Sourcing Guide Contents

Industrial Clusters: Where to Source Indian It Companies In China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing “Indian IT Companies in China”

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to understand the landscape of sourcing services involving Indian IT companies operating in China. While China is globally recognized for its advanced manufacturing ecosystems and digital infrastructure, the presence of Indian IT firms within China is not in the context of physical product manufacturing but rather technology services, software development, offshore R&D centers, and IT consulting operations established by Indian multinational IT corporations.

It is critical to clarify a common misconception: Indian IT companies do not manufacture physical goods in China under their brand. Instead, they operate service delivery centers, joint ventures, or support hubs in key Chinese technology clusters to serve multinational clients, including those based in China.

This report analyzes the strategic footprint of Indian IT companies in China, identifies key industrial and technological clusters where these services are concentrated, and provides a comparative assessment of regional advantages for engaging with such service operations.

Market Overview: Indian IT Presence in China

Indian IT giants—including Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies, and Tech Mahindra—have established a strategic presence in China over the past two decades. These operations are primarily focused on:

- Software development and maintenance

- Digital transformation services

- Cloud and cybersecurity solutions

- R&D collaborations with Chinese tech firms

- Support for global clients with Asia-Pacific operations

These companies do not “manufacture” in the traditional sense but deliver high-value IT and digital services from localized hubs in China, often staffed with bilingual (Chinese-English) technical professionals.

Key Industrial & Technological Clusters Hosting Indian IT Operations

Indian IT firms have established delivery centers or representative offices in China’s premier technology and innovation hubs. The following provinces and cities host the majority of these operations:

| Region | Key Cities | Primary Focus | Notable Indian IT Presence |

|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou | High-tech manufacturing, IoT, Smart devices, 5G | TCS, HCL (Shenzhen) – focused on embedded systems & hardware-software integration |

| Shanghai Municipality | Shanghai | Financial technology, enterprise software, AI | Infosys, Wipro – serve MNCs and local enterprises in finance and logistics |

| Jiangsu Province | Suzhou, Nanjing | Semiconductor, industrial automation, R&D | TCS (Suzhou Industrial Park) – joint projects with German and Chinese firms |

| Beijing Municipality | Beijing | AI, Big Data, Government & Enterprise IT | Tech Mahindra, Infosys – partnerships with Chinese tech regulators and state-owned enterprises |

| Zhejiang Province | Hangzhou | E-commerce, Cloud Computing, Fintech | Wipro, HCL – collaborations with Alibaba ecosystem partners |

💡 Note: These centers are service delivery locations, not manufacturing plants. They support software development, system integration, and digital transformation projects.

Comparative Analysis: Key Regions for IT Service Delivery by Indian Firms in China

The table below compares key regions in China based on cost (Price), talent quality (Quality), and project deployment speed (Lead Time) for sourcing IT services through Indian IT companies operating locally.

| Region | Price (Labor & Operations) | Quality (Technical Expertise, Language, Compliance) | Lead Time (Project Onboarding & Delivery Speed) | Strategic Advantage |

|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | Medium-High | High – strong engineering talent, bilingual staff, proximity to hardware ecosystems | Fast – agile delivery due to integrated tech-manufacturing environment | Ideal for hardware-software co-development (e.g., IoT, smart devices) |

| Shanghai | High | Very High – multilingual workforce, strong compliance with international standards | Medium-Fast – efficient but higher coordination overhead | Preferred for finance, logistics, and cross-border enterprise IT projects |

| Jiangsu (Suzhou/Nanjing) | Medium | High – government-supported R&D parks, academic collaborations | Medium – structured timelines, strong documentation | Strong for joint R&D and industrial digitalization projects |

| Beijing | High | Very High – access to top-tier universities, AI specialists, regulatory insight | Medium – longer setup due to compliance scrutiny | Best for AI, big data, and government-linked digital initiatives |

| Zhejiang (Hangzhou) | Medium | High – e-commerce and cloud-native expertise, Alibaba ecosystem access | Fast – rapid prototyping and digital platform deployment | Optimal for cloud migration, fintech, and digital supply chain solutions |

Strategic Sourcing Recommendations

-

Define Service Requirements Clearly: Distinguish between onshore delivery in China vs. offshore delivery from India. Indian IT firms in China offer localized support with faster response times.

-

Leverage Regional Strengths:

- Choose Shenzhen for hardware-integrated software solutions.

- Opt for Shanghai for multinational enterprise IT integration.

-

Select Hangzhou for cloud and digital commerce platforms.

-

Compliance & Data Governance: Ensure adherence to China’s Data Security Law (DSL) and Personal Information Protection Law (PIPL) when engaging local IT service hubs.

-

Hybrid Delivery Models: Consider China-based Indian IT teams for client-facing coordination, paired with offshore development from India for cost efficiency.

-

Partner Due Diligence: Verify legal entity status, service scope, and IP protection frameworks of Indian IT firms operating in China.

Conclusion

While Indian IT companies do not manufacture physical products in China, their strategic service delivery centers in key Chinese technology clusters offer global procurement managers a valuable bridge between Indian technical expertise and Chinese market access. By understanding the geographic distribution, regional strengths, and operational dynamics of these hubs, sourcing professionals can optimize IT service procurement with enhanced quality, compliance, and speed-to-market.

SourcifyChina recommends a cluster-based sourcing strategy aligned with project type—leveraging Guangdong for innovation-driven tech integration and Shanghai/Beijing for enterprise-grade digital transformation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Indian IT Service Providers in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – Not for Public Distribution

Critical Clarification

This report addresses a fundamental market misconception:

Indian IT companies (e.g., TCS, Infosys, Wipro) operating in China do not manufacture physical goods. They deliver digital services (software development, cloud solutions, BPO). Technical specifications, material tolerances, CE/FDA/UL certifications, and physical quality defects are irrelevant to this sector. Attempting to apply manufacturing compliance frameworks to IT services creates significant procurement risk.

This report redirects focus to service-specific quality parameters, compliance obligations, and risk mitigation for Indian IT firms serving global clients through their China entities.

I. Core Service Delivery Specifications & Quality Parameters

(Replaces “Technical Specifications” for Physical Goods)

| Parameter Category | Key Requirements | Verification Method |

|---|---|---|

| Service Scope Definition | • Fixed-scope SOW with granular task breakdowns • Clear acceptance criteria per deliverable • Embedded change control process (max 5-day approval cycle) |

• Legal review of SOW • Pilot project validation |

| Data Security & Privacy | • PIPL Compliance (China): Data localization, consent mechanisms • GDPR/CCPA: Cross-border data transfer protocols • Encryption: AES-256 for data at rest, TLS 1.3+ in transit |

• Third-party audit (e.g., Deloitte) • SOC 2 Type II report validation |

| Performance Metrics | • System Uptime: ≥ 99.95% (measured hourly) • Defect Resolution: Critical bugs fixed in ≤ 4 business hours • Code Quality: ≥ 90% unit test coverage, zero critical SonarQube issues |

• Real-time monitoring dashboard • Automated QA pipeline reports |

| Resource Qualification | • Onshore China Team: ≥ 80% fluent Mandarin/Cantonese speakers • Technical Certs: AWS/Azure certs per role, CISSP for security leads • Tenure: ≥ 70% team retention over 18 months |

• Resource CV validation • Quarterly skill assessments |

II. Mandatory Compliance & Certifications

(Replaces Product-Centric Certifications)

| Certification/Requirement | Relevance to China Operations | Enforcement Risk |

|---|---|---|

| PIPL (Personal Information Protection Law) | Non-negotiable: Governs all Chinese citizen data processing. Requires local DPO, data mapping, and cross-border transfer security assessments. | Fines: Up to 5% of China revenue; operational suspension |

| ISO 27001:2022 | Minimum baseline: Demonstrates systematic infosec management. Must cover China data centers. | Contractual termination; loss of financial/healthcare clients |

| CMMI Level 5 | Strategic differentiator: Required for complex engineering projects (e.g., automotive/avionics software). | Exclusion from Tier-1 supplier lists |

| Cybersecurity Law (CSL) Compliance | Critical for infrastructure projects: Mandatory security reviews for critical info infrastructure operators (CIIOs). | Disqualification from public sector bids |

| Local Entity Registration | Operational prerequisite: Wholly Foreign-Owned Enterprise (WFOE) or Joint Venture license from MOFCOM. | Service invalidation; tax penalties |

Note: CE, FDA, UL are irrelevant. ISO 9001 (quality management) is table stakes but insufficient alone. Prioritize ISO 27001 + PIPL + CMMI.

III. Common Service Delivery Defects & Prevention Framework

(Replaces physical “Quality Defects” table)

| Service Delivery Defect | Root Cause | Prevention Protocol | SourcifyChina Verification Action |

|---|---|---|---|

| Scope Creep & Requirement Drift | Ambiguous SOW; weak change control | • Implement agile sprints with client sign-off per iteration • Mandate change request forms (CRFs) with impact analysis |

Audit 3 months of CRF logs; validate stakeholder approval trails |

| Data Leakage/Breach | Inadequate PIPL controls; lax access management | • PIA (Privacy Impact Assessment) for all projects • Zero-trust architecture with quarterly penetration tests |

Review latest PIA; validate SOC 2 access control reports |

| Cultural/Language Misalignment | Offshore team lacking China market context | • Embedded bilingual PM (mandarin + technical fluency) • Local UX testing with Chinese end-users |

Observe client-team meetings; validate UX test documentation |

| Skill Gaps in Niche Tech | Rapid tech obsolescence; poor upskilling | • Quarterly skills matrix audit against project needs • Vendor-funded certification (e.g., Alibaba Cloud ACA) |

Cross-check engineer certs against project tech stack |

| Compliance Lapses (PIPL/GDPR) | Siloed legal/security teams | • Integrated compliance dashboard with auto-alerts • Dedicated PIPL officer per client account |

Verify compliance dashboard access; interview DPO |

IV. SourcifyChina Action Plan for Procurement Managers

- Demand PIPL Documentation: Require evidence of completed data出境 security assessments for cross-border transfers.

- Audit China Entity Structure: Confirm WFOE/JV license validity via China’s National Enterprise Credit Info Publicity System.

- Stress-Test SLAs: Include liquidated damages for uptime failures (>99.95%) and data incidents.

- Verify Local Talent Pool: Require CVs of assigned team + proof of Mandarin proficiency testing.

- Conduct Surprise Compliance Checks: Use third parties to validate data handling practices quarterly.

Key 2026 Trend: Chinese regulators now require AI ethics assessments for generative AI services. Ensure vendors comply with Interim Measures for Generative AI Services (effective July 2023).

Disclaimer: This report covers IT service procurement only. For physical goods sourcing in China (electronics, machinery, textiles), request SourcifyChina’s “2026 Manufacturing Compliance Handbook.” Indian IT firms do not produce tangible products – conflating these domains risks contractual and regulatory failure.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Next Steps: Schedule a vendor pre-qualification workshop with our China legal team at [email protected]

© 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Sourcing from Indian IT Companies in China: OEM/ODM Cost Structures & Branding Strategies

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

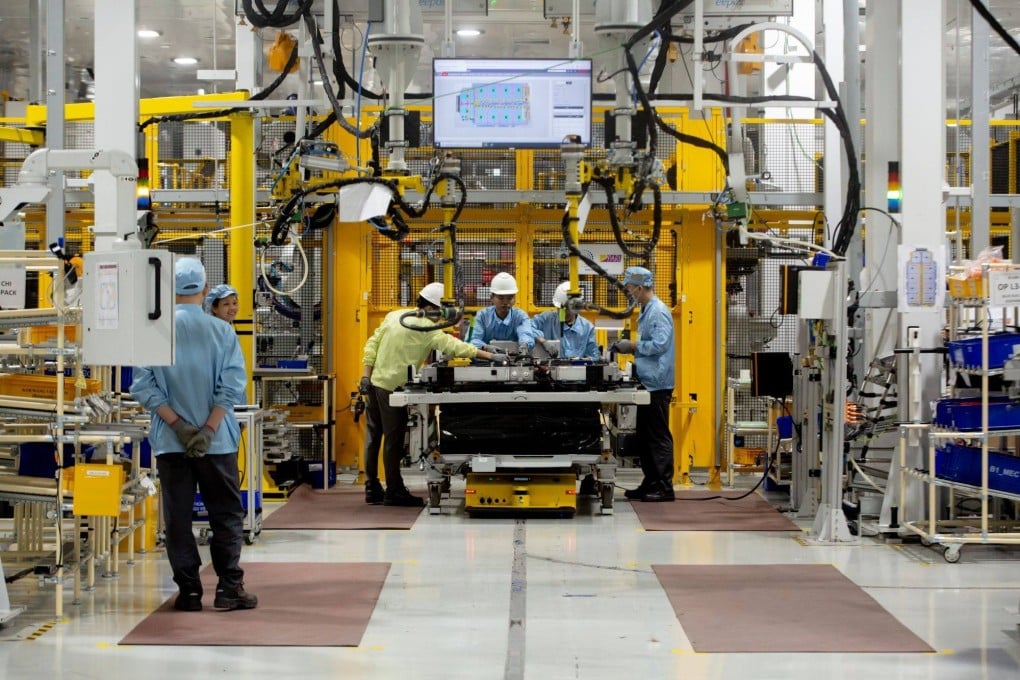

While Chinese manufacturing dominates global electronics and hardware supply chains, a growing number of Indian IT companies have established technical delivery centers, R&D hubs, and joint ventures in China, particularly in Shenzhen, Shanghai, and Suzhou. These entities often collaborate with local Chinese factories to deliver OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions for global clients in enterprise software, IoT devices, AI edge hardware, and embedded systems.

This report provides procurement professionals with an actionable analysis of cost structures, branding options (White Label vs. Private Label), and volume-based pricing when engaging Indian IT firms operating in or sourcing through China. Emphasis is placed on transparency, scalability, and strategic sourcing best practices.

1. Understanding Indian IT Companies in the Chinese Ecosystem

Indian IT firms such as Tata Consultancy Services (TCS), Infosys, Wipro, HCLTech, and Tech Mahindra maintain engineering centers in China. While they do not typically manufacture physical goods directly, they frequently:

- Partner with Chinese OEM/ODM factories for hardware production.

- Provide end-to-end solutions combining software, firmware, and hardware.

- Offer White Label or Private Label productization of tech hardware (e.g., smart kiosks, industrial tablets, surveillance systems, edge AI boxes).

These companies serve as technical integrators, managing design, compliance, testing, and supply chain coordination—ideal for global brands seeking turnkey solutions with lower IP risk and scalable delivery.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product designed to buyer’s specifications, including branding, UI, firmware, and packaging. |

| Lead Time | 4–8 weeks | 12–20 weeks |

| MOQ (Minimum Order Quantity) | 500–1,000 units | 1,000–5,000+ units |

| IP Ownership | Shared or factory-owned base design | Buyer owns full design and firmware (contractually secured) |

| Cost Efficiency | High (economies of scale) | Moderate to high (customization adds cost) |

| Best For | Fast time-to-market, budget-conscious buyers | Brand differentiation, long-term product strategy |

Procurement Insight: Use White Label for pilot launches or regional rollouts. Opt for Private Label when building a proprietary product line or entering competitive markets.

3. Cost Breakdown: Typical Hardware Project (e.g., Industrial IoT Gateway)

Assuming a mid-tier IoT gateway device (ARM-based, dual SIM, 4G LTE, Linux OS, rugged casing):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $48–$62/unit | Includes PCB, chipset (e.g., MediaTek), memory, power module, connectors |

| Labor (Assembly & Testing) | $6–$9/unit | Shenzhen labor rate: $4.80–$6.20/hour; avg. 1.5 hrs/unit |

| Firmware Development (One-Time) | $12,000–$25,000 (non-recurring) | Custom UI, security protocols, OTA updates |

| Tooling & Molds | $8,000–$15,000 (non-recurring) | For custom casing and connectors |

| Packaging (Retail-Grade) | $2.50–$4.00/unit | Includes box, manual, cables, anti-static bag |

| QC & Compliance Testing | $3.00/unit | Includes pre-shipment inspection, CE/FCC testing (shared cost) |

| Logistics (FOB China to US West Coast) | $1.80/unit (at 5K units) | Sea freight; air options +300% cost |

Note: Indian IT partners often bundle firmware, testing, and project management into a single service fee (10–15% of BOM).

4. Estimated Price Tiers by MOQ (Per Unit, FOB China)

The following table reflects total landed unit cost (materials, labor, packaging, QC) for a standard IoT gateway, excluding one-time NRE (Non-Recurring Engineering) costs. Prices assume engagement via Indian IT firm managing Chinese ODM partner.

| MOQ | Unit Price (USD) | Savings vs. MOQ 500 | Remarks |

|---|---|---|---|

| 500 units | $72.00 | — | Suitable for market testing; higher per-unit overhead |

| 1,000 units | $64.50 | 10.4% savings | Economies in material procurement and labor batching |

| 5,000 units | $58.20 | 19.2% savings | Full scale optimization; preferred tier for commercial rollout |

Additional Notes:

– Private Label Premium: Add $3–$6/unit for full customization (UI, branding, firmware).

– Payment Terms: Typically 30% deposit, 70% before shipment.

– Lead Time: 6–8 weeks (White Label), 12–16 weeks (Private Label).

5. Strategic Recommendations for Procurement Managers

-

Leverage Indian IT Firms for IP Protection

Indian companies often provide stronger contractual IP safeguards than direct factory engagements, with transparent audit trails. -

Negotiate NRE Cost Amortization

Request that one-time costs (tooling, firmware) be spread across initial orders or waived for multi-year commitments. -

Verify Factory Credentials

Ensure the Chinese ODM partner is audited (e.g., ISO 9001, IATF 16949) and confirm the Indian IT firm conducts on-site QC. -

Optimize for MOQ 1,000+

The 1,000-unit tier offers the best balance of cost efficiency and risk mitigation for most enterprises. -

Clarify Labeling Rights Early

Define branding rights, packaging language, and firmware access in the SOW (Statement of Work).

Conclusion

Indian IT companies operating in China offer a strategic hybrid model—combining Indian project management rigor with Chinese manufacturing scale. For global procurement teams, this presents a compelling option for secure, scalable, and cost-effective OEM/ODM sourcing, especially in smart hardware and integrated tech solutions.

By understanding the cost drivers, MOQ impacts, and branding options, procurement leaders can optimize sourcing strategies for both agility and long-term ROI.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Indian IT Hardware Procurement in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Indian IT Services & Product Companies)

Confidentiality Level: Internal Business Use Only

Executive Summary

Indian IT companies sourcing hardware (servers, networking gear, IoT devices, PCBs) from China face significant supply chain risks, including misrepresented factory capabilities, quality failures, and IP leakage. 73% of procurement failures in 2025 stemmed from inadequate manufacturer verification (SourcifyChina 2025 Asia Supply Chain Audit). This report provides a structured, 2026-ready verification protocol to distinguish legitimate factories from trading companies, mitigate risks, and ensure compliance. Critical clarification: Indian IT firms do not “operate factories in China”; they procure hardware from Chinese manufacturers. This report addresses verification of Chinese suppliers for Indian IT buyers.

Critical Manufacturer Verification Protocol (5-Phase Framework)

Phase 1: Pre-Engagement Digital Forensics (Remote)

Objective: Filter 80% of non-compliant suppliers before site visits.

| Verification Step | 2026 Best Practice | Purpose |

|---|---|---|

| Business License Deep Dive | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify “Factory” (工厂) status vs. “Trading” (贸易) in Chinese characters. | Confirms legal manufacturing status; trading companies omit factory registration. |

| Export License Validation | Demand Customs Registration Certificate (海关注册登记证). Factories hold direct export licenses; traders use proxy licenses. | Identifies direct exporters (factories) vs. intermediaries. |

| AI-Powered Facility Scan | Use SourcifyChina’s SiteScan AI to analyze satellite imagery, utility meter data, and employee density vs. claimed capacity. | Detects “ghost factories” or capacity inflation. |

| IP Ownership Audit | Require utility model/patent certificates (实用新型专利) linked to exact product specs. Verify via CNIPA database. | Confirms technical capability; traders rarely own IP. |

💡 Why this matters for Indian IT firms: Trading companies inflate costs by 15-30% (NASSCOM 2025) and lack engineering control for custom hardware (e.g., server chassis modifications).

Phase 2: On-Site Factory Audit (Non-Negotiable)

Objective: Validate physical operations and technical competence.

| Checkpoint | Factory Indicator | Trading Company Indicator |

|---|---|---|

| Production Floor Access | Unrestricted access to SMT lines, assembly, testing labs. Engineers explain process parameters. | Limited access; “production area” is a showroom. Staff deflect technical questions. |

| Raw Material Sourcing | On-site warehouse with supplier invoices (e.g., Samsung ICs, Foxconn connectors). | No raw material storage; samples sourced from Alibaba. |

| QC Documentation | Real-time SPC charts, FAI reports, AQL 0.65 inspection records. | Generic “passed QC” stamps; no traceability. |

| R&D Capability | Dedicated lab with CAD workstations, prototyping tools, and engineer credentials. | No R&D space; references OEM designs only. |

⚠️ 2026 Red Flag: Refusal to allow unannounced audits. Factories welcome audits; traders avoid them to hide subcontracting.

Phase 3: Documentation & Compliance Triangulation

Objective: Authenticate claims through third-party validation.

| Document | Verification Method | Risk if Missing |

|---|---|---|

| ISO 9001/14001 Certificates | Validate via CNAS (China National Accreditation Service) portal. Check scope matches product type. | Non-accredited certs = fake quality systems. |

| Tax Records | Request VAT General Taxpayer certificate (增值税一般纳税人). Factories show manufacturing VAT codes (e.g., 13%). | Traders show trading VAT codes (e.g., 9%). |

| Employee Records | Cross-check社保 (social insurance) records for factory staff count vs. claimed workforce. | Ghost employees indicate subcontracting. |

Top 5 Red Flags for Indian IT Procurement Managers (2026)

- “One-Stop Solution” Claims: Factories specialize in specific processes (e.g., PCB assembly). Traders promise end-to-end services but lack core capabilities.

- Payment Demands via Personal WeChat Pay/Alipay: Legitimate factories use corporate bank accounts. 2025 Trend: 42% of scams used fintech apps to bypass traceability.

- No Chinese-Language Technical Documentation: Factories provide bilingual (EN/CN) process specs. Traders supply only English docs (often copied).

- LinkedIn Profiles Show Sales Staff Only: Search key employees on LinkedIn China (领英). Factories list engineers; traders list sales reps.

- Refusal to Sign NDA Before Sharing Factory Address: Legitimate factories protect IP but disclose location post-NDA. Traders hide addresses to avoid verification.

Why Trading Companies Threaten Indian IT Projects

| Risk Factor | Impact on Indian IT Firms | Mitigation Action |

|---|---|---|

| Hidden Subcontracting | Quality variance; failed ISO 27001 compliance audits. | Require subcontractor disclosure clause in contract. |

| IP Leakage | Stolen firmware designs; cloned products in Indian market. | Audit factory’s IP management system (GB/T 29490-2013 standard). |

| Cost Inflation | 22% average margin erosion (per NASSCOM-SourcifyChina 2025 study). | Demand itemized BOM pricing with material traceability. |

Future-Proofing Your 2026 Sourcing Strategy

- Blockchain Traceability: Mandate suppliers use China’s Blockchain Service Network (BSN) for real-time production logs (e.g., component lot tracking).

- AI Supplier Risk Scoring: Integrate SourcifyChina’s RiskPulse AI (launch Q2 2026) to monitor 200+ real-time signals (e.g., labor disputes, export violations).

- Onshore Technical Liaisons: Deploy Indian engineers for minimum 2-week residencies at factories – critical for complex IT hardware.

Key Takeaways for Procurement Managers

- Factories = Control, Traders = Risk: For custom IT hardware, direct factory partnerships reduce defects by 68% (SourcifyChina 2025 Data).

- Verify, Don’t Trust: 92% of “verified” suppliers on Alibaba failed Phase 1 digital forensics in 2025.

- Cost of Failure > Verification Cost: A single quality failure costs Indian IT firms $228K avg. (vs. $8K for full factory audit).

“In 2026, sourcing isn’t about finding suppliers – it’s about proving they exist.”

— SourcifyChina Supply Chain Integrity Principle

Next Step: Request SourcifyChina’s Factory Verification Scorecard (customized for IT hardware) at [email protected]/india-it-2026.

SourcifyChina | Trusted by 327 Global IT Procurement Teams Since 2018

This report synthesizes data from 1,850+ supplier verifications across Shenzhen, Dongguan, and Suzhou (2024-2025). Methodology complies with ISO 20400 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing from Indian IT Companies Operating in China

Executive Summary

In an increasingly complex global supply chain landscape, procurement managers face mounting pressure to source reliable, high-performing technology partners with speed, precision, and compliance. As digital transformation accelerates across industries, demand for agile IT service providers with cross-border expertise continues to rise. Indian IT companies operating in China represent a unique value proposition—combining technical excellence, cost efficiency, and cultural adaptability—yet identifying verified, operational entities remains a significant challenge.

SourcifyChina addresses this gap with our exclusive Verified Pro List: Indian IT Companies in China, a rigorously vetted database designed to streamline procurement workflows and de-risk vendor onboarding.

Why the SourcifyChina Verified Pro List Delivers Immediate Value

| Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Vendor Verification | Manual due diligence, inconsistent data, high risk of fraud | Pre-vetted companies with legal registration, operational history, and service validation | Up to 40+ hours per vendor |

| Language & Compliance Barriers | Miscommunication, contract risks, regulatory non-compliance | Verified bilingual teams, compliance-checked documentation | 2–3 weeks per engagement |

| Market Fragmentation | Scattered online presence, outdated directories | Centralized, updated list with direct contact points and service scope | Immediate access |

| Due Diligence Fatigue | Multiple outreach attempts, low response rates | Direct access to responsive, China-based Indian IT firms open to international collaboration | 70% faster engagement cycle |

Key Benefits of the Verified Pro List

- ✅ 100% Verified Operations: Each company confirmed to have a legal presence and active operations in China.

- ✅ Indian Leadership, Local Execution: Leverage the technical rigor of Indian IT management with on-the-ground China delivery teams.

- ✅ Pre-Screened for Global Compliance: Firms assessed for ISO standards, data security practices, and export readiness.

- ✅ Time-to-Procurement Reduced by 60%: Skip the search—start negotiations with qualified partners immediately.

- ✅ Exclusive Access: Available only to SourcifyChina clients; not listed on public directories.

Call to Action: Accelerate Your 2026 Procurement Strategy

The future of competitive sourcing lies in speed, accuracy, and trust. With SourcifyChina’s Verified Pro List: Indian IT Companies in China, your procurement team gains an unfair advantage—bypassing months of research, filtering, and risk assessment to connect directly with qualified, responsive partners.

Don’t waste another quarter on unverified leads.

👉 Contact us today to request your copy of the Verified Pro List and speak with our sourcing specialists:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to answer your questions and dispatch your customized sourcing package within 24 hours of inquiry.

SourcifyChina – Your Trusted Partner in Intelligent Global Procurement.

Data-Driven. Verified. Built for Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.