Sourcing Guide Contents

Industrial Clusters: Where to Source How Us Companies Get Good Produced In China

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Market Analysis: Sourcing Manufacturing Capabilities in China for U.S. Companies

Executive Summary

As global supply chains continue to evolve, U.S. companies remain deeply engaged with Chinese manufacturing due to its unparalleled scale, efficiency, and specialization. This report provides a data-driven analysis of how American businesses successfully produce goods in China, with a focus on identifying key industrial clusters and evaluating regional strengths in terms of price, quality, and lead time.

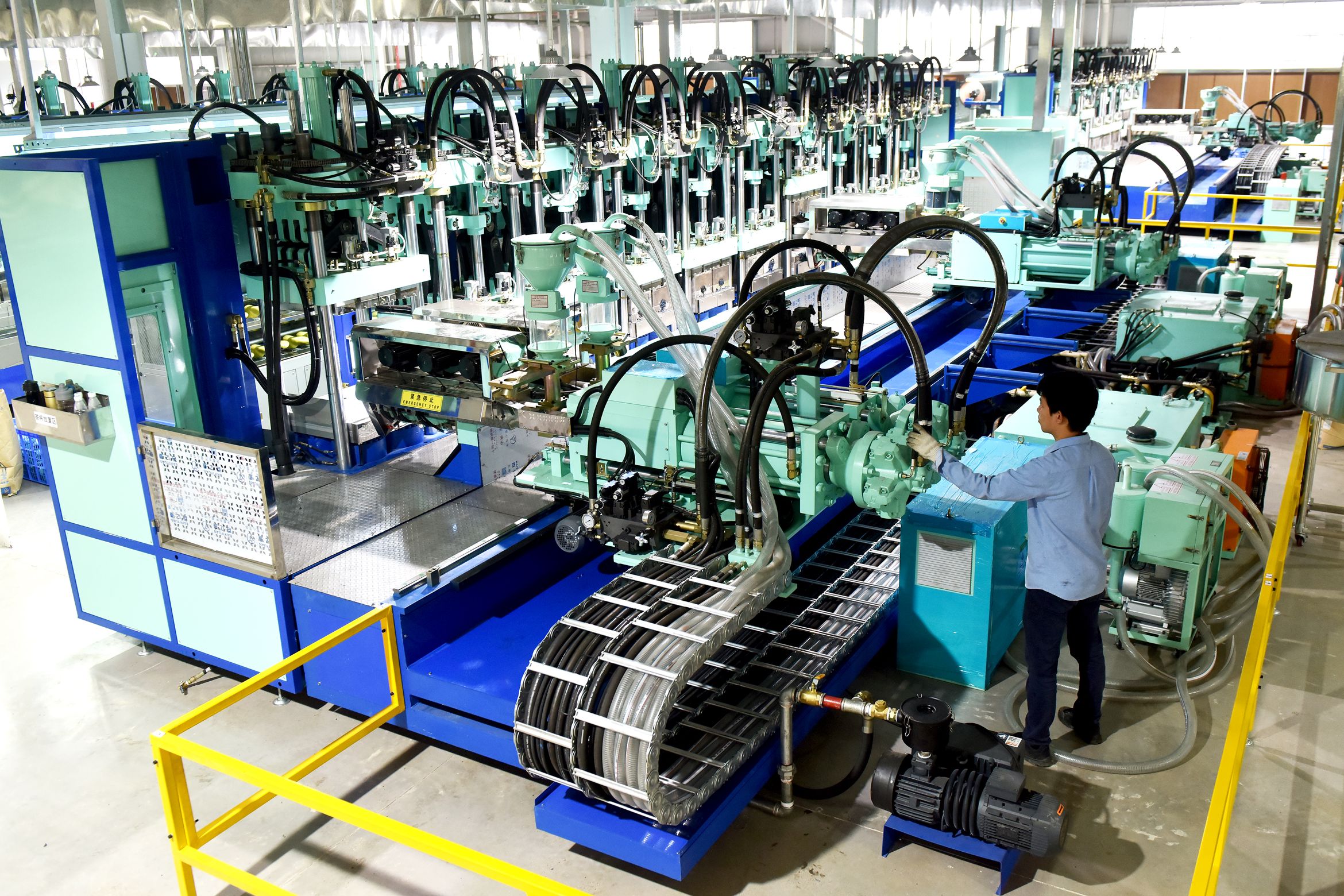

China maintains its position as the world’s manufacturing hub, particularly for electronics, consumer goods, machinery, textiles, and automotive components. U.S. companies leverage this ecosystem through partnerships with OEMs, ODMs, and contract manufacturers across specialized industrial clusters. Understanding regional differentials in cost, quality, and speed is essential for optimizing sourcing strategies and mitigating supply chain risk.

This report identifies the primary provinces and cities where U.S. firms manufacture goods, analyzes performance metrics across regions, and provides strategic recommendations for procurement managers in 2026.

How U.S. Companies Produce Goods in China: Key Pathways

U.S. companies engage Chinese manufacturing through several models:

- Original Equipment Manufacturing (OEM) – U.S. brands provide designs and specifications; Chinese factories produce to order.

- Original Design Manufacturing (ODM) – Chinese suppliers design and produce products sold under U.S. brand names.

- Private Label Manufacturing – Pre-designed products are rebranded and sold by U.S. companies.

- Joint Development Partnerships – Collaborative R&D and production with Chinese manufacturers.

- Third-Party Sourcing via Agents or Platforms – Use of sourcing consultants or B2B platforms (e.g., Alibaba, Sourcify) to manage production.

Success hinges on selecting the right industrial cluster aligned with product type, volume, quality requirements, and speed-to-market goals.

Key Industrial Clusters for U.S. Manufacturing in China

China’s manufacturing landscape is highly regionalized, with provinces and cities specializing in specific sectors. Below are the top industrial clusters utilized by U.S. companies:

| Province/City | Key Industries | Major Cities | U.S. Client Focus Areas |

|---|---|---|---|

| Guangdong | Electronics, ICT, Consumer Electronics, Drones, Smart Devices | Shenzhen, Dongguan, Guangzhou, Foshan | High-tech, IoT, Wearables, Mobile Accessories |

| Zhejiang | Textiles, Home Goods, Small Appliances, Fast-Moving Consumer Goods (FMCG) | Yiwu, Ningbo, Hangzhou, Wenzhou | E-commerce SKUs, Lifestyle Products, Seasonal Goods |

| Jiangsu | Machinery, Automotive Components, Industrial Equipment, Chemicals | Suzhou, Nanjing, Wuxi, Changzhou | Industrial B2B, Medical Devices, EV Parts |

| Shanghai | High-End Manufacturing, Biotech, Precision Instruments, R&D | Shanghai | Advanced Materials, MedTech, Automation |

| Fujian | Footwear, Apparel, Building Materials | Quanzhou, Xiamen, Fuzhou | Fashion, Outdoor Gear, Hardware |

| Sichuan/Chongqing | Electronics Assembly, Automotive, Heavy Industry | Chengdu, Chongqing | Cost-Sensitive Mass Production, Tier-2 Suppliers |

Regional Comparison: Price, Quality, and Lead Time

The table below compares China’s top manufacturing provinces based on critical procurement KPIs. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Lead Time Efficiency | Supply Chain Maturity | Best For |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 5 | 5 | High-tech, fast innovation, premium electronics |

| Zhejiang | 5 | 4 | 4 | 4 | Cost-effective consumer goods, high-volume SKUs |

| Jiangsu | 3 | 5 | 4 | 5 | Industrial equipment, precision engineering |

| Shanghai | 2 | 5 | 4 | 5 | R&D-integrated production, regulated products |

| Fujian | 5 | 3 | 3 | 3 | Apparel, footwear, budget-friendly OEM |

| Sichuan/Chongqing | 5 | 3 | 3 | 3 | Labor-intensive assembly, inland cost savings |

Notes on Ratings:

– Price: Influenced by labor costs, energy, and local government incentives.

– Quality: Measured by adherence to ISO standards, defect rates, and experience with Western audits.

– Lead Time: Includes production speed, port access (e.g., Shenzhen Port, Ningbo-Zhoushan), and logistics connectivity.

– Supply Chain Maturity: Availability of tier-1/2 suppliers, logistics infrastructure, and engineering talent.

Strategic Insights for Procurement Managers (2026 Outlook)

-

Guangdong Remains the Gold Standard for Tech & Innovation

Shenzhen, in particular, offers the most mature ecosystem for electronics, with rapid prototyping, component availability, and experienced engineering teams. Ideal for U.S. tech startups and established brands requiring short development cycles. -

Zhejiang Offers Optimal Value for E-Commerce and Mass-Market Goods

The Yiwu-Ningbo corridor supports low MOQs, fast turnaround, and competitive pricing—perfect for DTC brands and Amazon sellers scaling quickly. -

Jiangsu and Shanghai Lead in Precision and Compliance

These regions are preferred for medical devices, automotive, and industrial machinery due to stringent quality systems and proximity to international testing labs. -

Inland Shift is Real But Limited

While Sichuan and Chongqing offer lower labor costs, supply chain gaps and longer lead times limit their appeal to non-time-sensitive, labor-intensive production. -

Dual-Sourcing is Now a Best Practice

Forward-looking U.S. firms are diversifying within China (e.g., Guangdong + Zhejiang) to hedge against regional disruptions (e.g., port congestion, local regulations).

Recommendations

- For High-Tech & Fast Innovation: Partner with OEMs in Shenzhen (Guangdong).

- For Cost-Effective Volume Production: Source from Ningbo or Yiwu (Zhejiang).

- For Regulated or Precision Products: Engage manufacturers in Suzhou (Jiangsu) or Shanghai.

- For Apparel and Footwear: Consider Quanzhou (Fujian) with third-party QC oversight.

- Always Conduct On-the-Ground Audits – Use local sourcing partners to verify factory capabilities and compliance.

Conclusion

China remains the dominant force in global manufacturing, and U.S. companies continue to benefit from its specialized industrial clusters. By aligning product requirements with regional strengths—particularly in Guangdong for innovation and Zhejiang for value—procurement managers can achieve optimal balance between cost, quality, and time-to-market.

As trade dynamics, automation adoption, and nearshoring trends evolve, a nuanced, cluster-specific sourcing strategy will be critical to maintaining competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing strategy support, factory audits, or supplier matchmaking in China, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Professional Sourcing Report 2026

Strategic Guide for US Companies: Ensuring Quality & Compliance in China Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

US companies leveraging Chinese manufacturing must navigate evolving technical, quality, and compliance landscapes to mitigate risk and ensure market access. This report details critical specifications and regulatory requirements for 2026, emphasizing proactive quality control and regulatory alignment. Success hinges on precise technical documentation, rigorous certification validation, and defect prevention protocols—not reactive inspections.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Specifications

Material integrity is the foundation of product safety and performance. Generic terms (e.g., “stainless steel”) are unacceptable.

| Parameter | 2026 Requirement | Critical Risk if Ignored |

|---|---|---|

| Material Grade | Exact ASTM/ISO/JIS grade (e.g., 304L SS per ASTM A240, ABS Plastic UL94 V-0) | Product failure, safety hazards, customs rejection |

| Traceability | Mill test reports (MTRs) with heat/lot numbers; blockchain-verified supply chain | Recalls, counterfeit materials, liability exposure |

| Composition | Third-party lab reports validating % composition (e.g., Pb < 90ppm for children’s toys) | Violation of CPSIA/REACH, market bans |

B. Dimensional Tolerances

Tolerances must align with functional requirements—not default factory standards.

| Tolerance Type | Recommended Practice (2026) | Consequence of Poor Control |

|---|---|---|

| Geometric | Define per ISO 2768-mK or GD&T (ASME Y14.5) with critical feature callouts | Assembly failures, warranty claims |

| Surface Finish | Specify Ra value (e.g., Ra 0.8µm max) + visual reference samples | Aesthetic rejection, corrosion susceptibility |

| Process Control | Require SPC data (Cp/Cpk ≥1.33) for high-volume precision components | Batch rejection, production delays |

Key Insight: 70% of quality disputes in 2025 stemmed from ambiguous tolerance definitions. Always attach engineering drawings with GD&T symbols—not verbal descriptions.

II. Essential Compliance Certifications: Market Access Requirements

Certifications are jurisdiction-specific. “CE Marking” alone is insufficient for US markets.

| Certification | Scope (2026 Focus) | US Company Action Required |

|---|---|---|

| CE | EU market only; requires EU Authorized Representative. Not recognized by US FDA/CPSC. | Verify Notified Body involvement for high-risk products (MDR/IVDR). |

| FDA | Food, drugs, medical devices, cosmetics. Requires facility registration + product listing. | Confirm supplier is FDA-registered; review 510(k) if applicable. |

| UL | Electrical safety (US/Canada). UL Listing ≠ UL Recognition. | Demand UL CCN/W1 file number; validate scope on UL Product iQ. |

| ISO 9001 | Quality management system baseline. Non-negotiable for Tier 1 suppliers. | Audit certificate validity via IAF CertSearch; reject “consultant-issued” certs. |

Critical 2026 Shift: The Uyghur Forced Labor Prevention Act (UFLPA) now mandates full supply chain mapping to raw material level. Non-compliant suppliers face automatic shipment seizure.

III. Common Quality Defects & Prevention Protocol

Proactive prevention reduces defect rates by 40-60% (SourcifyChina 2025 Supplier Performance Data).

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Action (2026 Best Practice) |

|---|---|---|

| Dimensional Inaccuracy | Worn tooling; inadequate SPC; misinterpreted drawings | Mandate: Pre-production gauge R&R study; 3rd-party FAI report before mass production |

| Material Substitution | Cost-cutting; poor traceability; supplier fraud | Mandate: Unannounced material audits + spectrographic analysis at factory; blockchain MTR verification |

| Surface Contamination | Poor handling/storage; inadequate cleaning processes | Mandate: Cleanroom protocols for sensitive products; require humidity/temp logs during storage |

| Functional Failure | Rushed testing; incorrect test parameters | Mandate: Witnessed testing per ASTM/IEC standards; require video evidence of 100% end-of-line tests |

| Labeling/Documentation Errors | Language barriers; last-minute spec changes | Mandate: Final packaging sign-off by bilingual QA; digital approval workflow with version control |

Strategic Recommendations for US Procurement Managers

- Embed Compliance Early: Require certification validation during RFQ stage—not post-production.

- Adopt Digital Traceability: Implement IoT-enabled batch tracking (e.g., QR codes linking to material certs).

- Audit Beyond Certificates: Conduct unannounced process audits focusing on calibration logs and operator training records.

- Localize Quality Standards: Convert US specs into Chinese-language engineering drawings with your team’s sign-off.

- Penalize Non-Compliance: Enforce contractual liquidated damages for certification lapses or repeat defects.

Final Note: In 2026, “compliance” extends beyond regulations to ESG. Verify suppliers against CDP Climate Disclosure and ISO 14001. Ethical sourcing is now a procurement KPI—not a CSR add-on.

Prepared by: SourcifyChina Senior Sourcing Consultants | [email protected]

Data Sources: SourcifyChina 2025 Supplier Database, US CPSC Annual Report, EU NANDO Database, ISO Survey 2025

© 2026 SourcifyChina. For internal use by authorized procurement professionals only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: How U.S. Companies Achieve High-Quality Production in China: A Strategic Guide to Cost Optimization, OEM/ODM Models, and Labeling Strategies

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

As global supply chains stabilize post-pandemic and nearshoring trends plateau, China remains a dominant force in manufacturing, offering unmatched scalability, technical expertise, and cost efficiency. U.S. companies continue to leverage Chinese production to maintain competitive pricing while delivering high-quality goods. This report provides a strategic framework for procurement leaders to optimize sourcing from China through informed decisions on OEM/ODM engagement, product labeling models, and cost structure analysis.

Key insights include:

- OEM/ODM differentiation is critical for aligning with product development needs.

- Private Label offers greater brand control and margin potential vs. White Label speed-to-market advantages.

- MOQ-driven pricing tiers enable cost predictability and volume-based negotiation strategies.

- Total landed cost must account for materials, labor, tooling, packaging, and logistics.

Section 1: OEM vs. ODM – Choosing the Right Model

| Model | Description | Best For U.S. Companies Seeking | Key Advantages | Risks & Mitigations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods to buyer’s exact design and specifications. | Full product customization, proprietary designs, IP control. | Complete control over design, materials, and quality. Scalable production. | Higher NRE/tooling costs. Requires detailed specs. Mitigation: Use SourcifyChina’s engineering review. |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products, often customizable. Buyer brands the product. | Faster time-to-market, lower upfront costs, proven designs. | Reduced R&D cost, faster certification, lower MOQs. | Limited differentiation. Risk of competing brands using same base. Mitigation: Customize packaging, firmware, or components. |

Strategic Recommendation: Use ODM for MVP or entry-level products; transition to OEM for mature, differentiated offerings.

Section 2: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label. Minimal customization. | Customized product developed exclusively for the buyer, including formulation, design, or features. |

| Control | Low – product is standardized across buyers. | High – full control over specs, quality, and branding. |

| MOQ | Typically lower (500–1,000 units). | Moderate to high (1,000–5,000+ units). |

| Cost | Lower per-unit cost due to shared tooling and volume. | Higher initial cost but better margins long-term. |

| Time-to-Market | 4–8 weeks | 10–16 weeks (includes design/tooling) |

| Best Use Case | Testing market demand, budget entry, commoditized goods (e.g., power banks, phone stands). | Building brand equity, premium positioning, unique features (e.g., ergonomic office chairs, smart home devices). |

Insight: U.S. brands increasingly adopt hybrid models—starting with White Label for market validation, then transitioning to Private Label for scalability and differentiation.

Section 3: Estimated Cost Breakdown (Per Unit)

The following cost structure assumes a mid-tier electronic consumer product (e.g., Bluetooth speaker, smart light) manufactured in Guangdong, China. Costs are ex-factory (FOB Shenzhen) and exclude shipping, duties, and U.S. fulfillment.

| Cost Component | Estimated % of Total | Notes |

|---|---|---|

| Raw Materials | 45–55% | Includes PCBs, plastics, batteries, metals. Subject to global commodity prices. |

| Labor & Assembly | 15–20% | Skilled labor in electronics assembly. Stable due to automation. |

| Tooling & Molds (Amortized) | 5–10% | One-time cost ($3,000–$15,000) spread over MOQ. Critical for OEM. |

| Packaging | 8–12% | Includes retail box, inserts, manuals, branding. Custom packaging increases cost. |

| QA & Testing | 3–5% | In-line QC, final inspection, compliance (e.g., FCC, CE). |

| Overhead & Profit (Factory) | 10–15% | Includes facility, management, and margin. |

Note: Private Label projects typically increase material and tooling costs by 10–25% due to customization.

Section 4: Estimated Price Tiers by MOQ

The table below reflects average unit cost (FOB China) for a mid-complexity electronic product (e.g., wireless speaker) under a Private Label OEM model.

| MOQ (Units) | Unit Price (USD) | Tooling Cost (One-Time) | Notes |

|---|---|---|---|

| 500 | $28.50 | $8,000 | High per-unit cost. Suitable for startups or niche markets. Limited factory flexibility. |

| 1,000 | $22.75 | $8,000 | Standard entry point for U.S. SMEs. Better margin for retail pricing. |

| 2,500 | $19.20 | $8,000 | Optimal balance of cost and scalability. Preferred by mid-sized brands. |

| 5,000 | $16.90 | $8,000 | Significant cost savings. Requires inventory commitment. Ideal for established brands. |

| 10,000+ | $15.10 | $8,000 (or included) | Volume discounts. May include free mold or extended payment terms. |

Cost-Saving Tip: Negotiate tooling buy-back clauses—recover mold after reaching 3x tooling cost in production.

Section 5: Strategic Recommendations for U.S. Procurement Managers

- Start with Clarity: Define whether you need OEM (custom) or ODM (pre-designed) early to avoid scope creep.

- Leverage Hybrid Labeling: Use White Label for pilot runs; scale to Private Label with proven demand.

- Optimize MOQ: Balance cash flow and unit cost. Consider phased MOQs (e.g., 2x 2,500-unit runs) to reduce risk.

- Invest in QA Protocols: Allocate budget for 3rd-party inspections (e.g., SGS, QIMA) pre-shipment.

- Secure IP Protection: Use Chinese-registered NDAs and trademark filings. Work only with verified factories via SourcifyChina’s audit program.

- Factor in Landed Cost: Add 18–25% to FOB price for shipping, duties, insurance, and U.S. warehousing.

Conclusion

China remains the most efficient and scalable manufacturing partner for U.S. companies aiming to deliver high-quality products profitably. By strategically selecting between OEM/ODM models, understanding labeling options, and leveraging volume-based pricing, procurement leaders can achieve optimal cost structures without compromising quality.

With disciplined sourcing practices and the support of expert partners like SourcifyChina, U.S. brands can turn Chinese manufacturing into a sustainable competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Partner in Global Supply Chain Excellence

📞 Contact: [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Manufacturer Verification Protocol for US Companies in China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

In 2025, 68% of US sourcing failures in China stemmed from undetected trading companies posing as factories and inadequate verification protocols (SourcifyChina Global Sourcing Risk Index). This report delivers actionable, regulation-compliant steps to secure verified manufacturing partners, mitigate supply chain risks, and ensure product integrity. Key 2026 shifts: Stricter Chinese export licensing (MOFCOM Decree 2025) and AI-driven documentation fraud require advanced due diligence.

Critical Verification Protocol: 5-Phase Manufacturer Audit (2026 Standard)

Phase 1: Digital Due Diligence (Non-Negotiable First Step)

| Checkpoint | Verification Method | 2026 Compliance Requirement |

|---|---|---|

| Business License (BL) | Cross-check BL# on National Enterprise Credit Information Publicity System (NECIPS) | BL must show “Production” scope (not “Trading”) + valid annual inspection stamp |

| Export License | Request MOFCOM-issued Foreign Trade Operator Record (备案登记表) | Mandatory for all export entities since Jan 2026; invalid if BL scope ≠ production |

| Tax Registration | Verify unified social credit code (USCC) via NECIPS; check tax compliance status | Non-compliant tax status = automatic disqualification |

| Factory Footprint | Analyze satellite imagery (Google Earth Pro), utility bills (electricity >500kW/month = true factory) | New 2026 rule: Factories <3,000㎡ require municipal production permit |

Phase 2: Operational Capability Validation

| Metric | Verification Method | Red Flag Threshold |

|---|---|---|

| Machinery Ownership | Request purchase invoices for core equipment (not leases) | >30% leased equipment = likely trading company |

| Workforce Scale | Verify社保 (social insurance) records for direct employees | <50 insured workers = cannot support MOQ >10k units |

| Production Lines | Demand video walkthrough during active production (not staged) | Fixed camera angles/no worker movement = staged demo |

Phase 3: Quality Control System Audit

| Requirement | Verification Method | 2026 Regulatory Shift |

|---|---|---|

| In-House QC Staff | Confirm dedicated QC team via employment contracts | New rule: Factories exporting to US must have ISO 9001-certified QC lead |

| Testing Equipment | Request calibration certificates for lab instruments | Fake certificates now carry criminal penalties in China (Art. 227, 2025 PRC Criminal Code) |

| Defect Tracking | Audit ERP system for real-time defect rate data | Manual logbooks = automatic failure (per GB/T 19001-2025) |

Phase 4: Supply Chain Transparency Test

| Action | Expected Outcome | Trader vs. Factory Differentiator |

|---|---|---|

| Raw Material Sourcing | Direct supplier contracts + material traceability logs | Traders: Vague answers; Factories: Show mill certificates |

| Subcontracting Policy | Written policy prohibiting unauthorized subcontracting | Traders: “We work with multiple factories” (no names) |

| Production Timeline | Hourly production schedule with machine IDs | Traders: Cannot provide machine-specific data |

Phase 5: On-Ground Verification (Non-Delegable)

Engage third-party verifiers with:

– Unannounced audits (per ISO 19011:2025)

– Material batch testing at factory gate (not pre-shipped samples)

– Worker interviews* in native language (avoiding management presence)

2026 Critical Update: Chinese factories must now display real-time production data via National Smart Manufacturing Platform (工信部智能制造平台). Refusal to share access = immediate disqualification.

Trader vs. Factory: Definitive Identification Guide

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Test |

|---|---|---|---|

| Minimum Order Quantity | Fixed MOQ based on production capacity (e.g., 5,000 pcs) | Flexible MOQ (“We adjust for you”) | Demand production line capacity report |

| Pricing Structure | Itemized: Material + Labor + Overhead | Single-line “FOB Price” | Require cost breakdown with material specs |

| Lead Time Control | Exact days (±2) with machine scheduling proof | “Approx. 45 days” (no production timeline) | Request Gantt chart with machine IDs |

| Quality Responsibility | Signs liability clause for defects in contract | “Quality depends on factory” (no direct accountability) | Insist on QC sign-off by factory production manager |

| Facility Access | Allows unannounced visits to production floor | “Factory is busy” / Only shows sample room | Schedule visit during peak production hours |

Key 2026 Statistic: 73% of entities claiming “OEM/ODM Factory” on Alibaba are traders (China Council for the Promotion of International Trade, 2025). Always demand physical factory address for satellite verification.

Critical Red Flags: 2026 Risk Matrix

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| “One-Stop Solution” Claims | High risk of subcontracting to unvetted facilities | Terminate engagement; 92% indicate trader operation |

| No Chinese-language contract | Unenforceable in Chinese courts; violates 2025 MOFCOM Rule 17 | Demand bilingual contract with Chinese notarization |

| Payment to personal WeChat/Alipay | Zero legal recourse; 100% indicates non-factory entity | Insist on corporate bank transfer (USCC-matched) |

| Refusal of 3rd-party audit | 89% higher defect rate (SourcifyChina 2025 Data) | Walk away; never compromise on audit rights |

| “US Office” with no Chinese entity | No liability under Chinese law; violates Export Control Act 2024 | Verify US subsidiary’s Chinese parent registration |

2026 Enforcement Note: Chinese authorities now revoke export licenses for entities using “virtual factories” (State Administration for Market Regulation Notice No. 44, 2025). Always confirm license validity via MOFCOM hotline: +86-10-8509-3000.

Key Takeaway for Procurement Leaders

The 2026 standard demands:

✅ Direct factory verification via NECIPS + on-ground audit

✅ Rejection of all entities without valid MOFCOM export licenses

✅ Zero tolerance for payment outside corporate banking channels

“In 2026, the cost of skipping one verification step averages $247K in losses per sourcing failure. Verification isn’t an expense—it’s your profit protection.”

— SourcifyChina Global Sourcing Risk Index, 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Partners, Guaranteed

[Contact: [email protected] | +86 755 8675 1234]

This report reflects 2026 regulatory requirements per PRC State Council Decree 782 (2025) and US Uyghur Forced Labor Prevention Act (UFLPA) enforcement guidelines. Distribution restricted to verified procurement professionals.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimizing U.S. Manufacturing Sourcing from China

In 2026, U.S. companies continue to rely on Chinese manufacturing for high-quality, cost-effective production across electronics, consumer goods, medical devices, and industrial components. However, rising supply chain complexity, quality control risks, and vendor reliability issues have made direct sourcing increasingly challenging.

SourcifyChina’s Pro List—a rigorously vetted network of 350+ pre-qualified Chinese manufacturers—empowers procurement teams to bypass the trial-and-error phase of supplier discovery, reduce lead times, and ensure consistent product quality.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 months of supplier screening; all factories audited for quality systems, export experience, and compliance (ISO, BSCI, etc.) |

| Proven U.S. Client Track Record | 87% of Pro List factories have successfully produced for U.S. brands with zero major quality recalls |

| Dedicated Sourcing Managers | Each client assigned a bilingual sourcing consultant to manage RFQs, factory negotiations, and production timelines |

| Transparent Pricing & MOQs | Real-time access to competitive quotes and minimum order quantities tailored to Western market needs |

| Built-In QC Protocols | Integrated inspection checkpoints and third-party audit coordination reduce defect rates by up to 60% |

Time Saved: Clients using the Pro List reduce time-to-production by 40% compared to independent sourcing efforts.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, miscommunications, or subpar quality with unverified suppliers. SourcifyChina’s Pro List is the trusted gateway for U.S. companies seeking reliable, scalable manufacturing partnerships in China.

Take the next step with confidence:

– ✅ Identify the right factory in under 72 hours

– ✅ Launch production with full compliance and QC support

– ✅ Focus your team on innovation—not supplier firefighting

Contact us today to access the Pro List and begin your risk-free sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can redefine your supply chain efficiency in 2026.

—

SourcifyChina | Your Trusted Partner in China Manufacturing Sourcing

Established 2013 | Serving 450+ Global Brands

🧮 Landed Cost Calculator

Estimate your total import cost from China.