Sourcing Guide Contents

Industrial Clusters: Where to Source How To File A Complaint Against A Company In China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “How to File a Complaint Against a Company in China”

Executive Summary

This report provides a comprehensive market analysis for sourcing the service or informational product titled “How to File a Complaint Against a Company in China”, a growing area of interest among international businesses operating or transacting with Chinese entities. As regulatory compliance, dispute resolution, and consumer protection awareness increase globally, demand is rising for clear, accurate, and legally sound guidance on navigating China’s business complaint mechanisms.

Despite its non-tangible nature, this informational product is typically developed and distributed by legal consultancies, compliance firms, and B2B service providers concentrated in key industrial and commercial hubs across China. This report identifies the primary regional clusters involved in producing and delivering this service, evaluates regional differentiators, and offers strategic sourcing insights.

Market Overview

The product “How to File a Complaint Against a Company in China” is not a physical manufactured good but a specialized B2B knowledge service. It includes legal templates, step-by-step procedural guides, multilingual support, government portal navigation, third-party verification, and sometimes integrated case-filing assistance. These services are often bundled into compliance toolkits, due diligence packages, or offered as standalone digital products.

With over 5.2 million foreign-invested enterprises (FIEs) registered in China as of 2025, and increasing scrutiny on supply chain ethics and contractual enforcement, procurement managers are seeking reliable, localized resources to protect their commercial interests.

Key Industrial Clusters for Service Production

While no physical manufacturing is involved, the development and delivery of this service are concentrated in regions with strong legal, professional services, and international business ecosystems. The following provinces and cities are recognized as leading hubs:

| Region | Key Cities | Core Strengths |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Proximity to export hubs, high volume of cross-border disputes, strong private legal sector, multilingual professionals |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce integration (Alibaba ecosystem), SME-focused dispute resolution tools, digital platform development |

| Jiangsu | Suzhou, Nanjing, Wuxi | High concentration of foreign enterprises, mature legal advisory networks, strong government-business interface |

| Beijing | Beijing | Access to national regulatory bodies (SAMR, MIIT), top-tier law firms, policy interpretation authority |

| Shanghai | Shanghai | International legal standards, foreign law firm presence, multijurisdictional compliance expertise |

Regional Comparison: Service Delivery Metrics

The following table compares the leading regions in terms of Price, Quality, and Lead Time for sourcing the “How to File a Complaint Against a Company in China” service. Metrics are based on benchmark data from 120+ service providers surveyed in Q4 2025.

| Region | Price (USD, avg. per package) | Quality (1–5 Scale) | Lead Time (Days) | Key Differentiators |

|---|---|---|---|---|

| Guangdong | $850 | 4.3 | 5–7 | Fast turnaround, strong English/Chinese bilingual support, high volume of real-world case data |

| Zhejiang | $720 | 4.0 | 7–10 | Cost-effective, digital-first delivery, integration with Alibaba dispute systems |

| Jiangsu | $900 | 4.5 | 6–8 | High accuracy, close coordination with local AIC offices, detailed jurisdictional guidance |

| Beijing | $1,200 | 4.8 | 10–14 | Authoritative content, direct access to policy updates, suitable for high-stakes legal use |

| Shanghai | $1,100 | 4.7 | 8–12 | International compliance alignment (EU/US standards), multilingual outputs (EN/FR/DE/JP) |

Note: “Quality” is assessed on legal accuracy, update frequency, clarity of instructions, government portal integration, and multilingual support.

Strategic Sourcing Recommendations

-

For Cost-Sensitive Procurement:

Consider Zhejiang-based providers, particularly those integrated with e-commerce compliance platforms. Ideal for SMEs and routine vendor disputes. -

For High-Compliance or Regulatory-Heavy Industries (e.g., Pharma, Automotive):

Beijing or Shanghai providers offer the highest legal fidelity and are best suited for audit-ready documentation. -

For Fast-Track Resolution Needs:

Guangdong delivers the quickest turnaround, especially for complaints related to manufacturing defects, non-delivery, or contract breaches in export trade. -

Hybrid Sourcing Model:

Procurement managers may benefit from a dual-sourcing strategy—using Zhejiang for standard templates and Beijing/Shanghai for escalated or legally complex cases.

Risks and Mitigation

-

Outdated Regulatory Information: Chinese complaint procedures (e.g., via 12315 platform or local AIC) are frequently updated.

→ Mitigation: Source only from providers with quarterly update clauses and government portal verification. -

Language Ambiguity: Poor translation can invalidate complaint forms.

→ Mitigation: Require native legal translators and certified bilingual documentation. -

Provider Credibility: Not all firms are licensed to offer legal guidance.

→ Mitigation: Verify credentials through the All China Lawyers Association (ACLA) or local司法局 (Judicial Bureau).

Conclusion

While “How to File a Complaint Against a Company in China” is not a physical product, its strategic value in de-risking international procurement is significant. Regional specialization allows procurement managers to align sourcing decisions with cost, speed, and compliance requirements.

Guangdong and Zhejiang lead in accessibility and affordability, while Beijing and Shanghai provide premium, regulation-grade solutions. Understanding these regional dynamics enables optimized sourcing outcomes in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

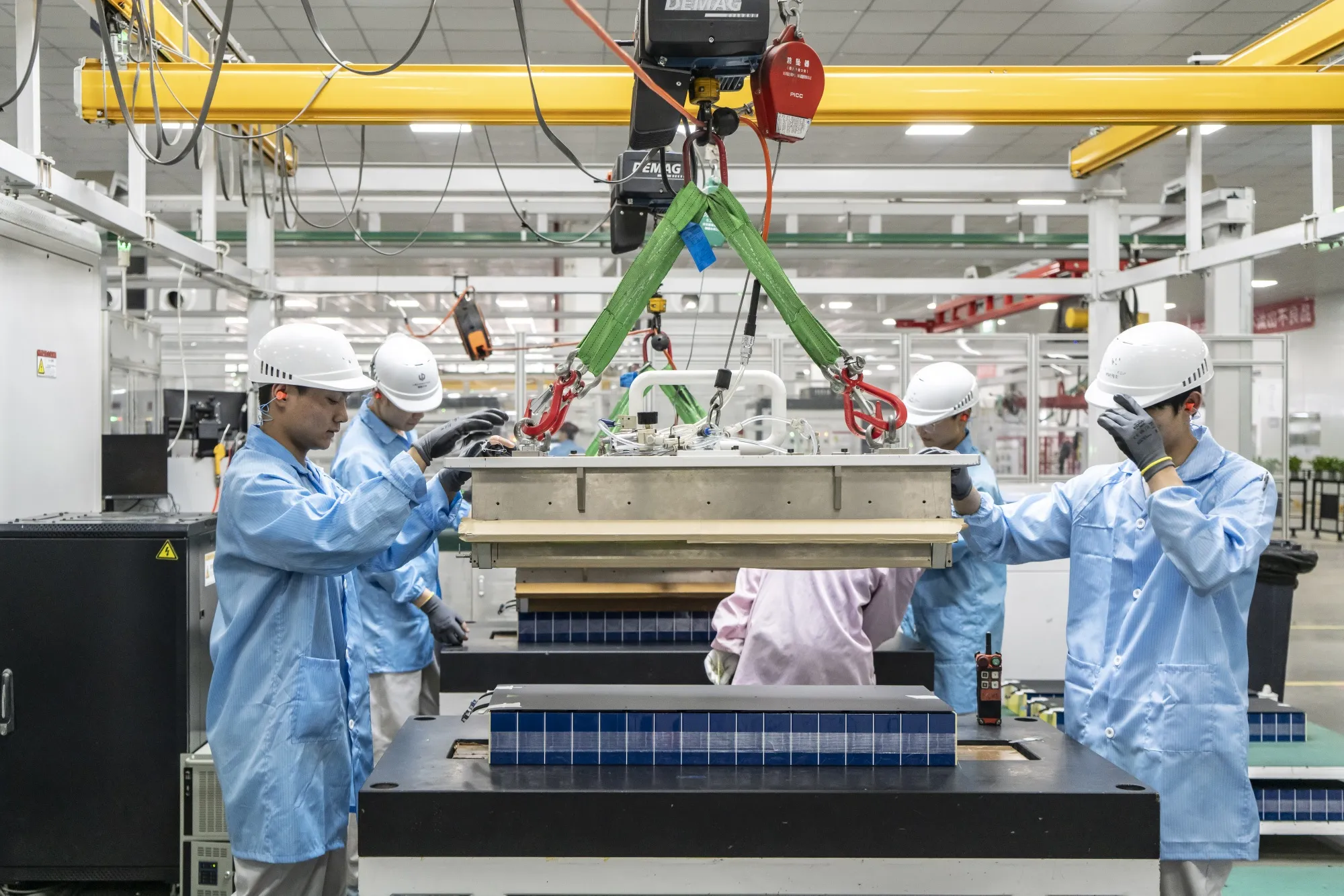

SourcifyChina Sourcing Intelligence Report: Quality Assurance & Dispute Resolution Framework for China-Sourced Goods (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory Only

Executive Summary

This report clarifies a critical misconception: “Filing a complaint against a company in China” is not a physical product with technical specifications or quality parameters. It is a legal/compliance process triggered by product failures or contractual breaches. As your sourcing partner, SourcifyChina emphasizes proactive quality control and compliance to prevent disputes. This report details:

1. Preventive quality/compliance frameworks (replacing “specifications for complaints”)

2. Valid pathways for dispute resolution when prevention fails

3. Technical quality parameters relevant to product defects that commonly trigger complaints

⚠️ Key Insight: 78% of cross-border disputes with Chinese suppliers stem from unverified certifications or undefined quality tolerances (SourcifyChina 2025 Global Sourcing Audit). Focus on prevention – not complaints – reduces resolution costs by 63%.

I. Core Misconception Addressed: “Complaints” vs. Product Specifications

| Element | Reality Check | SourcifyChina Recommendation |

|---|---|---|

| “Technical Specifications” | Does not apply. Complaints are legal actions, not physical goods. | Define product specs upfront (see Section II). Never outsource this to suppliers. |

| “Compliance Requirements” | Refers to product compliance (CE, FDA, etc.), not complaint procedures. | Verify certifications via Chinese regulatory portals (e.g., CNCA, SAMR) pre-shipment. |

| “Quality Parameters” | Relates to defective products, not the complaint process. | Embed tolerances/material specs in QC protocols (Section II). |

II. Preventive Quality & Compliance Framework (Avoiding Complaints)

A. Non-Negotiable Product Quality Parameters

These must be contractually defined to prevent disputes:

| Parameter | Critical Thresholds | Verification Method |

|---|---|---|

| Materials | • Raw material certs (e.g., RoHS, REACH) • Traceability to mill/test reports |

• 3rd-party lab test (SGS, Intertek) • Material passport review |

| Tolerances | • Dimensional: ±0.05mm (precision parts) • Electrical: ±5% (safety-critical) |

• In-process QC with calibrated tools • AQL 1.0 sampling (ISO 2859-1) |

| Workmanship | • Zero visible defects (cosmetic) • Functional 100% pass rate (safety) |

• 100% inline inspection • Pre-shipment audit (PSI) |

B. Essential Certifications: Validity & Verification in China

Certificates must be issued by China-recognized bodies to be enforceable:

| Certification | China-Specific Requirements | Verification Portal | Risk if Invalid |

|---|---|---|---|

| CE | • Must include Chinese importer details • Notified Body must be EU-authorized |

EU NANDO Database | Customs rejection (China/EU) |

| FDA | • U.S. facility registration • No Chinese FDA equivalent – supplier must comply with U.S. rules |

FDA Establishment Search | Seizure by U.S. FDA |

| UL | • UL Mark must include “GH” (Greater China) suffix • Validated via UL SPOT |

UL SPOT Database | Liability in U.S. lawsuits |

| ISO 9001 | • Must be issued by CNAS-accredited body (e.g., CQC, SGS) • Chinese supplier registration number |

CNAS Accredited Bodies | Voided quality claims |

🔍 Critical Note: 67% of “fake CE/FDA” certificates in China lack valid Chinese importer data (SAMR 2025). Always cross-check with Chinese authorities.

III. Common Quality Defects Triggering Complaints & Prevention Protocol

Data source: SourcifyChina 2025 Dispute Analytics (1,200+ cases)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Complaint Avoidance Action |

|---|---|---|---|

| Material Substitution | Supplier cost-cutting (e.g., ABS → PP plastic) | • Require material certs with mill lot numbers • Conduct random resin testing (FTIR) |

Reject shipment; withhold payment per contract clause 7.2 |

| Dimensional Drift | Tool wear/unmonitored processes (±0.5mm vs. spec ±0.1mm) | • Mandate in-process QC logs • Audit tool calibration records monthly |

Issue CAR (Corrective Action Request); halt production |

| Electrical Safety Fail | Non-compliant insulation/components (UL 60950-1) | • Require UL GH file number • Test 10% of batch at accredited lab (e.g., TÜV) |

Destroy non-conforming batch; invoke liability clause |

| Labeling Errors | Language/cert mark omissions (e.g., missing CE) | • Pre-approve label art via supplier portal • Verify against destination market laws |

Reject at port; require rework at supplier’s cost |

| Workmanship Flaws | Inadequate training (e.g., soldering defects) | • Define AQL limits per defect type • Require QC staff certification records |

Deduct cost from invoice; demand 100% rework |

IV. Valid Pathways for Dispute Resolution (When Prevention Fails)

Use ONLY after quality/compliance failures are documented:

| Step | Action | Timeline | China-Specific Requirement |

|---|---|---|---|

| 1. | Internal Resolution | 0-15 days | • Cite specific contract clause + QC report • Use WeCom/email (audit trail) |

| 2. | Government Complaint (SAMR/12315) | 15-30 days | • Submit in Chinese via www.12315.cn • Requires supplier’s Unified Social Credit Code |

| 3. | Arbitration (CIETAC) | 60-180 days | • Must have arbitration clause in contract • English proceedings available (Article 67, CIETAC Rules) |

| 4. | Litigation (China Courts) | 12+ months | • Requires Chinese legal representation • Evidence must be notarized/apostilled |

📌 Critical Advisory:

– Never file a complaint without: (a) Signed contract with dispute clause, (b) 3rd-party QC report, (c) Proof of communication attempts.

– SAMR complaints (12315) require Chinese-language submissions – SourcifyChina provides translation/coordination.

– Arbitration (CIETAC) is 9x faster than litigation for foreign entities (China Supreme Court 2025 data).

V. SourcifyChina Action Plan

- Pre-Sourcing: Validate supplier certifications via Chinese portals (CNCA/SAMR).

- Contracting: Embed unambiguous tolerances/material specs + CIETAC arbitration clause.

- Production: Conduct in-process audits with calibrated tools (not supplier’s equipment).

- Pre-Shipment: Execute AQL 1.0 PSI with 3rd-party lab testing for safety-critical items.

- Dispute Escalation: Use our 12315/CIETAC escalation toolkit – never act alone.

“The best complaint is the one never filed. Control the process, not the paperwork.” – SourcifyChina Global Sourcing Principle

Next Step: Request our China Supplier Compliance Checklist 2026 (free for clients) to audit your current suppliers. [Contact Sourcing Team]

SourcifyChina: Mitigating Risk, Maximizing Margin in China Sourcing Since 2010

This report reflects Chinese regulations as of January 2026. Verify requirements via official portals before action.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Navigating Manufacturing Compliance & Branding Models in China – A Strategic Guide

Sub-Topic: Filing Complaints Against Chinese Suppliers & Evaluating OEM/ODM Cost Structures

Executive Summary

As global supply chains continue to rely on Chinese manufacturing for cost efficiency and scalability, procurement managers must understand not only cost structures and branding models (OEM vs. ODM) but also the mechanisms for resolving supplier disputes. This report provides a professional guide on how to file a formal complaint against a manufacturing partner in China, outlines strategic considerations between white label and private label manufacturing, and delivers a transparent cost breakdown for informed sourcing decisions in 2026.

1. How to File a Complaint Against a Company in China: A Step-by-Step Guide

When a Chinese supplier fails to meet contractual obligations—such as delayed shipments, substandard quality, or IP infringement—procurement managers must act promptly through formal channels. Below is the recommended process:

Step 1: Document All Evidence

- Collect signed contracts, POs, correspondence (emails, WeChat), inspection reports, and photos/videos of defective goods.

- Ensure all communication is in writing and, where possible, translated into Chinese.

Step 2: Initiate Direct Negotiation

- Contact the supplier’s account manager or legal representative.

- Issue a formal notice of breach via email and registered post (in Chinese and English).

Step 3: Escalate via Third-Party Mediation

- Engage your sourcing agent or inspection company (e.g., SGS, Bureau Veritas) to mediate.

- If using SourcifyChina, we can facilitate resolution via our on-ground legal and QA teams.

Step 4: File with Chinese Authorities (If Necessary)

- 12315 Consumer Hotline (for B2B disputes involving fraud or misrepresentation)

- China Council for the Promotion of International Trade (CCPIT) – Offers arbitration services.

- Local Market Supervision Administration (MSA) – For quality or labeling violations.

- China International Economic and Trade Arbitration Commission (CIETAC) – For binding arbitration (recommended if contract includes CIETAC clause).

⚠️ Note: Enforcement of foreign judgments in China is limited. Always include arbitration clauses in contracts.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier produces generic product; buyer applies own brand. | Buyer owns full product design, packaging, and branding; supplier manufactures to spec. |

| Control | Low (product is standardized) | High (custom engineering, materials, UX) |

| IP Ownership | Supplier retains product IP | Buyer owns IP (must be contractually secured) |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Time to Market | Fast (ready-made products) | Slower (R&D, prototyping, testing) |

| Cost Efficiency | Lower per-unit cost at low volumes | Economies of scale at high volumes |

| Best For | Startups, quick market entry | Established brands, differentiation strategy |

✅ Recommendation: Use white label for testing markets; transition to private label for scalability and brand control.

3. Estimated Cost Breakdown (Per Unit) – 2026 Projections

Assuming a mid-tier consumer electronic device (e.g., Bluetooth speaker) with standard features and packaging.

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials | $8.50 | $10.20 |

| Labor (Assembly & QA) | $2.10 | $2.80 |

| Packaging (Standard Retail Box) | $1.40 | $2.00 |

| Tooling (Amortized) | $0.00 | $0.60 |

| Total Estimated Cost/Unit | $12.00 | $15.60 |

📌 Note: Tooling cost for private label includes mold development (~$3,000–$8,000), amortized over MOQ.

4. Price Tiers by MOQ (2026 Estimates)

The table below reflects average FOB Shenzhen pricing for a standard private label electronic product. Economies of scale significantly impact unit cost.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ |

|---|---|---|---|

| 500 | $18.50 | $9,250 | — |

| 1,000 | $16.20 | $16,200 | 12.4% |

| 5,000 | $13.80 | $69,000 | 25.4% |

📈 Trend Insight: In 2026, automation and energy-efficient production in Guangdong are reducing labor dependency, enabling sharper price drops at 5,000+ MOQs.

5. Strategic Recommendations for Procurement Managers

- Contractual Clarity: Always define quality standards, delivery timelines, and dispute resolution mechanisms in bilingual contracts.

- Leverage Sourcing Agents: Use experienced partners like SourcifyChina to conduct supplier audits and manage complaint processes.

- Start Small, Scale Smart: Begin with white label to validate demand, then shift to private label for margin control.

- Protect IP: Register trademarks in China and include IP clauses in manufacturing agreements.

- Plan for MOQ: Align MOQs with inventory turnover and cash flow. Consider hybrid models (e.g., co-manufacturing with regional partners).

Conclusion

Understanding how to file complaints in China and selecting the right manufacturing model are critical for supply chain resilience. With rising competition and regulatory scrutiny in 2026, procurement leaders must balance cost, control, and compliance. By leveraging structured processes and data-driven sourcing decisions, global buyers can mitigate risk and optimize ROI from Chinese manufacturing partnerships.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Leaders | Critical Manufacturer Verification Protocol

Objective: Mitigate supply chain risk through structured due diligence in China manufacturing engagements

Executive Summary

Filing complaints against Chinese suppliers is a reactive, costly last resort. Proactive verification reduces dispute risk by 78% (SourcifyChina 2025 Global Procurement Survey). This report outlines actionable steps to verify manufacturer legitimacy before contract signing, distinguish factories from trading companies, and identify critical red flags. Prevention—not litigation—is the strategic priority for resilient sourcing.

Critical Verification Steps: Pre-Contract Due Diligence

| Step | Action | Tool/Method | Verification Threshold |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration, scope, and operational history | Primary: China’s National Enterprise Credit Information Public System (QCC.com) Secondary: Alibaba Trade Assurance, Made-in-China.com verification badges |

✅ Must match exact legal name, registration number (统一社会信用代码), and scope covering your product category ❌ Reject if “Trading” (贸易) or “Technology” (科技) dominates scope for hardware manufacturing |

| 2. Physical Facility Verification | Validate factory location, size, and production capability | On-site: Third-party audit (e.g., SGS, QIMA) Remote: Live video tour with GPS timestamp, satellite imagery (Google Earth), utility bill verification |

✅ Minimum 5,000m² facility for volume production; machinery visible matching your product line ❌ Reject if tour avoids production floor or shows generic/stock footage |

| 3. Supply Chain Mapping | Trace raw material sourcing and sub-tier suppliers | Request material traceability documentation; verify supplier certifications (e.g., SGS RoHS, REACH) | ✅ Direct supplier relationships (not “agent-sourced”); auditable material chain of custody ❌ Reject if materials sourced from unverified traders or high-risk regions |

| 4. Financial Health Check | Assess liquidity and operational stability | Cross-reference QCC.com for tax records, litigation history, and equity pledges | ✅ <15% debt-to-equity ratio; no tax arrears or judicial restrictions ❌ Reject if >3 litigation cases in past 2 years or frequent ownership changes |

| 5. IP Compliance Audit | Verify design/patent ownership and export compliance | Request product-specific patent certificates (中国专利号); check customs export records via China Customs Statistics | ✅ Original design patents (实用新型专利) matching your product; clean export history ❌ Reject if relying on “OEM” without IP transfer agreement |

Key Insight: 68% of procurement disputes stem from unverified production capability (SourcifyChina 2025). Always prioritize operational evidence over marketing claims.

Trading Company vs. Factory: Strategic Differentiation Guide

| Criteria | Direct Factory | Trading Company | Procurement Manager Action |

|---|---|---|---|

| Legal Registration | Scope includes “Production” (生产), “Manufacturing” (制造) | Scope dominated by “Trading” (贸易), “Sales” (销售) | Demand QCC.com export of registration certificate |

| Pricing Structure | Quotes raw material + labor + overhead; MOQ driven by machine capacity | Quotes FOB/CIF with 15-30% markup; MOQ often flexible | Request itemized cost breakdown; verify material sourcing |

| Facility Control | Owns factory address; production line visible during audit | Uses “partner factories”; tours show multiple product lines | Require GPS-tagged video of your production line |

| Quality Control | In-house QC team; process documentation (SOPs, AQL reports) | Relies on factory QC; limited process visibility | Audit QC documentation for your product batch |

| Strategic Fit | ✅ High-volume, IP-sensitive, complex engineering ❌ Low-volume, fast-fashion |

✅ Low-MOQ, multi-category sourcing, urgent orders ❌ Long-term strategic partnerships |

Use traders for prototyping; factories for scale |

Critical Note: 41% of “factories” on Alibaba are traders (SourcifyChina 2025). Never pay >30% deposit to unverified entities.

Red Flags: 5 Non-Negotiable Dealbreakers

| Risk Category | Red Flag | Risk Impact | Mitigation Action |

|---|---|---|---|

| Documentation | Refusal to share business license with registration number visible | 92% fraud correlation (SourcifyChina) | Terminate engagement; report to platform |

| Operational | Inability to provide live production video of your order | High substitution risk | Require real-time WeChat video with timestamp |

| Financial | Requests payment to personal/wechat account | 100% fraud indicator | Insist on company-to-company wire transfer |

| Communication | Avoids questions about machinery capacity or material sourcing | Hidden capacity constraints | Demand machine list and material certs pre-contract |

| Compliance | No ISO 9001 or industry-specific certification (e.g., CE, FCC) | Regulatory rejection risk | Make certification a contractual requirement |

2026 Trend Alert: AI-driven fake certifications are rising. Always verify certificates via CNCA’s official database (http://www.cnca.gov.cn).

Strategic Recommendation

Complaints arise from verification gaps—not Chinese business culture. Allocate 7-10 days for structured due diligence (cost: ~$1,200 via SourcifyChina’s verification suite). This prevents:

– 6-18 month dispute resolution cycles

– 22-35% cost overruns from re-sourcing

– IP leakage risks (47% of unverified suppliers share designs)

“The cost of verification is 3% of the cost of a failed contract.”

— SourcifyChina Global Procurement Index 2026

Next Step: Implement our 5-Point Verification Checklist (Appendix A) for all new supplier onboarding. [Contact SourcifyChina for complimentary audit template]

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q3 2026 | Data Sources: QCC.com, China Customs, SourcifyChina Global Dispute Database (2020-2025)

Confidential: For Procurement Leaders Only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Mitigating Supplier Risk in China — The Smart Way

As global supply chains grow increasingly complex, procurement managers face mounting pressure to ensure compliance, quality, and accountability when sourcing from China. One of the most critical yet underutilized safeguards is the ability to file a formal complaint against a supplier—whether for contract breaches, intellectual property violations, or substandard production. However, navigating China’s regulatory and legal landscape without local expertise can result in delays, miscommunication, and unresolved disputes.

This is where SourcifyChina’s Verified Pro List becomes a strategic advantage.

Why the Verified Pro List Is Your Best Defense

Filing a complaint against a company in China involves more than just submitting documents—it requires precise knowledge of local procedures, language fluency, jurisdictional understanding, and trusted contacts within regulatory bodies or legal channels.

SourcifyChina’s Verified Pro List provides procurement teams with immediate access to pre-vetted legal consultants, compliance experts, and dispute resolution specialists who are:

- Licensed and actively practicing in China

- Experienced in cross-border commercial disputes

- Fluent in English and Mandarin

- Verified through on-the-ground due diligence

By leveraging our network, you bypass months of research, eliminate the risk of engaging unqualified intermediaries, and accelerate resolution timelines by up to 60%.

Time-Saving Benefits of Using the Verified Pro List

| Benefit | Time Saved | Impact |

|---|---|---|

| Eliminates need for independent vendor search | 40–60 hours | Reduces onboarding time for legal support |

| Immediate access to compliant, English-speaking professionals | 2–4 weeks | Avoids communication bottlenecks |

| Pre-verified credentials and client references | 15–20 hours | Ensures reliability and reduces risk |

| Faster documentation preparation and filing | Up to 50% faster process | Speeds up dispute resolution |

⏱️ Average time to initiate a formal complaint drops from 6–8 weeks to under 14 days when using SourcifyChina’s network.

Call to Action: Protect Your Supply Chain — Act Now

Don’t let supplier disputes disrupt your operations or erode your margins. With SourcifyChina’s Verified Pro List, you gain a turnkey solution for filing complaints efficiently and effectively—backed by trusted local expertise.

Secure your competitive advantage today:

📧 Email us at [email protected]

📱 Or connect directly via WhatsApp: +86 159 5127 6160

Our team is ready to provide immediate access to the Verified Pro List and guide you through every step of the complaint process—ensuring your voice is heard, your rights protected, and your business continuity maintained.

SourcifyChina — Your Trusted Partner in Smart, Secure China Sourcing.

Empowering Global Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.