The global check valve market is experiencing robust growth, driven by increasing demand across industrial, oil & gas, water and wastewater treatment, and power generation sectors. According to Mordor Intelligence, the check valve market was valued at USD 11.76 billion in 2023 and is projected to reach USD 16.24 billion by 2029, growing at a CAGR of approximately 5.6% during the forecast period. This expansion is fueled by rising infrastructure investments, stringent regulations around fluid control systems, and the global push toward efficient water management and energy transmission. Within this dynamic landscape, hydraulically operated (hyd) check valves have gained prominence for their reliability in preventing backflow and maintaining system integrity in high-pressure applications. As industries prioritize operational safety and efficiency, the demand for high-performance hyd check valves continues to surge. The following list highlights the top 10 manufacturers shaping this segment through innovation, global reach, and proven product reliability.

Top 10 Hyd Check Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Pinch Valves & Check Valves

Domain Est. 1995

Website: redvalve.com

Key Highlights: Red Valve is the largest manufacturer and supplier of pinch and check valves, and is the preferred supplier for municipalities and industrial plants worldwide….

#2 DFT® Valves

Domain Est. 1999 | Founded: 1943

Website: dft-valves.com

Key Highlights: Since 1943 DFT® Inc. has manufactured world class, problem solving, in-line, axial flow, nozzle style silent check valves and severe service control valves….

#3 https://www.dmic.com

Domain Est. 1995

Website: dmic.com

Key Highlights: Designer and Manufacturer of Ball valves, Check valves, Flow controls, Power unit accessories and Custom hydraulic components for the Fluid Power Industry….

#4 DeZURIK

Domain Est. 1996 | Founded: 1928

Website: dezurik.com

Key Highlights: Since 1928, DeZURIK is an innovative global leader as a valve manufacturer with a reputation for product innovation, reliability and service….

#5 Hydraulic Valve Manufacturers

Domain Est. 2002

Website: hydraulicvalves.org

Key Highlights: Use our comprehensive directory of hydraulic valve suppliers to compare companies by specialties, product range, certifications, and service capabilities. ……

#6 HydraForce: Your Source for Compact Hydraulics

Domain Est. 1995

Website: hydraforce.com

Key Highlights: HydraForce designs and manufactures products for hydraulically powered mobile equipment, including control valves, manifolds, and electronic controllers….

#7 Valves

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … Check Valve Series C/9C (Europe and Asia)”,”document-type”:”Static File … HYD UK Hydraulic Catalogue 2012″,”document-type”:”Static File”,”document ……

#8 Hydraulic Valves

Domain Est. 1996

Website: princehyd.com

Key Highlights: Use this tool to configure one of our products, by selecting the desired options it will generate a model number and list price….

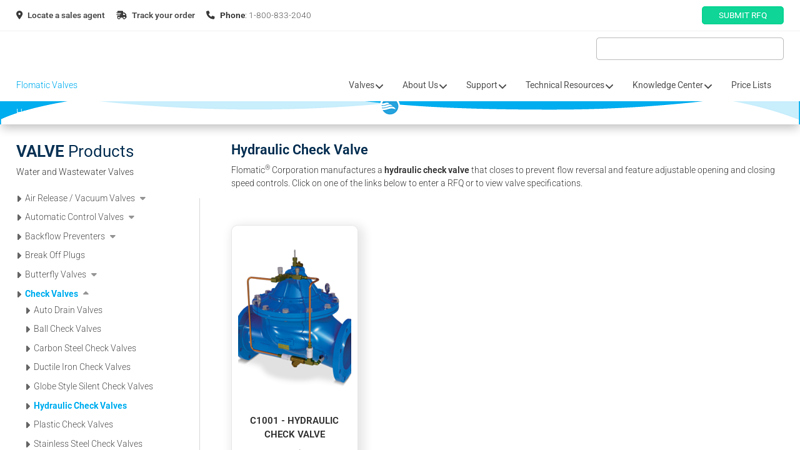

#9 Hydraulic Check Valve

Domain Est. 1996

Website: flomatic.com

Key Highlights: Flomatic Corporation manufactures a hydraulic check valve that closes to prevent flow reversal and feature adjustable opening and closing speed controls….

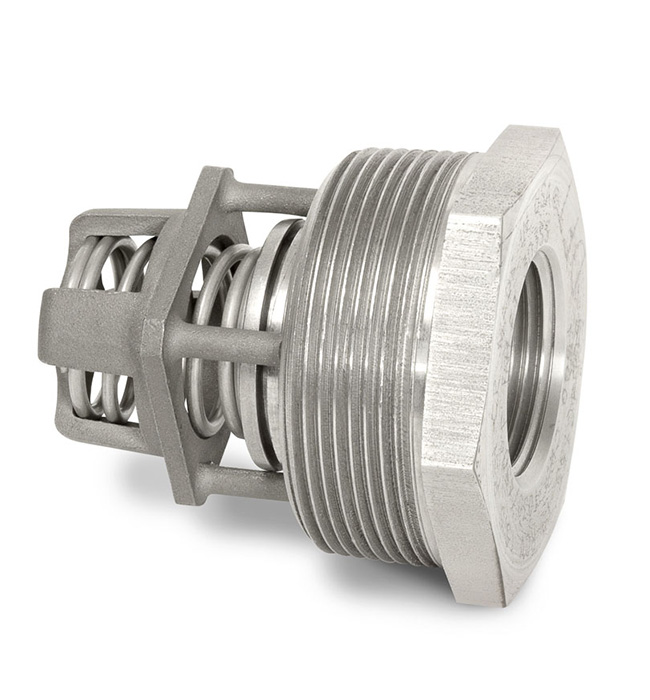

#10 Spring Check Valve

Domain Est. 1997

Website: checkall.com

Key Highlights: Check-All Valve is an experienced check valve manufacturing company providing a wide variety of valve products. Call (515) 224-2301 for more information….

Expert Sourcing Insights for Hyd Check Valve

H2: 2026 Market Trends for Hydraulic Check Valves

The global hydraulic check valve market is poised for steady growth through 2026, driven by advancements in industrial automation, increasing demand from heavy machinery sectors, and a growing emphasis on energy efficiency and system reliability. As critical components in hydraulic systems, check valves ensure unidirectional fluid flow, preventing backflow and enhancing operational safety across industries such as construction, manufacturing, oil & gas, and mobile hydraulics.

One of the key trends shaping the 2026 landscape is the integration of smart technologies. Manufacturers are increasingly embedding sensors and IoT (Internet of Things) capabilities into hydraulic check valves, enabling real-time monitoring of pressure, flow rate, and valve status. This shift toward smart hydraulics supports predictive maintenance, reduces downtime, and improves overall system performance—features that are especially valuable in industrial and off-highway equipment applications.

Another significant trend is the rising demand for compact and lightweight hydraulic components. With ongoing innovation in material science—such as the use of high-strength composites and corrosion-resistant alloys—hydraulic check valves are becoming more durable and efficient while reducing weight and footprint. This is particularly advantageous in mobile applications like agricultural machinery and construction equipment, where space and weight savings directly impact fuel efficiency and productivity.

Sustainability is also influencing market dynamics. Stricter environmental regulations are pushing industries to adopt energy-efficient hydraulic systems. As a result, manufacturers are focusing on low-leakage and high-efficiency check valve designs that minimize fluid loss and energy consumption. Additionally, there is a growing interest in recyclable materials and greener manufacturing processes to align with corporate sustainability goals.

Regionally, Asia-Pacific is expected to dominate the hydraulic check valve market by 2026, fueled by rapid industrialization, infrastructure development, and expansion of manufacturing hubs in countries like China, India, and South Korea. North America and Europe will maintain strong demand, supported by modernization of existing industrial plants and increasing adoption of automation in factory settings.

In summary, the 2026 hydraulic check valve market will be characterized by technological innovation, miniaturization, sustainability, and regional growth disparities. Companies that invest in smart valve solutions, advanced materials, and energy-efficient designs will be best positioned to capitalize on emerging opportunities in this evolving landscape.

H2: Common Pitfalls in Sourcing Hyd Check Valves (Quality and IP Considerations)

Sourcing hydraulic (Hyd) check valves involves several critical factors, particularly concerning quality and intellectual property (IP). Failure to address these can lead to system failures, safety hazards, and legal complications. Below are common pitfalls to avoid:

-

Compromised Quality from Unverified Suppliers

One of the most frequent issues is sourcing check valves from suppliers lacking proper certifications (e.g., ISO 9001, ISO 13849). Low-quality valves may use substandard materials or imprecise manufacturing, leading to premature wear, leakage, or failure under pressure. Always verify supplier credentials and request material test reports (MTRs) and performance certifications. -

Counterfeit or Non-Original Equipment Manufacturer (OEM) Parts

Counterfeit check valves that mimic reputable brands are prevalent in the market. These often lack proper IP authorization and can fail to meet original design specifications. Purchasing such parts risks voiding warranties and system reliability. Ensure parts are sourced directly from OEMs or authorized distributors. -

Inadequate IP Compliance

Using check valve designs that infringe on patented technologies or trademarks can result in legal action, especially in regulated industries. Verify that the supplier respects IP rights and can provide documentation confirming design legitimacy and licensing, if applicable. -

Mismatched Technical Specifications

Many sourcing errors arise from assuming interchangeability without confirming compatibility. Differences in pressure ratings, flow rates, port sizes, or cracking pressures can compromise system performance. Always cross-reference technical data sheets and validate against application requirements. -

Lack of Traceability and Documentation

Poor documentation—such as missing batch numbers, test results, or material certifications—can hinder quality audits and traceability during failure investigations. Ensure suppliers provide full documentation to support quality assurance and compliance. -

Ignoring Industry-Specific Standards

Certain sectors (e.g., aerospace, marine, oil & gas) require valves to meet stringent standards (e.g., API, ASME, DIN). Sourcing generic valves without verifying compliance can lead to non-conformance and safety risks. -

Overlooking Supply Chain Transparency

Without visibility into the supply chain, it’s difficult to assess the true origin and manufacturing processes of a check valve. This opacity increases the risk of receiving components made under unethical conditions or with undisclosed modifications.

To mitigate these risks, establish a sourcing strategy that emphasizes supplier vetting, technical validation, IP due diligence, and compliance with industry standards. Regular audits and long-term partnerships with trusted suppliers enhance reliability and reduce exposure to quality and IP-related pitfalls.

H2: Logistics & Compliance Guide for Hyd Check Valve

H2: Overview

This guide outlines the essential logistics and compliance considerations for the transportation, storage, handling, and regulatory adherence of Hyd Check Valves. Adherence to these guidelines ensures product integrity, regulatory compliance, and operational safety across the supply chain.

H2: Packaging & Handling

- Standard Packaging: Hyd Check Valves must be packaged in moisture-resistant, crush-proof containers with internal cushioning (e.g., foam inserts) to prevent mechanical damage.

- Labeling: Each package must include:

- Product name and model number

- Batch/lot number

- Net weight and dimensions

- Handling symbols (e.g., “Fragile,” “This Side Up”)

- Hazard classification (if applicable)

- Handling Instructions:

- Avoid dropping or impact.

- Handle with clean gloves to prevent contamination of sealing surfaces.

- Store valves in original packaging until ready for installation.

H2: Storage Conditions

- Environment: Store in a dry, temperature-controlled area (10°C to 30°C / 50°F to 86°F) with relative humidity below 70%.

- Position: Valves must be stored upright to prevent internal component displacement.

- Shelf Life: Maximum storage duration is 36 months from manufacture date unless otherwise specified. Inspect seals and coatings before use if nearing expiration.

- Segregation: Keep away from corrosive chemicals, oils, and high-vibration equipment.

H2: Transportation

- Mode-Specific Requirements:

- Road/Rail: Secure loads to prevent shifting. Use climate-controlled transport for extreme climates.

- Air: Comply with IATA Dangerous Goods Regulations if packaging includes pressurized testing components.

- Sea: Use moisture-barrier wrapping and desiccants. Confirm compliance with IMDG Code for marine shipments.

- Documentation: Bill of Lading, Packing List, and Commercial Invoice must accompany all shipments.

- Temperature Monitoring: Use data loggers for shipments in extreme environments (>40°C or <0°C).

H2: Regulatory Compliance

- International Standards:

- ISO 5208: Industrial Valve Leakage Classification

- API 598: Valve Inspection and Testing

- ASME B16.34: Valves—Flanged, Threaded, and Welding End

- Regional Requirements:

- EU: CE Marking per Pressure Equipment Directive (PED 2014/68/EU)

- USA: Compliance with ASME and ANSI standards; FDA approval not required unless used in food-grade systems

- Canada: CSA B51 compliance for pressure equipment

- China: AR/CR Certification (for pressure vessels and safety accessories)

- Environmental & Safety:

- REACH (EU): Registration of substances in valve materials

- RoHS (EU): Restriction of hazardous substances

- Conflict Minerals (US Dodd-Frank Act): Documentation of raw material sourcing

H2: Import/Export Documentation

- Required documents include:

- Certificate of Conformity (CoC)

- Material Test Report (MTR)

- Certificate of Origin

- Export Control Classification Number (ECCN), if applicable

- Sanction screening for destination countries (e.g., OFAC, EU sanctions)

- Customs Clearance: Provide HS Code 8481.80 for check valves (adjust based on material and application).

H2: Quality & Traceability

- Serial Number Tracking: Each valve must have a unique serial number for full traceability (manufacture to delivery).

- Test Records: Maintain pressure and leak test results for a minimum of 10 years.

- Non-Conformance Handling: Quarantine and report defective units per ISO 9001 procedures.

H2: Emergency Procedures

- Spill/Leak: No hazardous materials under normal conditions. If contaminated during testing, follow local hazardous waste protocols.

- Damage in Transit: Document with photos and file a claim with the carrier within 24 hours.

- Recall Protocol: Activate recall plan per ISO 1041 if compliance or safety issues arise.

For further assistance, contact:

Logistics Support: [email protected]

Compliance Officer: [email protected]

24/7 Emergency Line: +1-800-HYD-VALVE

Conclusion for Sourcing Hyd-Check Valves

In conclusion, sourcing Hyd-Check check valves requires a thorough evaluation of quality, compliance, lead times, and supplier reliability. These valves play a critical role in preventing backflow and ensuring system integrity in various industrial, commercial, and municipal applications. Selecting a reputable supplier that offers certified, durable, and tested products is essential to maintain operational efficiency and safety.

After assessing multiple vendors, it is evident that partnering with authorized distributors or directly with the manufacturer ensures access to genuine Hyd-Check products backed by technical support and warranties. Factors such as material specifications, pressure ratings, and application suitability must align with project requirements.

Ultimately, a strategic sourcing approach focused on long-term performance, lifecycle cost, and supplier credibility will ensure reliable system operation and reduce maintenance risks. Therefore, it is recommended to establish a preferred supplier list comprising vetted sources of Hyd-Check valves to support consistent procurement and project success.