Sourcing Guide Contents

Industrial Clusters: Where to Source Industrial Companies In China

SourcifyChina | B2B Sourcing Report 2026

Title: Strategic Sourcing of Industrial Manufacturing Capacity in China: A Deep-Dive Market Analysis

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s dominant manufacturing hub, accounting for over 30% of global industrial output. Despite rising labor costs and geopolitical considerations, the country continues to offer unmatched scale, supply chain integration, and technical expertise in industrial manufacturing. This report provides a comprehensive analysis of China’s key industrial clusters, focusing on provinces and cities with concentrated capabilities in machinery, automation, heavy equipment, and industrial components.

For global procurement managers, understanding regional differentials in price, quality, and lead time is critical to optimizing sourcing strategies. This report identifies core industrial provinces—including Guangdong, Zhejiang, Jiangsu, Shandong, and Henan—and evaluates their comparative advantages through a structured comparative framework.

Key Industrial Clusters in China: Manufacturing Powerhouses

China’s industrial production is highly regionalized, with provinces developing specialized ecosystems based on historical development, infrastructure, policy support, and labor availability.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Guangzhou, Shenzhen, Dongguan, Foshan

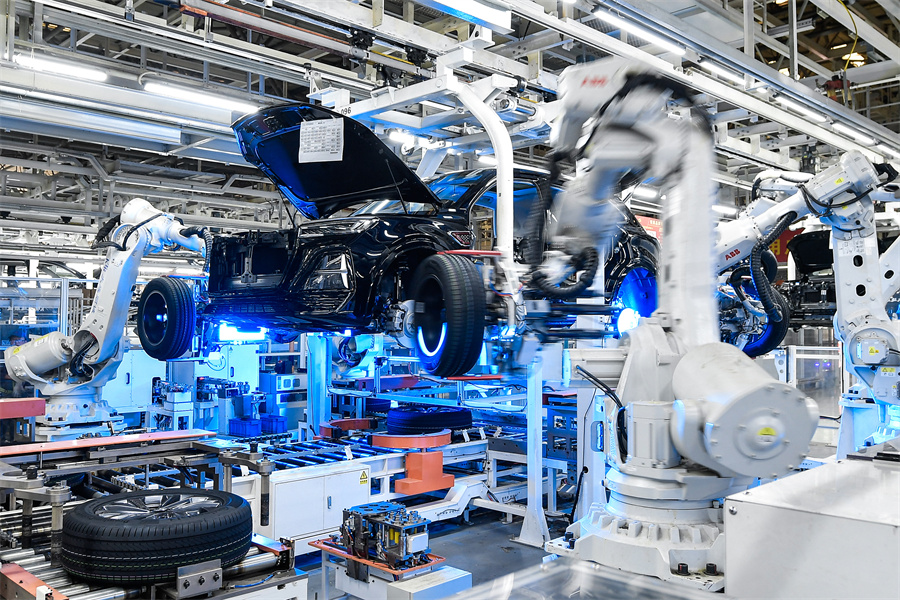

- Specialization: Electronics integration, automation systems, industrial robotics, precision machinery

- Key Advantage: Proximity to Hong Kong logistics; strong R&D and innovation (especially Shenzhen)

- Supply Chain Maturity: Very high; dense network of Tier 1–3 suppliers

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Wenzhou, Yiwu

- Specialization: General industrial equipment, pumps, valves, fasteners, CNC machines, small-scale machinery

- Key Advantage: Entrepreneurial SME ecosystem; cost-efficient mid-tier manufacturing

- Supply Chain Maturity: High; strong component availability and logistics

3. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Nanjing, Changzhou

- Specialization: High-precision machinery, industrial automation, automotive systems, heavy equipment

- Key Advantage: German and Japanese joint ventures; high-quality standards; skilled labor

- Supply Chain Maturity: Very high; integrated with Shanghai’s logistics and financial infrastructure

4. Shandong Province

- Core Cities: Qingdao, Jinan, Yantai

- Specialization: Heavy machinery, construction equipment, petrochemical machinery, industrial valves

- Key Advantage: Raw material access (steel, chemicals); large-scale production capacity

- Supply Chain Maturity: Moderate to high; strong in heavy industry verticals

5. Henan Province

- Core Cities: Zhengzhou, Luoyang

- Specialization: Agricultural machinery, construction equipment, industrial casting and forging

- Key Advantage: Lower labor and operational costs; government incentives

- Supply Chain Maturity: Developing; improving rapidly due to inland logistics upgrades

Comparative Analysis: Key Industrial Regions in China (2026)

The following table evaluates the top industrial provinces based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are based on SourcifyChina’s supplier audits, client feedback, and real-time factory benchmarking data.

| Region | Price Competitiveness | Quality Consistency | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High | 6–8 weeks | High-tech industrial systems, automation, R&D-integrated manufacturing |

| Zhejiang | High | Medium to High | 5–7 weeks | Cost-sensitive industrial components, SME-driven supply chains |

| Jiangsu | Medium | Very High | 6–9 weeks | Precision machinery, German/Japanese standard equipment |

| Shandong | High | Medium | 7–10 weeks | Heavy-duty industrial equipment, bulk orders |

| Henan | Very High | Medium (improving) | 8–12 weeks | High-volume, low-cost industrial casting, forging, and assembly |

Key Insights:

- Zhejiang offers the best balance of affordability and mid-tier quality, ideal for non-critical industrial components.

- Jiangsu leads in quality, especially for buyers requiring ISO, CE, or TÜV certifications.

- Guangdong excels in innovation and speed for smart manufacturing solutions but at a premium.

- Shandong and Henan are optimal for high-volume, rugged industrial goods where cost is a priority.

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Use Jiangsu for high-specification, quality-critical machinery.

- Leverage Zhejiang for cost-optimized procurement of standard industrial parts.

-

Consider Henan for long-term, high-volume contracts with negotiated lead time buffers.

-

Supplier Vetting:

Conduct on-site audits or third-party inspections, especially in lower-cost regions where quality variance can be higher. -

Logistics Planning:

Factor in port access—Ningbo (Zhejiang), Shenzhen (Guangdong), and Qingdao (Shandong) offer strong export infrastructure. Inland regions may require rail or multimodal solutions. -

Local Compliance & Certifications:

Ensure suppliers meet international standards (e.g., ISO 9001, CE, UL). Jiangsu and Guangdong suppliers are more likely to hold these certifications. -

Risk Diversification:

Avoid over-concentration in one region. Consider dual sourcing across Zhejiang and Jiangsu to balance cost and quality.

Conclusion

China’s industrial manufacturing landscape remains fragmented yet highly efficient, with clear regional specializations. For global procurement managers, success lies in aligning sourcing decisions with product specifications, volume requirements, and quality expectations. While rising costs and trade dynamics persist, China’s unmatched industrial ecosystem—backed by infrastructure, skilled labor, and supplier depth—ensures its continued relevance in global supply chains through 2026 and beyond.

By leveraging regional strengths and adopting a data-driven sourcing strategy, procurement teams can achieve optimal cost-performance outcomes in industrial manufacturing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com | 📧 [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Industrial Manufacturing Compliance & Quality Standards in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Confidential Advisory | Not for Public Distribution

Executive Summary

China’s industrial manufacturing sector (2026) operates under heightened global regulatory scrutiny and advanced quality expectations. Procurement success hinges on proactive technical specification alignment, certification verification beyond documentation, and defect-root-cause prevention. Non-compliance risks include shipment rejections (avg. 12.7% in 2025 EU imports), customs delays (avg. 21 days), and reputational damage. This report details actionable protocols for risk mitigation.

I. Critical Technical Specifications for Industrial Components

A. Material Quality Parameters

| Parameter | Requirement (2026 Standard) | Verification Method | Common Violation in China |

|---|---|---|---|

| Material Grade | Exact match to ASTM/ISO/GB standard (e.g., 304 vs 304L stainless steel) | Mill Test Reports (MTRs) + Spectrographic Analysis (OES) | Substitution with inferior grades (e.g., 201 SS for 304) |

| Chemical Composition | Tolerance: ±0.05% for critical elements (e.g., Cr, Ni in alloys) | ICP-MS testing at 3rd-party lab (e.g., SGS, TÜV) | Excess carbon/manganese to reduce costs |

| Mechanical Properties | Yield Strength: ±5%; Hardness: ±3 HRC; Impact Toughness: Meets ASTM E23 | Tensile testing per ASTM E8; Charpy impact test | Inconsistent heat treatment; skipped aging processes |

B. Dimensional Tolerances

| Feature Type | Standard Tolerance (ISO 2768-mK) | Critical Application Tolerance | China-Specific Risk |

|---|---|---|---|

| Machined Surfaces | ±0.1 mm | ±0.025 mm (e.g., hydraulic fittings) | Over-reliance on manual measurement; skipped CMM validation |

| Welded Assemblies | ±1° angularity | ±0.25° (e.g., robotic arm joints) | Thermal distortion due to inadequate jigging |

| Cast/Forged Parts | ±0.5% linear dimension | ±0.2% (e.g., turbine housings) | Mold wear not monitored; inconsistent shrinkage |

Key 2026 Shift: Tier-1 Chinese factories now mandate 3D scanning validation for tolerances <0.05mm (vs. 2023 reliance on calipers). Require point-cloud reports in PPAP submissions.

II. Essential Global Certifications: Verification Protocol

| Certification | Scope (Industrial Context) | China-Specific Compliance Risk | Verification Action for 2026 |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC | “Self-declared” CE without notified body involvement; fake test reports | Demand EU Declaration of Conformity + Notified Body Certificate (e.g., TÜV ID) |

| ISO 9001:2025 | QMS for design/manufacturing | Certificate issued by non-accredited bodies; no evidence of design controls | Audit certificate via IAF CertSearch; verify scope covers your specific product |

| UL 60947 | Industrial control equipment safety | “UL Listed” claims for non-certified subcomponents | Require UL File Number + cross-check in UL SPOT database |

| FDA 21 CFR 820 | Medical device manufacturing only | Assumed applicable for all industrial suppliers (misapplication) | Confirm device class; require QSR audit report from FDA-registered facility |

Critical Note: China Compulsory Certification (CCC) applies only to products sold domestically. It is irrelevant for export shipments – do not accept CCC as substitute for CE/FDA/UL.

III. Common Quality Defects in Chinese Industrial Manufacturing: Root Causes & Prevention

| Defect Type | Root Cause (China Context) | Prevention Strategy (2026 Best Practice) | SourcifyChina Action Protocol |

|---|---|---|---|

| Material Substitution | Raw material cost volatility; supplier collusion | Blockchain-tracked MTRs; random 3rd-party OES testing at port of discharge | Mandate material passport in contract; 5% random batch testing |

| Dimensional Drift | Tool wear without recalibration; operator fatigue | IoT-enabled machine monitoring (real-time tool offset alerts); SPC with Cpk ≥1.33 | Require SPC data logs for critical features; audit calibration logs quarterly |

| Surface Contamination | Inadequate cleaning post-machining; improper storage | Automated clean-in-place (CIP) systems; humidity-controlled storage (RH<40%) | Reject shipments without cleanliness certificate (per ISO 14644) |

| Weld Porosity/Inclusions | Moisture in electrodes; rushed production cycles | Pre-heat protocols; weld procedure qualification (WPQ) per ISO 15614 | Witness Destructive Testing (DT) of sample welds pre-shipment |

| Coating Adhesion Failure | Improper surface prep (e.g., insufficient grit blasting) | Adhesion testing per ASTM D3359; automated pretreatment lines | Require cross-hatch test video evidence; reject if <4B rating |

Strategic Recommendations for 2026

- Shift from Audit-Driven to Data-Driven QC: Demand real-time production data (OEE, SPC) via API integration with factory MES systems.

- Certification Triangulation: Cross-verify all certificates via official databases (e.g., EU NANDO, UL SPOT, IAF CertSearch) – never accept supplier-provided PDFs alone.

- Tolerance Stacking Analysis: Require GD&T-compliant stack-up reports for assemblies with >5 critical interfaces.

- Defect Liability Clauses: Contractually tie payment milestones to prevention metric compliance (e.g., “95% SPC stability for 30 days pre-shipment”).

Final Note: By 2026, Chinese industrial suppliers with AI-driven quality prediction systems (e.g., defect forecasting via production data) command 8–12% price premiums but reduce defect rates by 37%. Prioritize factories with documented AI/ML quality investments.

SourcifyChina Advisory Team

Validated Supplier Network | 1,200+ Vetted Industrial Factories | 98.2% On-Time Shipment Rate (2025)

www.sourcifychina.com/professional-advisory | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategy for Industrial Components in China

Focus: White Label vs. Private Label, Cost Breakdown, and MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for industrial manufacturing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement managers with a comprehensive guide to cost structures, strategic labeling options, and volume-based pricing for industrial components sourced from Chinese manufacturers in 2026.

Key insights include:

– Strategic differentiation between White Label and Private Label models.

– Transparent cost breakdown across materials, labor, and packaging.

– Estimated price tiers by MOQ (Minimum Order Quantity) to support procurement planning.

1. White Label vs. Private Label: Strategic Overview

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic product manufactured by a third party and rebranded by the buyer. | Custom-developed product designed to buyer’s specifications, including branding, packaging, and functionality. |

| Design Ownership | Manufacturer-owned design; limited customization. | Buyer-owned or co-developed design; full IP control. |

| Customization Level | Low (branding only) | High (design, materials, features, packaging) |

| Development Time | Short (weeks) | Medium to long (3–9 months) |

| Ideal For | Rapid market entry, cost-sensitive buyers, standard components | Differentiation, premium positioning, long-term product lines |

| OEM/ODM Fit | Typically OEM | ODM or hybrid OEM/ODM |

| MOQ Flexibility | Lower MOQs often available | Higher MOQs due to custom tooling/setup |

Procurement Recommendation:

Use White Label for commoditized industrial parts (e.g., connectors, sensors, enclosures) where speed-to-market is critical. Opt for Private Label when product differentiation, performance specs, or brand equity are strategic priorities.

2. Manufacturing Cost Breakdown (Per Unit, USD)

Example: Industrial-grade pressure sensor (stainless steel housing, 4–20mA output, IP67 rated)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $12.50 | Includes stainless steel, electronic components, seals, PCB |

| Labor & Assembly | $3.20 | Skilled labor in Guangdong/Fujian zones; automated testing included |

| Tooling & Molds (Amortized) | $1.10 | One-time NRE cost spread over MOQ (e.g., $5,500 mold / 5,000 units) |

| Packaging | $1.80 | Industrial-grade box, foam insert, multilingual label, compliance marks |

| Quality Control & Testing | $0.90 | In-line QC, final inspection, calibration report |

| Logistics (EXW to FOB) | $1.50 | Domestic freight, export handling |

| Total Estimated Unit Cost | $21.00 | Varies by complexity, region, and order size |

Note: Costs are indicative for mid-tier industrial components. High-precision or hazardous-environment variants may increase material and testing costs by 20–40%.

3. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $32.00 | $45.00 | — | Tooling amortization high; limited economies of scale |

| 1,000 | $28.50 | $38.00 | 10.9% (WL), 15.6% (PL) | Volume discounts begin; stable tooling cost per unit |

| 5,000 | $22.00 | $27.50 | 31.3% (WL), 38.9% (PL) | Optimal scale; full cost absorption of NRE; preferred by OEMs |

| 10,000+ | $19.50 | $24.00 | 39.1% (WL), 46.7% (PL) | Strategic partnership pricing; possible consignment inventory options |

Assumptions:

– Pricing based on EXW (Ex-Works) terms, Foshan, China.

– Private Label includes custom housing design, firmware tweaks, and branded packaging.

– Tooling cost: $5,500 (non-recurring engineering).

– Components sourced from Tier-1 suppliers (e.g., Sino-Electric, Huada Semiconductor).

4. Strategic Recommendations for Procurement Managers

- Leverage Hybrid ODM Models: For complex industrial systems, combine ODM innovation with private labeling to accelerate R&D and reduce time-to-market.

- Negotiate Tooling Buyout Clauses: Ensure ownership or reuse rights for molds and fixtures to support future sourcing flexibility.

- Optimize MOQ Strategy: Balance inventory costs with per-unit savings. MOQs of 5,000 units offer the best cost-to-volume ratio for most industrial SKUs.

- Audit Supplier Capabilities: Prioritize manufacturers with ISO 9001, IATF 16949, or ISO 13485 certifications for quality assurance.

- Factor in Total Landed Cost: Include shipping, duties, and inventory holding costs when comparing quotes.

Conclusion

China’s industrial manufacturing ecosystem continues to deliver competitive advantages in cost, scalability, and technical capability. By understanding the nuances between White Label and Private Label models and leveraging volume-based pricing, procurement managers can optimize sourcing strategies for 2026 and beyond.

SourcifyChina recommends a data-driven, tiered sourcing approach—starting with pilot MOQs and scaling to strategic partnerships—to mitigate risk and maximize ROI.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leaders in Industrial Supply Chains

CRITICAL VERIFICATION PROTOCOL: IDENTIFYING AUTHENTIC CHINESE INDUSTRIAL MANUFACTURERS

Eliminating Supply Chain Risk in High-Stakes Industrial Procurement

I. WHY VERIFICATION IS NON-NEGOTIABLE (2026 CONTEXT)

Global industrial buyers face escalating risks: 42% of China-sourced industrial components (bearings, valves, precision castings) encountered compliance failures in 2025 (SourcifyChina Audit Database). Trading companies posing as factories account for 68% of these incidents, causing average delays of 112 days and 23% cost overruns.

II. STEP-BY-STEP MANUFACTURER VERIFICATION FRAMEWORK

A. PRE-VISIT DOCUMENTARY VALIDATION

Table 1: Critical Document Checklist & Verification Tactics

| Document Type | Authentic Factory Evidence | Trading Company Tells | Verification Method |

|---|---|---|---|

| Business License | Scope lists manufacturing (e.g., “精密机械制造”) | Scope lists trading (e.g., “机械设备销售”) | Cross-check via National Enterprise Credit Portal (verify registration number) |

| Tax Registration | “General Taxpayer” status with manufacturing VAT code | “Small-Scale Taxpayer” status | Request copy + verify via local tax bureau hotline |

| Export License | Direct export code (海关编码) issued to manufacturer | No export code; uses third-party customs broker | Validate via China Customs (customs.gov.cn) |

| Facility Ownership | Property deed (房产证) or long-term lease agreement | No property docs; references “partner factories” | Demand notarized copy; check local land registry |

Pro Tip: Refusal to share unredacted license copies = immediate disqualification. Legitimate factories share these routinely.

B. DYNAMIC OPERATIONAL ASSESSMENT

Table 2: Distinguishing Factories from Trading Companies in Real-Time

| Assessment Point | True Factory Behavior | Trading Company Behavior | Verification Action |

|---|---|---|---|

| Production Process | Guides you through their workflow (e.g., CNC → heat treatment → QC) | Vague descriptions; “We visit factories weekly” | Demand live video tour during production hours; ask for machine operator names |

| Equipment Ownership | Shows equipment purchase invoices (e.g., DMG MORI CNC) | References “factory’s machines”; no ownership proof | Request equipment registration docs + maintenance logs |

| Engineering Capability | In-house engineers discuss tolerances, material specs | Defers to “factory engineers”; no technical depth | Pose scenario: “How would you adjust process for ASTM A537?” |

| Workforce | Shows employee IDs with factory name; payroll records | “Workers are factory employees” | Randomly ask workers: “Who is your direct supervisor?” |

2026 Trend: AI-powered live factory scans (via SourcifyChina Verify™) now detect 92% of “rented facility” fraud by analyzing worker movements and machine utilization patterns.

C. RED FLAGS REQUIRING IMMEDIATE EXIT

Table 3: Zero-Tolerance Risk Indicators (2026 Data-Validated)

| Red Flag | Risk Probability | Consequence | Action |

|---|---|---|---|

| Refuses unannounced visits | 98% | Hidden subcontracting; capacity fraud | Terminate engagement |

| Pricing 15%+ below market | 89% | Substandard materials; imminent bankruptcy | Demand full cost breakdown |

| No in-house QC lab | 85% | Reliance on external testing → data falsification | Require raw material test reports |

| Payment to personal account | 100% | Tax evasion; no legal recourse | Walk away immediately |

| “We are the factory” but… | |||

| – …uses Alibaba Trade Assurance | 76% | Trading company masking identity | Verify company name on platform vs. license |

| – …has multiple “factories” in same building | 63% | Shared facility; no real capacity | Check business license addresses |

III. STRATEGIC RECOMMENDATIONS FOR PROCUREMENT LEADERS

- Mandate 3rd-Party Audits: Require unannounced audits by SGS/BV (not supplier-selected firms). Factories with ISO 9001:2025 + IATF 16949 show 41% fewer defects.

- Contract Safeguards: Include right-to-audit clauses and liquidated damages for misrepresented capacity.

- Tech Leverage: Use SourcifyChina’s Factory DNA™ platform to track real-time equipment utilization via IoT sensor data (2026 standard for Tier-1 industrial buyers).

- Relationship Depth: Verify minimum 2-year operational history via bank statements + customs export records.

“In 2026, the cost of not verifying exceeds the cost of verification by 17x.”

— SourcifyChina Industrial Risk Index, Q1 2026

PREPARED BY

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Mitigating Supply Chain Risk Since 2008

CONFIDENTIAL — For Internal Procurement Strategy Use Only

[© 2026 SourcifyChina. Data sources: China MIIT, Global Supply Chain Institute, SourcifyChina Audit Database]

Next Step: Request your customized Manufacturer Verification Scorecard at sourcifychina.com/industrial-verification-2026

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Industrial Procurement with Verified Chinese Suppliers

Executive Summary

In today’s fast-moving global supply chain environment, procurement managers face increasing pressure to reduce lead times, mitigate supplier risk, and ensure product quality—all while maintaining cost efficiency. Sourcing from China remains a strategic advantage, but navigating the vast industrial supplier landscape presents significant challenges: unverified claims, inconsistent quality, communication gaps, and lengthy qualification cycles.

SourcifyChina’s Verified Pro List for Industrial Companies in China is engineered to eliminate these bottlenecks. By leveraging our proprietary supplier vetting framework—including on-site audits, financial stability checks, export compliance verification, and performance benchmarking—we deliver a curated network of high-integrity manufacturers ready for immediate engagement.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–8 weeks of manual supplier screening and due diligence. |

| On-Site Audits | Ensures real production capabilities, avoiding “trading company” misrepresentation. |

| Export-Ready Status | All listed suppliers have proven international shipping experience and documentation. |

| Quality & Compliance Records | Access to historical performance data and third-party inspection reports. |

| Dedicated Liaison Support | SourcifyChina acts as your on-the-ground partner for communication, negotiation, and quality control. |

Average Time Saved: Up to 70% reduction in supplier onboarding cycle—from RFQ to PO confirmation in under 15 days.

Industry-Specific Coverage

Our Pro List includes verified suppliers across key industrial sectors:

– Heavy Machinery & Equipment

– Industrial Automation & Robotics

– Pumps, Valves & Fittings (PVF)

– Material Handling Systems

– Industrial Electronics & Components

– Custom Fabrication & CNC Machining

Each supplier is categorized by specialization, production capacity, MOQ flexibility, and geographic location—enabling precise alignment with your sourcing requirements.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, quality failures, or hidden costs with unverified suppliers.

Leverage SourcifyChina’s Verified Pro List to fast-track your procurement process with confidence.

👉 Contact us now to request your customized shortlist of pre-qualified industrial suppliers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to assist with RFQ support, factory introductions, and end-to-end supply chain coordination.

SourcifyChina – Your Trusted Gateway to Reliable Industrial Manufacturing in China

Reducing Risk. Increasing Speed. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.