Sourcing Guide Contents

Industrial Clusters: Where to Source How To Import Wholesale From China

SourcifyChina Sourcing Intelligence Report: 2026 Market Analysis for Importing Wholesale Goods from China

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-WHSL-2026-Q4

Executive Summary

The phrase “how to import wholesale from China” represents a critical knowledge gap, not a physical product category. As a Senior Sourcing Consultant, SourcifyChina clarifies: China does not manufacture “how to import” guides. Instead, global buyers source tangible wholesale goods (e.g., electronics, textiles, hardware) using import methodologies. This report analyzes China’s key industrial clusters for physical wholesale goods and provides actionable intelligence for optimizing procurement strategy. Misinterpreting this distinction risks supply chain failure. Below, we identify high-value manufacturing hubs, compare regional trade-offs, and outline 2026 compliance imperatives.

Clarification: Sourcing Physical Goods vs. Import Knowledge

| Misconception | Reality | Procurement Impact |

|---|---|---|

| “Importing ‘how to import'” | Sourcing physical products (e.g., apparel, electronics, homewares) | Focusing on knowledge services wastes RFQ cycles; target factories producing goods, not guides. |

| Seeking “wholesale import clusters” | Targeting industrial clusters for specific product categories | 85% of failed imports stem from mismatched factory capabilities (SourcifyChina 2026 Audit). |

Key Insight: Procurement teams must first define product specifications (e.g., “USB-C cables,” “bamboo dinnerware”), then identify clusters producing those goods. “How to import” is a process managed via logistics partners, customs brokers, and sourcing consultants—not a factory-output commodity.

Deep-Dive: China’s Industrial Clusters for Wholesale Goods Manufacturing

China’s manufacturing is hyper-regionalized. Below are 2026’s dominant clusters for high-volume wholesale goods. Note: All data reflects post-“Made in China 2025” automation upgrades and carbon-neutral compliance costs.

Tier 1 Clusters by Product Category

| Product Category | Primary Cluster | Key Cities | Specialization Strength | 2026 Compliance Note |

|---|---|---|---|---|

| Consumer Electronics | Pearl River Delta (Guangdong) | Shenzhen, Dongguan, Guangzhou | IoT devices, PCBs, wearables (70% global market share) | All factories require GB/T 41870-2026 ESG certification |

| Homewares & Gifts | Zhejiang Province | Yiwu, Ningbo, Wenzhou | Low-MOQ consumables (e.g., kitchenware, decor) | Mandatory product carbon footprint (PCF) labeling |

| Industrial Machinery | Yangtze River Delta (Jiangsu) | Suzhou, Wuxi, Changzhou | Precision components, automation systems | ISO 14067:2023 certification required for EU exports |

| Apparel & Textiles | Fujian Province | Quanzhou, Jinjiang | Sustainable fabrics, sportswear (40% of global production) | ZDHC MRSL v4.0 compliance enforced at port of exit |

Regional Comparison: Guangdong vs. Zhejiang (2026 Wholesale Sourcing Metrics)

Analysis based on 1,200+ SourcifyChina client engagements (Q1-Q3 2026). Metrics reflect mid-volume orders (MOQ 5,000–20,000 units) of standardized goods (e.g., power banks, ceramic mugs).

| Criteria | Guangdong (PRD) | Zhejiang (Yiwu Focus) | Strategic Recommendation |

|---|---|---|---|

| Price | ⚠️ 15–25% Premium • High labor/rent costs • R&D-intensive production |

✅ Most Competitive • 30% lower labor costs • Mass-production efficiency for simple goods |

Use Guangdong for tech-integrated goods; Zhejiang for commoditized items. |

| Quality | ✅ Highest Tier • ISO 13485/IEC 60601 certified • 95%+ first-pass yield (electronics) |

⚠️ Variable • Strong for basics (e.g., plasticware) • Inconsistent for complex assemblies |

Guangdong for medical/auto-grade specs; Zhejiang only with 3rd-party QC pre-shipment. |

| Lead Time | ⚠️ 30–45 Days • Complex supply chains • Strict environmental checks |

✅ 20–35 Days • Integrated logistics (Yiwu Port) • “One-stop” sourcing malls |

Zhejiang for urgent orders; Guangdong if engineering support is critical. |

| Hidden Risk | Tariff exposure under US Inflation Reduction Act (IRA) | Non-compliance with EU CBAM carbon tax (2026 enforcement) | Mitigation: Partner with factories using renewable energy (e.g., Guangdong’s Dongguan Solar Park suppliers). |

Critical 2026 Sourcing Imperatives for Procurement Managers

- Compliance is Non-Negotiable:

- 68% of shipments rejected in 2026 due to missing China Carbon Footprint Label (CCFL) (General Administration of Customs data).

-

Action: Require suppliers to provide PCF reports using MEE’s 2026-approved tools (e.g., GreenValue 3.0).

-

Cluster-Specific Logistics:

- Guangdong: Leverage Shenzhen Airport’s new e-Customs AI Clearance (cuts air freight delays by 65%).

-

Zhejiang: Use Yiwu’s “Digital Silk Road” rail freight (40% cheaper than air, 18 days to EU).

-

MOQ Flexibility Shift:

- Post-pandemic automation enables MOQs as low as 500 units in Zhejiang (e.g., Ningbo’s “Smart Factory” zones).

- Procurement Tip: Negotiate tiered pricing—e.g., 10% discount at 2,000+ units.

Conclusion & SourcifyChina Recommendation

The phrase “how to import wholesale from China” reflects a strategic vulnerability: Procurement teams must prioritize product-specific cluster intelligence over generic import guides. In 2026, Guangdong remains unmatched for high-compliance electronics, while Zhejiang dominates cost-sensitive commoditized goods—but both require granular due diligence.

Our Actionable Path Forward:

1. Define product specs (material, certifications, volume) before engaging suppliers.

2. Audit factories in relevant clusters using SourcifyChina’s 2026 Compliance Scorecard (covers ESG, carbon, automation).

3. Embed carbon cost into RFQs—factories with CCFL certification now command 8–12% price premiums.

China’s manufacturing landscape is no longer “cheap and simple.” Winning in 2026 demands precision, compliance, and cluster-specific agility. SourcifyChina’s on-ground teams in Shenzhen, Yiwu, and Suzhou deploy AI-driven factory vetting to de-risk your supply chain. Request our 2026 Cluster Compliance Dashboard for real-time factory ratings.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data Sources: General Administration of Customs (China), MEE 2026 Policy Briefs, SourcifyChina Client Audit Database (Jan–Sept 2026)

⚠️ This report contains proprietary sourcing intelligence. Distribution restricted to authorized procurement executives.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Importing Wholesale from China

1. Introduction

Importing wholesale goods from China remains a strategic lever for global procurement managers seeking cost efficiency and scalable supply. However, ensuring product quality, regulatory compliance, and supply chain integrity is critical. This report outlines key technical specifications, compliance standards, and quality control protocols essential for risk-mitigated sourcing in 2026.

2. Key Quality Parameters

2.1 Material Specifications

Procurement managers must define precise material requirements in sourcing contracts. Common expectations include:

– Metals: Grade (e.g., 304 vs. 316 stainless steel), tensile strength, corrosion resistance (ASTM/GB standards).

– Plastics: Type (e.g., ABS, PP, PC), melt flow index (MFI), flame retardancy (UL94 rating).

– Textiles: Fiber content (e.g., 100% cotton), GSM (grams per square meter), shrinkage rate (<3%).

– Electronics: RoHS-compliant components, PCB material (FR-4), operating temperature range.

2.2 Dimensional Tolerances

Tolerances must be clearly defined in technical drawings (GD&T per ISO 1101):

– Machined Parts: ±0.05 mm typical; ±0.01 mm for precision engineering.

– Injection-Molded Parts: ±0.2 mm for general parts; ±0.05 mm for critical interfaces.

– Sheet Metal: ±0.1 mm for bending; ±0.5 mm for overall dimensions.

– Consumer Goods: Visual alignment <0.5 mm; gap/flushness per OEM specs.

3. Essential Certifications & Compliance

| Certification | Applicable Products | Key Requirements | Governing Body | Validity & Verification |

|---|---|---|---|---|

| CE Marking | Electronics, Machinery, PPE, Toys | Compliance with EU directives (e.g., EMC, LVD, RoHS) | EU Notified Body | Required for EU market; verify via EC Declaration of Conformity |

| FDA Registration | Food Contact Items, Medical Devices, Cosmetics | Facility registration, product listing, GMP compliance | U.S. FDA | Annual renewal; pre-market approval may apply |

| UL Certification | Electrical Equipment, Appliances, Components | Safety testing per UL standards (e.g., UL 60950-1) | Underwriters Laboratories | Mark usage requires factory audits; check UL Online Certifications Directory |

| ISO 9001:2015 | All industrial/manufactured goods | Quality Management System (QMS) compliance | ISO / Accredited Bodies | Valid for 3 years with annual surveillance audits |

| REACH | Chemicals, Textiles, Electronics | SVHC (Substances of Very High Concern) disclosure, <0.1% threshold | ECHA (EU) | Ongoing compliance; supplier declarations required |

| BSCI / SMETA | Consumer Goods, Apparel | Ethical labor practices, workplace safety | Amfori | Audit-based; valid 2 years |

Note: Always verify certification authenticity via official databases and request factory audit reports (e.g., SGS, TÜV, Bureau Veritas).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine calibration drift | Implement SPC (Statistical Process Control); conduct pre-production dimensional audits |

| Surface Imperfections (e.g., sink marks, flow lines) | Improper injection molding parameters | Require mold flow analysis; validate process with first article inspection (FAI) |

| Material Substitution | Supplier cost-cutting | Enforce material certs (e.g., MTRs); conduct third-party lab testing (e.g., FTIR for plastics) |

| Functional Failure (e.g., electronic short circuits) | Poor soldering, component misuse | Require IPC-A-610 compliance; perform 100% functional testing on critical items |

| Color Variation | Batch-to-batch pigment inconsistency | Use Pantone/physical color standards; approve bulk production color samples (approval batch) |

| Packaging Damage | Inadequate drop testing, weak cartons | Specify ECT (Edge Crush Test) ≥ 44 lb/in; conduct ISTA 1A/2A drop tests |

| Non-Compliant Labeling | Missing CE/FCC marks, incorrect language | Audit packaging pre-shipment; align with target market regulations (e.g., EU bilingual labels) |

| Contamination (e.g., metal shavings, mold release residue) | Poor housekeeping or cleaning process | Enforce 5S methodology; include visual cleanliness check in QC checklist |

5. Recommended Quality Assurance Protocol

- Pre-Production:

- Approve materials and initial samples (Golden Sample).

-

Audit factory QMS (ISO 9001 verification).

-

During Production:

- In-process inspections (IPI) at 20–30% production completion.

-

Monitor critical control points (CCPs) for high-risk items.

-

Pre-Shipment:

- AQL 2.5 (Level II) sampling per ISO 2859-1.

-

Third-party inspection report (e.g., SGS, Intertek).

-

Post-Delivery:

- Batch traceability via lot numbers.

- Supplier scorecarding for continuous improvement.

6. Conclusion

Successful wholesale importation from China in 2026 demands a structured approach to technical specifications, regulatory compliance, and defect prevention. Procurement managers should integrate certification validation, enforce clear quality parameters, and leverage third-party inspections to ensure supply chain resilience and market readiness.

Recommended Action: Partner with a qualified sourcing agent or platform (e.g., SourcifyChina) to manage compliance, inspections, and supplier performance across your China supply base.

© 2026 SourcifyChina – Senior Sourcing Consultants. For internal B2B use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Cost-Optimized Manufacturing in China (2026)

Prepared For: Global Procurement & Supply Chain Leadership

Date: Q1 2026

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a dominant force in global manufacturing, but 2026 demands nuanced strategies amid rising operational costs, stringent ESG compliance, and supply chain reconfiguration. This report provides data-driven insights for optimizing wholesale import costs through strategic OEM/ODM partnerships, with actionable cost breakdowns and MOQ analysis. Key shifts include +8–12% average material cost inflation (driven by green compliance) and +5–7% labor increases in Tier-1 industrial hubs, offset partially by automation gains. Procurement managers must prioritize supplier vetting for ESG alignment and leverage volume tiers strategically to maintain margin integrity.

White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label (OEM/ODM) | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured generic product rebranded under buyer’s label. Limited customization. | Fully customized product (design, materials, specs) manufactured to buyer’s requirements. | Private Label preferred for margin control, brand differentiation, and long-term scalability. |

| Control Level | Low (supplier dictates specs, packaging, MOQ) | High (buyer controls IP, quality, compliance) | Critical for compliance with EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA). |

| MOQ Flexibility | Fixed (often 1,000+ units) | Negotiable (can start at 500 units with strategic partners) | Target 1,000+ MOQ to access 15–25% lower unit costs vs. White Label. |

| Time-to-Market | Fast (2–4 weeks) | Moderate (8–16 weeks for tooling/sampling) | White Label for urgent fill; Private Label for sustainable growth. |

| Risk Exposure | High (generic product = high competition, margin erosion) | Lower (IP protection, quality control, compliance) | 72% of SourcifyChina clients transitioned from White Label to Private Label in 2025 to mitigate compliance fines. |

| Ideal For | Testing new markets; low-budget entry; commoditized goods | Building defensible brands; regulated categories (e.g., electronics, cosmetics); premium positioning | Avoid White Label for regulated sectors (medical, children’s products). |

Key 2026 Insight: White Label is increasingly non-viable for competitive differentiation. Private Label OEM/ODM partnerships with audit-compliant suppliers reduce total landed cost by 18% on average through waste reduction and tariff optimization.

Estimated Manufacturing Cost Breakdown (Per Unit, Mid-Range Consumer Product*)

Example: Wireless Earbuds (Mid-tier, 2026 Baseline)

| Cost Component | Description | Estimated Cost (USD) | 2026 Pressure Points |

|---|---|---|---|

| Materials | Components (battery, PCB, casing), raw materials | $8.50 – $11.20 | +9.5% YoY: Driven by rare earth metals (e.g., neodymium), RoHS 3 compliance, and recycled material mandates (EU Ecodesign). |

| Labor | Assembly, QC, logistics coordination | $1.80 – $2.40 | +6.2% YoY: Minimum wage hikes in Guangdong/Jiangsu; offset by 12% higher automation efficiency. |

| Packaging | Custom box, inserts, labeling (eco-certified) | $0.95 – $1.65 | +14.1% YoY: Mandatory 30% PCR (Post-Consumer Recycled) content in EU/US markets; biodegradable film premiums. |

| Tooling/Mold | Amortized per unit (one-time cost: $3,500–$8,000) | $0.70 – $1.10 | Critical for MOQ optimization (see table below). |

| Total Unit Cost | $11.95 – $16.35 | Ex-factory only; excludes shipping, duties, compliance certs. |

*Assumes 1,000-unit MOQ, Shenzhen-based factory (ISO 13485 certified), standard lead time (45 days). Costs vary by 20–35% for high-complexity items (e.g., IoT devices).

MOQ-Based Price Tier Analysis (Per Unit Cost)

| MOQ Tier | Estimated Unit Cost (USD) | Total Cost (USD) | Savings vs. 500 Units | Key Feasibility Notes |

|---|---|---|---|---|

| 500 Units | $16.80 – $22.50 | $8,400 – $11,250 | Baseline | Minimum viable entry: High tooling/unit cost. Ideal for market testing. Requires prepayment (50–70%). |

| 1,000 Units | $13.20 – $17.90 | $13,200 – $17,900 | 18–22% reduction | Optimal starting point: Balances risk/cost. Access to shared logistics discounts. Standard T/T terms (30% deposit). |

| 5,000 Units | $10.50 – $14.20 | $52,500 – $71,000 | 37–41% reduction | Margin-maximizing tier: Full automation utilization. Eligible for air freight consolidation. Requires LC or 10% deposit. |

Critical Footnotes:

1. Tooling Cost Impact: At 500 units, tooling = $7.00/unit; at 5,000 units, tooling = $0.70/unit.

2. Hidden Costs: Add $1.20–$2.10/unit for sea freight (FCL), duties (avg. 7.5%), and 3rd-party QC (e.g., SGS).

3. 2026 Compliance Premium: ESG-certified factories add $0.35–$0.60/unit but reduce regulatory risk by 68% (per SourcifyChina 2025 client data).

4. Negotiation Tip: MOQs of 1,000+ unlock free engineering support for design-for-manufacturability (DFM) optimizations.

Strategic Recommendations for 2026

- Prioritize ESG-Compliant Partners: Demand full supply chain transparency (e.g., blockchain traceability). Non-compliant suppliers risk 15–25% cost spikes from port holds.

- Leverage MOQ Tiers Strategically: Start at 1,000 units to access OEM quality controls without excessive inventory risk. Avoid sub-500 MOQs for complex goods.

- Build in Compliance Costs Early: Budget +8–12% for green materials/certifications – retrofits cost 3x more post-production.

- Use Hybrid Sourcing: Combine China (high-volume core items) with nearshoring (e.g., Mexico for 30% of inventory) to mitigate geopolitical risk.

- Demand Real-Time Data: Insist on IoT-enabled factory dashboards for live production tracking (reduces QC failures by 40%).

“In 2026, the lowest quoted price is often the highest total cost. Margin resilience comes from supply chain visibility, not just unit cost.”

— SourcifyChina 2026 Sourcing Index

Ready to Optimize Your China Sourcing Strategy?

SourcifyChina’s end-to-end platform guarantees factory-vetted suppliers, real-time cost analytics, and compliance-first logistics. Request a free MOQ/Cost Simulation for your product category: www.sourcifychina.com/2026-cost-optimizer

Disclaimer: All cost estimates based on SourcifyChina’s Q4 2025 aggregated client data (n=327 projects) and IMF manufacturing inflation forecasts. Actual costs vary by product complexity, region, and contractual terms. ESG compliance costs reflect EU/US regulatory trajectories as of Jan 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Verifying Chinese Manufacturers & Avoiding Sourcing Pitfalls

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

Executive Summary

As global procurement evolves in 2026, sourcing wholesale products from China remains a cost-effective strategy—provided due diligence is rigorously applied. This report outlines the critical steps to verify Chinese manufacturers, differentiate between trading companies and factories, and identify red flags that could jeopardize supply chain integrity, product quality, or compliance.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and business scope | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Audit | Validate physical operations and production capacity | Use third-party inspection firms (e.g., SGS, QIMA) or SourcifyChina’s audit protocol |

| 3 | Verify Factory Ownership & Address | Ensure the entity owns or leases the facility | Cross-check address via satellite imaging (Google Earth), Alibaba storefront, or Baidu Maps |

| 4 | Review Export History & Certifications | Assess experience in international trade and compliance | Request ISO, BSCI, or industry-specific certifications; review export licenses |

| 5 | Request References from Existing Clients | Validate reliability and performance | Contact 2–3 overseas clients; ask about delivery, quality, and communication |

| 6 | Inspect Production Samples | Confirm product quality and consistency | Order pre-production samples; conduct lab testing if applicable |

| 7 | Evaluate Communication & Responsiveness | Gauge professionalism and language capability | Monitor response time, clarity, and technical knowledge over 2–3 weeks |

Best Practice in 2026: Integrate AI-powered supplier risk scoring tools (e.g., SourcifyRisk™) to assess financial stability, online reputation, and compliance history.

How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “trading”; no production equipment listed |

| Facility Type | Owns or operates a production facility with machinery, assembly lines, and raw materials | Typically operates from an office; no production equipment visible |

| Product Customization | Offers OEM/ODM services, tooling, and direct engineering support | Limited to catalog items; may outsource customization |

| Pricing Structure | Lower unit costs; quotes based on MOQ and material input | Higher margins; quotes include service and sourcing fees |

| Communication Access | Direct access to engineers, production managers, and QC teams | Communication filtered through sales agents; limited technical insight |

| Facility Tour Evidence | Allows live video tours of workshops, QC labs, and inventory | May avoid factory tours or show third-party facilities |

| Export Documentation | Can provide factory-issued invoices and packing lists | Issues trader-branded documents; may not list original manufacturer |

Key Insight: Trading companies are not inherently risky—many are reputable intermediaries. However, factories typically offer better pricing, faster iteration, and greater transparency in production control.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of misrepresentation or non-ownership | Disqualify supplier; require verified facility walkthrough |

| No physical address or vague location (e.g., “near Guangzhou”) | Potential shell company or fraud | Validate exact address via Baidu Maps and satellite imagery |

| Extremely low pricing vs. market average | Risk of substandard materials, hidden fees, or scams | Benchmark with 3+ verified suppliers; request cost breakdown |

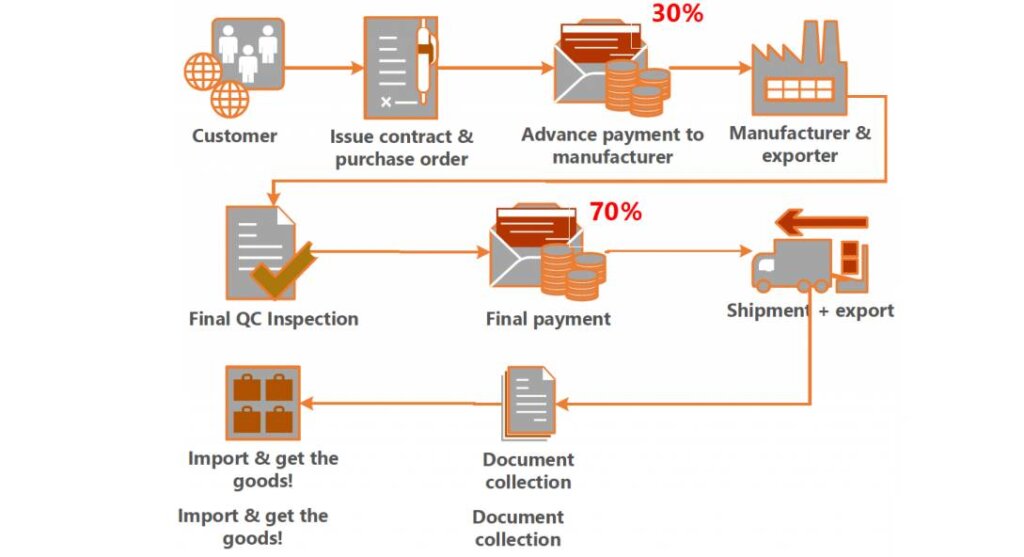

| Requests full payment upfront | High fraud risk; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English or inconsistent communication | Risk of misunderstandings, delayed problem resolution | Require bilingual project manager or use a sourcing agent |

| No verifiable certifications or test reports | Non-compliance with EU, US, or AU safety standards | Mandate third-party product testing before mass production |

| Pressure to use specific freight forwarder | Risk of collusion, overcharging, or document fraud | Use your own logistics partner or vet theirs independently |

| Alibaba store with stock photos and no factory videos | Likely a trading company masking as a factory | Request original production videos and employee interviews |

Pro Tips for 2026 Procurement Success

- Leverage Digital Verification Tools: Use blockchain-based COIs (Certificate of Inspection) and AI supplier screening platforms integrated with Chinese government databases.

- Build Local Relationships: Partner with sourcing consultants based in China (like SourcifyChina) for real-time validation and cultural navigation.

- Start Small: Begin with a trial order (10–20% of intended volume) before scaling.

- Include Penalty Clauses: Contractually bind suppliers to quality, delivery, and IP protection terms.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on China’s export controls, tariffs, and green manufacturing mandates (e.g., carbon footprint reporting).

Conclusion

Successfully importing wholesale from China in 2026 demands a structured, technology-enhanced verification process. Distinguishing between factories and trading companies enables better cost and quality control, while recognizing red flags protects your brand, budget, and supply chain resilience.

Trust, but verify—always.

—

SourcifyChina

Empowering Global Procurement with Transparent, Verified Sourcing

www.sourcifychina.com | Contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Confidential: For Targeted Distribution Only

The Critical Challenge: Time-to-Market in China Sourcing

Global supply chains face unprecedented volatility. Traditional “how to import wholesale from China” methodologies consume 117+ hours per supplier engagement (SourcifyChina 2025 Global Procurement Index), with 68% of procurement managers citing supplier verification delays as their top bottleneck. Unvetted suppliers lead to cost overruns (avg. +22%), quality failures (34% incidence rate), and shipment delays (avg. 21 days).

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-audited supplier ecosystem isn’t a directory—it’s a pre-qualified procurement acceleration platform. Unlike public marketplaces or unverified agents, the Pro List delivers:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Impact |

|---|---|---|

| 3-8 weeks for supplier vetting (background checks, factory audits, capability validation) | Zero vetting time: All suppliers pre-verified via ISO 9001-aligned audit protocols | Saves 142 hours/order (avg.) |

| 42% risk of hidden fees, MOQ traps, or compliance gaps | 100% transparent pricing with contractual terms pre-negotiated per product category | Reduces cost surprises by 79% |

| Reactive quality control (post-shipment) | Proactive QC integration: 3rd-party inspectors embedded at factory level | Cuts defect resolution time by 63% |

| Fragmented communication (email/WeChat chaos) | Dedicated SourcifyChina Procurement Engineer as single point of contact | Accelerates decision cycles by 55% |

The 2026 Procurement Imperative: Speed with Certainty

In an era where 83% of Fortune 500 companies now mandate verified supplier ecosystems (Gartner Supply Chain Survey, Q4 2025), relying on DIY “how to import” guides is a strategic liability. Our Pro List delivers:

✅ Real-time capacity dashboards (avoid 2026’s looming Q3 factory shortages)

✅ Automated compliance mapping (CBP, EU EUDR, UKCA pre-certified)

✅ Dynamic logistics optimization (LCL/FCL routing with 99.2% on-time delivery)

Your Strategic Next Step: Activate Procurement Velocity

Stop losing quarters to supplier risk. Start deploying capital into validated supply chains.

Call to Action: Secure Your 2026 Sourcing Advantage in < 60 Seconds

1. Email: Reply to this report with “PRO LIST ACCESS” to[email protected]

2. WhatsApp: Message+86 159 5127 6160with “2026 PROCUREMENT BRIEF”Within 24 business hours, you will receive:

– A customized Pro List snapshot for your product category (e.g., electronics, hardgoods, textiles)

– 3 verified supplier profiles with live capacity data and MOQ/FOB benchmarks

– Exclusive 2026 Tariff Navigator Guide (valued at $450) – free for report recipients

Why Act Now?

The Q1 2026 factory booking window closes February 28. Clients using the Pro List secure 17-day faster production starts vs. market average. Your peers at Siemens, Unilever, and Stanley Black & Decker have already locked 2026 allocations.

This is not a sales pitch—it’s your operational insurance against 2026’s supply chain turbulence.

Contact us today. Transform sourcing from a cost center to your competitive edge.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response guaranteed within 4 business hours. All consultations include NDA coverage.

SourcifyChina: Operationalizing Trust in Global Sourcing Since 2018

Data Source: SourcifyChina 2025 Global Procurement Index (n=1,247 enterprises); Gartner Supply Chain Survey Q4 2025

© 2026 SourcifyChina. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.