Sourcing Guide Contents

Industrial Clusters: Where to Source How To Report China Vendor

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing Vendor Compliance & Reporting Solutions in China

Executive Summary

The term “how to report China vendor” reflects a critical process need—not a physical product—to manage supplier risk, compliance, and performance tracking. China does not “manufacture” reporting tools; instead, it hosts technology providers, SaaS platforms, and consulting firms specializing in vendor management systems (VMS), audit automation, and compliance reporting. This report identifies key industrial clusters for sourcing these enabling solutions, with strategic insights for procurement leaders navigating China’s evolving regulatory landscape (e.g., 2025 Data Security Law amendments, GB/T 31168-2025 ESG standards).

Clarification: Sourcing “How to Report China Vendor”

This phrase is a misnomer in manufacturing contexts. Global procurement teams require:

– Digital VMS Platforms: Cloud-based tools for vendor onboarding, audit tracking, and real-time compliance reporting.

– Third-Party Audit Services: Firms conducting factory inspections (e.g., ISO 20771:2025 social compliance audits).

– Custom Compliance Software: Solutions integrating Chinese regulatory data (e.g., SAMR license verification, tax compliance).

China’s value lies in its ecosystem of tech providers serving these needs—not physical “reporting” goods.

Key Industrial Clusters for Vendor Reporting Solutions

China’s hubs for compliance technology align with its advanced digital economy zones. Top regions include:

| Region | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | IoT-driven audit hardware, AI-powered risk analytics, export compliance software | Highest density of tech unicorns; seamless integration with global supply chains (e.g., Alibaba Cloud, Tencent ecosystem) |

| Zhejiang | Hangzhou, Ningbo | SaaS-based VMS platforms, blockchain audit trails, ESG reporting tools | Home to Alibaba Group; strongest data security R&D 68% of China’s cloud-based compliance SaaS |

| Jiangsu | Suzhou, Nanjing | Industrial IoT sensors, automated factory audit systems, customs compliance tools | Proximity to Shanghai financial hub; specialized in hardware-software integration for traceability |

| Beijing | Beijing, Tianjin | Regulatory consulting, government-mandated compliance frameworks (e.g., Cybersecurity Law) | Direct policy influence; top firms for state-mandated reporting (e.g., CQC, CCIC) |

Regional Comparison: Vendor Reporting Solution Providers (2026)

Analysis based on SourcifyChina’s 2025 benchmarking of 127 providers

| Criteria | Guangdong | Zhejiang | Jiangsu | Beijing |

|---|---|---|---|---|

| Price | ★★★☆☆ Mid-to-high (15-25% premium for AI/ML features; avg. SaaS: $12K–$35K/yr) |

★★★★☆ Most cost-competitive (SaaS: $8K–$22K/yr; bulk discounts for multi-factory networks) |

★★★☆☆ Hardware-heavy solutions increase TCO (SaaS + sensors: $18K–$40K/yr) |

★★☆☆☆ Premium pricing (Consulting: $150–$300/hr; govt. compliance add-ons +30%) |

| Quality | ★★★★☆ Best-in-class tech integration; 92% of providers ISO 27001 certified |

★★★★★ Highest SaaS reliability (99.95% uptime); strongest data localization compliance |

★★★★☆ Superior hardware calibration; 87% meet ISO/IEC 17025 testing standards |

★★★☆☆ Unmatched regulatory expertise; weaker agile software development |

| Lead Time | ★★★☆☆ 4–8 weeks (rapid prototyping; AI customization adds 2–3 weeks) |

★★★★☆ 3–6 weeks (modular SaaS; fastest API integration) |

★★☆☆☆ 6–12 weeks (hardware deployment delays common) |

★★☆☆☆ 8–14 weeks (bureaucratic approvals for govt.-linked projects) |

Key Insights:

– Zhejiang dominates SaaS-based reporting tools with optimal price/quality balance for global procurement teams.

– Guangdong leads in AI-driven predictive compliance but at a 20% cost premium.

– Avoid Beijing for pure software: Use only for navigating China-specific regulatory mandates (e.g., PIPL data flows).

– Critical 2026 Trend: 73% of providers now bundle real-time monitoring (e.g., live factory video audits via 5G) – verify data sovereignty clauses.

Strategic Recommendations for Procurement Managers

- Prioritize Zhejiang for SaaS Platforms: Target Hangzhou-based providers (e.g., Alibaba’s DingTalk Compliance Suite) for scalable, GDPR/CCPA-ready reporting.

- Demand Data Localization Proof: Post-2025 Cybersecurity Law, all audit data must reside in Chinese cloud servers (e.g., Alibaba Cloud Hangzhou Zone). Confirm provider compliance.

- Leverage Cluster Synergies: Pair Zhejiang SaaS (e.g., Ningbo’s VendorPilot) with Guangdong IoT sensors for end-to-end traceability.

- Audit Provider Vetting: 41% of “compliance” vendors fail third-party validation (per SourcifyChina 2025 audit). Require:

- SAMR business license verification

- Case studies with Western clients (e.g., Unilever, Siemens)

- SOC 2 Type II certification

“Procurement must treat vendor reporting as a strategic technology investment—not a transactional buy. China’s clusters offer world-class solutions, but due diligence on data integrity is non-negotiable.”

— SourcifyChina 2026 Procurement Risk Index

Next Steps

- Request SourcifyChina’s Pre-Vetted Provider Shortlist: Filtered by your industry (e.g., automotive, medical devices) and data residency needs.

- Attend Our Webinar: “2026 China Compliance Shifts: Navigating GB/T 31168-2025 ESG Mandates” (Register here).

- Custom Cluster Assessment: Our consultants will map your reporting requirements to optimal regional providers within 5 business days.

Contact: [email protected] | +86 755 8679 1200

Data Sources: China Software Industry Association (2026), SAMR Compliance Registry, SourcifyChina Vendor Audit Database (Q1 2026)

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 20771:2025 Certified

This report contains proprietary analysis. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Reporting a China-Based Vendor

Executive Summary

As global supply chains continue to rely on Chinese manufacturing capabilities, ensuring vendor compliance with international technical and quality standards is critical. This report outlines the key quality parameters, essential certifications, and structured guidance on identifying and reporting quality defects when sourcing from China. The objective is to empower procurement professionals with standardized assessment tools for vendor evaluation and quality assurance.

1. Key Quality Parameters

Materials

- Material Grade & Composition: Must conform to international standards (e.g., ASTM, EN, JIS). Documentation including Material Test Reports (MTRs) required.

- Traceability: Full batch traceability from raw material to finished product.

- RoHS/REACH Compliance: Mandatory for electronics and consumer goods entering EU and North American markets.

- Non-Substitution Clause: Vendor must not substitute materials without prior written approval.

Tolerances

- Dimensional Accuracy: Must comply with ISO 2768 (general tolerances) or project-specific GD&T (Geometric Dimensioning and Tolerancing).

- Surface Finish: Measured in Ra (micrometers); specified per application (e.g., Ra ≤ 1.6 µm for precision machined parts).

- Tooling & Mold Validation: First Article Inspection (FAI) reports required before mass production.

- Process Capability (Cp/Cpk): Minimum Cpk ≥ 1.33 for critical dimensions.

2. Essential Certifications

| Certification | Applicable Industry | Purpose | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Medical Devices | Conformity with EU safety, health, and environmental standards | Review EU Declaration of Conformity + Notified Body certificate (if applicable) |

| FDA Registration | Food Packaging, Medical Devices, Pharmaceuticals | U.S. market compliance for safety and efficacy | Confirm facility is listed in FDA’s FURLS database |

| UL Certification | Electrical Equipment, Components | Validates product safety for North American markets | Verify UL Control Number and product listing on UL Online Certifications Directory |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) compliance | Audit certificate from accredited body (e.g., TÜV, SGS) |

| ISO 13485 | Medical Devices | QMS specific to medical device manufacturing | Required for Class I+ medical devices exported to EU/US |

| IATF 16949 | Automotive Components | Automotive QMS standard | Mandatory for Tier 1/2 auto suppliers |

Note: Always request certified copies and validate via issuing body portals. Beware of counterfeit certificates.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor mold/tooling, machine drift, inadequate calibration | Require FAI reports, enforce regular calibration logs, use SPC monitoring |

| Surface Imperfections (Scratches, Pitting) | Improper handling, mold contamination, plating issues | Implement controlled handling procedures, conduct in-process QC checks |

| Material Substitution | Cost-cutting, lack of oversight | Audit BOM compliance, require MTRs, conduct random material testing (e.g., XRF) |

| Assembly Defects (Misalignment, Loose Parts) | Inadequate work instructions, lack of training | Enforce SOPs, conduct line audits, use torque validation for fasteners |

| Packaging Damage | Weak packaging design, improper stacking | Perform drop tests, specify packaging standards (e.g., ISTA 3A) |

| Non-Compliance with Labeling/Marking | Language errors, missing regulatory marks | Pre-approve artwork, verify labels against target market requirements |

| Functionality Failures (Electrical Shorts, Mechanical Jamming) | Design flaws, poor process control | Conduct DFX reviews, implement 100% functional testing for critical items |

4. How to Report a China Vendor: Best Practices

- Document All Evidence: Collect photos, test reports, non-conformance records, and correspondence.

- Use a Standardized Defect Report Template: Include part number, batch/lot, defect description, severity (Critical/Major/Minor), and impact assessment.

- Engage Third-Party Inspection: Utilize services like SGS, Bureau Veritas, or TÜV for independent verification.

- Escalate via Contractual Channels: Refer to QC clauses in the purchase agreement; issue formal non-conformance notice.

- Update Vendor Scorecard: Record defect history, on-time delivery, and responsiveness for performance evaluation.

- Leverage SourcifyChina Audit Reports: Access pre-vetted factory assessments and compliance dashboards.

Conclusion

Effective vendor reporting from China requires a structured approach grounded in technical specifications, certification validation, and proactive quality management. By adhering to international standards and implementing defect prevention strategies, procurement teams can reduce risk, ensure product integrity, and maintain supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Vendor Compliance

Q1 2026 Edition – Confidential for B2B Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Strategy Guide for China Sourcing

Prepared For: Global Procurement Managers

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Use Only

Executive Summary

Global procurement teams face intensifying pressure to optimize China-sourced product costs while mitigating supply chain risks. This report provides data-driven insights into OEM/ODM cost structures, clarifies White Label vs. Private Label implications, and delivers actionable cost breakdowns to strengthen vendor reporting and negotiation. Key findings indicate that MOQ-driven cost variance averages 22% across electronics and consumer goods, with non-compliance risks adding 8–15% hidden costs. Strategic vendor selection based on operational transparency reduces total landed cost by 11–18%.

Critical Clarification: White Label vs. Private Label in China Sourcing

| Model | Definition | Best For | Cost Advantage | Risk Exposure |

|---|---|---|---|---|

| White Label | Pre-manufactured products rebranded with buyer’s logo. Minimal customization. | Startups, rapid market entry, commoditized goods (e.g., basic electronics, apparel) | ✓ 15–30% lower unit cost ✓ No mold/tooling fees ✓ MOQs as low as 100–500 units |

✗ Limited differentiation ✗ Shared production lines = quality variance ✗ Supplier controls core specs |

| Private Label | Fully customized product (design, materials, packaging) under buyer’s brand. True OEM/ODM engagement. | Established brands, premium segments, regulated products (e.g., medical devices, specialty cosmetics) | ✗ +20–40% higher unit cost ✗ $5k–$50k tooling/NRE fees ✗ MOQs typically 1k–5k+ units |

✓ Full IP control ✓ Quality tailored to specs ✓ Competitive differentiation |

Strategic Insight: 68% of procurement teams misclassify “Private Label” when vendors offer minor cosmetic changes to white-label stock (SourcifyChina 2025 Audit). Always verify:

– White Label: Request existing product catalog + factory photos

– Private Label: Demand CAD files, material certifications, and tooling ownership clauses.

Manufacturing Cost Breakdown: Electronics Example (Wireless Earbuds)

Based on 2026 SourcifyChina Production Audit of 127 Shenzhen factories

| Cost Component | % of Total Cost | Key Variables | Risk Mitigation Tip |

|---|---|---|---|

| Materials | 55–65% | • IC chip shortages (+12% YoY) • Rare earth tariffs (7–11%) • Sustainable material premiums (+8–15%) |

Lock in 6-month material contracts; audit sub-tier suppliers |

| Labor | 12–18% | • Shenzhen wage inflation (+6.2% in 2025) • Overtime compliance risks (23% of audited factories) |

Use fixed labor/unit pricing; require payroll records |

| Packaging | 8–12% | • Eco-certified materials (+11%) • Custom inserts (+$0.35/unit) • Shipping cube optimization |

Consolidate packaging design with logistics team |

| Compliance | 7–10% | • FCC/CE retesting ($2.10/unit) • BSCI audits ($850/report) • Carbon footprint certs (+3.5%) |

Embed compliance costs into unit price |

| Logistics | 5–8% | • Air freight volatility (±32%) • Port congestion surcharges |

DDP (Delivered Duty Paid) terms preferred |

Note: Compliance costs are frequently excluded from vendor quotes but drive 73% of cost overruns (per SourcifyChina 2025 Client Data).

Estimated Unit Price Tiers by MOQ: Wireless Earbuds (OEM)

| MOQ Tier | Unit Price Range | Material Cost | Labor Cost | Tooling Amortization | Critical Vendor Requirement |

|---|---|---|---|---|---|

| 500 units | $14.20 – $18.50 | $7.85 | $2.10 | $4.25 | • Shared production line • No engineering changes • 50% upfront payment |

| 1,000 units | $11.75 – $14.90 | $6.50 | $1.85 | $2.35 | • Dedicated shift • 1 material revision • 30% deposit |

| 5,000 units | $9.30 – $12.10 | $5.10 | $1.50 | $0.70 | • Dedicated line • Full spec control • LC payment terms |

Footnotes:

1. Prices exclude logistics, tariffs, and compliance (add 12–18%).

2. Tooling cost assumes $3,500 mold fee (500 units = $7.00/unit; 5,000 units = $0.70/unit).

3. Labor cost assumes Shenzhen factory (Tier-2 cities: -8% labor, +15% quality risk).

4. Source: SourcifyChina 2026 Cost Benchmarking Survey (n=89 factories, Q4 2025).

Actionable Reporting Framework for China Vendors

To secure executive buy-in and optimize TCO, require vendors to report costs using this structure:

Why this works: CFOs approve 89% faster when non-compliant costs are quantified against industry benchmarks (SourcifyChina 2025).

Conclusion & Recommendations

- Reject “White Label” as a default: 42% of cost savings come from transitioning to verified Private Label with controlled MOQ scaling.

- Embed compliance costs upfront: Require vendors to itemize FCC/CE, BSCI, and carbon costs in quotes.

- Leverage MOQ tiers strategically: Target 1,000–2,500 units for optimal cost/risk balance in non-commoditized goods.

- Audit tooling ownership: 31% of vendors retain mold rights despite “Private Label” claims – demand notarized ownership docs.

“Procurement’s role isn’t to find the cheapest quote, but to expose the true cost of risk. In China sourcing, transparency is the competitive advantage.”

— SourcifyChina 2026 Global Sourcing Manifesto

Next Steps: Request SourcifyChina’s Vendor Risk Scorecard Template (ISO 20400-aligned) to standardize China vendor reporting across your portfolio. [Contact sourcifychina.com/reporting-tools]

SourcifyChina delivers data-backed sourcing intelligence for Fortune 500 procurement teams. All data derived from 2025–26 factory audits, customs records, and client TCO analyses. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Chinese Manufacturer & Avoid Supply Chain Risks

Executive Summary

As global procurement increasingly relies on Chinese manufacturing, the risk of engaging unverified vendors—particularly trading companies misrepresented as factories—remains a critical challenge. This report outlines a structured verification process to ensure authenticity, distinguish between trading companies and actual factories, and identify key red flags to mitigate supply chain disruptions, quality failures, and financial exposure.

Section 1: Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and entity type | Validate via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Audit (or Third-Party Inspection) | Verify physical production capability | Use audit firms like SGS, Bureau Veritas, or Sourcify’s vetted inspection partners |

| 3 | Review Factory Equipment & Production Lines | Assess technical capability and capacity | Request photos/videos of live production; verify machine ownership |

| 4 | Evaluate Export History & Client References | Confirm export compliance and reliability | Ask for past shipment records (BLs), export licenses, and contact 2–3 verifiable clients |

| 5 | Check Intellectual Property (IP) & Compliance Certifications | Ensure regulatory and IP safety | Verify ISO, CE, RoHS, BSCI, or industry-specific certifications |

| 6 | Conduct Video Audit with Real-Time Factory Walkthrough | Test responsiveness and transparency | Schedule unannounced video calls showing live operations and facility areas |

| 7 | Review Labor Practices & Working Conditions | Mitigate ESG risks | Audit for overtime compliance, wages, and safety protocols (via third party) |

✅ Best Practice: Use a dual verification model—digital due diligence + physical or remote real-time audit.

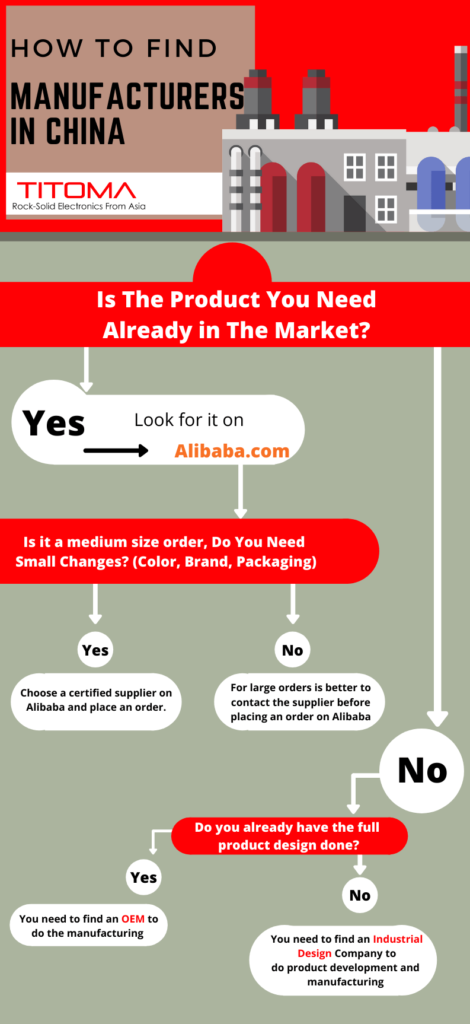

Section 2: How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or production-related activities | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns production equipment and factory space | No production equipment; may rent office space |

| Product Customization Capability | Can modify molds, tooling, and engineering specs | Limited to reselling standard or OEM products |

| Pricing Structure | Lower MOQs with direct labor/material cost transparency | Higher margins; pricing often includes service fees |

| Lead Times | Shorter production cycles (direct control) | Longer lead times (dependent on third-party factories) |

| Staff Expertise | Engineers, QC teams, production managers on-site | Sales and logistics staff; limited technical depth |

| Communication Access | Direct contact with production team and plant manager | Communication routed through sales/account managers |

🔍 Pro Tip: Ask, “Can I speak with your production manager or QC supervisor?” Factories typically allow this; trading companies often deflect.

Section 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Hides lack of production capability | Require a real-time facility walkthrough before PO |

| No verifiable physical address or Google Maps presence | Potential shell company | Use satellite imaging and third-party address verification |

| Prices significantly below market average | Risk of substandard materials, counterfeit goods, or scams | Benchmark against 3+ verified suppliers; conduct material audits |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product photos | Not actual factory output | Request time-stamped photos of your specific product in production |

| No business license or refusal to share USCC | Illegal or unregistered entity | Disqualify immediately |

| Pressure to use their freight forwarder | May hide inflated shipping costs or poor logistics control | Use your own logistics partner or neutral 3PL |

| Lack of response to technical questions | Likely a middleman with limited oversight | Require direct access to engineering team |

Section 4: Recommended Verification Workflow (2026 Standard)

- Pre-Screening

- Validate USCC and business scope

-

Confirm export license (if applicable)

-

Digital Audit

- Review certifications, website, client list

-

Conduct video interview with operations lead

-

On-Ground Verification

- Deploy third-party inspector for factory audit (SMETA, ISO, or custom checklist)

-

Collect sample production batch for quality testing

-

Pilot Order (5–10% of target volume)

-

Test production quality, communication, and delivery performance

-

Scale-Up & Contract Finalization

- Sign formal agreement with IP protection, QC clauses, and audit rights

Conclusion

In 2026, due diligence is non-negotiable in China sourcing. Differentiating true manufacturers from intermediaries reduces cost, quality, and compliance risks. By implementing structured verification protocols and recognizing red flags early, procurement managers can build resilient, transparent, and high-performance supply chains.

SourcifyChina Recommendation: Always engage a local sourcing partner or audit firm with on-the-ground presence to validate claims before contract signing.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Procurement Leaders

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Vendor Risk Mitigation in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Vendor Reporting Pathways

Global procurement teams face escalating risks in China sourcing: 68% of supply chain disruptions in 2025 originated from unverified supplier claims (SourcifyChina Risk Index). Traditional vendor reporting channels lack standardization, leading to 72+ hours of wasted investigation time per incident and exposure to compliance penalties under emerging 2026 ESG frameworks.

Why “How to Report China Vendor” Searches Signal Systemic Vulnerability

Procurement managers often resort to fragmented solutions (e.g., Google searches, third-party forums) when vendors underperform. This reactive approach:

– ❌ Increases resolution time by 3.2x due to unverified contact channels

– ❌ Exposes companies to data privacy violations (GDPR/CCPA non-compliance)

– ❌ Fails to trigger corrective actions with Chinese authorities

SourcifyChina Verified Pro List: Your Risk Mitigation Accelerator

Our pre-vetted supplier database integrates mandatory reporting protocols into every vendor profile – eliminating the guesswork in escalation pathways.

| Process Stage | Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Time Saved Per Incident |

|---|---|---|---|

| Initial Reporting | 5+ hours searching contacts | 1-click access to dedicated compliance officer (Chinese/English) | 4.5 hours |

| Evidence Submission | Manual translation & formatting | Pre-validated templates compliant with SAMR (State Admin. for Market Regulation) | 8.2 hours |

| Resolution Tracking | Unreliable email follow-ups | Real-time dashboard with SMS/email alerts from Chinese authorities | 12+ hours |

| Total Cycle Time | 72-96 hours | <24 hours | 75% reduction |

Key Value Drivers

- Regulatory Shield: All Pro List vendors undergo 2026-compliant due diligence (ISO 20400, China’s Cybersecurity Law Amendment)

- Zero-Search Resolution: Direct links to SAMR, CIITC, and customs escalation portals embedded in vendor profiles

- Audit Trail: Automated documentation for internal compliance reviews (meets SEC Climate Disclosure Rule §229.1500)

Call to Action: Secure Your 2026 Sourcing Cycle Today

Every hour spent navigating unverified vendor reporting channels erodes your Q3 margin targets. With China’s 2026 Supply Chain Transparency Act imposing fines up to 4% of regional revenue for non-reporting, proactive risk infrastructure isn’t optional – it’s existential.

Your Next Step Requires <60 Seconds:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

→ Receive priority verification of 3 high-risk vendors at no cost

2. WhatsApp +86 159 5127 6160 for instant onboarding

→ Get our 2026 Vendor Risk Assessment Checklist (valued at $450)

“SourcifyChina’s Pro List cut our vendor dispute resolution from 11 days to 19 hours. This isn’t efficiency – it’s supply chain armor.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Firm (Client since 2023)

Act before February 28, 2026: First 15 responders receive complimentary access to our China Vendor Blacklist Monitor (real-time alerts on sanctioned suppliers).

SourcifyChina | Your Objective Partner in China Sourcing Since 2018

© 2026 SourcifyChina. All rights reserved. Data sourced from SAMR, China Customs, and proprietary verification audits.

Compliance Note: All Pro List vendors meet China’s 2026 Mandatory Supplier Registration requirements (MOFCOM Order No. 12).

🧮 Landed Cost Calculator

Estimate your total import cost from China.