The Indian cotton fabric manufacturing industry continues to strengthen its position in the global textile landscape, driven by rising domestic demand, expanding export opportunities, and government initiatives supporting the sector. According to Mordor Intelligence, the India textiles market is projected to grow at a CAGR of over 10% from 2023 to 2028, with cotton remaining the most dominant fiber due to its comfort, breathability, and suitability for India’s climate. Cotton accounts for nearly 48% of total fiber consumption in India, as reported by Grand View Research, underscoring its strategic importance in both traditional and modern apparel production. Bolstered by a robust raw material supply—with India ranking as the world’s largest producer and second-largest exporter of cotton—the domestic manufacturing ecosystem has evolved into a highly integrated network spanning ginning, spinning, weaving, processing, and garmenting. This foundation has enabled a new generation of Indian cotton fabric manufacturers to scale operations, adopt sustainable practices, and cater to diverse markets including fashion, home textiles, and technical fabrics. In this data-driven context, we spotlight the top 10 Indian cotton fabric manufacturers shaping the industry through innovation, quality, and export excellence.

Top 10 Indian Cotton Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

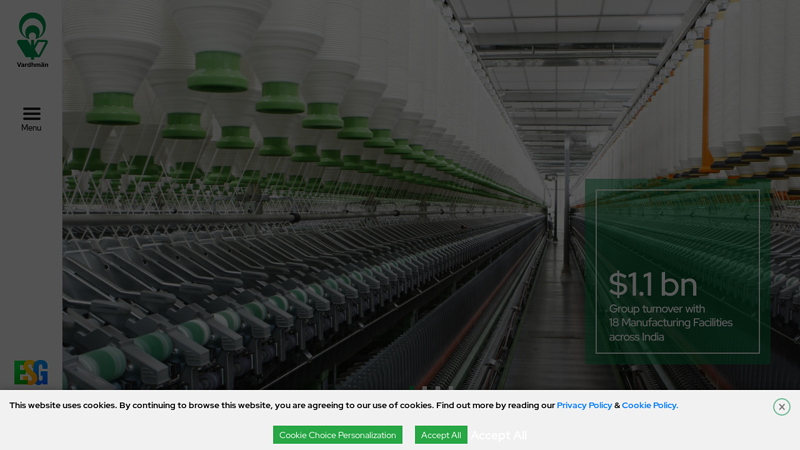

#1 Vardhman

Domain Est. 1998

Website: vardhman.com

Key Highlights: Vardhman is India’s largest vertically integrated textile manufacturer with multiple production facilities across India. It not only offers its clients ……

#2 Loyal Textiles

Domain Est. 1997

Website: loyaltextiles.com

Key Highlights: WE DESIGN FABRIC. Knitted and Woven fabrics are designed and developed within our existing facilities. 100% Cotton, Polyester Blends, Linen Blends and ……

#3 RSWM Limited

Domain Est. 2006

Website: rswm.in

Key Highlights: RSWM Limited, the flagship company of LNJ Bhilwara Group, is one of the leading manufacturers and exporters of synthetic, cotton and blended spun yarns in India ……

#4 Sutlej Textiles

Domain Est. 2009

Website: sutlejtextiles.com

Key Highlights: Sutlej Textiles, a renowned Cotton yarn manufacturer in India, pioneers in innovating textiles for home fabrics. Explore our high-quality Premium range of ……

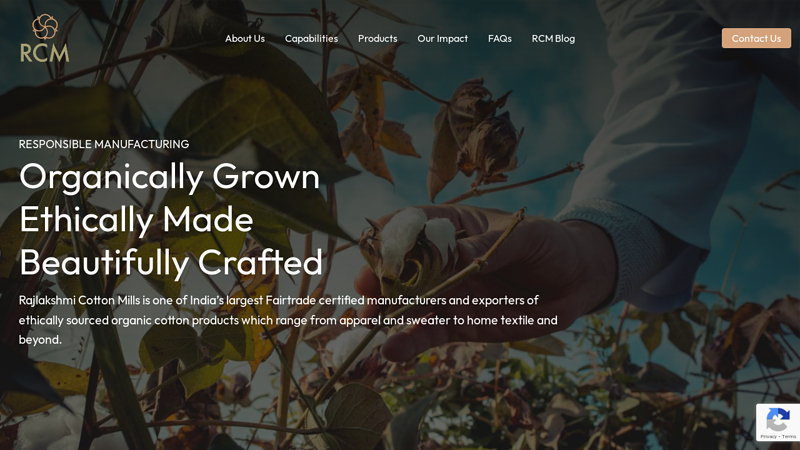

#5 Rajlakshmi Cotton Mills Pvt Ltd

Domain Est. 2018

Website: rcm-organic.co

Key Highlights: Rajlakshmi Cotton Mills is one of India’s largest Fairtrade certified manufacturers and exporters of ethically sourced organic cotton products….

#6 Jhakaria Fabrics

Domain Est. 2018 | Founded: 1987

Website: jakhariafabric.com

Key Highlights: The Jakharia group is into the business of textiles since 1987, It started the business with manufacturing of fabrics on power looms working on all types of ……

#7 Suiting Fabric Manufacturers

Domain Est. 2022

Website: panamtexfab.com

Key Highlights: Leading suiting fabric manufacturer – exporter, offering premium cotton, leisurewear, comfort wear, and travel wear fabrics for global market….

#8 Morarjee Textiles

Domain Est. 1997

Website: morarjee.com

Key Highlights: Morarjee Textiles have been the global leaders in the premium cotton shirting fabric and high fashion printed fabric industry for over a century. Fashion Prints….

#9 Jaydeep Cotton Fibers Pvt. Ltd., Cotton, Cotton India, Cotton …

Domain Est. 2004

Website: jaydeepcotton.com

Key Highlights: Welcome to Jaydeep Cotton Fibres Pvt. Ltd. An ISO 9001:2000 (by TUV Rheinland Group) certified Company, acclaimed for manufacturing best cotton in domestic ……

#10 Alok Industries

Domain Est. 2001

Website: alokind.com

Key Highlights: Explore Alok Industries, India’s top textile manufacturer, known for its high-quality fabric production and cutting-edge technology … Textiles, Cotton Yarn, ……

Expert Sourcing Insights for Indian Cotton Fabric

H2: Analysis of 2026 Market Trends for Indian Cotton Fabric

As India moves toward 2026, the cotton fabric market is poised for transformation driven by shifting consumer preferences, sustainability mandates, technological innovation, and global trade dynamics. This analysis explores key trends expected to shape the Indian cotton fabric industry in 2026.

1. Rising Domestic and Global Demand for Sustainable Cotton

Sustainability remains a dominant force in 2026. With global brands committing to eco-friendly supply chains, demand for certified organic and sustainably grown cotton (e.g., Fair Trade, GOTS-certified) is surging. India, already the world’s largest producer of organic cotton, is capitalizing on this shift. By 2026, a growing share of domestic cotton output is expected to meet global sustainability benchmarks, enhancing export competitiveness—particularly in Europe and North America.

2. Growth in Domestic Apparel and Home Textiles Segment

India’s expanding middle class and rising disposable incomes are fueling domestic demand for cotton fabrics in ready-made garments, ethnic wear, and home textiles (e.g., bed linens, curtains). The revival of traditional handloom and sustainable fashion brands is boosting demand for high-quality, locally woven cotton fabrics. Government initiatives like “Make in India” and PM-MITRA parks are expected to support this growth by modernizing production infrastructure.

3. Technological Advancements in Fabric Processing

By 2026, digitalization and automation are transforming Indian textile mills. Adoption of smart looms, AI-driven quality control, and waterless dyeing technologies are improving efficiency and reducing environmental impact. Cotton fabric manufacturers are investing in R&D to develop value-added textiles—such as antimicrobial, UV-protective, and moisture-wicking cotton blends—catering to performance wear and healthcare sectors.

4. Export Opportunities Amid Geopolitical Realignment

Global supply chain diversification (“China+1”) is benefiting Indian textile exports. In 2026, India is expected to strengthen its position as a reliable cotton fabric supplier to the U.S., EU, and ASEAN nations. Ongoing or proposed Free Trade Agreements (e.g., with the UK, EU, and Canada) could reduce tariffs and further boost export volumes. However, non-tariff barriers and stringent environmental regulations remain challenges.

5. Volatility in Raw Material Supply and Pricing

Cotton production in India remains vulnerable to climate change, with erratic monsoons affecting yield. In 2026, prices may experience fluctuations due to supply-demand imbalances. Farmers are gradually shifting toward drought-resistant Bt cotton variants and adopting precision farming, but consistent policy support and crop insurance will be critical for stabilizing raw material supply.

6. Emphasis on Traceability and Ethical Sourcing

Brands and consumers are demanding greater transparency in the cotton supply chain. Blockchain-enabled traceability systems are being piloted to track cotton from farm to fabric. By 2026, Indian manufacturers who adopt transparent, ethical sourcing practices are likely to gain a competitive edge in international markets.

7. Challenges and Policy Outlook

Despite positive trends, the sector faces challenges: fragmented MSMEs, outdated technology in smaller units, and infrastructure gaps. The Indian government’s National Textile Policy 2025 and Production Linked Incentive (PLI) scheme for textiles are expected to drive investment, modernization, and job creation by 2026.

Conclusion

By 2026, the Indian cotton fabric market is expected to evolve into a more sustainable, technology-driven, and globally integrated industry. Success will depend on adapting to environmental standards, embracing innovation, and leveraging India’s strengths in cotton cultivation and textile craftsmanship. With strategic investments and policy support, India is well-positioned to become a global leader in high-quality, sustainable cotton fabrics.

Common Pitfalls When Sourcing Indian Cotton Fabric (Quality & Intellectual Property)

Sourcing cotton fabric from India offers access to a diverse and vibrant textile industry, but it comes with challenges, particularly concerning quality consistency and intellectual property risks. Being aware of these pitfalls can help buyers mitigate risks and ensure a successful sourcing experience.

Inconsistent Fabric Quality

One of the most prevalent issues in sourcing Indian cotton fabric is variability in quality. Despite India being a leading cotton producer, inconsistencies can arise due to differences in raw material grading, spinning techniques, and finishing processes across numerous small and medium-sized mills. Buyers may receive fabrics that vary in thread count, shrinkage, color fastness, hand feel, and pilling resistance—even within the same order—leading to production delays and customer dissatisfaction.

Lack of Standardized Testing and Certification

Many suppliers may not adhere to international quality standards or conduct rigorous third-party testing. Without certifications such as OEKO-TEX®, GOTS (Global Organic Textile Standard), or ISO compliance, there’s a heightened risk of receiving fabrics treated with harmful chemicals or failing sustainability benchmarks. Relying solely on supplier claims without verified documentation can compromise brand integrity and regulatory compliance.

Misrepresentation of Fiber Content and Origin

Some suppliers may mislabel or blend cotton with synthetic fibers without disclosure, especially in lower-priced offerings. Additionally, “Indian cotton” branding may be used loosely, even when the raw cotton is imported or processed elsewhere. This lack of traceability undermines transparency and can mislead consumers seeking authentic, sustainably sourced materials.

Weak Intellectual Property Protection

India’s IP enforcement in the textile sector remains inconsistent, making it easier for suppliers to replicate patented weaves, prints, or designer patterns without authorization. Buyers risk having their proprietary designs copied and sold to competitors, especially if samples are shared without legal safeguards. Non-disclosure agreements (NDAs) and design registrations are often overlooked during early engagement, increasing vulnerability.

Inadequate Supply Chain Transparency

Many Indian textile suppliers subcontract parts of the production process to smaller units with limited oversight. This fragmented supply chain makes it difficult to monitor labor practices, environmental impact, and quality control at every stage. Without clear visibility, brands may inadvertently support unethical practices or face reputational damage.

Poor Communication and Cultural Misunderstandings

Differences in communication styles, time zones, and business practices can lead to misunderstandings about specifications, timelines, and expectations. Ambiguities in technical documents or verbal agreements may result in incorrect fabric deliveries, missed deadlines, or disputes over quality acceptance.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence, request physical samples, insist on third-party testing, formalize IP protections, and build long-term relationships with reputable, audited suppliers. Engaging local sourcing agents or using platforms with verified suppliers can also enhance reliability and reduce risk.

Logistics & Compliance Guide for Indian Cotton Fabric

Navigating the export of Indian cotton fabric requires careful attention to logistics, regulatory compliance, and international trade standards. This guide outlines key considerations to ensure smooth and lawful shipments.

Export Documentation Requirements

To legally export cotton fabric from India, exporters must prepare and submit several mandatory documents:

- Commercial Invoice: Details the transaction between buyer and seller, including product description, quantity, value, and terms of sale (e.g., FOB, CIF).

- Packing List: Provides a breakdown of each package, including weight, dimensions, and markings.

- Bill of Lading (B/L) or Air Waybill (AWB): Serves as a contract of carriage and receipt of goods; required for sea and air shipments respectively.

- Certificate of Origin: Often required by importing countries to verify the fabric was manufactured in India; may be needed for tariff concessions under trade agreements.

- Export Declaration (ICEGate Filing): Mandatory electronic filing through India’s Integrated Customs Electronic Gateway (ICEGate) under the Directorate General of Foreign Trade (DGFT).

- Letter of Credit (if applicable): A financial document issued by the buyer’s bank guaranteeing payment upon fulfillment of specified conditions.

Textile-Specific Compliance

Indian cotton fabric exports must comply with both Indian regulations and the standards of the destination country:

- Textile Import Licensing: Some countries (e.g., U.S., EU, Canada) require importers to have textile-specific licenses or quotas. Verify destination country requirements.

- Labeling and Marking: Ensure compliance with labeling laws (e.g., fiber content, country of origin, care instructions) as per the importing nation’s rules (e.g., FTC in the U.S., EU Textile Regulation (EU) No 1007/2011).

- Restricted Substances: Confirm that dyes, finishes, and treatments comply with regulations such as:

- EU REACH and OEKO-TEX® Standard 100

- U.S. CPSIA (Consumer Product Safety Improvement Act)

- CA Prop 65 (California)

- Quality Standards: Adhere to specified quality benchmarks (e.g., IS 1962 for cotton fabrics in India) or buyer-specific requirements.

Customs and Tariff Procedures

Proper classification and tariff assessment are critical for customs clearance:

- HS Code Classification: Indian cotton fabrics generally fall under HS Chapter 52 (Cotton). Typical codes include:

- 5208: Woven fabrics of cotton, weighing ≤ 200 g/m²

- 5209: Woven fabrics of cotton, weighing > 200 g/m²

- 5210–5212: Mixed or special cotton fabrics

Ensure accurate HS code selection to determine export duties, import tariffs, and eligibility for trade agreements. - Export Duty: As of current policy, cotton fabric exports from India are typically duty-free. However, verify updates from the DGFT or CBIC (Central Board of Indirect Taxes and Customs).

- GST and ITC Claims: Exporters can claim Input Tax Credit (ITC) on GST paid during production under the GST regime, especially when exporting under bond or Letter of Undertaking (LUT).

Logistics and Transportation

Efficient logistics planning ensures timely and safe delivery:

- Mode of Transport:

- Sea Freight: Most cost-effective for large volumes; use FCL (Full Container Load) or LCL (Less than Container Load) based on volume.

- Air Freight: Faster but more expensive; ideal for urgent or high-value shipments.

- Packaging Standards:

- Use moisture-resistant wrapping (e.g., polyethylene) to prevent mildew.

- Rolls should be tightly wound and protected with cardboard cores and outer wrappings.

- Palletize goods securely and label with handling instructions (e.g., “This Side Up,” “Fragile”).

- Port Handling:

- Major export ports: Mumbai (JNPT), Chennai, Kolkata, Mundra.

- Ensure timely customs clearance and coordination with freight forwarders.

- Insurance: Obtain marine cargo insurance to cover risks such as damage, delay, or loss during transit.

Sustainability and Ethical Compliance

Growing global demand for ethical sourcing requires adherence to sustainability standards:

- Organic Certification: For organic cotton fabric, obtain certification under standards like:

- GOTS (Global Organic Textile Standard)

- USDA Organic (if exporting to the U.S.)

- Fair Trade and Labor Standards: Comply with labor laws and consider certifications like Fair Trade or BCI (Better Cotton Initiative).

- Environmental Regulations: Follow waste and effluent discharge norms under India’s Environment Protection Act and comply with destination country environmental laws.

Key Regulatory Bodies in India

- Directorate General of Foreign Trade (DGFT): Oversees export policies and issues authorizations.

- Textiles Committee: Provides quality certification and inspection services.

- Customs Authorities (CBIC): Handles customs clearance and enforcement.

- Export Promotion Councils (e.g., TEXPROCIL): Offers guidance and support for textile exporters.

Conclusion

Successfully exporting Indian cotton fabric hinges on meticulous documentation, adherence to quality and safety standards, accurate classification, and reliable logistics. Staying updated with evolving trade policies and destination-specific requirements will help minimize delays, avoid penalties, and enhance competitiveness in global markets.

Conclusion on Sourcing Indian Cotton Fabric:

Sourcing cotton fabric from India presents a compelling opportunity for global buyers due to the country’s long-standing expertise in cotton production, vast manufacturing infrastructure, and competitive pricing. India is one of the largest producers and exporters of cotton and cotton textiles in the world, offering a wide variety of fabrics—including combed cotton, organic cotton, denim, and specialty weaves—that meet international quality standards.

The presence of a well-established textile ecosystem, skilled labor force, and government support through initiatives like “Make in India” further strengthens India’s position as a reliable sourcing destination. Additionally, an increasing number of Indian suppliers are adopting sustainable and ethical manufacturing practices, making them attractive partners for environmentally and socially conscious brands.

However, buyers should conduct thorough due diligence when selecting suppliers, focusing on quality consistency, compliance with international standards (such as OEKO-TEX, GOTS, or ISO certifications), and on-time delivery performance. Building strong relationships with suppliers and maintaining clear communication can help mitigate potential challenges related to lead times, order scalability, and customization.

In conclusion, India remains a strategic and cost-effective hub for sourcing high-quality cotton fabric. With the right partnerships and supply chain oversight, businesses can leverage India’s textile strengths to meet diverse market demands while ensuring sustainability and reliability in their sourcing operations.