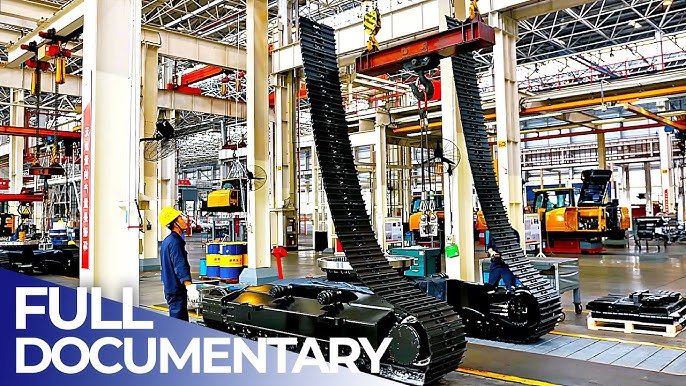

The global hydraulic remote-controlled (RC) excavator market is experiencing robust growth, driven by increasing demand for safer and more efficient excavation in hazardous environments. According to a report by Mordor Intelligence, the global excavator market was valued at USD 51.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2029. A key contributor to this expansion is the rising adoption of remote-controlled and automated machinery, particularly in mining, demolition, and deep-excavation applications where operator safety is paramount. Grand View Research further supports this trend, noting that technological advancements in hydraulics and remote operation systems are accelerating demand across both developed and emerging markets. As industries prioritize precision, productivity, and worker protection, leading manufacturers are investing heavily in smart, remotely operated hydraulic excavators. In this evolving landscape, six manufacturers stand out for their innovation, reliability, and global market presence.

Top 6 Hydraulic Rc Excavators Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Licensed RC Excavators

Domain Est. 2020

Website: doubleeagle-group.com

Key Highlights: Double E Hobby produces high quality, metal RC excavators and other RC construction vehicles. We are a leading manufacturer of hobby RC excavators….

#2 Radio Controlled (RC) Excavators

Domain Est. 2012

#3 1/14 RC Hydraulic Excavator 360L

Domain Est. 2012

#4 RC Hydraulic Excavators by Toucanhobby

Domain Est. 2016

#5 RC Excavators

Domain Est. 2021

Website: heavydutyrc.com

Key Highlights: Free delivery 14-day returnsWe offer both Electric and Hydraulic RC Excavators. The Electric RC Excavators are the beginner excavators and most affordable RC excavators. They do no…

#6 Hydraulic RC Excavators

Website: toucanhobby.eu

Key Highlights: Kabolite K980 1/14 Hydraulic RC Excavator SY980H Giant PL18 Lite Radio Control Digger Metal Manual Quick Release Coupler Electric Hammer Ripper….

Expert Sourcing Insights for Hydraulic Rc Excavators

H2: 2026 Market Trends for Hydraulic RC Excavators

The global market for Hydraulic Remote-Controlled (RC) Excavators is poised for significant transformation by 2026, driven by technological advancements, increasing demand for safety and efficiency in construction and mining operations, and growing automation trends. Several key factors are shaping the trajectory of this specialized segment within the broader construction equipment industry.

-

Rising Demand for Operator Safety

One of the primary drivers of the Hydraulic RC Excavator market is the growing emphasis on workplace safety. Remote-controlled systems allow operators to manage excavation tasks from a safe distance, particularly in hazardous environments such as unstable terrain, confined spaces, or areas with risk of collapses and explosions. By 2026, stricter occupational health and safety regulations—especially in North America and Europe—are expected to accelerate adoption across mining, demolition, and infrastructure projects. -

Integration of Advanced Technologies

Hydraulic RC Excavators are increasingly incorporating smart technologies such as real-time telemetry, GPS guidance, collision avoidance systems, and 5G-enabled remote operation. These innovations enhance precision, reduce downtime, and allow for seamless integration with digital construction management platforms. By 2026, AI-assisted automation and predictive maintenance features are expected to become standard in high-end models, further boosting market appeal. -

Growth in Mining and Underground Applications

The mining sector, particularly underground mining, is a major adopter of RC excavators due to their ability to operate in low-ventilation, high-risk zones. As global demand for minerals and metals rises—driven by electric vehicle (EV) battery production and renewable energy infrastructure—investment in remote-controlled machinery is expected to grow. This trend will be especially pronounced in regions like Australia, Canada, and parts of Africa. -

Expansion in Urban Infrastructure and Demolition Projects

Urban redevelopment and the need for precision in demolition work are also fueling demand. RC excavators offer enhanced control in tight urban spaces where traditional machines pose risks to nearby structures and personnel. By 2026, cities undergoing large-scale retrofitting and smart city development are expected to increasingly deploy these machines for safer, more efficient operations. -

Regional Market Dynamics

While North America and Europe lead in early adoption due to advanced infrastructure and regulatory support, the Asia-Pacific region is anticipated to witness the fastest growth. Countries like China, India, and Japan are investing heavily in infrastructure, supported by government initiatives and rising labor costs, which make automation more economically viable. -

Sustainability and Electrification Trends

Although most RC excavators remain diesel-powered, there is a growing shift toward hybrid and fully electric models to meet emissions standards and sustainability goals. By 2026, manufacturers are expected to launch more electric hydraulic RC excavators, particularly for indoor and environmentally sensitive applications. -

Competitive Landscape and Innovation

Major players such as Caterpillar, Komatsu, Volvo CE, and Hitachi are investing in R&D to expand their RC excavator portfolios. Smaller specialized firms are also entering the market with modular retrofit kits that convert standard hydraulic excavators into remote-controlled units—offering cost-effective solutions for small- to medium-sized contractors.

In summary, the 2026 market for Hydraulic RC Excavators will be defined by a convergence of safety imperatives, digital innovation, and sustainability. As industries prioritize efficiency and risk mitigation, the adoption of remote-controlled hydraulic excavators is expected to grow steadily across geographies and applications, positioning the segment for robust expansion in the coming years.

Common Pitfalls When Sourcing Hydraulic RC Excavators: Quality and Intellectual Property Risks

Sourcing hydraulic remote-controlled (RC) excavators, especially from international or non-traditional suppliers, presents several critical challenges. Buyers must be vigilant to avoid compromising on performance, safety, and legal compliance. Below are two major areas of concern: quality inconsistencies and intellectual property (IP) violations.

Quality-Related Pitfalls

One of the most significant risks in sourcing hydraulic RC excavators is receiving equipment that fails to meet expected performance, durability, or safety standards. Common quality pitfalls include:

- Substandard Components: Suppliers may use low-grade hydraulic pumps, valves, or hoses to cut costs, leading to frequent breakdowns, reduced efficiency, and increased maintenance costs.

- Inadequate Build Quality: Poor welding, improper assembly, or the use of inferior steel can compromise structural integrity, increasing the risk of failures under operational stress.

- Lack of Rigorous Testing: Some manufacturers skip comprehensive performance and safety testing, resulting in units that malfunction under real-world conditions or fail to operate reliably in extreme environments.

- Inconsistent Manufacturing Standards: Especially with OEMs in regions with lax oversight, batch-to-batch inconsistencies can lead to unpredictable machine behavior and reliability issues.

- Insufficient Technical Documentation: Missing or inaccurate manuals, schematics, or software interfaces can hinder maintenance, troubleshooting, and integration into existing operations.

To mitigate these risks, buyers should conduct factory audits, require third-party inspections, and insist on performance testing under simulated operating conditions.

Intellectual Property (IP) Infringement Risks

Sourcing RC excavators from certain suppliers—particularly those offering significantly lower prices—can expose buyers to legal and reputational risks related to intellectual property violations.

- Counterfeit or Clone Designs: Some manufacturers replicate patented designs, control systems, or software from established brands without authorization, infringing on trademarks, design patents, or utility patents.

- Unauthorized Use of Software/Firmware: RC excavators rely on proprietary control algorithms and communication protocols. Unauthorized duplication or reverse engineering of such software can violate copyright and licensing agreements.

- Grey Market Imports: Purchasing from unauthorized distributors may involve equipment that was diverted from official markets, potentially voiding warranties and exposing the buyer to IP litigation.

- Lack of IP Due Diligence: Buyers who do not verify the supplier’s right to manufacture and sell the equipment may inadvertently become complicit in IP theft, leading to seizure of equipment or legal action.

To avoid IP pitfalls, conduct thorough due diligence on the supplier’s manufacturing rights, request proof of IP ownership or licensing, and consider engaging legal counsel to review contracts and product documentation.

By proactively addressing these quality and IP-related pitfalls, buyers can ensure they source reliable, legally compliant hydraulic RC excavators that deliver long-term value and operational safety.

Logistics & Compliance Guide for Hydraulic RC Excavators

Introduction

Hydraulic Remote-Controlled (RC) Excavators are specialized construction and demolition machines that offer enhanced operator safety and precision in challenging environments. Proper logistics planning and regulatory compliance are essential for their legal, safe, and efficient transport, operation, and maintenance. This guide outlines key considerations for managing hydraulic RC excavators across their lifecycle.

Regulatory Compliance

Equipment Safety Standards

Hydraulic RC excavators must comply with relevant safety standards such as ISO 20474 (Earth-moving machinery – Safety), ISO 10218 (Safety of industrial robots), and applicable regional directives (e.g., EU Machinery Directive 2006/42/EC, OSHA regulations in the U.S.). These standards cover structural integrity, controls, emergency stop functions, and remote operation safety.

Electromagnetic Compatibility (EMC)

As remotely operated machines, RC excavators must meet EMC regulations (e.g., EU EMC Directive 2014/30/EU or FCC Part 15 in the U.S.) to ensure radio frequency controls do not interfere with other devices and are immune to external interference.

CE Marking & Technical Documentation

In the European Economic Area (EEA), RC excavators must bear the CE mark. Manufacturers and importers must prepare a Declaration of Conformity and maintain a comprehensive technical file, including risk assessments, design drawings, and test reports.

Operator Certification & Training

Operators of RC excavators must be certified and trained in both standard excavator operation and remote-control procedures. Training should cover line-of-sight requirements, signal range limitations, emergency protocols, and job site hazard awareness.

Transportation & Logistics

Pre-Transport Preparation

Before transport, secure all attachments (buckets, breakers, etc.), retract hydraulic cylinders, engage transport locks, and disable the remote control system. Lower the boom and arm to their transport positions and ensure the machine is clean and free of debris.

Load Securing & Vehicle Requirements

Hydraulic RC excavators must be transported on low-bed trailers or flatbed trucks appropriate for their weight and dimensions. Use rated chains, binders, and skid plates to secure the machine per the U.S. DOT’s Federal Motor Carrier Safety Regulations (FMCSR) or ADR/EU standards. Wheel and track excavators require different securing methods.

Permits & Route Planning

For oversized or overweight units, obtain special transport permits from state or national authorities. Plan routes to avoid low bridges, weak roads, and restricted zones. Notify local authorities if required, especially for cross-border movements within the EU or interstate haulage in the U.S.

Import/Export Compliance

When shipping internationally, ensure compliance with customs regulations, including accurate HS (Harmonized System) code classification (e.g., 8429.52 for hydraulic excavators), import duties, and documentation such as commercial invoices, packing lists, and certificates of origin. Verify adherence to EPA, CARB, or EU Stage V emissions standards where applicable.

On-Site Operation & Environmental Compliance

Site Risk Assessment

Conduct a site-specific risk assessment before deploying RC excavators. Evaluate terrain stability, overhead hazards, proximity to utilities, and signal interference risks. Establish exclusion zones and maintain clear line-of-sight between operator and machine.

Noise & Emissions Control

Ensure the RC excavator meets local noise and emissions regulations. Electric or hybrid models may be required in urban or environmentally sensitive areas. Monitor exhaust emissions and use approved filters or after-treatment systems if mandated.

Waste & Fluid Management

Prevent hydraulic oil, coolant, or fuel leaks. Use spill containment kits and follow proper disposal procedures for used fluids in accordance with EPA or local environmental regulations (e.g., RCRA in the U.S., WEEE and ELV directives in the EU).

Maintenance & Record Keeping

Scheduled Maintenance

Follow manufacturer-recommended maintenance schedules for hydraulic systems, control units, batteries, and structural components. Keep detailed logs of inspections, repairs, and component replacements.

Calibration & Software Updates

Regularly calibrate remote control systems and update firmware to ensure operational safety and compliance with evolving cybersecurity standards, especially for models with wireless connectivity.

Documentation & Audit Readiness

Maintain records of compliance certifications, operator training, maintenance logs, incident reports, and transport permits. These documents may be required during regulatory audits or insurance claims.

Conclusion

Effective logistics and compliance management for hydraulic RC excavators ensures operational safety, regulatory adherence, and reduced downtime. By integrating robust planning, training, and documentation practices, operators and contractors can maximize the benefits of remote-controlled technology while minimizing legal and environmental risks.

Conclusion for Sourcing Hydraulic RC Excavators

In conclusion, sourcing hydraulic remote-controlled (RC) excavators requires a comprehensive evaluation of key factors including operational requirements, machine specifications, reliability of suppliers, after-sales support, and total cost of ownership. These advanced machines offer significant advantages in terms of operator safety, precision, and efficiency—particularly in confined or hazardous environments such as demolition, trenching, and mining operations.

Selecting the right RC excavator involves balancing performance, durability, and technological features such as responsive control systems, robust hydraulic power, and compatibility with various attachments. Partnering with reputable manufacturers or distributors who provide genuine parts, training, and responsive service networks is essential to ensure long-term operational success.

Furthermore, considering future scalability, maintenance accessibility, and compliance with regional safety and emissions standards will enhance the return on investment. By conducting thorough market research, requesting equipment demonstrations, and performing due diligence on potential suppliers, organizations can make informed procurement decisions that align with their project goals and safety standards.

Ultimately, investing in high-quality hydraulic RC excavators not only improves worksite productivity and safety but also positions operations at the forefront of modern, technology-driven excavation practices.