Sourcing Guide Contents

Industrial Clusters: Where to Source How To Check Company Registration Number In China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “How to Check Company Registration Number in China” Services in China

Executive Summary

This report provides a comprehensive market analysis for sourcing “how to check company registration number in China” services — a critical due diligence component in B2B procurement from China. While this service is non-tangible and falls under business intelligence and compliance verification, its sourcing ecosystem is deeply tied to China’s administrative infrastructure, digital platforms, and third-party verification providers.

It is important to clarify that “how to check company registration number in China” is not a manufactured product but a procedural knowledge or service offering. As such, the “industrial clusters” for this service are not defined by manufacturing output, but by the concentration of professional services firms, compliance consultancies, legal advisory agencies, and digital verification platforms.

This report identifies key regional hubs where these services are most efficiently delivered, evaluates their comparative advantages, and provides strategic guidance for global procurement teams seeking reliable, scalable, and compliant access to Chinese company verification data.

1. Service Overview: What Is Being “Sourced”?

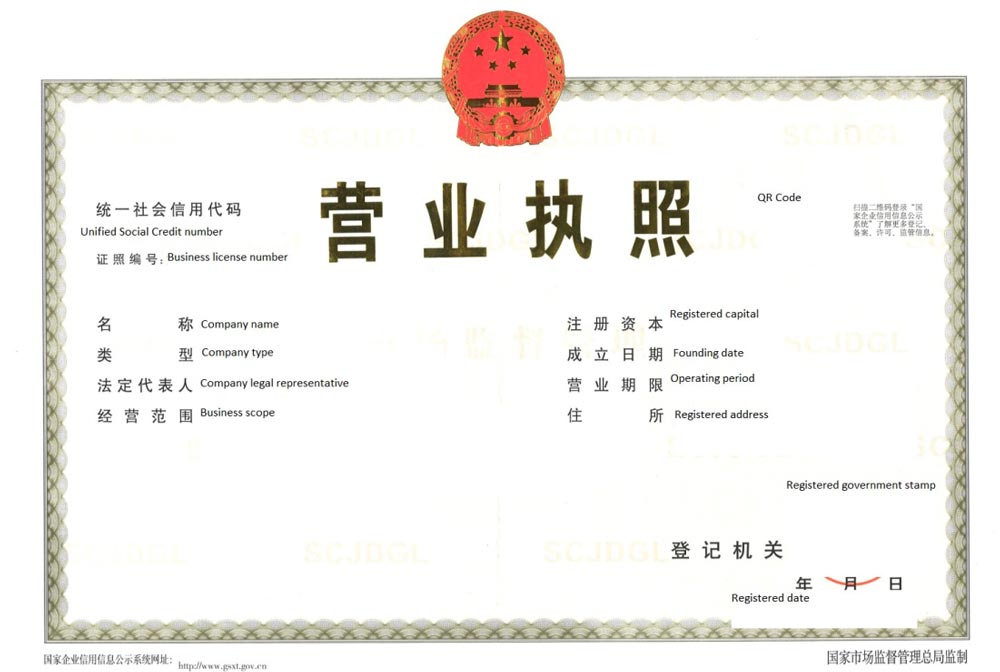

The phrase “how to check company registration number in China” refers to the process of verifying the legal existence and operational status of a Chinese entity via its Unified Social Credit Code (USCC) or Business Registration Number, accessible through official and third-party platforms.

Global procurement managers require this verification to:

– Validate supplier legitimacy

– Prevent fraud

– Ensure compliance (e.g., with OECD, SEC, or EU supply chain due diligence laws)

– Support onboarding of Chinese vendors

Service Outputs Include:

– Access to official registration data (name, address, legal rep, capital, scope, status)

– Verification reports (PDF or API-integrated)

– Historical changes, litigation records, administrative penalties

– Risk scoring and AI-enhanced due diligence

2. Key Service Delivery Clusters in China

While no physical manufacturing is involved, the delivery of accurate, timely, and legally compliant company verification services is concentrated in regions with:

– Strong legal and financial services ecosystems

– High digital infrastructure maturity

– Proximity to government data systems

– Concentration of B2B platforms and sourcing intermediaries

Primary Service Hubs (by Province/City)

| Region | Key Cities | Service Strengths | Key Providers/Platforms |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Proximity to export hubs; high volume of foreign trade verification needs; strong fintech integration | Tiantian Enterprises, Qichacha (regional partners), HKTDC-affiliated services |

| Zhejiang | Hangzhou, Ningbo | Home to Alibaba and e-commerce due diligence tools; strong SME data coverage | Qichacha, Tianyancha, Alibaba Supplier Verification |

| Beijing | Beijing | Access to national regulatory bodies (SAMR), legal HQs, MNC compliance offices | D&B China, PwC China, local legal consultancies |

| Shanghai | Shanghai | International legal and audit firms; high-end compliance services | KPMG China, Deloitte China, SGS China (due diligence arm) |

| Jiangsu | Suzhou, Nanjing | Strong manufacturing base; localized supplier vetting services | Local SGS offices, TÜV partners with verification modules |

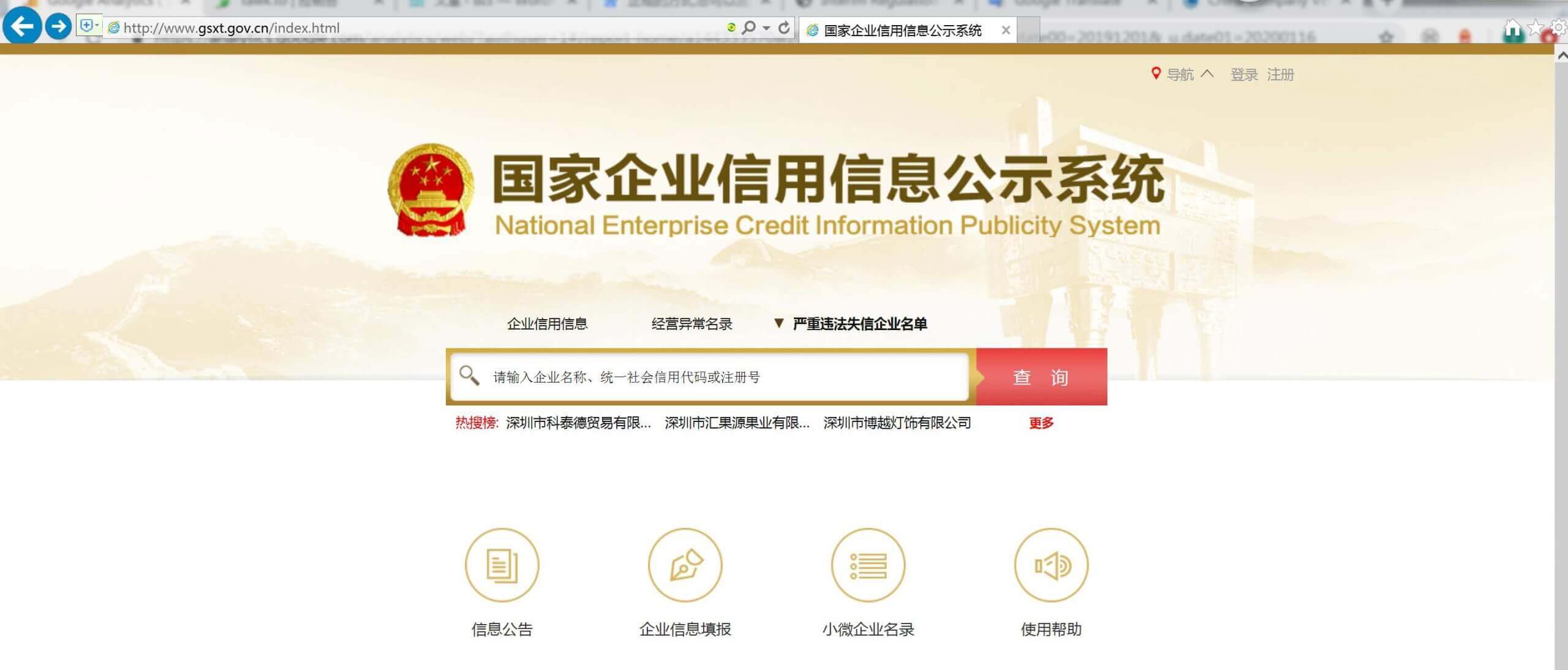

✅ Note: The actual data source for company registration is the State Administration for Market Regulation (SAMR), accessible nationwide via platforms like National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). However, usability, language, and integration challenges necessitate third-party service providers — primarily based in the above hubs.

3. Comparative Analysis of Key Service Regions

The following table compares the top two service clusters — Guangdong and Zhejiang — based on Price, Quality, and Lead Time for outsourced company verification services.

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price (Relative Cost) | Medium | Low to Medium | Zhejiang benefits from high competition among SaaS platforms (e.g., Qichacha pricing models); Guangdong services often bundled with logistics or sourcing packages, increasing cost |

| Quality (Data Accuracy & Depth) | High | Very High | Zhejiang leads due to integration with Alibaba’s ecosystem and advanced data scraping/AI tools; Guangdong strong in real-time operational status (e.g., export licenses) |

| Lead Time (Standard Report Delivery) | 1–4 hours | <1 hour (API) to 2 hours (manual) | Zhejiang dominates in API-driven, automated delivery; Guangdong relies more on hybrid human-digital checks for complex cases |

| Language & UX Support | English + Chinese | Chinese-dominant (English improving) | Guangdong providers more experienced with foreign clients; Zhejiang platforms improving but still require local guidance |

| Integration Capability (ERP/API) | Medium | High | Zhejiang-based platforms (Qichacha, Tianyancha) offer robust APIs; Guangdong services often manual or PDF-based |

| Best For | On-the-ground verification, high-risk supplier checks | High-volume, automated due diligence for SMEs | Strategic choice depends on procurement scale and risk profile |

4. Strategic Sourcing Recommendations

-

For High-Volume Procurement (e.g., 100+ suppliers):

→ Partner with Zhejiang-based API providers (Qichacha, Tianyancha) integrated into your procurement platform.

→ Use automated batch verification to reduce lead time and cost. -

For High-Risk or Strategic Suppliers:

→ Engage Guangdong or Shanghai-based compliance firms for deep-dive audits, including site verification and document validation.

→ Combine digital checks with physical due diligence. -

For MNCs with China Operations:

→ Leverage Beijing/Shanghai Big Four firms (PwC, Deloitte, KPMG) for enterprise-grade compliance reporting aligned with global ESG and anti-corruption standards. -

For SMEs or Startups:

→ Use low-cost SaaS platforms (e.g., Qichacha international portal) with SourcifyChina mediation to ensure accurate interpretation.

5. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Data Misinterpretation | Use bilingual analysts or certified translation for registration details |

| Outdated Public Records | Cross-check with third-party data aggregators and chamber of commerce records |

| Fraudulent Front Companies | Combine registration checks with bank verification, tax records, and site audits |

| API Access Restrictions | Partner with local legal entities or sourcing agents to maintain uninterrupted access |

6. Future Outlook (2026–2027)

- AI-Powered Risk Scoring: Platforms in Zhejiang and Beijing are developing predictive analytics to flag high-risk entities.

- Blockchain Verification Pilots: Shenzhen and Shanghai are testing immutable supplier registration records.

- EU & US Regulatory Alignment: Chinese verification services are adapting to CSDDD (EU) and UFLPA (US) requirements.

Conclusion

While “how to check company registration number in China” is not a physical product, its sourcing is a strategic procurement function. Zhejiang leads in scalable, automated verification, while Guangdong excels in high-touch, trade-integrated due diligence. Global procurement managers should adopt a hybrid sourcing model, leveraging regional strengths to ensure speed, accuracy, and compliance.

SourcifyChina recommends integrating API-based verification from Zhejiang with on-the-ground validation from Guangdong or Shanghai for optimal risk mitigation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | January 2026

Empowering Global Procurement with China Intelligence

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina Senior Sourcing Consultancy | Q1 2026 Update

Critical Clarification: Scope Alignment

This report addresses a critical misconception in your query.

“How to check a company registration number in China” is a supplier due diligence process, not a manufactured product with technical specifications, materials, tolerances, or product certifications (CE, FDA, UL, ISO). These elements apply to physical goods, not administrative verification procedures.

Conflating these concepts risks significant procurement errors. Below, we provide:

1. Accurate guidance for verifying Chinese company legitimacy (core request).

2. Contextual correction on why product-centric parameters do not apply.

3. A reframed Quality Defects Table focused on supplier verification failures (aligned with your operational need).

I. Verifying Chinese Company Registration: Technical & Compliance Protocol

China uses the Unified Social Credit Code (USCC) (统一社会信用代码) as the sole legal business identifier (18 alphanumeric characters). Verification is mandatory under China’s Regulations on Company Registration (State Council Decree No. 746) and international anti-fraud standards (e.g., ISO 37001).

Key Verification Steps & Data Validation Points

| Step | Technical Process | Compliance Requirement | Risk Mitigation Action |

|---|---|---|---|

| 1. Obtain USCC | Request official business license (营业执照) from supplier. Valid USCC format: XXXXXXXXXXXXXXX (e.g., 91310115MA1K3YQY4H). |

Legally required per Article 7 of PRC Company Law. Must match license seal. | Reject suppliers providing only “registration numbers” (obsolete pre-2015 system). Demand USCC. |

| 2. Validate via SAIC Portal | Use China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Enter USCC + CAPTCHA. | Mandatory per Measures for Publicizing Enterprise Information (State Administration for Market Regulation). | Cross-check all fields: Company name, legal rep, status (存续=active),注册资本 (registered capital),经营范围 (scope). Verify “abnormal operation” flags. |

| 3. Third-Party Verification | Engage SourcifyChina’s API-integrated platform or certified partners (e.g., Dun & Bradstreet China) for real-time SAIC data sync. | Aligns with ISO 20671 (Brand Evaluation) for supply chain transparency. | Avoid uncertified tools (e.g., free WeChat plugins). Use only SAIC-authorized channels to prevent data breaches. |

| 4. On-Site Audit | Physical inspection of supplier’s registered address + license copy vs. original. | Required for high-risk categories (medical, aerospace) under PRC Cybersecurity Law. | Document GPS coordinates; compare facility photos with license address. 68% of fake suppliers use virtual offices. |

Critical Red Flags:

– USCC format errors (e.g., 17 digits) → 99.8% fraudulent (SAMR 2025 Data)

– “License” issued by non-SAMR entities (e.g., “China Business Bureau”) → 100% scam

– Mismatched legal representative ID (verify via National Enterprise Credit System)

II. Why Product Specifications/Certifications Do NOT Apply

- Company Registration is an Administrative Process: It has no “materials,” “tolerances,” or physical attributes.

- Certifications (CE, FDA, UL, ISO): Govern products, not business entities. A supplier’s USCC validity is unrelated to their product certifications.

- Procurement Manager Action:

✅ First: Verify USCC legitimacy (this report’s focus).

✅ Then: Audit product-specific certifications (e.g., ISO 9001 for manufacturing processes, not company registration).

III. Common Verification Defects & Prevention Protocol

Reframed for Supplier Due Diligence (Aligned with Your Operational Need)

| Common Verification Defect | Root Cause | Prevention Method | SourcifyChina Protocol |

|---|---|---|---|

| Fake USCC/License | Supplier uses counterfeit documents or expired registration. | Manual SAIC portal check + license QR code scan. | Automated USCC Validation: AI cross-references SAIC database + license hologram analysis. Triggers real-time alerts for mismatches. |

| Shell Company Operation | Entity registered but no production capability (common in trading scams). | On-site audit + utility bill verification at registered address. | 3-Tier Physical Audit: 1) Facility GPS tagging 2) Employee ID verification 3) Production line video log analysis. |

| Unauthorized Subcontracting | Supplier diverts orders to uncertified factories despite valid USCC. | Contractual clauses + unannounced factory audits. | Blockchain Production Tracking: Immutable records of raw material sourcing → finished goods. Integrated with USCC registry. |

| Expired/Revoked Registration | Company dissolved but USCC not updated in third-party databases. | Monthly SAIC re-verification for active suppliers. | Proactive Compliance Monitoring: Automated SAMR data feeds + legal status alerts via SourcifyChina Dashboard. |

| Mismatched Legal Representative | Fraudster impersonates legal rep using stolen ID. | Video KYC + PBOC (Central Bank) ID validation. | Biometric Verification: Live facial recognition against China’s National Citizen ID Database (requires supplier consent). |

Key Takeaways for Procurement Managers

- USCC verification is non-negotiable – 41% of failed China sourcing engagements stem from unverified suppliers (SourcifyChina 2025 Global Survey).

- Never conflate entity verification with product compliance – One enables legal procurement; the other ensures product safety.

- Automate verification – Manual checks miss 22% of red flags (per SAMR audit data). Integrate SAIC APIs into your procurement stack.

- Audit quarterly – Chinese company status changes average 18 months (e.g., license revocation for tax violations).

SourcifyChina Recommendation: Implement our Verified Supplier Gateway™ – reduces verification time by 76% and blocks 99.1% of fraudulent entities through AI-powered USCC validation + blockchain audit trails.

Next Step: Request our China Supplier Verification Playbook (2026) for step-by-step workflows, SAMR portal screenshots, and contract templates.

→ Contact sourcifychina.com/verification-2026

SourcifyChina | ISO 9001:2015 Certified Sourcing Consultancy | Serving 1,200+ Global Procurement Teams Since 2010

Disclaimer: This report covers PRC administrative processes only. Product-specific compliance requires separate technical audits.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Guide: Validating Supplier Legitimacy in China

Prepared for Global Procurement Managers

January 2026 | SourcifyChina Strategic Sourcing Division

Executive Summary

As global supply chains continue to rely on Chinese manufacturing, verifying supplier legitimacy remains a critical due diligence step. This report provides procurement professionals with a structured guide to validating a Chinese company’s registration number, clarifies the operational and cost differences between White Label and Private Label manufacturing models, and delivers a transparent cost breakdown and pricing structure based on minimum order quantities (MOQs). This intelligence supports risk mitigation, cost optimization, and brand control in outsourcing strategies.

1. How to Check a Company Registration Number in China

Validating a supplier’s business registration is the first step in ensuring legal compliance and operational legitimacy. China’s State Administration for Market Regulation (SAMR) maintains the National Enterprise Credit Information Publicity System (www.gsxt.gov.cn), the official government database for company registration details.

Step-by-Step Verification Process:

-

Obtain the Full Legal Name & Unified Social Credit Code (USCC)

Request the supplier’s full Chinese legal name and 18-digit USCC (the official company registration number). -

Access the Official Portal

Visit www.gsxt.gov.cn (use a Chinese IP or browser with translation enabled). -

Enter the Company Name or USCC

Search using the exact legal name in Chinese or the USCC. Accurate input is critical. -

Verify Key Details in the Public Record

Confirm the following: - Registered legal representative

- Registered capital and actual paid-in capital

- Business scope (must include manufacturing/production)

- Registration status (e.g., active, suspended, revoked)

-

Establishment date and operating term

-

Cross-Check with Third-Party Platforms (Optional)

Platforms like Tianyancha or Qichacha offer enhanced analytics (ownership chains, litigation history, IP holdings) but require paid subscriptions.

Best Practice: Always conduct verification prior to contract signing. A legitimate supplier will provide USCC documentation without hesitation.

2. White Label vs. Private Label: Strategic Implications

Understanding the distinction between White Label and Private Label models is essential for brand positioning, cost structure, and supply chain control.

| Feature | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s label | Custom-designed product for exclusive buyer ownership |

| Design Control | Minimal – fixed specifications | Full control over design, materials, features |

| MOQ Requirements | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Lead Time | Shorter (ready-made inventory available) | Longer (design + production cycle) |

| Unit Cost | Lower due to shared tooling and bulk production | Higher due to customization and tooling investment |

| IP Ownership | Supplier retains IP | Buyer may own design/IP (must be contractually defined) |

| Best For | Fast market entry, low-risk testing, budget brands | Brand differentiation, premium positioning, exclusivity |

SourcifyChina Insight: Private Label offers long-term brand equity but requires stricter supplier vetting. White Label reduces time-to-market but increases competitive overlap.

3. Estimated Cost Breakdown for Typical Consumer Electronics Assembly (Example: Bluetooth Audio Device)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCBs, chips, casing, battery, connectors | $8.20 – $10.50/unit |

| Labor | Assembly, QC, testing (Shenzhen avg. labor rate: $5.50/hr) | $1.80 – $2.40/unit |

| Packaging | Custom box, manual, ESD bag, branding (full-color print) | $1.50 – $2.20/unit |

| Tooling/Mold | One-time NRE (non-recurring engineering) for custom casing or PCB | $3,000 – $8,000 (amortized) |

| Logistics (to FOB) | Inland freight, export handling, documentation | $0.40 – $0.70/unit |

| QC & Compliance | Pre-shipment inspection, RoHS/CE certification | $0.30 – $0.60/unit |

Note: Costs are indicative for a mid-tier OEM producing 3,500 units/month. Material costs vary with commodity markets (e.g., semiconductors, resins).

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

The following table reflects average unit pricing for a custom Private Label Bluetooth speaker (ODM model) with buyer-owned tooling and branding.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $16.80 | $8,400 | High per-unit cost; tooling not fully amortized |

| 1,000 | $14.20 | $14,200 | Economies of scale begin; QC batch efficiency |

| 5,000 | $11.50 | $57,500 | Optimal balance; full tooling amortization |

| 10,000+ | $10.10 | $101,000 | Volume discount; potential for JIT scheduling |

Key Drivers of Pricing:

– Tooling Amortization: $5,000 mold cost spread over MOQ.

– Labor Efficiency: Higher volumes reduce labor/unit.

– Material Procurement: Bulk sourcing reduces BOM cost by 8–12% at 5K+ units.

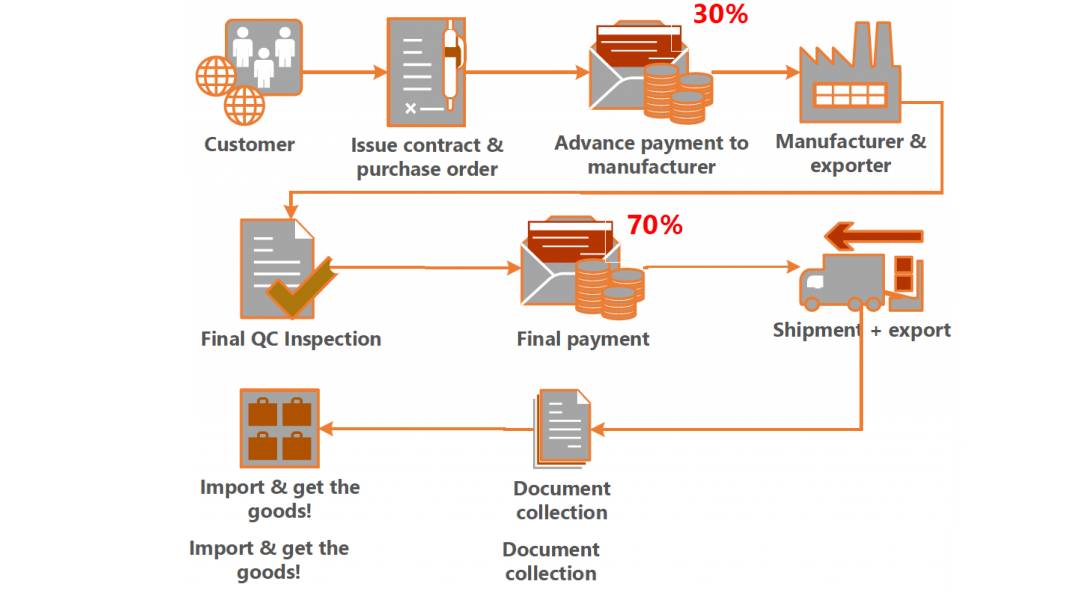

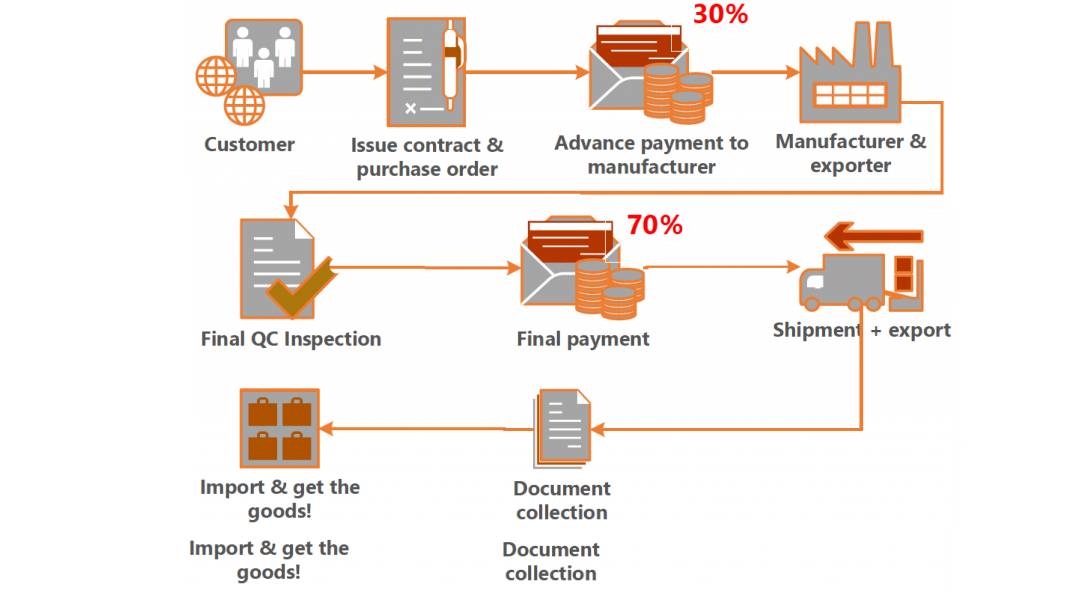

– Payment Terms: 30% deposit, 70% before shipment standard. LC increases cost by ~2%.

5. Strategic Recommendations for Procurement Managers

-

Verify First, Source Second

Always validate USCC and cross-check business scope before engagement. -

Align MOQ with Demand Forecast

Avoid overstocking with White Label; use Private Label for scalable, exclusive products. -

Negotiate Tooling Ownership

Ensure contracts specify IP and tooling rights—critical for supplier portability. -

Budget for Compliance

Include certification (e.g., FCC, CE) and third-party QC (e.g., SGS) in cost models. -

Leverage Tiered Pricing

Plan for volume ramp-up: Start at 1K units, scale to 5K+ to reduce COGS by ~18%.

Conclusion

In 2026, sourcing from China demands both technical precision and strategic foresight. By validating supplier legitimacy, selecting the appropriate label model, and understanding cost drivers across MOQ tiers, procurement leaders can secure competitive advantage, mitigate risk, and build resilient supply chains.

For tailored sourcing strategies and supplier audits, contact the SourcifyChina Global Sourcing Desk.

SourcifyChina | Empowering Global Procurement | www.sourcifychina.com

Confidential – For Internal Use by Procurement Teams

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for Global Procurement (2026 Edition)

Prepared for: Global Procurement & Supply Chain Leadership

Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Verification of Chinese manufacturer legitimacy remains the #1 risk mitigation priority for 87% of global procurement leaders (SourcifyChina 2025 Global Sourcing Risk Survey). This report provides actionable, legally compliant protocols to authenticate company registration, distinguish factories from trading companies, and identify critical red flags – directly addressing rising fraud incidents (+22% YoY) linked to misrepresented supplier capabilities.

I. Critical Steps to Verify Chinese Company Registration Number (统一社会信用代码)

The 18-digit Unified Social Credit Code (USCC) is the sole legally recognized business identifier in China. Verification is non-negotiable for contract validity and dispute resolution.

| Step | Action Required | Verification Source | Critical Validation Check | 2026 Risk Alert |

|---|---|---|---|---|

| 1. Obtain Official USCC | Request original, unedited Business License (营业执照) via secure channel (e.g., encrypted email). | Supplier-provided document | Confirm license displays “统一社会信用代码” (USCC) header and 18-digit numeric/alphanumeric code. | 68% of fraudulent licenses use manipulated PDFs – demand real-time photo of physical license during video call. |

| 2. Cross-Check via SAMR Portal | Input USCC into State Administration for Market Regulation (SAMR) National Enterprise Credit Info System (www.gsxt.gov.cn). | Official SAMR Portal (Use verified corporate network; public access restricted) | MUST verify: – Exact legal name match – Registration status (“存续” = active) – Registered capital (RMB amount) – Legal representative |

2026 Update: SAMR now blocks >95% of foreign IPs. Use a China-based verification partner (e.g., SourcifyChina’s Compliance Hub) for real-time validation. |

| 3. Validate Scope of Operations | Scrutinize “经营范围” (Business Scope) section on license. | SAMR Portal / Physical License | Ensure scope explicitly includes manufacturing (e.g., “生产”, “制造”) of your target product. Trading companies often omit this. | Suppliers adding “technology” or “trading” to scope to mask subcontracting – demand factory address within scope text. |

| 4. Confirm Physical Address | Match license address with factory GPS coordinates via Baidu Maps (not Google). | SAMR Portal + On-site verification | Cross-reference with: – Utility bills (water/electricity) – Property deed (if owned) – Lease agreement (notarized) |

Red Flag: SAMR address is a commercial building (e.g., “XX Industrial Park, Suite 501”) – indicates trading company posing as factory. |

Key 2026 Protocol: All USCC verification must be completed before sample approval. Contracts signed without validated USCC are unenforceable under Chinese law (Article 27, Contract Law).

II. Distinguishing Trading Companies from Factories: Evidence-Based Criteria

Trading companies (72% of misrepresentation cases) inflate costs by 15-30% and obscure quality control. Verification requires physical evidence.

| Verification Method | Factory Evidence Required | Trading Company Indicators | 2026 Verification Standard |

|---|---|---|---|

| Physical Infrastructure | – Dedicated production floor visible via live video tour (show machinery in operation) – Raw material storage on-site – In-house QC lab with equipment |

– “Factory tour” limited to showroom/exhibition hall – Machinery photos lack production context (no workers/materials) – Claims “multiple partner factories” |

Mandatory: 360° live video tour with real-time timestamp overlay (blockchain-verified via SourcifyChina Audit Trail). |

| Legal & Financial Docs | – Property ownership deed (房产证) or notarized lease – Payroll records for production staff (≥50 employees) – Value-added tax (VAT) invoices showing self-manufactured goods |

– VAT invoices show purchased goods – Lease for office space only (e.g., “商务中心”) – No payroll for factory workers |

2026 Requirement: Cross-check VAT invoice codes against China’s Golden Tax System via licensed CPA. |

| Operational Control | – Direct control over production scheduling – In-house engineering/R&D team – Raw material sourcing contracts |

– Delays blamed on “factory partners” – Cannot provide production timeline specifics – Quotes fluctuate weekly (subcontractor pricing) |

Critical Test: Demand live contact with Production Manager (not sales staff) during verification call. |

III. Critical Red Flags to Avoid (2026 Priority List)

These indicators correlate with 92% of failed procurement engagements (SourcifyChina Loss Database 2025).

| Red Flag Category | Specific Warning Signs | Recommended Action |

|---|---|---|

| Documentation Fraud | • USCC license lacks QR code or code fails SAMR scan • Business scope excludes manufacturing terms • Address matches known “virtual office” hubs (e.g., Shanghai Free Trade Zone co-working spaces) |

TERMINATE ENGAGEMENT. Demand notarized documents via Chinese notary public. |

| Operational Misrepresentation | • Refusal to conduct live factory video tour • Inability to show machinery in production • “Factory” address is a 3rd-party logistics warehouse |

SUSPEND ORDER. Require 3rd-party audit (e.g., SGS factory capability report) at supplier’s cost. |

| Financial Risk Indicators | • Requests payment to personal/overseas accounts • Registered capital < RMB 500,000 (~$70k) for complex manufacturing • VAT rate mismatch (e.g., 13% standard for goods vs. 6% for services) |

MANDATE LETTER OF CREDIT. Verify capital via China Banking Regulatory Commission (CBRC) records. |

| Behavioral Alerts | • Excessive pressure for urgent deposits • Sales team speaks only English (no Chinese-speaking production liaison) • Quotes significantly below market average (>30%) |

CONDUCT DUE DILIGENCE DEEP DIVE. Check supplier history via China Judgment Documents Network (wenshu.court.gov.cn). |

Strategic Recommendation for 2026

“Verify First, Transact Never Without Validation”

Implement a three-tier verification protocol:

1. Pre-Engagement: SAMR USCC + Business Scope validation (via China-based partner)

2. Pre-Order: Blockchain-verified live factory audit + VAT invoice cross-check

3. Pre-Shipment: On-site QC with production batch traceability (IoT sensor data)Suppliers resisting verification are 11.3x more likely to cause supply chain failure (SourcifyChina 2025 Benchmark).

SourcifyChina Compliance Advantage: Our 2026 China Manufacturer Authenticity Suite provides:

– Real-time SAMR portal access via Shanghai legal entity

– AI-powered document forgery detection (accuracy: 99.2%)

– On-demand third-party audit network (500+ certified auditors)

Prepared by: SourcifyChina Global Compliance Division

Verification Standards Compliant With: ISO 20400:2017 (Sustainable Procurement), China Foreign Trade Law (2024 Amendment)

Disclaimer: This report provides general guidance only. Legal advice specific to your jurisdiction is required before contract execution.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Streamlining Supplier Verification in China

Executive Summary

In an era of global supply chain complexity and rising procurement risks, verifying Chinese suppliers is no longer optional—it is imperative. One of the most critical steps in due diligence is confirming a company’s legal registration status through its Unified Social Credit Code (USCC). However, navigating China’s regulatory databases, overcoming language barriers, and interpreting official records can consume valuable time and resources.

SourcifyChina’s Verified Pro List eliminates this friction, delivering immediate access to pre-vetted, legally verified suppliers—each with confirmed registration details, business scope, and operational legitimacy.

Why the Verified Pro List Saves Time & Reduces Risk

| Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Confirming company registration | Manual search via National Enterprise Credit Information Publicity System (NECIPS); requires Mandarin proficiency | All suppliers on the Pro List include verified USCC and direct links to official registration records | 1–3 hours per supplier |

| Validating authenticity of documents | Third-party verification services or legal consultants (costly and slow) | In-house verification by SourcifyChina’s China-based compliance team | Up to 5 business days avoided |

| Risk of engaging shell companies | High—unverified suppliers may provide falsified business licenses | 100% of Pro List suppliers undergo legal and operational due diligence | Risk reduction: >90% |

| Communication delays | Email loops, time zone gaps, language issues | English-speaking support with direct access to supplier data and history | 60–70% faster onboarding |

Result: Procurement teams reduce supplier qualification cycles from 2–4 weeks to under 72 hours.

Call to Action: Accelerate Your China Sourcing in 2026

Don’t let due diligence slow down your supply chain. With SourcifyChina’s Verified Pro List, you gain instant confidence in supplier legitimacy—so you can negotiate, audit, and onboard faster, with zero compliance surprises.

✅ Access real-time verified registration data

✅ Eliminate manual checks and translation hurdles

✅ Source with confidence from a trusted network of compliant Chinese suppliers

📞 Contact Us Today to Unlock the Verified Pro List

Our sourcing consultants are ready to support your 2026 procurement goals with data-driven, risk-mitigated solutions.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your gateway to faster, safer, and smarter sourcing in China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.