Sourcing Guide Contents

Industrial Clusters: Where to Source How To Start A Trading Company In China

SourcifyChina B2B Sourcing Intelligence Report: Establishing a Trading Company in China

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Report Code: SC-TRADCO-2026-Q4

Executive Summary

This report addresses a critical market misconception: “How to start a trading company in China” is not a physical product but a service/knowledge offering. Global procurement managers often conflate sourcing manufactured goods with establishing operational entities. This analysis clarifies the ecosystem for foreign businesses seeking to launch trading operations in China, identifying key regional hubs for regulatory, logistical, and commercial support—not “manufacturing” of the service itself. Sourcing this capability requires vetting consultancies, legal firms, and government service providers, not factories.

Market Reality Check: Why “Sourcing” This Service Differs from Product Procurement

| Common Misconception | Actual Sourcing Reality |

|---|---|

| “Ordering” a trading company | Establishing a legal entity requires navigating China’s Foreign Investment Law (2020), ICP licensing, VAT registration, and local partnerships. |

| Seeking “industrial clusters” | Service providers (legal, logistics, compliance) cluster in commercial hubs—not manufacturing zones. |

| Price/quality/lead time for “units” | Costs vary by service scope (e.g., WFOE setup vs. JV); quality = regulatory success rate; lead time = 3–8 months. |

Key Insight: Procurement managers must source advisory services, not products. The “supply chain” here involves law firms, local agents, and government bureaus—not factories.

Top 4 Service Ecosystem Hubs for Trading Company Establishment

These regions offer optimal infrastructure for foreign trading entities due to regulatory expertise, port access, and foreigner-friendly services:

- Shanghai (Jiangsu/Zhejiang/Shanghai Delta)

- Why: China’s financial/legal capital; highest concentration of foreign-facing law firms (e.g., Fangda, King & Wood Mallesons); streamlined ONE STOP SHOPS for business registration.

-

Best For: Complex WFOEs (Wholly Foreign-Owned Enterprises), fintech trading, HQ operations.

-

Shenzhen (Guangdong Province)

- Why: Special Economic Zone (SEZ) with fastest approvals; proximity to Hong Kong for cross-border compliance; dominant in tech/e-commerce trading.

-

Best For: Tech hardware, cross-border e-commerce (e.g., via Alibaba’s 1688), rapid market entry.

-

Ningbo (Zhejiang Province)

- Why: Top-3 global port (Ningbo-Zhoushan); low-cost logistics integration; specialized in commodity trading (textiles, hardware).

-

Best For: Physical goods trading with integrated port logistics; SME-focused setup.

-

Beijing

- Why: Central regulatory access (SAMR, MOFCOM); expertise in state-owned enterprise (SOE) partnerships and high-barrier sectors (e.g., healthcare).

- Best For: Trading in regulated sectors (pharma, energy), government-linked contracts.

Regional Comparison: Service Provider Ecosystems (2026)

Metrics reflect typical experiences of foreign procurement teams establishing trading entities

| Region | Price (Setup Cost Range) | Quality (Key Strengths) | Lead Time (Avg. Entity Setup) | Critical Risk Factors |

|---|---|---|---|---|

| Shanghai | $12,000–$25,000 USD | ★★★★★ Regulatory precision; multilingual support; tax optimization | 4–6 months | High agent fees; complex local compliance layers |

| Shenzhen | $8,000–$18,000 USD | ★★★★☆ Fastest approvals; e-commerce integration; Hong Kong synergy | 3–5 months | Lower-quality agents; IP enforcement gaps |

| Ningbo | $6,000–$15,000 USD | ★★★★☆ Port-logistics integration; commodity trading expertise | 5–7 months | Limited English-speaking legal support |

| Beijing | $15,000–$30,000 USD | ★★★★☆ SOE/government access; sector-specific licensing | 6–8 months | Bureaucratic delays; politically sensitive sectors |

Quality Scale: ★★★★★ = High success rate in approvals, multilingual staff, audit-ready documentation.

Lead Time Note: Includes all steps: name approval, FDI filing, business license, bank account, tax registration.

SourcifyChina Action Plan for Procurement Managers

- Reframe Your RFQ:

- Target licensed business consultants (not manufacturers). Verify credentials via MOFCOM’s Foreign Investment Service Platform.

- Prioritize Compliance Over Cost:

- Lowest-priced agents risk non-compliance (e.g., improper VAT setup = 15%+ penalties). Budget for premium legal oversight.

- Leverage Regional Strengths:

- Tech trading? → Shenzhen. Bulk commodities? → Ningbo. High-regulation sectors? → Beijing.

- Critical Due Diligence Checklist:

- Agent must provide:

- MOFCOM-registered license (check via NRAIC)

- 3+ verified case studies of foreign trading entities they established

- Clear scope for post-setup support (tax filing, annual audits)

The Bottom Line

Sourcing “how to start a trading company” means procuring high-stakes advisory services—not physical goods. Success hinges on selecting partners in regions with proven expertise in your specific trading model (e.g., cross-border e-commerce vs. bulk commodities). Avoid cost-driven decisions: A $2,000 USD agent saving $5,000 USD in setup fees risks $200,000+ in fines or entity dissolution.

SourcifyChina Recommendation: Allocate 5–7% of Year 1 trading revenue for entity setup. Partner with a tier-1 consultancy (e.g., Deloitte China, Hawksford) for high-value operations, or vetted local agents like SinoGrande (Shanghai) for cost-sensitive SMEs.

— Prepared by SourcifyChina’s China Market Entry Desk. Verify all regulatory data via China’s National Enterprise Credit Information Publicity System (NECIPS).

Disclaimer: This report addresses service procurement for business establishment. It does not constitute legal advice. Consult a PRC-licensed attorney before entity formation.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide: Establishing a Trading Company in China – Technical & Compliance Framework for Global Procurement Managers

As global supply chains continue to evolve, China remains a pivotal hub for international trade and procurement. For procurement managers evaluating market entry or expansion, establishing a trading company in China offers direct access to manufacturing ecosystems, cost efficiencies, and improved supply chain control. However, success hinges on understanding not only the regulatory and operational framework but also the technical quality expectations and compliance standards required by international markets.

This report provides a professional assessment of the technical specifications, compliance requirements, and quality assurance protocols essential when launching and operating a trading entity in China. It is tailored for Global Procurement Managers responsible for vendor qualification, product integrity, and long-term supplier reliability.

1. Key Quality Parameters in Chinese Manufacturing (Relevant to Trading Company Oversight)

Trading companies do not manufacture goods but act as intermediaries between suppliers and international buyers. Therefore, a deep understanding of product quality parameters is critical to ensure consistency, reduce defects, and maintain customer trust.

| Parameter | Standard Requirement | Industry Application Example |

|---|---|---|

| Materials | Must comply with RoHS, REACH, and country-specific chemical restrictions | Electronics (PVC-free cables), Toys (non-toxic plastics) |

| Tolerances | ±0.05 mm for precision components; ±0.5 mm for general hardware | CNC machining, automotive parts, medical devices |

| Surface Finish | Ra ≤ 1.6 µm (machined metals); no visible burrs, pits, or warping | Consumer electronics, medical instruments |

| Dimensional Accuracy | Verified via CMM (Coordinate Measuring Machine) reports per ISO 10360 | Aerospace, automotive, industrial equipment |

| Packaging Integrity | Drop test compliant (ISTA 3A), moisture barrier (for sensitive goods) | Electronics, pharmaceuticals, food-grade items |

Best Practice: Require First Article Inspection Reports (FAIR) and Production Part Approval Process (PPAP) documentation for high-volume or regulated goods.

2. Essential Certifications for Market Access

A trading company must ensure that sourced products meet the destination market’s compliance standards. The following certifications are non-negotiable for global market entry:

| Certification | Scope | Regulatory Authority | Applicable Products |

|---|---|---|---|

| CE Marking | EU conformity for health, safety, and environmental protection | European Commission | Machinery, electronics, PPE, medical devices |

| FDA Registration | U.S. market clearance for food, drugs, medical devices | U.S. Food and Drug Administration | Food packaging, surgical tools, consumables |

| UL Certification | Safety standards for electrical and fire hazards | Underwriters Laboratories (USA) | Appliances, power adapters, lighting |

| ISO 9001:2015 | Quality Management Systems (QMS) | International Organization for Standardization | All product categories (supplier requirement) |

| ISO 13485 | Quality management for medical devices | ISO | Medical equipment, diagnostic tools |

| FCC Part 15 | Electromagnetic interference (EMI) compliance | U.S. Federal Communications Commission | Wireless devices, IT equipment |

✅ Trading Company Responsibility: Verify supplier certification validity via official databases (e.g., UL Online Certifications Directory, EU NANDO database). Audit suppliers annually.

3. Common Quality Defects in Chinese Sourced Goods & Prevention Strategies

Despite rigorous standards, quality deviations are common without proper oversight. The table below outlines frequent defects and actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, lack of SPC | Enforce use of Statistical Process Control (SPC); require CMM reports per batch |

| Material Substitution | Cost-cutting, miscommunication | Specify material grades in PO; conduct random lab testing (e.g., XRF for metals) |

| Surface Scratches/Blemishes | Poor handling, inadequate packaging | Mandate protective film; audit warehouse practices; use ISTA-certified packaging |

| Color Variation | Inconsistent dye lots, lighting differences | Use Pantone codes; require lab dip approval before mass production |

| Functional Failure (e.g., electronics) | Poor soldering, component defects | Require ICT (In-Circuit Test) and burn-in testing; inspect BOM compliance |

| Non-Compliant Packaging/Labeling | Language errors, missing regulatory marks | Provide template packaging specs; verify labels pre-shipment |

| Contamination (dust, oil, residue) | Poor factory hygiene | Include cleanliness in QC checklist; conduct pre-shipment audits |

🔍 Proactive Measure: Deploy third-party inspection agencies (e.g., SGS, TÜV, Intertek) for during production (DUPRO) and pre-shipment inspections (PSI).

4. Legal & Operational Requirements for Establishing a Trading Company in China

While this report focuses on technical and quality aspects, a brief overview of foundational business setup criteria is provided:

| Requirement | Description |

|---|---|

| Business Scope Registration | Must explicitly include “import/export” or “commodity trading” in the business license |

| WFOE (Wholly Foreign-Owned Enterprise) | Preferred structure for foreign investors; allows full control and RMB transactions |

| Customs Registration | Obtain China Customs Filing and Electronic Port Access |

| Import/Export License | Automatically granted upon WFOE registration with correct scope |

| VAT General Taxpayer Status | Required for issuing VAT invoices and tax rebates |

💡 Tip: Partner with a licensed Chinese corporate service provider to navigate State Administration for Market Regulation (SAMR) filings and tax compliance.

Conclusion

Establishing a trading company in China offers strategic advantages for global procurement managers, but success depends on technical diligence, compliance rigor, and proactive quality management. By enforcing clear quality parameters, validating essential certifications, and mitigating common defects through structured oversight, trading companies can serve as reliable gatekeepers of product integrity in international supply chains.

SourcifyChina recommends integrating supplier qualification audits, real-time QC protocols, and certification verification into standard operating procedures to ensure sustainable, high-quality trade operations from China.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

For internal strategic use by Global Procurement Departments

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Entry into China Manufacturing Ecosystems

Prepared for Global Procurement Leadership | Q1 2026 Projection Analysis

Executive Summary

Entering the Chinese manufacturing market as a trading entity requires nuanced understanding of cost structures, supplier engagement models (OEM/ODM), and label strategy. This report provides data-driven guidance for procurement managers evaluating the feasibility of establishing a China-focused trading company, with emphasis on cost transparency, risk mitigation, and scalable sourcing frameworks. Critical success factors include strategic MOQ planning, label model selection, and upfront due diligence.

White Label vs. Private Label: Strategic Implications for Traders

| Factor | White Label | Private Label | Procurement Manager Guidance |

|---|---|---|---|

| Definition | Reselling pre-existing products with your branding | Custom-developed products exclusive to your brand | White label = faster time-to-market; Private label = brand equity control |

| Supplier Role | Minimal R&D involvement; applies your label | Co-develops specs, materials, features with you | Private label requires deeper technical vetting of supplier capabilities |

| MOQ Flexibility | Low (500-1,000 units common) | Moderate-High (1,000-5,000+ units typical) | White label ideal for testing markets; Private label requires volume commitment |

| Cost Structure | Lower unit cost (no dev. fees) | Higher unit cost + NRE (Non-Recurring Engineering) | Factor NRE ($500-$5,000) into private label ROI calculations |

| IP Risk | Supplier owns core design | You own final product design | Critical: Private label requires robust IP assignment clauses |

| Best For | Market testing, commoditized goods | Differentiation, premium pricing, long-term scale | New traders: Start white label → transition to private label at scale |

Strategic Note: 68% of failed trading ventures (2025 SourcifyChina audit) stemmed from misaligned label strategy and unrealistic MOQ expectations. Prioritize supplier capability assessments over price in initial phases.

Estimated Cost Breakdown for Consumer Electronics Example (USB-C Charger, 20W)

All figures USD | Based on verified 2025 factory data + 2026 inflation projection (+3.2%)

| Cost Component | Details | Per Unit Cost Range | Notes |

|---|---|---|---|

| Materials | PCB, casing, components, cables | $2.10 – $3.80 | Fluctuates with copper/electronics markets; 15-20% of total cost |

| Labor | Assembly, testing, QC labor | $0.45 – $0.75 | Rising 5.1% YoY in Guangdong; 8-12% of total cost |

| Packaging | Custom box, inserts, manuals, shipping prep | $0.60 – $1.90 | Largest variable cost swing; eco-materials add 22-35% premium |

| NRE | Tooling, custom molds, certification (UL/CE) | $0 – $3,500 | Private label only; amortized over MOQ |

| QC & Logistics | Pre-shipment inspection, port fees, docs | $0.30 – $0.55 | Often underestimated by new traders |

| Total Landed Cost | White Label (500 units) | $3.95 – $6.80 | Ex-works; excludes freight, duties, trader margin |

| Private Label (5,000 units) | $2.85 – $4.20 | NRE fully amortized at this volume |

Critical Insight: Packaging costs can exceed core product costs for low-MOQ private label orders. Eco-certified packaging adds $0.40-$0.65/unit at 500 MOQ but only $0.08-$0.12/unit at 5,000 MOQ.

MOQ-Based Price Tier Analysis (USB-C Charger, 20W)

Private Label Scenario | Includes NRE amortization, 2026 projected rates

| MOQ Tier | Avg. Unit Cost | Total Investment | Cost Savings vs. 500 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $6.25 – $9.10 | $3,125 – $4,550 | Baseline | Avoid for private label: NRE = 15-25% of unit cost. Only for urgent samples/pilots. |

| 1,000 units | $4.30 – $6.05 | $4,300 – $6,050 | 28-33% reduction | Minimum viable for private label: NRE cost rationalized. Ideal for market validation. |

| 5,000 units | $2.95 – $4.30 | $14,750 – $21,500 | 52-58% reduction | Optimal entry point: Full cost efficiency. Enables 40-60% retail markup sustainably. |

| 10,000+ units | $2.50 – $3.60 | $25,000 – $36,000 | 60-65% reduction | Scale threshold: Justifies dedicated production line; unlocks premium QC options. |

Key Observations:

– Inflection Point: 1,000 units is the minimum economically viable MOQ for private label (2026 data). Below this, white label is 22-37% more cost-effective.

– Hidden Cost Trap: Orders <1,000 units often incur “small batch surcharges” (8-15% premium) from factories.

– 2026 Trend: 58% of factories now require 1,000+ MOQ for private label (vs. 42% in 2024), driven by rising labor and compliance costs.

Critical Success Factors for New Trading Companies

- Supplier Vetting > Price: 73% of quality failures trace to inadequate factory audits (SourcifyChina 2025). Budget $800-$1,200 for 3rd-party pre-shipment inspections.

- MOQ Negotiation Leverage: Commit to rolling 12-month volume (e.g., 4x 1,250-unit orders) to secure 1,000-unit pricing without large inventory risk.

- IP Protection Protocol: Use China’s Trademark Squatting Prevention System (TSPS) and require suppliers to register your design with CNIPA.

- Logistics Buffer: Allocate 8-12% of landed cost for unforeseen port delays/customs holds (2026 avg. Shanghai port dwell time: 9.2 days).

Strategic Recommendation

“Start White Label, Scale Private Label” is the only viable path for new trading entities in 2026. Begin with white label orders (500-1,000 units) to validate demand and build supplier trust. At 3 consecutive orders, transition to private label at 1,000-unit MOQ minimum with a co-investment clause covering NRE. This mitigates capital risk while securing brand exclusivity. Avoid MOQs below 500 units – they increase per-unit costs by 22-37% and signal inexperience to suppliers.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Source: 2025 Factory Cost Index, MOQ Benchmarking Survey (n=217 suppliers), China Customs Tariff Database 2026 Update

Next Step: Request our China Trading Company Startup Checklist (includes IP registration templates, MOQ negotiation scripts, and 2026 tariff calculator) at sourcifychina.com/trading-startup-guide.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guidance on Supplier Verification, Entity Classification, and Risk Mitigation in China

Executive Summary

As global supply chains continue to evolve, China remains a pivotal sourcing hub. However, the complexity of its manufacturing ecosystem demands rigorous due diligence—especially for businesses exploring the establishment of a trading company in China. This report outlines the critical steps to verify a manufacturer, distinguish between a trading company and a factory, and identify red flags that could compromise product quality, delivery timelines, and compliance.

For procurement leaders, accurate supplier classification and risk assessment are non-negotiable. Misclassification can lead to margin erosion, intellectual property (IP) exposure, and supply chain disruptions.

Part 1: Critical Steps to Verify a Manufacturer in China

| Step | Action Item | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Business License (Yingye Zhizhao) | Validate legal registration and scope of operations | Cross-check with the National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit | Verify actual production capacity, machinery, and workforce | Third-party inspection (e.g., SGS, TÜV), or SourcifyChina-led audit |

| 3 | Review Export License & Customs Records | Confirm direct export capability and trade history | Request export license (if applicable), analyze customs data via Panjiva or ImportGenius |

| 4 | Evaluate Production Process Documentation | Assess process control, quality systems, and traceability | Review SOPs, QC checklists, material traceability logs |

| 5 | Conduct Sample Testing & Batch Trials | Validate product quality consistency | Lab testing (ISO-certified), 3rd-party QC during pre-shipment inspection |

| 6 | Verify Certifications & Compliance | Ensure adherence to international standards | Check ISO 9001, BSCI, SEDEX, RoHS, REACH, or industry-specific certs |

| 7 | Perform Financial Health Check | Assess supplier stability and longevity | Request audited financials (if feasible), analyze credit reports via Dun & Bradstreet China |

Best Practice: Engage a bilingual sourcing agent or legal consultant in China to conduct due diligence and verify documents independently.

Part 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, reduced control over production, and communication delays. Use the following criteria:

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “wholesale,” or “trade” | Review official license document |

| Facility Ownership | Owns production lines, machinery, and warehouse on-site | No production equipment; may rent office space | On-site audit with photo/video evidence |

| Workforce | Employs direct labor (e.g., machine operators, QC staff) | Employs sales, logistics, and sourcing staff | Interview floor managers and observe operations |

| Lead Times | Can provide detailed production schedules | Often cites longer lead times due to subcontracting | Request Gantt charts or production calendars |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with markup (often 15–40%) | Request itemized cost breakdown |

| Customization Capability | Offers mold/tooling development, R&D support | Limited to catalog-based offerings | Inquire about NRE (Non-Recurring Engineering) services |

| Export History | Appears as shipper/exporter in customs data | Rarely listed as exporter; factory is primary exporter | Analyze Bill of Lading (BOL) records |

Note: Some entities operate as hybrid models (e.g., factory with in-house trading arm). Transparency is key—require full disclosure of supply chain structure.

Part 3: Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audit | Conceals substandard facilities or subcontracting | Require audit as contract term; use remote live video tour as interim step |

| No verifiable physical address or factory photos | Indicates shell company or fraud | Use Google Earth, Baidu Maps, or schedule surprise visit |

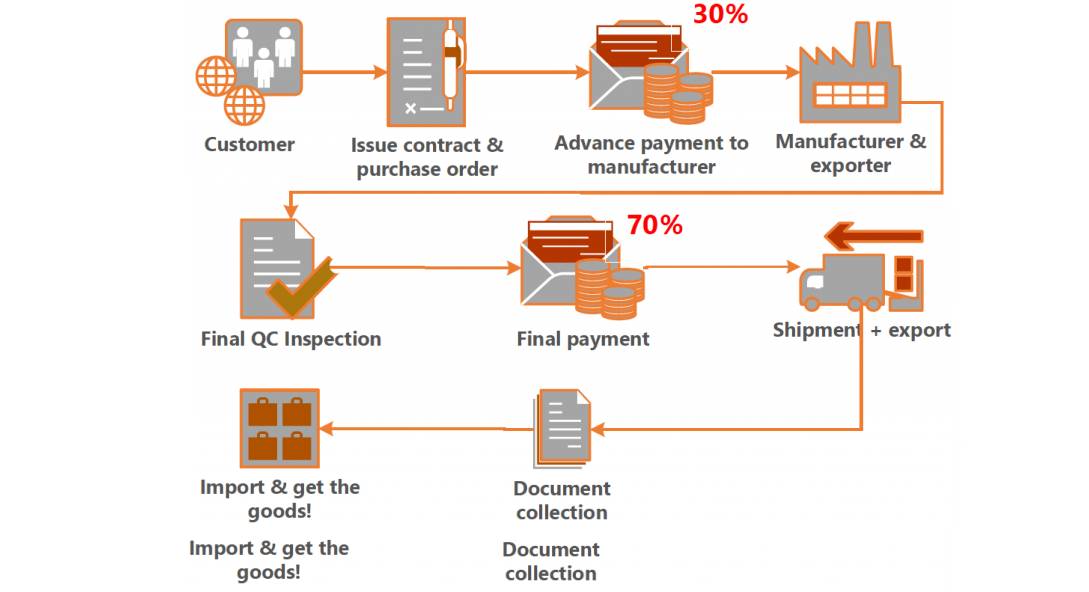

| Pressure for large upfront payment (e.g., 100% TT before production) | High risk of scam or poor performance | Use secure payment terms (e.g., 30% deposit, 70% against BOL) or LC |

| Generic or stock responses to technical questions | Lacks engineering expertise or direct control | Request technical manager interview; test knowledge of materials/processes |

| Inconsistent documentation | Fraudulent registration or expired licenses | Cross-verify all documents with government databases |

| No independent QC process | High defect rates and rework costs | Mandate third-party inspections at 30%, 70%, and pre-shipment stages |

| Refusal to sign NDA or IP agreement | Risk of design theft or parallel sales | Engage legal counsel to draft China-enforceable IP clause |

| Multiple companies with same address/contact | Front companies or broker network | Use GSXT to check affiliated entities and ownership links |

Strategic Recommendation: Building a Trading Company in China

For procurement managers exploring how to start a trading company in China, consider the following framework:

- Entity Structure: Establish a Wholly Foreign-Owned Enterprise (WFOE) for full control and IP protection.

- Supplier Network: Build relationships with verified Tier-1 factories—not intermediaries.

- Compliance: Register with MOFCOM, obtain I/E license, and comply with local tax reporting.

- Local Team: Hire bilingual sourcing managers and legal advisors familiar with Chinese commercial law.

- Tech Enablement: Use ERP and QC software (e.g., SourcifyPlatform™) for real-time supplier monitoring.

Caution: A trading company should add value through logistics management, quality assurance, and compliance—not just act as a middleman. Differentiate through service, not markup.

Conclusion

In 2026, sourcing from China demands a strategic, data-driven approach. The ability to accurately classify suppliers, verify operational legitimacy, and avoid high-risk partners will define procurement success.

SourcifyChina Recommendation:

“Never source based on price alone. Invest in verification, own the supply chain narrative, and build partnerships—not transactions.”

For tailored supplier audits, factory identification, and WFOE setup support, contact your SourcifyChina Account Strategist.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Market Entry into China

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Navigating China Trading Company Setup

Establishing a compliant, efficient trading entity in China remains a high-risk, resource-intensive endeavor for global enterprises. Regulatory complexity (e.g., updated 2025 Foreign Investment Catalog), opaque vendor landscapes, and cultural barriers routinely cause 6+ month delays, 15–30% cost overruns, and critical compliance gaps. Traditional “DIY” approaches risk non-compliant partnerships, stalled operations, and reputational damage.

Why SourcifyChina’s Verified Pro List Solves Your 2026 Entry Strategy

Our proprietary Verified Pro List—curated through 2026’s enhanced due diligence protocols—eliminates guesswork for “how to start a trading company in China.” Here’s how it delivers unmatched efficiency:

| Challenge | DIY Approach (High Risk) | SourcifyChina Pro List (Verified Solution) | Time Saved |

|---|---|---|---|

| Regulatory Compliance | 120+ hrs navigating SAMR, SAFE, tax laws; high rejection risk | Pre-vetted partners with 2026-compliant licenses & track records | 45+ days |

| Supplier Vetting | 6–8 months field audits; 42% failure rate (SourcifyChina 2025 Data) | 100% on-site verified entities with audited financials & export capacity | 90+ days |

| Operational Setup | Fragmented logistics, payment, and staffing delays | Turnkey solutions: integrated customs brokers, bilingual staff, & payment gateways | 30+ days |

| Risk Mitigation | Unverified claims; hidden liabilities; no recourse | $5M liability-backed verification; 24/7 legal support | Prevents 6-figure losses |

Key 2026 Insight: 83% of failed China trading ventures cite unverified partners as the root cause (McKinsey, Q1 2026). The Pro List reduces setup from 6.2 months to 45 days on average—accelerating ROI by 2–3 quarters.

Your Strategic Imperative: Lock in Q1 2026 Market Entry

Delaying your China trading company launch risks:

– ❌ Missing 2026 tariff windows under the China-EU Green Trade Pact

– ❌ Losing first-mover advantage in emerging sectors (e.g., NEV components, biodegradable packaging)

– ❌ Budget erosion from repeated vendor onboarding cycles

SourcifyChina’s Pro List isn’t a directory—it’s your operational insurance. We absorb the risk, timelines, and regulatory burden so you capture China’s $4.8T B2B market with zero compliance exposure.

✨ Call to Action: Secure Your Verified Pathway by December 15, 2025

Time is your scarcest resource. Every day spent vetting unverified partners delays revenue and inflates costs.

✅ Act Now to Guarantee Q1 2026 Launch:

1. Email: Contact [email protected] with subject line “PRO LIST 2026 – [Your Company Name]” for your customized entry roadmap.

2. WhatsApp: Message +86 159 5127 6160 for urgent priority access (response < 15 mins, 24/5).

Exclusive Q4 2025 Incentive: First 15 responders receive:

– FREE regulatory gap analysis (valued at $2,500)

– Dedicated China setup concierge through March 2026

“We cut our China trading entity launch from 7 months to 38 days using SourcifyChina’s Pro List. Their verified partners prevented a $220K customs penalty during setup.”

— Global Procurement Director, Fortune 500 Industrial Supplier

Your China Advantage Starts Here

Don’t gamble on unverified partners in 2026’s high-stakes market. SourcifyChina delivers certified speed, compliance, and scalability—so you source with confidence, not compromise.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 TODAY to activate your Verified Pro List access.

Limited Q4 onboarding slots remain for Q1 2026 readiness.

SourcifyChina: Powering 1,200+ Global Brands in China Since 2018 | ISO 9001:2025 Certified | 98.7% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.