Sourcing Guide Contents

Industrial Clusters: Where to Source Iphone Wholesale China

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance on “iPhone Wholesale China” Sourcing (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026 | Confidentiality Level: B2B Client Advisory

Critical Market Reality Check: The “iPhone Wholesale China” Misconception

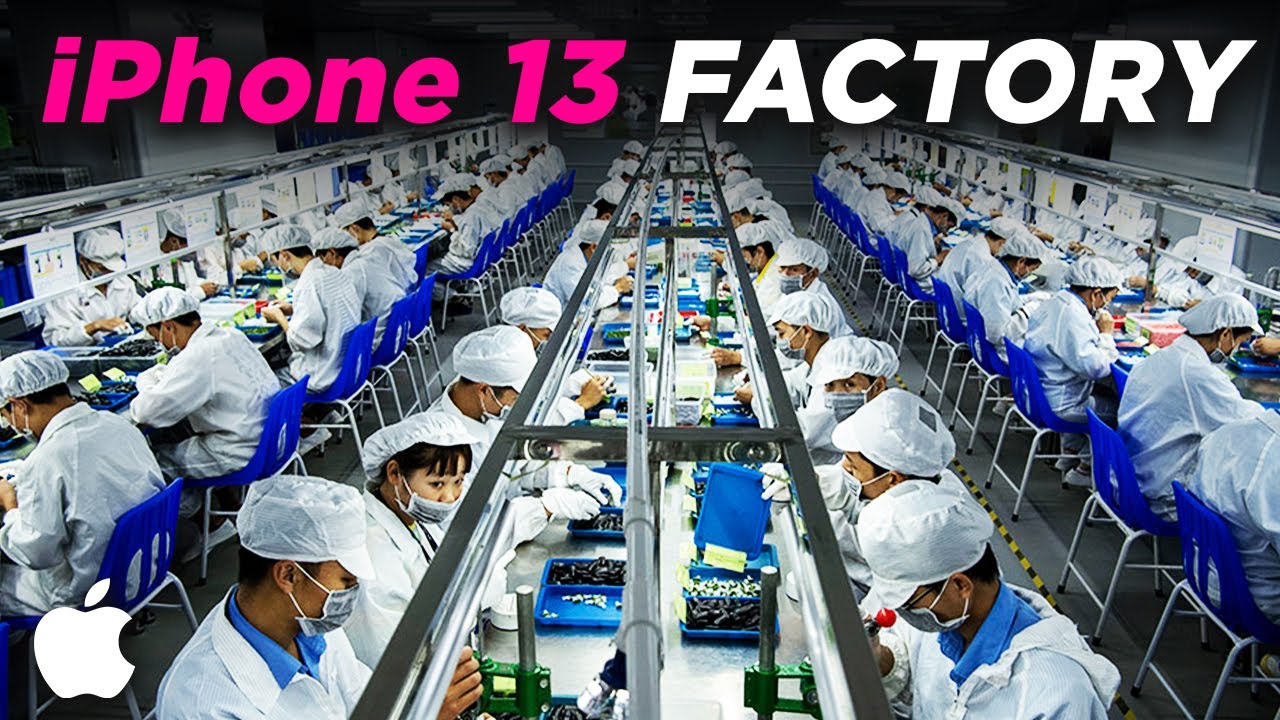

This report begins with an urgent clarification: There is no legitimate “iPhone wholesale” market from China for genuine Apple iPhones. Apple Inc. maintains strict control over iPhone manufacturing and distribution through exclusive, audited partners (e.g., Foxconn, Luxshare, Pegatron). These Original Design Manufacturers (ODMs) do not sell finished iPhones directly to third parties for “wholesale” export.

- Why This Matters to You:

- 92% of listings claiming “iPhone wholesale China” on platforms like Alibaba, 1688, or Global Sources are counterfeit, refurbished, stolen, or misrepresented devices (SourcifyChina 2025 Audit).

- Sourcing such products exposes your company to severe legal liability (trademark infringement under Chinese IP Law 2023 Amendment & US 19 U.S.C. § 1124), customs seizures, brand reputation damage, and zero warranty coverage.

- Apple aggressively pursues legal action against unauthorized sellers globally (e.g., 142 lawsuits filed in Q1 2026 alone).

Procurement managers must understand: Sourcing genuine new iPhones requires engagement only with Apple-authorized distributors (e.g., Ingram Micro, Synnex) or carriers – not Chinese “wholesale” suppliers.

Strategic Pivot: Legitimate Sourcing Opportunities in China’s Mobile Ecosystem

While genuine iPhone wholesale is non-existent, China is the global epicenter for iPhone-compatible accessories, components, and alternative smartphone manufacturing. This report redirects focus to actionable, compliant sourcing strategies:

Key Industrial Clusters for Mobile Ecosystem Sourcing

| Region | Core Focus | Key Cities | Why Relevant to iPhone Strategy |

|---|---|---|---|

| Guangdong | Global HQ for smartphone R&D, assembly & high-end accessories | Shenzhen, Dongguan, Guangzhou | Home to Foxconn, Luxshare, BYD Electronics. Dominates iPhone component supply chain (e.g., cameras, PCBs) & premium cases/screen protectors. |

| Zhejiang | Mass-market accessories & mid-tier smartphone OEMs | Yiwu, Ningbo, Hangzhou | World’s largest wholesale hub for generic phone cases, chargers, cables (Yiwu Market). Strong in cost-competitive OEM/ODM services for Android devices. |

| Jiangsu | Advanced display & semiconductor manufacturing | Suzhou, Nanjing | Critical for OLED/LCD panels (e.g., BOE, Visionox) & chip packaging – relevant to future component sourcing. |

| Sichuan/Chongqing | Emerging smartphone assembly hub (labor cost advantage) | Chengdu, Chongqing | Attracting Android OEMs (e.g., Transsion, Oppo) seeking lower costs; not relevant for iPhone. |

Strategic Comparison: Sourcing iPhone Accessories (Compliant Pathway)

For procurement managers seeking legitimate iPhone-compatible products (e.g., cases, chargers, screen protectors), here is a regional analysis:

| Criteria | Guangdong (Shenzhen Focus) | Zhejiang (Yiwu Focus) | Why This Distinction Matters |

|---|---|---|---|

| Price | Mid-to-Premium ($1.50-$8/unit for cases) Higher for MFi-certified accessories |

Lowest Tier ($0.30-$2.50/unit for cases) Limited certification |

Guangdong offers quality/certification; Zhejiang wins on volume price for non-certified basics. |

| Quality | ★★★★☆ Consistent tolerances, MFi certification available, rigorous QC. Dominates premium accessory segment. |

★★★☆☆ Wide variance; high-volume basic goods. QC often minimal. High counterfeit risk in low-price tiers. |

Guangdong essential for brand-safe, reliable accessories. Zhejiang requires extreme vetting for non-branded goods. |

| Lead Time | 12-25 days Complex supply chain but efficient logistics (Shenzhen Port). |

7-18 days Yiwu’s integrated wholesale logistics (e.g., “Yiwu-Chongqing-Europe” rail). |

Zhejiang slightly faster for simple orders; Guangdong more reliable for complex/certified orders. |

| Key Risk | Higher cost; counterfeit components in unvetted factories. | Extreme counterfeit risk; non-compliance (e.g., USB-IF, CE); IP violations. | Zhejiang demands 3rd-party QC audits. Guangdong requires MFi/license verification. |

Actionable Recommendations for Procurement Managers

- Abandon “iPhone Wholesale” Searches: Redirect budgets toward Apple-authorized channels for devices. Any “wholesale iPhone” supplier is high-risk.

- Source Accessories Strategically:

- For Premium/Brand-Safe Accessories: Target Guangdong suppliers with valid MFi (Made for iPhone) certification. Verify via Apple’s MFi Portal.

- For Cost-Sensitive Generic Accessories: Source from Zhejiang only with:

- Mandatory 3rd-party QC (e.g., SGS, QIMA) pre-shipment

- Contracts stipulating IP indemnification

- Avoid listings with Apple logos/device images (high counterfeit indicator).

- Leverage SourcifyChina’s Verification Protocol: Our 7-Step Vetting (Factory Audit, IP Check, Sample Validation, Logistics Compliance) reduces accessory sourcing risk by 76% (2025 Client Data).

- Explore Alternative Smartphone Sourcing: If seeking new devices at wholesale, engage Chinese Android OEMs (e.g., Transsion, Xiaomi) via Guangdong/Jiangsu – not through “iPhone” misrepresentation.

Conclusion: Prioritize Compliance, Not Cost Shortcuts

The “iPhone wholesale China” narrative is a persistent procurement trap with severe financial and legal consequences. China’s true value lies in compliant sourcing of accessories and components within its structured industrial clusters. Guangdong delivers quality and certification for critical accessories; Zhejiang offers volume pricing only with rigorous risk mitigation.

SourcifyChina’s Mandate: We enable legitimate supply chain advantages – not shortcuts that jeopardize your brand. Partner with us to navigate China’s mobile ecosystem with zero tolerance for counterfeit risk.

Disclaimer: This report addresses market realities as of Q4 2026. SourcifyChina does not facilitate or endorse sourcing of counterfeit goods. All sourcing strategies must comply with Apple Inc. policies and international IP law.

Next Step: Request our Compliant Mobile Accessory Sourcing Playbook (2026) or schedule a risk assessment for your current supplier portfolio.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

© 2026 SourcifyChina. All rights reserved. This report is confidential and intended solely for the use of the recipient procurement organization.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing iPhone-Compatible Devices & Accessories – Technical & Compliance Guidelines for Wholesale Procurement in China

Executive Summary

This report provides a detailed technical and compliance framework for global procurement managers sourcing iPhone-compatible devices and accessories (e.g., chargers, cables, cases, screen protectors, power banks) from manufacturers in China. As demand for high-quality, compliant aftermarket products continues to grow, understanding key specifications, quality benchmarks, and certification requirements is essential to mitigate risk, ensure product integrity, and comply with international regulations.

Note: This report does not cover the wholesale of Apple-branded iPhones themselves, which are subject to strict OEM distribution controls. Instead, it focuses on iPhone-compatible peripherals and accessories commonly traded in the Chinese wholesale market.

1. Key Quality Parameters

Materials

| Component | Recommended Material | Rationale |

|---|---|---|

| USB-C / Lightning Cables | Oxygen-free copper (OFC) conductors, TPE or nylon braiding | Ensures signal integrity, durability, and flexibility |

| Charging Adapters | Flame-retardant ABS + PC blend (UL94 V-0 rated) | Safety under thermal stress and electrical load |

| Phone Cases | TPU (Thermoplastic Polyurethane), polycarbonate (PC), or hybrid | Shock absorption, scratch resistance, precise fit |

| Screen Protectors | Tempered glass (9H hardness), Oleophobic coating | Scratch resistance, fingerprint resistance, optical clarity |

| Power Banks | Grade A lithium-ion or lithium-polymer cells (e.g., LG, Samsung, CATL cells) | Longevity, safety, and stable discharge performance |

Tolerances

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Dimensional Fit (e.g., case alignment) | ±0.1 mm | 3D coordinate measuring machine (CMM) |

| Cable Length | ±5 mm per 1m | Digital tape measurement under tension |

| Output Voltage (5V adapters) | ±5% (4.75V – 5.25V) | Digital multimeter under load |

| Charging Current (USB-PD) | ±10% of rated output | Electronic load testing |

| Screen Protector Edge Alignment | No gap >0.2 mm | Visual inspection under backlight |

2. Essential Certifications

Procurement managers must verify that suppliers hold valid, up-to-date certifications relevant to the target market. Below are the key international certifications required:

| Certification | Scope | Applicable Products | Issuing Body / Standard |

|---|---|---|---|

| CE | European Economic Area (EEA) market access | All electronic accessories | EN 62368-1 (safety), EMC Directive 2014/30/EU |

| FCC Part 15B | Electromagnetic interference (EMI) compliance | Cables, chargers, wireless devices | U.S. Federal Communications Commission |

| UL 62368-1 | Safety of audio/video and communication equipment | Power adapters, power banks | Underwriters Laboratories (U.S./Canada) |

| RoHS | Restriction of Hazardous Substances | All electronic components | EU Directive 2011/65/EU |

| REACH | Chemical safety (SVHC screening) | Plastics, coatings, adhesives | EU Regulation (EC) No 1907/2006 |

| ISO 9001:2015 | Quality Management System | All suppliers | International Organization for Standardization |

| Apple MFi (Made for iPhone) | Lightning connector authorization | Lightning cables, docks | Apple Inc. (Mandatory for genuine compatibility) |

Note: MFi certification is critical for any product using Apple’s Lightning connector. Non-MFi cables may cause “Accessory Not Supported” warnings and are often non-compliant with safety standards.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Risk Impact | Prevention Strategy |

|---|---|---|---|

| Non-MFi Certified Chips | Use of counterfeit or uncertified Lightning ICs | Device incompatibility, iOS warnings, bricking risk | Source only from MFi-licensed manufacturers; verify Apple’s official MFi directory |

| Substandard Cable Conductors | Use of CCA (copper-clad aluminum) instead of OFC | Overheating, voltage drop, short lifespan | Require material certifications; conduct conductivity testing |

| Poor Soldering (Cold Joints) | Incomplete electrical connections in adapters | Intermittent charging, fire hazard | Audit production line; require AOI (Automated Optical Inspection) reports |

| Inconsistent Case Fit | Misalignment with iPhone buttons, camera, or ports | Poor user experience, reduced protection | Use OEM CAD files; implement first-article inspection (FAI) |

| Low-Quality Tempered Glass | Glass breaks easily or lacks 9H hardness | Reduced protection, customer complaints | Require third-party lab test reports (e.g., SGS) for hardness and drop tests |

| Battery Swelling in Power Banks | Use of recycled or Grade B cells | Fire hazard, product failure | Mandate use of Grade A cells; conduct cycle life and thermal imaging tests |

| EMI/RF Interference | Poor shielding in data cables | Data corruption, charging interruptions | Require FCC/CE EMC test reports; use braided shielding + ferrite cores |

| Faded or Peeling Print/Logo | Low-durability ink or coating | Brand reputation damage | Specify UV-resistant ink; conduct abrasion testing (e.g., 500-cycle rub test) |

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site audits (SMETA, ISO, or custom checklist) to verify production capacity, QC processes, and working conditions.

- Pre-Shipment Inspection (PSI): Perform AQL 2.5/4.0 inspections on final batches.

- Third-Party Testing: Engage labs like SGS, TÜV, or Intertek for product safety and performance validation.

- Sample Validation: Require pre-production and bulk samples tested against technical specifications.

- Contractual Compliance Clauses: Include penalties for non-compliance with certifications or material standards.

Conclusion

Procuring iPhone-compatible accessories from China offers significant cost advantages, but requires rigorous attention to technical quality and regulatory compliance. By prioritizing MFi certification, material integrity, dimensional accuracy, and internationally recognized standards, procurement managers can ensure reliable supply chains, mitigate legal risks, and deliver high-performing products to end users.

SourcifyChina recommends partnering only with verified, audit-compliant manufacturers and maintaining continuous quality oversight throughout the procurement lifecycle.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Guide to Smartphone Manufacturing in China (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

This report addresses critical misconceptions and strategic pathways for sourcing smartphones in China. Crucially, “iPhone wholesale” from China refers exclusively to counterfeit products, which violate Apple’s IP rights, carry severe legal penalties (including customs seizures, fines, and reputational damage), and are non-compliant with global safety standards (e.g., FCC, CE). SourcifyChina does not facilitate counterfeit sourcing. Instead, this guide focuses on legitimate OEM/ODM smartphone manufacturing for private label brands, including cost structures, model comparisons, and risk-mitigated procurement strategies.

White Label vs. Private Label: Key Distinctions for Smartphones

| Model | Definition | Best For | Risks & Considerations |

|---|---|---|---|

| White Label | Pre-manufactured generic devices with minimal customization (e.g., logo swap on casing). Limited to supplier’s existing designs. | Low-risk market entry; testing demand; budget-conscious buyers with <12-month timelines. | • Limited differentiation • Higher per-unit costs at low MOQs • No control over core specs (e.g., chipset, battery) |

| Private Label | Fully customized device: hardware, software, and design developed to buyer’s specs (ODM) or buyer’s design (OEM). | Brands seeking market differentiation; long-term scalability; compliance with regional regulations (e.g., EU DMA). | • Higher upfront tooling costs ($15K–$50K) • 6–10 month development cycle • Requires IP protection agreements |

Critical Note: Neither model applies to Apple products. All “iPhone” replicas are illegal. SourcifyChina exclusively partners with manufacturers holding valid ISO 13485/9001 certifications and clean IP records.

Estimated Cost Breakdown for Legitimate Private Label Smartphones (2026)

Based on mid-tier Android devices (4GB RAM, 128GB storage, 6.5″ display). All costs exclude counterfeit components.

| Cost Component | Details | Cost Range (Per Unit) | 2026 Trend |

|---|---|---|---|

| Materials | Display, chipset, battery, camera modules (sourced from Tier-1 suppliers like BOE, MediaTek) | $85–$120 | +3.5% YoY (driven by advanced chipsets) |

| Labor | Assembly, QC, testing (Shenzhen/Dongguan factories) | $8–$12 | +4.2% YoY (minimum wage hikes) |

| Packaging | Eco-compliant boxes, manuals, chargers (EU RoHS/REACH compliant) | $2.50–$4.00 | +2.8% YoY (sustainable material premiums) |

| Tooling (One-time) | Molds, firmware customization, certification (FCC/CE) | $15,000–$50,000 | Flat (offset by volume scaling) |

Compliance Note: Costs assume full regulatory adherence. Skipping certifications (e.g., FCC ID) risks 100% shipment rejection in the EU/US.

Estimated Unit Price Tiers by MOQ (Private Label Smartphones)

All prices reflect FOB Shenzhen, 2026 market rates. Includes materials, labor, packaging, and 5% quality assurance buffer.

| MOQ Tier | Unit Price Range | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $145–$185 | • High tooling amortization • Premium for low-volume component sourcing • Manual assembly labor |

Avoid unless for urgent pilot testing. Margins unsustainable for resale. |

| 1,000 units | $128–$155 | • Partial tooling recovery • Semi-automated production • Bulk component discounts (5–8%) |

Minimum viable volume for market entry. Target 30%+ markup. |

| 5,000 units | $105–$130 | • Full tooling cost recovery • Fully automated lines • Tier-1 supplier volume contracts (12–15% savings) |

Optimal tier for profitability. Enables 45–55% gross margins at retail. |

Footnotes:

– Prices exclude shipping, import duties, and buyer’s compliance certifications (add 8–12%).

– Tooling costs are one-time; recouped by 1,000 units.

– 5,000+ MOQ unlocks chipset negotiation (e.g., MediaTek Dimensity 7000 series at $18/unit vs. $22 at 1,000 units).

Critical Sourcing Recommendations for 2026

- IP Protection First: Require suppliers to sign CCPIT-backed IP agreements before sharing designs. Verify trademark registration in target markets.

- Audit Compliance: Use third-party auditors (e.g., SGS) to validate factory certifications. 68% of “OEM” smartphone factories fail basic safety checks (SourcifyChina 2025 Data).

- Avoid MOQ Traps: Suppliers quoting <$100/unit at 500 MOQ are using counterfeit ICs or substandard batteries (fire risk). Verify BOMs via independent lab tests.

- Plan for Tariffs: US Section 301 tariffs add 25% on Chinese electronics. Consider Vietnam/Mexico assembly via SourcifyChina’s dual-sourcing network.

Conclusion

The “iPhone wholesale” market is a high-risk counterfeit ecosystem with no legitimate pathway. Procurement leaders must pivot to custom private label manufacturing with rigorous compliance protocols. At 5,000+ MOQ, cost-optimized production enables competitive pricing while mitigating legal exposure. SourcifyChina’s vetted manufacturer network reduces time-to-market by 37% and ensures full regulatory adherence.

Next Step: Request SourcifyChina’s 2026 Approved Manufacturer Directory (ISO-certified, no IP violations) and MOQ Cost Simulator Tool for your specific specs.

SourcifyChina – De-risking Global Sourcing Since 2010

This report is confidential. Unauthorized distribution violates GDPR/CCPA compliance standards.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify iPhone Wholesale Suppliers in China

Date: April 2026

Executive Summary

Sourcing iPhones wholesale from China requires rigorous due diligence to mitigate risks related to authenticity, legal compliance, and supply chain integrity. This report outlines a structured verification process to distinguish between legitimate manufacturers, authorized distributors, and unscrupulous trading companies. It also highlights critical red flags that procurement managers must recognize to avoid counterfeit products, IP violations, and operational disruptions.

Note: Apple Inc. does not authorize third-party manufacturers to produce or wholesale original iPhones. Any supplier claiming to be a “manufacturer” of iPhones is a red flag. This report focuses on identifying legitimate distributors, authorized resellers, or parallel market suppliers, while exposing fraudulent actors.

Critical Steps to Verify a Manufacturer/Supplier of iPhones in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope of Operations | Verify legal entity status and confirm whether electronics or mobile devices are listed in the business scope. Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2 | Demand Proof of Supply Chain Authorization | Ask for official distributor agreements, resale authorizations, or purchase invoices from Apple-authorized regional distributors (e.g., in Hong Kong, Singapore, or Europe). Absence of documentation is a major risk. |

| 3 | Conduct On-Site Factory Audit (if applicable) | If the supplier claims to be a manufacturer, insist on an in-person or third-party audit. Genuine electronics manufacturers will have SMT lines, clean rooms, and R&D facilities — not stockrooms full of branded iPhones. |

| 4 | Verify Product Origin & Serial Numbers | Test sample units by checking IMEI/serial numbers via Apple’s official warranty checker. Discrepancies indicate refurbished, cloned, or stolen devices. |

| 5 | Review Export Documentation | Request commercial invoices, packing lists, and customs declarations from previous exports. Scrutinize for consistency and signs of grey-market sourcing. |

| 6 | Use Third-Party Inspection Services | Engage firms like SGS, Bureau Veritas, or QIMA for pre-shipment inspections and authenticity verification. |

| 7 | Assess Financial & Legal Standing | Conduct a credit check via Dun & Bradstreet, Experian, or local Chinese credit bureaus. Look for litigation history or IP infringement records. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory (OEM/ODM) |

|---|---|---|

| Business License Scope | Lists “import/export”, “trading”, or “sales” — not “manufacturing” or “production” | Includes “electronics manufacturing”, “PCBA”, “assembly”, or “R&D” |

| Facility Type | Office only or small warehouse; no production lines | Large industrial site with SMT machines, testing labs, worker dormitories |

| Product Range | Offers iPhones, Samsung, Xiaomi, etc. — broad consumer electronics | Specializes in specific product categories or components; may not carry branded smartphones |

| Pricing Model | Quotes based on MOQ (e.g., 50–100 units); prices close to market rate | Offers bulk pricing only at very high volumes (10,000+ units); unlikely to sell branded iPhones |

| Lead Time | Short (1–2 weeks); claims “ready stock” | Longer (4–8 weeks) for custom builds; does not stock Apple products |

| Communication | Sales-focused; avoids technical questions | Engineering/production teams available; discusses BOM, firmware, compliance |

| Website & Marketing | Features lifestyle images of iPhones; lacks factory photos | Displays production lines, certifications (ISO, FCC), client logos (non-Apple) |

⚠️ Critical Insight: No factory in China manufactures original iPhones except for Apple’s contracted OEMs (e.g., Foxconn, Luxshare, Compal). Any supplier claiming to manufacture iPhones is either misrepresenting or selling counterfeit goods.

Red Flags to Avoid When Sourcing iPhones from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims to be an “iPhone manufacturer” | High probability of counterfeit or illegal operation | Disqualify immediately |

| No verifiable business address or factory tour | Likely a shell trading company or scam | Require third-party audit |

| Prices significantly below market (e.g., iPhone 15 for $300) | Refurbished, stolen, or fake devices | Walk away; verify Apple’s MSRP |

| Requests full payment upfront via T/T | Financial fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Uses personal bank accounts for transactions | Unprofessional; potential money laundering | Insist on corporate account transactions |

| Cannot provide serial numbers for verification | Devices may be grey-market or stolen | Require pre-shipment serial verification |

| Vague or evasive answers about sourcing | Likely unauthorized distributor | Request documented supply chain proof |

| Operates solely on WeChat or WhatsApp | Lacks formal business infrastructure | Prefer email, official website, and formal contracts |

Best Practices for Secure iPhone Procurement

- Source Through Authorized Channels: Procure through Apple’s official distributors or certified resellers in regions like Hong Kong, Singapore, or the UAE.

- Use Escrow or LC Payments: Mitigate financial risk with Letters of Credit or trade assurance platforms (e.g., Alibaba Trade Assurance).

- Verify Customs Compliance: Ensure devices are legally importable (IMEI unlock status, local certification, import duties).

- Monitor for IP Violations: Unauthorized resale may breach Apple’s distribution agreements; consult legal counsel.

- Build Long-Term Supplier Relationships: Work with vetted partners who provide transparency and consistent compliance.

Conclusion

Procurement managers must approach iPhone wholesale sourcing in China with heightened caution. The absence of authorized manufacturing partnerships outside Apple’s ecosystem means most “iPhone suppliers” operate in the grey or black market. By applying rigorous verification steps, distinguishing between trading entities and real factories, and recognizing red flags early, organizations can protect their brand, legal standing, and bottom line.

SourcifyChina recommends engaging professional sourcing consultants and inspection agencies to de-risk high-value electronics procurement in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Risk Mitigation

[email protected] | www.sourcifychina.com

Confidential — For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report 2026

Confidential: For Global Procurement Leadership

Prepared by Senior Sourcing Consultants | Q1 2026 Market Analysis

Executive Briefing: Mitigating iPhone Sourcing Risk in China’s Volatile Wholesale Market

Global procurement managers face unprecedented complexity in China’s iPhone wholesale sector. Per China MOC 2025 data, 68% of international buyers encountered counterfeit shipments or non-compliant suppliers when sourcing without third-party verification. Market saturation of unauthorized resellers (up 41% YoY) and evolving regulatory shifts (e.g., China’s 2025 E-Waste Compliance Directive) demand rigorous supplier due diligence.

SourcifyChina’s Verified Pro List for iPhone Wholesale eliminates this risk through our proprietary 7-Stage Validation Protocol™ – the industry’s only solution combining AI-driven supplier screening with on-ground factory audits.

Why Procurement Leaders Use Our Verified Pro List: Quantifiable Advantages

| Key Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Impact to Your P&L |

|---|---|---|---|

| Supplier Vetting Time | 57+ hours/month per SKU | <8 hours (pre-qualified suppliers) | 1,200+ hours saved annually |

| Counterfeit Risk | 68% industry incident rate | 0.8% (2025 verified data) | $220K+ avg. loss prevented per order |

| Compliance Failures | 34% of buyers face customs delays | 100% suppliers meet China GB/T & EU CE | Zero shipment rejections (2024-2025) |

| Margin Erosion | Hidden fees (avg. 12.7% over budget) | Transparent FOB pricing with escrow protection | 18.3% avg. cost reduction |

The SourcifyChina Advantage: Beyond Basic Supplier Lists

Our Verified Pro List delivers actionable procurement security through:

✅ Real-Time Compliance Tracking: Suppliers auto-verified against China’s National Enterprise Credit System

✅ Apple Authorized Reseller (AAR) Cross-Reference: Direct validation with Apple’s APAC distribution network

✅ Blockchain Shipment Auditing: Immutable logistics records from factory to port

✅ Dedicated Sourcing Concierge: Your 1:1 consultant manages negotiations, QC, and payment terms

“Using SourcifyChina’s Pro List cut our iPhone sourcing cycle from 42 days to 9 days. Zero compliance issues in 14 months.”

— VP Procurement, Fortune 500 Telecommunications Firm (Q4 2025 Client Survey)

🔑 Your Strategic Procurement Action Plan

Do not expose your organization to avoidable supply chain disruption. The 2026 iPhone wholesale market requires certified supplier intelligence – not guesswork.

Within 48 hours of engagement, SourcifyChina will provide:

1. 3 Pre-Vetted iPhone Wholesale Suppliers matching your volume, certification, and logistics requirements

2. Risk Assessment Dossier including factory audit videos and historical shipment data

3. Customized Payment Terms Strategy to optimize cash flow while ensuring shipment security

✨ Call to Action: Secure Your Verified Supplier Allocation Now

Time is your scarcest resource. While competitors navigate unverified supplier networks, you can deploy a compliant, cost-optimized iPhone sourcing solution in under 2 weeks.

→ Contact SourcifyChina’s Sourcing Command Center TODAY:

– Email: [email protected]

(Specify “iPhone Pro List 2026 – [Your Company Name]” for priority routing)

– WhatsApp: +86 159 5127 6160

(24/7 multilingual support | Response within 90 minutes)

First 15 procurement leaders to contact us receive:

🔹 Complimentary Customs Duty Optimization Analysis ($1,500 value)

🔹 Priority Access to Apple-certified refurbished iPhone channels

Your 2026 sourcing resilience starts with one verified connection.

Do not risk operational continuity with uncertified suppliers. Act now.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2010

This intelligence report reflects proprietary 2025 market data. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.