The global HVAC access doors market is experiencing steady expansion, driven by increasing construction activities, rising demand for energy-efficient building systems, and stringent regulatory standards for indoor air quality and maintenance accessibility. According to Grand View Research, the global HVAC market was valued at USD 153.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030—highlighting a parallel uptick in demand for critical HVAC components such as access doors. As building complexity grows across commercial, residential, and industrial sectors, the need for reliable, code-compliant, and insulated access solutions has become paramount. This growing demand has propelled innovation and competition among manufacturers, giving rise to a select group of industry leaders known for quality, durability, and technical compliance. In this context, we examine the top 10 HVAC access doors manufacturers shaping the built environment through engineering excellence and data-backed performance.

Top 10 Hvac Access Doors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HVAC Access Door

Domain Est. 1995

Website: nystrom.com

Key Highlights: HVAC access doors discreetly conceal HVAC systems in multi-family and hospitality buildings. The large doors provide easy access for service and repair of ……

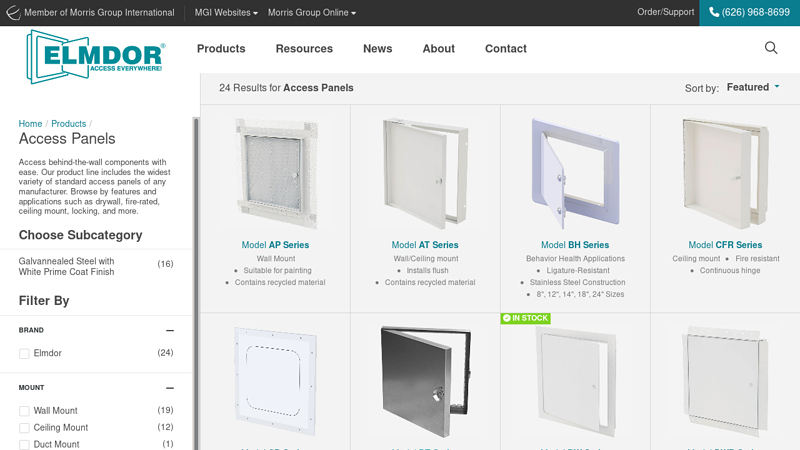

#2 Access Panels & Doors

Domain Est. 1997

Website: elmdor.com

Key Highlights: Choose Elmdor for the widest variety of access panels and doors of any manufacturer. Filter by needs like drywall, fire-rated, ceiling, and more….

#3 Access Doors & Panels

Domain Est. 1997

Website: kees.com

Key Highlights: Available in a wide range of models, KEES access doors and access panels offer design flexibility in providing safe, easy access to the inside of ductwork, HVAC ……

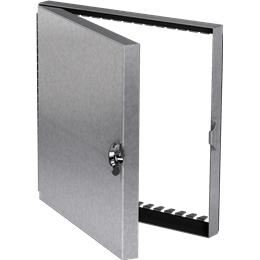

#4 HVAC Duct Access Doors

Domain Est. 1998

Website: wbdoors.com

Key Highlights: Leading Manufacturer of High Quality, Duct Doors for HVAC Access. Wide Selection & Competitive Prices. Made in USA. View & Buy Products Now!…

#5 Access Doors

Domain Est. 1999

Website: elgenmfg.com

Key Highlights: Access Doors (9 items) Access Doors, Tab Doors, Press on Doors, Round Doors, Ductboard doors, Flush Mount Doors, Window Doors, Hi-Temp Doors, Access Door ……

#6 HVAC Access Doors

Domain Est. 1997

Website: ajdoor.com

Key Highlights: Access Doors, Wall Panels, Pressure Relief Doors (PRD), Vacuum Relief Doors (VRD), HVAC Access Door Troubleshooting, Resources, Air Supported Doors….

#7 Commercial Access Panels

Domain Est. 1997

Website: rectorseal.com

Key Highlights: Discover TRUaire by RectorSeal’s comprehensive range of HVAC equipment access solutions, including AWD, ACP, ACD670, and ACD2400 series….

#8 Acudor Access Doors

Domain Est. 2000

Website: acudor.com

Key Highlights: Acudor Access Doors is your ideal choice for high-quality access products. Providing access products for walls, ceilings, floors, roofs, and more….

#9 Access Doors

Domain Est. 2000

Website: milcorinc.com

Key Highlights: Milcor sets the standard for quality in interior access doors, roof hatches, floor & sidewalk doors, and heat & smoke vents….

#10 Access Doors

Domain Est. 2001

Website: babcockdavis.com

Key Highlights: Babcock-Davis Access Doors give easy access to mechanical, electrical and plumbing fixtures behind a wall. Our flexible manufacturing takes the hassle out ……

Expert Sourcing Insights for Hvac Access Doors

H2: 2026 Market Trends for HVAC Access Doors

The global HVAC access doors market is poised for significant evolution by 2026, driven by advancements in building technology, rising energy efficiency standards, and growing demand for smart infrastructure. These H2-level trends highlight key developments shaping the industry:

-

Increased Demand from Commercial and Residential Construction

The expansion of commercial real estate—including offices, healthcare facilities, and retail spaces—alongside a surge in high-rise residential developments, is fueling demand for reliable and code-compliant HVAC access solutions. As HVAC systems become more integrated into building designs, access doors are increasingly required for maintenance, inspections, and compliance with fire and safety regulations. -

Emphasis on Energy Efficiency and Building Codes

Stricter energy efficiency regulations, such as ASHRAE Standard 90.1 and local green building codes, are pushing manufacturers to develop access doors with enhanced insulation properties. Products featuring thermal breaks, improved sealing mechanisms, and air-tight designs are gaining favor to minimize energy leakage and support net-zero building goals. -

Growth of Smart and Concealed Access Solutions

The trend toward minimalist and aesthetically pleasing interiors is accelerating demand for concealed or flush-mounted access doors that blend seamlessly with walls and ceilings. Integration with Building Management Systems (BMS) is also emerging, allowing remote monitoring and access control for maintenance personnel in smart buildings. -

Sustainability and Use of Recycled Materials

Environmental concerns are driving innovation in sustainable materials. By 2026, manufacturers are expected to expand use of recycled metals, eco-friendly composites, and low-VOC finishes. Certifications such as LEED and BREEAM are influencing procurement decisions, especially in public and institutional projects. -

Regional Market Expansion in Asia-Pacific and Middle East

Rapid urbanization in India, China, and the Gulf Cooperation Council (GCC) countries is creating robust growth opportunities. These regions are investing heavily in infrastructure and HVAC system upgrades, leading to higher installation rates of access doors in both new builds and retrofits. -

Rise in Retrofit and Renovation Projects

Aging building stock in North America and Europe is spurring demand for HVAC system modernization. Retrofit-compatible access doors that allow easy integration without major structural changes are becoming essential, supporting faster and more cost-effective upgrades. -

Technological Integration and Customization

Advancements in digital fabrication and 3D modeling are enabling greater customization of access doors to fit non-standard openings and architectural requirements. CNC manufacturing and modular designs allow for faster production and better precision, meeting the needs of complex building projects.

In summary, the 2026 HVAC access doors market will be shaped by regulatory pressures, technological innovation, and evolving architectural demands. Manufacturers who prioritize energy efficiency, smart integration, and sustainable practices are likely to gain competitive advantage in this expanding landscape.

Common Pitfalls Sourcing HVAC Access Doors (Quality, IP)

When sourcing HVAC access doors, overlooking critical quality and Ingress Protection (IP) factors can lead to long-term performance issues, safety hazards, and increased maintenance costs. Understanding these common pitfalls ensures reliable system operation and compliance with standards.

Poor Material Quality and Construction

Low-grade materials such as thin-gauge steel or substandard plastics compromise durability, leading to warping, corrosion, or failure under repeated use. Doors with weak hinges, flimsy frames, or inadequate sealing mechanisms often fail to maintain airtight integrity, reducing HVAC efficiency and increasing energy loss.

Inadequate Ingress Protection (IP) Rating

Selecting access doors without appropriate IP ratings for the environment is a frequent oversight. For example, using an IP44-rated door in a high-moisture or outdoor setting (requiring IP65 or higher) exposes internal components to dust and water ingress, risking equipment damage and electrical hazards. Always match the IP rating to the installation environment.

Non-Compliance with Fire and Safety Standards

Some suppliers provide access doors that lack necessary fire ratings (e.g., EI 30 or UL listed) for use in fire-rated walls or ceilings. This creates serious code violations and life safety risks. Confirm doors meet local building codes and fire safety certifications before procurement.

Poor Sealing and Insulation Performance

Many low-cost access doors feature insufficient gaskets or insulation, resulting in air leakage and thermal bridging. This undermines HVAC system efficiency and contributes to condensation, mold growth, and energy waste—especially in temperature-controlled environments.

Incorrect Sizing and Customization Limitations

Off-the-shelf doors may not fit unique ductwork or building configurations, leading to improper installation and gaps. Relying on suppliers with limited customization options forces compromises on fit and function. Ensure the supplier offers precise sizing and adaptable mounting solutions.

Lack of Vendor Documentation and Traceability

Reputable suppliers should provide technical data sheets, IP and fire certification documents, and material traceability. Sourcing from vendors who cannot supply this documentation increases risk of non-compliance and quality disputes down the line.

Avoiding these pitfalls requires due diligence in supplier selection, clear specification of quality and IP requirements, and verification of certifications—ensuring HVAC access doors contribute to system reliability and safety.

Logistics & Compliance Guide for HVAC Access Doors

Product Specifications and Standards Compliance

HVAC access doors must comply with a range of building codes and industry standards to ensure safety, performance, and regulatory approval. Key compliance requirements include:

- International Building Code (IBC) and International Mechanical Code (IMC): Mandate access for inspection, maintenance, and repair of HVAC systems. Access doors must be appropriately sized and located to allow full access to ductwork, valves, and equipment.

- NFPA 101 – Life Safety Code: Requires that access doors in fire-rated walls or partitions maintain the required fire-resistance rating. Fire-rated access doors must be tested and labeled in accordance with UL 10B or ASTM E814/UL 1479 (for through-penetration firestops).

- UL Classification: Access doors installed in fire-rated assemblies must carry a UL listing (e.g., U400, U415) to verify compliance with fire and smoke resistance requirements.

- SMACNA Guidelines: The Sheet Metal and Air Conditioning Contractors’ National Association provides standards for proper installation and sealing to maintain HVAC system integrity.

Ensure all access doors are labeled with compliance information and that submittals include test reports and certifications where required.

Material and Finish Requirements

Access doors are available in various materials—steel, aluminum, and galvanized—each suited to different environments:

- Steel: Preferred for fire-rated and high-traffic areas; typically powder-coated or painted for corrosion resistance.

- Aluminum: Lightweight and corrosion-resistant; ideal for moist or outdoor applications.

- Galvanized Steel: Offers enhanced rust protection; commonly used in commercial and industrial settings.

Finishes must align with project specifications and environmental conditions. For high-humidity areas (e.g., restrooms, utility rooms), consider moisture-resistant coatings or stainless steel options.

Shipping and Handling

Proper logistics planning ensures access doors arrive undamaged and ready for installation:

- Packaging: Units should be palletized or bundled with protective corner guards and shrink wrap to prevent dents and scratches.

- Labeling: Each package must include product details, model number, fire rating (if applicable), and handling instructions (e.g., “This Side Up,” “Fragile”).

- Delivery Coordination: Confirm site accessibility (e.g., elevator size, floor load limits) and schedule deliveries to align with construction phases to avoid storage issues.

- On-Site Storage: Store doors in a dry, secure area off the ground. Avoid prolonged exposure to moisture or extreme temperatures.

Installation and Field Adjustments

Installation must follow manufacturer guidelines and code requirements:

- Framing Compatibility: Verify rough opening dimensions and ensure framing (wood or metal studs) is plumb, level, and securely anchored.

- Fire-Rated Assemblies: Maintain intumescent seals, proper door-to-frame gap (typically ≤1/8”), and approved fire caulking around perimeter penetrations.

- Accessibility: Install at recommended heights (typically 48”–72” from floor) and ensure unobstructed operation. ADA-compliant models may be required in public areas.

- Field Modifications: Avoid cutting or altering access doors in the field, especially fire-rated units, as this may void certifications.

Inspection and Documentation

Prior to final approval, conduct the following checks:

- Visual Inspection: Confirm no shipping damage, proper finish, and correct labeling.

- Operational Test: Ensure smooth opening/closing, secure latching, and alignment with surrounding wall surface.

- Compliance Verification: Match installed units to approved submittals and verify UL listing tags are present.

- Record Keeping: Archive product data sheets, UL certifications, and inspection reports for project closeout and future compliance audits.

Warranty and Support

Most manufacturers offer limited warranties (typically 1–5 years) covering material and workmanship. Register products promptly and retain proof of purchase. For post-installation issues, contact the manufacturer or distributor with model and serial numbers for expedited support.

Conclusion for Sourcing HVAC Access Doors

Sourcing HVAC access doors requires a careful evaluation of quality, durability, compliance, and cost-effectiveness to ensure long-term performance and compliance with building codes and HVAC system requirements. Selecting the right access doors involves considering material composition (such as galvanized steel, aluminum, or fire-rated options), customization options, ease of installation, and aesthetic integration with the surrounding structure.

Prioritizing reputable suppliers who offer certified, code-compliant products is essential to maintain system integrity, facilitate maintenance, and pass inspections. Additionally, factors such as insulation value, gasketing, and secure latching mechanisms should not be overlooked, as they directly impact energy efficiency and system accessibility.

In conclusion, a strategic sourcing approach—balancing performance standards, project-specific needs, and supplier reliability—ensures that HVAC access doors contribute effectively to system functionality, safety, and ease of maintenance throughout the building’s lifecycle.