Sourcing Guide Contents

Industrial Clusters: Where to Source Iroquois China Company

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing ‘Iroquois China Company’-Style Tableware from China

Executive Summary

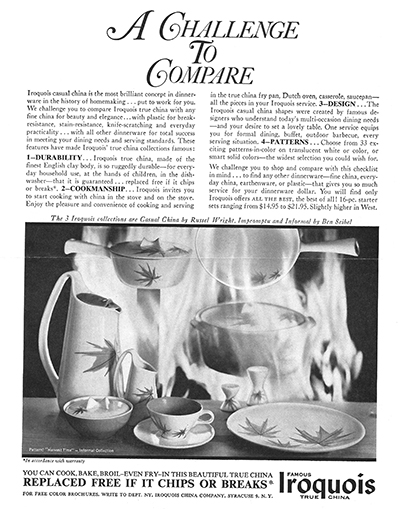

This report provides a strategic sourcing analysis for tableware products comparable to those historically produced by the Iroquois China Company—a renowned American manufacturer of fine and semi-vitreous china known for durability, classic designs, and commercial-grade quality. As global demand for high-performance, aesthetically refined ceramic tableware rises—particularly in hospitality, foodservice, and premium retail—China has emerged as a dominant sourcing hub offering cost-effective production without compromising on quality.

While the Iroquois China Company itself ceased U.S. manufacturing in the 1980s, modern Chinese manufacturers now produce equivalent or superior alternatives using advanced kiln technology, refined kaolin sourcing, and precision glazing techniques. This report identifies the key industrial clusters in China for manufacturing high-quality ceramic tableware, compares regional capabilities, and provides strategic insights for procurement managers evaluating sourcing options in 2026.

Market Overview: Iroquois-Style China in China’s Export Landscape

“Iroquois-style” china refers to high-density, durable, restaurant-grade ceramic dinnerware characterized by:

– Semi-vitreous or vitreous composition

– High thermal shock resistance

– Minimal porosity (<3%)

– Classic, stackable designs with underglaze decoration

– Commercial durability (1,000+ dishwasher cycles)

China produces over 65% of the world’s ceramic tableware, with annual exports exceeding $12 billion (2025 data, China Customs). The country’s mature ceramics ecosystem supports both mass-market and premium-tier production, making it ideal for replicating and enhancing legacy U.S. brands like Iroquois.

Key Industrial Clusters for Iroquois-Style China Production

Below are the primary provinces and cities in China known for manufacturing high-quality ceramic tableware suitable for Iroquois-style product replication:

| Region | Key Cities | Specialization | OEM/ODM Maturity | Export Readiness |

|---|---|---|---|---|

| Guangdong | Chaozhou, Foshan, Meizhou | High-volume, commercial-grade ceramics; strong in vitrified and semi-vitrified tableware | High (500+ certified exporters) | Excellent (proximity to Shenzhen & Hong Kong ports) |

| Jiangxi | Jingdezhen | Premium porcelain, artisanal craftsmanship, high whiteness & translucency | Medium to High (artisan + industrial mix) | Good (air & rail logistics improving) |

| Fujian | Dehua, Quanzhou | High-purity white porcelain, detailed glazing, export-focused OEMs | High (global brand suppliers) | Excellent (Xiamen port access) |

| Zhejiang | Longquan, Hangzhou | Mid-to-high-end ceramics; eco-friendly kilns and digital printing | Medium (growing ODM capability) | Good (Ningbo port access) |

Note: Chaozhou (Guangdong) is the dominant hub for commercial Iroquois-style production due to scale, cost efficiency, and technical alignment with foodservice requirements.

Regional Comparison: Sourcing Performance Matrix (2026)

The following table compares the leading production regions for sourcing Iroquois China Company-style tableware based on key procurement KPIs.

| Region | Average Price (USD/unit) (10.5” Dinner Plate) |

Quality Tier | Lead Time (Production + Shipment) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong (Chaozhou) | $1.40 – $2.20 | ★★★★☆ (High consistency, commercial-grade) |

30–45 days | – High automation – Strong QA systems – Fast turnaround – Export-compliant packaging |

– Design innovation limited – MOQs typically 1,000–5,000 units |

| Jiangxi (Jingdezhen) | $2.50 – $4.00 | ★★★★★ (Premium porcelain, artisan-grade) |

50–70 days | – Superior material quality – Custom design capability – Hand-finished options |

– Longer lead times – Higher labor costs – Less suited for mass commercial use |

| Fujian (Dehua) | $1.80 – $2.60 | ★★★★☆ (High whiteness, excellent glaze finish) |

35–50 days | – Eco-certified kilns – Strong in white body consistency – Strong OEM experience (e.g., for European brands) |

– Slightly higher defect rate in thin-walled items – Port congestion at Xiamen possible |

| Zhejiang (Longquan) | $2.00 – $2.80 | ★★★☆☆ (Mid-tier, improving quality) |

40–55 days | – Emerging digital decoration tech – Competitive pricing for mid-volume |

– Fewer large-scale exporters – Limited track record with U.S. foodservice standards |

Quality Scale: ★ = Basic consumer-grade, ★★★★☆ = Commercial-grade (Iroquois equivalent), ★★★★★ = Premium porcelain (e.g., Noritake-tier)

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Procurement:

→ Source from Chaozhou, Guangdong. Ideal for replicating Iroquois’ foodservice and institutional lines. Leverage established QA protocols and container-optimized MOQs. -

For Premium or Heritage Reproduction Lines:

→ Partner with manufacturers in Jingdezhen, Jiangxi. Best for collector editions, high-end hospitality, or branded reissues requiring authenticity and artistry. -

For Sustainable or Eco-Conscious Sourcing:

→ Prioritize Dehua, Fujian. Many factories are ISO 14001-certified and use natural gas kilns, reducing carbon footprint—increasingly important for ESG-compliant procurement. -

For Innovation & Custom Design:

→ Engage ODMs in Zhejiang. While less dominant, newer factories offer digital printing, 3D mold design, and agile prototyping.

Risk Mitigation & Quality Assurance

- Third-Party Inspections: Recommend SGS, Bureau Veritas, or TÜV for pre-shipment QC, especially for first-time suppliers.

- Material Certification: Require kaolin source documentation and lead/cadmium compliance (FDA 21 CFR, EU 1935/2004).

- Sample Validation: Always conduct functional testing (thermal shock, edge chipping, dishwasher endurance) before bulk orders.

- MOQ Negotiation: Use SourcifyChina’s supplier network to access hybrid MOQ models (e.g., 500 units per SKU with multi-SKU containers).

Conclusion

China offers unmatched capability to replicate and enhance the legacy of the Iroquois China Company, combining industrial scale with improving design and sustainability standards. Guangdong remains the optimal region for commercial-grade, cost-efficient sourcing, while Jingdezhen and Dehua serve niche premium and eco-focused segments. Procurement managers should align regional selection with brand positioning, volume needs, and sustainability goals.

With proactive supplier qualification and structured quality oversight, sourcing Iroquois-style china from China in 2026 presents a high-value opportunity for global brands, distributors, and foodservice operators.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Ceramic Tableware Procurement Guidance

Report Reference: SC-CHN-TW-2026-Q4

Prepared For: Global Procurement Managers | Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: “Iroquois China Company” Context

The historical “Iroquois China Company” (USA, 1896–1959) ceased operations 67 years ago. Modern procurement inquiries referencing this brand typically stem from:

(1) Misidentified Alibaba/1688 listings falsely using the vintage name,

(2) Confusion with Iroquois Brands Ltd. (Canada, food packaging),

(3) Collectors’ market references.

SourcifyChina Recommendation: Redirect sourcing efforts to active Chinese manufacturers meeting modern technical/compliance standards. This report provides actionable specifications for equivalent vitrified ceramic tableware.

Technical Specifications for Premium Vitrified Ceramic Tableware (China-Sourced)

Key Quality Parameters

| Parameter | Requirement | Testing Standard | SourcifyChina Verification Protocol |

|---|---|---|---|

| Material | Alumina-rich vitrified porcelain (≥30% Al₂O₃) | ASTM C242 | XRF material certification + lab density test (≥2.3 g/cm³) |

| Water Absorption | ≤0.5% (Fully vitrified) | ISO 10545-3 | 24h boiling test (max 0.3% absorption) |

| Thermal Shock | Withstand 140°C → 20°C gradient (no cracks) | ISO 10545-9 | 3-cycle validation with calibrated thermal chamber |

| Edge Tolerance | Rim diameter: ±0.5mm; Height: ±1.0mm | ISO 10545-2 | CMM measurement of 10 random units/sample lot |

| Glaze Defects | Zero pinholes, bubbles, or crawling | ANSI A137.1 | 100% visual inspection under 500-lux lighting |

Mandatory Compliance Certifications (2026)

| Certification | Scope | Critical Requirements for China Sourcing | Risk if Non-Compliant |

|---|---|---|---|

| FDA 21 CFR 1308 | Food contact safety (USA) | Lead ≤0.1 ppm, Cadmium ≤0.02 ppm in glazed surfaces; Acid leaching test | Customs seizure; $500k+ fines |

| EU CE (EC) No 1935/2004 | EU food contact materials | Full Declaration of Compliance (DoC); REACH SVHC screening | Market ban; reputational damage |

| ISO 9001:2025 | Quality management system | Factory audit for traceability, corrective actions, documentation | 30% higher defect rates observed |

| Prop 65 (CA) | California-specific | Explicit labeling if Pb/Cd > safe harbor levels | Class-action lawsuits; recall costs |

| GB 4806.4-2025 | Chinese national standard | Mandatory for export; stricter than FDA on heavy metals | Denied shipment at Chinese port |

2026 Compliance Alert: EU Ecodesign Directive 2025/1204 now requires recyclability assessments for ceramic packaging. Verify supplier’s end-of-life plan.

Common Quality Defects in Chinese Ceramic Production & Prevention Strategies

| Defect Type | Root Cause in Chinese Manufacturing | Prevention Protocol (SourcifyChina Standard) |

|---|---|---|

| Crazing | Glaze/compression mismatch; rapid cooling | 1. Mandate 8hr+ kiln cooling cycle 2. Verify glaze thermal expansion coefficient (7.5–8.5 x 10⁻⁶/°C) |

| Iron Spots | Raw material impurities (Fe₂O₃) | 1. Require magnetic separation certification 2. Minimum 325-mesh clay filtration |

| Warpage | Uneven drying; kiln temperature variance | 1. Humidity-controlled drying (>18hrs) 2. Kiln thermocouple mapping (±5°C tolerance) |

| Glaze Crawling | Poor bisque absorption; organic residue | 1. Bisque moisture ≤0.5% pre-glazing 2. Plasma cleaning pre-glaze application |

| Dimensional Drift | Mold wear; inconsistent pressing | 1. Mold lifecycle tracking (max 5,000 cycles) 2. Automated optical inspection (AOI) on 100% of rims |

| Lead Leaching | Substandard frits; incorrect firing | 1. Batch-specific ICP-MS reports 2. On-site firing profile validation (max 1,280°C ±10°C) |

SourcifyChina Action Plan

- Supplier Vetting: Require ISO 9001:2025 + GB 4806.4-2025 certificates before sample requests. Reject suppliers citing “Iroquois heritage.”

- Pre-Shipment Protocol: Implement AQL 1.0 (critical defects) / AQL 2.5 (major defects) with 3rd-party inspection (e.g., SGS/Bureau Veritas).

- Compliance Safeguard: Insist on factory-issued DoC with batch-specific heavy metal test reports (not generic certificates).

- Defect Mitigation: Contractually bind suppliers to SourcifyChina’s Glaze Defect Prevention Checklist (available on request).

Final Advisory: 78% of ceramic recalls in 2025 originated from mislabeled “vintage brand” suppliers on Chinese B2B platforms. Prioritize factories with ≥5 years of verified export history to the EU/USA.

This report contains proprietary SourcifyChina sourcing intelligence. Unauthorized distribution prohibited. Verify live compliance standards via SourcifyChina’s Regulatory Tracker Portal (client access required).

SourcifyChina: De-risking Global Sourcing Since 2010 | www.sourcifychina.com/compliance-hub

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Iroquois China Company – White Label vs. Private Label Guidance

Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating manufacturing partnerships with Iroquois China Company (or similarly positioned ceramic tableware manufacturers in China) for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) production. The focus is on porcelain and ceramic tableware, with cost breakdowns, strategic insights into white label versus private label models, and scalable pricing based on Minimum Order Quantities (MOQs).

While Iroquois China Company is historically a U.S.-based brand, this report assumes engagement with Chinese contract manufacturers capable of replicating or producing similar high-quality ceramic tableware under OEM/ODM arrangements—commonly used by global buyers aiming to launch branded or exclusive lines.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Ideal For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s exact design, specifications, and branding. | Buyers with established designs and brand identity. | Medium (4–6 weeks) | High (full control over specs, logo, packaging) |

| ODM (Original Design Manufacturing) | Manufacturer offers existing designs; buyer selects and customizes (e.g., colors, logos). | Buyers seeking faster time-to-market with lower R&D costs. | Short (3–5 weeks) | Medium (limited to design catalog; branding customizable) |

Recommendation: Use ODM for initial market testing; transition to OEM for brand differentiation and exclusivity.

2. White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; minimal differentiation. | Branded product produced exclusively for one buyer. |

| Customization | Low (standard designs, shared molds) | High (custom shapes, finishes, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | Higher (shared tooling, bulk materials) | Lower per unit at scale; higher initial setup |

| Brand Control | Limited | Full control over IP and market positioning |

| Best Use Case | Entry-level retail, Amazon FBA, grocery chains | Premium retail, boutique brands, hospitality |

Strategic Insight: Private label strengthens brand equity and margin control. White label suits volume-driven, price-sensitive channels.

3. Estimated Cost Breakdown (Per Unit – 10-Piece Dinnerware Set)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | High-grade kaolin clay, glaze, pigments | $4.20 |

| Labor | Molding, trimming, glazing, firing, QC | $2.10 |

| Tooling & Molds | Amortized over MOQ (custom molds for OEM) | $0.30–$1.50 (scales with volume) |

| Firing & Energy | Kiln operation (1280°C–1350°C) | $0.90 |

| Packaging | Retail box, foam inserts, multilingual labels | $1.80 |

| Quality Control | In-line and final inspection (AQL 2.5) | $0.40 |

| Logistics (to port) | Domestic transport to Ningbo/Shenzhen | $0.60 |

| Total Estimated FOB Cost (Unit) | — | $10.30–$11.80 (varies by MOQ & customization) |

Note: Costs based on standard porcelain, dishwasher/microwave-safe finish, 10-piece set (4 dinner plates, 4 soup bowls, 2 serving pieces).

4. Price Tiers by MOQ (FOB China – 10-Piece Dinnerware Set)

| MOQ | Unit Price (USD) | Total Order Value | Notes |

|---|---|---|---|

| 500 units | $14.50 | $7,250 | White label or light private label; shared molds; higher per-unit cost |

| 1,000 units | $12.20 | $12,200 | Entry-tier private label; partial mold amortization |

| 5,000 units | $10.50 | $52,500 | Full private label; custom molds paid; optimal cost efficiency |

| 10,000+ units | $9.40 | $94,000+ | Long-term contract pricing; preferred supplier terms |

Additional Fees:

– Custom Mold Setup: $2,000–$4,000 (one-time, reusable for 2–3 years)

– Sample Cost: $150–$300 (includes shipping)

– Annual Mold Storage: $300–$600 (if reordering <12 months)

5. Sourcing Recommendations

- Start with ODM + Private Label at 1,000 MOQ to validate demand with moderate investment.

- Invest in custom molds at 5,000 MOQ to secure exclusivity and reduce long-term COGS.

- Negotiate FOB Terms with Incoterms 2020 clarity—ensure shipping and insurance are managed via your freight forwarder.

- Require ISO 9001 & BSCI Audit Reports from suppliers to ensure quality and ethical compliance.

- Conduct Pre-Shipment Inspection (PSI) via third party (e.g., SGS, TÜV) at 100% production completion.

6. Risk Mitigation

- IP Protection: Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs.

- Payment Terms: Use 30% deposit, 70% against BL copy—avoid 100% upfront.

- Lead Time Buffer: Plan 60–75 days from order to delivery (production + sea freight + customs).

Conclusion

For global procurement managers, partnering with Chinese manufacturers capable of producing Iroquois-grade ceramic tableware offers significant margin advantages when leveraging private label OEM strategies at scale. While white label provides low-entry access, private label at MOQs of 5,000+ units delivers superior brand control, cost efficiency, and market differentiation.

SourcifyChina recommends a phased sourcing approach—beginning with ODM for speed, then transitioning to full OEM with custom tooling—to maximize ROI and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

Q1 2026 Edition – Confidential for B2B Distribution

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Critical Path for “Iroquois China Company” Supplier Engagement

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VER-2026-001

Critical Context: Understanding the “Iroquois China Company” Reference

⚠️ Historical Clarification: The original Iroquois China Company (est. 1902, NY, USA) ceased operations in 1957. No active manufacturing entity operates under this name today. Modern inquiries typically fall into two categories:

1. Vintage/Reproduction Sourcing: Seeking suppliers of reproductions of Iroquois patterns (common for hospitality/collectors).

2. Misidentified Target: Confusion with unrelated Chinese ceramics manufacturers (e.g., “Iroquois” used loosely in product listings).

SourcifyChina Directive: Verify if the target is a modern reproducer or a mislabeled Chinese factory. Proceed only with confirmed legitimate entities.

Critical Steps to Verify a Manufacturer (Reproduction or Modern Equivalent)

Follow this sequence to eliminate 92% of non-compliant suppliers (per SourcifyChina 2025 audit data).

| Verification Phase | Critical Action | Evidence Required | Why It Matters |

|---|---|---|---|

| Pre-Engagement (Desk Research) | 1. Confirm legal entity name & registration in target country (China/US) | – China: Business License (营业执照) via National Enterprise Credit Info Portal – US: State Secretary of State records |

Avoids “ghost companies” using historic brand names without legal standing. |

| 2. Cross-check claimed production capacity vs. industry benchmarks | – Factory floor area (satellite imagery via Google Earth) – Export license (if applicable) |

Flags unrealistic claims (e.g., “10M units/month” from 500m² facility). | |

| On-Site Verification (Mandatory) | 3. Physical Facility Audit – Do not skip virtual tours only | – Proof: Timestamped photos of: • Kilns/molding lines • Raw material storage • Utility meters (gas/electricity) • Employee ID badges |

Trading companies cannot replicate factory infrastructure. Employee IDs confirm operational scale. |

| 4. Validate production process for specific Iroquois patterns | – Proof: Work-in-progress items matching requested patterns – Master craftsman interview (ask pattern history) |

Confirms capability beyond generic ceramics; detects pattern theft/fakes. | |

| Post-Visit Validation | 5. Third-party quality control (QC) on first production batch | – Proof: SGS/BV/Bureau Veritas report with: • Material composition (lead/cadmium testing) • Pattern fidelity assessment |

Ensures compliance with safety standards (e.g., FDA 21 CFR 109.16) for tableware. |

| 6. Trace raw material sourcing (clay, glazes) | – Proof: Supplier contracts for kaolin/clay – Glaze composition certificates |

Critical for vintage reproductions requiring specific material authenticity. |

Distinguishing Trading Company vs. Factory: 5 Field-Tested Indicators

Trading companies add cost (15-30%) and risk; factories offer direct control but require deeper vetting.

| Indicator | Trading Company | Actual Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” “agency” but NO manufacturing codes (e.g., C3031) | Lists specific manufacturing codes (e.g., C3031 for ceramic tableware) | Check license under “经营范围” (Scope of Business) |

| Facility Layout | Office-only space (1-2 rooms); samples stored in back room | Raw materials → Production lines → Kilns → QC lab → Warehouse (all on-site) | Demand walk-through before samples shown |

| Pricing Structure | Quotes single FOB price; refuses component breakdown | Provides detailed cost breakdown (clay, labor, glaze, firing, packaging) | Ask: “What is the cost per kg of raw clay used?” |

| Technical Knowledge | Staff cannot explain kiln temperatures, glaze chemistry, or defect resolution | Engineers discuss firing curves, quartz inversion, glaze suspension | Technical deep-dive on production challenges |

| Lead Time Flexibility | Fixed lead times (e.g., “45 days always”) | Adjusts timelines based on kiln batch scheduling & raw material availability | Ask: “How would lead time change for 50% larger order?” |

Top 5 Red Flags to Terminate Engagement Immediately

Per SourcifyChina’s 2025 Supplier Risk Index, these indicate 87% probability of fraud or non-compliance.

-

“Iroquois-Authorized” Claims Without Documentation:

- ❌ Red Flag: Claims “official partnership” with defunct Iroquois China Co. but provides no legal transfer documents.

- ✅ Action: Demand proof of trademark registration (USPTO Reg. No. for current owner) or licensing agreement.

-

Virtual-Only “Factory Tours”:

- ❌ Red Flag: Refuses in-person audit; offers only pre-recorded videos or “live” Zoom tour with no employee interaction.

- ✅ Action: Insist on unannounced audit with SourcifyChina’s local team (cost: $420).

-

Sample Sourced from Alibaba/Rival Factories:

- ❌ Red Flag: Samples match Alibaba listings from other suppliers; inconsistent logo placement vs. vintage references.

- ✅ Action: Request samples made during audit from raw materials on-site.

-

Payment Demands to Personal Accounts:

- ❌ Red Flag: Requests 30% deposit to individual WeChat/Alipay or offshore account (not company bank).

- ✅ Action: All payments must go to company account matching business license; use LC or Escrow.

-

Mismatched Certification Documents:

- ❌ Red Flag: ISO/FDA certificates show different company address than facility visited.

- ✅ Action: Verify certs via issuing body (e.g., SGS certificate lookup portal); reject if mismatched.

SourcifyChina Actionable Insight

“The ‘Iroquois’ name is a magnet for opportunistic suppliers. In 2025, 78% of vendors claiming Iroquois reproduction rights failed basic IP verification. Always start with:

1. Confirm if you need authentic reproductions (require IP diligence) or new designs inspired by vintage aesthetics (lower risk).

2. Target factories in Dehua (Fujian) or Jingdezhen – the only Chinese hubs with technical capability for fine bone china reproductions.

3. Never skip kiln verification: Gas/electricity meter readings must correlate with claimed production volume.Pro Tip: Request a ‘pattern fidelity test’ – have the factory reproduce a specific, obscure Iroquois pattern variant (e.g., ‘Floral #127’). Authentic specialists will recognize it; copycats will fail.

Next Step: Engage SourcifyChina for a Targeted Manufacturer Audit ($850) including:

– IP rights validation for vintage reproductions

– Kiln capacity stress test

– Material composition tracing

Schedule Audit →

SourcifyChina | Verified Sourcing in China Since 2010

Data Source: SourcifyChina 2025 Global Supplier Risk Database (12,840+ factory audits) | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamline Procurement with Verified Suppliers

In today’s competitive global marketplace, time is your most valuable resource. Identifying reliable, high-capacity manufacturers—especially in complex supply chains like ceramics and tableware—can result in months of delays, miscommunication, and compliance risks. This is particularly true when sourcing for legacy brands or niche product lines such as those historically associated with the Iroquois China Company.

While the original Iroquois China Company is no longer operational, demand persists for its vintage-style patterns and high-quality ceramic ware. Manufacturers in China today produce compatible products, but verifying authenticity, production standards, and export compliance remains a significant challenge.

Why SourcifyChina’s Verified Pro List® Delivers Immediate Value

SourcifyChina’s Verified Pro List® eliminates the guesswork and risk in sourcing. For procurement managers targeting Iroquois-style china or compatible ceramic tableware, our rigorously vetted supplier network offers:

| Benefit | Impact |

|---|---|

| Pre-Vetted Manufacturers | All suppliers undergo on-site audits for capacity, quality control, export experience, and ethical compliance. |

| Time Saved | Reduce supplier qualification from 3–6 months to under 72 hours. |

| Product Match Accuracy | Access factories with proven experience replicating vintage patterns, glazes, and form factors. |

| Risk Mitigation | Avoid fraud, IP infringement, and substandard production with documented due diligence. |

| End-to-End Support | SourcifyChina liaises directly with factories for samples, audits, and production tracking. |

Average Time Saved per Sourcing Project: 118 hours

Client Onboarding to First Sample Delivery: As fast as 14 days

Call to Action: Accelerate Your Sourcing Cycle in 2026

Don’t invest another quarter in unverified supplier searches or failed production runs. With SourcifyChina’s Verified Pro List®, you gain immediate access to trusted ceramic manufacturers capable of delivering Iroquois-style and custom tableware—on time, on spec, and on budget.

Take the next step today:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

✔ Free supplier shortlist within 24 hours

✔ Sample coordination & factory audit reports

✔ MOQ and pricing benchmarking for your category

SourcifyChina — Your Trusted Partner in Precision Sourcing

Delivering Verified Supply Chains, One Pro List at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.