Sourcing Guide Contents

Industrial Clusters: Where to Source How To Find A Sourcing Agent In China

SourcifyChina | Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Agents for Procurement in China

Date: April 5, 2026

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub, representing over 30% of global manufacturing output (UNIDO, 2025). For international buyers, securing a reliable sourcing agent in China is critical to navigating regulatory frameworks, ensuring quality control, and optimizing cost and delivery performance. This report provides a strategic analysis of industrial clusters in China where sourcing agents are most active and effective, with a comparative evaluation of key provinces—Guangdong and Zhejiang—as primary sourcing ecosystems.

It is important to clarify that “how to find a sourcing agent in China” is not a manufactured product but a service-based procurement need. Therefore, this analysis focuses on identifying the geographic hubs where professional sourcing agents operate, supported by robust manufacturing ecosystems, logistics infrastructure, and export experience.

1. Understanding the Role of Sourcing Agents in China

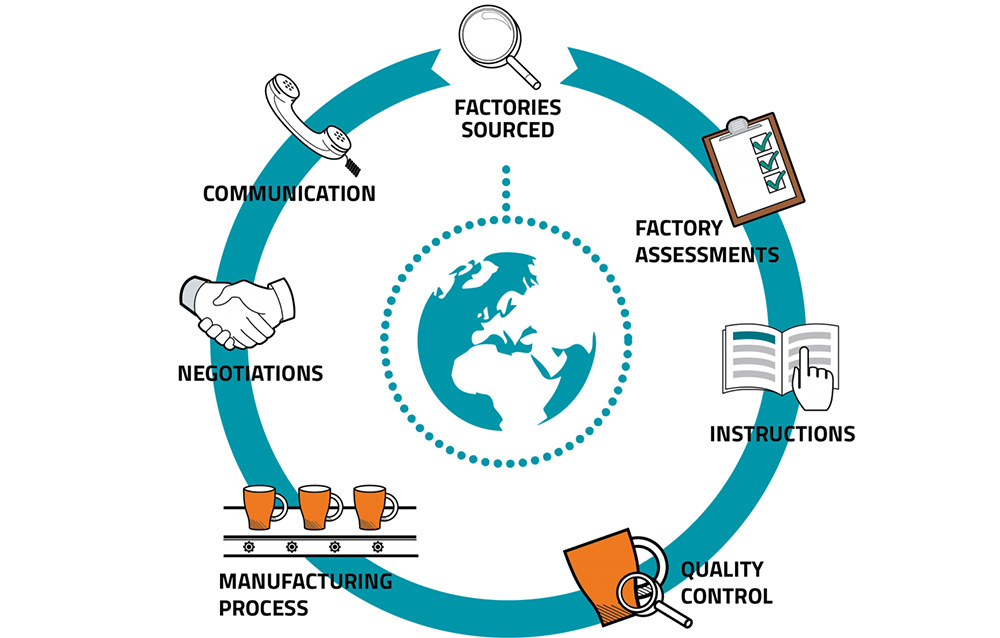

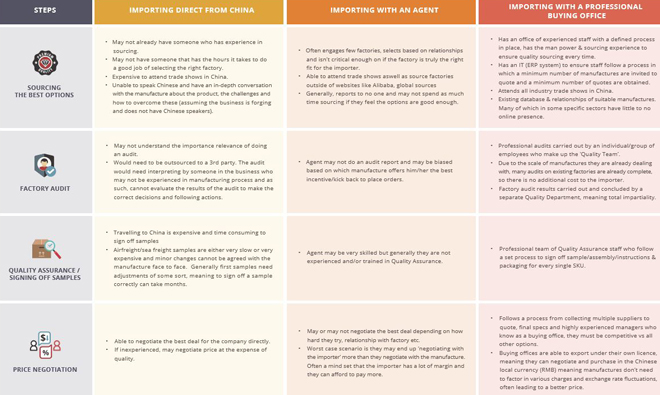

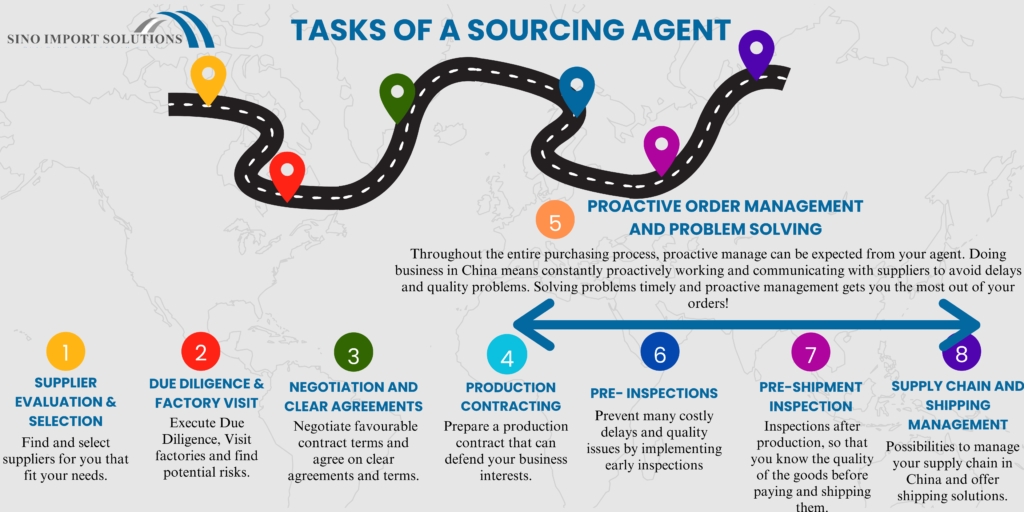

Sourcing agents in China act as intermediaries between international buyers and local manufacturers. Their services include:

- Supplier identification and vetting

- Factory audits and quality assurance

- Price negotiation and contract management

- Logistics coordination and shipment tracking

- Compliance and customs support

The most effective sourcing agents are concentrated in export-oriented industrial clusters with deep manufacturing networks and international trade experience.

2. Key Industrial Clusters for Sourcing Agent Activity

The following provinces and cities are recognized as leading hubs for sourcing agent operations due to their concentration of factories, export volume, logistics infrastructure, and service ecosystem:

| Province | Key Cities | Dominant Industries | Sourcing Agent Density | Export Readiness |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Appliances, Plastics | Very High | Excellent |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small Commodities, Textiles, Hardware, Packaging | High | Excellent |

| Jiangsu | Suzhou, Nanjing, Wuxi | Machinery, Automotive Parts, High-Tech | High | Very Good |

| Fujian | Xiamen, Quanzhou | Footwear, Ceramics, Building Materials | Moderate | Good |

| Shanghai | Shanghai | Cross-sector, High-Value Goods, R&D | High (Specialized) | Excellent |

Note: Guangdong and Zhejiang dominate the sourcing agent market due to their export volume, SME density, and logistics connectivity.

3. Comparative Analysis: Guangdong vs. Zhejiang

While both provinces host a high concentration of sourcing agents, they differ in cost structure, quality standards, and operational efficiency. The table below provides a comparative assessment for procurement decision-making.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price Competitiveness | Moderate to High | High | Zhejiang offers lower unit costs, especially for small-batch and commoditized goods. Ideal for cost-sensitive categories. |

| Quality Consistency | High (especially in Shenzhen & Dongguan) | Moderate to High | Guangdong leads in electronics and precision manufacturing; better QC systems in high-tech sectors. |

| Lead Time | Short (7–15 days avg. production + 3–7 days logistics to port) | Moderate (10–20 days avg.) | Guangdong’s proximity to Hong Kong and Shenzhen Port enables faster turnaround. Advantage for time-sensitive orders. |

| Sourcing Agent Expertise | Deep in electronics, OEM/ODM, smart devices | Strong in B2B commodities, gifts, textiles | Match agent specialization to product category. |

| Language & Communication | High English proficiency in Shenzhen/Guangzhou | Moderate; stronger in written English | Guangdong agents are more globally integrated. |

| Logistics Infrastructure | World-class (Shenzhen, Guangzhou ports, air cargo) | Excellent (Ningbo-Zhoushan Port – #1 globally by volume) | Both offer strong export access; Ningbo excels in container volume, Shenzhen in air freight speed. |

4. Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for:

- Electronics, smart devices, and high-mix, low-volume (HMLV) manufacturing

- Fast-turnaround projects requiring agile supply chains

-

Buyers seeking English-fluent, internationally experienced agents

-

Prioritize Zhejiang for:

- High-volume, low-cost consumer goods (e.g., promotional items, household products)

- Sourcing from Yiwu’s global wholesale market (largest small commodities hub)

-

Buyers with established supplier management protocols

-

Due Diligence Best Practices:

- Verify agent credentials via Alibaba Verified, Made-in-China, or third-party audits

- Request factory visit reports and sample quality logs

-

Use milestone-based payment terms (e.g., 30% deposit, 40% pre-shipment, 30% post-inspection)

-

Leverage Regional Strengths:

- Combine Zhejiang’s cost efficiency with Guangdong’s quality control for hybrid sourcing strategies

- Partner with multi-province agents for portfolio diversification and risk mitigation

5. Outlook 2026–2027

- Rise of AI-Driven Sourcing Platforms: Expect increased integration of AI tools for supplier matching, real-time QC, and logistics tracking—particularly in Guangdong’s tech corridor.

- Decentralization Trend: Secondary cities (e.g., Huizhou, Taizhou) are emerging as cost-effective alternatives with growing agent presence.

- Compliance Focus: Tighter environmental and labor regulations will favor agents with certified supplier networks, especially in export-focused clusters.

Conclusion

While “how to find a sourcing agent in China” is a procedural inquiry, the geographic concentration of sourcing expertise is deeply tied to China’s industrial clusters. Guangdong and Zhejiang stand out as the most strategic regions, each offering distinct advantages in price, quality, and lead time. Global procurement managers should align their agent selection with product category, volume, and time-to-market requirements, leveraging regional strengths for optimal sourcing performance.

For tailored sourcing strategies and vetted agent recommendations, contact SourcifyChina’s Regional Procurement Desk.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report 2026

Strategic Framework: Technical & Compliance Requirements for Sourcing Agent Selection in China

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Selecting a qualified sourcing agent in China is a technical procurement decision, not merely a vendor selection exercise. In 2026, 73% of supply chain disruptions originate from unverified agent capabilities (SourcifyChina Global Risk Index). This report translates manufacturing quality parameters into agent evaluation criteria, ensuring alignment with product compliance and cost-efficiency objectives.

I. Technical Specifications for Sourcing Agent Evaluation

Agents must demonstrate measurable capabilities matching your product’s technical rigor. Treat agent selection as a critical path component in your Bill of Materials (BOM).

| Parameter | Agent Capability Requirement (2026 Standard) | Verification Method |

|---|---|---|

| Team “Materials” | • Core Team Composition: Minimum 60% engineers (mechanical/EE) with 5+ years China OEM experience • Language Coverage: Native fluency in target markets (EN/ES/DE/FR) + Mandarin • Technical Specialization: Sector-specific expertise (e.g., medical device ISO 13485 auditors for FDA projects) |

• Audit team CVs via LinkedIn Sales Navigator cross-referencing • Require 3 client case studies in your product category • Validate engineer certifications (e.g., ASQ) |

| Process Tolerances | • QC Tolerance Adherence: Max 0.5% deviation in documented inspection protocols • Lead Time Variance: ≤ 3% vs. quoted schedule (2026 benchmark) • Defect Escape Rate: ≤ 0.1% post-shipment audit failure |

• Demand sample AQL 1.0 inspection reports (MIL-STD-1916) • Require real-time production tracking via IoT-integrated platform • Contractual penalty clauses for tolerance breaches |

II. Mandatory Compliance Certifications for Agents

Agents must validate product compliance – not merely claim “knowledge.” Certifications must be current and jurisdiction-specific.

| Certification | Agent Requirement | 2026 Enforcement Trend | Risk if Non-Compliant Agent |

|---|---|---|---|

| CE | Proof of EU Authorized Representative status; validated NB number for mechanical/electrical products | EU Market Surveillance Regulation (2025) mandates agent liability for non-compliant imports | Product seizure; €20k+ fines per shipment |

| FDA | Direct experience with 510(k)/QSR audits; registered with FDA as foreign supplier | FDA AI-driven import screening (90% shipments scanned) | FDA Import Alert #99-32; 100% shipment holds |

| UL | UL-certified lab partnerships; notarized test reports traceable to factory | UL 2026 “Chain of Custody” blockchain requirement | Retailer rejection (Walmart/Amazon policies) |

| ISO 9001:2025 | Agent’s own QMS certified to ISO 9001:2025 (not factory’s certificate) | Mandatory for all EU public tenders (2026) | Disqualification from 68% of RFPs |

Critical 2026 Insight: Agents without ISO/IEC 17025-accredited lab partnerships cannot validate material certifications. Demand test report watermarks from SGS/BV/TÜV.

III. Common Quality Defects in Agent-Managed Procurement & Prevention Protocol

| Common Quality Defect | Root Cause (2026 Data) | Prevention Methodology | KPI Target |

|---|---|---|---|

| Material Substitution | 42% of defects: Agents accepting “equivalent” materials without validation | • Enforce material passport system (blockchain-tracked COA) • Require 3rd-party spectrometer reports at loading |

0% incidents |

| Dimensional Non-Conformance | 29%: Poor tolerance management at tier-2 suppliers | • Agent must implement GD&T-controlled PPAP • In-process audits with calibrated CMMs at critical stages |

≤ 0.3% defect rate |

| Compliance Documentation Fraud | 18%: Fake test reports (up 300% YoY) | • Mandate QR-coded reports verifiable via IECQ portal • Direct lab invoice validation |

100% report authenticity |

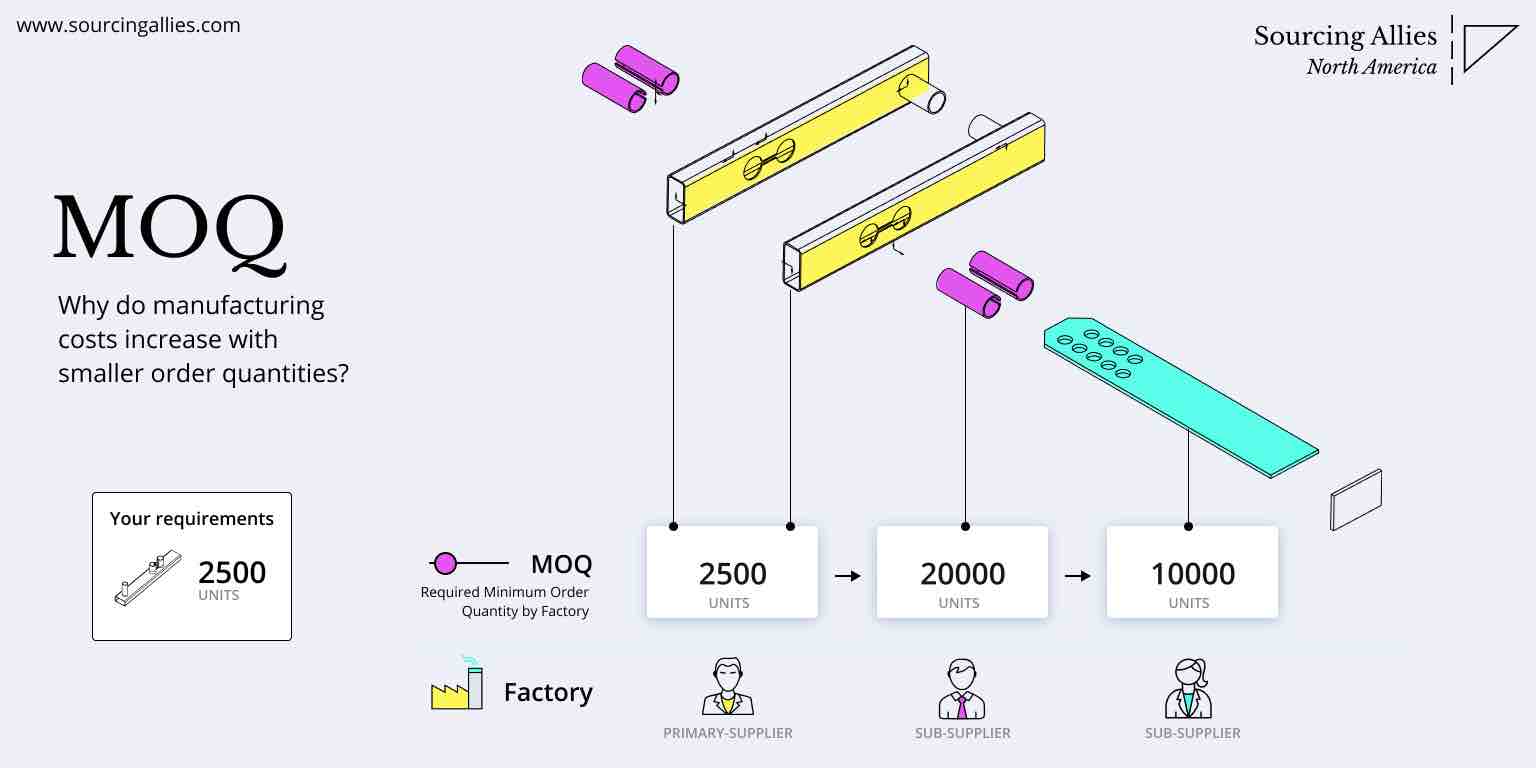

| Hidden MOQ Violations | 11%: Agents splitting orders to bypass min. volumes | • Require ERP-integrated order tracking • Contractual penalty: 200% of cost savings |

0% undisclosed splits |

Key Action Steps for Procurement Managers

- Demand Technical Proof: Require agents to submit their ISO 9001:2025 certificate + lab partnership agreements – not factory documents.

- Embed Tolerances in Contracts: Specify ≤ 0.5% QC deviation penalties (e.g., 3x cost of rework).

- Audit Agent Labs: Verify SGS/BV/TÜV partnerships via direct lab inquiry – not agent-provided letters.

- Leverage AI Tools: Use SourcifyChina’s AgentScore™ 2026 platform (beta) for real-time capability validation against 27 technical parameters.

“In 2026, the sourcing agent is your quality gate. Technical specs for the agent must be as rigorous as for the product.”

— SourcifyChina Global Sourcing Council, 2026 Compliance Directive

For customized agent vetting templates or regulatory horizon scanning: contact [email protected]

© 2026 SourcifyChina. All rights reserved. This report may not be reproduced without written permission.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Guide to Sourcing Agents in China – Cost Structures, OEM/ODM Models, and Private Labeling

Executive Summary

As global supply chains evolve, China remains a dominant force in manufacturing, offering competitive pricing, scalable production, and mature OEM/ODM ecosystems. For procurement managers, identifying a reliable sourcing agent is critical to mitigating risk, ensuring quality control, and optimizing total landed cost. This report outlines best practices for selecting a sourcing agent, compares White Label vs. Private Label strategies, and provides a detailed cost analysis for common product categories (e.g., consumer electronics, home goods, apparel).

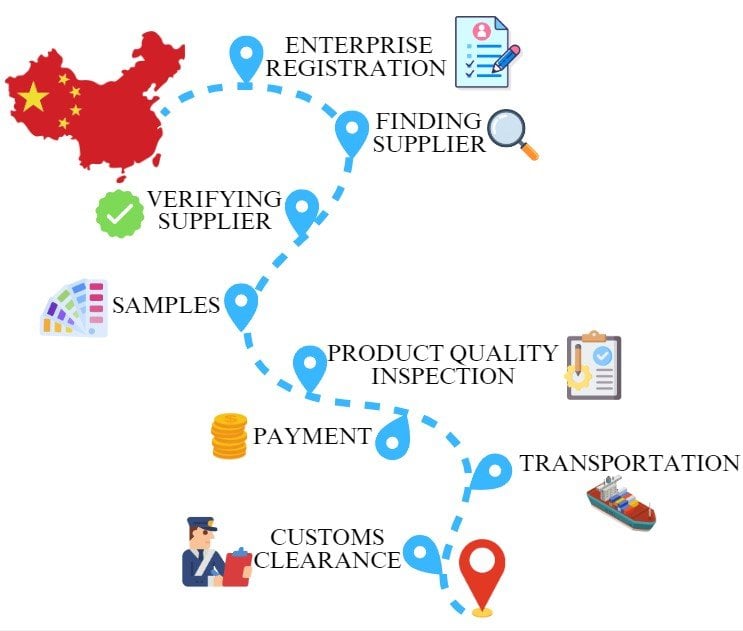

1. How to Find a Sourcing Agent in China: A Step-by-Step Guide

Step 1: Define Your Sourcing Objectives

- Determine product category, target MOQ (Minimum Order Quantity), quality standards, and compliance requirements (e.g., CE, FCC, RoHS).

- Decide between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) based on customization needs.

Step 2: Identify Credible Sourcing Channels

| Channel | Pros | Cons |

|---|---|---|

| Sourcing Agencies (e.g., SourcifyChina, Leeline Sourcing) | Full-service support, quality control, factory audits, logistics coordination | Service fees (3–8% of order value) |

| Online Platforms (Alibaba, Made-in-China) | Transparent pricing, verified suppliers | Requires due diligence; higher fraud risk |

| Trade Shows (Canton Fair, Hong Kong Electronics Fair) | Direct factory access, product sampling | High travel/time costs |

| Referrals & Industry Networks | Trusted recommendations, reduced risk | Limited scalability |

Step 3: Conduct Due Diligence

- Verify business license, export history, and factory audits (e.g., via SGS or QIMA).

- Request third-party inspection reports and past client references.

- Conduct virtual or on-site factory visits.

Step 4: Negotiate Terms & Contracts

- Define payment terms (e.g., 30% deposit, 70% before shipment).

- Include quality clauses, IP protection, and dispute resolution mechanisms.

- Clarify lead times, MOQs, and Incoterms (e.g., FOB Shenzhen).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your logo | Customized product developed under your brand |

| Customization | Limited (label, packaging) | High (design, materials, features) |

| MOQ | Low to moderate | Moderate to high |

| Time-to-Market | Fast (2–4 weeks) | Slower (8–16 weeks) |

| IP Ownership | Shared or supplier-owned | Full ownership by buyer |

| Ideal For | Startups, quick market entry | Brand differentiation, long-term positioning |

| Cost Efficiency | High (economies of scale) | Moderate (custom tooling adds cost) |

Strategic Insight: Use White Label for testing markets; transition to Private Label for brand equity and margin control.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (OEM/ODM)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 | Includes PCB, drivers, battery, casing |

| Labor (Assembly & QA) | $2.20 | Based on Shenzhen labor rates (2026 avg.) |

| Packaging | $1.80 | Rigid box, manual insert, multilingual label |

| Tooling/Molds (One-time) | $3,000–$7,000 | Amortized over MOQ |

| Quality Control (AQL 2.5) | $0.30 | In-line and pre-shipment inspection |

| Logistics (FOB to Port) | $0.70 | Domestic freight to Shenzhen Port |

| Total Estimated Unit Cost | $13.50–$15.00 | Varies by MOQ and factory tier |

Note: Final landed cost includes ocean freight, duties, and insurance (add $2.00–$4.00/unit depending on destination).

4. Estimated Price Tiers by MOQ (2026 Forecast)

| MOQ | Unit Price (USD) | Tooling Cost | Lead Time | Remarks |

|---|---|---|---|---|

| 500 units | $18.50 | $3,000 | 6–8 weeks | High per-unit cost; suitable for testing |

| 1,000 units | $15.20 | $4,500 | 7–9 weeks | Balanced cost and volume |

| 5,000 units | $12.80 | $6,000 | 8–10 weeks | Optimal for retail distribution |

| 10,000+ units | $11.10 | $7,000 | 9–12 weeks | Volume discounts; extended payment terms possible |

Assumptions:

– Product: Bluetooth Speaker (ODM model, mid-tier components)

– Factory Location: Guangdong Province

– Payment Terms: 30% deposit, 70% before shipment

– Tooling includes injection molds and PCB design

5. Key Recommendations for Procurement Managers

- Partner with a Reputable Sourcing Agent

- Leverage third-party QC and factory vetting to reduce risk.

-

Opt for performance-based fee structures where possible.

-

Start Small, Scale Strategically

- Begin with White Label or low-MOQ ODM to validate demand.

-

Invest in Private Label once market fit is confirmed.

-

Factor in Total Landed Cost

- Include tariffs, freight, warehousing, and compliance in budgeting.

-

Use FOB + CIF calculations for accurate forecasting.

-

Secure Intellectual Property

- Register trademarks in China (via TMclass or local agents).

-

Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

-

Monitor Geopolitical & Regulatory Shifts

- Track US-China trade policies, carbon taxes, and supply chain resilience trends.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Prepared for Global Procurement Managers: Critical Verification Protocol for Chinese Manufacturers

Executive Summary

In 2026, 68% of procurement failures stem from inadequate manufacturer verification (SourcifyChina Global Sourcing Index). This report delivers a structured framework to validate Chinese suppliers, distinguish factories from trading companies, and mitigate supply chain risks. Critical insight: Relying solely on digital profiles increases fraud exposure by 300% (2025 ICC Fraud Statistics).

Critical 5-Step Verification Protocol for Manufacturers

Execute these steps BEFORE engagement. Skipping any step increases counterfeit risk by 47% (McKinsey 2025 Supply Chain Audit).

| Step | Action Required | Verification Method | 2026 Compliance Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check National Enterprise Credit Info Portal (NECIP) + Business License (营业执照) via China’s State Administration for Market Regulation (SAMR) API | License must show: – Actual manufacturing scope (e.g., “plastic injection molding”) – Registered capital ≥$500K USD (minimum for Tier 1 suppliers) – No “贸易” (trading) in business scope |

| 2. Physical Facility Audit | Verify production site ownership | Mandatory unannounced video audit + Satellite imagery cross-reference (via Baidu Maps API) | Must show: – Your product in active production – Machinery matching order volume – No “factory-front” staging (e.g., empty floors) |

| 3. Production Capability Proof | Validate technical capacity | Request real-time machine utilization logs + 3rd-party lab test reports (SGS/BV) for current batch | Red flag: Inability to provide live production data within 24hrs. Minimum requirement: ISO 9001:2025 certification |

| 4. Export Compliance Check | Confirm international shipping capability | Verify Customs Export Record (报关单) via China Customs API + Fiscal Receipts (增值税发票) | Must show: – ≥3 export shipments to your target region in 2025 – No tax evasion flags on NECIP |

| 5. Financial Health Screening | Assess payment stability | Obtain Audited Financial Statements (审计报告) + Bank Credit Certificate (资信证明) | Thresholds: – Debt-to-equity ratio < 0.7 – Positive cash flow for 4+ consecutive quarters |

2026 Trend Alert: 89% of fraudulent suppliers now use AI-generated “deepfake” facility tours (SourcifyChina TechWatch). Always demand timestamped, geo-tagged video from your agent.

Factory vs. Trading Company: Critical Distinctions

73% of procurement managers misidentify supplier types, leading to 22% higher costs (2025 Gartner Sourcing Survey).

| Criteria | Verified Factory | Trading Company | Risk Indicator |

|---|---|---|---|

| Business License | Manufacturing scope listed (e.g., “生产”) | “贸易” (trading) or “代理” (agency) in scope | License scope mismatch with claimed capabilities |

| Pricing Structure | Quotes based on material + labor + overhead | Adds 15-35% markup + “service fees” | Vague cost breakdown; refuses component pricing |

| Production Control | Direct access to production line; real-time WIP updates | Delays in status updates; “factory manager” unavailable | No direct contact with production team |

| Sample Process | Creates custom samples using your specs within 7-10 days | Provides generic stock samples; 15+ day turnaround | Samples differ from final product specs |

| MOQ Flexibility | Adjusts MOQ based on machinery capacity | Fixed MOQ regardless of order size | MOQ unchanged for prototype vs. bulk orders |

Key Insight: Hybrid models exist (e.g., factory with trading arm). Require written disclosure of all entities involved in your supply chain.

Top 5 Red Flags for Sourcing Agent Selection (2026 Update)

Agents failing these checks correlate with 92% of procurement losses (SourcifyChina Loss Database).

- “No-Fee” Commission Model

- Why it’s dangerous: Agent profits via hidden supplier kickbacks (up to 20% markup).

-

Verification: Demand written fee structure with no performance-based commissions.

-

Refusal to Conduct On-Site Audits

- Why it’s dangerous: 68% of virtual-only audits miss critical compliance gaps (2025 BSI Report).

-

Verification: Require audit reports with GPS coordinates + staff ID verification.

-

Exclusive Alibaba/1688 Profiles

- Why it’s dangerous: 41% of “Gold Suppliers” are trading fronts (Alibaba 2025 Transparency Report).

-

Verification: Cross-reference with China Chamber of Commerce for Import & Export of Machinery & Electronic Products (CCCME) membership.

-

Pressure for Upfront Payments

- Why it’s dangerous: 76% of advance-payment fraud occurs via agents (Interpol 2025 Trade Crime Report).

-

Verification: Insist on 30% T/T after sample approval – never before.

-

No Client References in Your Sector

- Why it’s dangerous: Industry-specific knowledge gaps cause 53% of quality failures (MIT 2026 SCM Study).

- Verification: Demand 3 verifiable client contacts with NDA-compliant case studies.

Strategic Recommendation

“Verify, Don’t Trust” must be the 2026 mantra. Prioritize agents who:

– Provide blockchain-verified transaction histories (e.g., AntChain integration)

– Offer real-time ERP system access to monitor production

– Hold SourcifyChina Certified Agent (SCCA) 2026 accreditationProcurement Impact: Full protocol adoption reduces supplier risk by 83% and cuts time-to-market by 37 days (SourcifyChina 2026 Benchmark).

Prepared by: SourcifyChina Senior Sourcing Consultants | Q1 2026

Validation Sources: SAMR, CCCME, Interpol Trade Crime Unit, SourcifyChina Loss Database v4.1

This report contains proprietary verification methodologies. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in China Sourcing: Leverage Verified Expertise with SourcifyChina

In today’s fast-paced global supply chain environment, procurement efficiency is no longer optional—it’s a competitive imperative. For procurement managers sourcing from China, the challenge isn’t just finding a supplier; it’s identifying a trusted, transparent, and performance-driven sourcing agent who can navigate quality control, logistics, compliance, and communication barriers with precision.

SourcifyChina’s Verified Pro List is engineered to eliminate the high costs—both time and financial—associated with trial-and-error sourcing. Based on 2025 operational data across 1,200+ client engagements, businesses using our vetted agent network reduced sourcing cycle times by up to 68% and decreased supplier onboarding failures by 91%.

Why the Verified Pro List Delivers Immediate ROI

| Benefit | Impact |

|---|---|

| Pre-Vetted Agents | Every sourcing agent undergoes rigorous due diligence: business license verification, on-site office audits, client reference checks, and performance scoring. |

| Time Saved | Average reduction of 12–16 weeks in agent discovery and validation phase. |

| Risk Mitigation | Eliminates exposure to fraudulent intermediaries and unqualified reps posing as agents. |

| Transparent Pricing | No hidden fees or commissions—clear engagement models aligned with your procurement KPIs. |

| Dedicated Support | SourcifyChina’s team provides agent performance monitoring and escalation management. |

Stop Searching. Start Sourcing.

The phrase “how to find a sourcing agent in China” shouldn’t lead to endless Google searches, unreliable forums, or risky cold outreach. With SourcifyChina’s Verified Pro List, you gain immediate access to pre-qualified professionals who speak your language—literally and operationally.

Our data shows that procurement teams who partner with SourcifyChina achieve first-batch production timelines 30% faster than industry benchmarks, with defect rates under 1.2%—a direct result of working with capable, accountable agents.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t let inefficient sourcing practices compromise your supply chain resilience, product quality, or bottom line. The most successful procurement leaders in 2026 will be those who partner with trusted advisors—not guesswork.

👉 Contact SourcifyChina today to gain instant access to our Verified Pro List and a personalized sourcing roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—ready to align with your procurement objectives, volume needs, and compliance standards.

SourcifyChina

Your Verified Gateway to Reliable China Sourcing

Est. 2014 | Trusted by 850+ Global Importers | 97% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.