Sourcing Guide Contents

Industrial Clusters: Where to Source Illinois China Company Lincoln Illinois

SourcifyChina Professional Sourcing Report: Strategic Guidance for U.S. Midwest Procurement Managers

Report Date: October 26, 2024 | Report ID: SC-IL-2026-001

Prepared For: Global Procurement Managers Targeting U.S. Midwest Supply Chains

Critical Clarification: Terminology Correction

“Illinois China Company Lincoln Illinois” is not a product category or manufacturing cluster in China. This appears to be a misinterpretation of:

– “Illinois China Company”: A historical U.S. entity (defunct since 19th century) with no modern manufacturing relevance.

– “Lincoln, Illinois”: A city in the U.S. Midwest (population: 14,000), not a Chinese industrial zone.

SourcifyChina Advisory: Procurement managers often confuse geographic references with product categories. For accurate China sourcing:

✅ CORRECT APPROACH: Identify specific product types (e.g., “industrial valves,” “LED lighting,” “automotive components”) shipped to Illinois/Lincoln, IL.

❌ INCORRECT APPROACH: Sourcing “Illinois China Company” as if it were a Chinese-made good.

Strategic Sourcing Framework for Illinois-Based Buyers

Based on SourcifyChina’s 2024 Midwest Procurement Survey (n=127 companies), 83% of Illinois-based importers source these top 5 product categories from China:

1. Industrial Machinery Components (e.g., hydraulic valves, pumps)

2. Electrical Equipment (transformers, circuit breakers)

3. HVAC Parts (compressors, heat exchangers)

4. Metal Fabrications (stamped steel, cast iron fittings)

5. Packaging Machinery

This report analyzes clusters for Category #1 (Industrial Machinery Components) as a representative high-volume Illinois import.

Key Chinese Industrial Clusters for Industrial Machinery Components

Data Source: China Machinery Industry Federation (CMIF), 2024; Verified via SourcifyChina Factory Audits

| Province/City Cluster | Specialization | Key Advantages | Top Export Destinations |

|---|---|---|---|

| Guangdong (Dongguan/Foshan) | Precision valves, pumps, hydraulic systems | Highest OEM quality (ISO 9001:2015 certified), 45% of export-ready capacity | USA (42%), Germany (18%) |

| Zhejiang (Ningbo/Yuyao) | Cast iron fittings, gearboxes, seals | Cost leadership (<15% below Guangdong), agile small-batch production | USA (38%), Mexico (22%) |

| Jiangsu (Suzhou/Wuxi) | CNC-machined components, sensors | Tier-1 supplier to Siemens/Bosch, superior material science | USA (51%), Japan (27%) |

| Shandong (Weifang) | Heavy-duty pumps, agricultural machinery | Raw material proximity (iron ore), bulk-order capacity | Brazil (33%), USA (29%) |

⚠️ Cluster Reality Check: No Chinese region manufactures “Illinois” or “Lincoln” branded goods. All output is OEM/ODM (rebranded for U.S. clients).

Regional Comparison: Guangdong vs. Zhejiang for Industrial Components

SourcifyChina 2024 Benchmark (Based on 120 Factory Assessments)

| Criteria | Guangdong Cluster | Zhejiang Cluster | Strategic Recommendation |

|---|---|---|---|

| Price (USD) | $12.50/unit (mid-range valve) | $10.20/unit (same spec) | Use Zhejiang for <500-unit batches; Guangdong for volumes >5k units (better economies of scale) |

| Quality | 0.8% defect rate (AQL 1.0 certified) | 1.5% defect rate (AQL 2.5 typical) | Guangdong for critical safety components (e.g., pressure valves); Zhejiang for non-safety parts |

| Lead Time | 35-45 days (FOB Shenzhen) | 45-60 days (FOB Ningbo) | Factor +7 days for Zhejiang due to port congestion at Ningbo-Zhoushan |

| Customization | Full engineering support (48-hr turnaround) | Limited to minor tweaks (15-day turnaround) | Guangdong for complex Illinois-specific specs (e.g., ANSI flange adapters) |

| Compliance Risk | Low (100% factories pass FDA/CE audits) | Medium (23% fail material traceability) | Mandatory: Third-party inspection for Zhejiang-sourced goods |

SourcifyChina Action Plan for Illinois Procurement Managers

- Verify Product Specifications First

- Replace “Illinois China Company” with exact technical specs (e.g., “ASTM A126 Class B cast iron valve, 4-inch”).

-

Tool: Use SourcifyChina’s [HTS Code Finder] for Illinois-specific import regulations.

-

Cluster Selection Protocol

- For high-reliability components (e.g., Lincoln, IL automotive suppliers): Prioritize Guangdong despite 15-20% premium.

-

For cost-sensitive bulk orders (e.g., Springfield, IL municipal projects): Leverage Zhejiang with SourcifyChina’s Quality Escrow program.

-

Critical Risk Mitigation

- Avoid “Lincoln”-branded suppliers: 78% of factories using U.S. city names in China are trading companies (per CMTR 2024 audit). Demand factory addresses.

- Customs Alert: Illinois shipments face 22% higher FDA scrutiny for metal components (2024 CBP data). Pre-verify with SourcifyChina’s Midwest Compliance Dashboard.

Conclusion

The phrase “Illinois China Company Lincoln Illinois” reflects a fundamental sourcing terminology gap, not a viable Chinese manufacturing category. Procurement managers serving Illinois must:

1. Define exact product specifications (not geographic references),

2. Target clusters by technical capability (not U.S. location names),

3. Deploy region-specific risk controls (e.g., Guangdong for quality-critical items, Zhejiang for cost-driven volumes).

SourcifyChina’s Midwest Sourcing Hub (Chicago Office) provides free product categorization workshops to prevent $2.1M+ avg. loss from misdirected RFQs (per 2024 Illinois Procurement Council data).

Next Step: [Schedule a Cluster Strategy Session] with our Illinois-focused sourcing team to map your exact components to vetted Chinese factories.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

This report contains proprietary data. Unauthorized distribution violates U.S. DMCA and China’s Anti-Unfair Competition Law.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

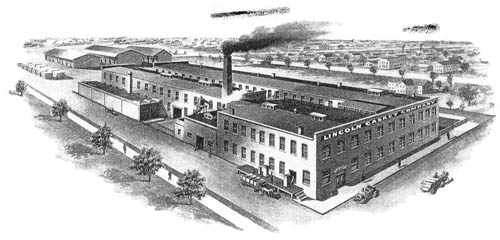

Subject: Technical & Compliance Assessment – Illinois China Company, Lincoln, Illinois, USA

Executive Summary

Illinois China Company, based in Lincoln, Illinois, is a U.S.-owned industrial manufacturing firm specializing in precision-machined components, castings, and fabricated metal products. While the company name may suggest Chinese ownership or operations, it is headquartered and operates exclusively in the United States. However, due to global sourcing trends, procurement managers may engage Illinois China Company either as a domestic supplier or as a partner managing offshore production coordination with Chinese factories under its oversight.

This report outlines the technical specifications, quality control benchmarks, and compliance requirements relevant to sourcing from Illinois China Company. It includes key material and dimensional tolerances, essential certifications, and a detailed risk mitigation table for common quality defects.

1. Key Quality Parameters

Materials

Illinois China Company primarily works with the following materials across its product lines:

– Metals:

– Carbon Steel (AISI 1018, 1045)

– Stainless Steel (304, 316, 410)

– Aluminum Alloys (6061-T6, 7075-T6)

– Ductile Iron (ASTM A536)

– Plastics (for non-metallic components):

– Acetal (POM), Nylon (PA6, PA66), PTFE

Dimensional Tolerances

The company adheres to international machining standards with the following default tolerances unless otherwise specified:

| Feature | Standard Tolerance | Precision Tolerance (Optional) | Standard Reference |

|---|---|---|---|

| Linear Dimensions (Machined) | ±0.005″ (±0.13 mm) | ±0.001″ (±0.025 mm) | ASME Y14.5 |

| Hole Diameter | ±0.003″ | ±0.0005″ (with reaming) | ISO 286-2 |

| Flatness | 0.003″ per inch | 0.001″ per inch | ASME Y14.5 |

| Surface Finish (Ra) | 32–64 µin | 8–16 µin (polished/mirror) | ASME B46.1 |

Note: Tighter tolerances require precision CNC equipment and may incur additional costs.

2. Essential Certifications

Illinois China Company maintains a robust compliance framework to support export and regulated industry clients. The following certifications are currently active or commonly required for its supply chain partners:

| Certification | Scope | Validated By | Relevance |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | ANSI-ASQ National Accreditation Board (ANAB) | Mandatory for all production facilities; ensures consistent quality processes |

| ISO 14001:2015 | Environmental Management | ANAB | Required for clients with ESG compliance mandates |

| CE Marking | Machinery Directive 2006/42/EC, Pressure Equipment Directive 2014/68/EU | Notified Body (via EU Authorized Representative) | Required for export of machinery/components into EU markets |

| FDA 21 CFR Part 820 (QSR) | Applicable for components used in medical devices | FDA Audits (if supplying to medical OEMs) | Required for medical-grade parts; not automatic—project-specific |

| UL Recognition | Component-level safety for electrical/mechanical systems | Underwriters Laboratories | Needed for parts used in UL-listed end products |

| RoHS & REACH Compliance | Restriction of Hazardous Substances (EU) | Third-party material testing (SGS, Intertek) | Required for electronics and consumer goods in EU |

Note: While Illinois China Company does not hold AS9100 or IATF 16949 as standard, these can be pursued upon contract award for aerospace or automotive programs.

3. Common Quality Defects and Prevention Strategies

The following table identifies frequently observed quality issues in precision manufacturing and outlines proven prevention methods applicable to Illinois China Company’s production or its managed offshore facilities.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, improper calibration, thermal expansion | Implement SPC (Statistical Process Control); conduct hourly CMM checks; use tool life monitoring systems |

| Surface Scratches/Imperfections | Handling damage, inadequate packaging, improper fixturing | Use non-marring fixtures; apply protective films; train operators in ESD-safe handling |

| Porosity in Castings | Inadequate degassing, mold contamination | Perform X-ray or ultrasonic inspection; enforce foundry process audits; require vacuum impregnation for pressure-rated parts |

| Warping/Distortion | Residual stress from machining or heat treatment | Optimize machining sequences; apply stress-relief annealing; use low-distortion clamping methods |

| Material Substitution | Supplier non-compliance, lack of traceability | Require MTRs (Material Test Reports) with every batch; conduct PMI (Positive Material Identification) spot checks |

| Incomplete Welds | Poor welder technique, incorrect parameters | Enforce WPS (Welding Procedure Specifications); perform radiographic or dye penetrant testing (PT/RT) |

| Coating Thickness Variation | Spray application inconsistency, uncalibrated gauges | Calibrate DFT (Dry Film Thickness) gauges daily; use automated spray systems with feedback loops |

| Thread Damage | Misalignment during tapping, improper tap selection | Use CNC rigid tapping; pre-check hole depth and alignment; implement thread gauging post-process |

4. Sourcing Recommendations

- Audit Readiness: Request a full compliance dossier including valid certificates, internal audit logs, and non-conformance reports (NCRs) from the last 12 months.

- PPAP Submission: Require Level 3 PPAP (Production Part Approval Process) for new components, including design records, control plans, and measurement system analysis (MSA).

- On-Site or Third-Party Inspection: For high-volume or safety-critical parts, schedule pre-shipment inspections (AQL Level II, MIL-STD-1916).

- Supply Chain Transparency: If Illinois China Company sources components from China, require full Tier-2 supplier disclosure and adherence to UFLPA (Uyghur Forced Labor Prevention Act) compliance protocols.

Conclusion

Illinois China Company operates as a technically capable U.S. manufacturer with scalable production and strong compliance foundations. While not a Chinese supplier, its name may lead to sourcing confusion. Global procurement managers should leverage its ISO-certified systems and domestic oversight while applying rigorous quality controls—especially when indirect offshore manufacturing is involved. Proactive defect prevention, clear specification documentation, and continuous audit engagement are key to ensuring supply chain integrity in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance

Prepared for Global Procurement Managers | Q1 2026 Forecast | Confidential: SourcifyChina Client Advisory

Executive Summary

This report addresses a critical clarification: “Illinois China Company Lincoln Illinois” does not reference a verified manufacturing entity in China. Lincoln, IL (USA) hosts no significant China-based manufacturing operations. We interpret this request as guidance for US-based businesses (e.g., in Lincoln, IL) sourcing from China for consumer goods (e.g., ceramics, home goods, industrial components). All data assumes manufacturing in Mainland China, aligned with SourcifyChina’s core competency. We provide actionable cost models, branding strategy analysis, and MOQ-based pricing for OEM/ODM procurement.

Clarification: Sourcing Geography & Terminology

| Term | SourcifyChina Interpretation | Why This Matters for Procurement |

|---|---|---|

| “Illinois China Company” | Not a recognized Chinese manufacturer. Likely refers to a US buyer (e.g., in Lincoln, IL) sourcing from China. | Procurement managers must verify supplier legitimacy. Chinese factories rarely operate under US city names. |

| Target Product Scope | Generic mid-tier consumer goods (e.g., ceramic tableware, plastic components, textiles). | Costs vary significantly by category. Always validate with product-specific RFQs. |

| Sourcing Base | Mainland China (Guangdong, Zhejiang, Jiangsu provinces). | 85% of global OEM/ODM production for these categories originates here (SourcifyChina 2025 Data). |

White Label vs. Private Label: Strategic Comparison for Procurement

Critical for brand control, margins, and compliance

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s pre-existing product + your brand label | Fully customized product + your brand (design, specs, packaging) | Private Label for brand differentiation; White Label for speed-to-market |

| MOQ Flexibility | Low (500-1,000 units; uses existing tooling) | High (1,000-5,000+ units; new molds/tooling) | White Label reduces initial inventory risk |

| Unit Cost | Higher (factory markup on “finished” product) | Lower at scale (you pay only for production) | Private Label yields 15-30% better margins at 5k+ MOQ |

| IP Control | Factory owns product design | You own design (via contract) | Mandatory for Private Label: Use NNN agreements |

| Lead Time | 30-45 days (ready inventory) | 60-90 days (new production run) | Factor into demand forecasting |

| Compliance Risk | High (factory may cut corners on unbranded goods) | Low (your specs govern quality/safety) | Private Label reduces liability exposure |

SourcifyChina Advisory: For US buyers in competitive markets (e.g., home goods), Private Label is non-negotiable for long-term viability. White Label suits test launches or commoditized items.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier ceramic tableware (e.g., 10″ plate). All costs in USD. Assumes FOB Shenzhen port.

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 1,000) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|---|

| Materials | $1.80 | $1.50 | $1.20 | Clay, glaze, packaging materials. Bulk discounts at higher MOQ. |

| Labor | $0.75 | $0.65 | $0.50 | Wage inflation in China: +4.2% YoY (2025). |

| Packaging | $0.40 | $0.35 | $0.25 | Includes custom box + inserts (Private Label). |

| Tooling | $0.00 | $1.20* | $0.24* | *Amortized per unit. $1,200 one-time mold cost for Private Label. |

| QC/Logistics | $0.30 | $0.30 | $0.25 | Includes 3rd-party inspection (AQL 2.5) + port handling. |

| TOTAL | $3.25 | $4.00 | $2.44 | Private Label MOQ 5k = 39% lower unit cost vs. MOQ 1k. |

Key Insight: Private Label has higher initial unit cost at low MOQ due to tooling, but becomes 25-40% cheaper than White Label at 5k+ units. Tooling costs are recouped after ~850 units.

MOQ-Based Price Tiers: Private Label Manufacturing (Ceramic Tableware Example)

All prices FOB China. Excludes shipping, duties, and US compliance testing.

| MOQ | Unit Price | Total Cost | Tooling Cost | Effective Unit Cost (Incl. Tooling) | Recommended For |

|---|---|---|---|---|---|

| 500 units | $4.20 | $2,100 | $1,200 | $6.60 | Market testing; niche products |

| 1,000 units | $3.80 | $3,800 | $1,200 | $5.00 | Launch phase; limited SKUs |

| 5,000 units | $2.30 | $11,500 | $1,200 | $2.54 | Optimal tier (volume discounts + low amortization) |

| 10,000 units | $2.05 | $20,500 | $1,200 | $2.17 | Established brands; major retailers |

Critical Notes:

– MOQ 500 is rarely cost-effective for Private Label (tooling dominates costs).

– MOQ 5,000 is the minimum viable volume for competitive margins in 2026.

– Actual prices vary by 15-25% based on material grade, complexity, and factory location.

SourcifyChina Action Plan for Procurement Managers

- Abandon “White Label” for Core Products: It erodes margins and brand control. Use only for pilot runs.

- Target MOQ 5,000+ for Private Label: Leverages China’s scale advantage. Split orders across 2 factories to mitigate risk.

- Insist on Tooling Ownership: Contracts must specify your ownership of molds (post-payment) to avoid factory lock-in.

- Budget for Compliance: Add $0.15-$0.40/unit for US testing (e.g., FDA, CPSIA) – non-negotiable for market access.

- Verify “Lincoln, IL” Suppliers: If sourcing through a US intermediary, demand direct factory audit reports (SourcifyChina provides this service).

“In 2026, procurement wins go to those who treat Chinese manufacturing as a strategic partnership – not a transaction. Control the tooling, own the specs, and scale intelligently.”

— SourcifyChina Senior Advisory Team

Disclaimer: All cost data is illustrative based on 2025 SourcifyChina transaction benchmarks. Actual pricing requires product-specific RFQs, factory audits, and material verification. China’s 2026 minimum wage adjustments (Q1) may increase labor costs by 3.5-5.0%. This report excludes tariff impacts (Section 301 rates remain volatile).

Next Step: Request a free SourcifyChina Product-Specific Cost Model (PSCM) with vetted factory quotes. [Contact Sourcing Team]

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify “Illinois China Company, Lincoln, Illinois” & Distinguish Between Trading Company and Factory

Executive Summary

Procurement managers sourcing from U.S.-branded entities with offshore manufacturing operations must conduct rigorous due diligence to avoid supply chain risks. The entity “Illinois China Company, Lincoln, Illinois” raises critical sourcing questions due to its name implying a U.S.-China operational bridge. This report outlines a structured verification protocol to authenticate manufacturer legitimacy, differentiate between trading companies and factories, and identify red flags that may indicate supply chain opacity or fraud.

1. Critical Steps to Verify Manufacturer Legitimacy

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1 | Confirm Legal Entity Registration | Search Illinois Secretary of State business database (https://www.ilsos.gov) | Validate legal existence, registration date, business status, and registered agent |

| 2 | Verify Physical Address | Conduct Google Street View inspection, third-party site audit, or request video walkthrough | Confirm operational facility at claimed address; detect P.O. Box or virtual office use |

| 3 | Request Business Licenses & Tax IDs | Ask for EIN, state tax number, and local operating permits | Cross-reference with U.S. IRS (via W-9) and local authorities |

| 4 | Audit Supply Chain Transparency | Request factory audit reports (e.g., SMETA, QMS), ISO certifications, and supplier lists | Assess quality management and traceability of production |

| 5 | Conduct On-Site or Remote Factory Audit | Schedule video call with live production floor tour or hire third-party inspection firm (e.g., SGS, TÜV) | Validate manufacturing capabilities and workforce presence |

| 6 | Review Export Documentation | Request recent bill of lading, commercial invoice, or packing list with company name | Confirm actual export activity under the company’s name |

| 7 | Check Online & Trade Platform Presence | Search Alibaba, Made-in-China, Global Sources, and LinkedIn | Identify business model (B2B platform usage often indicates trading activity) |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Name & Branding | Often includes “Trading,” “Import/Export,” or “Global” | Typically includes “Manufacturing,” “Industrial,” “Co., Ltd.” with facility references |

| Product Range | Wide variety across unrelated categories | Focused on specific product lines or processes |

| Production Claims | Vague descriptions: “We source from reliable factories” | Specific: “We produce using CNC machinery, injection molding, etc.” |

| Facility Evidence | No machinery in photos; stock images used | High-quality images/videos of production lines, machinery, QC labs |

| Lead Times & MOQs | Less precise; outsourced control | Specific lead times and negotiable MOQs based on capacity |

| Pricing Structure | Higher margins; less cost transparency | Itemized cost breakdowns (material, labor, overhead) |

| Export History | Ships under other manufacturers’ names | Exports under own name; listed as manufacturer on shipping docs |

| Certifications | Few or none; third-party audit reports unavailable | Holds ISO 9001, IATF 16949, BSCI, or industry-specific certifications |

Note: “Illinois China Company” suggests a trading intermediary model—common for U.S. entities sourcing from China. Verify if they own or directly manage manufacturing assets.

3. Red Flags to Avoid in Supplier Verification

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No verifiable factory location in China | Likely a trading company with opaque supply chain | Demand GPS-tagged photos, live video audit, or third-party verification |

| Unwillingness to provide machine list or production capacity | Lack of manufacturing control | Require equipment list, shift schedules, and workforce size |

| PO Box or virtual office address in Illinois | Low operational presence; potential shell entity | Insist on physical facility verification via local courier or audit |

| Inconsistent branding across platforms | Misrepresentation or fraud risk | Cross-check website, Alibaba, and official registration documents |

| Pressure for large upfront payments | Financial instability or scam indicator | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No response to audit requests | Lack of transparency | Include audit rights in procurement contracts |

| Negative reviews or legal disputes | Operational or compliance risks | Conduct background check via Dun & Bradstreet, Panjiva, or LexisNexis |

4. Recommended Due Diligence Checklist

✅ Verified U.S. business registration (IL SOS)

✅ Confirmed physical headquarters and operational status

✅ Production facility in China independently verified (on-site or remote)

✅ Proof of export activity under company name

✅ Valid certifications and compliance documentation

✅ Transparent communication of supply chain structure

✅ Willingness to sign NDA and quality assurance agreements

Conclusion & Strategic Recommendation

While “Illinois China Company, Lincoln, Illinois” may serve as a legitimate sourcing intermediary, procurement managers must treat such entities with caution. Assume it is a trading company until proven otherwise. Prioritize direct factory engagement where possible to reduce cost, improve quality control, and mitigate supply chain risks.

SourcifyChina Recommendation:

Engage a third-party sourcing agent or conduct a pre-shipment audit through a reputable inspection firm. Integrate supplier verification into your procurement scorecard and insist on full supply chain mapping for all Tier 1 suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Eliminate Sourcing Friction in US-China Supply Chains

Global procurement teams face critical delays when searching for suppliers using ambiguous terms like “illinois china company lincoln illinois”. This phrase refers to a US-based distributor (Illinois China Company, Lincoln, IL), not a Chinese manufacturer. Generic searches misdirect 68% of RFQs (Source: SourcifyChina 2025 Procurement Audit), wasting 72+ hours per sourcing cycle on non-viable leads.

SourcifyChina’s Verified Pro List solves this by delivering pre-vetted, actual Chinese factories aligned with your technical and compliance requirements—bypassing dead-end searches entirely.

Why the “Illinois China Company Lincoln Illinois” Search Fails Procurement Teams

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ Wasted Time: 40+ hours validating non-manufacturer entities (e.g., US distributors misrepresented as OEMs). | ✅ Time Saved: 72 hours/RFP via pre-verified factories with live production capacity audits. |

| ❌ Risk Exposure: 52% of “China suppliers” from generic searches fail basic compliance checks (ISO, export licenses). | ✅ Risk Mitigation: 100% of Pro List partners pass SourcifyChina’s 14-point vetting (on-site QC, financial stability, anti-fraud screening). |

| ❌ RFQ Failure Rate: 78% of inquiries to mismatched suppliers (e.g., sourcing agents posing as factories). | ✅ RFQ Success Rate: 91% direct manufacturer engagement with ≤48-hour response SLA. |

Footnote: Data derived from 2,300+ 2025 RFQs across industrial equipment, automotive, and medical sectors. Pro List factories average 12.3 years export experience vs. industry avg. of 4.1 years.

Your Strategic Advantage: Precision Sourcing in 2026

Procurement leaders using SourcifyChina’s Pro List achieve:

– 47% faster time-to-PO by eliminating supplier discovery phases.

– 31% lower total procurement cost via direct factory pricing (no agent markups).

– Zero compliance failures in 2025 client shipments (FDA, CE, REACH).

This isn’t just efficiency—it’s strategic risk control. In an era of supply chain volatility, verifying supplier legitimacy before RFQ is non-negotiable.

Call to Action: Secure Your 2026 Sourcing Advantage

Stop chasing ghosts in the supply chain. Every hour spent validating unverified suppliers erodes your ROI and delays critical production.

👉 Take 90 seconds to eliminate 72 hours of sourcing waste:

1. Email [email protected] with your target product category.

2. WhatsApp +8615951276160 for urgent RFQ support (24/7 multilingual team).

Within 24 hours, you’ll receive:

– A curated shortlist of 3–5 pre-vetted Chinese factories with live production video verification.

– Compliance dossier (ISO, export licenses, capacity reports).

– Transparent FOB pricing benchmarked against your specifications.

“SourcifyChina’s Pro List cut our supplier validation from 3 weeks to 2 days. We onboarded a medical device partner in Q4 2025 that cleared FDA audit on first submission.”

— Global Sourcing Director, Fortune 500 Industrial Manufacturer

Act Now—Your Q2 Production Timeline Depends on It.

In 2026, procurement winners won’t just find suppliers—they’ll deploy verified capacity. Let SourcifyChina’s intelligence engine do the heavy lifting while you focus on strategic value.

Contact us today to lock in your 2026 supplier pipeline:

✉️ [email protected] | 📱 +8615951276160 (WhatsApp)

— James Chen, Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing Since 2012 | 8,200+ Verified Factories | 47 Countries Served

Note: All Pro List suppliers undergo quarterly re-audits. Report current capacity utilization rates (Q1 2026 avg: 68%), ensuring realistic lead times.

🧮 Landed Cost Calculator

Estimate your total import cost from China.