The global hydraulic pumps and gearboxes market is experiencing robust expansion, driven by increasing demand from construction, manufacturing, and agriculture sectors. According to a report by Mordor Intelligence, the hydraulic pump market is projected to grow at a CAGR of over 4.5% from 2024 to 2029, with gearboxes playing a critical role in enhancing system efficiency and reliability. Similarly, Grand View Research estimates that the global industrial gearbox market size was valued at USD 110.6 billion in 2023 and is expected to expand at a CAGR of 5.2% through 2030, fueled by automation trends and the need for high-performance fluid power systems. As industries prioritize energy efficiency and operational durability, the integration of advanced hydraulic pump and gearbox systems has become pivotal. This growing demand has elevated the prominence of leading manufacturers who combine engineering precision with innovation. Below are the top 10 hydraulic pump gearbox manufacturers shaping the future of industrial motion control.

Top 10 Hydraulic Pump Gearbox Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hydraulic Pump Manufacturer

Domain Est. 2023

Website: hydraulicpump-motor.com

Key Highlights: Guangdong KEDA Hydraulic Technology Co., Ltd. is an industry leader in producing high-pressure piston pumps and high-speed motors….

#2 Hydro

Domain Est. 1996

Website: hydro-gear.com

Key Highlights: Hydro-Gear is the world’s leading manufacturer of drivetrain solutions from industrial machines to residential mowers….

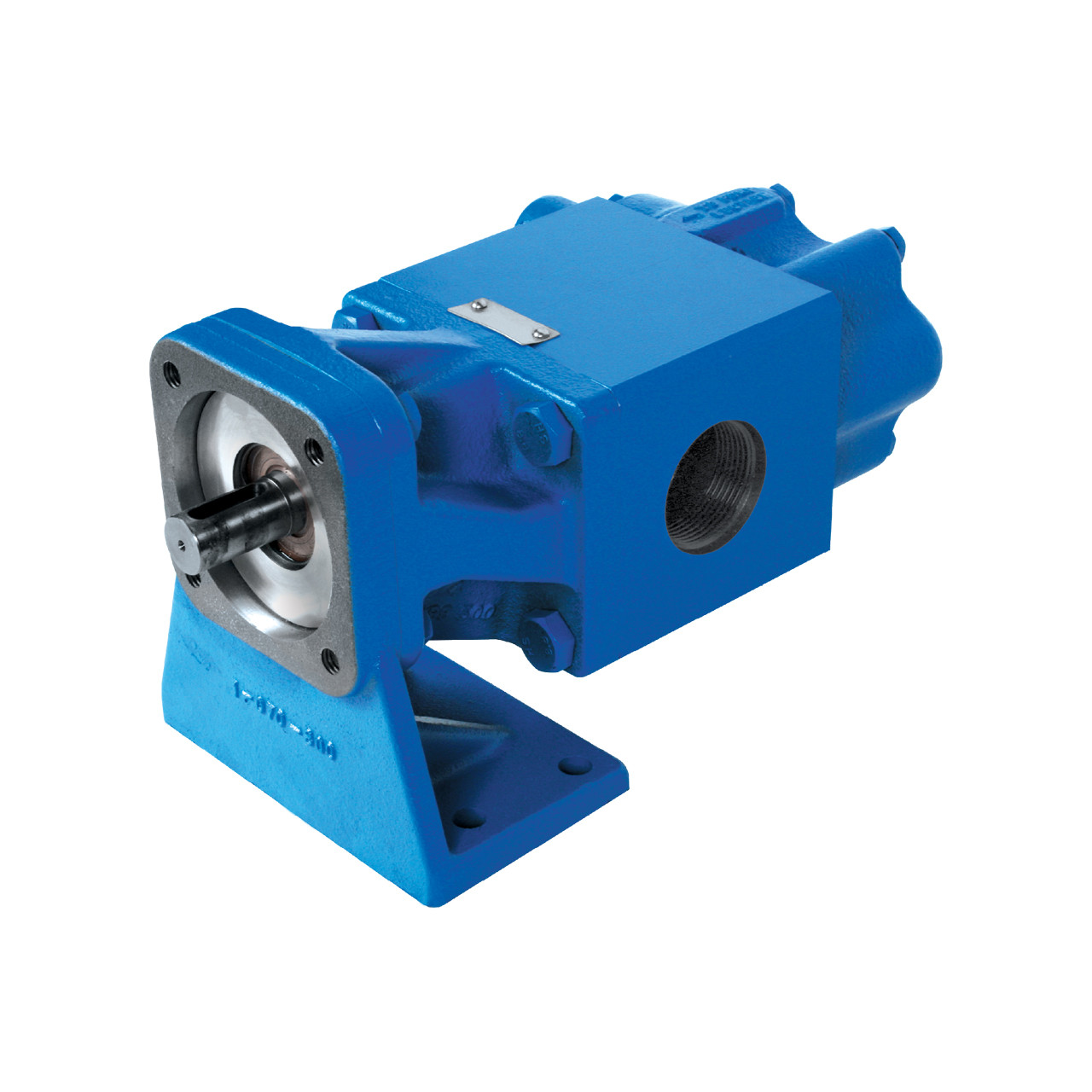

#3 Viking Pump

Domain Est. 1996

Website: vikingpump.com

Key Highlights: Viking Pump is the leading manufacturer of positive displacement pumps. Our industrial internal and external gear pumps, hygienic pumps, and energy pumps ……

#4 High

Domain Est. 1995

Website: oilgear.com

Key Highlights: Oilgear is a leading manufacturer of high-performance pumps, valves, and rotary actuators, offering comprehensive services, training, and test equipment….

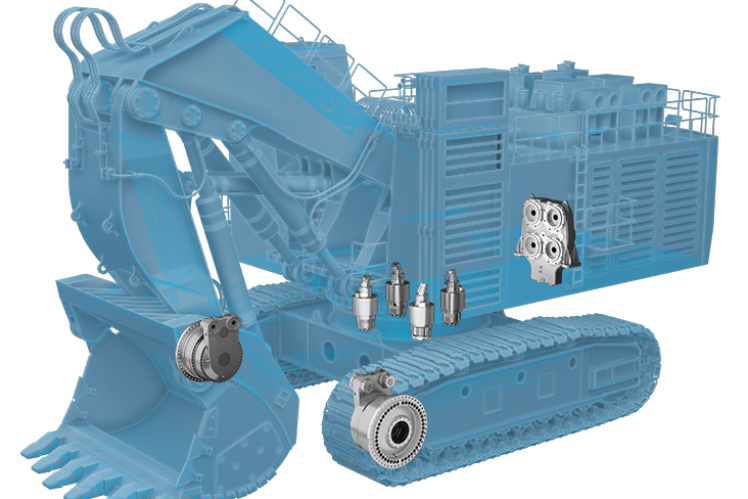

#5 ZF Product Range Industrial Gearboxes

Domain Est. 1996

Website: zf.com

Key Highlights: ZF Pump Distribution Gears for driving different hydraulic pumps simultaneously are ideally suited for installation in large hydraulic excavators. Catologue ……

#6 Philadelphia Gear

Domain Est. 1996

Website: philagear.com

Key Highlights: Philadelphia Gear operates at the core of critical applications, providing a complete range of custom-engineered gearbox products and gear services….

#7 Neugart

Domain Est. 1997

Website: neugart.com

Key Highlights: Discover the high-quality planetary and custom gearboxes from Neugart GmbH. As one of the leading gearbox manufacturers, we offer innovative drive solutions ……

#8 Hema Driveline and Hydraulics Inc.: Hema Usa

Domain Est. 2019

Website: hema-usa.com

Key Highlights: Hema Usa, Explore the reliable gear pump, gear motors, orbital motor from Hema Driveline and Hydraulics Inc. for smooth hydraulic operations….

#9 Hydraulic Pump and Motor Division

Domain Est. 1995

Website: parker.com

Key Highlights: Increase efficiency & precision with Parker’s HPM Division offering piston pumps, integrated hydrostatic transmissions, gear pumps, configured ePumps, ……

#10 Hydraulic Pumps

Domain Est. 1997

Website: munciepower.com

Key Highlights: Muncie Power Products manufactures premium hydraulic pumps. We offer piston, gear, dump, refuse and clutch pumps to meet any of your hydraulic application ……

Expert Sourcing Insights for Hydraulic Pump Gearbox

2026 Market Trends for Hydraulic Pump Gearbox

The global hydraulic pump gearbox market is poised for significant transformation by 2026, driven by technological innovation, increasing automation, and a shift toward energy efficiency across key industrial sectors. Below is an in-depth analysis of the expected trends shaping the industry in the coming years.

Rising Demand in Industrial Automation and Manufacturing

Industrial automation continues to be a major growth driver for hydraulic pump gearboxes. As manufacturing facilities adopt smart factory technologies and Industry 4.0 principles, the need for reliable, high-performance power transmission systems intensifies. Hydraulic pump gearboxes play a critical role in machinery requiring precise control of motion and force, such as injection molding machines, metal presses, and CNC equipment. With global investments in automation projected to rise, demand for durable and efficient gearboxes is expected to grow steadily through 2026.

Expansion in Construction and Off-Highway Equipment

The construction, mining, and agricultural sectors remain key end-users of hydraulic systems. Equipment such as excavators, loaders, tractors, and harvesters rely heavily on hydraulic pump gearboxes for power transfer and operational efficiency. As infrastructure development accelerates in emerging economies and governments invest in large-scale projects, the demand for off-highway vehicles equipped with advanced hydraulic systems will rise. This trend is expected to contribute significantly to market growth by 2026.

Emphasis on Energy Efficiency and Sustainability

Regulatory pressures and corporate sustainability goals are pushing manufacturers to develop more energy-efficient hydraulic systems. In response, gearbox producers are focusing on reducing internal friction, improving gear design, and integrating condition monitoring features to minimize energy loss and downtime. Lightweight materials and compact designs are also being adopted to improve overall system efficiency. By 2026, energy-efficient hydraulic pump gearboxes are expected to dominate new installations, especially in Europe and North America, where environmental standards are stringent.

Integration with Smart Technologies and IoT

The integration of hydraulic systems with IoT (Internet of Things) and predictive maintenance platforms is a transformative trend. By 2026, smart hydraulic pump gearboxes equipped with sensors and real-time monitoring capabilities will become increasingly common. These systems enable remote diagnostics, predictive failure alerts, and performance optimization, reducing maintenance costs and enhancing uptime. OEMs and end-users alike are adopting these technologies to improve operational efficiency, particularly in mission-critical applications.

Regional Market Dynamics

Asia-Pacific is expected to lead global market growth by 2026, fueled by rapid industrialization, expanding manufacturing bases, and infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe will maintain strong demand, driven by technological upgrades, replacement cycles, and high adoption of automation. Meanwhile, Latin America and the Middle East are anticipated to show moderate growth, supported by localized construction and energy projects.

Competitive Landscape and Innovation

The hydraulic pump gearbox market is becoming increasingly competitive, with leading players investing in R&D to differentiate their offerings. Companies are focusing on modular designs, customization, and hybrid systems that combine hydraulic and electric technologies. Strategic partnerships, mergers, and acquisitions are also expected to reshape the competitive landscape by 2026 as firms aim to expand their global footprint and technological capabilities.

Conclusion

By 2026, the hydraulic pump gearbox market will be defined by innovation, efficiency, and digital integration. Growth will be sustained by industrial automation, infrastructure development, and a global push toward smarter, more sustainable machinery. Manufacturers that adapt to these trends—by embracing smart technologies, improving energy performance, and expanding in emerging markets—are likely to capture significant market share in the years ahead.

Common Pitfalls Sourcing Hydraulic Pump Gearbox (Quality, IP)

Sourcing a Hydraulic Pump Gearbox involves critical considerations beyond just price and delivery. Overlooking key aspects related to quality and intellectual property (IP) can lead to significant operational, financial, and legal risks. Here are the most common pitfalls to avoid:

Overlooking Build Quality and Material Specifications

A frequent mistake is focusing solely on initial cost while neglecting the long-term implications of subpar materials and manufacturing. Low-quality gearboxes often use inferior steel, inadequate heat treatment, or imprecise machining, leading to premature wear, gear failure, or bearing collapse under load. Always verify material certifications (e.g., ISO, ASTM), surface finish tolerances, and manufacturing processes. Poor build quality can result in unplanned downtime, high maintenance costs, and safety hazards.

Ignoring IP Infringement Risks with Copycat Suppliers

Many suppliers, especially in certain regions, offer “compatible” or “generic” gearboxes that closely mimic branded originals. While seemingly cost-effective, these products may infringe on patents, trademarks, or design rights. Purchasing from such suppliers exposes your company to legal liability, seizure of goods by customs, reputational damage, and potential product recalls. Always vet suppliers for legitimate IP rights and avoid those offering suspiciously cheap replicas of well-known brands.

Assuming IP Clearance Without Due Diligence

Even if a supplier claims their product is “IP-free” or “not infringing,” buyers must conduct independent due diligence. Relying solely on supplier assurances is risky. Conduct patent landscape searches or consult IP legal counsel to confirm that the gearbox design does not violate existing patents—especially for complex gear geometries, sealing mechanisms, or integration features. Failure to do so can result in costly litigation.

Prioritizing Price Over Long-Term Reliability and Warranty

Choosing the cheapest option often leads to hidden costs. Low-priced gearboxes may lack robust quality control, have shorter service lives, or come with limited or unenforceable warranties. Ensure the supplier offers a clear, comprehensive warranty covering defects in materials and workmanship. Consider total cost of ownership, including maintenance, energy efficiency, and downtime, rather than just the upfront purchase price.

Failing to Verify IP Ownership in Custom Designs

When sourcing custom-designed gearboxes, it’s crucial to clarify IP ownership in the contract. Some suppliers may retain design rights, limiting your ability to reproduce or modify the gearbox in the future. Ensure agreements explicitly state that IP developed for your project is assigned to your company, or at minimum, that you receive full, royalty-free usage rights.

By proactively addressing these quality and IP-related pitfalls, organizations can mitigate risks, ensure reliable performance, and protect themselves from legal and financial exposure when sourcing hydraulic pump gearboxes.

Logistics & Compliance Guide for Hydraulic Pump Gearbox

Product Classification & Documentation

Ensure accurate classification of the hydraulic pump gearbox for international trade. Typically, such components fall under HS Code 8483.40 (gear boxes and other speed changers). Confirm the exact code with local customs authorities or a licensed customs broker. Required documentation includes a commercial invoice, packing list, bill of lading or air waybill, and a certificate of origin. For certain destinations, an export declaration or import permit may also be necessary.

Export Controls & Regulatory Compliance

Hydraulic pump gearboxes may be subject to export control regulations depending on their technical specifications, end-use, or destination country. Verify compliance with relevant regulations such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. If the gearbox incorporates advanced materials or is intended for military or critical infrastructure applications, a license may be required. Screen end-users and destinations against denied party lists (e.g., BIS, EU Consolidated List) prior to shipment.

Packaging & Handling Requirements

Package the hydraulic pump gearbox to withstand international shipping conditions, including vibration, temperature fluctuations, and moisture. Use robust, wooden or composite crates with internal cushioning to prevent movement. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include product identification, part numbers, and safety warnings. Seal all openings to prevent ingress of dust or moisture, and consider desiccants for long transit durations.

Transportation Modes & Lead Times

Select the appropriate transportation mode based on urgency, cost, and destination. Air freight offers faster delivery (3–7 days) but at a higher cost, suitable for urgent or high-value shipments. Ocean freight is cost-effective for large or heavy units (20–45 days), ideal for bulk orders. Ensure compatibility with container dimensions and weight limits. Coordinate with freight forwarders to optimize routing and minimize delays at transshipment points.

Import Duties & Taxes

Research import duties, value-added tax (VAT), and other local taxes applicable in the destination country. Duty rates vary by country and HS code classification—use duty calculators or consult a customs broker for accurate estimates. Provide complete and accurate product descriptions and declared values to avoid customs delays, penalties, or reclassification. Consider using Incoterms (e.g., DDP, CIF) to clarify responsibility for duties and taxes.

Environmental & Safety Regulations

Comply with environmental standards such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) if shipping to the EU. Ensure any lubricants or coatings used on the gearbox meet local environmental and safety regulations. Provide Safety Data Sheets (SDS) for any hazardous materials included with the product. Adhere to IATA and IMDG regulations if shipping with associated chemicals or pressurized components.

After-Sales & Warranty Logistics

Establish a clear process for handling warranty claims, repairs, and returns. Define return material authorization (RMA) procedures and designate regional service centers if applicable. Include warranty documentation and service contact information with each unit. Coordinate reverse logistics to ensure timely return and repair of defective gearboxes, minimizing downtime for end customers.

Recordkeeping & Audit Preparedness

Maintain comprehensive records of all shipments, compliance certifications, export licenses, and correspondence with regulatory authorities. Retain documentation for a minimum of five years, or as required by local law. Conduct periodic internal audits to verify compliance with logistics and trade regulations, and prepare for potential customs or regulatory inspections.

Conclusion for Sourcing Hydraulic Pump Gearbox

Sourcing a hydraulic pump gearbox requires a strategic approach that balances performance requirements, reliability, cost-efficiency, and long-term support. After thorough evaluation of technical specifications, supplier capabilities, quality certifications, and total cost of ownership, it is evident that selecting the right gearbox is critical to the optimal operation of hydraulic systems.

The chosen supplier should demonstrate proven expertise in manufacturing precision gearboxes, offer customization options to meet specific application needs, and provide robust after-sales support, including maintenance and spare parts availability. Additionally, prioritizing energy-efficient designs and durable materials contributes to reduced downtime and operational costs over the equipment’s lifecycle.

In conclusion, a well-informed sourcing decision—based on technical compatibility, supplier reputation, and lifecycle value—ensures reliable integration of the hydraulic pump gearbox into the system, ultimately enhancing overall performance, efficiency, and operational safety. Regular reviews and performance monitoring post-installation will further support continuous improvement and informed future procurement decisions.