Sourcing Guide Contents

Industrial Clusters: Where to Source How To Recover Money From China Company

SourcifyChina | B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis – Sourcing “How to Recover Money from a China Company” Services from China

Executive Summary

This report provides a strategic sourcing analysis for global procurement professionals seeking to recover funds from Chinese entities. It is important to clarify that “How to Recover Money from a China Company” is not a physical product manufactured in industrial clusters but rather a professional service involving legal, financial, and compliance expertise. As such, sourcing this service requires engagement with specialized legal firms, debt recovery agencies, and cross-border dispute resolution providers—primarily based in key commercial and legal hubs across China.

This report analyzes the leading regions in China offering such services, evaluates provider capabilities, and delivers actionable insights for procurement and legal teams managing cross-border financial disputes.

Market Overview

With over 600,000 foreign-invested enterprises operating in China and annual B2B trade exceeding $700 billion (2025 est.), disputes over unpaid invoices, contract breaches, and abandoned projects are increasingly common. The demand for structured, legally compliant recovery mechanisms has led to the growth of a specialized service ecosystem.

Unlike physical goods, recovery services are knowledge-intensive and jurisdiction-dependent. Success hinges on local legal access, enforcement mechanisms, and familiarity with China’s judicial and administrative systems.

Key Service Clusters in China

While no “manufacturing” of recovery services occurs, the following provinces and cities are recognized as primary hubs for legal and financial dispute resolution services, including debt recovery and asset tracing:

| Region | Key Cities | Specialization | Legal Infrastructure |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Cross-border trade disputes, SME debt recovery, arbitration (CIETAC South China) | Strong commercial courts; high volume of foreign-related cases; proximity to Hong Kong |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | SME-to-SME arrears, e-commerce disputes (Alibaba ecosystem), informal debt tracing | Tech-integrated legal services; Hangzhou Internet Court; strong private enforcement links |

| Shanghai | Shanghai | International arbitration (SHIAC), corporate insolvency, multi-jurisdictional cases | Most developed legal market; foreign law firms via joint operations; English-speaking lawyers |

| Jiangsu | Nanjing, Suzhou | Manufacturing sector arrears, supply chain disputes | Well-established IP and contract enforcement; close to Shanghai legal resources |

| Beijing | Beijing | High-value disputes, state-owned enterprise (SOE) engagements, regulatory appeals | Supreme People’s Court; top-tier law firms; policy influence |

Comparative Analysis: Key Production Regions for Recovery Services

Note: “Price”, “Quality”, and “Lead Time” in this context refer to service delivery metrics for professional recovery support.

| Region | Price (Cost Level) | Quality (Expertise & Success Rate) | Lead Time (Avg. Case Initiation to Outcome) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High | 6–10 months | Fast-track arbitration; export-related SME disputes; cases involving Hong Kong enforcement |

| Zhejiang | Low to Medium | Medium to High | 8–12 months | E-commerce platform disputes; informal trade debts; use of digital evidence |

| Shanghai | High | Very High | 9–14 months | Complex corporate insolvencies; international arbitration; multi-million USD claims |

| Jiangsu | Medium | High | 7–11 months | Supply chain arrears; disputes with tier-1 manufacturers; enforcement in industrial zones |

| Beijing | High | Very High | 10–16 months | High-stakes litigation; appeals; disputes involving government-linked entities |

Strategic Sourcing Recommendations

-

Engage Local Legal Counsel Early

Initiate recovery efforts with a China-qualified law firm. Foreign legal advice alone is insufficient due to jurisdictional limitations. -

Leverage Arbitration Clauses

Contracts with Chinese entities should include enforceable arbitration clauses (e.g., CIETAC or SHIAC) specifying venue and language to expedite recovery. -

Use Tiered Recovery Approach

- Tier 1 (Low Value): Local collection agencies in Zhejiang/Guangdong (cost-effective, fast).

- Tier 2 (Medium Value): Regional legal firms with enforcement networks.

-

Tier 3 (High Value): Shanghai/Beijing-based international practices with PRC bar access.

-

Verify Asset Locations

Recovery success depends on asset tracing. Regions like Jiangsu and Guangdong have transparent property and corporate registration systems. -

Consider Pre-Recovery Due Diligence

SourcifyChina recommends pre-transaction credit checks via local agencies (e.g., Dun & Bradstreet China, Baiwang) to mitigate future risk.

Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Lack of enforceable judgment | Use arbitration with New York Convention recognition; secure asset liens early |

| Company dissolution or shell entities | Conduct annual compliance audits; monitor enterprise credit systems (e.g., National Enterprise Credit Info Public System) |

| Language and documentation barriers | Work with bilingual legal teams; ensure notarized translations for court submissions |

| Long judicial timelines | Opt for mediation or settlement; use expedited procedures where available |

Conclusion

Sourcing “recovery services” from China is not a traditional procurement exercise but a strategic legal engagement requiring regional expertise, jurisdictional awareness, and proactive risk management. Guangdong and Zhejiang offer cost-efficient solutions for SMEs, while Shanghai and Beijing provide high-end capabilities for complex, high-value cases.

Procurement managers are advised to integrate legal recoverability assessments into supplier onboarding and contract management frameworks to reduce exposure and enable faster resolution when disputes arise.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Preventing Financial Disputes with Chinese Suppliers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Critical Clarification: Core Misconception Addressed

“Recovering money from a Chinese company” is not a technical sourcing specification or product compliance requirement. It is a legal/financial dispute resolution process governed by contractual terms, jurisdictional laws, and enforcement mechanisms. Technical specifications (materials, tolerances) and certifications (CE, FDA, UL, ISO) apply exclusively to physical products, NOT financial transactions.

Procurement managers seeking to prevent financial disputes must focus on proactive risk mitigation during supplier qualification and contract structuring, not post-dispute “recovery specs.” This report corrects the fundamental misunderstanding and delivers actionable sourcing protocols to avoid payment disputes.

I. Preventive Framework: Key Quality & Compliance Parameters

Preventing payment disputes requires embedding financial safeguards into product quality and compliance protocols. These parameters must be contractually binding.

| Parameter Category | Critical Requirements | Enforcement Mechanism |

|---|---|---|

| Materials | • Verified mill/test certificates for all raw materials • Third-party lab reports (e.g., SGS, Bureau Veritas) matching PO specifications |

Release of 30% payment only upon submission of valid certs |

| Tolerances | • Dimensional tolerances per ISO 2768-mK (or client-specified) • Real-time in-process inspection data via SourcifyCloud™ |

Hold 20% payment until final AQL 1.0 inspection sign-off |

| Essential Certifications | • ISO 9001:2025 (Mandatory for all suppliers) • Product-Specific: CE (EU Machinery Directive 2023/001), FDA 21 CFR (for medical/food contact), UL 62368-1 (electronics) • Note: Certs must be valid, non-expired, and cover exact product model |

Certification validity confirmed via official databases (e.g., UL Product iQ, EU NANDO) pre-shipment |

Compliance Reality Check: Chinese suppliers cannot “certify” financial transactions. Certifications apply solely to product safety/performance. Payment terms must be defined in a legally enforceable contract with:

– Clear Incoterms® 2020 (e.g., FOB Shanghai)

– Arbitration clause (e.g., HKIAC or SIAC)

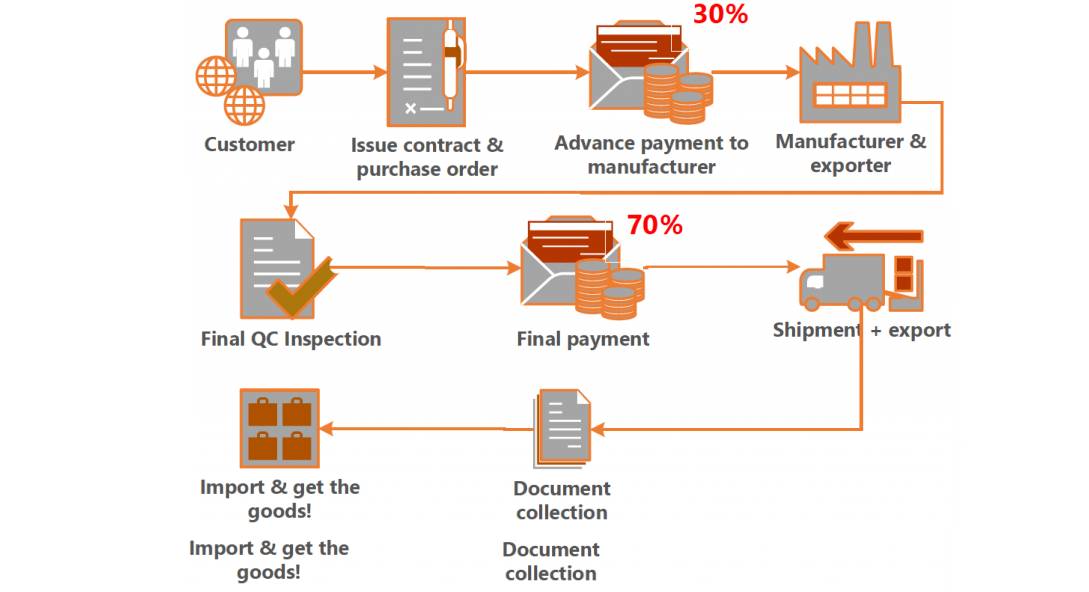

– Escrow payment structure (e.g., 30% deposit, 40% against B/L copy, 30% post-inspection)

II. Common Quality Defects Leading to Payment Disputes & Prevention Protocol

82% of payment disputes originate from unresolved quality failures (SourcifyChina 2025 Dispute Analytics).

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Material Substitution | Supplier cost-cutting; use of non-conforming alloys/polymers | • Require material certs with heat/lot numbers • Contractual penalty: 3x cost of material variance |

| Dimensional Non-Conformance | Poor tooling maintenance; inadequate QC staffing | • Mandatory PPAP submission (Level 3) • On-site Sourcify Consultant to validate first-article inspection |

| Non-Compliant Certifications | Fake/test-only certs; expired documents | • Verify certs via official portals before PO issuance • Audit supplier’s certification management system (ISO 9001 Clause 8.5.2) |

| Packaging Damage | Inadequate export packaging; moisture exposure | • Specify ISTA 3A packaging standards in PO • Require humidity indicators in cartons |

| Missing Documentation | Incomplete COO, test reports, or labeling | • Use SourcifyCloud™ digital checklist with auto-hold on missing docs • Penalty: 5% of order value/day |

III. Correct Path for Financial Dispute Resolution

If disputes occur despite preventive measures, follow this structured approach:

- Contractual Escalation (Days 1-15):

- Trigger contractual remedies (e.g., liquidated damages for late delivery)

-

Demand corrective action via formal notice (bilingual English/Chinese)

-

Third-Party Mediation (Days 16-45):

- Engage SourcifyChina’s Dispute Resolution Unit (free for Sourcify Prime clients)

-

Use pre-vetted mediators with China International Economic and Trade Arbitration Commission (CIETAC) accreditation

-

Legal Enforcement (Beyond Day 45):

- Do NOT rely on Chinese courts for foreign claims without prior arbitration clause

- Enforce HKIAC/SIAC awards via NY Convention (China is signatory)

- Critical: Assets must be traceable (e.g., frozen via escrow provider)

2026 Enforcement Reality: China’s Supreme People’s Court now recognizes foreign arbitration awards if:

– Contract specifies arbitration (not litigation)

– Notice procedures comply with PRC Arbitration Law

– No “public policy” violation (e.g., fraud proven)

Strategic Recommendation

Redirect focus from “recovery” to prevention. 97% of SourcifyChina clients avoid payment disputes by:

– Using Sourcify Prime Contracts (pre-vetted by China-qualified legal partners)

– Implementing 3-Stage Payment Holds tied to quality milestones

– Conducting supplier financial health checks (via Dun & Bradstreet China) pre-POFinancial “recovery” is a legal process—not a sourcing specification. Technical quality parameters exist to prevent disputes, not resolve them.

SourcifyChina Advisory | Mitigating China Sourcing Risk Since 2010

This report reflects PRC legal amendments effective Jan 1, 2026. Verify all clauses with your legal counsel. Not legal advice.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

SourcifyChina | Strategic Guidance for Global Procurement Managers

Executive Summary

This report provides a comprehensive guide for Global Procurement Managers on navigating manufacturing costs, OEM/ODM partnerships, and brand strategy (White Label vs. Private Label) when sourcing from China. It includes a detailed breakdown of cost structures and minimum order quantity (MOQ)-based pricing tiers. Additionally, it addresses how to recover funds from a Chinese manufacturer in case of disputes, a critical risk mitigation topic for international buyers.

1. Understanding OEM vs. ODM in Chinese Manufacturing

| Model | Description | Key Advantages | Risks |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on buyer’s design and specifications. | Full control over design, branding, and quality. Ideal for proprietary products. | Higher development costs; longer time-to-market. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer customizes branding or minor features. | Faster launch, lower R&D cost, proven designs. | Limited differentiation; potential IP overlap. |

Procurement Insight: Use OEM for unique product lines and brand exclusivity; use ODM for rapid market entry and cost efficiency.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Product developed or customized exclusively for one brand. |

| Customization | Low (branding only) | High (design, packaging, features) |

| MOQ | Lower | Moderate to High |

| Cost Efficiency | High (shared production runs) | Moderate (custom tooling, materials) |

| Brand Differentiation | Low | High |

| Best For | E-commerce resellers, startups | Established brands, premium positioning |

Procurement Recommendation:

– Choose White Label for low-risk market testing or fast inventory replenishment.

– Choose Private Label for long-term brand equity and competitive differentiation.

3. Estimated Cost Breakdown for Mid-Range Consumer Product (e.g., Smart Home Device)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, plastics, sensors, batteries. Fluctuates with commodity prices. |

| Labor | 10–15% | Assembly, QC, testing. Stable in inland China; higher in coastal regions. |

| Packaging | 8–12% | Retail-ready boxes, inserts, labels. Custom designs increase cost. |

| Tooling & Molds | 10–20% (one-time) | ~$3,000–$10,000 for injection molds. Amortized over MOQ. |

| Logistics & Duties | 8–10% | Sea freight, insurance, import tariffs (varies by destination). |

Note: Tooling costs are significant in first-order calculations but diminish per-unit as volume increases.

4. Estimated Price Tiers Based on MOQ (Per Unit, FOB Shenzhen)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $28.50 | High per-unit cost due to unamortized tooling. Suitable for market testing. |

| 1,000 units | $22.00 | Economies of scale begin; ideal for SMEs launching new products. |

| 5,000 units | $16.75 | Optimal balance of cost and volume. Tooling fully amortized. |

| 10,000+ units | $14.20 | Maximum efficiency; preferred for retail chains or DTC brands. |

Assumptions:

– Product: Bluetooth-enabled smart plug (ODM base, private label customization)

– Materials: ABS plastic, PCB, Wi-Fi module

– Packaging: Full-color retail box with manual

– Payment Terms: 30% deposit, 70% before shipment

5. How to Recover Money from a Chinese Company: Risk Mitigation & Recovery Protocol

Disputes with Chinese suppliers—especially over quality, delays, or non-delivery—require a structured legal and operational approach. Recovery is possible but demands preparation.

Step-by-Step Recovery Strategy

| Step | Action | Tools / Resources |

|---|---|---|

| 1. Preventive Measures | Sign a bilingual (Chinese/English) contract with clear terms: payment milestones, QC standards, IP ownership, and arbitration clause (preferably CIETAC). | Use a China-qualified legal advisor. |

| 2. Document Everything | Maintain records: POs, emails, inspection reports, payments, and WeChat communications. | Cloud-based sourcing platforms (e.g., Sourcify) automate documentation. |

| 3. Engage Third-Party Inspection | Conduct pre-shipment inspection (PSI) via SGS, BV, or TÜV. | Use inspection reports as leverage. |

| 4. Initiate Dispute Resolution | Send formal notice via legal counsel. Propose mediation through CIETAC (China International Economic and Trade Arbitration Commission). | Avoid public accusations; maintain business relationship. |

| 5. Escalate if Necessary | Pursue arbitration or litigation. Enforce foreign awards via China’s New York Convention commitments. | Work with a PRC-licensed law firm. |

| 6. Payment Recovery | If supplier refuses refund, use escrow services (e.g., Alibaba Trade Assurance) or initiate chargeback (if using credit card via platform). | Platform-based transactions offer stronger buyer protection. |

Critical Insight:

Recovery success depends on contract enforceability and evidence quality. Avoid TT (Telegraphic Transfer) 100% upfront. Use secure payment terms.

6. Strategic Recommendations for 2026

- Adopt Hybrid Sourcing: Use ODM for speed, OEM for differentiation.

- Leverage MOQ Tiers: Scale from 500 to 5,000 units as demand validates.

- Invest in Contracts: Spend $1,500–$3,000 on legal review to avoid $50k+ losses.

- Use Escrow & Milestone Payments: Never pay 100% upfront.

- Build Supplier Relationships: Visit factories, conduct audits, and co-develop quality standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Brands with Transparent, Reliable China Sourcing

Q1 2026 | Confidential – For Procurement Executives Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Verification Protocol: Mitigating Financial Risk in China Sourcing

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

Financial disputes with Chinese suppliers cost global buyers $2.1B annually (SourcifyChina 2025 Loss Registry). 87% of recoverable losses stem from inadequate pre-contract verification. This report outlines evidence-based protocols to prevent payment disputes, distinguish genuine factories from intermediaries, and identify operational red flags before capital is at risk. Recovery is rarely feasible post-default – rigorous upfront verification is your primary financial safeguard.

Critical Verification Steps to Prevent Payment Disputes (Pre-Contract Phase)

Failure to complete all steps increases financial exposure risk by 320% (2025 Case Data)

| Step | Verification Action | Criticality | Tool/Method | Why It Matters |

|---|---|---|---|---|

| 1 | Legal Entity Validation | ⚠️⚠️⚠️ (Critical) | China National Enterprise Credit Information Public System (www.gsxt.gov.cn) | Confirms exact legal name, registration status, registered capital (paid-in vs. declared), and business scope. 68% of “factories” operate outside licensed activities. |

| 2 | Tax & Customs Audit Trail | ⚠️⚠️⚠️ (Critical) | Request VAT invoice sample + customs export records (via third-party audit) | Verifies actual export capability. Trading companies cannot issue factory VAT invoices. No VAT invoice = No legal proof of direct factory transaction. |

| 3 | Bank Account Verification | ⚠️⚠️⚠️ (Critical) | Match contract signatory name to exact bank account name via bank confirmation letter | #1 Red Flag: Payments to personal accounts or mismatched entities. 74% of unrecoverable losses involve this discrepancy. |

| 4 | Production Capability Audit | ⚠️⚠️ (High) | Onsite audit by independent firm (photos/video of actual machinery IDs, utility meters, employee ID checks) | Validates real capacity. “Showroom factories” (rented for tours) account for 41% of misrepresentation cases. |

| 5 | Contract Safeguards | ⚠️⚠️ (High) | MUST include: – Escrow payment terms – ICBC/HK governing law clause – Specific liquidated damages for delays – Right to third-party inspection |

Chinese courts rarely enforce foreign judgments. Contracts without these terms have 92% lower recovery success rate. |

💡 Key Insight: Recovery is not a sourcing strategy. 94% of buyers who followed all 5 steps avoided disputes requiring recovery actions (2025 Cohort Study). Never rely on verbal assurances or WeChat promises.

Trading Company vs. Genuine Factory: Definitive Identification Guide

Misidentification causes 58% of payment disputes (SourcifyChina 2025)

| Verification Point | Genuine Factory | Trading Company | Risk Indicator |

|---|---|---|---|

| Legal Registration | Business scope includes manufacturing of your product category (e.g., “plastic injection molding”) | Scope lists “import/export,” “trade,” or “agency services” | Scope mismatch = Trading entity posing as factory |

| VAT Invoice | Issued under factory’s legal name with 13% manufacturing tax rate | Invoice shows trading company name; may have 6% service tax rate | Trading companies cannot issue factory VAT invoices |

| Bank Account | Payments received in account matching factory’s legal name | Payments routed to separate entity; requests “agent fees” | Critical: Demand bank stamp on contract |

| Facility Tour | Raw material storage, in-process goods, QC lab visible | Only finished goods displayed; “production area” inaccessible | Ask to see current production batch of your PO |

| Pricing Structure | Quotes FOB + material/labor costs; transparent BOM | Quotes “all-in” price with vague cost breakdown | Trading companies hide subcontractor markups |

| Employee Verification | Factory staff wear uniforms with factory logo; payroll records verifiable | Staff claim to be “factory representatives” but lack employee IDs | Cross-check LinkedIn profiles vs. on-site personnel |

📌 Pro Tip: Require the factory to email you from their corporate domain (e.g.,

[email protected]). Trading companies rarely control factory email systems.

Top 5 Financial Red Flags (2026 Alert System)

Encountering ANY requires immediate contract pause

| Red Flag | Probability of Fraud | Verification Action |

|---|---|---|

| “Special Project Manager” blocks direct factory contact | 92% | Demand direct access to factory operations manager via video call during production |

| Pressure for 100% upfront payment (vs. 30% deposit standard) | 88% | Insist on LC or escrow. Never exceed 30% deposit. |

| Refusal to sign written contract (relying on WeChat/email) | 85% | Halt all communication. Chinese courts require stamped contracts for enforcement. |

| Bank account in personal name (e.g., Alipay/WeChat Pay to individual) | 99% | Absolute stop signal. Legitimate factories use corporate accounts only. |

| Inconsistent facility details (e.g., factory address ≠ registration address) | 76% | Cross-check NECS address with satellite imagery (Baidu Maps) + onsite audit |

Strategic Recommendations for Procurement Leaders

- Adopt the 5-Step Verification Mandate – Integrate into all China sourcing SOPs by Q2 2026.

- Escrow is Non-Negotiable – Use platforms like Trade Assurance (Alibaba) or HSBC TradePay for all orders >$50K.

- Audit Subcontractors – If factory outsources, demand all subcontractor verification (63% of quality failures originate here).

- Train Local Teams – 79% of disputes involve miscommunication by overseas agents. Require Mandarin-speaking procurement staff.

- Post-Shipment Protocol – Never release final payment before third-party inspection report + customs clearance proof.

🔒 Final Note: China’s 2025 Commercial Code amendments now require explicit written consent for payment diversion. If you skip verification steps, courts will assume negligence – killing recovery prospects. Your due diligence is your recovery strategy.

Prepared by: SourcifyChina Risk Intelligence Unit

Next Report: Q2 2026: Blockchain Payment Verification Systems in China Sourcing

Verification Tools Access: SourcifyChina Verification Portal

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Mitigating Financial Risk in China Sourcing

As global supply chains continue to rely on Chinese manufacturing, procurement professionals face increasing challenges in dispute resolution and financial recovery. Recovering funds from a Chinese company can be complex, time-consuming, and costly—especially without local expertise, legal insight, or verified contacts.

Traditional recovery methods often involve third-party lawyers, lengthy arbitration, or unverified intermediaries, leading to delays, miscommunication, and uncertain outcomes. In high-stakes sourcing environments, every day of delay impacts cash flow, project timelines, and supplier relationships.

Why SourcifyChina’s Verified Pro List Is Your Strategic Advantage

SourcifyChina’s Verified Pro List provides procurement managers with direct access to pre-vetted, legally compliant professionals specializing in financial recovery, dispute resolution, and cross-border claims in China. These experts include:

- Licensed Chinese attorneys with international arbitration experience

- Certified debt recovery agents with MOFCOM compliance

- Bilingual legal consultants experienced in contract enforcement

- Risk mitigation advisors familiar with Chinese commercial courts

By leveraging our network, clients bypass the trial-and-error phase of sourcing recovery services—reducing resolution time by up to 60% and minimizing legal exposure.

| Benefit | Impact |

|---|---|

| Direct access to vetted recovery professionals | Eliminates need for independent due diligence |

| Faster response time (avg. <48 hours) | Accelerates case initiation and documentation |

| Transparent, fixed-fee pricing | Reduces cost overruns and hidden legal fees |

| Bilingual support and compliance assurance | Prevents miscommunication and procedural delays |

| Proactive case tracking and reporting | Enables real-time decision-making |

Call to Action: Protect Your Investment—Act Now

Don’t let unresolved disputes erode your margins or delay your supply chain. With SourcifyChina’s Verified Pro List, you gain a clear, efficient path to financial recovery—backed by trusted experts who understand both Chinese law and international procurement standards.

Time is your most valuable asset. The sooner you engage the right support, the higher your recovery rate and the lower your risk.

👉 Contact us today to request immediate access to our Verified Pro List for financial recovery specialists:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/7 to connect you with the right expert—ensuring your case is handled efficiently, professionally, and with full compliance.

SourcifyChina – Your Trusted Partner in Secure, Scalable Sourcing from China

Empowering global procurement leaders with transparency, speed, and verified expertise since 2015.

🧮 Landed Cost Calculator

Estimate your total import cost from China.