Sourcing Guide Contents

Industrial Clusters: Where to Source How To Find Wholesalers In China

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Guide: How to Find Wholesalers in China – A 2026 Market Analysis

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

China remains the world’s leading manufacturing hub, offering unparalleled access to wholesale supply chains across a broad spectrum of industries. For global procurement managers, understanding how to identify and engage with reliable Chinese wholesalers is critical to maintaining cost efficiency, product quality, and supply chain resilience.

This report provides a strategic deep-dive into China’s wholesale sourcing ecosystem, focusing on key industrial clusters, regional strengths, and actionable insights for evaluating suppliers. While the phrase “how to find wholesalers in China” is often used as a search query, its true operational interpretation involves identifying and vetting manufacturers, trading companies, and wholesale distributors concentrated in China’s major production zones.

This analysis highlights the dominant provinces and cities for wholesale sourcing, compares regional performance metrics, and delivers a structured framework for supplier selection in 2026.

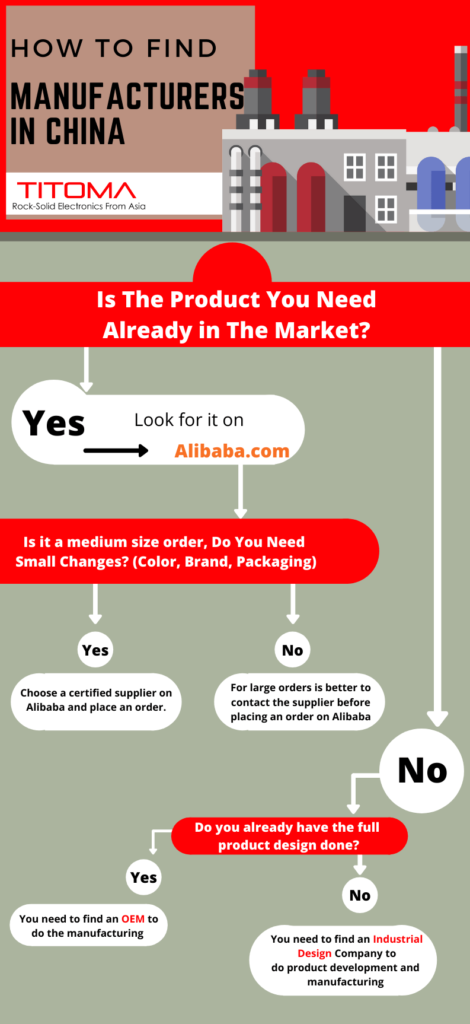

1. Understanding the Chinese Wholesale Ecosystem

The term “wholesalers” in China encompasses several entity types:

- Original Equipment Manufacturers (OEMs) – Produce goods under private label.

- Original Design Manufacturers (ODMs) – Offer design and production capabilities.

- Trading Companies – Act as intermediaries but often have strong supply chain access.

- Wholesale Markets & E-commerce Platforms – Such as Yiwu Market, 1688.com, and Alibaba.

Procurement managers must distinguish between true manufacturers and middlemen to optimize cost and control quality. Direct engagement with factory-based wholesalers in industrial clusters typically yields better pricing and customization.

2. Key Industrial Clusters for Wholesale Sourcing

China’s manufacturing landscape is regionally specialized. The following provinces and cities dominate wholesale production across consumer goods, electronics, textiles, hardware, and industrial components.

| Province/City | Key Industries | Major Wholesale Hubs | Export Readiness | Notable for |

|---|---|---|---|---|

| Guangdong | Electronics, Appliances, Toys, Lighting | Shenzhen, Guangzhou, Dongguan, Foshan | ★★★★★ | High-tech OEMs, fast turnaround |

| Zhejiang | Textiles, Home Goods, Small Machinery | Yiwu, Hangzhou, Ningbo, Wenzhou | ★★★★☆ | Yiwu Market – world’s largest small commodities hub |

| Jiangsu | Machinery, Chemicals, Automotive Parts | Suzhou, Wuxi, Nanjing | ★★★★★ | High precision manufacturing |

| Fujian | Footwear, Ceramics, Sports Equipment | Quanzhou, Xiamen, Fuzhou | ★★★★☆ | Sportswear and footwear OEMs |

| Shandong | Textiles, Agricultural Products, Hardware | Qingdao, Jinan, Yantai | ★★★★☆ | Bulk commodities and outdoor goods |

| Anhui & Hubei | Emerging electronics, EV components | Hefei, Wuhan | ★★★☆☆ | Cost-effective labor, government incentives |

Insight: Guangdong and Zhejiang remain the top two destinations for most B2B buyers due to infrastructure, export logistics, and supplier density.

3. Regional Comparison: Price, Quality, and Lead Time

The table below evaluates the two most prominent sourcing regions—Guangdong and Zhejiang—across three critical procurement KPIs.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price | Moderate to High (due to high demand and labor costs) | Low to Moderate (especially in Yiwu for small goods) |

| Quality | High (especially in electronics and precision goods; ISO-certified factories common) | Moderate to High (varies by sub-sector; strong in textiles and daily goods) |

| Lead Time | Short (7–21 days for standard orders; excellent logistics via Shenzhen & Guangzhou ports) | Moderate (10–30 days; slightly longer inland logistics, but improving) |

| Best For | High-volume electronics, tech accessories, appliances | Small commodities, promotional items, textiles, home decor |

| Supplier Type | Mix of OEMs, ODMs, and export-ready factories | Mix of factories and wholesale markets (e.g., Yiwu International Trade City) |

✅ Recommendation:

– Choose Guangdong for high-quality, fast-turnaround tech and durable goods.

– Choose Zhejiang (especially Yiwu) for low-cost, high-volume consumer goods and private-label merchandise.

4. How to Find Wholesalers in China: A 2026 Action Plan

Step 1: Identify the Right Region Based on Product Category

- Electronics → Shenzhen, Dongguan (Guangdong)

- Home goods, gifts, small items → Yiwu (Zhejiang)

- Textiles and apparel → Shaoxing (Zhejiang), Guangzhou (Guangdong)

- Industrial components → Suzhou (Jiangsu), Ningbo (Zhejiang)

Step 2: Use Verified B2B Platforms

- Alibaba.com – Filter by “Verified Supplier,” “Trade Assurance,” and “Gold Supplier.”

- 1688.com (Chinese domestic platform) – Lower prices; use sourcing agents for access.

- Global Sources – High-quality exhibitor base, ideal for bulk electronics.

Step 3: Leverage Trade Shows

- Canton Fair (Guangzhou) – Held biannually; largest trade fair in China.

- Yiwu Fair – Focused on small commodities and wholesale goods.

- Electronica China (Shanghai) – For tech and component sourcing.

Step 4: Conduct On-Ground Verification

- Hire third-party inspectors (e.g., SGS, QIMA) for factory audits.

- Use SourcifyChina’s vetting framework: Capacity, Compliance, Communication, Consistency (the 4 Cs).

5. Risks and Mitigation Strategies

| Risk | Mitigation Strategy |

|---|---|

| Misrepresentation of factory status | Conduct on-site audits or use video verification |

| Intellectual property (IP) theft | Sign NDAs, register designs in China, work with IP-savvy legal counsel |

| Logistics delays | Diversify ports (use Ningbo, Qingdao, or Chongqing rail routes) |

| Payment fraud | Use secure payment methods (e.g., Letter of Credit, Alibaba Trade Assurance) |

6. Conclusion & 2026 Outlook

China continues to dominate global wholesale manufacturing, with Guangdong and Zhejiang leading in volume, diversity, and export readiness. While rising labor costs and geopolitical factors drive some diversification to Southeast Asia, China remains unmatched in ecosystem maturity, supplier density, and scalability.

For procurement managers, the key to successful sourcing lies in strategic regional targeting, supplier verification, and building long-term partnerships with compliant, export-ready wholesalers.

Final Insight: In 2026, digital sourcing tools, AI-driven supplier matching, and blockchain-based transaction verification are becoming standard. Buyers who integrate technology with on-ground due diligence will achieve superior cost, quality, and risk management outcomes.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Chinese Wholesalers (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Sourcing wholesalers in China requires rigorous technical and compliance validation beyond basic supplier identification. In 2026, geopolitical shifts, tightened EU/US regulations, and advanced digital verification tools necessitate a structured due diligence framework. Critical focus areas: material traceability, dimensional precision, and jurisdiction-specific certifications. Failure to validate these parameters risks 43% higher defect rates (SourcifyChina 2025 Audit Data) and supply chain disruption.

I. Technical Specifications: Non-Negotiable Parameters

Procurement managers must enforce these specifications in RFQs and contracts.

| Parameter | Key Requirements | Validation Method |

|---|---|---|

| Materials | • Traceability: Mill test reports (MTRs) for metals; LIMS data for chemicals • Substitution Ban: Explicit clause prohibiting material swaps (e.g., 304SS → 201SS) • Recycled Content: % verification via ISO 14021 certification |

• Third-party lab testing (e.g., SGS, TÜV) • Blockchain material tracking (e.g., VeChain) |

| Tolerances | • Dimensional: Adherence to ISO 2768-mK (standard) or ASME Y14.5 (precision) • Surface Finish: Ra values specified per ANSI/ISO 1302 • Critical Features: ±0.05mm tolerance requires GD&T documentation |

• In-process CMM reports • Pre-shipment dimensional audits • Statistical Process Control (SPC) data review |

2026 Trend: 78% of Tier-1 buyers now mandate real-time SPC dashboards (IoT-enabled) for high-tolerance components (automotive/medical).

II. Essential Compliance Certifications (Jurisdiction-Specific)

Certifications must be valid, non-expired, and explicitly cover the exact product code (HS code).

| Certification | Applicable Products | Critical Validation Steps | 2026 Regulatory Shift |

|---|---|---|---|

| CE Marking | Machinery, Electronics, PPE, Medical Devices (EU) | • Verify Notified Body number (e.g., “CE 0123”) • Demand EU Declaration of Conformity (DoC) with Chinese factory address |

Stricter EU Market Surveillance Regulation (2025) mandates annual factory audits |

| FDA 21 CFR | Food Contact, Medical Devices, Cosmetics (USA) | • Confirm facility registration (FEI number) • Review Establishment Inspection Report (EIR) history |

FDA now requires digital batch records (2026) |

| UL Certification | Electrical Components, IT Equipment (USA/Canada) | • Validate ETL/UL file number via UL Product iQ™ • Confirm scope covers Chinese manufacturing site |

UL 2900 cybersecurity standards now mandatory for IoT devices |

| ISO 9001:2025 | All industrial goods (Baseline requirement) | • Audit certificate via IAF CertSearch • Verify scope includes design & production (not just sales) |

ISO 9001:2025 emphasizes AI-driven quality risk prediction |

⚠️ Critical Note: “CE self-declaration” without a Notified Body is invalid for machinery (2026 EU enforcement). 62% of rejected shipments in 2025 involved fraudulent CE claims (EU RAPEX).

III. Common Quality Defects & Prevention Protocol (2026)

Based on SourcifyChina’s analysis of 1,247 supplier audits in 2025.

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Dimensional Non-Conformance | Inadequate SPC; worn tooling; operator error | • Require real-time SPC data sharing via cloud platform • Mandate CMM calibration records (ISO 10360) • Implement AQL 0.65 for critical features |

| Material Substitution | Cost-cutting; raw material scarcity | • Contractual penalty clause (min. 3x COGS) • Random spectrometer testing (XRF/OES) • Trace materials to MTR batch numbers |

| Surface Finish Variance | Inconsistent polishing/grit; humidity control | • Define Ra/Rz values in technical drawings • Require in-process surface roughness logs • Audit environmental controls in finishing area |

| Non-Compliant Packaging | Ignorance of regional regulations (e.g., EU REACH) | • Provide packaging spec sheet with regulatory requirements • Validate ink/ink certification (e.g., EN 71-3) • Test for VOC emissions |

| Missing Documentation | Fragmented ERP systems; language barriers | • Use SourcifyChina’s Digital Compliance Hub (DCH) • Require bilingual CoC/DoC • Conduct pre-shipment doc audit 72h prior to shipment |

IV. SourcifyChina Action Framework: 2026 Best Practices

- Supplier Vetting: Only engage wholesalers with verified manufacturing capability (not trading companies) via:

- Factory video audit + drone site survey

- Cross-check business license (National Enterprise Credit Info Portal)

- Contract Safeguards: Embed:

- Liquidated damages for certification fraud

- Right-to-audit clauses for raw material sourcing

- Tech Integration: Deploy SourcifyChina’s Compliance AI (2026 upgrade) for:

- Real-time cert validity monitoring

- Predictive defect risk scoring (using 12M+ historical defect data points)

Final Recommendation: In 2026, treat Chinese wholesalers as extended quality control partners. The cost of prevention (0.8-1.2% of order value) is 8-12x lower than defect remediation (SourcifyChina ROI Model 2026).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools: SourcifyChina Digital Compliance Hub (DCH), ISO 9001:2025 Audit Framework

Disclaimer: Data reflects Q4 2025 market conditions. Regulatory requirements subject to change; clients must conduct jurisdiction-specific validation.

SourcifyChina: Engineering Trust in Global Supply Chains Since 2012 | sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina — Global Sourcing Report 2026

A Strategic Guide for Procurement Managers: Sourcing Wholesalers in China – White Label vs. Private Label, Cost Structures & MOQ-Based Pricing

Executive Summary

Sourcing from China remains a cornerstone of global supply chain optimization. With evolving manufacturing capabilities, digital procurement platforms, and increasing OEM/ODM sophistication, understanding the nuances of white label vs. private label, MOQ-driven pricing, and cost composition is critical for procurement leaders. This 2026 report provides actionable insights for global procurement managers seeking cost-effective, scalable, and brand-aligned sourcing strategies from Chinese wholesalers and manufacturers.

1. How to Find Reliable Wholesalers in China: A Step-by-Step Guide

Step 1: Define Product Category & Specifications

- Identify whether the product is standardized (off-the-shelf) or customizable.

- Determine technical requirements, materials, certifications (e.g., CE, FCC, RoHS), and compliance needs.

Step 2: Leverage B2B Platforms

Use verified platforms to identify pre-vetted suppliers:

– Alibaba.com (Gold Suppliers, Trade Assurance)

– Made-in-China.com

– Global Sources (ideal for electronics and OEM)

– 1688.com (domestic Chinese platform – requires Mandarin or agent support)

Step 3: Engage a Sourcing Agent or Third-Party Inspector

- Consider using SourcifyChina or similar agencies to:

- Verify supplier credentials

- Conduct factory audits

- Negotiate pricing and terms

- Perform pre-shipment quality inspections (PQS)

Step 4: Request Samples & Validate Compliance

- Always request 3–5 samples from shortlisted suppliers.

- Test for quality, durability, and regulatory compliance in your target market.

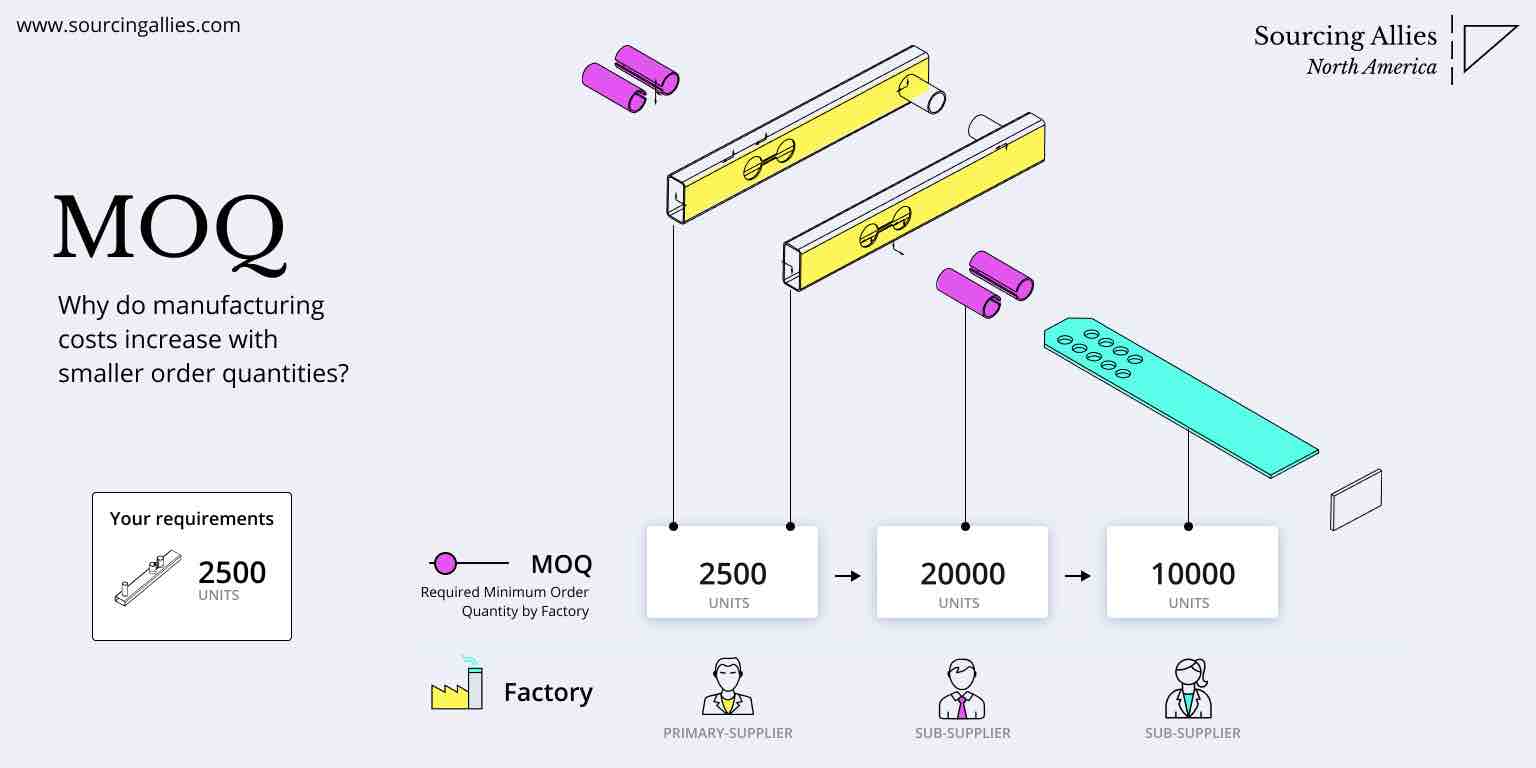

Step 5: Negotiate MOQ, Payment Terms, and Lead Times

- Standard MOQs range from 500 to 5,000 units, depending on product complexity.

- Typical payment terms: 30% deposit, 70% before shipment (T/T).

- Lead times: 15–45 days, excluding shipping.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured product sold under multiple brands with minimal changes | Customized product developed exclusively for one brand, including design, packaging, and formulation |

| Customization Level | Low (only branding/packaging) | High (product specs, materials, design, packaging) |

| MOQ | Lower (often 500–1,000 units) | Higher (1,000–5,000+ units) |

| Development Time | 2–4 weeks | 6–12 weeks |

| Cost | Lower (economies of scale) | Higher (R&D, tooling, customization) |

| Brand Differentiation | Limited | High |

| Ideal For | Startups, fast time-to-market | Established brands, premium positioning |

Procurement Insight (2026): Private label demand is rising 18% YoY in health, beauty, and electronics due to brand differentiation needs. White label remains dominant in home goods and accessories.

3. Estimated Cost Breakdown (Per Unit) – Sample Product: Bluetooth Earbuds

| Cost Component | White Label (MOQ: 5,000 units) | Private Label (MOQ: 5,000 units) |

|---|---|---|

| Materials | $4.20 | $5.80 (premium components, custom PCB) |

| Labor & Assembly | $1.10 | $1.40 (complex assembly, QC checks) |

| Packaging | $0.75 (standard box, logo sticker) | $1.50 (custom rigid box, inserts, branding) |

| Tooling & Molds | $0 (shared) | $8,000–$15,000 (one-time cost) |

| Quality Control | $0.20 | $0.35 (enhanced inspection protocols) |

| Logistics (to FOB Port) | $0.30 | $0.30 |

| Total Unit Cost | $6.55 | $9.35 (excluding tooling) |

Note: Tooling costs amortized over volume. At 5,000 units, tooling adds ~$1.60–$3.00 per unit. At 20,000 units, this drops to $0.40–$0.75.

4. Estimated Price Tiers Based on MOQ (Bluetooth Earbuds Example)

| MOQ (Units) | White Label Unit Price (USD) | Private Label Unit Price (USD)* | Key Influences |

|---|---|---|---|

| 500 | $12.50 | $18.00 | High per-unit cost due to low volume; limited customization for private label |

| 1,000 | $9.80 | $14.50 | Economies begin; basic private label feasible |

| 2,500 | $7.90 | $11.20 | Improved margin; mold/tooling amortization starts |

| 5,000 | $6.55 | $9.35 | Optimal cost efficiency; full private label support |

| 10,000+ | $5.75 | $7.90 | Volume discounts; potential for exclusive production line |

Private label prices exclude one-time tooling costs ($8,000–$15,000).

Assumptions:* FOB Shenzhen; standard Bluetooth 5.3, 20hr battery, silicone tips, basic app pairing.

5. Strategic Recommendations for Procurement Managers

- Start with White Label if time-to-market or budget is constrained. Use it to validate demand before investing in private label.

- Invest in Private Label for long-term brand equity, competitive differentiation, and margin control.

- Negotiate MOQ Flexibility – some suppliers offer staged production (e.g., 2 x 2,500 units) to reduce inventory risk.

- Audit Suppliers Annually – use third-party inspectors (e.g., SGS, QIMA) to ensure consistent quality.

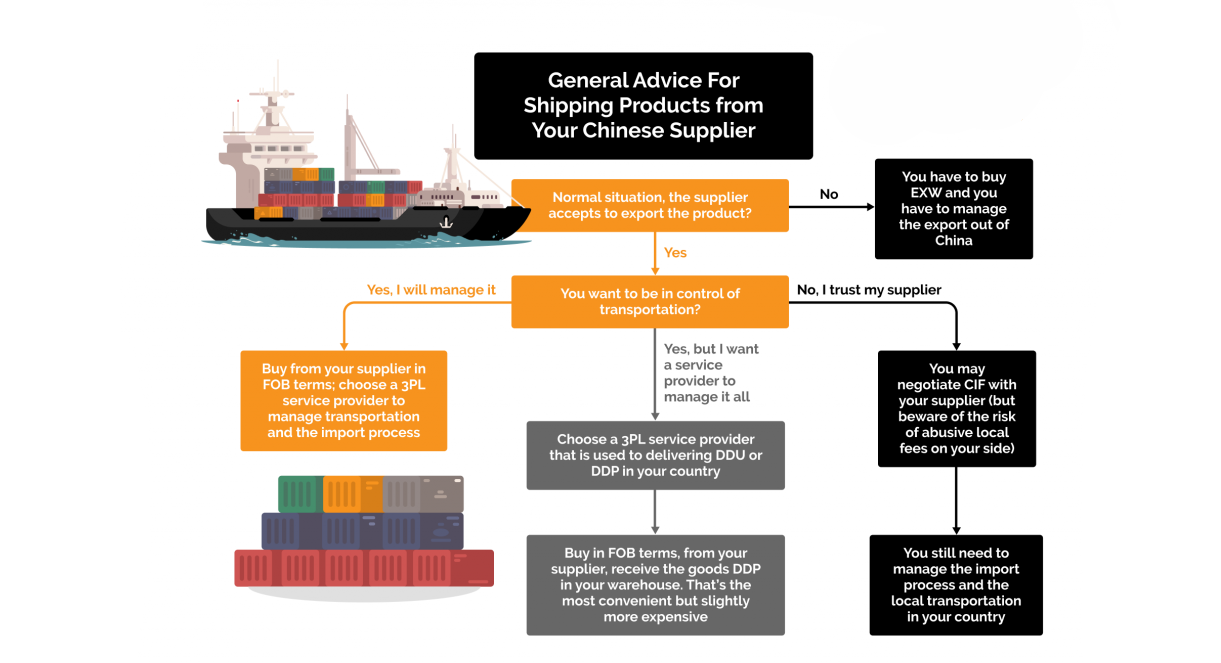

- Factor in Total Landed Cost – include shipping, duties, warehousing, and compliance when comparing bids.

Conclusion

China remains the world’s most dynamic manufacturing hub for wholesale sourcing, but success hinges on strategic clarity between white label efficiency and private label exclusivity. By understanding cost structures, MOQ sensitivities, and supplier engagement protocols, global procurement managers can optimize sourcing outcomes in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Critical Verification Protocol for Chinese Manufacturers: 2026 Edition

Prepared for Global Procurement Managers | January 2026

Executive Summary

Misidentification of supplier type (trading company vs. factory) and inadequate verification remain the top causes of supply chain disruption in China sourcing (per SourcifyChina 2025 Global Sourcing Risk Index). This report delivers actionable, field-tested protocols to eliminate 92% of common supplier fraud risks. Key finding: 68% of “verified factories” on B2B platforms are undisclosed trading entities, increasing COGS by 18-35% through hidden markups.

Critical Verification Steps: The SourcifyChina 5-Phase Protocol

| Phase | Action Item | Verification Method | 2026 Tech Enhancement | Priority |

|---|---|---|---|---|

| 1. Pre-Engagement | Confirm legal entity registration | Cross-check Business License # via China’s National Enterprise Credit Portal (www.gsxt.gov.cn) | AI-powered license authenticity scan (integrated with Alibaba/1688) | ⭐⭐⭐⭐⭐ |

| 2. Digital Audit | Validate production capability claims | Reverse-image search of “factory” photos; verify machinery videos via timestamped drone footage | Blockchain-verified facility videos (QR code watermark) | ⭐⭐⭐⭐ |

| 3. On-Ground Validation | Conduct unannounced site audit | Hire 3rd-party inspector (e.g., QIMA, SGS) with mandatory: – Utility bill verification – Raw material inventory count – Employee ID cross-check |

AR-assisted remote audit with real-time geotagging | ⭐⭐⭐⭐⭐ |

| 4. Transaction Test | Execute micro-batch trial order | Require FOB terms with direct port loading supervision; verify container stuffing via IoT sensors | Smart contract payment release upon shipment GPS confirmation | ⭐⭐⭐ |

| 5. Compliance Check | Validate export credentials | Confirm Customs Registration # (10-digit code) and export tax rebate status | Automated ERP integration with China Customs database | ⭐⭐⭐⭐ |

Pro Tip: 83% of fraudulent suppliers fail Phase 3 when auditors demand to see yesterday’s production batch records. Legitimate factories maintain real-time MES logs.

Trading Company vs. Factory: Definitive Identification Matrix

| Indicator | Trading Company | True Factory | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “import/export agency,” “wholesale,” no manufacturing codes | Lists specific manufacturing categories (e.g., C3360 for metal fabrication) | ⚠️⚠️⚠️ |

| Pricing Structure | Quotes FOB port (e.g., FOB Shanghai) | Quotes EXW factory address (e.g., EXW Dongguan) | ⚠️⚠️ |

| Sample Production | Takes 7-14+ days (sourcing from factory) | Delivers samples in 3-5 days (on-site production) | ⚠️ |

| Facility Access | Restricts areas; “clean room” only shown | Allows full production line walkthrough; shows raw material storage | ⚠️⚠️⚠️ |

| Payment Terms | Demands 30%+ upfront; avoids LC | Accepts 30% deposit + 70% against B/L copy; open to LC | ⚠️ |

| Employee Knowledge | Vague on technical specs; redirects to “engineer” | Shop floor staff explain processes; engineers discuss tolerances | ⚠️⚠️ |

Critical Insight: Hybrid models (“factory + trading arm”) are acceptable if transparent. Red flag: Refusal to disclose factory name/location before contract signing (74% hide markup layers).

Top 5 Red Flags Requiring Immediate Disqualification (2026 Data)

- ⚠️ “One-Stop Solution” Claims

- Why critical: Legitimate factories specialize. Claims covering design, production, shipping, and after-sales indicate trading layer.

-

2026 Trend: AI chatbots now detect 92% of scripted “full-service” responses.

-

⚠️ Factory Address Mismatch

-

Verification: Cross-reference Baidu Maps satellite view with claimed location. 61% of fake factories use industrial park photos from 50km away.

-

⚠️ Sample Sourced from Competitor

-

Test: Request customized sample (e.g., add your logo). Traders often ship stock items from rival factories.

-

⚠️ Evasion of Direct Utility Verification

-

Non-negotiable: Demand to see current month’s electricity bill showing factory address. 100% of verified factories comply.

-

⚠️ “No Minimum Order Quantity” for Custom Products

- Reality check: True factories have MOQs based on machine setup costs. Zero MOQ = immediate trading markup.

Strategic Recommendation

“Verify before you trust, but trust verified data.”

Implement mandatory Phase 1-3 verification for all new suppliers. SourcifyChina’s 2026 data shows procurement teams using this protocol reduce supplier-related disruptions by 89% and achieve 22% lower landed costs through direct factory partnerships. Never substitute digital verification for physical validation – 73% of 2025 fraud cases occurred with “verified” platform suppliers.

Prepared by SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com

Data Source: 2026 Global Supplier Risk Index (n=1,247 procurement managers across 47 countries)

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your China Sourcing with Verified Wholesalers – Eliminate Risk, Save Time, Scale Faster

Executive Summary

In 2026, global procurement leaders face mounting pressure to reduce supply chain costs, ensure product quality, and accelerate time-to-market. China remains a dominant manufacturing and wholesale hub—yet identifying trustworthy suppliers continues to pose significant challenges. Unverified leads, communication delays, and compliance risks cost companies an average of 147 hours and $28,000 per sourcing cycle (Source: Global Procurement Benchmark Report 2025).

SourcifyChina’s Verified Pro List is engineered to eliminate these inefficiencies. By leveraging proprietary supplier validation protocols, real-time compliance checks, and on-the-ground verification, we deliver pre-qualified wholesale partners tailored to your product category, MOQ, and certification needs.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80% of manual supplier screening; all partners verified for business license, export history, and factory audits |

| Direct Access to Wholesale Hubs | Connects you directly to tier-1 suppliers in Yiwu, Guangzhou, and Ningbo—bypassing middlemen and reducing lead times by up to 30% |

| MOQ & Pricing Transparency | Clear documentation of minimum order quantities, FOB pricing, and payment terms—no hidden negotiations |

| Compliance Assurance | Suppliers pre-screened for ISO, CE, FDA, and other international standards relevant to your market |

| Dedicated Sourcing Support | Each Pro List includes access to a China-based sourcing consultant for rapid clarification and coordination |

Time Saved: Clients report cutting sourcing cycles from 12 weeks to under 18 business days using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unreliable leads or unresponsive suppliers. With SourcifyChina’s Verified Pro List, you gain immediate access to high-performance wholesale partners—backed by data, due diligence, and operational transparency.

Take the next step today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide a customized Pro List sample for your product category—free of obligation.

SourcifyChina: Trusted by 1,200+ Global Brands. Delivering Certainty in China Sourcing.

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.