The global instant water heater market is experiencing robust growth, driven by rising energy efficiency standards, increasing urbanization, and growing consumer demand for compact, on-demand heating solutions. According to Grand View Research, the global electric water heater market size was valued at USD 11.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This surge is further amplified by rapid infrastructural development in emerging economies and a shift toward sustainable home appliances. With technological advancements enhancing performance and safety, instant electric water heaters have become a preferred choice in both residential and commercial sectors. As competition intensifies, a select group of manufacturers are leading innovation, scalability, and market penetration. Here’s a look at the top 9 instant water heater electric manufacturers shaping the industry’s future.

Top 9 Instant Water Heater Electric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

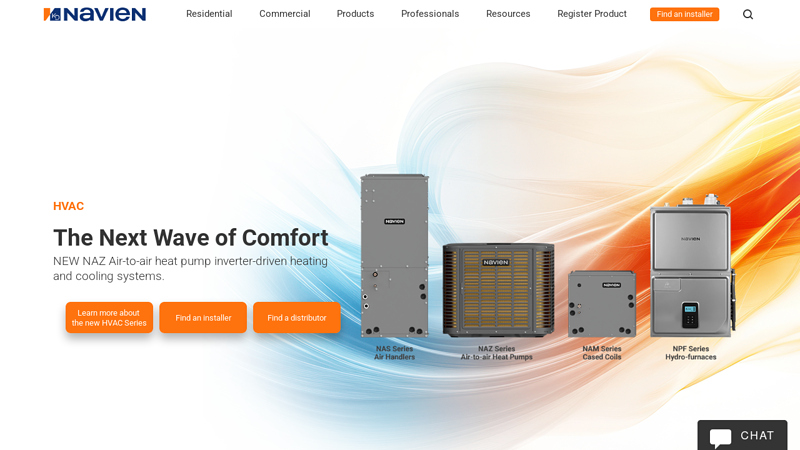

#1 Navien: High

Domain Est. 2016

Website: navieninc.com

Key Highlights: Advanced water heating, HVAC & water treatment solutions built on intelligent technology for lasting performance in residential & commercial environments….

#2 Rheem Manufacturing Company

Domain Est. 1995

Website: rheem.com

Key Highlights: Learn about Rheem’s innovative and efficient heating, cooling, and water heating solutions for homes and businesses….

#3 Eemax

Domain Est. 1999

Website: eemax.com

Key Highlights: At Eemax, our goal is to design and build safe, efficient, code-compliant tankless and miniature tank electric water heaters that support sustainable, ……

#4 Chronomite

Domain Est. 1999

Website: chronomite.com

Key Highlights: By heating water instantaneously, Chronomite electric tankless water heaters offer water & energy savings, resulting in lower maintenance & operational ……

#5 Noritz

Domain Est. 1999

Website: noritz.com

Key Highlights: Noritz tankless water heaters are engineered for superior performance, offering endless hot water while reducing energy costs and environmental impact….

#6 Reliance Water Heaters

Domain Est. 2002

Website: reliancewaterheaters.com

Key Highlights: Find residential tankless models, tank, heat pumps, and pump tanks. Explore Reliance Water Heater’s line of gas and electric water heaters….

#7 Tankless Electric Water Heaters

Domain Est. 2004

Website: richmondwaterheaters.com

Key Highlights: Instant Hot Water / Point of Use & Whole Home Options / Easy Installation / Heats Water Only When You Need It for Maximum Savings…

#8 EcoSmart

Domain Est. 2008

Website: ecosmartus.com

Key Highlights: Why Tankless Electric Water Heater? Tankless water heaters provide the comfort & convenience of having a continuous supply of hot water. Read More ……

#9 Intellihot

Domain Est. 2005

Website: intellihot.com

Key Highlights: Intellihot’s innovative tankless designs makes it the best commercial tankless water heater manufacturer in the United States and Canada….

Expert Sourcing Insights for Instant Water Heater Electric

H2: 2026 Market Trends for Instant Water Heater Electric

The global market for electric instant water heaters is poised for significant transformation by 2026, driven by technological innovation, sustainability imperatives, and evolving consumer demands. Here’s a comprehensive analysis of key trends shaping this sector:

1. Smart Integration & IoT Connectivity (H3)

By 2026, smart features will become standard rather than premium. Electric instant water heaters will increasingly integrate with home automation ecosystems (e.g., Google Home, Apple HomeKit, Amazon Alexa). Users will control temperature, monitor energy usage, and receive maintenance alerts via smartphone apps. Predictive algorithms will optimize heating schedules based on usage patterns, enhancing convenience and efficiency.

2. Energy Efficiency & Regulatory Pressure (H3)

Stricter global energy efficiency standards (e.g., updated MEPS in Asia-Pacific, EU Ecodesign) will push manufacturers to innovate. Expect widespread adoption of high-efficiency heating elements, advanced insulation materials, and real-time power modulation. Units with ENERGY STAR or equivalent certifications will dominate, driven by consumer awareness and government incentives for green appliances.

3. Sustainability & Green Materials (H3)

Environmental concerns will influence design and manufacturing. Brands will prioritize recyclable materials (e.g., aluminum, stainless steel) and reduce plastic components. Carbon footprint labeling and take-back programs will emerge as competitive differentiators. Low-GWP (Global Warming Potential) manufacturing processes and supply chain transparency will gain importance.

4. Compact & Space-Optimized Designs (H3)

Urbanization and smaller living spaces (especially in Asia and Europe) will fuel demand for ultra-compact, wall-mountable units. Design innovation will focus on minimalist aesthetics, easy retrofitting into existing plumbing, and reduced visual footprint. Point-of-use (POU) heaters under sinks or in bathrooms will see accelerated adoption.

5. Advanced Safety & Diagnostics (H3)

Safety features will become more sophisticated. Beyond standard dry-fire and overheat protection, AI-driven diagnostics will detect limescale buildup, voltage fluctuations, or component wear, alerting users proactively. Enhanced leak detection and automatic shutdown systems will bolster consumer confidence.

6. Regional Market Divergence (H3)

– Asia-Pacific: Dominates volume growth (led by China, India, Southeast Asia) due to urbanization, rising disposable income, and government electrification programs. Tankless models favored for water-scarce regions.

– North America & Europe: Driven by renovation markets, energy regulations, and smart home trends. Higher willingness to pay for premium, feature-rich models.

– Emerging Markets (Africa, LATAM): Growth tied to infrastructure development and off-grid solar compatibility.

7. Competitive Landscape & Pricing (H3)

Market consolidation will accelerate, with key players (e.g., AO Smith, Haier, Stiebel Eltron, Bosch) expanding portfolios through R&D and acquisitions. Mid-tier brands will compete on price-performance, while premium segments emphasize design and smart features. Entry-level models will become more affordable, expanding market reach.

8. Electrification & Renewable Energy Synergy (H3)

As global electrification of heating increases, instant electric water heaters will align with solar PV and battery storage systems. Units with load-shifting capabilities (e.g., heating during off-peak solar hours) will gain traction, supporting grid stability and reducing energy costs.

Conclusion:

By 2026, the electric instant water heater market will be defined by intelligence, efficiency, and sustainability. Success will hinge on integrating cutting-edge technology with eco-conscious design, while adapting to diverse regional needs. Consumers will prioritize not just instant hot water, but seamless, energy-smart, and future-proof solutions.

Common Pitfalls When Sourcing Instant Water Heater Electric (Quality, IP)

Sourcing instant electric water heaters requires careful attention to both product quality and Ingress Protection (IP) ratings to ensure safety, durability, and performance. Overlooking key factors can lead to poor user experiences, safety hazards, or costly replacements. Below are common pitfalls to avoid:

1. Prioritizing Low Cost Over Build Quality

One of the most frequent mistakes is selecting the cheapest available unit without evaluating internal components. Low-cost models often use inferior materials such as:

- Thin or low-grade heating elements prone to scaling and burnout

- Plastic tanks or housings that degrade over time

- Poorly sealed electrical connections increasing risk of leaks or shorts

Solution: Invest in units from reputable manufacturers using high-quality materials like copper or stainless-steel heating elements and robust housings.

2. Ignoring Ingress Protection (IP) Ratings

The IP rating indicates protection against dust and water ingress. Using a unit with an insufficient IP rating—especially in humid environments like bathrooms—can lead to electrical failures or safety risks.

Common Pitfalls:

– Selecting IPX4 units for direct shower installation (minimal splash protection)

– Installing indoor-rated units (e.g., IP24) outdoors or in wet zones

– Not verifying both digits of the IP rating (e.g., IP25 = limited dust protection, water jets from one direction)

Solution: Choose a minimum of IPX5 for bathroom installations near showers, and IP65 or higher for outdoor or exposed wet areas.

3. Overlooking Safety Certifications

Units lacking recognized safety certifications (e.g., CE, UL, ETL, SAA, or local standards) may not meet electrical or thermal safety requirements.

Risk: Non-certified heaters can overheat, leak, or cause electric shocks due to inadequate grounding or faulty thermostats.

Solution: Always verify compliance with regional safety standards and request certification documentation from suppliers.

4. Mismatched Power and Water Flow Requirements

Sourcing heaters without matching local voltage, phase, and water pressure can lead to underperformance or damage.

Pitfalls:

– Installing a 3-phase unit where only single-phase power is available

– Using high-flow models with low water pressure, resulting in lukewarm output

– Exceeding circuit load capacity, tripping breakers

Solution: Confirm electrical specs (kW, voltage, amperage) and water flow rates (L/min) align with site conditions.

5. Poor Thermal Efficiency and Energy Waste

Low-quality instant heaters often lack precision temperature control and efficient heat transfer, leading to:

- Overheating and scalding risks

- Inconsistent water temperature

- Higher electricity consumption

Solution: Choose models with digital thermostats, overheat protection, and energy-saving modes.

6. Inadequate Warranty and After-Sales Support

Some suppliers offer long warranties but lack local service centers or spare parts, making repairs difficult.

Pitfall: Buying from unknown brands with no technical support or repair network.

Solution: Source from suppliers with clear warranty terms and accessible customer service and spare parts.

7. Misunderstanding Installation Environment

Failing to assess ambient conditions—such as ambient temperature, humidity, and exposure to weather—can result in premature failure.

Example: Installing a non-weatherproof unit in a semi-outdoor bathroom with high humidity.

Solution: Match the heater’s IP rating and enclosure type to the installation environment.

By avoiding these common pitfalls, you can ensure reliable, safe, and efficient performance from your sourced instant electric water heaters. Always prioritize certified quality, appropriate IP ratings, and technical compatibility.

Logistics & Compliance Guide for Instant Water Heater (Electric)

This guide outlines essential logistics considerations and compliance requirements for the distribution, import, and sale of electric instant water heaters. Adhering to these guidelines ensures safe handling, regulatory conformity, and market access.

Product Classification and Documentation

Accurate product classification is critical for customs clearance and regulatory compliance. Electric instant water heaters typically fall under Harmonized System (HS) codes related to electrical heating equipment. Common classifications include:

– HS Code Example: 8516.10 (Electric instantaneous or storage water heaters)

Documentation required for international logistics includes:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Product Compliance Certificates (e.g., CE, UL, CCC)

– Technical data sheets and user manuals

Regulatory Compliance by Region

Electric instant water heaters must meet region-specific safety and performance standards. Key certifications include:

– North America (USA & Canada):

– UL 174 or UL 499 (Standard for Electric Storage-Type Water Heaters or Heating Appliances)

– CSA C22.2 No. 69 (Canadian standards for electric water heaters)

– ENERGY STAR certification (if applicable for energy efficiency)

– European Union:

– CE Marking per Low Voltage Directive (LVD 2014/35/EU) and Electromagnetic Compatibility (EMC) Directive (2014/30/EU)

– Compliance with EN 60335-1 and EN 60335-2-21 (safety of household water heaters)

– Ecodesign and Energy Labeling Regulations (EU) 2015/1188

– China:

– CCC (China Compulsory Certification) under GB 4706.1 and GB 4706.11

– China Energy Label (CEL) required

– Australia & New Zealand:

– RCM Mark (Regulatory Compliance Mark)

– Compliance with AS/NZS 3947.5.4 and AS/NZS 60335.2.21

– GEMS (Greenhouse and Energy Minimum Standards) Registration

Packaging and Handling Requirements

Proper packaging ensures product integrity during transit:

– Use sturdy, corrugated cardboard boxes with internal cushioning (foam inserts or molded pulp)

– Include moisture-resistant wrapping to prevent condensation damage

– Clearly label packages with:

– Product name and model number

– Weight, dimensions, and handling symbols (e.g., “Fragile,” “This Side Up”)

– Regulatory marks (e.g., CE, UL)

– Barcodes and serial numbers for traceability

Import and Customs Clearance

Successful customs clearance depends on:

– Accurate HS code classification to determine tariffs and duties

– Submission of required compliance documents (test reports, certificates)

– Compliance with local import regulations (e.g., EPA rules in the U.S., REACH in the EU)

– Payment of applicable import duties, VAT, or GST

– Use of licensed customs brokers for complex markets

Storage and Inventory Management

Optimize warehouse operations by:

– Storing units in dry, temperature-controlled environments

– Avoiding stacking beyond recommended limits to prevent damage

– Implementing FIFO (First In, First Out) inventory rotation

– Securing units against theft and environmental hazards (e.g., water, dust)

Transportation and Distribution

Choose transportation modes based on cost, speed, and product sensitivity:

– Maritime Shipping: Preferred for large volumes; ensure containers are sealed and protected from humidity

– Air Freight: Faster but costlier; suitable for urgent or high-value shipments

– Overland Transport: Ideal for regional distribution; use enclosed, climate-controlled trucks when possible

– Monitor shipments using GPS tracking and ensure carriers are experienced in handling electrical appliances

End-of-Life and Environmental Compliance

Comply with environmental regulations for product disposal and recycling:

– Adhere to WEEE (Waste Electrical and Electronic Equipment) Directive in the EU

– Follow EPA guidelines for disposal in the U.S.

– Provide take-back programs or partner with certified e-waste recyclers

– Design for disassembly and recyclability to meet circular economy standards

Quality Control and Post-Market Surveillance

Maintain compliance throughout the product lifecycle:

– Conduct pre-shipment inspections to verify product conformity

– Monitor customer feedback and field failures

– Report and address safety incidents per regulatory requirements (e.g., RAPEX in the EU, CPSC in the U.S.)

– Maintain technical files and test reports for audit readiness

Adherence to this logistics and compliance guide ensures safe, legal, and efficient distribution of electric instant water heaters across global markets.

In conclusion, sourcing an instant electric water heater requires careful consideration of several key factors to ensure optimal performance, safety, energy efficiency, and cost-effectiveness. It is essential to evaluate the product specifications—such as wattage, flow rate, temperature control, and voltage requirements—based on the intended application and regional electrical standards. Sourcing from reputable suppliers or manufacturers with certifications (e.g., CE, UL, RoHS) ensures product reliability and compliance with safety regulations.

Additionally, comparing prices, warranties, and after-sales support can significantly impact long-term satisfaction and maintenance costs. Whether sourcing for residential, commercial, or industrial use, understanding local climate conditions and water quality will help in selecting a durable and efficient model. Partnering with trusted suppliers who offer technical support and scalable solutions further enhances the sourcing process.

Ultimately, a well-informed sourcing strategy for instant electric water heaters not only ensures immediate usability but also contributes to energy conservation, reduced operational costs, and improved user satisfaction.