The Indian ceramic tiles market is undergoing a transformative expansion, fueled by rising urbanization, increasing investments in infrastructure, and growing consumer preference for aesthetically enhanced living spaces. According to Mordor Intelligence, the India Ceramic Tiles Market is projected to grow at a CAGR of over 5.8% during the forecast period 2023–2028, driven by robust demand from residential and commercial construction sectors. Additionally, government initiatives such as “Housing for All” and the surge in smart city development are further accelerating tile consumption. With India ranking among the top ceramic tile producers in Asia-Pacific, domestic manufacturers are scaling production, adopting advanced technologies, and expanding exports. In this evolving landscape, the top 10 Indian tiles manufacturers have emerged as industry leaders, combining innovation, quality, and market reach to capture significant shares in both domestic and international markets.

Top 10 Indian Tiles Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Premium Tiles Collection – Kajaria

Domain Est. 1998

Website: kajariaceramics.com

Key Highlights: Kajaria is India’s largest manufacturer of ceramic and vitrified tiles, with an annual production capacity of 90.50 million square meters. Read More. Kajaria is ……

#2 Itaca

Domain Est. 2009

Website: itaca.in

Key Highlights: Discover Itaca, a leading ceramic tiles manufacturer and supplier from Morbi,India. Offering premium quality tiles with innovative designs and global export ……

#3 Luxury Vitrified Tiles Company in Morbi, India

Domain Est. 2014

Website: simero.in

Key Highlights: Simero Ceramics, the largest manufacturer of ceramics and premium vitrified tiles in Morbi, India, offers unique collections featuring diamond and ……

#4 Lexus Granito (INDIA) Limited

Domain Est. 2018 | Founded: 2007

Website: lexusgranito.com

Key Highlights: Established in 2007, the Lexus Granito (INDIA) Limited is a leading manufacturer & supplier of Polished Glazed Vitrified Tiles, Glazed Vitrified Tiles and ……

#5 Marfil Tiles

Domain Est. 2020

Website: marfiltiles.net

Key Highlights: We are India’s leading Full Body Tiles Manufacturer. Our 15mm full body tiles are available in sizes of 600×600, 600×1200, 800×1600 for outdoor areas….

#6 Orkay Tiles

Domain Est. 2021

Website: orkaytiles.com

Key Highlights: Explore a premium collection of GVT/PGVT and porcelain tiles from Orkay Tiles, a leading manufacturer and exporter in India. We guarantee quality ……

#7 Leading Premium and Designer Tiles Brand in India

Domain Est. 1998

Website: hrjohnsonindia.com

Key Highlights: H & R Johnson is among leading Premium and Designer Tiles Brand in India. We have a wide range of Indian and Italian tiles for all space at an affordable ……

#8 Varmora Tiles

Domain Est. 2003

#9 Naveen Tile – India’s Top Tile Company

Domain Est. 2006

Website: naveentile.com

Key Highlights: As India’s No. 1 trusted tile company, Naveen Tile offers ceramic, vitrified, and designer tiles for homes & offices. Explore 40+ years of expertise and a ……

#10 AGL Tiles: Best Tiles Company in India

Domain Est. 2013

Website: aglasiangranito.com

Key Highlights: AGL tiles is India’s leading tiles brand that offers a wide collection of premium floor tiles, wall tiles, bathroom tiles, outdoor tiles, vitrified tiles, and ……

Expert Sourcing Insights for Indian Tiles

H2: Market Trends Shaping the Indian Tiles Industry in 2026

By 2026, the Indian tiles market is poised for significant transformation, driven by evolving consumer preferences, technological advancements, sustainability mandates, and economic shifts. H2 analysis reveals several key trends defining the sector’s trajectory:

1. Sustainability & Eco-Friendly Materials as a Core Driver:

* H2 Focus: Environmental regulations (like stricter effluent norms) and rising consumer eco-consciousness are pushing sustainability to the forefront.

* Trends: Increased demand for tiles made from recycled content (ceramic, glass), low-VOC (Volatile Organic Compounds) glazes, and energy-efficient manufacturing processes. Water-saving production technologies will be standard. “Green Building” certifications (like GRIHA, IGBC) will increasingly influence commercial and premium residential projects, mandating sustainable tile choices. Bio-based or rapidly renewable materials may gain niche traction.

2. Large-Format & Slim Tiles Dominance:

* H2 Focus: Aesthetic minimalism, seamless design, and the demand for spacious-feeling interiors are accelerating the shift.

* Trends: Large-format tiles (1200x2400mm, 1200x1200mm and larger) will dominate premium residential and commercial spaces (offices, hotels, retail). Ultra-slim porcelain tiles (SPTs, 3-6mm thick) will see significant growth due to their lightweight nature (reducing structural load and transportation costs), versatility (can be retrofitted over existing flooring), and suitability for facade cladding. Digital printing enables realistic replication of natural stone, wood, and concrete in these large formats.

3. Hyper-Realistic Digital Printing & Customization:

* H2 Focus: Technology enables unprecedented design flexibility and personalization.

* Trends: High-resolution inkjet printing will produce tiles with incredibly realistic textures, depth, and variation, blurring the line between ceramic and natural materials. Demand for customized designs, unique patterns, and personalized tiles (e.g., with logos, family crests, specific images) will surge, fueled by digital manufacturing capabilities. AI-driven design tools may assist consumers and architects in visualization.

4. Growth of Premium & Luxury Segments:

* H2 Focus: Rising disposable incomes in urban areas and aspirational spending fuel demand beyond basic functionality.

* Trends: Increased market share for high-end porcelain stoneware, glazed vitrified tiles (GVT) with advanced textures (matte, ultra-matte, structured), and specialty tiles (metallic, 3D textured, lappato). Focus on unique aesthetics, superior durability, stain resistance, and advanced surface treatments (e.g., anti-bacterial, easy-clean). Brands will compete heavily on design innovation and perceived quality.

5. E-commerce & Omnichannel Retail Revolution:

* H2 Focus: Changing consumer behavior and the need for wider reach are transforming distribution.

* Trends: Online sales of tiles (especially through brand websites, marketplaces, and specialized platforms) will grow significantly, aided by augmented reality (AR) apps for virtual try-ons and room visualization. However, physical touchpoints (showrooms, experience centers) remain crucial for texture and quality assessment. Successful players will master the omnichannel approach, seamlessly integrating online research, offline experience, and convenient delivery/installation.

6. Consolidation & Brand Power:

* H2 Focus: Intense competition and rising input/capex costs favor larger, efficient players.

* Trends: Increased M&A activity is expected as large players acquire regional brands or struggling units to gain market share, access new technologies, and achieve economies of scale. Brand reputation, trust, marketing reach, and consistent quality will become critical differentiators, accelerating the shift from unorganized/local players to organized national and international brands.

7. Technological Integration in Manufacturing:

* H2 Focus: Efficiency, quality control, and cost management are paramount.

* Trends: Widespread adoption of Industry 4.0 principles: IoT sensors for real-time process monitoring, AI/ML for predictive maintenance and quality defect detection, automation in pressing, glazing, and packaging. This leads to reduced waste, higher consistency, lower energy consumption, and faster production cycles.

8. Focus on Functional & Smart Tiles:

* H2 Focus: Moving beyond aesthetics to enhanced performance and integrated technology.

* Trends: Increased demand for tiles with inherent functional benefits: high slip resistance (especially for bathrooms, outdoor areas), anti-bacterial/anti-microbial properties (post-pandemic focus), thermal comfort (tiles with better insulation properties), and easy-to-clean surfaces. Early adoption of “smart tiles” with embedded sensors (for temperature, humidity, occupancy) or conductive elements (for underfloor heating) may begin in high-end smart homes and commercial buildings.

9. Regional Development & Tier II/III City Growth:

* H2 Focus: Urbanization and infrastructure development are spreading beyond metros.

* Trends: Significant growth potential lies in Tier II and Tier III cities driven by new housing projects, renovation, and rising standards of living. Manufacturers will expand distribution networks and tailor product ranges (e.g., cost-effective vitrified tiles) to cater to these price-sensitive but quality-conscious segments. Regional manufacturing clusters may see investments.

10. Raw Material Price Volatility & Supply Chain Resilience:

* H2 Focus: Geopolitical factors and domestic supply issues will remain a key challenge.

* Trends: Fluctuations in energy (natural gas, electricity) and key raw material (feldspar, quartz, kaolin) prices will continue to pressure margins. Companies will invest in backward integration (owning mines), long-term supply contracts, alternative fuel sources (solar), and diversified sourcing to build resilience. Local sourcing of raw materials will be encouraged.

Conclusion:

The 2026 Indian tiles market, analyzed through the H2 lens, reveals a dynamic landscape characterized by a powerful convergence of sustainability, technological sophistication (digital printing, manufacturing, e-commerce), premiumization, and consolidation. Success will belong to players who innovate in design and function, embrace digital transformation across the value chain, prioritize environmental and social governance (ESG), build strong brands, and efficiently navigate cost and supply chain challenges while meeting the diverse needs of a rapidly urbanizing population.

Common Pitfalls Sourcing Indian Tiles (Quality, IP)

Sourcing tiles from India can offer cost advantages and access to diverse designs, but it comes with significant challenges, particularly in quality control and intellectual property (IP) risks. Buyers must be vigilant to avoid costly mistakes.

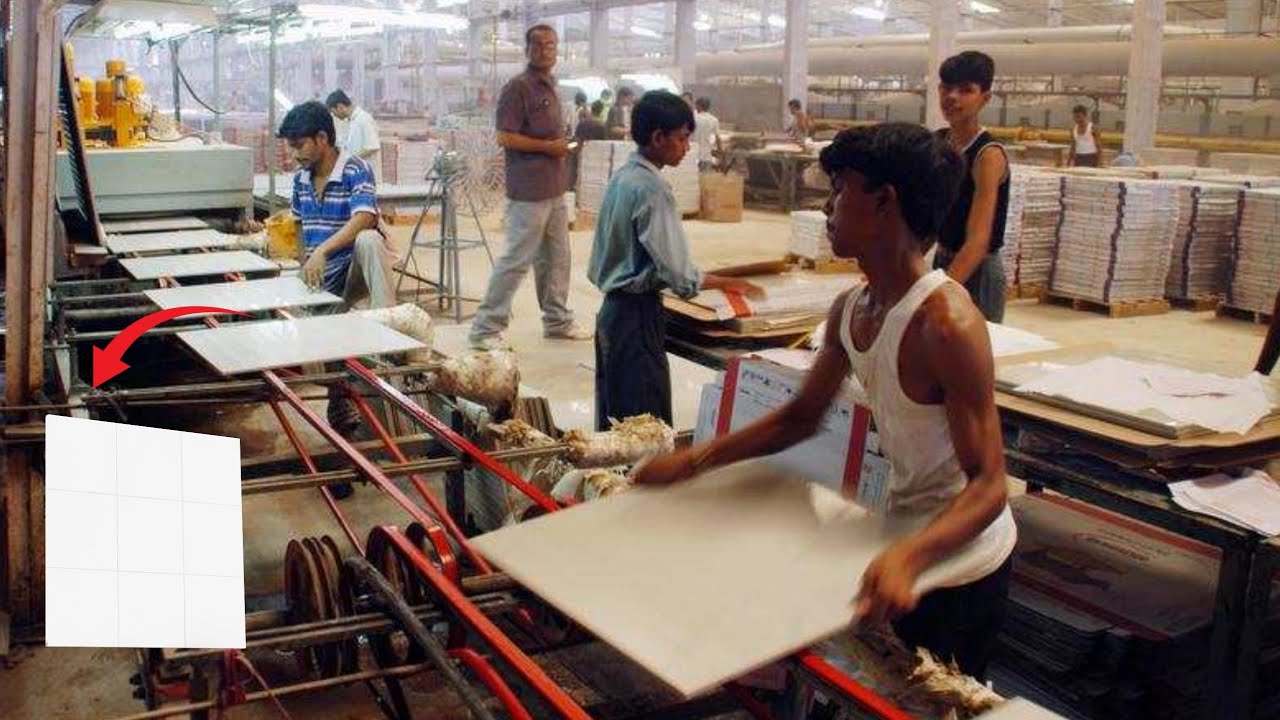

Quality Inconsistencies and Defects

One of the most frequent issues when sourcing Indian tiles is inconsistent product quality. Variations can occur between batches due to differences in raw materials, manufacturing processes, or lack of standardized quality control. Common defects include chipping, warping, color variation, surface pitting, and inaccurate sizing. These inconsistencies can lead to installation problems, customer dissatisfaction, and increased waste on construction or renovation projects. To mitigate this, buyers should insist on third-party inspections, review factory certifications (e.g., ISO), and request physical samples from actual production batches—not just showroom samples.

Lack of Reliable Supplier Verification

Many small or unverified manufacturers operate in India’s fragmented tile industry, making due diligence essential. Some suppliers may misrepresent their production capabilities, quality standards, or export experience. Red flags include reluctance to provide factory audits, inconsistent communication, or refusal to allow pre-shipment inspections. Engaging sourcing agents or conducting on-site factory visits can help verify supplier credibility and production standards.

Intellectual Property (IP) Infringement Risks

Indian tile manufacturers are sometimes known to replicate popular international designs, including patterns, textures, and finishes protected by copyright or design patents. Purchasing such tiles—even unknowingly—can expose buyers to legal liability, especially in markets with strict IP enforcement (e.g., the EU or U.S.). Customs seizures, lawsuits, and reputational damage are real risks. To avoid IP issues, ensure suppliers provide documentation confirming design originality or proper licensing, and avoid ordering products that closely mimic branded or patented designs.

Misleading Specifications and Testing Data

Some suppliers may exaggerate product performance—such as water absorption, slip resistance, or PEI rating—without proper testing or certification. This can result in tiles being unsuitable for intended applications (e.g., using wall tiles on floors or non-slip tiles in wet areas). Always request independent test reports from accredited labs (e.g., Bureau of Indian Standards or international equivalents) and verify compliance with destination market regulations.

Communication and Cultural Barriers

Differences in language, business practices, and expectations can lead to misunderstandings. For example, delivery timelines may be quoted optimistically, or contract terms may be interpreted differently. Clear, detailed contracts and regular communication are essential. Using an experienced sourcing partner familiar with Indian business culture can help bridge these gaps.

Logistics and Lead Time Delays

Port congestion, customs delays, and supply chain disruptions are common in India. Lead times can extend unexpectedly, affecting project schedules. Plan for buffer time in delivery schedules and ensure Incoterms are clearly defined in contracts to avoid disputes over shipping responsibilities and costs.

By proactively addressing these pitfalls—through due diligence, quality assurance protocols, and IP compliance checks—buyers can successfully source Indian tiles while minimizing risks.

Logistics & Compliance Guide for Indian Tiles

Overview of Indian Tile Exports

India is one of the leading exporters of ceramic and porcelain tiles globally, with major production hubs in Gujarat, Rajasthan, and Andhra Pradesh. Indian tiles are known for their quality, design variety, and cost-effectiveness. Exporting tiles from India involves a structured logistics and compliance process to ensure timely delivery and adherence to international standards.

Key Export Regulations and Documentation

To legally export tiles from India, exporters must comply with several regulatory requirements:

- IEC (Import Export Code): Mandatory registration with the Directorate General of Foreign Trade (DGFT).

- GSTIN and PAN: Required for customs clearance and tax compliance.

- Commercial Invoice: Details product value, quantity, and transaction terms.

- Packing List: Specifies packaging details, weight, and dimensions.

- Bill of Lading/Airway Bill: Issued by the carrier as proof of shipment.

- Certificate of Origin: Often required by importing countries for tariff benefits under trade agreements.

- Phytosanitary Certificate (if applicable): Rarely needed for tiles, but may be required if wooden packaging is used.

Product Standards and Quality Compliance

Indian tiles must meet both domestic and destination country standards:

- BIS Certification (IS 15622:2006): Indian Standard for ceramic tiles, often mandatory for domestic and export markets.

- ISO 13006: International standard for ceramic tiles; compliance enhances market acceptance.

- CE Marking (for EU): Required for tiles exported to European countries, indicating conformity with health, safety, and environmental protection standards.

- REACH & RoHS Compliance: Ensures tiles are free from hazardous chemicals like lead and cadmium.

- Custom Requirements: Some countries (e.g., USA, Australia) may require additional testing for slip resistance, durability, or VOC emissions.

Packaging and Labeling Requirements

Proper packaging ensures tiles reach destinations undamaged:

- Material: Use strong wooden crates or pallets with edge protectors and moisture-resistant wrapping.

- Stacking: Tiles should be stacked uniformly with spacers to prevent chipping.

- Labeling: Include product code, size, color, batch number, country of origin, and handling instructions (e.g., “This Side Up,” “Fragile”).

- Barcodes & HS Code: Attach barcodes for inventory tracking and include the correct HS code (typically 6907 or 6908 for ceramic tiles).

Logistics and Shipping Options

Choose the most suitable mode based on cost, volume, and destination:

- Sea Freight: Ideal for bulk shipments. Use 20’ or 40’ containers (FCL/LCL). Transit time varies (e.g., 20–30 days to Europe).

- Air Freight: Faster (3–7 days) but expensive; suitable for samples or urgent orders.

- Inland Transportation: Use insured trucks from factory to port (e.g., Pipavav, Mundra, JNPT).

- Freight Forwarders: Engage experienced logistics partners for door-to-door service, customs brokerage, and documentation.

Customs Clearance and Duties

Smooth customs processing depends on accurate documentation:

- HS Code Classification: 6907 (ceramic flagstones, paving, etc.) or 6908 (ceramic wall/floor tiles).

- Export Declaration: File Electronic Shipping Bill via ICEGATE.

- Duty Drawback/Export Incentives: Claim under schemes like RoDTEP (Remission of Duties and Taxes on Exported Products).

- Destination Customs: Importer handles clearance abroad; ensure all required certificates are provided to avoid delays.

Risk Management and Insurance

Protect shipments against potential losses:

- Marine Cargo Insurance: Covers damage, theft, or loss during transit.

- Incoterms Clarity: Define responsibilities using standard terms (e.g., FOB, CIF, DAP).

- Quality Audits: Conduct pre-shipment inspections to meet buyer specifications.

Sustainability and Environmental Compliance

Increasing global focus on green building materials:

- Eco-friendly Manufacturing: Use low-emission kilns and recycled materials where possible.

- EPD (Environmental Product Declaration): Provides transparency on environmental impact.

- LEED Compatibility: Tiles contributing to LEED certification are preferred in markets like the USA.

Conclusion

Successfully exporting Indian tiles requires attention to regulatory compliance, proper packaging, efficient logistics, and adherence to international quality standards. By following this guide, exporters can minimize delays, reduce risks, and enhance competitiveness in global markets. Regular updates on destination country regulations and investment in certification are key to long-term success.

Conclusion for Sourcing Indian Tiles:

Sourcing tiles from India presents a compelling opportunity for businesses and individuals seeking high-quality, cost-effective, and diverse design options. India’s well-established ceramic and porcelain tile industry offers extensive product ranges—from traditional handcrafted designs to modern, technologically advanced tiles—catering to a wide array of aesthetic and functional requirements. The country’s competitive pricing, large production capacity, and strong export infrastructure make it a reliable source in the global market.

Additionally, Indian manufacturers are increasingly adopting sustainable practices and international quality standards, enhancing their appeal to environmentally conscious buyers and premium markets. However, successful sourcing requires due diligence in selecting reputable suppliers, ensuring compliance with quality certifications, and managing logistics and lead times effectively.

In conclusion, with the right partner and clear quality specifications, sourcing tiles from India can offer excellent value, design versatility, and scalability—making it a strategic choice for residential, commercial, and hospitality projects worldwide.