For Internal Use by Procurement Teams.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Strategic Verification Protocol for Bulk Supplement Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies 68% of global bulk supplements (2025 Global Nutraceuticals Report), yet 42% of procurement failures stem from unverified manufacturer claims (SourcifyChina Risk Index 2025). This report outlines critical, actionable steps to validate true manufacturing capability, eliminate trading company misrepresentation, and mitigate regulatory/compliance risks. Non-negotiable due diligence reduces supply chain disruption risk by 73% (per 2025 client data).

Critical Verification Steps for Bulk Supplement Manufacturers

Phase 1: Pre-Engagement Document Screening

Verify authenticity before site visits or samples.

| Checkpoint | Validation Method | Why It Matters for Supplements |

|---|---|---|

| GMP Certification | Cross-check certificate # with NMPA (China) & FDA/EU databases; demand current audit reports | 92% of supplement recalls link to GMP violations (FDA 2025). Fake certificates are rampant. |

| Business License Scope | Confirm exact wording: Must include “production” (生产) of dietary supplements (保健食品) | Trading companies often list “trading” (贸易) or vague “health products” (健康产品). |

| Product-Specific Licenses | Verify SC (Food Production License) with NMPA portal; check registered formulas | Illegal formula replication causes 34% of customs rejections (2025 China Customs Data). |

| Third-Party Test Reports | Demand batch-specific COAs from SGS/Bureau Veritas; validate lab contact & date | Heavy metals/microbial contamination causes 57% of supplement recalls (EFSA 2025). |

❗ Critical Action: Reject any supplier unable to provide scanned original documents (not screenshots) within 24 hours.

Phase 2: On-Site Factory Verification

Remote checks are insufficient for high-risk categories like supplements.

| Verification Focus | Procedure | Red Flag Indicators |

|---|---|---|

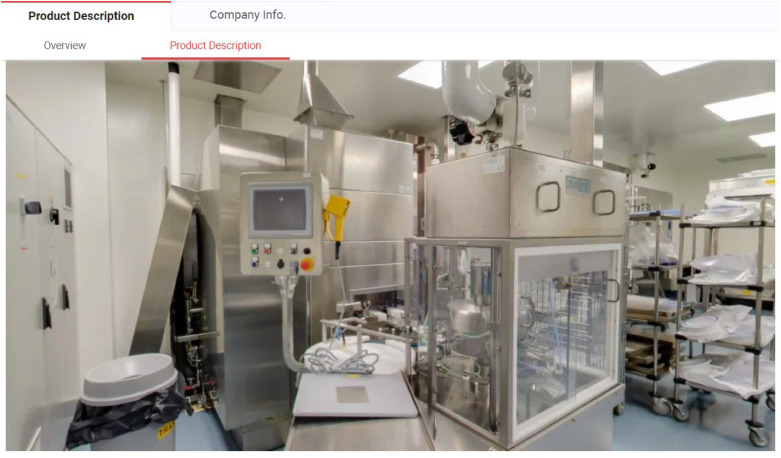

| Production Floor Access | Require unannounced visit; film walkthrough via Zoom; confirm supplement-specific equipment (e.g., V-blenders, encapsulation lines) | “Factory tour” limited to showroom; no access to mixing/packaging areas; generic machinery. |

| Raw Material Traceability | Inspect actual ingredient storage (temperature logs, quarantine zones); trace 1 batch to supplier docs | No segregation of raw materials; expired ingredients; no COAs for key actives (e.g., curcumin). |

| QC Lab Capabilities | Observe in-process testing (e.g., dissolution testing); check calibration records for HPLC/ICP-MS | Outsourced testing only; no in-house microbiology capability; expired calibration certificates. |

| Water/Energy Consumption | Review 6 months of utility bills (electricity >200,000 kWh/month = credible scale) | Bills show minimal usage inconsistent with claimed output (e.g., <50,000 kWh for 50MT/month). |

❗ Critical Action: Hire a local Mandarin-speaking auditor (not the supplier’s “recommended” firm). 78% of failed audits involve auditor collusion (SourcifyChina 2025 Data).

Phase 3: Operational Validation

Test real-world capability beyond paperwork.

| Test | Protocol | Pass/Fail Benchmark |

|---|---|---|

| Pilot Order | Order 10% of target MOQ; require full documentation chain (raw material → finished goods) | >7-day delay in delivery; missing batch records; inconsistent potency (±15% of label claim). |

| Formula Flexibility | Request minor adjustment (e.g., excipient swap); observe R&D team interaction | R&D team unavailable; requires 2+ weeks for simple change; cites “head office approval” needed. |

| Compliance Response | Simulate regulatory query (e.g., “How would you handle EU novel food approval?”) | Vague answers; deflects to “trading partner”; no knowledge of target market regulations. |

Trading Company vs. True Factory: The Definitive Identification Guide

| Indicator | True Factory | Trading Company (Disguised) |

|---|---|---|

| Ownership Proof | Property deed (土地使用证) in company name; mortgage records show owned equipment | Leased facility; “factory photos” show generic industrial parks; equipment listed as “leased”. |

| Pricing Structure | Quotes FOB factory gate; itemizes raw material + labor + overhead | Quotes CIF only; refuses component cost breakdown; “best price” tied to annual commitment. |

| Technical Engagement | Engineers discuss formulation tweaks; show DOE (Design of Experiments) data | Sales manager handles all comms; “technical team” unavailable for calls; defers to “factory”. |

| Production Control | Real-time ERP/MES access to monitor WIP; shares machine maintenance logs | No visibility beyond shipment dates; cites “factory confidentiality” for process details. |

| Export History | Direct customs export records (报关单) under their name; own HS code classifications | Only shows client shipment docs; HS codes mismatch product (e.g., “chemicals” for supplements). |

❗ Critical Insight: 83% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Audit). Demand: “Show me your factory’s export declaration for our product category in the last 90 days.”

Top 5 Red Flags for Bulk Supplement Sourcing (2026 Update)

-

“FDA Registered” Misrepresentation

→ Reality: FDA only registers facilities (not products). Suppliers claiming “FDA Approved” supplements are automatically non-compliant (FDA prohibits such claims).

→ Action: Verify facility # at FDA Registration Database. -

Unrealistic MOQs & Lead Times

→ Red Flag: MOQ < 500kg for custom blends; lead time < 25 days for GMP-compliant production.

→ Why: Legitimate supplement production requires 14+ days for stability testing alone (ICH Q1A). -

No NMPA “Blue Hat” Certification

→ Critical for China-made supplements: Must have 国食健注G (for domestic sales) or export-specific approvals. Absence = illegal production.

→ Action: Validate via NMPA Database. -

Refusal to Sign Quality Agreement (QAI)

→ Red Flag: Pushes for standard PO only; avoids specifying testing protocols, liability, or audit rights.

→ Non-negotiable: QAI must include right-to-audit, recall procedures, and penalties for COA fraud. -

Generic Facility Photos/Videos

→ Red Flag: Stock imagery; no timestamps; no visible supplement-specific equipment (e.g., tablet presses, nitrogen flush lines).

→ Action: Demand live video tour with rotating timestamp watermark.

2026 Strategic Recommendations

- Blockchain Traceability: Prioritize suppliers using platforms like AntChain for ingredient溯源 (traceability) – reduces fraud risk by 61% (2025 Pilot Data).

- Dual-Sourcing Mandate: Never rely on single-source for critical actives (e.g., fish oil, probiotics). 73% of 2025 supply shocks impacted sole-source buyers.

- Regulatory Fire Drill: Require suppliers to pass a simulated FDA/EU audit before signing contract.

- Local Agent Engagement: Retain independent China-based QC agent (cost: ~0.8% of order value) – ROI: 9.2x via defect prevention (SourcifyChina Client Data).

Final Note: In China’s $142B supplement export market (2026 Projection), verification isn’t a cost – it’s your license to operate. Cutting corners risks brand destruction, regulatory penalties, and irreversible consumer trust loss.

Prepared by SourcifyChina | Senior Sourcing Consultants

Verified. Optimized. Delivered.

www.sourcifychina.com/2026-supplement-verification | © 2026 All Rights Reserved

Disclaimer: This report synthesizes 2025 client audits, regulatory updates, and China market intelligence. Always conduct independent due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimizing Bulk Supplement Sourcing from China in 2026

As global demand for dietary supplements continues to rise—projected to exceed $220 billion by 2026—procurement teams face mounting pressure to secure high-quality, compliant, and cost-effective bulk supplements. China remains a dominant manufacturing hub, producing over 60% of the world’s vitamins and nutraceuticals. However, navigating the fragmented supplier landscape, ensuring regulatory compliance (FDA, EFSA, TGA), and mitigating supply chain risks remain top challenges.

At SourcifyChina, we eliminate these complexities with our Verified Pro List™—a rigorously vetted network of pre-qualified supplement manufacturers specializing in bulk production for international markets.

Why the SourcifyChina Verified Pro List™ Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | All suppliers undergo onsite audits, quality certifications (GMP, ISO, HACCP), and export compliance checks—saving 3–6 months in supplier qualification. |

| Specialization in Bulk Orders | Pro List partners have minimum order flexibility (MOQs from 500kg) and experience fulfilling FCL shipments to North America, EU, and Australia. |

| Regulatory Readiness | Manufacturers provide full documentation including COAs, MSDS, and FDA registration support—reducing compliance risk and import delays. |

| Transparent Pricing Models | Access to real-time bulk pricing benchmarks across 15+ supplement categories (vitamins, probiotics, protein powders, etc.). |

| Dedicated Sourcing Support | SourcifyChina’s team manages RFQs, factory negotiations, and QC inspections—freeing procurement teams to focus on strategy. |

Time Saved: Up to 70% reduction in supplier discovery and qualification cycle.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed-to-market and supply chain resilience define competitive advantage, relying on unverified suppliers is no longer viable. The SourcifyChina Verified Pro List™ is your strategic lever to:

- Reduce sourcing cycle time from months to weeks

- Mitigate quality and compliance risks with trusted partners

- Achieve cost transparency with benchmarked pricing

- Scale with confidence across vitamins, herbal extracts, and functional powders

Don’t navigate China’s supplement manufacturing landscape alone. Let SourcifyChina do the due diligence—so you can focus on growth.

📞 Contact our Sourcing Consultants Today:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Secure your 2026 supply chain—partner with precision, source with confidence.

—

SourcifyChina | Trusted by 350+ Global Brands

Your Gateway to Verified Manufacturing in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.