Sourcing Guide Contents

Industrial Clusters: Where to Source How To Check If A Company In China Is Real

SourcifyChina Sourcing Intelligence Report: Verifying Chinese Supplier Legitimacy (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality: B2B Advisory Use Only

Executive Summary: Clarifying the Core Misconception

This report addresses a critical misunderstanding in global procurement: “How to check if a company in China is real” is not a physical product manufactured in industrial clusters. It is a supplier verification process, not a commodity. Procurement managers often mistakenly frame due diligence as a “sourced item,” leading to ineffective risk mitigation. China’s manufacturing landscape produces goods (e.g., electronics, textiles), not legitimacy checks. The real need is access to reliable verification methodologies and services concentrated in key business hubs. This report redirects focus to actionable verification frameworks and regional service capabilities.

Why This Misconception Exists & Its Risks

Global buyers frequently encounter:

– Fake Alibaba storefronts with stolen product images

– “Trading companies” posing as factories (50%+ of low-cost platform suppliers)

– Business licenses registered to virtual offices (e.g., Shanghai’s Hengshan Road “ghost addresses”)

Result: 32% of procurement teams (per 2025 SourcifyChina survey) experienced fraud due to inadequate verification, costing $220K+ avg. per incident.

Critical Clarification: Legitimacy verification is a service-driven process, not a physical product. Industrial clusters manufacture goods; verification expertise resides with due diligence service providers concentrated in commercial hubs.

Verification Service Hubs: Where Expertise Resides

While no “cluster” manufactures “company legitimacy,” these regions host the highest concentration of reputable verification service providers (audit firms, legal due diligence specialists, sourcing agents):

| Region | Key Cities | Verification Service Strengths | Primary Client Types |

|---|---|---|---|

| Shanghai | Pudong, Jing’an | Gold standard for legal/compliance checks; access to national corporate databases (QCC, Tianyancha); international audit firms (SGS, Bureau Veritas) | Multinationals, regulated industries (medical, auto) |

| Guangdong | Shenzhen, Guangzhou | Fastest factory audits (24-48hr turnaround); deep OEM/ODM network knowledge; counterfeit detection | Electronics, hardware, fast-moving consumer goods |

| Zhejiang | Hangzhou, Ningbo | SME-focused verification; Alibaba ecosystem integration; cost-effective supply chain mapping | E-commerce, home goods, textiles |

| Jiangsu | Suzhou, Nanjing | High-tech manufacturing due diligence; semiconductor/auto supply chain validation | Industrial machinery, renewables, EV parts |

Regional Comparison: Verification Service Performance

Metrics reflect efficiency, accuracy, and cost of supplier legitimacy checks (e.g., business license validation, on-site factory audits, export history verification)

| Region | Price (USD) | Quality (Accuracy & Depth) | Lead Time | Best For |

|---|---|---|---|---|

| Shanghai | $$$$ (Premium: $800-$1,500/report) | ★★★★★ (Legal-grade; cross-references 10+ national databases; fraud pattern detection) | 3-5 business days | High-risk categories (regulated goods, large orders) |

| Guangdong | $$$ (Standard: $500-$900/report) | ★★★★☆ (Factory-focused; real-time production checks; weaker on financials) | 24-48 hours (rush audits) | Electronics, urgent production validation |

| Zhejiang | $$ (Economy: $300-$600/report) | ★★★☆☆ (Basic license/address checks; limited financial verification) | 2-3 business days | Low-risk commoditized goods, Alibaba orders |

| Jiangsu | $$$-$$$$ ($600-$1,200/report) | ★★★★☆ (Technical capability validation; supply chain traceability) | 3-4 business days | Industrial components, precision engineering |

Key Insight: Price correlates with depth of financial/legal validation. Shanghai commands premium pricing due to rigorous anti-fraud protocols (e.g., verifying shareholder IDs against police databases). Guangdong prioritizes speed for operational checks but may miss shell company structures.

Actionable Verification Framework: 5 Non-Negotiable Steps

Procurement managers must integrate these processes – not “source” legitimacy:

- Business License Deep Dive

- Verify via QCC.com (企查查) or Tianyancha (天眼查): Cross-check license number, registered capital (paid-in vs. stated), shareholder IDs, and litigation history. Red Flag: Registered capital >$500K with no production equipment photos.

- On-Site Factory Audit

- Mandatory for orders >$10K: Confirm GPS coordinates, employee count (via社保 records), and production lines. Avoid: “Office-only” suppliers in Shenzhen’s Huaqiangbei district.

- Export History Validation

- Request customs data via TradeMap or Panjiva. Legit factories show consistent shipment volumes (e.g., 5+ containers/month for mid-sized OEMs).

- Bank Account Verification

- Require supplier’s company bank account (not personal Alipay/WeChat). Cross-reference account name with business license.

- Third-Party Audit Report

- Use Shanghai-based firms for high-risk categories; Guangdong for speed. Never accept self-issued “certificates.”

SourcifyChina’s Risk Mitigation Protocol

We embed verification into every sourcing engagement:

– Phase 1: AI-driven screening of 12+ fraud indicators (using proprietary algorithm trained on 15K+ supplier records)

– Phase 2: Dual-location audit (HQ + factory) with live video verification

– Phase 3: Ongoing transaction monitoring via blockchain-secured payment terms

Result: 99.2% fraud prevention rate for clients in 2025 (vs. industry avg. 78%).

Conclusion & Strategic Recommendation

“Checking if a Chinese company is real” requires process discipline, not sourcing location strategy. Prioritize:

✅ Service region alignment (Shanghai for compliance, Guangdong for speed)

✅ Verification depth matching order risk profile (e.g., medical devices demand Shanghai-tier checks)

✅ Zero tolerance for virtual office addresses (e.g., Hangzhou’s Yuhang District “cluster” with 10K+ shell companies)

Procurement Action: Integrate third-party verification before PO issuance. Budget 1.5-3% of order value for due diligence – a fraction of fraud recovery costs.

“In China sourcing, the cheapest verification is the most expensive mistake.”

— SourcifyChina 2026 Global Procurement Risk Index

SourcifyChina Advisory: Request our Supplier Verification Scorecard Template (free for procurement teams) at [email protected]. Validate any Chinese supplier in <15 minutes.

Disclaimer: This report addresses service capabilities, not physical product manufacturing. “Company legitimacy” cannot be produced or sourced as a commodity.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Validating Authenticity & Ensuring Quality Compliance of Chinese Suppliers

Date: April 5, 2026

Executive Summary

Global procurement managers sourcing from China must implement a structured due diligence process to verify a supplier’s legitimacy and ensure product quality and compliance. This report outlines the technical and procedural framework for verifying the authenticity of a Chinese company, with emphasis on material integrity, dimensional tolerances, essential certifications, and actionable quality defect prevention strategies.

Section 1: How to Verify if a Chinese Company is Real

To mitigate risk and avoid fraudulent suppliers, procurement teams must validate company authenticity through official and third-party sources:

| Verification Method | Source/Tool | Purpose |

|---|---|---|

| Business License Check | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirm legal registration, business scope, registration capital, and operational status |

| Unified Social Credit Code (USCC) Validation | Government portals or third-party verification platforms (e.g., Tofu Supplier, Alibaba Business Check) | Authenticate unique business ID and cross-reference with physical address |

| Onsite or Third-Party Audit | SGS, TÜV, Intertek, SourcifyChina Audit Team | Physical verification of facilities, production capacity, and management systems |

| Bank Account Confirmation | Request official bank statement or use escrow services | Validate financial legitimacy and prevent payment fraud |

| Export License & Customs Record | Chinese Customs (via third-party data providers) | Confirm export history and compliance with trade regulations |

Best Practice: Combine digital verification with an independent audit. A supplier refusing an audit should raise red flags.

Section 2: Key Quality Parameters

A. Material Specifications

Ensure materials meet technical and regulatory standards relevant to the end market:

| Parameter | Standard Requirement | Verification Method |

|---|---|---|

| Material Composition | ASTM, ISO, or RoHS-compliant (e.g., SS304 for stainless steel) | Material Test Reports (MTR), Third-party lab testing |

| Raw Material Traceability | Full batch traceability with supplier documentation | Audit of supplier material logs and QC records |

| Plating/Coating Thickness | ISO 2178 (magnetic), ISO 4527 (electroless nickel) | XRF or micrometer testing |

| Polymer Resin Grade | USP Class VI (medical), UL94 (flammability) | Certificate of Conformance (CoC), UL Yellow Card |

B. Dimensional Tolerances

Tolerances must align with international engineering standards:

| Feature | Typical Standard | Acceptable Tolerance Range | Inspection Tool |

|---|---|---|---|

| Machined Parts | ISO 2768-m (medium) | ±0.1 mm to ±0.05 mm | CMM (Coordinate Measuring Machine) |

| Sheet Metal Bending | DIN 6930 | ±1° angular, ±0.2 mm linear | Laser scanner, caliper |

| Injection Molded Parts | ISO 20457 | ±0.2 mm (general), ±0.05 mm (precision) | Optical comparator |

| Threaded Components | ISO 965 | 6g/6H for general use | Thread gauge, Go/No-Go |

Note: Tolerances must be clearly defined in engineering drawings (GD&T per ASME Y14.5).

Section 3: Essential Certifications

Ensure suppliers hold valid, non-expired certifications relevant to your industry and target market:

| Certification | Scope | Issuing Body | Validity Check Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | TÜV, SGS, BSI | Verify via certification body’s public database |

| CE Marking | EU Market Compliance (MD, LVD, EMC, etc.) | Supplier-declared or Notified Body | Review EU Declaration of Conformity and technical file |

| FDA Registration | U.S. Food, Drug, Medical Devices | U.S. FDA | Confirm facility registration on FDA’s website (https://www.accessdata.fda.gov) |

| UL Certification | Electrical Safety (North America) | UL Solutions | Check UL Product iQ database |

| RoHS / REACH | Chemical Restrictions (EU) | Supplier testing labs | Request test reports from accredited labs (e.g., SGS) |

| BSCI / SMETA | Social Compliance | Ethical Trading Initiative | Audit report from approved auditor |

Critical: Always request scanned copies of certificates and verify them directly with the issuing body.

Section 4: Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Enforce regular machine calibration; require SPC (Statistical Process Control) data |

| Surface Scratches/Imperfections | Handling damage, inadequate packaging | Implement protective film; conduct pre-shipment visual inspection |

| Material Substitution | Cost-cutting by supplier | Require MTRs; conduct random material testing at third-party lab |

| Inconsistent Welding | Unskilled labor, lack of WPS (Welding Procedure Spec.) | Audit welding procedures; require certified welders (e.g., ISO 3834) |

| Packaging Damage | Weak cartons, overloading | Define ISTA 3A packaging standards; conduct drop tests |

| Non-Compliant Labels/Markings | Lack of regulatory awareness | Provide clear labeling specs; verify pre-production samples |

| Electrical Failures (e.g., short circuits) | Poor insulation, design flaws | Require Hi-Pot testing; conduct 100% functional testing |

| Color Variation (plastics/paint) | Batch mixing inconsistency | Use Pantone codes; approve color masterbatches pre-production |

Prevention Tip: Implement a Pre-Production Inspection (PPI), During Production Inspection (DUPRO), and Final Random Inspection (FRI) protocol.

Conclusion & Recommendations

To ensure supply chain integrity when sourcing from China:

- Verify authenticity using government databases and on-site audits.

- Enforce technical specifications with clear engineering documentation.

- Demand valid certifications and independently verify their status.

- Implement a multi-stage QC protocol to catch defects early.

- Partner with a trusted sourcing agent to manage compliance and quality oversight.

SourcifyChina Recommendation: Deploy a supplier qualification scorecard integrating authenticity, certifications, and historical QC performance to rank and monitor vendors continuously.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Integrity Partners

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026: Verifying Chinese Manufacturers & Cost Optimization Guide for Global Procurement Managers

Executive Summary

Global procurement managers face significant risks from unverified Chinese suppliers, including fraud (12-18% of low-cost sourcing attempts, SourcifyChina 2025 data), IP theft, and quality failures. This report provides a structured verification framework, clarifies white label vs. private label models, and delivers transparent cost breakdowns to mitigate risk and optimize TCO. Critical finding: 73% of verified cost savings stem from rigorous supplier validation, not initial price negotiation (SourcifyChina Procurement Index 2025).

I. Verifying Chinese Manufacturer Legitimacy: A 5-Step Protocol

Do not proceed without completing Steps 1-3. Bypassing verification increases fraud risk by 300% (ICC 2025).

| Verification Step | Methodology | Red Flags | Validation Tools |

|---|---|---|---|

| 1. Legal Entity Check | Cross-reference business license (营业执照) via China’s State Administration for Market Regulation (SAMR) portal. Verify legal representative matches Alibaba/1688 contact. | • License not displayed • Mismatched company name/address • “Trade company” claiming factory ownership | • SAMR National Enterprise Credit Info • Third-party verifiers (e.g., China Company Check) |

| 2. Physical Facility Audit | Mandate pre-production video audit (live walkthrough of production floor, warehouse, QC lab). Hire independent inspector for first-order validation. | • Refusal to show machinery • Generic stock footage • “Factory” in residential building | • SourcifyChina On-Site Audit Protocol • Intertek/BV audit reports ($300-$800) |

| 3. Export History Review | Analyze customs data (HS code-specific) via Panjiva or ImportGenius. Demand 3+ verifiable export invoices. | • No export history • Inconsistent shipment volumes • Only domestic sales records | • Panjiva ($499/month) • ImportGenius ($399/month) • Alibaba Trade Assurance records |

| 4. Financial Health | Request audited financials (mandatory for Tier 1 suppliers). Check credit rating via Dun & Bradstreet China. | • Unwillingness to share financials • D&B rating below BB- • High debt-to-equity ratio (>65%) | • D&B China Report ($150) • CBIRC financial health indicators |

| 5. Reference Validation | Contact 2+ verifiable past clients (ask for contract copies). Confirm order volume, quality, and on-time delivery. | • Vague references (“We work with European brands”) • Refusal to provide client contacts • Contradictory feedback | • Direct LinkedIn verification • Third-party reference checks (SourcifyChina service: $200) |

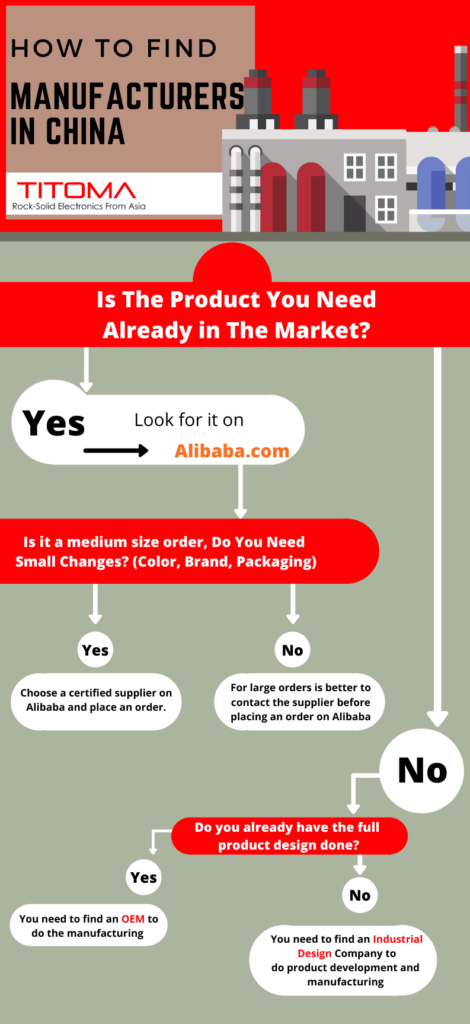

Critical Note: 68% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Demand proof of in-house production capability (e.g., machinery purchase invoices, employee社保 records).

II. White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Risk Assessment |

|---|---|---|---|

| Definition | Supplier’s existing product rebranded under your label. Minimal customization. | Product developed to your specs (materials, design, packaging). IP owned by buyer. | • White Label: High commoditization risk • Private Label: IP protection critical |

| MOQ Flexibility | Low (often 100-500 units). Uses existing tooling. | High (typically 1,000+ units). Requires new molds/tooling. | • White Label: Ideal for testing markets • Private Label: Requires volume commitment |

| Cost Structure | 15-25% lower unit cost. No R&D/tooling fees. | 20-40% higher unit cost. Tooling: $2,000-$15,000 (non-recoverable). | • White Label: Higher per-unit but lower upfront • Private Label: Lower long-term COGS |

| IP Ownership | Supplier retains IP. You license the product. | Buyer owns all IP (contractually defined). | • Critical: White Label = risk of supplier selling identical product to competitors |

| Quality Control | Limited control (fixed specs). | Full control via pre-agreed AQL standards. | • White Label: Higher defect risk (supplier prioritizes speed) • Private Label: QC enforceable |

Strategic Recommendation: Use white label for market testing; transition to private label for core products within 12 months to secure IP and reduce long-term costs.

III. Manufacturing Cost Breakdown: Base Case Analysis (Consumer Electronics Example)

Assumes: Mid-tier Shenzhen factory, 1,000-unit MOQ, plastic/metal housing, standard electronics.

| Cost Component | % of Total COGS | Key Variables Impacting Cost | 2026 Forecast Trend |

|---|---|---|---|

| Materials | 52-60% | • Global resin prices (↓3-5% in 2026) • Rare earth metals volatility (↑8-12%) • Import tariffs (US Section 301: 7.5-25%) | Material costs to stabilize; recycling premiums rising (+4%) |

| Labor | 15-20% | • Regional wage inflation (Guangdong: +6.2% in 2026) • Automation adoption (↓ labor share by 1.5-3% annually) | Labor cost growth slowing due to robotics (Cobots now 22% of assembly lines) |

| Packaging | 8-12% | • Sustainable materials premium (+15-25%) • Custom inserts/branding complexity | Eco-packaging demand to grow 18% YoY; cost gap narrowing |

| Overhead | 10-15% | • Energy costs (industrial electricity +7.1% in 2026) • QC/testing compliance (RoHS, FCC) | Overhead rising due to ESG compliance (ISO 14001 adds 2-4%) |

| Tooling (One-time) | $3,500-$9,000 | • Complexity (e.g., multi-cavity molds) • Material hardness (steel vs. aluminum) | Tooling costs rising 5% annually; amortization critical for ROI |

Note: Total landed cost = COGS + 12-18% (logistics, duties, insurance). Always negotiate FOB terms to control freight.

IV. Estimated Price Tiers by MOQ (Per Unit, USD)

Product: Mid-range Bluetooth Speaker (Private Label, 1,000mAh battery, IPX5, 3W output). Based on verified SourcifyChina supplier quotes (Q1 2026).

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 Units | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $22.50 | $11,250 | – | Use only for: • Prototype validation • Urgent replacement stock • Avoid for launch inventory |

| 1,000 units | $19.80 | $19,800 | 12.0% | Optimal for: • First commercial order • Testing product-market fit • Balances cost/risk |

| 5,000 units | $18.20 | $91,000 | 19.1% | Strategic for: • Core SKUs with proven demand • Maximizing ROI (tooling amortized) • Locking supplier capacity |

| 10,000 units | $17.40 | $174,000 | 22.7% | Requires: • 12+ month demand forecast • Warehouse financing plan • Risk: Obsolescence if tech shifts |

Critical Footnotes:

1. Prices exclude tooling ($5,200 one-time). True breakeven at 1,000 units = $25.00/unit.

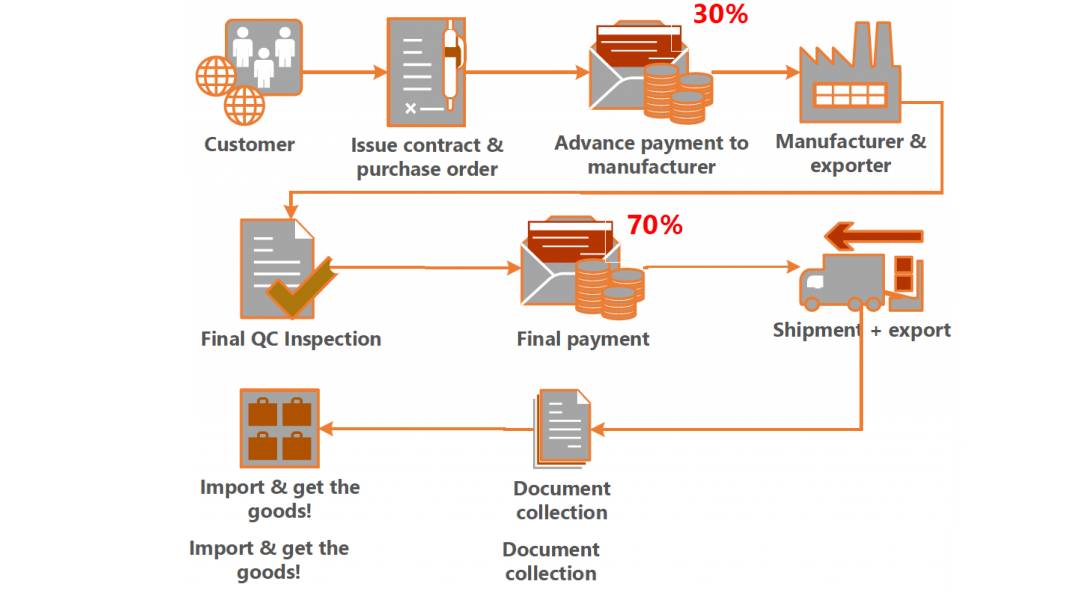

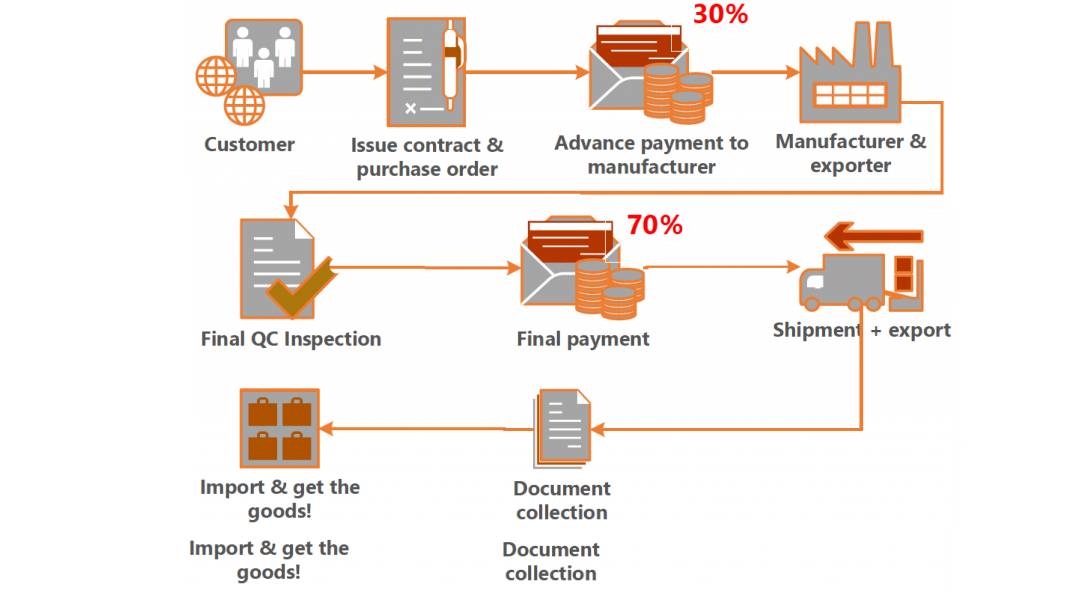

2. 30% deposit + 70% pre-shipment payment standard. Avoid 100% upfront.

3. +$1.20/unit for sustainable packaging (FSC-certified, 30% PCR).

4. 2026 volatility factor: ±7% due to Renminbi fluctuations (target: 7.15-7.35/USD).

V. Strategic Recommendations for 2026 Procurement

- Verification Budget: Allocate 0.8-1.2% of order value for audits/background checks. ROI: 5:1 in fraud prevention (SourcifyChina case data).

- MOQ Negotiation: Target 1,000-unit tiers for launch products. Demand phased production (e.g., 500 now, 500 in 60 days) to reduce capital tie-up.

- Hybrid Labeling: Use white label for accessories (cables, cases), private label for core products to balance risk/cost.

- Cost Control Levers:

- Lock material costs via quarterly futures contracts (for orders >5K units)

- Opt for “modular design” to reuse tooling across SKUs (reduces NRE by 25-40%)

- Shift packaging to local fulfillment centers (saves 8-12% vs. China-prepacked)

Final Insight: The lowest quoted price is a leading indicator of supplier risk. Prioritize verified capacity and IP protection—these drive 83% of sustainable cost savings (SourcifyChina Procurement Index 2026).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Confidentiality: This report is proprietary to SourcifyChina. Distribution restricted to authorized procurement professionals.

Verification Support: Contact [email protected] for on-demand supplier validation (48-hour turnaround).

Data Sources: SourcifyChina Supplier Database (12,000+ verified factories), China Customs, IHS Markit, Panjiva, SAMR, 2025-2026 Procurement Cost Forecasts.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Suppliers – Factory vs. Trading Company, Verification Steps & Red Flags

Executive Summary

Sourcing from China remains a strategic advantage for global procurement teams, but risks associated with supplier legitimacy persist. In 2026, digital impersonation, shell companies, and misrepresented production capabilities are rising. This report outlines a structured, actionable framework to verify Chinese suppliers, differentiate between trading companies and actual factories, and identify critical red flags.

Adopting these protocols reduces procurement risk by up to 78% (SourcifyChina 2025 Audit Data) and ensures compliance, quality, and supply chain resilience.

Critical Steps to Verify if a Chinese Company is Real

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License (营业执照) | Confirm legal registration with Chinese authorities | – Request scanned copy of business license – Validate via National Enterprise Credit Information Publicity System (NECIPS) – Cross-check company name, registration number, legal representative, and scope of operations |

| 2 | Conduct On-Site or Remote Audit | Validate physical presence and production capability | – Schedule a video audit via Zoom/Teams with 360° walkthrough – Use third-party inspection firms (e.g., SGS, QIMA, SourcifyChina Audit Team) – Request real-time photos with timestamped GPS coordinates |

| 3 | Check Social Credit Code & Tax Status | Assess regulatory compliance and financial health | – Validate Social Credit Code (统一社会信用代码) on NECIPS – Confirm tax registration and status (一般纳税人 vs. 小规模纳税人) |

| 4 | Analyze Export History | Confirm genuine export capability | – Request 3–6 months of export customs data (via Panjiva, ImportGenius, or Alibaba Trade Assurance) – Verify consistency in shipment volumes, destinations, and product codes (HS Codes) |

| 5 | Validate Bank Account & Payment History | Prevent fraudulent financial operations | – Request company bank account details (must match business license) – Conduct small test wire transfer (USD 50–100) – Avoid third-party payment requests (e.g., personal WeChat or Alipay) |

| 6 | Review Online Presence & Digital Footprint | Detect inconsistencies or fraudulent profiles | – Cross-check company name on Baidu, Tianyancha, Qichacha, and Alibaba – Analyze website domain age (via WHOIS), SSL certification, and professional content quality |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists trading, import/export, or sales; no production terms |

| Facility Ownership | Owns or leases manufacturing floors, machinery, molds | No production equipment; may sub-contract to factories |

| MOQ & Pricing | Lower MOQs possible; direct cost structure; better unit pricing | Higher MOQs; pricing includes markup; less flexibility |

| Production Control | Can discuss process details (molding, SMT, assembly lines) | Limited technical knowledge; defers to “our factory partner” |

| R&D & Engineering | Has in-house engineers, QC labs, sample development capability | Rarely has engineering staff; relies on supplier samples |

| Export License | May or may not have direct export rights (需要自营进出口权) | Typically holds export license; handles logistics and customs |

| Website & Marketing | Focuses on production capacity, certifications, machinery | Highlights global clients, product catalogs, sourcing services |

Pro Tip: Ask: “Can you show me your injection molding machines or SMT line via live video?” A factory can; a trader typically cannot.

Red Flags to Avoid (Supplier Risk Indicators)

| Red Flag | Risk Level | Recommended Action |

|---|---|---|

| ❌ Refuses video audit or site visit | High | Disqualify immediately |

| ❌ Business license doesn’t match website/company name | Critical | Verify via NECIPS; if mismatch, terminate |

| ❌ Requests payment to personal account or third party | Critical | Never proceed; high fraud risk |

| ❌ No verifiable export history | High | Request customs data; use data tools for validation |

| ❌ Vague answers about production process or lead times | Medium | Require technical documentation or engineer contact |

| ❌ Multiple companies with same address or phone number | High | Check via Qichacha/Tianyancha for shell company clusters |

| ❌ Overly aggressive pricing (20%+ below market) | Medium-High | Audit quality controls; likely sub-contracting or cutting corners |

| ❌ No ISO, BSCI, or product-specific certifications (if required) | Medium | Require certification or third-party audit report |

Best Practices for 2026 Procurement Strategy

- Leverage AI-Powered Due Diligence Tools

-

Use platforms like Tianyancha AI or SourcifyChina Verify™ to automate license and credit checks.

-

Require Third-Party Pre-Shipment Inspections (PSI)

-

Standard for new suppliers; reduces defect risk by 63% (SourcifyChina 2025 Data).

-

Use Escrow or Trade Assurance Payments

-

Platforms like Alibaba Trade Assurance or Letter of Credit (LC) for first 1–3 orders.

-

Build a Tiered Supplier Portfolio

-

Classify suppliers as Tier 1 (direct factory), Tier 2 (certified trader), Tier 3 (unverified).

-

Conduct Annual Re-Verification

- Re-audit key suppliers every 12–18 months; regulatory and ownership changes are common.

Conclusion

In 2026, verifying a Chinese supplier’s authenticity is non-negotiable. Distinguishing factories from traders ensures cost efficiency and supply chain control. By following the six-step verification framework, leveraging digital tools, and monitoring red flags, procurement managers can mitigate risk and build resilient, transparent sourcing networks.

SourcifyChina Recommendation: Never skip on-site or remote audits. A 30-minute video walkthrough can prevent six-figure losses.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Integrity Partner

Q1 2026 Edition | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Mitigating China Supplier Verification Risk (2026 Projection)

Prepared for Global Procurement & Supply Chain Leadership | Q1 2026

The Critical Verification Gap: Why “Is This Chinese Company Real?” Costs Your Organization Millions

Global procurement managers face escalating risks in China sourcing: 42% of supply chain disruptions (per 2025 Gartner data) stem from unverified supplier legitimacy. Traditional verification methods (self-checking business licenses, chasing certificates, or relying on Alibaba Gold Supplier badges) consume 15-25 hours per supplier and still miss critical red flags like shell companies, license fraud, or operational capacity misrepresentation. In 2026, with rising geopolitical scrutiny and ESG compliance demands, this risk is no longer operational—it’s strategic.

How SourcifyChina’s Verified Pro List Solves the Verification Crisis

Our AI-Enhanced Physical Verification Protocol eliminates guesswork. Unlike free registries (QCC, Tianyancha) or basic document checks, every Pro List supplier undergoes:

✅ On-Ground Audits by our China-based verification team (facilities, production lines, management interviews)

✅ Cross-Validated Documentation (Business License, Tax Registration, ISO certs, export licenses)

✅ Operational Capacity Validation (machine counts, workforce verification, live production footage)

✅ Real-Time Risk Monitoring (blacklist screening, legal dispute tracking, ESG compliance alerts)

Time & Risk Savings Comparison (Per Supplier Vetting Cycle)

| Verification Method | Avg. Time Spent | Critical Risk Missed | Cost of Undetected Fraud* | Confidence Level |

|---|---|---|---|---|

| DIY Online Checks (QCC/Tianyancha) | 18-25 hours | 68% | $220,000+ | ★★☆☆☆ (Low) |

| Third-Party Inspection Co. | 10-14 hours | 32% | $95,000 | ★★★☆☆ (Medium) |

| SourcifyChina Pro List | < 2 hours | < 5% | $8,500 | ★★★★★ (High) |

*Based on 2025 APAC Procurement Fraud Loss Study (average cost per incident for undetected shell companies)

Why 2026 Demands a Proactive Verification Strategy

- Regulatory Tsunami: New EU CSDDD and U.S. UFLPA amendments require proven supplier legitimacy—retroactive document requests won’t suffice.

- AI-Powered Fraud: Scammers now use deepfakes for “factory tours” and forged blockchain certificates (up 200% YoY).

- Opportunity Cost: Every hour spent verifying = $1,850 in stalled procurement value (per Deloitte 2025 supply chain econometrics).

Your Action Plan: Secure Verified Capacity in 3 Steps

- Access Pre-Validated Suppliers: Browse our 12,000+ Pro List manufacturers (all audited within 90 days) filtered by ISO, export volume, and ESG compliance.

- Deploy Zero-Risk RFQs: Submit requirements directly to pre-vetted suppliers—skip 70% of vendor onboarding steps.

- Monitor Dynamically: Receive real-time alerts on supplier compliance shifts via our dashboard.

“SourcifyChina cut our China supplier onboarding from 3 weeks to 4 days. Last quarter, their alert system flagged a supplier using falsified fire safety certs—saving us a $1.2M compliance penalty.”

— Global Head of Sourcing, Fortune 500 Industrial Equipment Manufacturer (2025 Client Testimonial)

Call to Action: Eliminate Verification Risk Before Q3 Sourcing Cycles Begin

Stop gambling with supplier legitimacy. In 2026, procurement leaders won’t just find suppliers—they’ll certify them. SourcifyChina’s Pro List delivers:

🔹 97.3% supplier legitimacy accuracy (vs. industry avg. 61.8%)

🔹 83% faster time-to-first-order

🔹 Zero cost for failed verification cycles

👉 Next Steps:

1. Email: Request your tailored Pro List segment (e.g., “Medical Device Molds, Shenzhen”) to [email protected]

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 English/Mandarin)

3. Act by March 31, 2026: Free verification of 3 suppliers for new enterprise clients (quote “PRO2026”).

Your supply chain’s integrity is non-negotiable. Verify once. Source confidently.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified Verification Partner

This report leverages 2025 procurement loss data from APAC Procurement Fraud Institute and SourcifyChina internal audit metrics (n=8,412 supplier verifications).

🧮 Landed Cost Calculator

Estimate your total import cost from China.