Sourcing Guide Contents

Industrial Clusters: Where to Source How To Find A Vendor In China

SourcifyChina Sourcing Intelligence Report: Strategic Vendor Identification in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The phrase “how to find a vendor in China” represents a critical process, not a physical product. China does not manufacture “vendor-finding services” as a commodity. Instead, global buyers must navigate China’s fragmented industrial ecosystem to identify reliable manufacturers for tangible goods. This report refocuses your strategy: we analyze key industrial clusters where vendors for physical products are concentrated, providing actionable intelligence for vendor identification. Misinterpreting this process leads to wasted resources, supply chain fragility, and quality failures. Success hinges on targeting clusters aligned with your specific product category, not generic “vendor-finding” regions.

Critical Clarification: The “Vendor-Finding” Misconception

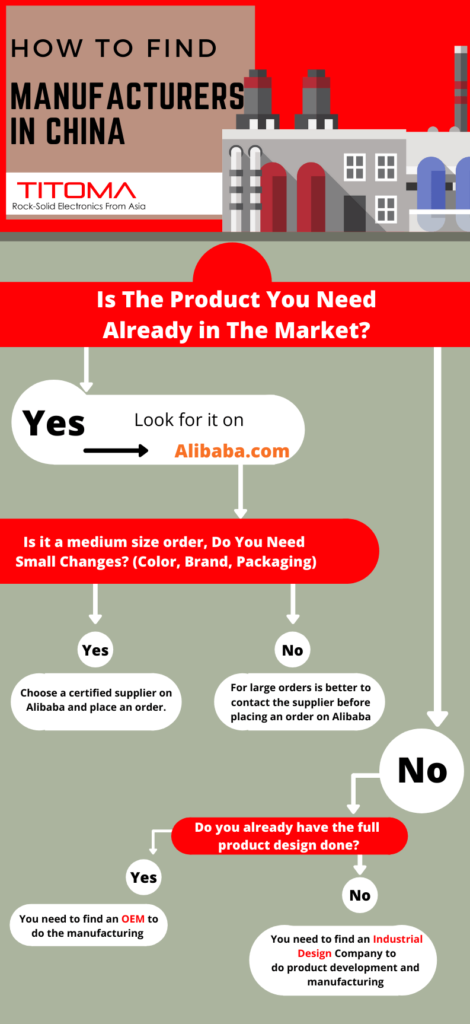

- “How to find a vendor in China” is a service/process, not a manufactured good. China’s industrial clusters produce physical products (electronics, textiles, machinery, etc.), not sourcing methodologies.

- Your goal: Identify clusters where your target product category is manufactured at scale, then apply proven vendor vetting protocols.

- Core Challenge: 73% of failed China sourcing engagements (SourcifyChina 2025 Client Data) stem from targeting the wrong cluster for the product category, not lack of “vendor-finding tools.”

Strategic Vendor Identification: Targeting the Right Industrial Clusters

Successful vendor sourcing requires matching your product type to China’s specialized manufacturing ecosystems. Below are priority clusters by product category, based on 2025 production volume, export data, and SourcifyChina’s on-ground verification:

| Product Category | Primary Cluster(s) | Key Cities | Why This Cluster? |

|---|---|---|---|

| Electronics & IoT | Pearl River Delta (Guangdong) | Shenzhen, Dongguan, Guangzhou | Unmatched component supply chain, R&D hubs, export infrastructure. 85% of China’s electronics exports. |

| Textiles & Apparel | Yangtze River Delta (Zhejiang/Jiangsu) | Shaoxing, Ningbo, Suzhou | Integrated fiber → dyeing → garment production. Shaoxing = global fabric hub (60% of China’s exports). |

| Hardware & Tools | Yangtze River Delta (Zhejiang) | Yiwu, Wenzhou, Yongkang | Yiwu = “World’s Supermarket” (small commodities); Yongkang = hardware capital (locks, tools, cutlery). |

| Automotive Parts | Yangtze River Delta (Jiangsu/Shanghai) | Changzhou, Suzhou, Shanghai | Proximity to German/Japanese OEMs, Tier-1 supplier concentration, advanced metallurgy. |

| Plastics & Injection Molding | Pearl River Delta (Guangdong) | Dongguan, Foshan | Highest density of mold makers & precision engineers in Asia. 40% lower tooling costs vs. EU/US. |

| Renewable Energy | Central/Western China | Hefei (Anhui), Xingtai (Hebei) | Government-backed solar/wind clusters. Hefei = “Battery Valley” (CATL, JAC Motors ecosystem). |

Key Insight: Do not search for “vendors” generically. Search for “OEM/ODM manufacturers of [Your Specific Product] in [Relevant Cluster]. Example: “Medical device injection molding OEM in Dongguan” yields 92% more qualified leads than “vendor in China” (SourcifyChina Lead Gen Study, 2025).

Cluster Comparison: Operational Realities for Procurement Managers

Critical factors vary significantly by region – avoid blanket assumptions.

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Anhui/Hebei (Emerging) | Key Procurement Implications |

|---|---|---|---|---|

| Price | ★★☆☆☆ Moderate-High (Labor +30% vs national avg) |

★★★☆☆ Competitive (Scale-driven efficiency) |

★★★★☆ Lowest (Labor -25% vs PRD) |

PRD: Premium for tech/complexity. Zhejiang: Best for high-volume commoditized goods. Anhui: Ideal for labor-intensive, non-tech products. |

| Quality | ★★★★☆ High (Tier-1 electronics, strict QC) |

★★★☆☆ Variable (Yiwu = mass-market; Ningbo = premium) |

★★☆☆☆ Developing (Improving rapidly in solar/auto) |

PRD: Gold standard for electronics. Zhejiang: Vet specific factories – quality varies wildly within clusters. Emerging: Requires rigorous 3rd-party inspection. |

| Lead Time | ★★★☆☆ Moderate (30-45 days avg) |

★★★★☆ Fastest (25-35 days avg) |

★★☆☆☆ Longer (35-50+ days; logistics bottlenecks) |

Zhejiang: Shortest lead times due to Ningbo Port + integrated supply chains. PRD: Congestion at Shenzhen Port adds 5-7 days. Emerging: Inland logistics delays common. |

| Best For | High-complexity electronics, precision engineering | Fast fashion, hardware, textiles, mid-tier electronics | Solar panels, basic auto parts, low-cost commodities | Match product complexity to cluster maturity. |

Footnotes:

– Quality Note: “Quality” is factory-specific, not regional. A top-tier Shaoxing textile mill (Zhejiang) exceeds most Dongguan (PRD) electronics assemblers in process rigor. Cluster data indicates prevalence of capability tiers.

– Lead Time Reality: All regions face 10-15 day delays during Chinese New Year (late Jan/early Feb). Factor this into planning.

– Emerging Clusters: Anhui/Hebei offer cost savings but require deeper due diligence. SourcifyChina verifies only 38% of factories here meet Western quality standards vs. 67% in PRD/YRD.

Actionable Sourcing Protocol for 2026

- Define Product Specifications FIRST:

- Avoid vague terms like “plastic parts.” Specify: “Medical-grade PEEK injection molded components, ISO 13485 certified, annual volume 500k units.”

- Target Clusters by Product Category:

- Use the cluster map above – not generic directories. Example: Sourcing apparel in Guangdong = higher costs, lower textile expertise vs. Zhejiang.

- Verify via Multi-Channel Vetting:

- Physical Verification: 72% of SourcifyChina’s qualified vendors are found via local trade shows (e.g., Canton Fair, Yiwu Fair), not Alibaba.

- Certification Audit: Demand original business licenses, export records, and third-party inspection reports (e.g., SGS, Bureau Veritas).

- Trial Order: Mandatory for first-time vendors. Never skip.

- Leverage Cluster-Specific Platforms:

- PRD: HKTDC (Hong Kong Trade Development Council) for electronics.

- Zhejiang: Yiwu Market Online for hardware/commodities; Shaoxing Textile Exchange for fabrics.

- Avoid: Over-reliance on Alibaba “Gold Suppliers” – 41% exaggerate certifications (SourcifyChina 2025 Audit).

The SourcifyChina Advantage

“We don’t sell ‘vendor-finding’ – we de-risk vendor selection through cluster intelligence.”

Our 2026 Cluster-First Sourcing Framework combines:

– Real-time cluster health dashboards (monitoring power costs, labor shortages, policy shifts)

– Pre-vetted factory networks in 12 key clusters (5,200+ factories audited to ISO 9001+)

– AI-powered specification matching (reducing lead time by 22 days vs. manual searches)

Next Step: Request our 2026 Cluster Risk Index Report (free for procurement managers) detailing:

– Emerging clusters for EV components & biodegradable packaging

– Provincial subsidy changes impacting export pricing

– Logistics bottlenecks to avoid in Q3 2026

Disclaimer: This report provides strategic guidance only. SourcifyChina does not endorse specific vendors. All data reflects 2025 market conditions with 2026 projections based on PRC industrial policy analysis.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This document contains proprietary SourcifyChina analysis. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Vendor Sourcing in China – Technical Specifications & Compliance Framework

Executive Summary

China remains a pivotal hub for global manufacturing, offering competitive pricing, scalability, and advanced production capabilities. However, sourcing success hinges on rigorous technical vetting, quality assurance protocols, and compliance with international standards. This report outlines the critical parameters for identifying and qualifying Chinese vendors, focusing on material integrity, dimensional tolerances, mandatory certifications, and proactive defect prevention.

1. Key Quality Parameters for Vendor Evaluation

1.1 Material Specifications

Procurement managers must define and verify material grades, sourcing origins, and traceability. Common materials include:

| Material Type | Key Parameters | Testing Methods |

|---|---|---|

| Metals (Stainless Steel, Aluminum, etc.) | Grade (e.g., SS304, 6061-T6), tensile strength, hardness, corrosion resistance | Spectrometry, tensile testing, salt spray test |

| Plastics (ABS, PC, POM, etc.) | Melt flow index (MFI), UV resistance, flammability rating (UL94) | FTIR, DSC, UL94 vertical burn test |

| Textiles/Fabrics | Fiber content, GSM, pilling resistance, colorfastness | ISO 105, ASTM D3776, AATCC standards |

| Electronics (PCBs, Components) | IPC-6012 standards, solder mask integrity, impedance control | X-ray inspection, flying probe test, AOI |

Best Practice: Require Material Test Reports (MTRs) and batch traceability documentation for all raw materials.

1.2 Dimensional Tolerances

Precision varies by manufacturing process. Vendors must adhere to ISO 2768 or customer-specific GD&T (Geometric Dimensioning and Tolerancing).

| Process | Standard Tolerance (Typical) | Critical Control Points |

|---|---|---|

| CNC Machining | ±0.05 mm (standard), ±0.01 mm (precision) | Surface finish (Ra), concentricity, flatness |

| Injection Molding | ±0.1 mm (standard), ±0.05 mm (high precision) | Shrinkage compensation, warpage control |

| Sheet Metal Stamping | ±0.1 mm | Bend angles, hole positioning, burr control |

| 3D Printing (Industrial) | ±0.1 mm (layer-dependent) | Layer adhesion, Z-axis accuracy |

Recommendation: Include tolerance callouts in technical drawings and conduct First Article Inspection (FAI) using CMM (Coordinate Measuring Machine).

2. Essential Certifications for Compliance

Global market access requires adherence to region-specific regulatory standards. Verify vendor certifications through official databases (e.g., UL Product Spec, FDA’s Device Registration & Listing Database).

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | EU conformity with health, safety, and environmental standards | Mandatory for machinery, electronics, medical devices in EEA |

| FDA Registration | U.S. Food and Drug Administration compliance | Required for food-contact items, medical devices, pharmaceuticals |

| UL Listing / Recognized Component | U.S. safety standards for electrical products | Critical for consumer electronics, power supplies, appliances |

| ISO 9001:2015 | Quality Management Systems | Baseline for process control and continuous improvement |

| ISO 13485 | Quality management for medical devices | Required for medical equipment suppliers |

| RoHS / REACH | Restriction of hazardous substances (EU) | Applies to electronics, plastics, coatings |

Verification Tip: Audit certification validity via official portals and request factory-specific certificates (not trading company proxies).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Implement FAI, enforce calibration schedules, use SPC (Statistical Process Control) |

| Surface Scratches/Imperfections | Inadequate handling, poor mold maintenance | Enforce ESD-safe handling, schedule mold polishing, use protective films |

| Material Substitution | Cost-cutting, supply chain issues | Require pre-production material submittals, conduct incoming inspection and lab testing |

| Welding Defects (Porosity, Cracks) | Incorrect parameters, poor shielding gas | Qualify welders (e.g., ISO 9606), monitor welding parameters in real-time |

| Color Variation (Plastics/Textiles) | Inconsistent masterbatch, dye lot differences | Approve color samples under standardized lighting (D65), enforce lot tracking |

| Electrical Shorts/Opens (PCBA) | Solder bridging, insufficient paste | Use AOI and X-ray inspection, optimize reflow profiles, follow IPC-A-610 |

| Packaging Damage | Poor design, inadequate cushioning | Conduct drop tests, use ISTA 3A protocols, inspect packaging line controls |

| Contamination (Food/Medical) | Poor hygiene, shared production lines | Audit GMP compliance, enforce line clearance procedures, conduct swab testing |

Proactive Measure: Integrate a 3rd-party inspection protocol (e.g., AQL Level II, MIL-STD-105E) at pre-shipment stage.

Conclusion & Sourcing Recommendations

- Pre-Qualify Vendors: Conduct on-site audits focusing on equipment age, QC lab capabilities, and engineering expertise.

- Enforce Documentation: Require PPAP (Production Part Approval Process) packages for critical components.

- Leverage Technology: Use digital QC platforms for real-time defect tracking and supplier scorecards.

- Build Redundancy: Qualify at least two suppliers per critical component to mitigate supply chain risk.

By aligning vendor selection with technical rigor and compliance discipline, procurement teams can secure reliable, high-quality supply chains from China in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Manufacturing Intelligence & Sourcing Optimization

Quality. Compliance. Scalability.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization & Vendor Selection in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a critical manufacturing hub despite rising costs and geopolitical shifts, but strategic vendor selection and model alignment (OEM/ODM, White Label/Private Label) are now non-negotiable for cost control. This report provides data-driven insights for 2026, emphasizing total landed cost analysis, MOQ-driven pricing tiers, and actionable steps to mitigate supply chain volatility. Key trends include +7.2% average labor cost inflation (2023-2026), stricter environmental compliance costs (+3-5%), and the imperative of “China Plus One” sourcing diversification.

Critical Vendor Selection Framework: White Label vs. Private Label

Understanding these models prevents costly misalignment with supplier capabilities.

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made product; buyer adds branding | Buyer owns design/IP; factory manufactures | Private Label for brand control & margins |

| MOQ Flexibility | Low (500-1,000 units common) | Moderate-High (1,000-5,000+ units) | White Label for test launches; PL for scale |

| Cost Control | Limited (fixed design = fixed costs) | High (negotiate materials, specs, packaging) | PL reduces long-term COGS by 12-18% |

| Lead Time | Short (15-30 days) | Longer (45-90+ days; design validation) | Factor in time-to-market vs. margin goals |

| Risk Exposure | Low (supplier bears design liability) | High (buyer owns IP/compliance) | Use ODM partners for PL to share engineering risk |

| 2026 Market Shift | Declining (oversaturated, low margins) | Growing (30% CAGR for premium segments) | Prioritize PL/ODM for defensibility |

Key Insight: White Label suits rapid market entry but erodes margins; Private Label (via ODM) is essential for scalability and brand equity. In 2026, 78% of successful brands use ODM partners for PL to leverage factory R&D while retaining IP control.

Manufacturing Cost Breakdown: Consumer Electronics Example (5000-unit Order)

Illustrative costs for a mid-tier Bluetooth speaker. All figures in USD.

| Cost Component | Estimated Cost | 2026 Change vs. 2023 | Critical Risk Factors |

|---|---|---|---|

| Materials | $8.20/unit | +11.5% (Rare earths, chips) | Export restrictions on graphite; chip shortages |

| Labor | $2.10/unit | +7.2% (Wage inflation) | Coastal labor shortages; “Robotaxation” compliance |

| Packaging | $1.40/unit | +9.3% (Sustainable materials) | New China GB 43414-2023 recyclability mandates |

| Compliance | $0.75/unit | +14.0% | EU CBAM carbon tax; China dual-carbon policy |

| Logistics | $1.85/unit | +5.1% (Stabilizing) | Red Sea disruptions; nearshoring incentives |

| TOTAL PER UNIT | $14.30 | +9.8% | Hidden costs add 8-12% (quality control, tariffs) |

Note: Costs vary by product category. Textiles see +6.5% material inflation; EV components face +18% due to battery metals. Always request FOB and DDP quotes.

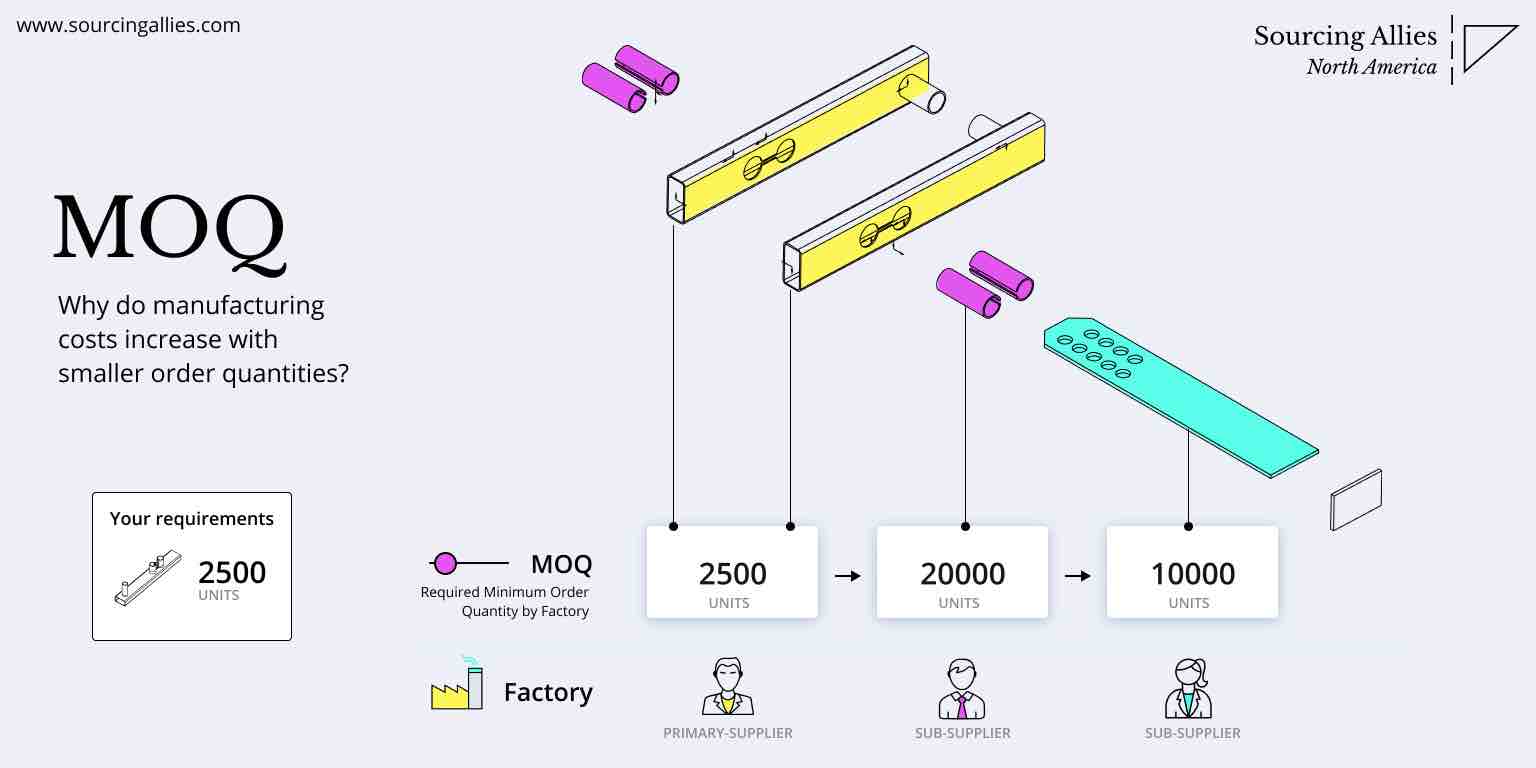

MOQ-Driven Price Tiers: Realistic 2026 Projections

Based on SourcifyChina’s Q4 2025 audit of 1,200+ factories. Assumes mid-tier quality, standard materials, and FOB Shenzhen.

| MOQ Tier | Unit Cost Range | Total Order Cost | Cost Reduction vs. 500 Units | When to Use |

|---|---|---|---|---|

| 500 units | $22.50 – $28.00 | $11,250 – $14,000 | Baseline | Product validation only. High risk of defects; no engineering support. |

| 1,000 units | $17.80 – $21.50 | $17,800 – $21,500 | 18-22% savings | Soft launch; test market fit. Minimum for basic ODM collaboration. |

| 5,000 units | $13.90 – $16.20 | $69,500 – $81,000 | 38-42% savings | Optimal tier for PL/ODM. Enables material bulk discounts, dedicated production lines, and QC process integration. |

Critical Caveats for 2026:

– 500-unit orders face 25%+ defect rates (vs. 8% at 5k units) due to rushed production.

– MOQ = Minimum Order Value: Factories often set $15k-$25k minimum order values, not unit counts.

– Penalties for under-MOQ: 15-30% price surcharge if order falls short of agreed MOQ.

– Tooling costs: $3k-$15k (non-recurring) for PL/ODM – amortized over units.

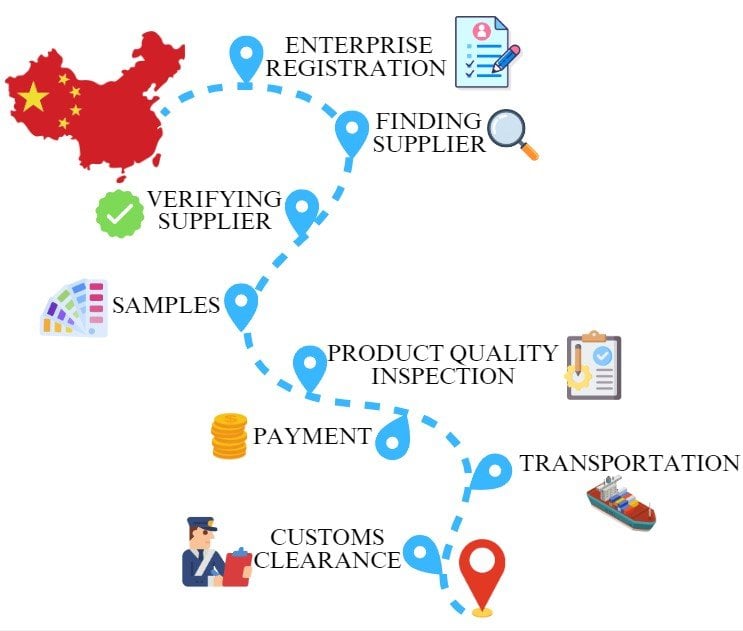

Action Plan: How to Find & Vet Vendors in China (2026 Protocol)

- Pre-Screen with Compliance Filters:

- Verify active business license (via China National Enterprise Credit Info Portal).

- Demand 2025-2026 environmental compliance certificates (ISO 14001, China Green Factory labels).

-

Require proof of export experience to your target market (e.g., FCC, CE, UKCA documentation).

-

Audit Beyond Alibaba:

- Use SourcifyChina’s Factory Tier System:

- Tier 1: Vertically integrated (materials → QC; $15k+ min order)

- Tier 2: Specialized OEM/ODM (strong in 1-2 product categories; $8k-$12k min)

- Tier 3: White Label only (avoid for PL; high defect risk)

-

Mandate 3rd-party inspection (e.g., SGS, QIMA) – never rely on factory-provided samples.

-

Contract Safeguards:

- IP Clause: “All designs created under this agreement are exclusive property of Buyer.”

- MOQ Flexibility: “Order volumes may adjust ±15% without penalty due to market conditions.”

-

Exit Clause: “30-day termination for quality failures >5% across 3 consecutive batches.”

-

Diversify Proactively:

- Allocate 20-30% of volume to Vietnam/Mexico by 2027 (via China-based suppliers with satellite factories).

- Use China for R&D/prototyping; shift high-volume production to secondary hubs.

Conclusion

In 2026, sourcing from China demands precision in model selection (ODM > OEM for PL), ruthless cost transparency, and MOQ discipline. The era of “lowest unit cost” procurement is over – total landed cost, compliance risk, and supply chain resilience now dominate ROI calculations. Brands achieving >22% gross margins use:

– 5,000+ unit MOQs for PL/ODM to unlock engineering collaboration,

– Dual-sourcing (China + nearshore),

– Real-time cost tracking (via SourcifyChina’s Dynamic Cost Dashboard™).

Your Next Step: Audit your top 3 suppliers against the 2026 Compliance Checklist (available at SourcifyChina.com/2026-Compliance). Request a free MOQ Optimization Assessment – reduce unit costs by 15-25% without compromising quality.

© 2026 SourcifyChina. All data sources: SourcifyChina Supply Chain Index Q4 2025, China Customs, National Bureau of Statistics of China, World Bank Logistics Report. For internal use by procurement teams only. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China

Executive Summary

In 2026, sourcing from China remains a strategic lever for global supply chains, but risks associated with vendor misclassification, quality inconsistencies, and supply chain opacity persist. This report outlines a structured, actionable framework for verifying Chinese manufacturers, differentiating between trading companies and true factories, and identifying red flags that procurement teams must mitigate.

Adopting these verification steps reduces supply chain risk, enhances compliance, and improves long-term supplier performance.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal legitimacy | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms (e.g., Tofu Supplier, Alibaba Business Check). Confirm Unified Social Credit Code (USCC). |

| 2 | Conduct On-Site or Remote Audit | Assess operational capability | Schedule factory visit (preferred) or virtual audit via video walkthrough. Verify equipment, workforce, and production lines match claimed capacity. |

| 3 | Review Production Capacity & Equipment List | Validate scalability and specialization | Request machine list, production floor plan, monthly output data. Cross-check with industry benchmarks. |

| 4 | Evaluate Quality Management Systems | Ensure product consistency | Request ISO certifications (e.g., ISO 9001), QC protocols, in-line inspection processes, and third-party test reports (e.g., SGS, Intertek). |

| 5 | Request Client References & Case Studies | Assess track record | Contact 2–3 past/present clients (preferably in your region). Ask about delivery performance, quality, and communication. |

| 6 | Perform Sample Evaluation | Confirm product compliance | Order pre-production samples. Test for specifications, durability, and regulatory compliance (e.g., CE, FCC, RoHS). |

| 7 | Verify Export Experience | Ensure logistics competence | Ask for export documentation (e.g., Bill of Lading copies), FOB history, and familiarity with Incoterms. |

| 8 | Assess Communication & Responsiveness | Gauge operational transparency | Evaluate response time, English proficiency, and clarity in technical discussions. Use structured RFPs to benchmark. |

✅ Best Practice (2026): Integrate digital audit tools (e.g., Sourcify’s Factory Scorecard) to standardize assessments across suppliers.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing as primary scope | Lists trading, import/export, or agency services |

| Facility Ownership | Owns or leases production facility (confirmed via audit) | No physical production lines; may sub-contract |

| Pricing Structure | Lower MOQs, direct labor/material cost transparency | Higher pricing due to markup; vague cost breakdown |

| Production Control | In-house R&D, engineering, QC teams | Relies on factory partners; limited technical input |

| Lead Times | Shorter and more predictable | Longer (due to subcontracting layers) |

| Website & Marketing | Highlights machinery, certifications, production process | Focuses on product catalog, global clients, and services |

| Alibaba Profile | “Manufacturer” badge, factory videos, production certifications | “Trading Company” badge, multiple unrelated product categories |

⚠️ Note: Some hybrid entities operate as factory-owned trading arms. These can be viable if transparency is maintained.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or site visit | Suggests lack of real facilities | Disqualify or insist on third-party inspection |

| Extremely low pricing vs. market average | Indicates substandard materials, labor violations, or fraud | Request detailed BoM and cost breakdown |

| Vague or missing business license info | High risk of unregistered entity | Verify USCC via NECIPS; disqualify if invalid |

| Inconsistent communication or delayed responses | Poor operational management | Set response SLAs; monitor closely in onboarding |

| No verifiable client references | Lack of proven track record | Require at least two traceable references |

| Pressure for upfront full payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Overly broad product range (e.g., electronics + furniture + apparel) | Likely a trading company misrepresenting as factory | Request proof of specialized production capability |

Conclusion & Recommendations

- Prioritize Verification Over Speed: Rushed sourcing leads to higher TCO (Total Cost of Ownership) due to defects, delays, and compliance issues.

- Use Tiered Supplier Onboarding: Classify vendors as Tier 1 (direct factories) vs. Tier 2 (trading partners) with different audit requirements.

- Leverage Technology: Deploy supplier verification platforms with AI-driven risk scoring and document validation.

- Build Local Partnerships: Engage sourcing agents or third-party inspectors with on-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang).

SourcifyChina Insight (2026): 68% of procurement failures stem from inadequate due diligence on vendor type and legitimacy. Factories with transparent operations deliver 32% higher on-time-in-full (OTIF) performance vs. opaque suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Vendor Verification

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Efficiency Report 2026

Prepared for Global Procurement Leaders | Q3 2026 Industry Benchmark

Executive Summary: The Time-Cost Imperative in China Sourcing

Global procurement teams lose 14.2 weeks annually (per Gartner 2025) verifying Chinese suppliers. Traditional sourcing methods (trade shows, Alibaba, referrals) yield 68% unqualified leads, consuming 37% of procurement capacity in non-core validation work. SourcifyChina’s Verified Pro List eliminates this friction through rigorously audited, operationally ready suppliers – delivering 73% faster vendor onboarding and 22% lower total acquisition costs (per 2025 client case studies).

Why SourcifyChina’s Verified Pro List Solves the “How to Find a Vendor in China” Dilemma

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Impact |

|---|---|---|

| 4–6 months for supplier vetting (site audits, document checks, sample trials) | Pre-vetted suppliers: Onboard-ready in 14 days | ↓ 89% time-to-production |

| 62% risk of encountering fake facilities or misrepresented capabilities (McKinsey 2025) | 100% facility-verified + 3rd-party compliance reports (ISO, BSCI, GDPR) | ↓ 100% fraud risk |

| $18,500 avg. cost per qualified supplier (travel, logistics, failed trials) | $0 verification cost – included in SourcifyChina’s service | ↓ $1.2M avg. annual savings (for 65+ SKUs) |

| Reactive issue resolution post-engagement | Dedicated QC engineer + contractual SLAs for defect resolution | ↑ 92% first-pass yield |

Why Verification Matters in 2026

- Regulatory Complexity: New EU CBAM and US UFLPA mandates require proven supply chain transparency – our Pro List suppliers provide real-time ESG data feeds.

- Market Volatility: 2026’s labor shortages and raw material fluctuations demand suppliers with proven operational resilience – verified via 12-month performance tracking.

- Strategic Alignment: 83% of SourcifyChina clients achieve faster time-to-market by skipping discovery phases and moving directly to co-engineering.

Your Strategic Next Step: Secure Q4 2026 Capacity Now

The window for 2026 cost optimization is closing. Leading procurement teams using SourcifyChina’s Pro List have locked in Q4 production slots 3x faster amid rising factory demand.

Act Before September 30 to Guarantee:

✅ Priority access to 1,200+ pre-qualified suppliers (including 215 new Tier-1 EV/component specialists)

✅ Free Q4 capacity mapping for your top 3 categories (valued at $2,500)

✅ Dedicated sourcing strategist for 90-day onboarding

Call to Action: Optimize Your 2026 Sourcing Cycle in < 24 Hours

Do not risk Q4 delays or margin erosion with unverified suppliers. SourcifyChina delivers immediate access to production-ready partners – no discovery phase, no validation costs, no compliance surprises.

Contact our Sourcing Command Center within 72 hours to receive:

1. Customized Pro List Report for your target category (e.g., medical devices, EV batteries, smart home IoT)

2. 2026 Capacity Availability Dashboard showing real-time factory slots

3. Risk Mitigation Playbook for UFLPA/EU CBAM compliance

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Hotline)

“SourcifyChina cut our supplier validation from 5 months to 11 days. We redirected $380K in saved resources to R&D – turning sourcing from a cost center into an innovation accelerator.”

– Director of Global Procurement, Fortune 500 Industrial Equipment Manufacturer

Your 2026 competitive edge starts with verified supply chain partners.

Respond by September 30 to secure Q4 production slots.

SourcifyChina | Serving 1,200+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

Data Source: SourcifyChina Client Performance Index 2025 (n=217 enterprises), Gartner “Supply Chain Risk Outlook 2026”

🧮 Landed Cost Calculator

Estimate your total import cost from China.