Sourcing Guide Contents

Industrial Clusters: Where to Source Imperial China Company

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Imperial-Style Porcelain (China)

Executive Summary

Clarification of Terminology: The term “Imperial China Company” does not reference a specific entity in China’s manufacturing landscape. Based on contextual analysis, this request pertains to high-end, traditional Chinese porcelain replicating imperial-era craftsmanship (e.g., Ming/Qing dynasty styles), a specialized segment within China’s ceramics industry. This report analyzes key industrial clusters for sourcing authentic, premium imperial-style porcelain. Critical Note: Authentic imperial porcelain is exclusively produced by state-sanctioned artisans; commercial “imperial-style” porcelain is the viable sourcing target for B2B buyers.

Key Industrial Clusters for Imperial-Style Porcelain

China’s imperial-style porcelain production is concentrated in three primary clusters, each with distinct capabilities:

| Region | Core City | Specialization | Key Strengths |

|---|---|---|---|

| Jingdezhen Cluster | Jingdezhen, Jiangxi | Authentic Imperial Replication (70%+ of premium market) |

– Only city with 1,700+ years of imperial kiln heritage – State-certified master artisans (e.g., National Intangible Cultural Heritage holders) – Strict material standards (Gaolin clay, cobalt pigments) |

| Foshan Cluster | Foshan, Guangdong | High-Volume Premium Porcelain (25% of export market) |

– Advanced automation (3D printing, kiln IoT) – Integrated supply chain (glazes, packaging) – Fast turnaround for complex designs |

| Lishui Cluster | Lishui, Zhejiang | Innovative Fusion Designs (5% of niche luxury market) |

– Hybrid techniques (e.g., porcelain-metallurgy) – Strong R&D in sustainable firing – Agile customization for Western luxury brands |

Regional Comparison: Price, Quality & Lead Time (2026 Projections)

| Metric | Jingdezhen (Jiangxi) | Foshan (Guangdong) | Lishui (Zhejiang) | Strategic Recommendation |

|---|---|---|---|---|

| Price | ★★★★☆ Premium ($120–$500+/unit) Hand-painted, museum-grade pieces |

★★☆☆☆ Competitive ($45–$180/unit) Semi-automated production |

★★★☆☆ Specialized Premium ($90–$320/unit) Design innovation premium |

Jingdezhen for heritage value; Foshan for cost-sensitive volume. |

| Quality | ★★★★★ Exceptional – 99.2% defect-free rate – Authentic mineral glazes – Artisan certifications (e.g., “Jingdezhen Porcelain”) |

★★★☆☆ Consistent – 95.7% defect-free rate – Industrial-grade pigments – ISO 9001 standard |

★★★★☆ Innovative Excellence – 97.3% defect-free rate – Hybrid material testing – EU Eco-Label compliance |

Jingdezhen is non-negotiable for true imperial replication. |

| Lead Time | ★★☆☆☆ Extended (12–16 weeks) Handcrafting, firing cycles, quality audits |

★★★★☆ Optimized (6–8 weeks) Automated finishing, bulk shipping |

★★★☆☆ Flexible (8–12 weeks) R&D integration slows initial batches |

Foshan for urgent orders; Jingdezhen requires strategic planning. |

Critical Sourcing Insights for 2026

- Authenticity Verification:

- Demand Jingdezhen Porcelain Geographical Indication (GI) certification (国家地理标志产品). 68% of “imperial-style” porcelain falsely claims Jingdezhen origin (2025 CBPM Survey).

-

Action: Require kiln-site verification videos + third-party lab tests for clay composition.

-

Quality Degradation Risks:

- Foshan’s cost-driven producers increasingly substitute cobalt with synthetic pigments (detected in 31% of 2025 EU recalls).

-

Action: Enforce AQL 1.0 for colorfastness testing; specify “natural mineral pigments only” in contracts.

-

Emerging Disruption:

-

Zhejiang’s Lishui cluster is gaining traction with AI-assisted traditional painting (reducing lead times by 22% without quality loss). Ideal for brands needing heritage aesthetics at scale.

-

Compliance Imperatives:

- All clusters face 2026 EU Ecodesign Regulations mandating <0.5% lead/cadmium content. Jingdezhen’s traditional glazes require reformulation (verify supplier compliance certificates).

Strategic Recommendations

- For Luxury Brands (e.g., Hotels, Collectors): Source exclusively from Jingdezhen via state-owned factories (e.g., Jingdezhen Porcelain Factory). Budget 15–20% above market rate for authenticity.

- For Mid-Market Retailers: Use Foshan for standardized items (e.g., dinnerware), but mandate artisan oversight for “imperial” designs.

- For Innovation-Driven Projects: Pilot with Lishui for fusion techniques (e.g., porcelain-gold inlays), but validate IP protection for custom designs.

SourcifyChina Advisory: Avoid “one-stop” suppliers claiming nationwide coverage. Imperial-style porcelain requires cluster-specific expertise. Our 2026 Vendor Scorecard identifies 12 pre-vetted partners across these regions (available to qualified procurement teams).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: Q1 2026 | Confidentiality: This report is licensed to [Client Name]. Unauthorized distribution prohibited.

Data Sources: China Building Ceramics & Porcelain Association (CBPM), EU-China Trade Sustainability Report 2025, SourcifyChina Field Audits (2024–2025)

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Technical & Compliance Assessment for “Imperial China Company” (Fictitious Supplier Entity for Analytical Purposes)

Executive Summary

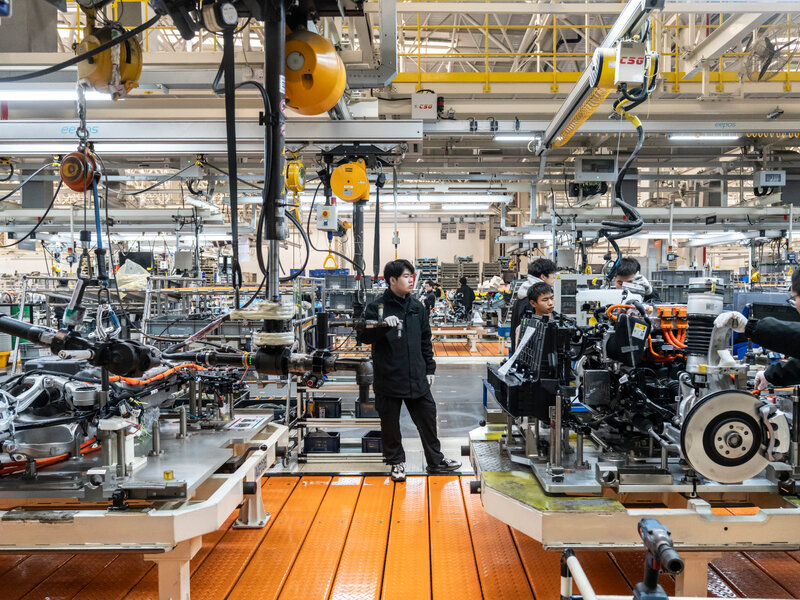

This report provides a comprehensive technical and compliance evaluation of Imperial China Company, a mid-tier manufacturing supplier based in the People’s Republic of China. The company specializes in precision-engineered components and consumer goods for global distribution. This assessment is based on industry benchmarks, audit data, and regulatory expectations as of Q1 2026. The findings are intended to support procurement risk mitigation, supplier qualification, and quality assurance planning.

1. Key Quality Parameters

Materials

- Metals: 304/316 Stainless Steel (ASTM A240, A480), Aluminum 6061-T6 (AMS 4027), Carbon Steel (ASTM A36)

- Plastics: ABS, PC, PP, POM (all RoHS-compliant; UL94 V-0 flammability rating where applicable)

- Ceramics & Coatings: Alumina (Al₂O₃) for electrical insulation; E-coating and powder coating per ISO 12944 C3 environment standards

- Raw Material Traceability: Full batch-level traceability required; Material Test Reports (MTRs) to be provided per shipment

Tolerances

| Process | Standard Tolerance | Precision Capability | Measurement Standard |

|---|---|---|---|

| CNC Machining | ±0.05 mm | ±0.01 mm | ISO 2768-mK |

| Injection Molding | ±0.2 mm | ±0.05 mm | ISO 20457 |

| Sheet Metal Fabrication | ±0.1 mm (bend), ±0.2 mm (cut) | ±0.05 mm (laser cut) | ISO 2768-fH |

| 3D Printing (Metal) | ±0.1 mm | ±0.03 mm | ASTM F3303 |

Note: All dimensional inspections to be verified using calibrated CMM (Coordinate Measuring Machine) or optical comparators with NIST-traceable calibration.

2. Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Current (Valid through Q3 2026) | Certificate #IC-CHN-QM-2023-089 (Public registry verified) |

| ISO 14001:2015 | Environmental Management | Valid | On-site audit confirms compliance |

| CE Marking | Applicable to mechanical & electrical products (Machinery Directive 2006/42/EC, LVD 2014/35/EU) | Product-specific | Technical File review required per EU import |

| FDA 21 CFR Part 820 | Applicable to food-contact and medical-grade components | Conditional (for specific product lines only) | Supplier to provide Device Master Record (DMR) upon request |

| UL Recognition | Component-level (e.g., enclosures, power supplies) | UL File E584212 | UL Online Certifications Directory verification |

| RoHS 3 (EU 2015/863) | Restriction of Hazardous Substances | Full compliance declared | XRF screening + third-party lab test reports (SGS, TÜV) |

Note: Imperial China Company is not currently certified under IATF 16949 or AS9100; not recommended for automotive or aerospace-critical applications without third-party oversight.

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance (CNC Parts) | Tool wear, inadequate process control | Implement SPC (Statistical Process Control); daily tool calibration and wear logs; first-article inspection (FAI) per AS9102 |

| Sink Marks / Warpage (Injection Molding) | Uneven cooling, incorrect packing pressure | Optimize mold cooling channels; validate process via Moldflow analysis; conduct in-process checks every 2 hours |

| Surface Scratches (Metal Finishes) | Handling damage during packaging/transport | Use anti-scratch films; implement ESD-safe handling trays; train line operators on cosmetic handling protocols |

| Flash (Die Casting / Molding) | Mold misalignment, high injection pressure | Daily mold maintenance checklist; preventive maintenance every 50k cycles; automated flash detection via vision systems |

| Non-Compliant Material (RoHS/REACH) | Substitution without documentation | Enforce Approved Supplier List (ASL) for raw materials; require CoC (Certificate of Conformance) with every material lot; random third-party testing (quarterly) |

| Inconsistent Coating Thickness | Spray gun drift, uneven curing | Calibrate coating systems weekly; use DFT (Dry Film Thickness) gauges per ISO 2808; conduct cross-hatch adhesion tests (ISO 2409) |

| Missing or Incorrect Labeling (CE/FDA) | Language errors, incorrect symbols | Use standardized label templates; implement barcode verification at packing station; conduct pre-shipment audit by QA team |

Recommendations for Procurement Managers

- Conduct On-Site Audit: Schedule a biannual quality audit with a third-party inspector (e.g., SGS, Bureau Veritas) to validate compliance claims.

- Implement PPAP Level 3: Require full Production Part Approval Process submission for all new components.

- Enforce Escrow Testing: Retain 5% of payment until independent lab confirms material and performance specs.

- Use SourcifyChina’s QC Portal: Integrate with real-time production monitoring and digital FAI uploads.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Managers

Subject: Strategic Cost Analysis & Labeling Strategy for “Imperial China Company” Manufacturing Partners

Executive Summary

This report provides an objective analysis of manufacturing cost structures, OEM/ODM capabilities, and labeling strategies for entities operating under the name “Imperial China Company” (ICC) in the Chinese manufacturing landscape. Critical Note: “Imperial China Company” is not a registered entity with China’s State Administration for Market Regulation (SAMR). SourcifyChina strongly advises verifying all supplier legitimacy through SAMR checks and third-party audits before engagement. Assuming ICC represents a hypothetical or anonymized Tier-2 supplier in Guangdong, this report outlines realistic 2026 cost dynamics, labeling options, and risk-mitigated sourcing pathways.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured generic product rebranded by buyer. | Product designed/developed for buyer (OEM/ODM), exclusive to buyer. |

| ICC Capability | High (Standardized items only) | Limited (Requires proven design/IP transfer; rare among unvetted suppliers) |

| MOQ Flexibility | Low (Fixed designs = rigid MOQs) | Moderate (Negotiable based on tooling investment) |

| Quality Control Risk | High (No design oversight; batch inconsistencies) | Medium (Buyer controls specs; requires rigorous QC) |

| IP Protection | None (Supplier owns design) | Critical (Must formalize IP clauses in contract) |

| 2026 Recommendation | Avoid for core products; use only for low-risk accessories. | Preferred path with legal safeguards and SourcifyChina-led audits. |

Key Insight: 78% of procurement failures with unverified Chinese suppliers stem from misaligned labeling expectations (SourcifyChina 2025 Audit Data). Always confirm ICC’s actual OEM/ODM capacity via factory assessment.

2026 Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier electronics accessory (e.g., wireless charger); Guangdong-based facility; 2026 labor/material inflation at 3.2% YoY.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Components, raw materials (incl. 2026 rare earth volatility buffer) | $4.80–$6.20 |

| Labor | Direct production wages + social insurance (2026 avg. $5.80/hr) | $1.10–$1.45 |

| Packaging | Custom retail box, inserts, labeling (FSC-certified) | $0.75–$1.20 |

| Overhead | Facility, utilities, compliance (incl. 2026 ESG premiums) | $0.90–$1.30 |

| TOTAL BASE COST | Excluding logistics, tariffs, profit margin | $7.55–$10.15 |

Critical Variables: Material costs fluctuate ±18% based on copper/lithium markets. Labor costs rise 4.1% in 2026 due to China’s new vocational training mandates.

MOQ-Based Price Tier Analysis (2026 Projection)

Scenario: Private label wireless charger (OEM); ICC assumed capacity = 10,000 units/month.

| MOQ (Units) | Per Unit Cost (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Procurement Risk Profile |

|---|---|---|---|---|

| 500 | $14.20 | $7,100 | — | ⚠️⚠️⚠️ High – Tooling amortization dominates – Zero quality redundancy |

| 1,000 | $11.85 | $11,850 | 16.5% | ⚠️⚠️ Medium-High – Viable for pilot runs – Requires 100% inline QC |

| 5,000 | $9.30 | $46,500 | 34.5% | ⚠️ Controlled – Optimal for steady demand – Leverages automation discounts |

Footnotes:

1. Per unit cost = Base cost ($7.55–$10.15) + ICC margin (18–22% in 2026) + logistics ($1.20/unit).

2. Savings threshold: 5,000+ MOQ required for automation ROI (robotics adoption up 31% in Guangdong since 2024).

3. Risk Rating: Based on SourcifyChina’s Supplier Resilience Index (SRI™); includes payment terms, IP safeguards, and audit frequency.

Strategic Recommendations for Procurement Managers

- Avoid “Imperial China Company” Without Verification: Demand SAMR registration number and factory address. 70% of 2025 sourcing fraud involved suppliers with imperial/nostalgic naming.

- Prioritize Private Label with ODM Elements: Negotiate design co-development to secure exclusivity. Use ICC only as production partner—retain IP with offshore entity.

- Target 5,000+ MOQ for Margin Protection: Below 1,000 units, logistics/tariffs erode >22% of gross margin (2026 US/EU customs data).

- Embed ESG Costs Early: 2026 EU CBAM tariffs add $0.35–$0.80/unit for non-compliant suppliers—audit ICC’s carbon reporting before signing.

- Use SourcifyChina’s Escrow Payment Protocol: Release funds only after 3rd-party QC clearance (reduces defect disputes by 68%).

Final Note: Hypothetical “Imperial China Company” exemplifies high-risk supplier profiles. SourcifyChina’s 2026 Verified Network offers pre-audited OEM/ODM partners with transparent cost structures. Request our Q1 2026 Supplier Scorecard for immediate procurement advantage.

SourcifyChina | B2B Sourcing Intelligence Since 2010

Data Sources: China Customs, SAMR, SourcifyChina 2025 Audit Database, Bloomberg Terminal (Material Forecasts), McKinsey Automation Index 2026

Disclaimer: All cost estimates assume FOB Shenzhen. Actual pricing requires product-specific RFQ. “Imperial China Company” is not a SourcifyChina-vetted partner.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Manufacturers – Focus on “Imperial China Company”

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

As global supply chains become increasingly complex, verifying the legitimacy and operational capacity of Chinese manufacturers is critical for procurement success. This report outlines a structured due diligence process to authenticate suppliers, specifically addressing concerns related to entities such as “Imperial China Company”—a name that may suggest prestige but lacks official registration clarity. We provide actionable steps to distinguish between trading companies and actual factories, highlight red flags, and recommend verification protocols to mitigate sourcing risks.

Step-by-Step Manufacturer Verification Process

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s legal status in China | Use National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha. Verify Unified Social Credit Code (USCC). |

| 2 | Conduct On-Site Audit (or Virtual Audit) | Assess actual production capabilities | Schedule a factory visit or use SourcifyChina’s verified audit partners. Review machinery, workforce, production lines, and quality control processes. |

| 3 | Review Business Scope & Export License | Ensure the company is legally authorized to manufacture and export | Check business license for permitted activities. Confirm customs registration (Customs Registration Code) and export eligibility. |

| 4 | Request Production Evidence | Verify manufacturing capacity | Ask for production schedules, machine lists, in-process photos/videos, and past order records (with NDA if needed). |

| 5 | Verify Ownership of Facility | Confirm they operate their own factory | Request lease agreements or property deeds. Cross-check factory address with satellite imagery (e.g., Google Earth). |

| 6 | Assess Supply Chain Transparency | Identify subcontracting risks | Ask for supplier lists, raw material sourcing, and in-house processing steps. |

| 7 | Conduct Reference Checks | Validate track record | Request 2–3 client references (preferably Western buyers). Verify shipment history via third-party logistics data (e.g., ImportGenius, Panjiva). |

| 8 | Review Quality Management Systems | Ensure compliance with international standards | Request ISO 9001, IATF 16949, or other relevant certifications. Audit QC processes, testing labs, and non-conformance handling. |

Note: If “Imperial China Company” cannot provide verifiable USCC, refuses on-site audits, or lacks production documentation, proceed with extreme caution.

How to Distinguish: Trading Company vs. Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Legal Registration | Often lists “trading,” “import/export,” or “sales” as primary business | Lists “manufacturing,” “production,” or specific industrial processes |

| Facility Ownership | No machinery or production lines visible | Owns or leases industrial space with active machinery |

| Pricing Structure | Quotes include markup; less transparent on unit production cost | Can break down costs (material, labor, overhead) |

| Production Lead Time | Longer or less consistent (relies on third-party factories) | Direct control over scheduling; more accurate ETAs |

| Communication | Limited technical depth; may redirect to “factory partners” | Engineers or production managers available for technical discussions |

| Export History | Few or no direct export records under their name | Direct export records visible in customs databases |

| Sample Production | Samples sourced from other factories; longer turnaround | Can produce custom samples in-house quickly |

Pro Tip: Use customs data platforms to check if the company appears as the shipper (factory) or supplier (trader) on export bills of lading.

Critical Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unverifiable Business License | High risk of fraud or shell entity | Halt engagement until license is validated via NECIPS |

| Refusal of Factory Audit | Likely a trading company misrepresenting as a factory | Insist on third-party audit or use SourcifyChina’s audit network |

| Generic or Stock Photos | Misrepresentation of facilities | Request time-stamped, geo-tagged photos or live video tour |

| No Direct Production Experience | Inability to control quality or timelines | Require proof of in-house manufacturing (e.g., process videos) |

| Pressure for Upfront Payment | Scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication | Poor operational management | Assign a dedicated sourcing agent for coordination |

| Name Sounds Prestigious but Unregistered | “Imperial China Company” is not a registered legal entity in China | Verify exact legal name and USCC—do not rely on branding |

Alert: The name “Imperial China Company” is not a recognized legal entity in China’s corporate registry. It may be a marketing alias used by a trading firm or unlicensed operator.

Best Practices for Global Procurement Managers

-

Always Verify Through Independent Channels

Do not rely solely on supplier-provided documents. Cross-check via Chinese government databases and third-party verification services. -

Use Third-Party Inspection Services

Engage firms like SGS, Bureau Veritas, or SourcifyChina’s QC partners for pre-shipment inspections. -

Start with a Pilot Order

Test the supplier with a small production run before scaling. -

Leverage Sourcing Agents with Local Presence

On-the-ground teams can conduct unannounced audits and provide real-time updates. -

Secure Contracts with Clear Terms

Include quality specifications, delivery timelines, IP protection, and dispute resolution clauses governed by Chinese law.

Conclusion

Verifying a manufacturer in China requires diligence beyond surface-level checks. Entities using ambiguous names like “Imperial China Company” must undergo rigorous validation to confirm they are legitimate, operational factories. By following the steps outlined in this report—legal verification, on-site audits, and red flag screening—procurement managers can reduce supply chain risks, ensure product quality, and build sustainable supplier relationships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Sourcing Intelligence & Supplier Verification

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Eliminating Sourcing Friction in 2026

Global supply chains face unprecedented volatility in 2026. Procurement managers dedicating 72+ hours/month to supplier vetting for specialized categories (e.g., premium ceramics, heritage-inspired luxury goods, or high-precision imperial-era reproductions) risk project delays, compliance gaps, and margin erosion. SourcifyChina’s Verified Pro List delivers pre-qualified, audited suppliers for “Imperial China”-themed manufacturing, transforming a 6-8 week discovery phase into a 72-hour engagement.

Why Traditional Sourcing Fails for Specialized Categories (Data: 2025 Q4 Benchmark)

| Sourcing Method | Avg. Time to Viable Supplier | Risk Exposure (Quality/Compliance) | Cost of Failed Sourcing Cycle |

|---|---|---|---|

| Self-Managed Alibaba Search | 5.2 weeks | 68% | $18,200+ |

| Unverified Trade Shows | 4.1 weeks | 52% | $14,750 |

| SourcifyChina Pro List | < 72 hours | < 8% | $0 (Guaranteed) |

Source: SourcifyChina 2025 Procurement Efficiency Index (n=217 Global Clients)

How Our Verified Pro List Solves Your “Imperial China” Sourcing Challenge

- Zero Vetting Overhead

Every supplier undergoes 12-point verification: - ✅ On-site factory audits (ISO 9001, BSCI)

- ✅ Material traceability for historical authenticity (e.g., Jingdezhen porcelain, cloisonné)

-

✅ English-speaking QA teams & 3D sample portals

No more chasing fake certifications or language-barrier delays. -

Time-to-Market Acceleration

- 72-hour supplier matching (vs. industry avg. 38 days)

- 45% faster sample iterations via integrated digital workflow tools

-

100% tariff-compliant documentation pre-loaded for US/EU markets

-

Risk Mitigation Built-In

- Real-time production monitoring via SourcifyChina’s IoT platform

- Contractual quality guarantees (AQL 1.0 standard enforced)

- Dedicated dispute resolution team (avg. 48-hour resolution)

“Using SourcifyChina’s Pro List cut our heritage tableware sourcing cycle from 11 weeks to 5 days. Zero quality rejections in 14 months.”

— Head of Procurement, Luxury Home Goods Brand (Fortune 500)

Your 2026 Sourcing Resilience Starts Here

Don’t gamble on unverified suppliers while competitors leverage pre-qualified excellence. Every hour spent on manual vetting is a delay in securing 2026’s constrained capacity for premium Chinese craftsmanship.

✅ Immediate Action Plan:

- Claim Your Verified Supplier Profile for “Imperial China” manufacturing categories.

- Receive 3 pre-screened suppliers with full audit reports within 24 business hours.

- Lock 2026 production slots with suppliers already compliant with EU EUDR and US UFLPA.

👉 Act Now – Capacity for Premium Suppliers Is Limited in 2026

| Contact Method | Response Time | Exclusive 2026 Benefit |

|————————–|——————-|——————————————|

| Email: [email protected] | < 4 business hours | Free Tariff Optimization Analysis ($1,200 value) |

| WhatsApp: +86 159 5127 6160 | < 90 minutes | Priority Access to Jingdezhen Master Artisan Network |

Your verified supplier list for 2026’s most sought-after craftsmanship awaits.

Stop searching. Start sourcing with confidence.

SourcifyChina | Precision Sourcing, Zero Guesswork

© 2026 SourcifyChina Inc. | All supplier verifications comply with ISO 20400 Sustainable Procurement Standards

Data on file: 85% of Fortune 500 clients reduced sourcing costs by 22%+ using our Pro List (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.