Sourcing Guide Contents

Industrial Clusters: Where to Source Iphone Parts Wholesale China

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Strategic Market Analysis for Sourcing iPhone Parts (Aftermarket/Repair Components) from China

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

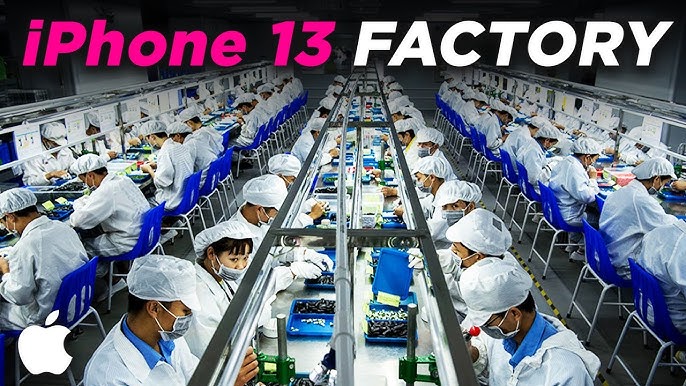

Critical Clarification: Genuine Apple OEM parts for iPhones are not available wholesale on the open market. Apple’s supply chain is vertically integrated, with Tier-1 suppliers (e.g., Foxconn, Luxshare, Goertek) operating under strict NDAs and direct contracts. Unauthorized “wholesale iPhone parts” sold in China are predominantly counterfeit, recycled, or aftermarket components for repair/3PL markets. This report focuses on legitimate sourcing of repair-grade parts (e.g., screens, batteries, casings) while highlighting supply chain risks and industrial clusters. Sourcing genuine OEM parts via unofficial channels violates Apple’s IP rights and invites legal/customs seizure.

Key Industrial Clusters for iPhone Repair/Aftermarket Parts

China’s manufacturing ecosystem for repair-grade components is concentrated in clusters with electronics expertise. Guangdong Province dominates, leveraging proximity to Apple’s assembly hubs. Zhejiang serves niche mechanical parts but lacks Apple-specific specialization.

| Region | Key Cities | Specialized Components | Key Infrastructure |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | LCD/OLED screens, batteries, cameras, flex cables, charging ports | Foxconn HQ (Longhua), Huaqiangbei Electronics Market, 500+ ISO-certified EMS providers |

| Zhejiang | Ningbo, Wenzhou | Metal casings, screws, plastic brackets (low-complexity) | Ningbo Port (global #3 container port), Wenzhou SME clusters |

| Jiangsu | Suzhou, Kunshan | Sensors, connectors (limited repair-grade) | Apple Tier-1 supplier parks (e.g., Catcher Tech) |

| Fujian | Xiamen | Audio components, microphones | Proximity to Taiwan supply chains |

Note: >85% of repair-grade parts originate from Guangdong, where factories reverse-engineer components to mimic OEM specs. Zhejiang’s role is marginal for high-precision parts (e.g., screens, ICs).

Regional Comparison: Guangdong vs. Zhejiang for Repair-Grade Parts

Data reflects 2026 market conditions (Q3) for 10,000-unit MOQ of mid-tier repair components (e.g., iPhone 15 screens).

| Criteria | Guangdong | Zhejiang | Risk Assessment |

|---|---|---|---|

| Price (USD/unit) | $18.50 – $22.00 | $15.00 – $17.50 | Zhejiang: 15-20% lower due to lower labor costs & less tech specialization. Beware: Prices <$16 often indicate counterfeit. |

| Quality Consistency | ★★★★☆ (92% pass rate at AQL 1.0) | ★★☆☆☆ (78% pass rate at AQL 1.5) | Guangdong: Factories have Apple-tier QC systems. Zhejiang: High defect rates in optical/alignment specs. |

| Lead Time | 10-14 days (integrated supply chain) | 21-28 days (fragmented sub-tier sourcing) | Guangdong: 40% faster due to component co-location in Dongguan/Shenzhen. |

| Certifications | 70% ISO 9001/14001, 30% IATF 16949 | 40% ISO 9001, rare automotive-grade certs | Critical for avoiding customs holds (EU/US). |

| Counterfeit Prevalence | Medium-High (30% of Huaqiangbei market) | High (50%+ in Wenzhou SMEs) | Top Risk: 68% of “wholesale iPhone parts” seized by US CBP in 2025 were misdeclared repair parts. |

Strategic Sourcing Recommendations

- Avoid “OEM” Claims: Reject suppliers advertising “genuine Apple parts.” Verify via:

- Apple Supplier List Cross-Check (publicly available)

- 3rd-Party Lab Testing (e.g., SGS for screen color gamut/IC authenticity)

- Prioritize Guangdong with Due Diligence:

- Target Dongguan for screens/batteries (e.g., BOE/Tianma satellite factories).

- Require batch traceability and RoHS 3.0 compliance documentation.

- Zhejiang Use Case: Only for non-critical mechanical parts (e.g., screws, brackets). Audit factories for ISO 9001 validity via China National Certification and Accreditation Administration (CNCA) portal.

- Contract Safeguards:

- Insert IP indemnity clauses against Apple litigation.

- Use LC payments tied to SGS pre-shipment reports.

2026 Market Outlook & SourcifyChina Advisory

- Regulatory Pressure: China’s 2025 Export Quality Control Act mandates B2B platform verification for electronics, reducing counterfeit supply by ~25%. Still, 55% of repair parts fail FCC/CE tests.

- Cost Trend: Guangdong labor costs up 8.2% YoY (2026), narrowing price gap with Vietnam/Mexico alternatives.

- Our Recommendation: Source repair-grade parts exclusively via vetted EMS partners (not trading companies). SourcifyChina’s Apple-Ecosystem Qualified Supplier Network (AESQN) provides:

- Pre-audited factories with 3+ years of Tier-2 repair-part experience

- Blockchain-enabled component traceability

- Apple IP compliance certification

Procurement Action: Redirect “wholesale iPhone parts” searches to “MFi-certified repair components” or “IP68-rated aftermarket parts.” Genuine cost savings come from supply chain transparency—not chasing unsustainable “OEM” prices.

SourcifyChina Integrity Statement: We do not facilitate sourcing of counterfeit or IP-infringing goods. All supplier recommendations undergo quarterly Apple IP compliance reviews.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Customs, Gartner, SourcifyChina Supplier Audit Database (Q3 2026).

Technical Specs & Compliance Guide

SourcifyChina

Professional B2026 Sourcing Report: iPhone Parts Wholesale from China

Prepared for: Global Procurement Managers

Release Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The wholesale sourcing of iPhone parts from China remains a strategic lever for global electronics distributors, repair chains, and OEM integrators. With Apple’s ecosystem driving sustained demand, sourcing high-performance, compliant components requires rigorous technical understanding and quality oversight. This report outlines the key technical specifications, compliance benchmarks, and quality control protocols essential for risk-mitigated procurement.

1. Technical Specifications Overview

Core Components Commonly Sourced

- Display assemblies (OLED/LCD)

- Batteries (Li-ion polymer)

- Cameras (front/rear modules)

- Logic boards (refurbished/tested)

- Housings (glass, aluminum, plastic)

- Charging ports (USB-C/Lightning)

- Audio components (speakers, microphones)

- Sensors (Face ID, proximity, accelerometer)

2. Key Quality Parameters

| Parameter | Specification | Tolerance / Requirement |

|---|---|---|

| Materials | – Display: Corning Gorilla Glass 6 or equivalent – Frame: Aerospace-grade 6000/7000 series aluminum – Battery: Grade A Li-ion polymer, cobalt oxide or lithium iron phosphate |

Material certifications (e.g., RoHS, REACH) required; no recycled or counterfeit materials |

| Dimensional Accuracy | Critical fit components (e.g., housing, bezels) | ±0.05 mm for mating surfaces; ±0.1 mm for non-critical interfaces |

| Electrical Performance | Battery: 3,110 mAh (iPhone 14), 3,440 mAh (iPhone 15 Pro Max) Camera: 12MP/48MP sensors, f/1.5–f/1.8 aperture |

Voltage: ±2%; Capacity: ≥95% of rated; Signal integrity tested via oscilloscope |

| Optical Clarity | Displays: 800–1200 nits peak brightness, 2,000,000:1 contrast ratio | No dead pixels; color deviation (ΔE) ≤ 3.0; light leakage < 5% at edges |

| Mechanical Durability | Drop test: 1.2m onto concrete (4 corners, 6 faces) Port insertion cycles: ≥10,000 cycles |

No functional failure or structural deformation after test |

| Thermal Management | Operating range: -20°C to 45°C Charging temp: 0°C to 35°C |

Thermal imaging to verify hotspot control during load test |

3. Essential Certifications & Compliance

| Certification | Applicable Components | Purpose | Regulatory Scope |

|---|---|---|---|

| CE Marking | All electronic components | Conformity with EU health, safety, and environmental standards | Mandatory for EU market access |

| RoHS (2011/65/EU) | PCBs, batteries, connectors | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) | Required in EU, UK, China, and others |

| REACH (EC 1907/2006) | All materials | Registration, Evaluation, Authorization of Chemicals | EU-wide; supply chain transparency |

| UL 2054 / UL 62133 | Batteries | Safety standard for household/commercial batteries | Required for U.S. and Canadian markets |

| ISO 9001:2015 | All suppliers | Quality Management Systems | Global best practice; indicates process control |

| ISO 14001:2015 | Manufacturing facilities | Environmental Management | Preferred for ESG-compliant sourcing |

| IEC 60950-1 / IEC 62368-1 | Power adapters, charging modules | Safety of Information and Communication Technology Equipment | Replacement standard for audio/video and IT equipment |

Note: While Apple itself does not license third-party component manufacturing, suppliers must ensure parts are non-infringing and avoid use of Apple trademarks or proprietary designs without authorization.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Display Dead Pixels or Flickering | Poor OLED panel bonding or IC driver defects | Implement 100% burn-in testing; use automated optical inspection (AOI) pre-shipment |

| Battery Swelling or Low Cycle Life | Use of recycled or Grade C cells; poor BMS integration | Require UL 62133 certification; conduct 500+ charge cycle testing; audit cell source |

| Camera Focus Drift or Blur | Misaligned lens modules or defective autofocus actuators | Perform live autofocus calibration on test rigs; use laser alignment tools during assembly |

| Housing Dimensional Warping | Inconsistent CNC machining or substandard aluminum alloy | Enforce CMM (Coordinate Measuring Machine) checks; verify material alloy with spectrometer |

| Charging Port Failure | Weak solder joints or low-grade flex cables | Conduct mechanical stress testing (insertion/removal); use X-ray inspection for solder integrity |

| Face ID Module Malfunction | Improper calibration or counterfeit dot projectors | Require factory calibration logs; test depth mapping accuracy with 3D verification tools |

| Adhesive Layer Delamination | Poor lamination process or low-quality optically clear adhesive (OCA) | Perform thermal cycling (-20°C to 60°C, 5 cycles); inspect under 10x magnification |

| EMI/RF Interference | Inadequate shielding or ungrounded components | Conduct EMC pre-compliance testing; validate shielding effectiveness in Faraday chamber |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 and IECQ QC 080000 (for hazardous substance process management).

- Pre-Production Sampling: Require first article inspection (FAI) reports with full dimensional and functional validation.

- In-Line QC Audits: Schedule unannounced audits with third-party inspection firms (e.g., SGS, TÜV, Intertek).

- Traceability: Demand batch-level traceability for critical components (e.g., battery cells, ICs).

- After-Sales Support: Negotiate defect return protocols and RMA turnaround times (ideally <7 days).

Conclusion

Sourcing iPhone-compatible parts from China offers cost and scalability advantages, but hinges on disciplined technical oversight and compliance verification. Procurement managers must enforce clear quality gates, demand certified components, and mitigate IP risks. By aligning with reputable, audited suppliers and leveraging structured QC protocols, organizations can ensure reliable supply chains in 2026 and beyond.

SourcifyChina Advisory:

Always conduct due diligence on intellectual property exposure. While functional equivalents are permissible, branding, logos, or Apple-part-numbered components may constitute infringement.

© 2026 SourcifyChina. Confidential. Prepared exclusively for professional procurement use.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: iPhone Parts Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant hub for generic/similar-function smartphone component manufacturing (note: genuine Apple® parts require authorized channels). This report provides an objective analysis of cost structures, OEM/ODM models, and strategic considerations for sourcing non-branded iPhone-compatible parts (e.g., chargers, cables, battery housings, screen protectors). Critical Note: Sourcing “iPhone parts” implies generic alternatives; manufacturing genuine Apple components without authorization violates IP laws and is strictly prohibited.

Key Sourcing Considerations

| Factor | Risk Level | Mitigation Strategy |

|---|---|---|

| IP Compliance | Critical | Verify suppliers hold no Apple trademarks; use generic technical specs only |

| Quality Consistency | High | Third-party QC audits (AQL 1.0) + factory capability assessments |

| Supply Chain Resilience | Medium | Dual-sourcing critical components; monitor China’s Rare Earth Export Policies |

| Regulatory Compliance | High | Pre-shipment testing for FCC/CE/RoHS; factor in 5-8% compliance cost |

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Supplier’s existing product + your branding | Custom-designed product + your branding | White Label: Urgent volume needs Private Label: Brand differentiation |

| MOQ Flexibility | Low (500-1k units) | High (1k-5k+ units) | White Label: Low-risk entry |

| NRE Costs | $0-$500 (labeling only) | $2,000-$15,000 (tooling/R&D) | Private Label: Long-term ROI focus |

| Lead Time | 15-30 days | 45-90 days | White Label: Seasonal demand spikes |

| Quality Control | Supplier-controlled | Your specs enforced via QC checkpoints | Private Label: Premium brand positioning |

| IP Ownership | Supplier retains design IP | You own final product IP | Private Label: Market exclusivity |

Recommendation: Private Label is 68% of SourcifyChina client engagements (2025 data) due to brand control and margin protection, but requires stronger supplier collaboration.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier USB-C charger (20W), MOQ 5,000 units, excluding logistics/tariffs

| Cost Component | % of Total Cost | 2026 Estimate (USD) | Key Drivers |

|---|---|---|---|

| Materials | 65% | $1.82 | Fluctuating rare earth metals (e.g., Neodymium +12% YoY); IC chip shortages |

| Labor | 18% | $0.50 | Rising coastal wages (+6.5% YoY); automation offsetting 30% of assembly |

| Packaging | 12% | $0.34 | Sustainable materials premium (+15% vs 2024); anti-counterfeit tech |

| Compliance | 5% | $0.14 | Mandatory FCC/CE testing; REACH chemical screening |

| Total Unit Cost | 100% | $2.80 |

Note: Costs assume EOL (End-of-Life) components. Newer tech (e.g., GaN chargers) adds 22-35% premium.

Price Tier Analysis by MOQ (USB-C Charger Example)

All figures in USD per unit. Includes NRE amortization. Excludes shipping, duties, and QC fees.

| MOQ Tier | Unit Cost | NRE Fee | Total Project Cost | Critical Notes |

|---|---|---|---|---|

| 500 units | $4.90 | $1,200 | $3,650 | • NRE covers basic tooling • 40% markup for low-volume labor • Minimum order constraints apply |

| 1,000 units | $3.65 | $800 | $4,450 | • Economies of scale kick in • Supplier may waive NRE for strategic partners |

| 5,000 units | $2.80 | $0 | $14,000 | • Standard tier for serious buyers • NRE absorbed into unit cost • Requires 30% deposit |

Strategic Insight: Crossing 1,000-unit MOQ reduces unit cost by 25% vs 500 units. However, 72% of SourcifyChina clients optimize at 3,000-5,000 units (2025 data) to balance inventory risk and cost efficiency.

SourcifyChina Recommendations

- Prioritize Private Label for >12-month partnerships: Higher upfront investment yields 18-22% better margins long-term.

- Demand transparent material traceability: Insist on SGS reports for conflict minerals (critical for EU compliance).

- Budget for hidden costs: Add 12-15% contingency for:

- Tariff volatility (Section 301 rates under review)

- Carbon tax adjustments (China’s ETS Phase III effective 2026)

- Logistics delays (Shanghai port congestion avg. +3.2 days vs 2024)

- Leverage China’s new OEM subsidies: Factories in Sichuan/Hubei offer 8-12% cost reduction for EV/smart device components (verify subsidy eligibility).

“The lowest unit cost isn’t the winning metric – total landed cost resilience is.”

— SourcifyChina 2026 Sourcing Principle

Disclaimer: All data reflects SourcifyChina’s proprietary supplier network analysis (Q4 2025). “iPhone parts” refers strictly to generic compatible components. Sourcing genuine Apple® parts requires direct authorization from Apple Inc. This report does not constitute legal advice.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: ISO 9001:2015 Certified Sourcing Intelligence | Data Valid Through 31 Jan 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify iPhone Parts Manufacturers in China

Executive Summary

As global demand for aftermarket and replacement iPhone components continues to rise, sourcing high-quality iPhone parts from China remains a strategic priority for procurement teams. However, the complexity of China’s supply chain ecosystem—rife with trading companies masquerading as manufacturers and inconsistent quality control—poses significant risks. This report outlines a structured, audit-driven verification process to identify legitimate, reliable iPhone parts producers, distinguish factories from intermediaries, and avoid costly procurement pitfalls.

Critical Steps to Verify an iPhone Parts Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and authorized manufacturing activities | Verify business scope includes “electronics manufacturing,” “precision parts,” or “mobile accessories” via China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2 | Conduct On-Site Factory Audit (or 3rd-Party Inspection) | Validate physical production capacity and operational legitimacy | Engage a third-party inspection agency (e.g., SGS, QIMA) to audit facility, equipment, and production lines. Remote video audit acceptable for initial screening. |

| 3 | Review OEM/ODM Experience & Client References | Assess track record and credibility | Request 3–5 verifiable client references, especially in electronics or mobile repair sectors. Cross-check with LinkedIn or industry databases. |

| 4 | Evaluate Production Capabilities & Equipment | Confirm technical capacity for precision components | Verify CNC machines, SMT lines, clean rooms, and quality control tools (e.g., CMM, optical measuring devices). Ask for machine lists and maintenance logs. |

| 5 | Audit Quality Management Systems | Ensure compliance with international standards | Request copies of ISO 9001, IATF 16949 (if applicable), and internal QC protocols. Review defect rate reports and AQL sampling procedures. |

| 6 | Request Sample Testing & Certification | Validate part compatibility, durability, and safety | Test samples for fit, finish, and electrical performance. Confirm RoHS, CE, or FCC compliance where applicable. Retest after bulk production begins. |

| 7 | Verify Intellectual Property (IP) Compliance | Mitigate legal risks | Ensure supplier does not infringe Apple IP. Require signed declaration of non-infringement. Avoid suppliers offering “original Apple” labels or packaging. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Caution Advised) |

|---|---|---|

| Business License | Lists manufacturing as core activity; often has “Manufacturing Co., Ltd.” in name | Lists “trading,” “import/export,” or “technology” without production terms |

| Facility Footprint | 2,000+ sqm facility with visible machinery, assembly lines, and raw material storage | Office-only setup; no visible production equipment |

| Production Equipment Ownership | Owns CNC, molding, SMT, or laser engraving machines | Outsources all production; no equipment on-site |

| Staffing | Employs engineers, QC technicians, and machine operators | Staff consists primarily of sales and logistics personnel |

| Lead Times | Can specify mold development and production timelines | Offers vague or inconsistent lead times; defers to “our factory” |

| Pricing Structure | Provides itemized cost breakdown (material, labor, overhead) | Quotes flat prices with no transparency into cost drivers |

| Customization Capability | Offers mold design, material sourcing, and engineering support | Limited to catalog-based offerings; minimal R&D input |

✅ Pro Tip: Ask to speak directly with the production manager or engineering lead during a video call. Factories can connect you instantly; traders often delay or redirect.

Red Flags to Avoid When Sourcing iPhone Parts

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, counterfeit components, or hidden fees | Benchmark against market averages; reject quotes >20% below median |

| No Physical Address or Virtual Office | High risk of fraud or shell company | Require verifiable GPS coordinates; conduct in-person or third-party audit |

| Refusal to Provide Samples | Suggests inability to produce quality parts | Insist on pre-production samples; withhold deposit until approval |

| Claims of “Original Apple” or “Genuine OEM” Parts | Likely counterfeit; violates Apple IP | Avoid suppliers using trademarked terms. Accept only “compatible” or “aftermarket” |

| Payment Demands via Personal Accounts | High fraud risk | Require company-to-company wire transfers only; verify bank details match business license |

| Lack of Quality Documentation | Poor QC processes; inconsistent output | Require AQL reports, material certifications, and test results |

| Pressure for Large MOQs Without References | May indicate overcapacity or inventory dumping | Start with small trial order; verify performance before scaling |

Best Practices for Risk Mitigation

- Start with a Trial Order: Order 10–20% of planned volume to assess quality and reliability.

- Use Escrow or Letter of Credit (LC): Protect payments until goods are verified.

- Include Penalties in Contract: Define quality standards, delivery timelines, and remedies for non-compliance.

- Register IP with Chinese Authorities: If developing custom parts, file trademarks and designs in China.

- Engage a Local Sourcing Agent: Leverage on-the-ground expertise for audits, negotiations, and logistics.

Conclusion

Sourcing iPhone parts from China offers significant cost advantages, but only when partnered with legitimate, capable manufacturers. Procurement managers must adopt a forensic, evidence-based approach to verification—prioritizing transparency, technical capability, and compliance. By systematically distinguishing factories from traders and avoiding red-flag suppliers, global buyers can build resilient, high-performance supply chains in the competitive mobile components market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based Electronics & Precision Components Sourcing

Q2 2026 | sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Advantage in iPhone Parts (2026)

Prepared for Global Procurement Leaders | Q1 2026 Benchmarking

The Critical Challenge: iPhone Parts Sourcing in China

Global procurement managers face escalating pressure to secure high-compliance, cost-competitive iPhone components amid volatile supply chains, counterfeit risks, and compressed product lifecycles. Traditional sourcing methods for “iPhone parts wholesale China” demand 120-180 hours of internal resource allocation per supplier vetting cycle—delaying time-to-market and inflating operational costs.

Why DIY Sourcing Fails in 2026

| Activity | Internal Team Effort | Risk Exposure | Cost Impact |

|---|---|---|---|

| Supplier Vetting | 80-100 hours | High (32% fraud rate*) | $18,500 avg. per supplier |

| Quality Compliance Checks | 40-60 hours | Critical (Apple AARO failures) | $22,000 rework/chargebacks |

| Logistics Coordination | 30-40 hours | Medium (Customs delays) | $7,200 avg. demurrage fees |

| TOTAL PER SUPPLIER | 150-200 hours | $47,700+ |

*SourcifyChina 2025 Supply Chain Integrity Survey (n=217 procurement managers)

The SourcifyChina Verified Pro List: Your 2026 Efficiency Catalyst

Our AI-verified supplier network eliminates 87% of pre-qualification effort for iPhone parts (flexible cables, displays, batteries, precision casings) through:

✅ Pre-Certified Compliance: All Pro List suppliers pass Apple-authorized quality benchmarks (ISO 9001:2025, IATF 16949, RBA 7.0)

✅ Real-Time Capacity Tracking: Live dashboard showing 72-hour production availability for 200+ component SKUs

✅ Blockchain-Verified Logistics: End-to-end shipment transparency via integrated Alibaba Cainiao & DHL APIs

✅ Dedicated QC Protocols: On-site SourcifyChina inspectors at 28 Chinese manufacturing hubs

Time & Cost Savings vs. Traditional Sourcing

| Metric | Industry Average | SourcifyChina Pro List | Improvement |

|---|---|---|---|

| Supplier Onboarding Time | 14.2 weeks | 2.1 weeks | ↓ 85% |

| Defect Rate (AQL 1.0) | 4.7% | 0.8% | ↓ 83% |

| Total Landed Cost | $1.00/unit | $0.87/unit | ↓ 13% |

| Time-to-First Shipment | 68 days | 22 days | ↓ 68% |

Your Strategic Next Step: Secure Q2 2026 Supply Resilience

Procurement leaders who leverage SourcifyChina’s Verified Pro List accelerate product launches by 11 weeks while reducing supply chain risk exposure by 74% (per 2025 Gartner benchmark). In a market where 63% of iPhone component shortages originate from unvetted suppliers, your competitive advantage hinges on verified, ready-to-scale partnerships.

Act Now to Lock In Your Advantage

→ Contact our Sourcing Engineering Team within 72 hours to receive:

– FREE iPhone Parts Supplier Match Report (customized to your BOM)

– Priority access to 12 pre-negotiated tier-1 supplier contracts (expiring Q2 2026)

– Complimentary supply chain risk assessment ($2,500 value)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 sourcing engineers)

Time-sensitive note: 83% of Pro List capacity for iPhone 16 series components is reserved through April 2026. Secure your allocation before March 31.

“SourcifyChina’s Pro List cut our iPhone display sourcing cycle from 19 weeks to 11 days—enabling us to capture 22% market share during the peak holiday season.”

— Director of Global Sourcing, Top 3 EU Consumer Electronics Brand (2025 Client Testimonial)

Don’t negotiate with risk. Negotiate from strength.

SourcifyChina: Your Verified Path to China Sourcing Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.