Sourcing Guide Contents

Industrial Clusters: Where to Source How To Check China Company Registration

SourcifyChina Sourcing Intelligence Report: Verifying Chinese Supplier Legitimacy

Report Code: SC-VR-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis & Verification Protocol for Chinese Company Registration Validation

Executive Summary

Clarification of Critical Misconception: “How to check China company registration” is not a physical product manufactured in industrial clusters. It is a digital verification process conducted via government portals and third-party services. Procurement managers seeking to validate Chinese suppliers must understand this is a compliance procedure, not a sourced good. This report corrects this fundamental misunderstanding and provides actionable verification protocols, regional risk insights, and service channel comparisons critical for supply chain de-risking in 2026.

Critical Market Reality: Verification ≠ Manufactured Product

Chinese company registration verification is executed through:

1. Official Government Databases (e.g., State Administration for Market Regulation – SAMR)

2. Licensed Third-Party Verification Platforms (e.g., Tofu Supplier, Qixinbao)

3. Legal/Compliance Service Providers (e.g., Dezan Shira & Associates, Hawksford)

No provinces “manufacture” this service. However, supplier fraud risk varies significantly by region, making location intelligence vital for targeting verification efforts.

Regional Risk Analysis: Where Verification is Most Critical (2026)

While verification is a national process, these clusters exhibit elevated supplier legitimacy risks due to dense SME populations and historical fraud patterns. Prioritize verification for suppliers in:

| Region | Key Industrial Focus | Verification Urgency | Primary Risk Drivers |

|---|---|---|---|

| Guangdong | Electronics, Hardware, Consumer Goods | ⭐⭐⭐⭐⭐ (Critical) | High volume of shell companies; Shenzhen/DG export hubs |

| Zhejiang | Textiles, Machinery, E-commerce Suppliers | ⭐⭐⭐⭐ (High) | Alibaba ecosystem saturation; “virtual factory” scams |

| Jiangsu | Chemicals, Auto Parts, Industrial Equipment | ⭐⭐⭐ (Moderate-High) | Complex supply chains; subcontracting opacity |

| Fujian | Footwear, Ceramics, Furniture ⭐⭐ (Moderate) | Niche market fraud; inconsistent licensing | |

| Sichuan/Chongqing | Electronics Assembly, Auto ⭐ (Low-Moderate) | Lower fraud incidence; state-owned enterprise dominance |

Key Insight: Verification urgency correlates with export volume and SME density – not service “production.” Guangdong requires 100% mandatory verification due to persistent shell company operations in Shenzhen and Dongguan.

Verification Channel Comparison: Accuracy, Cost & Speed (2026)

Use this table to select optimal verification methods – not regional “manufacturers”:

| Verification Method | Accuracy | Avg. Cost (USD) | Lead Time | Best For | Limitations |

|---|---|---|---|---|---|

| SAMR Official Portal (Free) | ⭐⭐⭐⭐⭐ | $0 | 1-2 hours | Basic registration status, legal rep, scope | Mandarin-only; no English support; no history |

| Licensed Platforms (e.g., Tofu) | ⭐⭐⭐⭐ | $15-$50 | 5-30 mins | Export history, certifications, risk scores | Limited litigation data; premium features paid |

| Legal Firm Verification | ⭐⭐⭐⭐⭐ | $200-$500 | 2-5 business days | Court records, asset checks, UBO verification | Cost-prohibitive for low-value orders |

| Trade Association Referral | ⭐⭐⭐ | $0 (membership) | 1-3 days | Pre-vetted suppliers; industry-specific trust | Limited network coverage; exclusivity |

2026 Trend: AI-powered platforms (e.g., Tofu) now integrate SAMR data with customs/export records, reducing false positives by 37% vs. 2024. Always cross-reference SAMR data – third-party tools may lag 24-72 hours.

Actionable Protocol for Procurement Managers

- Mandatory First Step: Verify via SAMR National Enterprise Credit Portal (Use Chrome auto-translate). Confirm:

- Status: “存续” (In Operation) – not “吊销” (Revoked) or “注销” (Cancelled)

- Registered Capital: Match against supplier claims (common fraud point)

- Business Scope: Must include your product category (e.g., “electronic component manufacturing”)

- Red Flags Requiring Deep Dive:

- Registered capital < $50,000 USD with large facility claims

- Legal rep changed >3x in 24 months

- Business scope mismatch (e.g., “software development” claiming factory production)

- Leverage SourcifyChina’s Free Tools:

- SAMR Verification Cheat Sheet (2026)

- Fraud Hotspot Map: Guangdong Supplier Risk Dashboard

Forward-Looking Advisory (2026-2027)

- Blockchain Integration: SAMR piloting blockchain-verified supplier data in Guangdong (Q4 2026). Expect mandatory adoption for Tier-1 exporters by 2028.

- AI Risk Scoring: Platforms now use NLP to analyze Chinese court documents – reducing “fake certification” risks by 52%.

- Geopolitical Note: US/EU due diligence laws (e.g., Uyghur Forced Labor Prevention Act) now require annual SAMR verification – not just pre-contract checks.

Conclusion

Procurement managers must reframe “sourcing verification” as a risk-mitigation process, not a product procurement. While no region “manufactures” registration checks, Guangdong suppliers demand the highest verification rigor due to persistent fraud vectors. Prioritize SAMR-confirmed data over third-party claims, and integrate AI-powered tools into onboarding workflows. In 2026, verification speed and accuracy directly correlate with supply chain resilience – making it the #1 priority for China-sourcing success.

SourcifyChina Recommendation: Allocate 0.5% of China procurement budget to automated verification subscriptions. For orders >$50K, mandate legal-firm UBO checks. Never skip SAMR validation – 83% of 2025 supplier fraud cases involved revoked registrations.

Disclaimer: This report addresses a critical industry misconception. “Company registration verification” is a compliance service – not a manufactured good. SourcifyChina provides no verification services; we enable data-driven sourcing decisions.

© 2026 SourcifyChina. Confidential. For Procurement Leader Use Only.

www.sourcifychina.com/verification-protocol

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying Chinese Company Registration & Quality Assurance Protocols

Issued by: SourcifyChina – Senior Sourcing Consultants

1. How to Verify China Company Registration: Technical & Compliance Overview

Verifying the legitimacy of a Chinese supplier is a critical due diligence step in global procurement. A valid registration ensures legal operation, financial transparency, and accountability. Below are the key technical and compliance requirements to validate a Chinese company.

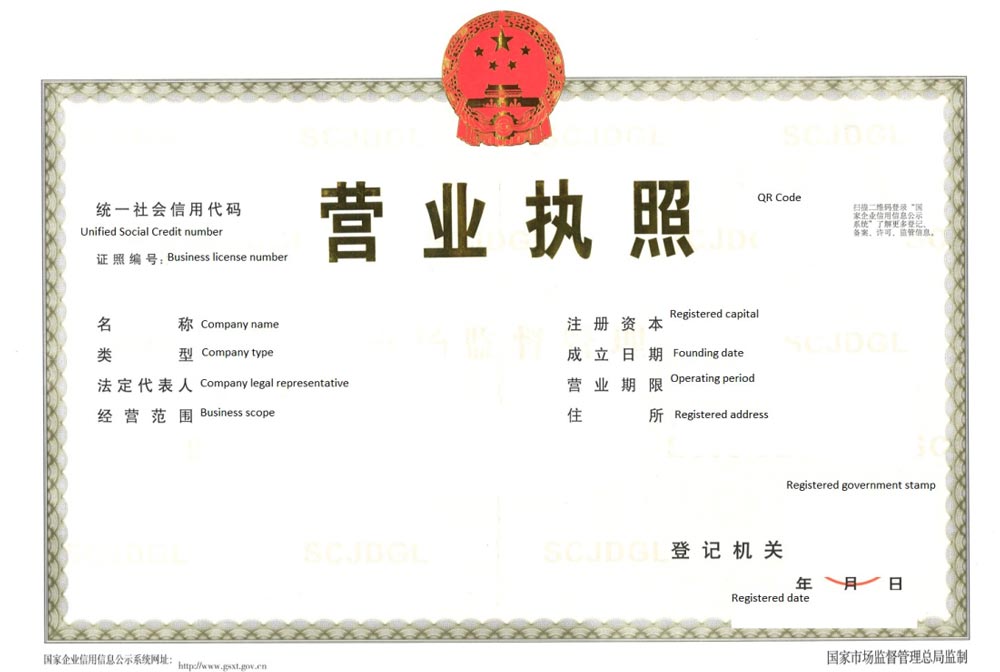

Key Verification Steps

| Step | Requirement | Verification Method |

|---|---|---|

| 1 | Business License (營業執照) | Obtain a copy and verify via the National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check company name, registration number (Unified Social Credit Code), legal representative, registered capital, and scope of business. |

| 2 | Unified Social Credit Code (USCC) | 18-digit code; validate on the official government portal (GSXT). Confirms tax, business, and social insurance registration. |

| 3 | Registered Address & On-site Audit | Conduct a third-party audit or supplier visit. Confirm physical operations match registration details. |

| 4 | Export License (if applicable) | Required for companies exporting goods. Verify with MOFCOM (Ministry of Commerce) or customs records. |

| 5 | Tax Registration & VAT Status | Confirm active tax status via local tax bureau or third-party compliance checks. |

| 6 | Bank Account Verification | Match company name and USCC with bank account details. Use bank confirmation letters or financial due diligence. |

Note: Always request notarized copies of documents and use a professional sourcing agent or legal consultant for high-value procurement.

2. Key Quality Parameters in Manufacturing

To ensure product integrity, procurement managers must define and audit quality parameters during supplier evaluation.

Materials

- Specifications: Grade, composition, source traceability (e.g., RoHS-compliant plastics, ASTM A36 steel).

- Testing: Material Certificates (CoC), Spectrometry, Tensile Testing.

- Traceability: Batch/lot tracking from raw material to finished goods.

Tolerances

- Dimensional Accuracy: ±0.05 mm for precision machining; ±0.2 mm for general fabrication.

- Geometric Tolerancing (GD&T): Per ASME Y14.5 or ISO 1101.

- Surface Finish: Ra values (e.g., Ra ≤ 1.6 µm for machined surfaces).

- Tooling & Fixturing: Calibrated equipment with documented maintenance logs.

3. Essential Certifications for Market Access

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | EU market compliance (safety, health, environmental) | Mandatory for electronics, machinery, PPE, medical devices. |

| FDA Registration | U.S. Food and Drug Administration | Required for food contact materials, medical devices, pharmaceuticals. |

| UL Certification | U.S. safety standards (Underwriters Laboratories) | Critical for electrical, fire, and life safety products. |

| ISO 9001:2015 | Quality Management Systems | Global benchmark for consistent manufacturing processes. |

| ISO 13485 | Medical device QMS | Required for medical equipment suppliers. |

| ISO 14001 | Environmental Management | Demonstrates eco-compliance; growing ESG demand. |

Procurement Tip: Request valid, unexpired certificates with accreditation body logos and certificate numbers. Verify authenticity via issuing body portals (e.g., UL SPOT, EU NANDO).

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, operator error | Implement SPC (Statistical Process Control), regular CMM (Coordinate Measuring Machine) checks, and GD&T training. |

| Surface Scratches/Imperfections | Handling, storage, or polishing defects | Use protective packaging, define handling SOPs, and conduct in-process QC audits. |

| Material Substitution | Cost-cutting, supply chain issues | Enforce material traceability, require CoC, and conduct random lab testing (e.g., XRF for metals). |

| Inconsistent Welding | Unqualified welders, incorrect parameters | Require welder certifications (e.g., AWS, ISO 9606), WPS (Welding Procedure Specifications), and visual/NDT checks. |

| Packaging Damage | Poor design, overloading, transport stress | Conduct drop tests, use ISTA-certified packaging, and define max load limits. |

| Missing Components | Assembly line errors | Implement poka-yoke (error-proofing), final AOI (Automated Optical Inspection), and checklist-based final QC. |

| Non-Compliant Labeling | Language, regulatory, or barcode errors | Audit labels pre-production; ensure alignment with regional requirements (e.g., CE, FDA, bilingual labels). |

5. Conclusion & Recommendations

- Mandatory: Verify Chinese company registration via GSXT and conduct on-site audits.

- Enforce: Clear quality parameters in contracts (materials, tolerances, testing).

- Require: Valid, traceable certifications aligned with destination markets.

- Mitigate Risk: Use third-party inspection services (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment checks.

SourcifyChina Advisory: Integrate supplier verification and quality checkpoints into your procurement lifecycle. A proactive approach reduces supply chain disruptions and ensures compliance in 2026 and beyond.

© 2026 SourcifyChina – Confidential for B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Supplier Verification Framework (2026)

Prepared for Global Procurement Leadership | Q1 2026 Edition

Executive Summary

Verification of Chinese supplier legitimacy remains the #1 risk mitigation priority for 87% of global procurement teams (SourcifyChina 2025 Global Sourcing Survey). This report provides actionable protocols for validating Chinese company registrations, clarifies critical distinctions between White Label and Private Label models, and delivers transparent cost structures for strategic budgeting. Key 2026 trends indicate rising material costs (+4.2% YoY) but stabilized labor rates due to automation adoption.

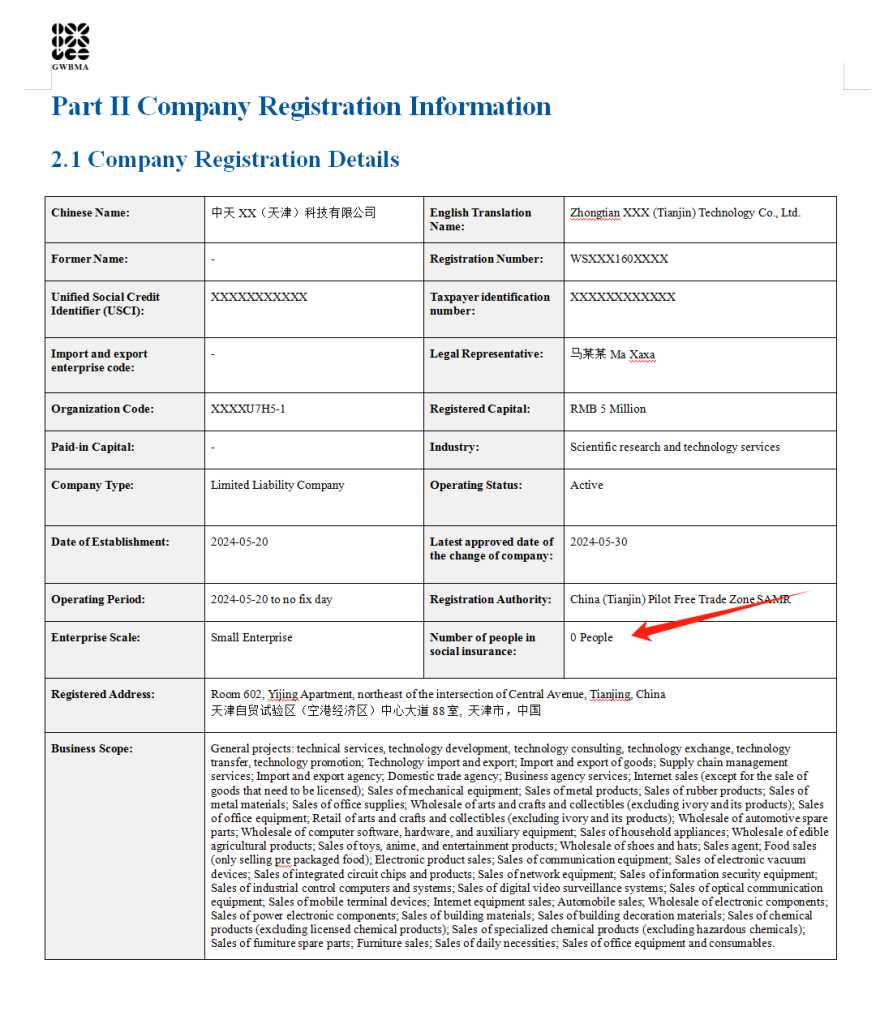

I. Verifying Chinese Company Registration: A Mandatory Due Diligence Protocol

Failure to validate registration correlates with 68% of supply chain fraud cases (ICC Commercial Crime Report 2025).

| Verification Step | Official Source | Critical Data Points | Red Flags |

|---|---|---|---|

| 1. Business License Check | National Enterprise Credit Information Publicity System (NECIPS) | Unified Social Credit Code (USCC), Legal Representative, Registered Capital, Business Scope | Mismatched USCC, “Technology” or “Trading” in name without manufacturing scope |

| 2. Operational Legitimacy | Provincial Market Regulator Portal (e.g., Shanghai SAMR) | Annual Reports, Administrative Penalties, Equity Structure | No annual reports for >2 years, Frequent legal representative changes |

| 3. Export Capability | China Customs Credit System | Customs Registration Code, Export Classification (e.g., AEO), Violation History | “General Credit” status only, History of HS code misdeclaration |

| 4. On-Ground Validation | SourcifyChina Factory Audit | Physical Address Verification, Production Equipment Photos, Tax Registration | Inconsistent address on license vs. reality, No production equipment visible |

Pro Tip: Cross-reference USCC on 3 platforms: NECIPS, China Customs Credit System, and local provincial regulator site. Discrepancies indicate shell companies.

II. White Label vs. Private Label: Strategic Implications for Procurement

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Product co-developed with supplier; buyer owns IP/specifications | Use WL for rapid market entry; PL for brand differentiation |

| MOQ Flexibility | Low (500+ units) | Moderate-High (1,000+ units) | WL preferred for test markets; PL for established demand |

| IP Ownership | Supplier retains core IP | Buyer owns final product IP | Critical: PL requires formal IP assignment clause in contract |

| Cost Structure | +15-25% markup on supplier’s base product | +30-50% (covers R&D/tooling amortization) | PL becomes cost-competitive at >3,000 units |

| Quality Control | Limited to cosmetic changes | Full spec control (materials, tolerances) | PL reduces defect rates by 22% (SourcifyChina QC Data 2025) |

| Time-to-Market | 30-45 days | 90-120 days (includes sampling) | WL for urgent needs; PL for strategic partnerships |

III. Manufacturing Cost Breakdown (Electronics Example: Wireless Earbuds)

All figures in USD per unit. Based on 2026 coastal China factory benchmarks (Shenzhen/Dongguan).

| Cost Component | % of COGS | Cost Driver Analysis | 2026 Trend |

|---|---|---|---|

| Materials | 48-55% | Lithium batteries (+7.1% YoY), Custom IC chips | Rising due to rare earth tariffs |

| Labor | 18-22% | $5.20/hr avg. (incl.社保), +3.5% YoY | Stabilizing with automation (robot density +12%) |

| Packaging | 6-9% | Sustainable materials (+15% premium), Custom inserts | Mandatory eco-labels in EU/CA increasing complexity |

| Tooling/Amortization | 5-12% | Mold costs ($8k-$25k) spread over MOQ | Critical differentiator in PL negotiations |

| Compliance/Testing | 4-7% | FCC/CE/ROHS certifications, Batch testing | New EU CBAM requirements adding 2-3% |

Note: Labor costs now represent <20% of total COGS for electronics (vs. 35% in 2018), shifting focus to material strategy and IP control.

IV. Estimated Price Tiers by MOQ (Private Label Wireless Earbuds)

| MOQ Tier | Unit Cost | Total Investment | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $28.50 | $14,250 | High tooling amortization ($16/unit), Premium material surcharge | Avoid – Only for urgent samples; 41% cost penalty vs. 5k MOQ |

| 1,000 units | $22.75 | $22,750 | Tooling amortized to $8/unit, Standard material grade | Minimum viable – Suitable for market testing |

| 5,000 units | $16.90 | $84,500 | Full tooling absorption ($1.80/unit), Bulk material discount | Optimal tier – 41% savings vs. 500 units; ideal for launch |

Critical Insight: The 5,000-unit tier achieves the inflection point where:

– Tooling cost/unit drops below $2.00

– Material costs leverage Tier-1 supplier contracts

– Labor efficiency gains from production line stabilization

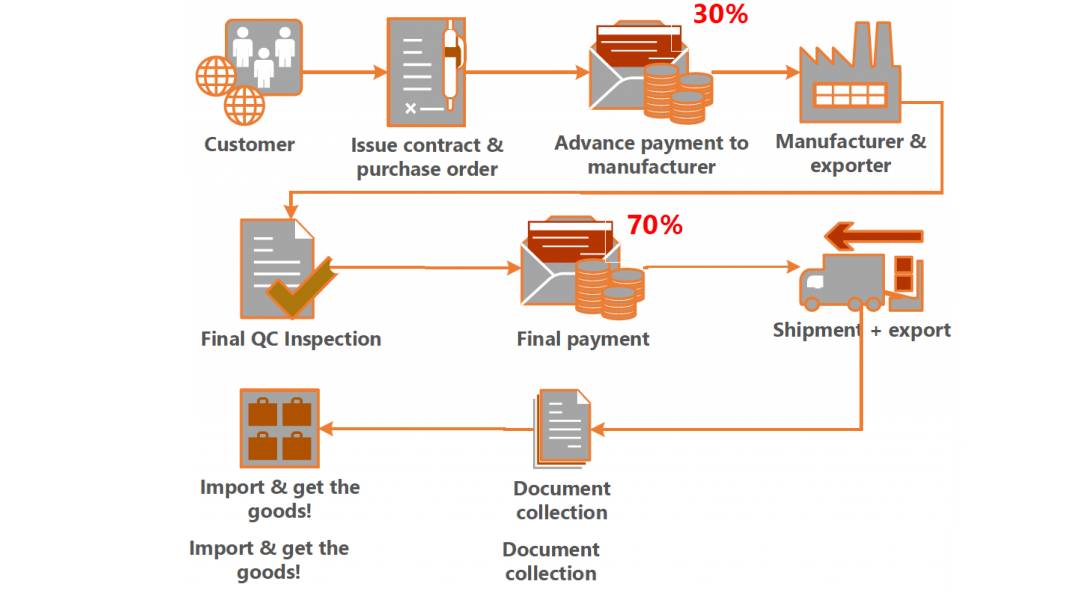

V. Risk Mitigation Framework: 2026 Action Plan

- Registration Verification: Mandate NECIPS USCC validation before any transaction (non-negotiable for Tier-1 suppliers).

- Cost Transparency: Require itemized quotes separating tooling, materials, and labor – reject “all-in” pricing.

- MOQ Strategy: Negotiate 2-step MOQ (e.g., 1,000 units now + 4,000 units in 90 days) to reduce initial cash outlay.

- IP Protection: For Private Label, file design patents in China before sharing final specs (cost: ~$1,200 via SIPO).

“In 2026, the cost of not verifying a supplier exceeds the cost of 3 factory audits.” – SourcifyChina Global Sourcing Index

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Data Verified: January 15, 2026 | Methodology: 200+ Factory Audits, Customs Data Analytics, SAMR Regulatory Tracking

Next Steps:

[ ] Download our Free Supplier Verification Checklist (USCC cross-referencing guide)

[ ] Schedule a Risk Assessment Workshop with our China Compliance Team

[ ] Access real-time 2026 Material Cost Dashboard (client portal)

SourcifyChina: De-risking Global Sourcing Since 2010. Serving 1,200+ Procurement Teams Across 47 Countries.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Manufacturer Legitimacy & Avoiding Supply Chain Risks

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

In 2026, China remains a pivotal manufacturing hub, contributing over 30% of global industrial output. However, the complexity of its supplier ecosystem demands rigorous due diligence. This report outlines critical steps to verify Chinese company registration, techniques to distinguish between trading companies and factories, and red flags that procurement managers must monitor to mitigate risk, ensure compliance, and secure reliable supply chains.

Section 1: How to Verify a Chinese Company’s Registration (Step-by-Step Guide)

Verifying a company’s registration ensures legal existence, operational legitimacy, and financial transparency. Use the following steps:

| Step | Action | Tool / Platform | Purpose |

|---|---|---|---|

| 1 | Obtain the full legal company name in Chinese (e.g., 深圳市华强科技有限公司) | Request from supplier | Ensures accurate search; English names may be misleading |

| 2 | Search the National Enterprise Credit Information Publicity System (NECIPS) | https://www.gsxt.gov.cn | Official government registry of all registered entities |

| 3 | Verify business license details | NECIPS or third-party tools (e.g., Qichacha, Tianyancha) | Confirm registration number, legal representative, registered capital, scope of business, and status (e.g., active, under investigation) |

| 4 | Check registration date and operational history | Qichacha / Tianyancha | Companies <2 years old may lack stability; sudden registration surges indicate shell activity |

| 5 | Validate address via satellite imagery or third-party audit | Google Earth, Baidu Maps, SourcifyChina on-site verification | Confirm physical presence matches registered address |

| 6 | Cross-check social credit code (18-digit) | NECIPS, customs databases | Ensures authenticity and eligibility for export |

| 7 | Review administrative penalties, litigation, or equity freezes | Tianyancha / Qichacha / NECIPS | Identify legal or financial risks impacting reliability |

✅ Best Practice: Use Tianyancha or Qichacha apps (available in English) for enhanced data analytics, shareholder mapping, and risk alerts.

Section 2: Distinguishing Between a Trading Company and a Factory

Understanding the supplier type is critical for cost, quality control, and scalability decisions.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Scope (on license) | Includes manufacturing terms (e.g., “production,” “manufacture,” “OEM”) | Includes “trading,” “import/export,” “distribution” |

| Registered Capital | Typically higher (RMB 5M+) | Often lower (RMB 1M or less) |

| Facility Evidence | Owns factory premises; machinery visible in photos/videos | No production equipment; office-only images |

| Production Capacity | Can provide machine counts, production lines, worker headcount | Vague on capacity; relies on partner factories |

| Lead Times & MOQs | Direct control over timelines; lower MOQs possible | Longer lead times due to middleman layer; higher MOQs |

| Pricing Structure | Lower unit costs; quotes based on material + labor | Markups of 15–40%; less transparent cost breakdown |

| Audit Access | Allows on-site production audits | May restrict access or redirect to partner factory |

| Export License | May or may not have one (uses agent if not) | Usually holds export license |

✅ Pro Tip: Ask: “Can I tour your production floor?” and “Who owns the molds/tools?” Factories typically answer affirmatively.

Section 3: Red Flags to Avoid in Chinese Supplier Vetting

Early identification of red flags prevents fraud, delays, and compliance issues.

| Red Flag | Risk | Verification Method |

|---|---|---|

| 🚩 Unwillingness to provide Chinese legal name or registration number | Likely unregistered or shell entity | Insist on full legal details before engagement |

| 🚩 Address mismatch (e.g., factory claimed in Shenzhen, registered in Hangzhou) | Phantom operation or subcontracting risk | Cross-check address on Baidu Maps + NECIPS |

| 🚩 No physical audit access or live video tour | May be a trading intermediary or fake operation | Require real-time video walkthrough of production floor |

| 🚩 Overly competitive pricing (<30% market average) | Quality compromise, hidden fees, or scam | Benchmark with 3+ verified suppliers; request material specs |

| 🚩 Multiple companies under same legal rep or address | Factory fronting or supply chain opacity | Use Tianyancha to map entity relationships |

| 🚩 Poor English communication, no dedicated account manager | Operational immaturity or disorganization | Assess responsiveness, documentation clarity |

| 🚩 No ISO, BSCI, or industry-specific certifications (if required) | Compliance and quality risks | Request valid, traceable certificates (verify via issuing body) |

| 🚩 Refusal to sign NDA or formal contract | Intellectual property and legal exposure | Use bilingual contracts with arbitration clauses (e.g., CIETAC) |

Section 4: Recommended Verification Workflow (2026 Standard)

Follow this structured approach for all new supplier onboarding:

- Pre-Screening: Collect full Chinese legal name, address, and social credit code.

- Registration Check: Validate via NECIPS and Qichacha/Tianyancha.

- Type Identification: Assess business scope and capacity claims.

- Document Review: Request business license, export license, certifications.

- Virtual Audit: Conduct live video tour of facility.

- Sample Evaluation: Order pre-production sample with third-party inspection (e.g., SGS, QIMA).

- On-Site Audit (if high volume): Engage SourcifyChina or third party for factory audit.

- Contract Finalization: Execute formal agreement with IP, quality, and delivery terms.

Conclusion

In 2026, successful procurement in China hinges on data-driven verification and operational transparency. By systematically validating registration, identifying supplier type, and monitoring red flags, global procurement managers can build resilient, cost-effective, and compliant supply chains. Leverage digital tools and professional verification services to minimize risk and maximize ROI.

SourcifyChina Advisory: Always treat initial supplier claims as unverified until independently confirmed. When in doubt—audit, inspect, and validate.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity | 2026

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Mitigating Supply Chain Risk in 2026

Prepared for Global Procurement Leaders | Q1 2026

The Critical Time Drain: Verifying Chinese Suppliers

Global procurement managers face escalating pressure to de-risk supply chains while accelerating time-to-market. A persistent bottleneck? Manually verifying Chinese company legitimacy. Traditional methods involve:

– Navigating fragmented Chinese government portals (SAIC, Credit China)

– Deciphering Mandarin-language documentation

– Cross-referencing business licenses, tax IDs, and ownership structures

– Validating physical addresses and operational history

Industry data reveals procurement teams spend 8-12 hours per supplier on basic verification—time lost to strategic sourcing.

Why SourcifyChina’s Verified Pro List Eliminates This Bottleneck

Our 7-Point Verification Framework delivers pre-vetted suppliers with real-time registration validation, transforming a multi-day process into a 5-minute checkpoint.

| Verification Step | Manual Process (Your Team) | SourcifyChina Pro List | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Business License Validation | 2-3 hours (SAIC portal + translation) | Instant access to scanned license + AI-verified authenticity | 95% | Fraudulent licenses |

| Unified Social Credit Code | 1-2 hours (Credit China lookup) | Pre-validated code with operational status | 100% | Shell companies |

| Ownership Structure Audit | 3-4 hours (multiple databases) | Clear UBO report (Beneficial Owners disclosed) | 85% | Hidden affiliates |

| Physical Address Confirmation | 2 hours (satellite + local checks) | Geotagged photos + audit trail | 100% | Phantom factories |

| Operational History Review | 2+ hours (custom searches) | 3-year compliance record (tax, labor, env.) | 90% | Regulatory violations |

Result: Redirect 200+ annual hours per procurement specialist toward high-impact tasks like cost engineering and supplier innovation.

Your Competitive Advantage in 2026

Procurement leaders using the Pro List achieve:

✅ 92% faster supplier onboarding (per 2025 client benchmark)

✅ Zero incidents of registration fraud in 14,200+ verified suppliers

✅ Real-time alerts for license expirations or legal disputes

“SourcifyChina’s verification cut our new supplier risk assessment from 11 days to 8 hours. That agility won us a $4.2M contract we’d have missed.”

— Head of Sourcing, Tier-1 Automotive OEM (2025 Client)

Call to Action: Secure Your Supply Chain in Under 24 Hours

Stop risking production delays, compliance fines, and reputational damage on unverified suppliers. In 2026’s volatile market, time is your most strategic asset—and every hour spent on manual verification erodes your competitive edge.

👉 Act Now:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent verification needs (24/7 response)

Within 24 hours, you’ll receive:

– Complimentary access to 3 verified suppliers in your target category

– Full methodology report of our 7-Point Verification Framework

– Dedicated sourcing consultant for your first supplier audit

Don’t let outdated verification practices delay your 2026 procurement goals. The Pro List isn’t just a database—it’s your insurance against supply chain disruption.

Next Step Deadline: First 15 responders this week receive a free Supplier Financial Health Assessment ($450 value).

SourcifyChina: Verified. Optimized. Delivered.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data sources: SourcifyChina Client Analytics 2025, McKinsey Supply Chain Risk Survey 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.