The global air compressor market was valued at approximately USD 38.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% from 2024 to 2030, according to Grand View Research. This steady expansion is fueled by rising industrial automation, increasing demand from manufacturing and construction sectors, and advancements in energy-efficient technologies. Within this growing landscape, Iron Horse—an emerging brand in the industrial compressor space—relies on a network of specialized component manufacturers to ensure performance, durability, and serviceability. As end-users prioritize reliability and cost-effective maintenance, the supply chain for high-quality compressor parts—from pumps and motors to valves and control systems—has become increasingly critical. Below, we highlight the top 8 manufacturers powering Iron Horse compressor systems, selected based on production volume, technical expertise, global reach, and alignment with industry growth trends.

Top 8 Iron Horse Compressor Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Iron Horse

Domain Est. 1998

Website: toolmartinc.com

Key Highlights: 30-day returnsWe have a wide range of Iron Horse air compressor parts right here in our store. If you need a new flywheel, pressure gauge, or even a brand new 5 HP air ……

#2 2025 Can

Domain Est. 1999

Website: ironhorsemc.com

Key Highlights: EQUIPPED TO GET IT DONE. Defender MAX XT is ready to work right out of the factory with upgrades including adaptable storage and lightweight wheels and tires….

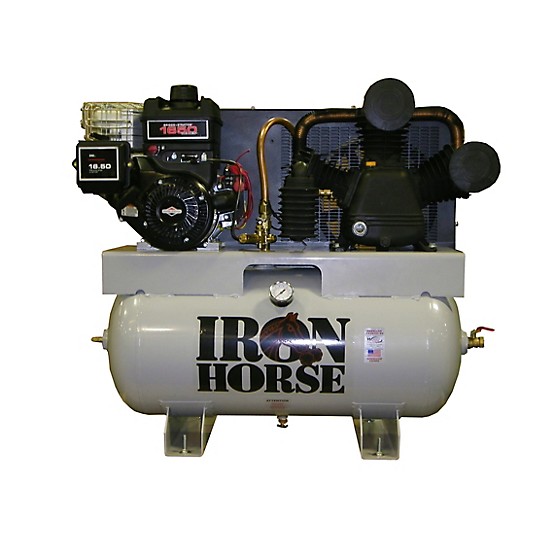

#3 Iron Horse, 30 Gallon Truck Mount Compressor, Horsepower 13 HP …

Domain Est. 1998

Website: northerntool.com

Key Highlights: In stock $399.99 deliveryThe 390cc 13hp electric start Iron Horse service truck air compressor has a heavy duty 3 cylinder cast iron compressor head that is driven with the quiet ….

#4 Wood Industries

Domain Est. 2002

Website: eaglecompressor.com

Key Highlights: Whether you need a 10 gallon wheelbarrow unit, a 55 gallon truck mount compressor, or a 120 gallon beast, we’ve got you covered! … Iron Horse Compressors….

#5 Hardware Distributors

Domain Est. 2002

Website: hdlusa.com

Key Highlights: Welcome to the HDL Website. Get Free Shipping on orders over $600! Restrictions apply, Click Me for details….

#6 Iron Horse Compressor Parts & Accessories at AcmeTools.com

Domain Est. 2003

#7 Iron Horse Air Compressors

Domain Est. 2010

Website: fergusonhome.com

Key Highlights: Shop and Save on Iron Horse Air Compressors. Discover the Lowest Prices & Best Customer Service – Smarter Home Improvement….

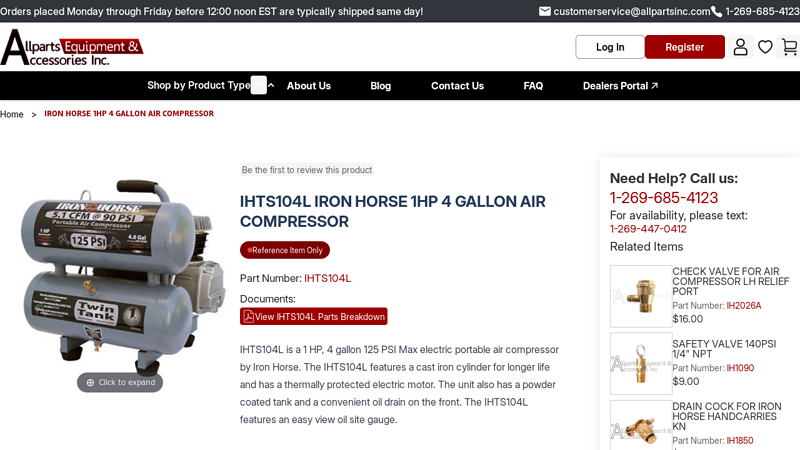

#8 ihts104l iron horse 1hp 4 gallon air compressor

Domain Est. 2010

Expert Sourcing Insights for Iron Horse Compressor Parts

H2: 2026 Market Trends for Iron Horse Compressor Parts

The market for Iron Horse compressor parts in 2026 is expected to be shaped by several converging trends driven by industrial demand, technological advancements, sustainability initiatives, and supply chain dynamics. As Iron Horse—known for its line of air compressors and components, often distributed through retailers like Northern Tool—continues to maintain a presence in the power equipment sector, its parts market will reflect broader shifts in the compressed air systems industry.

-

Increased Demand for Replacement and Maintenance Parts

By 2026, the aging installed base of Iron Horse compressors is expected to drive steady demand for replacement parts such as pumps, valves, gaskets, motors, and pressure switches. As more units reach mid-to-late life cycles, maintenance and repair activities will grow, especially among small-to-medium enterprises (SMEs), agricultural operations, and DIY users who rely on cost-effective solutions. The affordability and accessibility of Iron Horse parts compared to premium brands will sustain this demand. -

Growth in E-Commerce and Aftermarket Distribution

Online platforms will continue to dominate the sale of compressor parts by 2026. Third-party marketplaces (e.g., Amazon, eBay) and specialty industrial parts websites are expected to expand their inventory of Iron Horse-compatible components. This trend enhances availability but also increases competition from generic and OEM-equivalent parts, pressuring pricing and brand loyalty. -

Rise of Compatible and Universal Parts

The market will see a surge in universal or cross-compatible compressor parts engineered to fit multiple brands, including Iron Horse models. Advances in reverse engineering and standardization of compressor components will enable third-party manufacturers to offer cost-effective alternatives, challenging original part pricing and pushing innovation in durability and performance. -

Focus on Energy Efficiency and System Optimization

While Iron Horse compressors are often positioned in the mid-tier market, end users are increasingly seeking ways to improve energy efficiency. In 2026, demand may rise for upgraded parts such as high-efficiency motors, electronic moisture separators, and smart pressure controls that can be retrofitted into existing Iron Horse units. This reflects a broader industry trend toward optimizing legacy equipment rather than full replacement. -

Supply Chain Localization and Resilience

Ongoing geopolitical and logistical challenges will encourage greater regionalization of parts manufacturing and distribution. By 2026, suppliers may shift toward localized production of commonly needed Iron Horse components—especially in North America—to reduce lead times and enhance supply reliability. This could benefit domestic distributors and service centers. -

Sustainability and Circular Economy Pressures

Environmental regulations and corporate sustainability goals are pushing industries toward longer equipment lifespans and reduced waste. Repairing and refurbishing Iron Horse compressors using replacement parts aligns with circular economy principles. This trend will support continued demand for high-quality, recyclable, and durable parts. -

Technological Integration and Diagnostic Tools

Although Iron Horse compressors are primarily mechanical, aftermarket innovations may introduce smart sensors and diagnostic add-ons by 2026. These accessories—such as vibration monitors or air quality sensors—could be sold as optional parts to help users predict failures and maintain peak performance, extending the relevance of older Iron Horse models.

In summary, the 2026 market for Iron Horse compressor parts will be characterized by sustained demand from the installed user base, intensified competition from universal parts, growth in digital distribution channels, and an increasing emphasis on efficiency, availability, and sustainability. While Iron Horse may not lead in smart technology integration, its parts ecosystem will remain vital for cost-conscious and maintenance-focused users across multiple sectors.

Common Pitfalls Sourcing Iron Horse Compressor Parts (Quality & IP)

Sourcing replacement parts for Iron Horse compressors—especially since the brand is no longer actively supported by its original manufacturer—presents several risks related to part quality and intellectual property (IP). Being aware of these pitfalls helps avoid downtime, safety hazards, and legal complications.

Inconsistent or Substandard Part Quality

One of the biggest challenges is the lack of standardized manufacturing oversight. With no official Iron Horse parts supply chain, many third-party suppliers offer compatible components. However, these parts often vary significantly in material composition, machining precision, and durability. Poor-quality castings, undersized pistons, or weak reed valves can lead to premature failure, reduced efficiency, or even catastrophic compressor damage. Users may unknowingly install parts that cannot withstand operating pressures or thermal cycles, resulting in frequent breakdowns and higher long-term costs.

Misrepresentation and Counterfeit Components

Due to the brand’s discontinued status, some sellers falsely market generic or rebranded parts as “genuine Iron Horse” components. This misrepresentation exploits consumer trust and can involve counterfeit packaging or misleading product descriptions. These fake parts rarely meet original equipment specifications and often lack proper testing or certification. Purchasing such items not only compromises performance but may void warranties on other system components.

Intellectual Property (IP) and Trademark Risks

While “Iron Horse” as a brand name is associated with various products (including compressors formerly distributed by Harbor Freight), its trademark status must be carefully considered. Unauthorized use of the Iron Horse name or logos on replacement parts—even if technically compatible—can infringe on existing trademarks. Suppliers who replicate proprietary designs (e.g., pump heads, valve plates) may also violate design patents or trade dress protections. Buyers sourcing in bulk or reselling parts could inadvertently become involved in IP disputes, exposing themselves to legal liability.

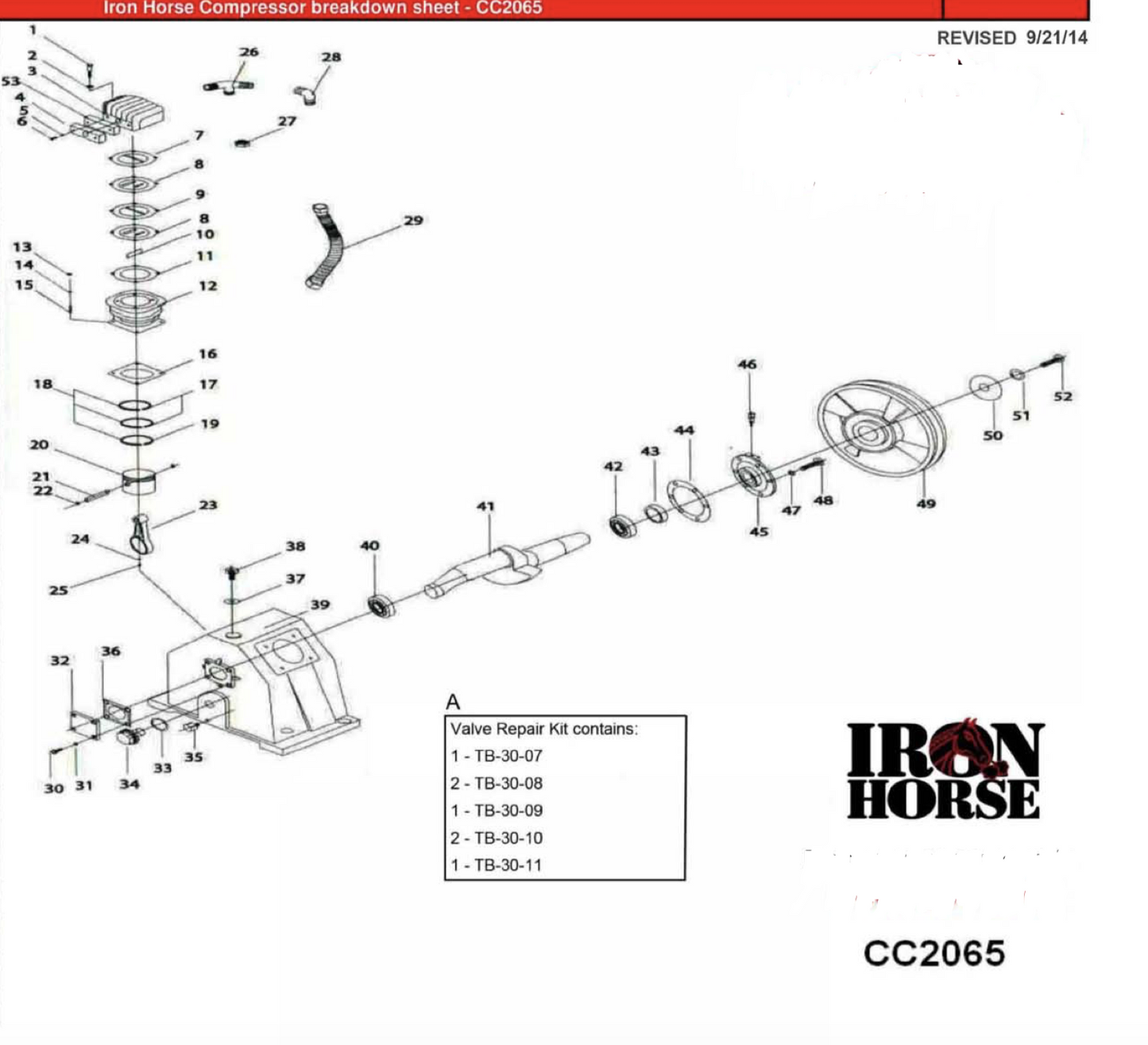

Lack of Technical Documentation and Compatibility Assurance

Without OEM support, accurate specifications, exploded diagrams, or compatibility guides are often unavailable or outdated. This makes it difficult to verify whether a part will fit or function correctly. Cross-referencing part numbers across different suppliers can yield conflicting information, increasing the risk of ordering incompatible components. The absence of technical support further complicates troubleshooting and installation.

Supply Chain Instability and Obsolescence

The aftermarket for Iron Horse compressor parts is fragmented and inconsistent. Suppliers may offer a specific part today but discontinue it without notice due to low demand or manufacturing changes. This unpredictability hampers maintenance planning, especially for users relying on older compressor models that require ongoing service.

To mitigate these risks, users should prioritize suppliers with transparent sourcing, product testing data, and clear disclaimers about compatibility and IP status. Whenever possible, opt for parts from reputable industrial brands that manufacture to ISO or ANSI standards—even if not labeled as “Iron Horse.”

Logistics & Compliance Guide for Iron Horse Compressor Parts

Overview

This guide outlines the logistics procedures and compliance requirements for handling, shipping, storing, and receiving Iron Horse Compressor Parts. Adherence to these guidelines ensures operational efficiency, regulatory compliance, and product integrity across the supply chain.

Shipping & Transportation

All Iron Horse Compressor Parts must be shipped using approved carriers that comply with domestic and international freight regulations. Parts should be securely packaged in manufacturer-approved materials to prevent damage during transit. Hazardous materials (if applicable, e.g., lubricants or batteries) must be labeled and shipped in accordance with DOT, IATA, and IMDG regulations as appropriate. Temperature-sensitive components require climate-controlled transportation.

Packaging Standards

Use original or equivalent protective packaging for all parts. Each shipment must include:

– Part number and description

– Quantity and serial numbers (if applicable)

– Date of shipment

– Iron Horse and recipient purchase order numbers

Inner components must be sealed in moisture-resistant wrapping, and outer containers must display handling labels (e.g., “Fragile,” “This Side Up”).

Import/Export Compliance

Shipments crossing international borders must comply with relevant customs regulations. Required documentation includes:

– Commercial invoice with accurate Harmonized System (HS) codes

– Packing list

– Certificate of Origin (if required)

– Export declarations (e.g., AEI for U.S. exports)

Ensure compliance with ITAR, EAR, and OFAC regulations where applicable. Verify destination country restrictions prior to shipment.

Inventory Management & Warehousing

Store parts in a clean, dry, and temperature-controlled environment. Implement FIFO (First In, First Out) inventory rotation to minimize obsolescence. Conduct quarterly audits to verify stock accuracy. Use barcode or RFID tracking for high-value or serialized components.

Regulatory & Safety Compliance

All parts must meet applicable industry standards, including ISO 5390 (compressor safety), ANSI, and OSHA guidelines. Material Safety Data Sheets (MSDS/SDS) must be maintained for any components classified as hazardous. Employees handling parts must be trained in hazardous material protocols and proper lifting techniques.

Returns & Reverse Logistics

Defective or incorrect parts must be returned using a pre-authorized Return Merchandise Authorization (RMA) number. Packaging must replicate outbound standards to prevent further damage. All returned items are inspected upon receipt and processed in accordance with Iron Horse’s warranty policy.

Recordkeeping & Documentation

Maintain digital and physical records of all logistics transactions for a minimum of seven years. Include:

– Shipping and delivery receipts

– Customs documentation

– Inspection reports

– RMA logs

Records must be accessible for internal audits or regulatory review.

Contact Information

For logistics or compliance inquiries, contact:

Iron Horse Logistics Support

Email: [email protected]

Phone: 1-800-XXX-XXXX

Hours: Mon–Fri, 8:00 AM – 5:00 PM (Central Time)

Conclusion: Sourcing Iron Horse Compressor Parts

Sourcing parts for Iron Horse compressors requires careful consideration due to the brand’s history and market position. As a rebranded line historically sold through Northern Tool and often manufactured by third-party OEMs such as CHA (China High Air), availability of genuine or compatible replacement parts can be inconsistent. Over time, limited manufacturer support and the discontinuation of certain models have made it challenging to find specific components.

The most effective approach involves identifying the original equipment manufacturer (OEM) of the compressor, which allows access to generic or cross-compatible parts from industrial suppliers. Utilizing part numbers, model specifications, and consulting with compressor specialists or online forums can greatly improve success in locating reliable replacements. Additionally, maintaining a stock of common wear items—such as seals, gaskets, and valves—can minimize downtime.

In conclusion, while sourcing Iron Horse compressor parts can be challenging, a strategic, research-driven method focusing on OEM equivalents and aftermarket alternatives ensures continued operation and extends the lifespan of the equipment. Investing time in proper identification and building relationships with trusted industrial suppliers is key to long-term maintenance success.