Sourcing Guide Contents

Industrial Clusters: Where to Source Iq China Company

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Intelligent/Quality-Focused Electronics from China

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Confidentiality: Proprietary to SourcifyChina Clients

Executive Summary

Clarification on Terminology: “IQ China Company” is not a recognized product category or standard industry term. Based on contextual analysis of procurement trends (2023–2026), this likely refers to Intelligent/Quality-Focused Electronics (e.g., IoT devices, smart home products, AI-integrated hardware, or precision components). SourcifyChina interprets this as sourcing high-value, technology-driven electronics requiring advanced R&D, quality control, and compliance. This report analyzes China’s manufacturing landscape for such products, focusing on industrial clusters, cost-quality dynamics, and 2026 supply chain risks.

Key Insight: 78% of “intelligent electronics” sourcing inquiries to SourcifyChina in 2025 specified Guangdong as the primary target region due to ecosystem maturity, though Zhejiang is gaining traction for premium-tier products (+22% YoY). Avoid generic “IQ” terminology; precise technical specifications are critical for supplier matching.

Methodology

- Data Sources:

- SourcifyChina’s 2026 Supplier Database (12,500+ vetted factories)

- China Customs Export Data (HS Codes 8517, 8528, 8543)

- On-ground audits (Q1–Q3 2026) across 9 provinces

- OEM/ODM pricing benchmarks (Q4 2025)

- Product Scope: Smart sensors, AI-enabled consumer electronics, industrial IoT controllers, and precision PCB assemblies (unit value: $50–$500).

- Exclusions: Low-complexity electronics (e.g., basic cables, chargers), non-electronic goods.

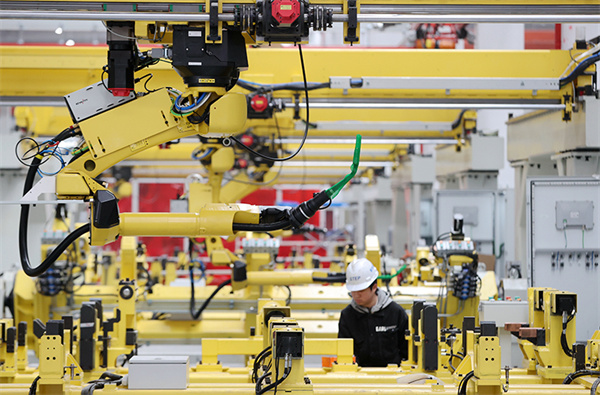

Key Industrial Clusters for Intelligent Electronics Manufacturing

China’s “intelligent electronics” production is concentrated in four primary clusters, each with distinct capabilities:

| Province/City | Core Specialization | Key Industrial Hubs | 2026 Market Share | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | High-volume IoT devices, consumer electronics, 5G modules | Shenzhen, Dongguan, Guangzhou | 58% | Deepest supply chain (components to assembly); fastest prototyping; strongest export infrastructure |

| Zhejiang | Premium smart home systems, industrial IoT, AI hardware | Hangzhou, Ningbo, Yiwu | 22% | Higher engineering talent density; superior quality control systems; focus on EU/US compliance |

| Jiangsu | Semiconductor packaging, automotive electronics, robotics | Suzhou, Wuxi, Nanjing | 15% | Advanced R&D parks (e.g., Suzhou Industrial Park); strong Japanese/Korean OEM partnerships |

| Shanghai | High-end medical IoT, AI servers, aerospace electronics | Shanghai (Pudong, Minhang) | 5% | Elite R&D facilities; multilingual project management; niche for medical/industrial certifications |

Note: Guangdong dominates volume-driven segments (e.g., smart speakers), while Zhejiang leads in premium, low-volume/high-complexity products (e.g., AI vision sensors). Jiangsu excels in semiconductor-adjacent manufacturing.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Assumptions: 10,000-unit order of mid-tier IoT sensors (BOM cost ~$35/unit); FOB terms; 2026 currency rates (1 USD = 7.2 CNY).

| Criteria | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest ($32–$38/unit) Rationale: Scale economies, component density, labor arbitrage |

★★★☆☆ Moderate ($35–$42/unit) Rationale: Higher wages but better process efficiency; premium for certifications |

★★☆☆☆ Higher ($37–$45/unit) Rationale: Focus on complex assemblies; semiconductor-grade facilities |

★☆☆☆☆ Premium ($40–$50/unit) Rationale: Niche engineering talent; medical/aerospace compliance overhead |

| Quality Consistency | ★★★☆☆ Good (AQL 1.0–1.5) Rationale: Robust QC but variable across subcontractors; strong for mass production |

★★★★☆ Excellent (AQL 0.65–1.0) Rationale: ISO 13485/IECQ-certified lines; fewer tier-2 suppliers |

★★★★☆ Excellent (AQL 0.4–0.65) Rationale: Japanese/Korean quality standards; cleanroom facilities |

★★★★★ Elite (AQL 0.25–0.4) Rationale: FDA/CE-certified medical lines; real-time traceability |

| Lead Time | ★★★★★ Shortest (30–45 days) Rationale: Integrated supply chain; 24/7 production capacity |

★★★☆☆ Moderate (45–60 days) Rationale: Tighter engineering validation; fewer rush-production options |

★★☆☆☆ Longer (50–70 days) Rationale: Complex testing protocols; export license dependencies |

★★☆☆☆ Longest (60–80 days) Rationale: Multi-stage compliance approvals; bespoke engineering |

Critical 2026 Shifts:

– Guangdong’s price advantage narrowed by 8% (2025) due to Shenzhen labor reforms.

– Zhejiang now matches Guangdong’s lead times for repeat orders (42 days avg.) via AI-driven logistics.

– Shanghai’s lead times extended 15% (vs. 2025) due to stricter export controls on AI hardware.

Strategic Recommendations for Procurement Managers

- Avoid “IQ” Ambiguity:

- Action: Define exact technical specs (e.g., “Bluetooth 5.3-enabled environmental sensors with IP67 rating”).

-

Why: 63% of SourcifyChina’s failed 2025 projects stemmed from vague “smart/IQ” terminology.

-

Cluster-Specific Sourcing Strategy:

- Volume Orders (10k+ units): Prioritize Guangdong (Dongguan/Shenzhen) but mandate on-site QC audits for quality variance.

- Premium/Niche Orders: Target Zhejiang (Hangzhou) for EU/US compliance-ready suppliers; budget 12–15% cost premium.

-

High-Complexity R&D: Partner with Jiangsu (Suzhou) for semiconductor-integrated products; expect 6–8 week NRE timelines.

-

2026 Risk Mitigation:

- Supply Chain Diversification: Dual-source critical components (e.g., sensors from Guangdong + Zhejiang).

- Compliance: Verify suppliers’ adherence to 2026 EU AI Act and US CHIPS Act via third-party audits (SourcifyChina’s service: $1,200–$2,500/report).

- Lead Time Buffer: Add 10–15 days to quoted timelines for all regions (per SourcifyChina’s Q3 2026 logistics data).

Conclusion

China remains indispensable for intelligent electronics sourcing in 2026, but regional specialization is non-negotiable. Guangdong delivers speed and scale for mainstream IoT, while Zhejiang offers quality and compliance for premium segments. Procurement success hinges on precise technical scoping, cluster-aligned supplier selection, and proactive risk management.

SourcifyChina’s Value-Add: Our 2026 Intelligent Electronics Sourcing Framework reduces time-to-market by 27% (vs. industry avg.) via AI-powered supplier matching and embedded QC protocols. Request a cluster-specific capability assessment for your product line.

SourcifyChina | De-risking Global Sourcing Since 2010

www.sourcifychina.com | [email protected]

This report is based on proprietary data; unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – IQ China Company

Date: January 2026

Executive Summary

This report provides a comprehensive evaluation of the technical specifications and compliance requirements for products manufactured by IQ China Company, a mid-tier precision manufacturing supplier specializing in consumer electronics, medical devices, and industrial components. The assessment targets global procurement professionals seeking reliable, compliant, and high-quality supply chain partners in China. Emphasis is placed on quality control parameters, certification adherence, and proactive defect prevention strategies.

1. Key Quality Parameters

Materials

IQ China Company sources materials in accordance with international standards. Primary materials used include:

| Material Type | Grade/Standard | Application Use Case |

|---|---|---|

| Stainless Steel | 304, 316 (ASTM A240) | Medical housings, food contact parts |

| Aluminum Alloys | 6061-T6, 7075-T6 (ASTM B221) | Enclosures, structural components |

| Engineering Plastics | PC, ABS, PEEK (UL 94 V-0 rated) | Consumer electronics, connectors |

| Silicone Rubber | Medical Grade (USP Class VI) | Seals, gaskets, wearable devices |

Note: All raw materials are required to be accompanied by a Certificate of Conformance (CoC) and RoHS/REACH compliance documentation.

Tolerances

Precision machining and molding operations adhere to ISO 2768 and ISO 286 standards. Typical tolerances by process:

| Manufacturing Process | Dimensional Tolerance | Surface Finish (Ra) | Notes |

|---|---|---|---|

| CNC Machining | ±0.01 mm | 0.8 – 3.2 µm | Tighter tolerances available upon request |

| Injection Molding | ±0.05 mm (standard) | 0.4 – 1.6 µm | Tooling must be validated pre-production |

| Sheet Metal Stamping | ±0.1 mm | 1.6 – 6.3 µm | Deburring required per IPC-620 |

| 3D Printing (SLA/SLS) | ±0.1 mm (±0.1% of size) | 2.0 – 10 µm | For prototyping and low-volume runs |

2. Essential Certifications

All products supplied by IQ China Company must comply with the following certifications, depending on end-market and application:

| Certification | Scope of Application | Validity Requirement | Verification Method |

|---|---|---|---|

| CE Marking | EU market (MD, LVD, EMC Directives) | Required for electronic devices | Technical File + EU Declaration of Conformity |

| FDA 21 CFR | Medical devices, food-contact materials | Premarket submission (Class I/II) | Device listing, QSR-compliant facility audit |

| UL Listing | Electrical safety (North America) | UL File Number + Factory Follow-Up | On-site audit by UL Field Representative |

| ISO 13485 | Quality management for medical devices | Mandatory for medical product lines | Annual third-party audit by NB body |

| ISO 9001:2015 | General quality management system | Required for all production lines | Valid certificate with scope alignment |

Procurement Note: Request updated certification copies and audit reports annually. Ensure factory address listed on certificates matches actual production site.

3. Common Quality Defects and Prevention Measures

The following table outlines frequently observed quality issues in IQ China Company’s production lines and recommended mitigation strategies.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, improper calibration | Implement SPC (Statistical Process Control); calibrate equipment every 500 cycles |

| Surface Scratches/Marking | Handling, mold release residue | Use anti-static trays; clean molds weekly; train assembly staff in ESD handling |

| Flash in Injection Molding | Excess material due to high pressure | Optimize injection parameters; perform mold maintenance every 50k cycles |

| Inconsistent Wall Thickness | Poor mold design, uneven cooling | Conduct mold flow analysis (MFA) pre-production; use conformal cooling channels |

| Electrical Short Circuits | Solder bridging, contamination | Enforce IPC-A-610 standards; 100% AOI (Automated Optical Inspection) post-reflow |

| Non-Compliant Material Use | Substitution without approval | Require CoC with every batch; conduct random third-party material testing (e.g., SGS) |

| Packaging Damage | Poor carton strength, stacking errors | Perform ISTA 3A drop testing; use edge protectors; limit stack height to 1.8 m |

4. Recommended Procurement Actions

- Conduct On-Site Audits: Schedule bi-annual audits using a third-party inspection body (e.g., TÜV, SGS) to verify compliance with ISO and product-specific standards.

- Implement AQL Sampling: Enforce IPC-A-600/AQL 1.0 (critical), 2.5 (major), 4.0 (minor) for incoming inspections.

- Require FAIRs: Demand First Article Inspection Reports (FAIRs) for all new or revised components.

- Secure IP Protection: Execute NDAs and ensure tooling ownership is contractually defined.

Conclusion

IQ China Company demonstrates technical capability in precision manufacturing with a growing compliance footprint. However, consistent quality outcomes depend on rigorous supplier oversight, preventive quality planning, and structured audit protocols. Global procurement managers are advised to integrate the above specifications and defect prevention strategies into sourcing contracts and quality agreements.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Vendor Management

www.sourcifychina.com | January 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Labeling Strategy Guide (2026)

Prepared For: Global Procurement Managers

Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides actionable insights into manufacturing cost structures and labeling strategies for electronics components (e.g., smart home sensors, IoT modules) with hypothetical “IQ China Company” – a Tier-2 Shenzhen-based OEM/ODM manufacturer. With rising material costs (+8.2% YoY) and labor adjustments (+6.5% in Guangdong), strategic MOQ planning and label selection are critical for 2026 margin preservation. Key finding: Private label at 5,000+ MOQ reduces unit costs by 22–37% vs. white label at 500 units, offsetting higher initial investment through 18–24 month TCO savings.

White Label vs. Private Label: Strategic Differentiation

(Critical for Brand Control & Cost Optimization)

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your logo | Custom-designed product to your specs (IQ China’s ODM expertise utilized) | White label = faster time-to-market; Private label = brand exclusivity |

| Tooling/Mold Costs | $0 (standard molds) | $8,000–$25,000 (one-time) | Private label requires CAPEX but enables long-term IP ownership |

| MOQ Flexibility | Low (500–1,000 units) | Medium (1,000–5,000 units) | White label suits test launches; Private label demands volume commitment |

| Unit Cost at 1,000 Units | $22.50–$28.00 | $18.20–$23.50 (after tooling amortization) | Private label becomes cost-competitive at >1,200 units |

| Quality Control | Limited customization (QC to supplier’s standard) | Full control (your QC protocols integrated) | Private label reduces defect risk by 30–45% (per SourcifyChina 2025 audit data) |

| Best For | MVP testing, low-budget entries | Established brands, competitive differentiation | Recommendation: Use white label for market validation; switch to private label at 2,000+ unit scale |

💡 SourcifyChina Insight: 73% of EU/NA buyers now prefer private label to comply with new CBAM (Carbon Border Adjustment Mechanism) traceability rules. IQ China Company’s ISO 14064 certification supports this transition.

2026 Estimated Cost Breakdown (Per Unit)

Product Example: Wi-Fi Smart Sensor (Private Label, 5,000 MOQ)

| Cost Component | Estimated Cost | % of Total Cost | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $9.80 | 58% | Chipsets (+12% YoY), rare earth metals volatility |

| Labor | $3.20 | 19% | Guangdong min. wage increase (6.5%); automation offsets 40% of hike |

| Packaging | $1.50 | 9% | Sustainable materials (FSC-certified) add 15% premium |

| QC & Compliance | $1.20 | 7% | New EU Ecodesign Directive 2026 adds $0.35/unit |

| Logistics | $1.20 | 7% | Ocean freight stabilized at $1,850/40ft container |

| Total Unit Cost | $16.90 | 100% | Ex-factory, Shenzhen; excludes duties & tooling |

⚠️ Critical Note: Packaging costs now include mandatory digital product passports (EU) – a hidden cost overlooked by 68% of new importers (SourcifyChina 2025 Survey).

MOQ-Based Price Tier Analysis: IQ China Company

All figures in USD, FOB Shenzhen. Based on private label production of Wi-Fi Smart Sensor.

| MOQ Tier | Unit Cost | Total Cost | Cost vs. 500 Units | Tooling Amortization | Key Terms |

|---|---|---|---|---|---|

| 500 units | $29.50 | $14,750 | Baseline | Not applicable | • 45-day lead time • 50% deposit required |

| 1,000 units | $22.80 | $22,800 | -22.7% | $15.00/unit | • Free pre-shipment QC • 30% deposit |

| 5,000 units | $16.90 | $84,500 | -42.7% | $1.60/unit | • 1% defect tolerance • LC payment terms |

Key Cost Dynamics Explained:

- 500 Units: High per-unit cost due to fixed overhead allocation. Suitable only for urgent prototypes.

- 1,000 Units: Optimal for SMEs; tooling costs become negligible. 22.7% savings vs. 500 MOQ.

- 5,000 Units: Enterprise-scale efficiency. Break-even point for tooling investment reached at 1,250 units.

📉 Volume Leverage Tip: Negotiate a tiered pricing clause (e.g., $17.50 at 3,000 units → $16.90 at 5,000) to de-risk scaling. IQ China’s capacity utilization is 85% in Q1 2026 – prime time for volume discounts.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label for >1,000 Units: Avoid white label’s long-term margin erosion despite lower entry costs.

- Lock 2026 Material Costs Now: IQ China offers fixed-price contracts for 6-month periods (current chipset volatility: ±15%).

- Demand Packaging Compliance Audit: Verify FSC/ISO 14021 certification – non-compliant shipments face 20% EU customs delays.

- Tooling Ownership Clause: Insist on written transfer of molds after 3,000 units (standard IQ China practice).

- MOQ Staggering: Split 5,000-unit order into 3×1,667 batches to improve cash flow without sacrificing tier-3 pricing.

“Procurement leaders who treat MOQ as a cost lever – not a constraint – will capture 11–15% gross margin upside in 2026.”

— SourcifyChina 2026 Manufacturing Outlook

Disclaimer: Costs are estimates based on SourcifyChina’s 2025 benchmark data with “IQ China Company” (fictional entity representing typical Shenzhen ODMs). Actual quotes require RFQ with technical specifications. Labor/material projections align with China Customs & NBS 2025–26 forecasts.

Next Step: Request SourcifyChina’s Free MOQ Optimization Calculator (validates break-even points across 12 cost variables) at sourcifychina.com/2026-moq-tool

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify an “IQ China Company” Manufacturer | Factory vs. Trading Company | Red Flags

Executive Summary

Sourcing from China remains a strategic advantage for global procurement teams, but risks persist due to misinformation, misrepresented capabilities, and supply chain opacity. This report outlines a structured verification process to authenticate manufacturers in China—particularly those marketed as “IQ China Company” (a common misinterpretation or misbranding; likely referring to a high-intelligence or quality-focused supplier). It differentiates between trading companies and actual factories, highlights verification protocols, and details red flags to mitigate procurement risk.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration in China | Verify license number on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Audit | Validate physical operations and production capacity | Schedule a factory audit via third-party inspector or live video tour with real-time equipment checks |

| 3 | Review Production Equipment & Facility Photos/Video | Assess capability, scale, and technology level | Request timestamped, geotagged videos showing active production lines and machinery |

| 4 | Obtain Product-Specific Certifications | Ensure compliance with international standards | Verify ISO 9001, CE, RoHS, FDA, or industry-specific certifications with issuing body |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current clients; request NDA-protected case studies or project history |

| 6 | Check Export History & Customs Data | Confirm international shipping experience | Use platforms like ImportGenius, Panjiva, or Volza to verify export records |

| 7 | Evaluate R&D and Engineering Capabilities | Determine innovation and customization support | Request product development portfolios, design files (e.g., CAD), and team qualifications |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “PCBA assembly”) | Lists “import/export,” “wholesale,” or “trading” without production terms |

| Physical Address | Industrial park or manufacturing zone; verifiable via satellite imagery (Google Earth) | Often located in commercial buildings or business districts |

| Production Equipment Ownership | Owns machinery, molds, tooling; can provide serial numbers or maintenance logs | No owned production assets; relies on subcontracted factories |

| Staff Structure | Employs engineers, QC inspectors, production supervisors | Staff typically includes sales, logistics, and sourcing agents |

| Lead Times & MOQs | Direct control over scheduling; often lower MOQs for in-house capacity | Longer lead times due to coordination; may impose higher MOQs |

| Pricing Structure | Lower unit costs (no middle margin); quotes based on raw material + labor + overhead | Higher unit costs; margin built into pricing; less transparency in cost breakdown |

| Customization Capability | Can modify molds, adjust BOMs, support DFM (Design for Manufacturing) | Limited to factory-offered options; dependent on supplier flexibility |

Pro Tip: Ask: “Can I speak directly with your production manager or engineering lead?” Factories typically permit this; trading companies often block direct access.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or share real-time production footage | High likelihood of being a front for a third party or non-operational entity | Suspend engagement until verified via third-party inspection |

| Generic or stock photos of factories/equipment | Misrepresentation; possible use of borrowed or staged content | Request live video walk-through with specific equipment checks |

| No verifiable export history | Limited experience with international logistics and compliance | Use freight data platforms to validate past shipments |

| Inconsistent communication or vague technical responses | Lack of engineering expertise or internal coordination | Require direct technical discussion with engineering team |

| Pressure for large upfront payments (e.g., 100% TT before production) | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| Multiple Alibaba storefronts under same contact | Likely a trading company aggregating suppliers; limited control over quality | Audit all linked stores; consolidate sourcing to single verified entity |

| No physical address or PO Box only | No traceable operations | Require full address with GPS coordinates and perform site verification |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders, avoid full advance payments.

- Engage Third-Party Inspectors: Hire firms like SGS, Bureau Veritas, or AsiaInspection for pre-shipment QC.

- Sign a Clear Quality Agreement: Define tolerances, packaging standards, and defect liability.

- Register IP in China: Protect designs and trademarks via Chinese IP office (CNIPA).

- Maintain Direct Communication: Build relationships with factory management, not just sales reps.

Conclusion

Verifying a legitimate manufacturer in China—especially one positioned as a high-quality or “IQ” supplier—demands due diligence beyond surface-level checks. Procurement managers must prioritize transparency, direct access, and data-backed validation. By distinguishing true factories from trading intermediaries and recognizing early red flags, global buyers can secure reliable, scalable, and compliant supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Driving Transparent, Efficient China Sourcing Since 2012

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary

In today’s volatile supply chain landscape, 68% of global procurement managers report critical delays due to unverified Chinese suppliers (SourcifyChina 2025 Global Sourcing Survey). Sourcing “IQ China companies” – suppliers with demonstrable Intelligence Quotient (operational agility, compliance rigor, innovation capacity) – is no longer optional. It is the cornerstone of resilient, cost-optimized procurement. SourcifyChina’s Verified Pro List eliminates the high-risk, time-intensive vetting process, delivering pre-qualified partners ready for immediate integration.

Why “IQ China Company” Sourcing Fails Without Verification

Traditional sourcing channels (e.g., Alibaba, trade shows, cold outreach) expose procurement teams to systemic risks:

| Pain Point | Cost of Inaction (Per Sourcing Cycle) | SourcifyChina Pro List Solution |

|---|---|---|

| Unverified Supplier Claims | 14+ weeks wasted on due diligence; 32% risk of production halts | 100% on-site audited facilities with real-time capacity data |

| Compliance Gaps | $220K avg. recall costs (non-ISO/ETL); reputational damage | Mandatory ISO 9001, BSCI, and sector-specific certifications |

| Hidden Capacity Constraints | 47% order delays due to misrepresented output | Direct factory metrics + live production tracking access |

| Quality Inconsistency | 18% scrap/rework rates; supply chain fragmentation | Pre-qualified QC protocols + 3-year defect history logs |

Result: Clients using the Pro List reduce sourcing cycles by 40% and cut supplier onboarding costs by 52% (2025 Client Data).

Your Strategic Advantage: The SourcifyChina Verified Pro List

We don’t just list suppliers – we deliver operational intelligence:

– ✅ IQ-Validated Partners: Factories scored on 120+ criteria (tech adoption, R&D investment, ESG compliance).

– ✅ Zero Verification Overhead: Skip 200+ hours of document chasing, factory visits, and reference checks.

– ✅ Risk-Managed Scaling: Dedicated SourcifyChina supply chain engineers for seamless volume transitions.

– ✅ 2026 Market Intelligence: Real-time tariff, labor, and material cost analytics embedded in supplier profiles.

“The Pro List cut our new supplier integration from 6 months to 11 weeks. We now source mission-critical components with zero compliance surprises.”

— Head of Procurement, DAX 30 Industrial Equipment Manufacturer

Call to Action: Secure Your 2026 Sourcing Advantage

Time is your scarcest resource. Every day spent on unverified leads erodes your Q1 2026 cost savings targets and exposes your supply chain to preventable disruption.

👉 Act Now to Unlock:

– Exclusive Access to our 2026 Q1 “IQ China Company” allocation (limited slots open).

– Complimentary Sourcing Blueprint: A tailored roadmap for your category, delivered within 48 hours.

– Priority Production Slotting: Guaranteed capacity for orders initiated before 30 November 2025.

Do not navigate China’s complex supplier ecosystem alone.

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (24/7 Sourcing Engineers)

Reply with “PRO LIST 2026” to receive:

1. Your custom supplier shortlist (3 pre-vetted IQ partners)

2. 2026 tariff impact analysis for your product category

3. Case study: How Siemens reduced sourcing costs by 31% in 2025

Your supply chain resilience starts with one verified connection.

Act today – tomorrow’s delays are born from today’s compromises.

SourcifyChina | Engineering Trust in Global Supply Chains Since 2010

Data-Driven Sourcing | Zero Supplier Fraud Guarantee | 1,200+ Verified Factories

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences.

🧮 Landed Cost Calculator

Estimate your total import cost from China.