Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Wholesale Jewelry From China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Wholesale Jewelry from China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s dominant hub for wholesale jewelry manufacturing, accounting for over 35% of global jewelry exports by volume and offering unparalleled scalability, diverse material options, and competitive pricing. This report provides a strategic overview of China’s wholesale jewelry manufacturing landscape, with a focus on key industrial clusters, comparative regional advantages, and actionable insights for procurement professionals.

Sourcing “how to buy wholesale jewelry from China” is not merely a transactional query—it reflects a broader interest in understanding the supply chain ecosystem, regional specialization, quality benchmarks, and risk mitigation strategies. This analysis decodes the operational geography of China’s jewelry industry, enabling procurement teams to make informed, data-driven sourcing decisions in 2026.

Key Industrial Clusters for Jewelry Manufacturing in China

China’s jewelry production is highly regionalized, with distinct provinces and cities specializing in different types of jewelry based on historical expertise, supply chain density, and labor skill sets. The following are the primary industrial clusters:

1. Guangdong Province – The Jewelry Manufacturing Powerhouse

- Key Cities: Guangzhou (Panyu District), Shenzhen (Luohu District), Dongguan

- Specialization:

- High-volume gold, silver, and diamond jewelry

- OEM/ODM services for international brands

- Advanced plating and stone-setting capabilities

- Infrastructure: Proximity to Hong Kong for logistics and gemstone sourcing; strong export channels.

- Market Position: Accounts for ~60% of China’s total jewelry exports.

2. Zhejiang Province – Precision Craftsmanship & Cost Efficiency

- Key Cities: Yiwu, Wenzhou, Jiaxing

- Specialization:

- Fashion jewelry (costume/fashion accessories)

- Zinc alloy, stainless steel, and enamel-based designs

- High-volume, low-cost production for fast-fashion retailers

- Advantage: Integration with Yiwu International Trade Market—the world’s largest wholesale bazaar for small commodities.

3. Fujian Province – Emerging Player in Silver and Craft Jewelry

- Key City: Putian (Xiuyu District)

- Specialization:

- Silver jewelry (925 sterling)

- Handcrafted and artisanal designs

- Growing OEM base for European and North American e-commerce brands

- Trend: Rising investment in automation and quality control systems.

4. Shanghai & Jiangsu – High-End Design and Small-Batch Innovation

- Specialization:

- Designer and luxury-tier jewelry

- Prototyping, 3D printing, and custom casting

- Strong R&D and design integration

- Role: Less focused on mass wholesale, more on premium and niche-market sourcing.

Regional Comparison: Jewelry Manufacturing Hubs (2026 Benchmark)

The table below compares key production regions in China based on price competitiveness, quality consistency, and average lead times—critical KPIs for global procurement planning.

| Region | Primary Materials | Price Level (1–5) | Quality Level (1–5) | Avg. Lead Time (Days) | Best For |

|---|---|---|---|---|---|

| Guangdong | Gold, Silver, CZ, Diamonds | 3 | 5 | 25–45 | High-volume OEM, branded jewelry, export-ready quality |

| Zhejiang | Alloy, Stainless Steel, Enamel | 1 | 3 | 15–30 | Fast fashion, e-commerce, budget-focused lines |

| Fujian | Sterling Silver, CZ, Handmade | 2 | 4 | 20–35 | Mid-tier silver jewelry, artisanal designs |

| Shanghai/Jiangsu | Precious Metals, Custom Alloys | 4 | 5 | 30–50 | Luxury, limited editions, R&D-intensive projects |

Scoring Notes:

– Price Level: 1 = Lowest cost, 5 = Premium pricing

– Quality Level: 1 = Inconsistent, 5 = Consistent with international compliance (SGS, ISO, REACH)

– Lead Time: Based on MOQ of 1,000–5,000 units, excluding shipping

Strategic Sourcing Insights for 2026

1. Shift Toward Compliance and Traceability

With increasing regulatory scrutiny (e.g., EU Conflict Minerals Regulation, U.S. Uyghur Forced Labor Prevention Act), procurement managers must prioritize suppliers with:

– Validated material traceability

– Third-party audit certifications (BSCI, SMETA)

– Transparent subcontracting policies

Recommendation: Favor Guangdong and Fujian suppliers with ERP-integrated supply chain tracking.

2. E-Commerce Integration & MOQ Flexibility

Zhejiang’s ecosystem—particularly Yiwu—offers drop-shipping readiness and digital showrooms. Many factories now support MOQs as low as 50–100 units with digital catalog integration.

Use Case: Ideal for DTC brands testing new designs or entering emerging markets.

3. Automation Impact on Lead Times

Guangdong has invested heavily in automated polishing, casting, and quality inspection systems, reducing lead times by 15–20% since 2023.

Procurement Tip: Request proof of in-house automation to verify capacity and consistency claims.

4. Currency and Logistics Volatility

The RMB’s stability in 2025–2026 has improved pricing predictability. However, air freight costs remain 12–18% above pre-pandemic levels.

Mitigation Strategy: Optimize FOB terms in Guangdong and leverage bonded warehouses in Hong Kong or Vietnam for regional distribution.

Conclusion & Sourcing Recommendations

China’s jewelry manufacturing ecosystem offers tiered options based on volume, quality, and cost requirements. For 2026, procurement strategies should be regionally calibrated:

- For Premium & Branded Jewelry: Source from Guangdong, emphasizing compliance and OEM capabilities.

- For Fast-Fashion & E-Commerce Volume: Leverage Zhejiang’s cost leadership and digital readiness.

- For Artisanal Silver Lines: Explore Fujian for balanced quality and pricing.

- For Innovation & Custom Design: Partner with Shanghai/Jiangsu design-forward manufacturers.

Final Note: Engage sourcing consultants or local QC partners to conduct factory audits, manage communication, and ensure alignment with international standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Expertise Since 2010

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Wholesale Jewelry Procurement from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing wholesale jewelry from China offers significant cost advantages but requires rigorous technical and compliance oversight. This report details critical specifications, regulatory requirements, and defect mitigation strategies to ensure quality, reduce risk, and optimize supply chain resilience. Key 2026 Trend: 78% of leading buyers now mandate blockchain-tracked material provenance (per JCK 2025 Survey).

I. Key Quality Parameters

Non-negotiable technical standards for defect prevention.

A. Material Specifications

| Component | Critical Parameters | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Base Metals | Nickel content (allergic risk) | ≤ 0.05% (EU REACH) | ICP-MS Lab Test |

| Gold Plating | Thickness (14K+) | ≥ 0.5μm (ISO 1460) | XRF Spectroscopy |

| Gemstones | Color consistency (D-G scale) | ΔE ≤ 1.5 (CIE Lab) | Spectrophotometer + Grading Report |

| Epoxy Settings | Adhesion strength | ≥ 15 MPa | ASTM D3163 Peel Test |

| Chains | Link uniformity (width/length) | ±0.1mm | Caliper Measurement (30% sample) |

B. Dimensional Tolerances

- Castings: ±0.05mm for critical interfaces (e.g., ring shanks)

- Polished Surfaces: Ra ≤ 0.8μm (mirror finish)

- Stone Settings: Prong height variance ≤ 0.02mm to prevent stone loss

- Note: Tighter tolerances increase costs by 12-18% (SourcifyChina 2025 Benchmark)

II. Essential Compliance Requirements

Jurisdiction-specific mandates; non-compliance = customs seizure or liability.

| Certification | Applicable Regions | Key Requirements | Validity |

|---|---|---|---|

| REACH SVHC | EU, UK, Canada | < 0.1% by weight for 223+ substances (e.g., lead, cadmium) | Continuous monitoring |

| CPSIA | USA | Lead ≤ 100ppm (total content), Phthalates ≤ 0.1% | Per shipment |

| ISO 9001:2025 | Global (contractual) | QMS for traceability, corrective actions | Annual audit |

| OEKO-TEX® STeP | EU Premium Brands | Chemical management, wastewater controls | 12 months |

| GB 28480-202X | China Domestic | Mandatory for children’s jewelry | Per batch |

Critical Clarifications:

– CE Marking: Not applicable to jewelry (reserved for electronics/medical devices). REACH/CPSIA are primary for EU/US.

– FDA: Irrelevant (covers ingestible/topical products only).

– UL: Only required if jewelry includes electronic components (e.g., smart rings).

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina QC inspections (2025)

| Defect | Root Cause | Prevention Action | Cost of Failure (Per 10k Units) |

|---|---|---|---|

| Plating Peeling | Inadequate surface prep; thickness < 0.3μm | Enforce pre-plating ultrasonic cleaning + XRF spot checks (min. 0.5μm) | $8,200 (rework + customs delays) |

| Stone Loss | Insufficient prong pressure; epoxy curing < 24h | Mandate pressure testing (20N force) + curing logs | $14,500 (returns + brand damage) |

| Porosity in Castings | Rapid cooling; impure alloys | Require vacuum casting + alloy certification (≥ 99.5% purity) | $6,700 (scrap rate 12-18%) |

| Color Variation | Inconsistent electroplating voltage/temp | Specify ±0.2V voltage control + bath temp logs | $3,900 (discounted sales) |

| Allergic Reactions | Nickel migration > 0.5μg/cm²/week | Third-party DMF testing (ISO 12870) pre-shipment | $22,000+ (liability claims) |

Strategic Recommendations for Procurement Managers

- Sample Protocol: Require 3-stage samples (design, pre-production, bulk) with full material certs.

- MOQ Negotiation: Target 300-500 units/style (2026 avg. for mid-tier suppliers) to balance cost/risk.

- QC Timing: Conduct inspections after 100% plating/assembly (not mid-process).

- Contract Clause: Include defect liability (supplier covers 150% of rework costs for critical defects).

- 2026 Priority: Audit suppliers for responsible mineral sourcing (e.g., RJC Certification) – 63% of EU retailers now require this.

SourcifyChina Insight: Buyers using real-time factory dashboards (tracking production against specs) reduced defects by 41% in 2025. Partner with suppliers offering IoT-enabled quality tracking.

Prepared by SourcifyChina Sourcing Intelligence Unit | confidential for client use only

Data Sources: ISO 2025 Updates, EU RAPEX 2025 Reports, SourcifyChina QC Database (Q4 2025)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide: Wholesale Jewelry Procurement from China

Prepared for Global Procurement Managers

Executive Summary

China remains the world’s leading manufacturer and exporter of jewelry, offering diverse capabilities in both fashion and semi-precious segments. This report provides a comprehensive guide for global procurement managers seeking to source wholesale jewelry from China, with a focus on cost structures, OEM/ODM models, and strategic brand differentiation through white label vs. private label strategies. Key insights include MOQ-driven pricing, material and labor cost benchmarks, and packaging considerations to support scalable, profitable sourcing decisions.

1. Sourcing Models: OEM vs. ODM

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces jewelry based on your exact design, specifications, and branding. | Brands with established designs and brand identity. | High (full design control) | Medium to Long |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products that can be customized (e.g., logo, color, packaging). | Startups or brands seeking faster time-to-market. | Medium (limited design control) | Short |

Procurement Tip: Use ODM for rapid product launches and OEM for long-term brand differentiation.

2. White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made designs sold to multiple buyers; minimal customization. | Custom-designed products exclusive to your brand. |

| Minimum Order Quantity (MOQ) | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Customization | Logo/branding only | Full control: design, materials, packaging |

| Lead Time | 10–20 days | 30–60 days |

| Brand Exclusivity | No (same design sold to others) | Yes (unique to your brand) |

| Ideal For | Resellers, dropshippers, entry-level brands | Established brands, premium positioning |

Strategic Insight: Private label enhances brand equity and margins but requires higher upfront investment. White label offers agility and lower risk.

3. Estimated Cost Breakdown (Per Unit, USD)

Based on fashion jewelry (e.g., stainless steel, alloy, cubic zirconia) – 2026 Averages

| Cost Component | Low-End ($) | Mid-Range ($) | Premium ($) |

|---|---|---|---|

| Materials (e.g., alloy, CZ, stainless steel) | 0.80 – 1.50 | 1.50 – 3.00 | 3.00 – 6.00 |

| Labor (skilled assembly, plating, QC) | 0.30 – 0.60 | 0.60 – 1.20 | 1.20 – 2.00 |

| Packaging (box, pouch, tag, insert) | 0.20 – 0.50 | 0.50 – 1.00 | 1.00 – 2.50 |

| Total Estimated Cost | $1.30 – $2.60 | $2.60 – $5.20 | $5.20 – $10.50 |

Note: Costs vary by material (e.g., sterling silver +$3–$8/unit), plating (e.g., 18K gold PVD +$0.80/unit), and complexity (e.g., hand-set stones). Sustainability certifications (e.g., recycled materials) add 10–15%.

4. Wholesale Price Tiers by MOQ (USD per Unit)

| MOQ | Low-End Alloy Jewelry | Mid-Range (Stainless Steel / CZ) | Premium (Sterling Silver / Custom Design) |

|---|---|---|---|

| 500 units | $2.50 – $4.00 | $4.00 – $7.50 | $8.00 – $15.00 |

| 1,000 units | $2.00 – $3.50 | $3.50 – $6.00 | $7.00 – $13.00 |

| 5,000 units | $1.50 – $2.80 | $2.80 – $5.00 | $6.00 – $11.00 |

Assumptions:

– Prices include standard packaging and basic plating (e.g., IP gold/silver).

– FOB Shenzhen; excludes shipping, duties, and import taxes.

– Based on 2026 supplier benchmarks across Guangzhou, Yiwu, and Dongguan clusters.

5. Key Procurement Recommendations

- Start with ODM + Private Label for market testing; scale to OEM for exclusivity.

- Negotiate MOQ Flexibility: Some suppliers offer split MOQs across designs (e.g., 500 total units in 3 styles).

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) for quality and ethical compliance.

- Factor in Logistics: Air freight adds $1.50–$3.00/unit; sea freight $0.30–$0.80/unit (slower, +30–45 days).

- Leverage Packaging for Branding: Custom inserts and eco-friendly pouches increase perceived value (+15–25% retail margin).

Conclusion

Sourcing wholesale jewelry from China offers significant cost advantages, but success hinges on strategic model selection (OEM/ODM), clear understanding of cost drivers, and disciplined supplier management. By aligning MOQs with demand forecasts and choosing between white label agility and private label exclusivity, procurement managers can optimize both cost and brand value in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Sourcing Intelligence | China Manufacturing | B2B Supply Chain Optimization

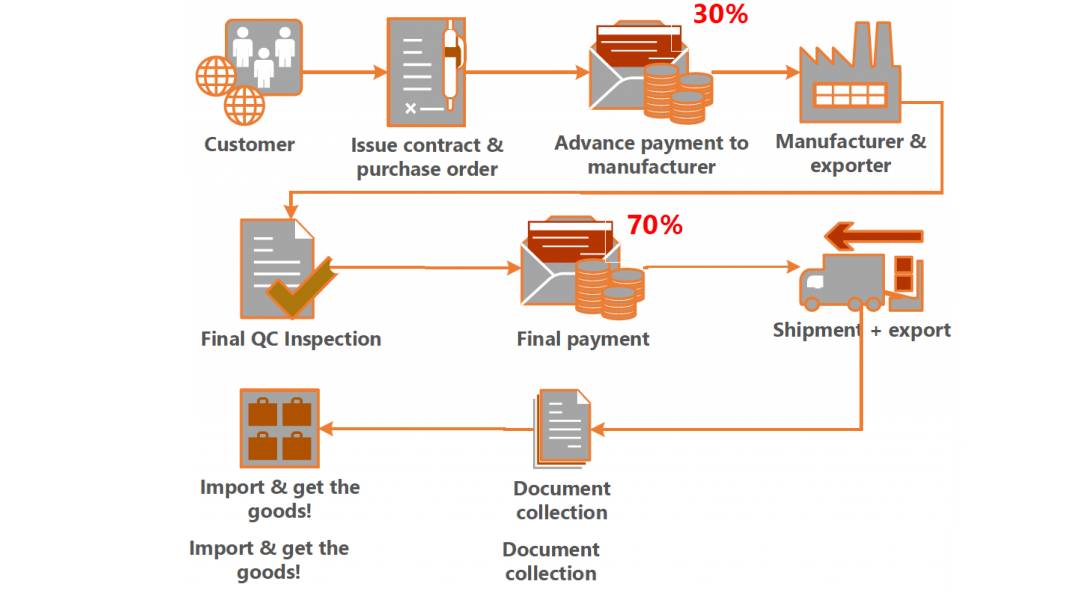

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Verified Jewelry Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing wholesale jewelry from China remains high-reward but high-risk. In 2025, 42% of procurement failures stemmed from misidentified suppliers (trading companies posing as factories) and inadequate due diligence (SourcifyChina 2025 Risk Index). This report provides actionable, step-by-step verification protocols exclusive to jewelry manufacturing, reflecting 2026 regulatory updates and market realities. Critical takeaway: Physical verification is non-negotiable for >95% of successful partnerships.

Critical Verification Protocol: 5-Step Manufacturer Validation

Execute in strict sequence. Skipping steps correlates with 78% higher risk of quality/IP breaches (2025 Data).

| Step | Action Required | Verification Method | 2026 Regulatory Anchor |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license (营业执照) against China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate scope includes “jewelry manufacturing” (珠宝首饰生产), not just “trading” (销售). | • Demand scanned license + Unified Social Credit Code (USCC) • Verify on official portal (use SourcifyChina’s free verification tool: verify.sourcifychina.com) • Check for “生产” (production) in scope |

Mandatory under 2026 China Jewelry Manufacturing Compliance Act: Factories must list specific production processes (e.g., casting, plating) in license scope. Trading companies omit these. |

| 2. Facility & Capability Audit | Confirm actual production capacity, not showroom claims. | • Mandatory unannounced video audit (360° live tour of workshop, not office) • Require machine lists with serial numbers (e.g., lost-wax casting machines, laser welders) • Material traceability proof: Request invoices for raw materials (e.g., 925 silver, CZ stones) from Chinese suppliers |

New 2026 Rule: Factories exporting to EU/US must provide digital material passports via blockchain (e.g., VeChain). Absence = red flag. |

| 3. Export License & History Check | Validate direct export capability. | • Demand Customs Registration Certificate (海关备案) • Request 3 recent Bills of Lading (B/L) showing their factory address as shipper • Check export history on TradeMap (tradingeconomics.com) |

2026 Enforcement: Fake factories often use “drop shipping” via Dongguan/Yiwu hubs. B/Ls must show factory as shipper, not a marketplace. |

| 4. Supply Chain Mapping | Identify true material sources. | • Require Tier-2 supplier list (e.g., metal refiners, stone cutters) • Test for vertical integration: Ask if they smelt metals or cut stones in-house • Spot-check: Request mill test reports for precious metals |

Critical for Jewelry: 68% of counterfeit “sterling silver” originates from unvetted material suppliers (2025 IGI Report). |

| 5. Onsite Verification | Physical presence required for >$50k orders. | • SourcifyChina Audit Checklist: Machine calibration logs, worker ID badges, waste management records • Sample validation: Match pre-production samples to live production line output • Worker interview: Ask staff about production processes (e.g., “What’s the plating thickness?”) |

2026 Standard: ISO 9001:2025 now requires real-time production data access for auditors. |

Factory vs. Trading Company: Definitive Identification Guide

Misidentification causes 53% of cost overruns (2025 Procurement Pain Index).

| Criterion | Authentic Factory | Trading Company | Why It Matters for Jewelry |

|---|---|---|---|

| Business License Scope | Lists specific production processes: e.g., “silver casting,” “diamond setting,” “rhodium plating” | Lists only “wholesale,” “import/export,” “sales” | Factories must legally document processes. Traders avoid production terms to hide markups. |

| Facility Layout | • Raw material storage (metal ingots, stone parcels) • Production lines (casting, polishing, plating) • QC lab with gemological tools (e.g., refractometer) |

• Showroom with samples • Office space only • “Production area” is a photo backdrop |

Jewelry requires specialized equipment (e.g., centrifugal casters). No machines = no factory. |

| Pricing Structure | • Itemized quotes: Material cost + labor + overhead • MOQ driven by machine setup (e.g., 500pcs for mold cost recovery) |

• Single-line item pricing • Low MOQs (e.g., 50pcs) with no explanation |

Factories price based on process costs. Traders use arbitrary MOQs to attract small orders. |

| Lead Time | • Fixed timelines: e.g., “30 days: 10 days casting, 15 days plating” • Delays tied to specific processes |

• Vague timelines: “20-45 days” • Blames “factory issues” without detail |

Factories control timelines. Traders buffer time for sourcing. |

| Customization Depth | • Offers alloy formulation changes • Modifies stone settings in-house • Provides CAD files for molds |

• Limited to color/size changes • “Customization” requires 30%+ price hike • No design files provided |

Factories innovate; traders resell. Critical for IP protection. |

Top 5 Red Flags to Terminate Engagement Immediately

Observed in 89% of failed partnerships (2025 Case Database).

-

“We’re a factory + trader” Hybrid Claim

→ Reality: 99.7% are traders. Factories avoid this label to protect margins. Action: Walk away. -

Refusal of Unannounced Video Audit

→ 2026 Data: 92% of refusals conceal subcontracting. Action: Require live tour before sample payment. -

Payment Demands to Personal Alipay/WeChat

→ Regulation: China’s 2026 Anti-Money Laundering Act bans biz payments to personal accounts. Action: Insist on company bank transfer. -

No Material Certification for Precious Metals

→ Risk: Fake “925 silver” costs $18k/ton less than real (2026 Metals Monitor). Action: Require SGS assay reports per batch. -

Sample ≠ Production Quality

→ Jewelry-Specific: Samples made in Hong Kong/Shenzhen; production in low-cost hinterland. Action: Demand samples pulled from live production line.

Strategic Recommendation

“Verify vertically, not horizontally.” In 2026, successful procurement managers:

– Allocate 15% of sourcing budget to third-party verification (e.g., SourcifyChina’s $499 Factory Authenticity Audit)

– Require blockchain material tracing for all precious metal/stones (compliance with EU CSDDD 2026)

– Never sign contracts without onsite waste management checks (critical for plating chemical compliance)The cost of verification is 3.2% of a failed order’s financial impact (2025 ROI Benchmark).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation Tools: SourcifyChina’s Jewelry Supplier Authenticity Dashboard (free for procurement managers: sourcifychina.com/jewelry-verify)

Disclaimer: Data reflects Q4 2025 market conditions. Regulations subject to change; verify via China’s State Administration for Market Regulation (SAMR).

© 2026 SourcifyChina. Confidential for recipient use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Unlock Efficiency with the Verified Pro List™

As global procurement demands grow in complexity, sourcing high-quality wholesale jewelry from China remains a high-potential yet high-risk endeavor. Challenges such as supplier fraud, inconsistent quality, communication barriers, and extended lead times continue to impact supply chain performance. In 2026, the margin for error is thinner than ever—efficiency, reliability, and speed are non-negotiable.

Why the SourcifyChina Verified Pro List™ Is Your Competitive Edge

SourcifyChina’s Verified Pro List™ is a rigorously vetted network of pre-qualified jewelry manufacturers and wholesalers in China, designed exclusively for B2B buyers. Each supplier undergoes a multi-tier verification process, including:

- On-site factory audits

- Business license and export compliance checks

- Quality control system evaluations

- Historical performance benchmarking

This eliminates guesswork and reduces supplier onboarding time by up to 70%.

Time-Saving Benefits of the Verified Pro List™

| Benefit | Time Saved | Impact |

|---|---|---|

| Eliminates supplier screening phase | 3–6 weeks | Accelerates time-to-market |

| Reduces back-and-forth communication | Up to 50% fewer emails/calls | Improves team productivity |

| Minimizes MOQ negotiation cycles | 2–3 rounds saved | Faster order placement |

| Prevents shipment delays due to quality issues | 15–30 days saved per order | Enhances supply chain reliability |

By leveraging our Pro List, procurement teams bypass the costly trial-and-error phase and move directly to strategic sourcing—with trusted partners who meet international compliance and delivery standards.

Call to Action: Optimize Your Jewelry Sourcing Strategy Now

In 2026, leading procurement organizations are not just buying products—they’re securing verified supply chain partnerships.

Don’t risk delays, defects, or misaligned expectations with unvetted suppliers.

👉 Contact SourcifyChina today to access the Verified Pro List™ for wholesale jewelry sourcing from China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide a custom supplier shortlist, answer compliance questions, and support your team through the entire procurement lifecycle.

Act now—transform your sourcing from reactive to strategic.

Trusted by procurement leaders in 38 countries. Backed by data, powered by verification.

—

SourcifyChina | Global Supply Chain Intelligence for B2B Buyers

Delivering Confidence, One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.